8th Oct 2025 07:00

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY IN OR INTO AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA, THE UNITED STATES, ANY TERRITORY OR POSSESSION THEREOF OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION.

08 October 2025

Hamak Strategy Limited

("Hamak Strategy" or the "Company")

Wide Gold Intersections from Nimba Drilling

Hamak Strategy Ltd. (LSE: HAMA / OTCQB: HASTF), a company combining traditional gold exploration in Africa with a Digital Asset Treasury Management strategy, is pleased to announce the first drilling results from its joint venture (JV) with First Au Limited (ASX: FAU) on its 65% owned Nimba gold project.

Highlights

· Hole FADD25-001 intersected a wide mineralised zone of 29m at 0.97g/t Au from 49m to 78m

o Including 23m at 1.15g/t Au from 49m to 72m depth, with individual high-grade intersections of 4.1g/t Au, 3.1g/t Au, 2.7g/t Au, 2.3g/t Au and 2.0g/t Au

· A deeper intersection also yielded 8m at 2.55g/t Au from 130m to 138m

o Including 2m at 8.37g/t Au with individual intersections of 7.7g/t Au and 9.1g/t Au

· These intersections confirm the continuity of mineralisation at depth from the first Hamak drilling that intersected 20m at 7g/t Au closer to surface

· The gold mineralisation remains open at depth

· Assay results for the next two holes, FADD-002 and 003, are expected in the near future

Nick Thurlow, Executive Chairman of Hamak Strategy, commented:

"We are greatly encouraged by the wide intersections of gold mineralisation returned from the first hole assay results, which confirm the depth extensions to the high-grade discovery made by Hamak. We look forward to advancing the drilling programme and reporting further assay results, in partnership with and funded by our JV partners, First Au Limited."

Nimba Drilling and Results Update

Hamak's joint venture partner, FAU (35% project owner), is fully funding exploration work at Nimba to include an initial 3,000m drilling programme at the Ziatoyah gold discovery. Drilling is currently ongoing with five holes for 948.90 metres having been completed to date. The objective of the drilling to confirm the original high-grade drilling results of Hamak has been successfully achieved, and further drilling is ongoing to determine the continuity and structural control of the gold mineralisation.

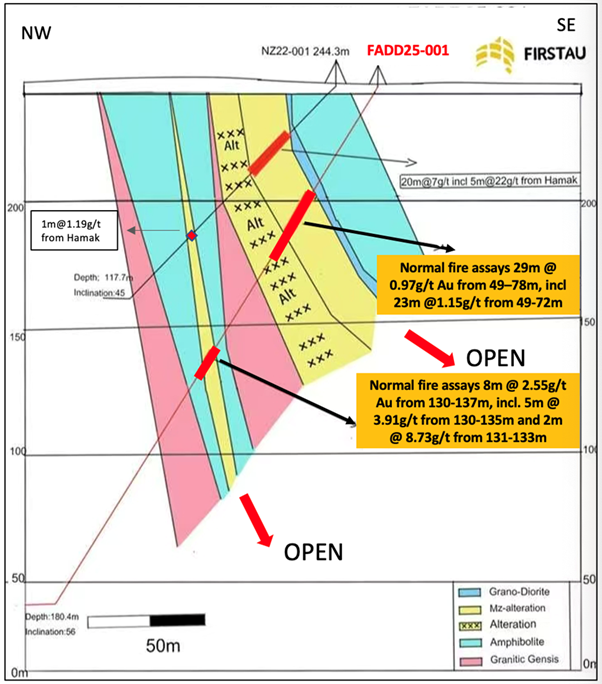

The first hole drilled, FADD25-001, was oriented with the objective to prove the depth extensions of Hamak's near-surface and high-grade intersection of 20m at 7g/t Au (hole NZ22-001). The assay results confirm a wider intersection of 29m at 0.97g/t Au, which included a higher grade zone of 23m at 1.15g/t Au. A second deeper zone returning 8m at 2.55g/t Au was also intersected, confirming the widening of a narrower zone intersected by Hamak's drilling of 2m at 1.2g/t Au (Tables 1 and 2 and Figure 1).

Table 1: Drill Hole Information for Current Programme and Hamak Strategy's Discovery Hole

Hole | Easting | Northing | Elevation (m) | Azimuth (degrees) | Inclination (degrees) | End of Hole (m) |

FADD-001 | 562032 | 744094 | 243.26 | 293 | -50 | 240.0 |

FADD-002 | 562074 | 744139 | 241.50 | 293 | -60 | 280.5 |

FADD-003 | 562069 | 744238 | 240.60 | 293 | -62 | 264.5 |

FADD-004 | 562129 | 744238 | 241.50 | 293 | -60 | 99.7 |

FADD-005 | 561803 | 744897 | 246.17 | 305 | -55 | 102.20 |

|

|

|

|

|

|

|

NZ22-001 | 562015 | 744095 | 244.30 | 292 | -45 | 117.7 |

Table 2: Significant Downhole Intercepts of FADD25-001 and NZ22-001

Hole | From (m) | To (m) | Downhole Length (m) | Grade (g/t AU) |

FADD-001 | 49 | 78 | 29 | 0.97 |

including | 49 | 72 | 23 | 1.15 |

| 130 | 137 | 8 | 2.55 |

including | 130 | 135 | 5 | 3.91 |

and including | 131 | 133 | 2 | 8.73 |

|

|

|

|

|

NZ22-001 | 29 | 49 | 20 | 6.98 |

including | 35 | 40 | 5 | 21.73 |

| 85 | 87 | 2 | 1.19 |

Figure 1: Section of Drilling and Mineralisation at Holes NZ22-001 and FADD25-001

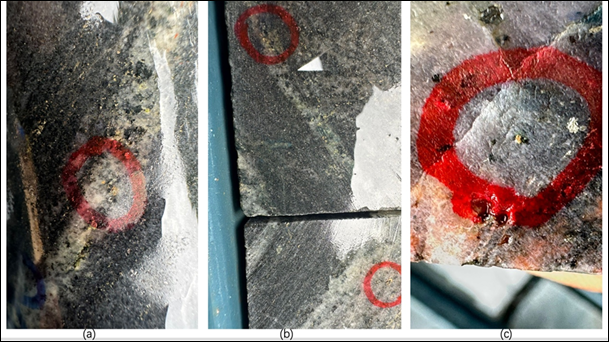

A number of high-grade intersections were made in the wider mineralised zone of hole FADD-001 (Table 2) and repeat assays show variability in some results, which is indicative of coarse native gold. Visible gold was observed in both FAU's hole FADD25-001 (Figure 2) and Hamak's hole NZ22-001.

Figure 2: Visible gold (circled in red) captured at 51m (a), 60.95m (b) and 132m (c) from hole FADD25-001

Screen fire assays are currently underway to verify the potential presence of larger gold particles that may have been under-represented in the initial crushed pulp assays.

Drill holes FADD-002 (280.50m) and FADD-003 (264.50m) have been completed and assays are pending. Drill hole FADD-004 was abandoned at 99.7m due to ground conditions.

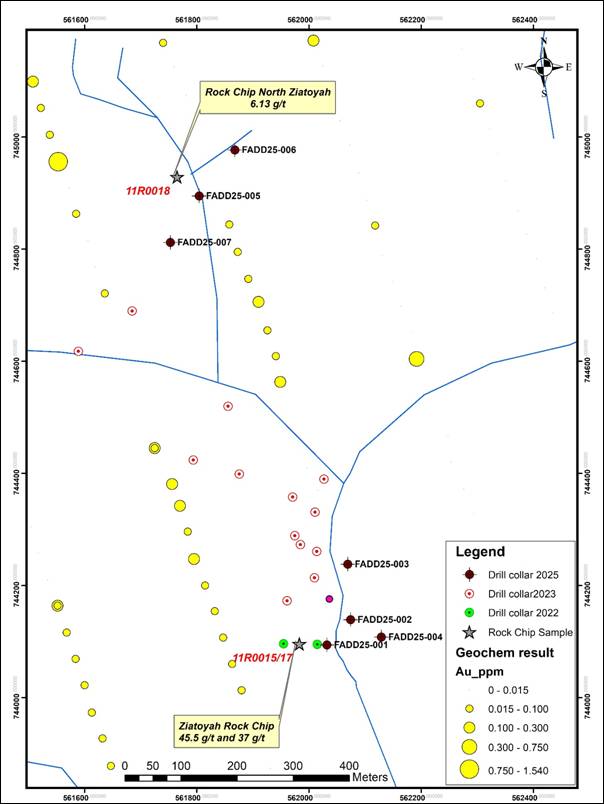

Holes FADD-005 (100.20m) and FADD-006 (in progress) and 007 are located some 500m to the north of the Ziatoyah discovery and are testing a new area where artisanal gold mining coincides with strong geochemical soil anomalies and a surface rock sample assay that returned a grade of 6.13g/t Au (Figure 3).

Further updates on progress will be announced in due course.

Figure 3: Drill Hole Location and Geochemical Gold in Soil Anomalies

For further information you are invited to view the company's website at https://hamakstrategy.com/ or please contact:

Hamak Strategy Limited Nick Thurlow

Karl Smithson |

|

| |

AlbR Capital Limited (Corporate Broker) Yellow Jersey PR Annabelle Wills | +44 (0) 20 7469 0930

+44 (0) 20 3004 9512

|

About Hamak Strategy Limited

Hamak Strategy Limited (LSE: HAMA / OTCQB: HASTF) is a UK listed company focussed on gold exploration in Africa and with a strategy of pursuing an appropriate and compliant BTC/ crypto treasury management policy.

Important Notice

The Company maintains some of its treasury reserves and surplus cash in Bitcoin, a form of cryptocurrency. The Company is not authorised or regulated by The Financial Conduct Authority (FCA) and Bitcoin investments are generally not subject to regulation by the FCA or otherwise in the United Kingdom. Neither the Company nor investors in the Company's shares are protected by the UK's Financial Ombudsman Service or the Financial Services Compensation Scheme.

The FCA considers Bitcoin investments to be high-risk. The value of Bitcoin can go up as well as down, leading to fluctuations in the value of the Company's Bitcoin holdings, and the Company may not be able to realise its Bitcoin holdings for the same amount it paid to acquire them, or even for the value the Company currently attributes to its Bitcoin positions.

The Company's Board of Directors have identified the following risks in relation to the holding of Bitcoin, which are not exhaustive:

• The value of Bitcoin can be highly volatile, with its value falling as quickly as it rises. Investors in Bitcoin must be prepared to lose all money invested.

• The Bitcoin market is largely unregulated. There is a risk of losing money due to factors such as cyber-attacks, financial crime, and counterparty failure.

• The Company may not be able to sell its Bitcoin at will. The ability to sell Bitcoin depends on various factors, including the supply and demand in the market at the relevant time. Operational failings such as technology outages, cyber-attacks, and comingling of funds could cause unwanted delays.

• Cryptoassets carry a perception of fraud, money laundering, and financial crime.

An investment in the Company is not an investment in Bitcoin itself, but prospective investors in the Company are encouraged to conduct their own research before investing and should be aware that they will have indirect exposure to the high-risk nature of cryptoassets, including their volatility, and could therefore sustain large or total losses of their investment.

Related Shares:

Hamak Strategy