3rd Feb 2026 07:00

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN ARTICLE 7 OF THE MARKET ABUSE REGULATION NO. 596/2014 ("MAR") AS IN FORCE IN THE UNITED KINGDOM PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

3 February 2026

Alkemy Capital Investments Plc

TVL FEED Study Confirms Low Capex and Strong Economics

Tees Valley Lithium Limited ("TVL"), a wholly owned subsidiary of Alkemy Capital Investments plc ("Alkemy") (LSE: ALK) (FRA: JV2) is pleased to announce the outcomes of its Front-End Engineering Design ("FEED") programme for its proposed lithium hydroxide refinery in Teesside, UK.

TVL's projected capital intensity positions it at the lower end of the global cost curve and materially below that of comparable European lithium refining projects. It also has strong economics with a Capex of US$243.6 million and an EBITDA of US$65.9 million per annum.

The FEED work has delivered a defined technical and commercial framework for TVL's initial production train, providing the necessary clarity to support financing, contracting, and progression to Final Investment Decision ("FID").

Project Overview and Market Context

TVL's proposed facility is designed to produce 25,000 tpa of battery-grade lithium hydroxide monohydrate ("LHM") for the European electric vehicle and battery supply chain. European battery manufacturing is forecast to exceed 900GWh per annum by 2030,1 driven by committed gigafactory developments across the UK and mainland Europe and underpinned by long-term policy support for electrification and energy transition.

This level of capacity equates to an estimated lithium requirement of approximately 720,000 tpa of Lithium carbonate equivalent ("LCE")2 by 2030. Against this backdrop, TVL's initial production train would represent less than 3% of projected European lithium chemical demand, with the potential to increase this share through phased capacity.

This demand growth continues to drive the need for secure, domestic lithium chemical refining capacity capable of supporting European battery manufacturers with reliable, low-carbon supply.

FEED Outcomes

The FEED programme has established the basis of design for TVL's initial production train, including:

· A nameplate production capacity of 25,000 tonnes per annum of battery-grade lithium hydroxide monohydrate.

· A refined capital cost estimate of US$243.6 million, consistent with TVL's previously communicated capital framework.

· An updated operating cost estimate of US$33.2 million per annum, reflecting optimisation of energy consumption, reagent usage, and maintenance strategy.

· A developed process flowsheet, plot layout, equipment list, and execution plan suitable for progression into detailed engineering and construction

This process design is based on Veolia's proven, industrially deployed technology and is configured to act as a merchant refinery, providing enhanced feedstock flexibility and supply security.

Alkemy Chairman, Paul Atherley, added:

"We are delighted with the work done by Vikki and the team with Veolia and Wave International and a number of local contractors in completing a FEED study which has clearly demonstrated that a Teesside based merchant Lithium refinery can be both world class in scale and also internationally highly competitive. The low capital costs and strong economics underpinned by tier one offtake partners puts the company in a strong position to complete the financing and move to FID in the very near future."

Tees Valley Lithium CEO, Vikki Jeckell, added:

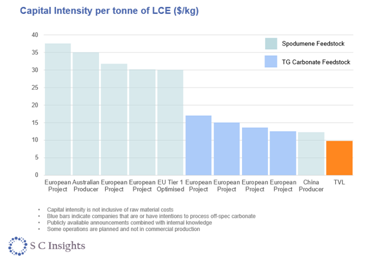

"The FEED work has provided the level of definition required to progress confidently towards Final Investment Decision, while maintaining a disciplined focus on capital efficiency, operating cost control, and deliverability. Independent benchmarking from SC Insights confirms the project's competitive cost position relative to peer European developments, and site ownership further enhances long-term cost certainty and execution confidence."

Site Control and Infrastructure Strategy

The FEED outcomes are underpinned by Alkemy selecting to purchase rather than lease the industrial plot for the TVL facility3, which will support both the initial production train and future expansion phases. Site ownership provides long-term control over the project footprint, reduces lifecycle cost exposure, and removes rental escalation and lease renewal risk over the operating life of the facility.

The site configuration and engineering design incorporate defined boundary connections to power, water, and other essential utilities, enabling efficient integration with existing industrial infrastructure while limiting capital requirements. This approach supports a capital-efficient development strategy, reduces execution and schedule risk during construction and commissioning, and provides a stable platform for long-term operations and expansion.

Project Economics

The FEED programme has enabled TVL to develop a defined economic model for the initial production train, reflecting the refined capital and operating cost estimates, site ownership, infrastructure strategy, and previously announced commercial arrangements.

Based on the FEED outcomes, the project economics for the initial production train demonstrate a robust and competitive financial profile, with attractive cash generation and returns across lithium price cycles.

A summary of the key project economic metrics derived from the FEED work is set out below.

Base Case Financials FEED Study | |

Revenue4,5 US $M/a | $99.1 |

EBITDA US $M/a | $65.9 |

Total CAPEX US $M | $243.6 |

Total annual OPEX US $M | $33.2 |

TVL notes that the project economics are supported by the previously announced binding offtake agreement covering up to 40% of initial production capacity, as well as independent third-party benchmarking of capital and operating costs.

Design for Delivery and Cost Discipline

The facility has been engineered using a modular, plug-and-play design philosophy, enabling:

· Simplified construction sequencing and reduced interface risk;

· Early procurement of long-lead equipment; and

· Reduced on-site construction intensity through off-site fabrication and modular assembly.

The FEED outcomes reflect a disciplined approach to capital and operating cost control, with project layout, infrastructure strategy, and operating philosophy designed to minimise fixed overheads while maintaining product quality, reliability, and operational resilience. Based on the current construction execution plan, the project is expected to require approximately 450,000 direct field man-hours, supporting an average on-site workforce of approximately 100 personnel per day over the build programme.

Independent Cost Benchmarking

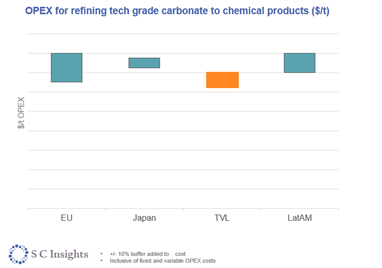

As part of the FEED programme, TVL worked with independent third-party analysis from SC Insights assessing the projected capital and operating cost position of TVL's refinery to comparable lithium refining projects both in Europe and globally.

Based on this analysis, TVL's projected capital intensity per tonne of LCE is positioned at the lower end of the global cost curve and materially below that of comparable European lithium refining projects. The benchmarking indicates that TVL's capital intensity compares favourably not only against European peer developers but also against established producers, reflecting the benefits of site ownership, infrastructure integration, modular design, and the use of proven process technology.

In addition, SC Insights' analysis of operating costs for refining technical-grade lithium carbonate indicates that TVL's projected operating cost profile is among the lowest in the regions assessed, with operating costs materially below those observed in Europe and Japan and competitive with lower-cost regions globally.

The benchmarking assessment is based on publicly available disclosures from lithium refining projects and producers, supplemented by SC Insight's internal industry knowledge and adjusted for feedstock type, process route, project maturity, and regional cost structures.

LIB Supply Chain Specialist of SC Insights, Jon Mulcahy, commented:

"Lithium-ion battery value chains are a core platform industry underpinning 21st-century industrial development. Completion of the FEED study during a cyclical slowdown has left TVL well-placed to move forward in a market which has seen prices increase over 100% in the past two months. Given the acute shortage of lithium conversion capacity in the UK and Europe, TVL represents a strategically important project, enhancing supply-chain resilience while reducing dependence on imported materials."

Commercial Positioning and Offtake

As previously announced, TVL has secured a binding offtake agreement covering up to 40% of the initial production capacity with a wholly owned subsidiary of Glencore Plc, a major participant in the global battery materials supply chain. The FEED outcomes confirm TVL's ability to meet the product quality, volume, and delivery requirements associated with this agreement.

Next Phase

With the FEED programme having established a robust technical and commercial foundation, the Company is progressing final project financing, contractor engagement, and remaining regulatory and permitting activities in parallel, with the objective of advancing the project to Final Investment Decision.

1. Publicly announced European cell capacity by 2030 as of October 2025.

2. Based on 0.8kg LCE per KWh.

3. Further details relating to the land asset will be released in accordance with regulatory disclosure.

4. Based on a long-term battery-grade lithium hydroxide index price of $20,000 per tonne

5. Revenue is based on an effective processing fee per tonne of LHM

Further information

For further information, please visit Alkemy's website: www.alkemycapital.co.uk or TVL's website www.teesvalleylithium.co.uk.

-Ends-

Alkemy Capital Investments Plc

| Tel: 0207 317 0636 |

Zeus Capital | Tel: 0203 829 5000 |

ABOUT US

Alkemy Capital Investments plc: Alkemy is focused on the development of critical mineral infrastructure to support the global energy transition. Through its wholly owned subsidiary, TVL, Alkemy is leading the way in establishing Europe's first independent lithium hydroxide refinery.

Tees Valley Lithium Limited: TVL is dedicated to providing battery-grade lithium chemicals to meet the growing demand of the electric vehicle supply chain in Europe. Strategically located at in Teesside, TVL is committed to sustainable, efficient, and world-class operations.

Forward Looking Statements

This news release contains forward‐looking information. The statements are based on reasonable assumptions and expectations of management and Alkemy provides no assurance that actual events will meet management's expectations. In certain cases, forward‐looking information may be identified by such terms as "anticipates", "believes", "could", "estimates", "expects", "may", "shall", "will", or "would". Although Alkemy believes the expectations expressed in such forward‐looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those projected. In addition, factors that could cause actual events to differ materially from the forward-looking information stated herein include changes in market conditions, changes in metal prices, general economic and political conditions, environmental risks, and community and non-governmental actions. Such factors will also affect whether Alkemy will ultimately receive the benefits anticipated pursuant to relevant agreements. This list is not exhaustive of the factors that may affect any of the forward‐looking statements. These and other factors should be considered carefully, and readers should not place undue reliance on forward-looking information.

Related Shares:

Alkemy Capital.