7th Aug 2025 07:00

7 August 2025

Aterian Plc("Aterian" or the "Company")

Three new licences in the Kalahari Copperbelt

Aterian Plc (LSE: ATN), the Africa-focused critical minerals exploration and development company, is pleased to announce a significant expansion of its high-potential copper and silver exploration portfolio following the award of three new Prospecting Licences ("PLs") in the world-renowned Kalahari Copperbelt ("KCB"), located in the Republic of Botswana ("Botswana"). The PLs are held by the Company's 90%-owned subsidiary, Atlantis Metals (Pty) Ltd ("Atlantis"), and target sediment-hosted copper and silver ("Cu-Ag") mineralisation. The licences are in a region attracting strong global interest from major copper exploration and mining companies.

Highlights:

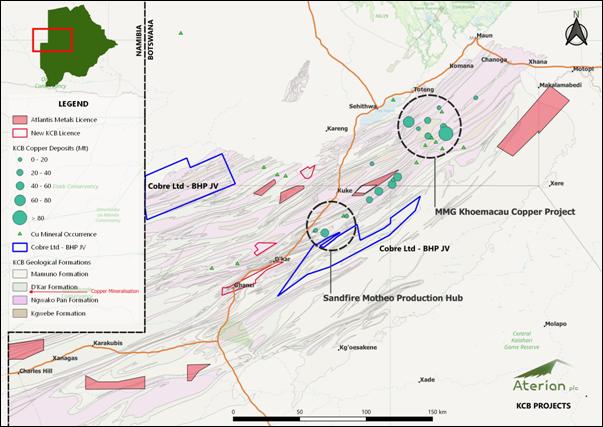

· 3 Prospecting Licences awarded to the Company's subsidiary, Atlantis Metals, covering an area of 329.16 km².

· 2 licences lie to the southwest of the Motheo production hub owned by Sandfire Resources.

· Significant KCB portfolio expanded to 10 licences covering an aggregate of 2,298.34 km².

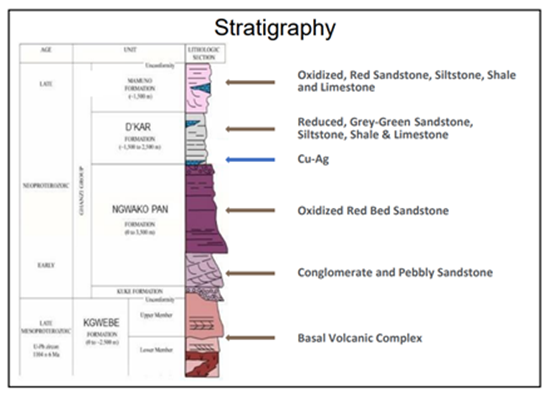

· The licences target the lower D'Kar Formation, a proven host for world-class sediment-hosted copper-silver (Cu-Ag) deposits, positioning Aterian at the forefront of the region's discovery potential.

· Several historic copper-in-soil geochemical anomalies reported.

· Botswana remains a top-ranked mining jurisdiction, offering a stable, mining-friendly environment crucial for value creation.

Aterian Chairman, Charles Bray, commented,

"This strategic expansion represents a meaningful step in enhancing portfolio value for our shareholders. By increasing our presence in the Kalahari Copperbelt, Aterian gains exposure to one of the world's most prospective copper-silver regions. With copper demand accelerating due to the global energy transition, Aterian is strongly positioned to advance these exploration assets and contribute to the future supply of critical metals. We remain focused on advancing our portfolio and pursuing strategic partnerships or transactions that have the potential to deliver significant value for our shareholders."

Portfolio now increased to 10 licences in the Kalahari Copperbelt

The three new prospecting licences, covering a total area of 329.16 km², are granted for an initial three-year term and can be renewed twice thereafter for an additional two years per renewal. Upon each renewal, 50% of the licence area must be relinquished. The KCB portfolio now comprises 10 PLs covering a total area of 2,298.34 km2. The licences target the highly prospective lower D'Kar Formation, known to host regionally significant Cu-Ag deposits. Two of the licences lie to the southwest of Sandfire Resources' Motheo production hub. The third licence, located towards the northern margin of the KCB, has several historically reported copper-in-soil geochemical anomalies from work completed by MOD Resources prior to its acquisition by Sandfire Resources in 2019 for AS$167 million.

Next Steps for the New Licences

An independent consultancy is currently acquiring historical airborne geophysical raw line data for the new licences to reprocess this information for Atlantis. This effort is expected to improve our understanding of the underlying geological formations. By mapping the contact between the D'Kar Formation and the underlying red beds of the Ngwako Pan Formation through geophysical interpretation, we aim to generate more accurate targets.

The Kalahari Copperbelt - A Significant Investment Opportunity

The Kalahari Copperbelt in Botswana is emerging as a highly attractive region for copper exploration and investment due to a compelling combination of geological potential, a favourable investment climate, and improving infrastructure. The key investment criteria are:

Exceptional Geological Potential | World-Class Sediment-Hosted Deposits | The KCB hosts significant sediment-hosted copper-silver deposits, like those found in the Central African Copperbelt, with over 8 million tonnes of identified contained copper. |

Underexplored, Under Cover

| Much of the KCB is covered by Kalahari sands, which have complicated exploration in the past. However, advancements in techniques such as airborne geophysics and seismic surveys now enable companies to identify previously hidden deposits, creating significant opportunities for new discoveries. | |

Key Mineralisation Targets | Copper-silver mineralisation is commonly located at the base of the D'Kar Formation, especially at its contact with the Ngwako Pan Formation. Exploration targets these geological contacts, frequently linked to fold hinges and structures that enabled the flow of mineralising fluids. | |

Presence of Giant Deposits | The KCB hosts one of only seven global "giant" sediment-hosted copper deposits, including MMG's Zone 5 deposit. | |

Favourable Investment Climate in Botswana | Political Stability | Botswana is one of Africa's most politically stable and secure countries, making it crucial for long-term mining investments. |

Supportive Mining Policies | The Botswanan government has demonstrated a pro-mining stance, actively promoting diversification of its economy beyond diamonds through targeted exploration of critical minerals. It consistently ranks high in the Fraser Institute's Annual Survey of Mining Companies for investment attractiveness. | |

Recent Major Acquisitions and Investments | The KCB has garnered significant international interest and investment, indicating strong confidence in its potential. Key developments include: · China's MMG Ltd acquired the Khoemacau Copper Mine in 2024 for US$1.73 billion, with an additional US$700 million planned to double output. · BHP invested up to $25 million in Cobre Limited in March 2025 for exploration, including seismic surveys and deep diamond drilling. | |

Improving Infrastructure | Developing Power Grid | The North-West Transmission Grid Project, commissioned by Botswana Power Corporation (BPC), aims to provide reliable power to mining operations in the KCB, addressing essential infrastructure needs for large-scale mining. |

Enhanced Accessibility | The previously remote region is now more accessible, thanks to paved roads that connect it to major towns like Gaborone and Maun, as well as to Namibia. Maun also has an international airport for logistics. | |

Strategic Importance of Copper | Global Demand | Copper is vital for the global energy transition, as it is crucial for electric vehicles and renewable energy systems. The rising demand for copper makes underexplored resource regions highly attractive. |

Diversification for Botswana | Botswana's renewed exploration interest in the KCB helps diversify its mining economy beyond diamonds, promoting industrialisation and new value chains. |

Aterian's Strategy

Aterian's strategy focuses on developing high-potential critical mineral assets in Africa, transforming early-stage opportunities into valuable, low-risk projects. By leveraging regional expertise and adopting a disciplined approach to acquisition and development, Aterian aims to maximise the economic potential of its portfolio while adapting to market cycles.

The Company is seeking partnerships or divestments with global operators and investors who require secure access to essential metals for the energy transition, including copper, lithium, and other battery metals.

The Kalahari Copperbelt

The Kalahari Copperbelt is one of the world's most prospective areas for yet-to-be-discovered sediment-hosted copper deposits (USGS, 2020) and hosts several large stratabound, sediment-hosted copper-silver deposits.

The KCB is a northeast-trending Meso- to Neoproterozoic belt that occurs discontinuously from western Namibia and stretches into northern Botswana along the northwestern edge of the Paleoproterozoic Kalahari Craton. It is approximately 1,000 km long and up to 250 km wide, containing copper-silver mineralisation that is generally stratabound and hosted in metasedimentary rocks, which have been folded, faulted, and metamorphosed to greenschist facies during the Damara Orogeny. Typically, the deposits comprise stratabound, disseminated, and structurally controlled ore bodies that are 5 to 40 m thick and have strike lengths of 1.5 to 4 km. The main target for copper mineralisation lies towards the base of the D'Kar Formation, near the contact with the underlying red beds of the Ngwako Pan Formation.

(Source: https://www.geologyforinvestors.com/khoemacau-africas-newest-copper-silver-mine)

- ENDS -

This announcement contains information which, prior to its disclosure, was inside information as stipulated under Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations 2019/310 (as amended).

Engage with the Aterian PLC management team directly by asking questions, watching video summaries, and seeing what other shareholders have to say. Navigate to our interactive investor hub here: https://aterianplc.com/s/fcf8eb

For further information, please contact:

Investor questions on this announcement We encourage all investors to share questions on this announcement via our investor hub |

https://aterianplc.com/s/fcf8eb |

Aterian Plc:

Charles Bray, Executive Chairman - [email protected]

Simon Rollason, Director - [email protected]

Financial Adviser and Joint Broker:

Novum Securities Limited

David Coffman

Colin Rowbury

Tel: +44 (0)207 399 9400

Joint Broker:

SP Angel Corporate Finance LLP

Ewan Leggat / Adam Cowl

Tel: +44 (0)203 470 0470

Financial PR:

Bald Voodoo - [email protected]

Ben KilbeyTel: +44 (0)7811 209 344

Subscribe to our news alert service: https://atn-l.investorhub.com/auth/signup

Notes to Editors:

About Aterian plc

www.aterianplc.com

Aterian plc is an LSE-listed exploration and development company with a diversified African portfolio of critical metals projects.

Aterian plc is actively seeking to acquire and develop new critical metal resources to strengthen its existing asset base while supporting ethical and sustainable supply chains as the world transitions to a sustainable, renewable future. The supply of these metals is vital for developing the renewable energy, automotive, and electronic manufacturing sectors, which are increasingly important in reducing carbon emissions and meeting global climate ambitions.

The Company has entered into a joint venture agreement with Rio Tinto Mining and Exploration Limited. Rio Tinto are earning into the HCK project in southern Rwanda, exploring and developing a lithium-tantalum-niobium-tin mining operation. The Company also holds an exploration licence in Rwanda. Aterian has a portfolio of multiple copper-silver (+ gold) and base metal projects in Morocco. Aterian holds a 90% interest in Atlantis Metals. This private, Botswana-registered company holds ten mineral prospecting licences for copper-silver in the world-renowned Kalahari Copperbelt and three for lithium brine exploration in the Makgadikgadi Pans region.

The Company's strategy is to seek new exploration and production opportunities across the African continent and to develop new sources of critical mineral assets for exploration, development, and trading.

Related Shares:

Aterian Plc