15th Apr 2025 07:00

Greatland Gold plc (AIM: GGP)

Greatland Gold plc (AIM: GGP)

W: https://greatlandgold.com

: twitter.com/greatlandgold

: twitter.com/greatlandgold

NEWS RELEASE | 15 April 2025

Telfer Ore Reserve, 2-Year Outlook and Havieron expansion

Initial Greatland Telfer Ore Reserve delivers 712koz gold and 23kt copper

Telfer 2-Year Outlook to extend dual-train production through FY27, bridging any 'gap' to Havieron production

Integrated Havieron and Telfer production expected to commence during FY28 and result in a step change cost reduction and sustained higher volume production

Havieron Feasibility Study to assess mining rate expansion from2.8Mtpa to 4.0 - 4.5Mtpa, an increase of 43% - 60%

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED UNDER THE UK MARKET ABUSE REGULATIONS. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

Greatland Gold plc (AIM:GGP) (Greatland or the Company), is pleased to provide this initial Greatland Ore Reserve and updated 2-year outlook for the Telfer gold-copper mine (Telfer).

Highlights

Updated Telfer 2-Year Outlook1,2

§ Updated Telfer 2-Year Outlook follows less than five months after Greatland's acquisition and extends pre-acquisition mine plan by a further 18 months through FY27, before integrated Telfer and Havieron production is expected to begin in FY283.

§ Telfer 2-Year Outlook expected to be further refined and optimised as Greatland continues to progress and evaluate Telfer opportunities, including based on the results from current drilling programs and ongoing optimisation work.

§ Dual train production to continue with annual average production of 280 - 320koz of gold plus 7 - 11kt of copper.

§ Annual production target and costs outlook (Telfer 2-Year Outlook):

| FY26 | FY27 | Average |

Production (koz Au) | 300 - 340 | 260 - 300 | 280 - 320 |

Production (kt Cu) | 9 - 13 | 5 - 9 | 7 - 11 |

AISC4 (A$/oz) | 2,400 - 2,600 | 2,750 - 2,950 | - |

§ Bridges any previously perceived 'gap' before Havieron production is expected to begin during FY283, avoiding the need to idle infrastructure and ensuring operational and workforce continuity.

§ Telfer AISC expected to increase in FY27 as more mined inventory is processed (vs. stockpiled ore), however there is potential for improvement if higher grade ore sources are confirmed and/or costs are further optimised.

§ Havieron ore processing is expected to begin during FY283, augmenting production with high grade ore feed and creating a step change reduction in AISC. Telfer outlook beyond the two-year current outlook period to FY27 is supported by a further year of mining from the West Dome Open Pit Stage 7 Extension plus 19Mt of LG Stockpiles (Ore Reserves). Refer to 'Outlook from FY28' below.

§ Continued high volume gold production from Telfer into a strong gold price environment is expected to generate significant cash flow, further strengthening Greatland's robust balance sheet and de-risking the funding to complete Havieron's development.

§ Greatland intends to continue downside price protection through gold put options, while maintaining full upside exposure to the gold price. A significant proportion of anticipated CY25 - CY26 gold production is already protected with put options:

Quarter End Date | Gold Volumes Under Put Options (koz) | Weighted Average Strike Price (A$/oz) |

30-Jun-2025 | 46,302 | 3,905 |

30-Sep-2025 | 38,910 | 3,905 |

31-Dec-2025 | 30,792 | 3,905 |

31-Mar-2026 | 37,502 | 4,200 |

30-Jun-2026 | 37,502 | 4,200 |

30-Sep-2026 | 37,502 | 4,200 |

31-Dec-2026 | 37,498 | 4,200 |

Total | 266,008 | 4,071 |

§ Production Target:

‒ The updated Telfer 2-Year Outlook comprises inventory from the currently active West Dome Open Pit and Main Dome Underground, ROM stockpiles and LG stockpiles. Refer to 'Inventory sources' section below.

‒ The Telfer 2-Year Outlook is a Production Target, based on inventory comprising 79% Measured / Indicated Resource, 16% Inferred Resource, 5% Exploration Target (aggregate for FY26 - FY27).1

‒ Cautionary statement: There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the Production Target itself will be realised. The potential quantity and grade of an Exploration Target is conceptual in nature, there has been insufficient exploration to determine a Mineral Resource and there is no certainty that further exploration work will result in the determination of Mineral Resources or that the Production Target itself will be realised.

‒ The Telfer 2-Year Outlook is not intended as guidance. Greatland will announce guidance annually each financial year. FY26 guidance is expected to be announced following the conclusion of FY25.

§ Resource conversion: Greatland considers there is a high likelihood of substantial conversion of Inferred Resource and unclassified mineralisation inventory within the Telfer 2-Year Outlook into Indicated Resource, on the basis that:

‒ Telfer mine has operated for over 40 years, with the orebodies well understood.

‒ Historical conversion rates at Telfer are supportive of high percentage of Mineral Resource converting to Ore Reserves.

‒ Inferred and unclassified inventory is sourced from extensions to currently active mining areas (West Dome Open Pit and Main Dome Underground).

‒ Over 23,000 metres of drilling has been completed since December 2024, targeting the Inferred Resource and unclassified mineralisation included in the Telfer 2-Year Outlook inventory, with further drilling in progress.

Outlook from FY28

§ Havieron production: First gold production from Havieron is expected during FY283, augmenting Telfer production with high grade ore feed and expected to result in a step change reduction in AISC per ounce and sustained higher volume production:

‒ Ore Reserve grade: 25Mt at 3.0g/t Au & 0.44% Cu

‒ Indicated Resource grade: 50Mt at 2.6g/t Au & 0.33% Cu

‒ Exceptional ounce per vertical metre profile (OPVM)5:

§ First 300 vertical metres of ore body averaging >9,150 OPVM

§ 1,000 vertical metres of ore body averaging >7,900 OPVM

Driving globally lowest quartile Havieron AISC4,6.

§ Havieron expansion: Feasibility Study assessing an expanded mining rate of 4.0 - 4.5Mtpa (refer below).

§ Telfer growth and extension: Opportunities for further growth and extension of Telfer production substantially beyond FY27 include:

‒ Further year of planned mining from West Dome Open Pit Stage 7 Extension.

‒ 19Mt LG Stockpiles (Ore Reserves) remaining in July 2027.

‒ Additional residual Telfer Mineral Resources contained within:

§ West Dome Open Pit: potential southern and central extensions; and

§ Main Dome Underground: lower mine extensions (LLU, B30, Kylo).

‒ Main Dome underground:

§ Eastern stockwork corridor (ESC) extensions (near mine opportunity); and

§ Vertical stockwork corridor (VSC) (bulk, long life opportunity).

‒ West Dome Underground Project:

§ New high grade, underground potential mine area below the West Dome Open Pit, accessible from current Main Dome Underground infrastructure.

§ Second phase underground drilling campaign planned to commence in June 2025 quarter targeting infill of existing mineralisation and continued extensions along strike and down dip, to support definition of an inaugural Mineral Resource estimate.

§ Development of a second development drive from Main Dome Underground to West Dome Underground commenced in March 2025 quarter.

‒ Main Dome Open Pit: East ramp cutback to be evaluated during 2025, along with further extension opportunities.

Havieron expansion being assessed by Feasibility Study

§ Havieron Feasibility Study design criteria has been finalised, the study will assess an initial mining rate (post ramp-up) of 2.8Mtpa, increasing to between 4.0Mtpa - 4.5Mtpa by development of an underground crusher and material handling system.

§ Increased mining rate has the potential to be highly value accretive with existing Telfer infrastructure and processing capacity already in place, and limited expansions or upgrades required to planned Havieron site infrastructure.

§ Expansion is expected to be largely self-funded from anticipated future Havieron cash flows.

§ Feasibility Study targeted for completion in H2 CY2025.

Ore Reserves as at 31 December 2024:

§ Initial Greatland Telfer Ore Reserves as at 31 December 2024:

‒ 46.1Mt @ 0.48g/t Au and 0.05% Cu for 712koz Au and 23kt Cu, comprising:

§ West Dome Open Pit: 14.2Mt @ 0.60g/t Au & 0.05% Cu for 273koz Au & 8kt Cu.

§ Stockpiles (ROM): 9.6Mt @ 0.68g/t Au & 0.07% Cu, for 209koz Au & 6kt Cu.

§ Stockpiles (LG): 20.3Mt @ 0.33g/t Au & 0.04% Cu, for 215koz Au & 9kt Cu.

§ Dump leach (DL): 2.0Mt @ 0.23g/t Au, for 15koz Au.

‒ Further growth potential: Ore Reserve prepared on schedule in preparation for the Company's upcoming ASX listing, 19 weeks since completion of the Telfer acquisition and four weeks after Greatland's inaugural Telfer Mineral Resource estimate, assessing only the West Dome Open Pit Stage 7 Cutback and Stage 2 Extension mining areas. Further West Dome Open Pit extensions and Main Dome Underground areas contained in the 2024 Group Mineral Resource to be assessed in future Ore Reserve updates.

§ Group Ore Reserves (including Havieron) increased to 71.0Mt @ 1.36g/t Au and 0.19% Cu for 3.1Moz Au and 132kt Cu

‒ Havieron growth potential: The Havieron Ore Reserve, last updated in March 2022, is currently 24.9Mt @ 2.98g/t Au and 0.44% Cu for 2.4Moz Au and 109kt Cu.

‒ The Havieron Indicated Mineral Resource now 50Mt @ 2.60g/t Au and 0.33% Cu, for 4.2Moz Au and 165kt Cu, has grown by 1.1Moz (contained gold) since the last Ore Reserve update. This considerable additional Indicated Resource will be considered when the Havieron Ore Reserve is next updated in the Havieron Feasibility Study, targeted for completion in H2 CY2025.

Notes:

1. The updated Telfer 2-Year Outlook is a Production Target, refer to the cautionary statement above. All material assumptions on which the Telfer 2-Year Outlook is based are detailed in the Material Information Summary included in this announcement and in the technical information included in Appendix 1. While the Company considers all the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct.

2. Telfer 2-Year Outlook is a sub-set of a longer life mine plan for Telfer. Greatland expects Havieron production to begin during FY283, augmenting Telfer production. As the Havieron Feasibility Study remains in progress no allowance for production estimates or associated capital expenditure for Havieron has been included in this Telfer 2-Year Outlook. After the Havieron Feasibility Study has been completed, Greatland will be in a position to update the market on the outlook for integrated Telfer and Havieron operations.

3. Subject to completion of the Feasibility Study, FID and receipt of required permits and approvals within expected timeframes. The Havieron Feasibility Study will include an executable project schedule.

4. All-in sustaining cost (AISC) is stated per ounce of gold produced, net of by-product (copper) credits. AISC excludes inventory movements which mainly relate to stockpiles acquired as part of the Telfer acquisition at 4 December 2024.

5. Refer to Greatland's announcement of 21 December 2023 titled 'Havieron Mineral Resource Estimate Update'.

6. Havieron stand-alone AISC. Refer to the 'Greatland Base Case' for Havieron in the Company's Admission Document dated 10 September 2024 which assessed a Havieron mining rate of 2.8Mtpa and indicated globally lowest quartile AISC. Greatland continues to progress the Havieron Feasibility Study, targeted for completion in H2 CY2025, which will refine the base case, incorporate optimisation opportunities to the extent they are identified and validated, and define an executable project schedule and capital expense estimate. The Company's expectation is that globally lowest quartile AISC will be indicated by the Feasibility Study, however there is no certainty that this will prove to be correct.

Greatland Managing Director, Shaun Day, commented:

"Greatland has made a tremendous start to our ownership of Telfer, producing over 90,000 ounces of gold and generating over A$250 million in free cash flow in the March 2025 quarter.

"When we acquired Telfer, we set out an initial mine plan of 15 months together with a number of opportunities we had identified during acquisition due diligence to extend that plan. Alongside continued safe and profitable production, Telfer mine life extension is our key objective.

"After only five months since the acquisition, this initial updated Telfer outlook already provides for a substantial 18-month extension of dual train processing at Telfer through FY27, expected to deliver on average 280,000 - 320,000 ounces of gold (plus copper) per annum over the next two years, with opportunities to further augment this as we continue to optimise our initial mine planning.

"The Telfer Ore Reserve and updated outlook are the result of a tremendous amount of work by our team in due diligence and the short time since the acquisition. The 2-year outlook demonstrates the extension of Telfer production and closing of any previously perceived 'gap' before Havieron production.

"This is an excellent financial outcome that allows us to reinvest in Telfer and provides us the confidence that completion of Havieron's development can be funded by existing cash, future Telfer cashflows and debt finance. Importantly, it means operationally that we can maintain our workforce and infrastructure for first gold from Havieron.

"Augmenting production with high grade Havieron ore feed, expected to begin during FY28, is expected to result in a step change reduction in AISC and sustained higher volume annual production. Havieron is a world-class ore body with exceptional ounces per vertical metre, resulting in excellent cost efficiency.

"Additionally, the Havieron Feasibility Study will assess a significantly expanded Havieron mine, increasing from an initial (post ramp-up) 2.8Mtpa mining rate up to between 4.0 - 4.5Mtpa, by development of an underground crusher and material handling system. This expansion is expected to be highly value accretive and potentially self-funded from initial Havieron production. We look forward to delivering the Feasibility Study in H2 CY2025."

Telfer 2-Year Outlook

The Telfer 2-Year Outlook is a Production Target extending Telfer production through FY27, with annual average production for FY26 to FY27 of 280 - 320koz Au and 7 - 11kt Cu.

Production target and costs outlook

Table 1: Summary of updated Telfer 2-Year Outlook production target and cost outlook

| FY26 | FY27 | Average |

Inventory processed (Mt) | 17.0 - 17.5 | 17.0 - 17.5 | 17.0 - 17.5 |

Production Au (koz) | 300 - 340 | 260 - 300 | 280 - 320 |

Production Cu (kt) | 9 - 13 | 5 - 9 | 7 - 11 |

AISC (A$/oz) | 2,400 - 2,600 | 2,750 - 2,950 | - |

Growth capital (A$m) - Telfer | 80 | - | - |

Notes to Table 1:

1. All-In Sustaining Cost (AISC) is stated per ounce of gold produced, net of by-product (copper) credits. AISC excludes inventory movements which mainly relate to stockpiles acquired as part of the Telfer acquisition at 4 December 2024. Major TSF construction works are included in growth capital to set the facilities up for long term production.

2. The updated Telfer 2-Year Outlook is a Production Target, based on inventory comprising 79% Measured / Indicated Resource, 16% Inferred Resource, 5% Exploration Target (aggregate for FY26 - FY27). Refer to the cautionary statement above in the Highlights summary.

3. Processing configuration: Updated Telfer 2-Year Outlook assumes dual train processing (utilising both of Telfer's two 10Mtpa nominal capacity processing trains) at an annual rate of approximately 17.0 - 17.5Mtpa.

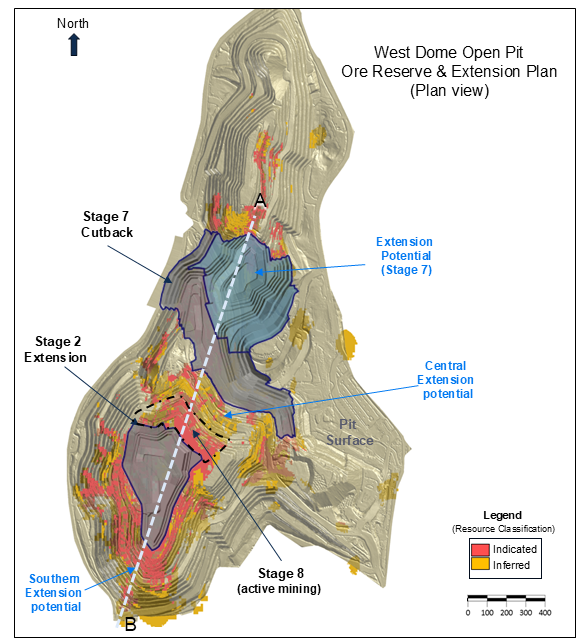

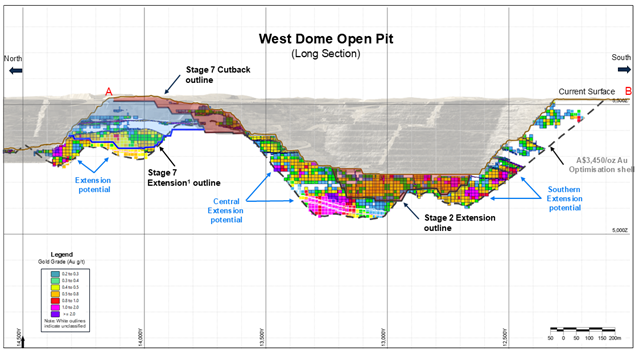

4. Inventory sources are illustrated in Table 2 and Figures 1 - 3 below.

5. Material assumptions on which the Telfer 2-Year Outlook is based are detailed in the Material Information Summary included in this announcement and in the technical information included in Appendix 1. While Greatland considers all the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct.

6. As the Havieron Feasibility Study remains in progress, no allowance for production estimates or associated capital expenditure has been included in this Telfer 2-Year Outlook.

Annual operations commentary

FY26: Total inventory processed of 17.3Mt, comprising a base-load of West Dome Open Pit inventory (both mined and ROM stockpiles) supplemented by Main Dome Underground inventory. ROM stockpiles acquired through the Telfer acquisition are fully utilised.

FY27: Total inventory processed of 17.3Mt, comprising a base-load feed of West Dome Open Pit inventory (mined), supplemented by Main Dome Underground inventory and LG stockpiles. The AISC increases as Greatland incurs mining costs for a larger proportion of processed inventory.

The outlook for FY26 - FY27 is expected to be further refined and optimised as Greatland continues to progress and evaluate Telfer opportunities, including based on the results from current drilling programs and ongoing optimisation work.

FY28+:

§ Havieron production: Processing and production from high grade Havieron ore feed is expected to commence during FY28. Havieron production is expected to result in substantially reduced AISC per ounce and sustained high volume production. Refer to the 'Havieron' section below for further details.

§ Havieron expansion: Feasibility Study is assessing an initial mining rate (post ramp-up) of 2.8Mtpa, increasing to between 4.0Mtpa - 4.5Mtpa by development of an underground crusher and material handling system. Refer to the 'Havieron' section below for further details.

§ Telfer growth and extension: Potential to bring in further mining inventory with the integrated production of Telfer and Havieron, including:

‒ 19Mt of LG stockpiles (Ore Reserves).

‒ Continuation of Stage 7 Extension (Figure 1 & 2 below) for further year post FY27.

‒ Further extension and growth opportunities in the West Dome Open Pit (southern and central extensions).

‒ Main Dome Underground and West Dome Underground opportunities.

Refer to 'Telfer growth opportunities' section below for further details.

Inventory sources

The updated Telfer 2-Year Outlook comprises inventory from the following sources (refer Table 2 and Figures 1 - 3).

Table 2: Inventory sources (Telfer 2-Year Outlook, FY26 - FY27)

Potential inventory source | Description / status | In Telfer 2-Year Outlook? |

West Dome Open Pit (refer Figures 1 and 2) | ||

Stage 8 | Current active mining area | ✔ |

Stage 2 | Current active mining area | ✔ |

Stage 7 Cutback | Ore Reserve, approved and commenced mining March Q 25 | ✔ |

Stage 2 Extension | Ore Reserve, approved and continuation of Stage 2 | ✔ |

Stage 7 Extension | East expansion of the Stage 7 Cutback, drilling underway | ✔ 1 |

Central Extension | Large potential cutback to north of Stage 2 Extension | - |

South Extension | Large potential cutback to south of West Dome Open Pit | - |

Main Dome Open Pit | Exploration target, historical mining area | - |

Main Dome Underground (refer Figure 3) | ||

M-Reefs | Current active mining area | ✔ |

A-Reefs | Current active mining area | ✔ |

Rey | Current active mining area | ✔ |

ESC | Exploration Target, drilling underway | ✔ |

LLU | Near mine high confidence Mineral Resource | ✔ |

VSC | Large multi-year underground sublevel cave potential | - |

West Dome Underground | New potential underground mining area | - |

Stockpiles | ||

ROM | 9.6Mt at 0.68g/t Au and 0.07% Cu at 31 Dec 2024 | ✔ |

LG | 20.3Mt at 0.33g/t Au and 0.04% Cu at 31 Dec 2024 | ✔ 2 |

Havieron Underground | Havieron production expected to commence during FY28. Feasibility Study will assess an initial mining rate (post ramp-up) of 2.8Mtpa, increasing to between 4.0 - 4.5Mtpa | - |

Notes to Table 2:

1. Updated Telfer 2-Year Outlook includes only a portion of the West Dome Open Pit Stage 7 Extension, with this cutback planned to extend a further year of mining beyond FY27.

2. Updated Telfer 2-Year Outlook includes only 1.1Mt of LG Stockpiles, with ~19Mt of further LG Stockpiles (Ore Reserves) expected to remain at the beginning of FY28.

Figure 1: Telfer 2-Year Outlook mining areas (West Dome Open Pit, Plan View)

Figure 2: Telfer 2-Year Outlook mining areas (West Dome Open Pit, Long Section)

Notes to Figures 1 and 2:

1. Stage 2 Extension and Stage 7 Cutback areas (shaded red) are included in the 2024 Telfer Ore Reserve and approved for mining. Mining of Stage 7 Cutback commenced in the March 2025 Quarter.

2. Stage 7 Extension (shaded blue) sits within the current site LOM plans and is a natural progression of the Stage 7 Cutback mining area, removing the entire saddleback between northern and southern parts of West Dome Open Pit. This cutback extends a further year from July 2027, and as such a significant portion is not included in the 2 Year Outlook. Drilling is currently underway.

Figure 3: Telfer 2-Year Outlook mining areas (Main Dome Underground)

Classification

The classification of inventory in the updated Telfer 2-Year Outlook is shown in Figure 4 below.

In aggregate for FY26 to FY27 the Telfer 2-Year Outlook comprises 79% Measured / Indicated Resource, 16% Inferred Resource, and 5% Exploration Target.

Figure 4: Telfer 2-Year Outlook gold production by JORC Classification (percentage, FY26 - FY27)

The estimated Ore Reserves, Mineral Resources and Exploration Targets underpinning the Telfer 2-Year Outlook have been prepared by Competent Persons in accordance with the requirements in the JORC Code. The Telfer 2-Year Outlook and the estimated Ore Reserves, Mineral Resources and Exploration Target underpinning them (as applicable) have been reviewed by SRK Consulting (Australasia) Pty Ltd (SRK), and SRK considers them to have been reported in accordance with guidelines and principles outlined in the 2012 edition of the Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code, 2012 edition). The Telfer 2-Year Outlook is a Production Target; refer to the cautionary statement above in the Highlights summary.

Physicals and Operating Cost Summary

Table 3: Telfer 2-Year Outlook summary physicals and operating costs for period FY26-27

Source | West Dome Open Pit | Main Dome Underground | Stockpiles (LG) | Total |

Mining | ||||

Waste (Mt) | 30.3 | 0.3 | - | 30.6 |

Inventory Mined (Mt) 1 | 25.4 | 3.4 | - | 28.8 |

Total (Mt) | 55.7 | 3.7 | - | 59.4 |

W:O Strip Ratio | 1.19 | - | - | - |

Milling | ||||

Inventory Milled (Mt)2,3 | 30.0 | 3.4 | 1.1 | 34.6 |

Milled Grade (g/t Au) | 0.52 | 1.46 | 0.33 | 0.61 |

Milled Grade (% Cu) | 0.05% | 0.31% | 0.04% | 0.07% |

Gold Recovery (%) | 84.7% | 90.6% | 78.5 % | 86.0% |

Copper Recovery (%) | 61.6% | 85.6% | 45.0% | 71.5% |

Gold recovered (koz Au)3 | 443 | 145 | 9 | 597 |

Copper recovered (kt Cu) | 9 | 9 | 0 | 18 |

Operating Costs (A$/t processed) | ||||

Mining | 19.5 | 123.0 | - | 29.1 |

Processing | 15.2 | |||

General and Administration | 4.8 | |||

AISC (A$/oz gold recovered)5 | 2,670 | |||

Notes to Table 3:

1. West Dome Open Pit Inventory Mined includes dump leach tonnes but does not include stockpiles rehandling tonnes

2. West Dome Open Pit Inventory Milled includes stockpiles tonnes but excludes dump leach tonnes

3. Inventory Milled does not include dump leach tonnes, however gold recovered includes recovered dump leach gold ounces

4. Normal pit and underground haulage cost, including rehandling on the ROM, is included in each area's mining costs. Rehandle cost for the LG stockpiles are included in the processing cost as it does not incur a mining cost.

5. All-in sustaining cost (AISC) is stated per ounce of gold produced, net of by-product (copper) credits. AISC excludes inventory movements which mainly relate to stockpiles acquired as part of the Telfer acquisition at 4 December 2024

Havieron

As the Havieron Feasibility Study remains in progress, no allowance for production estimates or associated capital expenditure for Havieron has been included in the Telfer 2-Year Outlook. After the Havieron Feasibility Study has been completed, Greatland will be in a position to update the market on the outlook for integrated Telfer and Havieron operations.

Processing of Havieron ore is expected to begin during FY28, augmenting Telfer production with high grade ore feed. The timing of commencement of Havieron gold production remains subject to completion of the Feasibility Study, final investment decision (FID) and receipt of required approvals and permits within expected timeframes. The Feasibility Study will include define an executable project schedule for Havieron.

Base case

Greatland's Admission Document dated 10 September 2024 set out a base case Havieron development and mine plan, reviewed and reported on in the Competent Person's Report contained in the Admission Document.

The Havieron base case demonstrated a compelling multi-decade Havieron mine plan, for:

§ Havieron to operate with a steady state mining throughput rate of 2.8Mtpa and average grade processed of 2.74g/t Au and 0.32% Cu;

§ Havieron ore to be processed through the Telfer processing facility, with utilisation of a single processing train through Telfer's Train 1 circuit at 750t/h, on a campaign basis at approximately 50% utilisation;

§ Havieron to produce on average 221koz Au annually during steady state operations, first 15 years;

§ a steady state operational period of 15 years, total mine life of 20 years, and total processing period of 19 years; and

§ first development ore production from Havieron in H2 2026, and first gold in H2 2027.

Expansion case

Greatland is currently completing the Feasibility Study for Havieron to refine the base case, incorporate optimisation opportunities to the extent they are identified and validated, and define an executable project schedule and capital expense estimate for the completion of Havieron's development.

Greatland is pleased to confirm that the Feasibility Study design criteria has been finalised, with the study to assess an initial mining rate of 2.8Mtpa (post ramp-up), increasing to between 4.0Mtpa - 4.5Mtpa by development of an underground crusher and material handling system (Expansion Case).

The Expansion Case remains subject to ongoing assessment in the Feasibility Study, however it is expected to be significantly value accretive for the following reasons:

§ Telfer infrastructure has sufficient capacity to process increased Havieron ore feed.

§ Planned haul road and infrastructure corridor between Telfer and Havieron does not need to be expanded to accommodate increased Havieron throughput.

§ Havieron site infrastructure only requires moderate expansion to accommodate increased throughput.

§ Development of the underground crusher and material handling system is expected to be largely self-funded from Havieron cash flows.

The Havieron Feasibility Study is in progress and due for completion in H2 CY2025. First production from Havieron is expected during FY28. While Greatland awaits the executable project schedule to be delivered as part of the Feasibility Study, de-risking of the project schedule through critical path analysis is being undertaken (including through the award of the early works package for blind bore ventilation shafts, as announced on 14 April 2025).

Telfer extension opportunities

There are a number of Telfer growth and extension opportunities outside the Telfer 2-Year Outlook, shown in Figure 5 below.

Figure 5: Telfer extension and growth opportunities

West Dome Open Pit

The evaluation of multiple extension opportunities within the active West Dome Open pit operations are continuing, with work to date identifying the Stage 7 Extension (part of which is included in the Telfer 2-Year Outlook, Central Extension and Southern Extension (Figure 5) as priority drilling areas.

West Dome Underground

The West Dome Underground Project (WDU) at Telfer is a high grade near-mine underground opportunity, below the West Dome Open Pit, accessible by an existing 1.9km exploration drive connecting it to the active Main Dome underground.

Results from the maiden underground drill program (announced on 20 February 2025) confirmed high grade mineralisation in the WDU is associated with the same geological units seen at the active Main Dome Underground. The drilling program's success supported the approval and commencement in the March 2025 quarter of a second 1.8km development drive from the Main Dome Underground to West Dome Underground.

The WDU is a priority drill area for Greatland with two underground diamond drill rigs mobilising to site to carry out an extensive infill and expansion program.

Main Dome Underground

The recently announced Telfer 2024 Mineral Resource (announced in March 2025) identified 5.6Mt @ 2.65g/t & 0.56% Cu of Indicated & 2.3Mt @ 2.55g/t & 0.39% Cu of Inferred Mineral Resources, all situated within the current Main Dome Underground footprint. Significant potential exists for a considerable portion of this material to be incorporated into upcoming mine inventory with further evaluation.

Outside of the 2024 Telfer Mineral Resource, the VSC (vertical stockwork corridor) is an area of unclassified mineralisation predominantly comprised of a large low-grade mineralised breccia and stockwork and is the continuation of the mineralisation previously mined at Telfer via sublevel caving (SLC). The VSC is considered to have the potential to be a long-life mining front with both geological and engineering evaluation work scheduled for 2025.

Main Dome Open Pit

The potential Main Dome Stage cutback proposes the mining out of the eastern ramp, by establishing alternate access form the south, along the western side of the existing pit (Figure 5). This proposed cutback targets the continuation of well understood mineralisation (E Reefs and Middle Vale Reef) that was the focus of previous open pit mining. As with the West Dome cutbacks, this cutback was not considered economic under previous ownership at their metal price and cost assumptions and will be re-evaluated at Greatland's metal price and cost assumptions.

Greatland 2024 Group Ore Reserve Statement

The 2024 Group Ore Reserve consists of:

§ Telfer:

‒ Two extensions to the currently active West Dome Open Pit mine; the Stage 7 Cutback and Stage 2 Extension (refer Figures 1 - 2);

‒ ROM and LG stockpiles;

‒ Dump leach material; and

§ Havieron Underground.

Table 4: 2024 Group Ore Reserve Statement

Area | Proven | Probable | Combined | ||||||||

Tonnes(Mt) | Aug/t | Cu% | Tonnes(Mt) | Au (g/t) | Cu% | Tonnes(Mt) | Aug/t | Cu% | Au(koz) | Cu(kt) | |

Telfer: West Dome Open Pit | - | - | - | 14.2 | 0.60 | 0.05 | 14.2 | 0.60 | 0.05 | 273 | 8 |

Telfer Stockpiles (ROM) | 9.6 | 0.68 | 0.07 | - | - | - | 9.6 | 0.68 | 0.07 | 209 | 6 |

Telfer Stockpiles(LG) | - | - | - | 20.3 | 0.33 | 0.04 | 20.3 | 0.33 | 0.04 | 215 | 9 |

Telfer Dump Leach (DL) | - | - | - | 2.0 | 0.23 | - | 2.0 | 0.23 | - | 15 | - |

Telfer (total) 2 | 9.6 | 0.68 | 0.07 | 36.5 | 0.43 | 0.05 | 46.1 | 0.48 | 0.05 | 712 | 23 |

Havieron Underground 3 | - | - | - | 24.9 | 2.98 | 0.44 | 24.9 | 2.98 | 0.44 | 2,391 | 109 |

Group total | 9.6 | 0.68 | 0.07 | 61.4 | 1.47 | 0.20 | 71.0 | 1.36 | 0.19 | 3,103 | 132 |

Notes:

1. 2024 Group Ore Reserves are reported as at 31 December 2024. Grades are reported to two decimal places to reflect appropriate precision in the estimate, and this may cause apparent discrepancies in totals.

2. Telfer:

- The 2024 Telfer Ore Reserve estimate is based on the December 2024 Telfer Mineral Resource detailed in the Company's announcement of 18 March 2025 titled '2024 Group Mineral Resource Statement'.

- Cut-offs for the Telfer Ore Reserve are applied based on net smelter return (NSR) for each mining location, averaging A$24.8/t processed for open pits and A$13.7/t to 17.2/t processed for stockpiles, and metal prices of A$3,450/oz and $4.16/lb copper and exchange rate of 0.65 USD per AUD.

- Material assumptions on which the Telfer Ore Reserve is based are detailed in the Material Information Summary included in this announcement and in the technical information included in the appendices. While the Company considers all the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct.

- No comparison is made to historical Ore Reserves. Refer to the 'Material Information Summary: Telfer Ore Reserve' in this announcement for further explanation.

3. Havieron:

- Refer to Greatland's announcement of 3 March 2022 titled 'Havieron Resource and Reserve Update'.

- Cut-offs for the Havieron Ore Reserve are applied based on an NSR of A$95/t processed, and metal prices of U$1,450/oz and U$3.23/lb copper and exchange rate of 0.73 USD per AUD.

- Reserves are reported within mining shapes based on a sub-level open stoping mining method. All reported metal was derived from the SE Crescent geological zone only and only the Indicated Mineral Resource component thereof.

- The Company confirms that it is not aware of any new information or data that materially affects the March 2022 Havieron Ore Reserve estimate, and that all material assumptions and technical parameters underpinning the estimate continue to apply and have not materially changed. Although the Havieron Feasibility Study is in progress and will differ from the March 2022 Havieron Reserve Case, it remains incomplete and accordingly Greatland considers that the Havieron March 2022 Reserve Case remains appropriate to present in the Greatland Group Ore Reserves.

This initial Telfer Ore Reserve estimate has been prepared on schedule in preparation for the Company's upcoming ASX listing, within a relatively short time since completion of the Telfer acquisition, and four weeks from completion of Greatland's inaugural Telfer Mineral Resource estimate. Accordingly, the Ore Reserve assessed only the West Dome Open Pit Stage 7 Cutback and Stage 2 Extension, and already mined stockpiles. Further West Dome Open Pit extension opportunities and the Telfer underground will be assessed in the Company's next Ore Reserve update.

Telfer is an operating mine with substantive experience in the current mining locations. This Ore Reserve Estimate is a natural extension of the current operations to account for significant upside movement in the metal price assumptions since the last mine design update was completed under previous ownership, and to incorporate ongoing updates to the Mineral Resource model.

The West Dome Open Pit continues to employ truck and shovel operations, executed by the same contractor since 2016. The extensions to the open pits are all within the current approved pit boundary and supported by the existing infrastructure and mining fleet, therefore requiring very low capital investment. The existing low-grade stockpiles operating performance, included in the Ore Reserve estimate, is well understood from recent processing operations. The modifying factors applied to convert the Mineral Resource to an Ore Reserve are therefore well understood and based on a proven operating history.

Conference Call

Shaun Day (Managing Director) and Rowan Krasnoff (Head of Business Development) will host a conference call for shareholders, research analysts and interested stakeholders this Wednesday, 16 April 2025 at 1:00 pm AWST (3.00 pm AEST, 6:00 am BST).

To listen in live, please click on this link and register your details:

https://webcast.openbriefing.com/greatlandgold-ann-2025/

It is recommended to log on at least five minutes before the commencement time to ensure you are joined in time for the start of the call. A recording of the call will be available on the same link after the conclusion of the webcast.

Group Mineral Resources Statement

Greatland's group Mineral Resources at 31 December 2024 comprised 285Mt @ 1.1g/t Au and 0.14% Cu, for 10.2Moz gold and 387kt copper, consisting of the 2024 Telfer Mineral Resource Estimate (MRE) (refer to Greatland's announcement dated 18 March 2025 titled '2024 Group Mineral Resource Statement') and the previously reported Havieron MRE (refer to Greatland's announcement dated 21 December 2023 titled 'Havieron Mineral Resource Estimate Update'). There has been no material change to the Telfer MRE and Havieron MRE since their respective releases.

Table 5: 2024 Group Mineral Resource Statement

Area | Measured | Indicated | Inferred | Combined | ||||||||||

Tonnes(Mt) | Aug/t | Cu% | Tonnes(Mt) | Au g/t | Cu% | Tonnes(Mt) | Aug/t | Cu% | Tonnes(Mt) | Aug/t | Cu% | Au(Moz) | Cu(kt) | |

Havieron Deposit | - | - | - | 50 | 2.60 | 0.33 | 81 | 1.10 | 0.13 | 131.0 | 1.67 | 0.21 | 7.0 | 270 |

Telfer West Dome Open Pit | - | - | - | 28.8 | 0.57 | 0.05 | 86.8 | 0.55 | 0.05 | 115.6 | 0.55 | 0.05 | 2.1 | 61 |

Telfer Main Dome Underground | - | - | - | 5.6 | 2.65 | 0.56 | 2.3 | 2.55 | 0.39 | 7.9 | 2.62 | 0.51 | 0.7 | 40 |

Telfer Stockpiles | 10.3 | 0.68 | 0.07 | 20.3 | 0.33 | 0.04 | - | - | - | 30.6 | 0.45 | 0.05 | 0.4 | 16 |

Combined | 10.3 | 0.68 | 0.07 | 104.7 | 1.60 | 0.21 | 170 | 0.84 | 0.09 | 285 | 1.11 | 0.14 | 10.2 | 387 |

Notes:

Mineral Resources are reported as at 31 December 2024, grades are reported to two decimal places to reflect appropriate precision in the estimate, and this may cause apparent discrepancies in totals. Cutoffs for the Telfer MRE are applied based on a NSR using metal prices of A$3,450/oz Au and A$5.30/lb Cu for the West Dome cutback & stockpiles and A$3,150/oz and A$5.30/lb for the Main Dome underground. Cutoffs for the Havieron Deposit Mineral Resources were based on a NSR using metal prices of A$2,360/oz Au and A$5.20/lb Cu.

Material Information Summary: Telfer Ore Reserve

A Material Information Summary for the Telfer Ore Reserve is provided in accordance with JORC Code 2012 Edition requirements. The Assessment and Reporting Criteria in accordance with the JORC Code 2012 are presented in Appendix 1.

The Telfer Ore Reserve estimate is based on the December 2024 Mineral Resource, as detailed in the Company's announcement dated 18 March 2025 titled '2024 Group Mineral Resource Statement'. Ore Reserves are a subset of Measured and Indicated Mineral Resources only.

Ore Reserves have been generated from design studies based on current operating experience at the Telfer mine and are considered to a Pre-Feasibility level of accuracy or better. Appropriate cost, geotechnical, slope design, dilution, recovery, cut-off grade and mining and metallurgical recovery parameters are specific to each pit stage and material type and are based on current and historical operating practice.

Mining methods applied are extensions of the current operations and considered the most appropriate method for the specific resource. GEOVIA WhittleTM and Vulcan (open pit) mining software was used to create mine designs. An A$3,450/oz gold price and A$4.6/lb copper price have been used to establish Ore Reserves and determine appropriate cut-off grades.

Mining, milling and additional overhead costs are based on currently contracted and budgeted operating costs. Mill recoveries for all ore types are based upon operating experience or metallurgical test work. Ore Reserves consider environmental, tenement, government and infrastructure approvals along with transportation requirements to market. Telfer is an operating site and has all the required major infrastructure such as power generation, processing, waste rock and tailings disposal, process and potable water, camp, airport, access roads and port handling facilities.

Stockpiles consist of ROM stocks and low-grade stocks both mined by Greatland and accumulated by previous owners.

Open Pit Methodology

Ore Reserves are based on pit designs - with appropriate modifications to the original Whittle shell outlines to ensure compliance with practical mining parameters.

Geotechnical parameters aligned to the open pit Ore Reserves are either based on observed existing pit performance specifics or domain specific expectations / assumptions. Various geotechnical reports and retrospective reconciliations were considered in the design parameters.

No further mine dilution is applied to the resource model as the smallest sub-cell in the block model is larger than the minimum mining unit of the current mining equipment in operation. An ore loss of 6% was applied to insitu tonnes to account for losses during mining.

Minimum mining widths have been accounted for in the designs as per the current operating fleet, with the utilisation of CAT793 trucking parameters and CAT6060 digger parameters.

No specific ground support requirements are needed outside of suitable pit slope design criteria based on specific geotechnical domains. Mining sequence is included in the mine scheduling process for determining the economic evaluation and takes into account available operating time and mining equipment size and performance.

No Inferred material is included within the open pit Ore Reserve, though in various pit shapes Inferred material is present. In these situations this Inferred material is classified as waste.

Historical Ore Reserves

The last historical Ore Reserves reported for the Telfer mine were by Newcrest Mining Limited (Newcrest) in July 2023. Following Newmont Mining Corporation (Newmont) acquiring Newcrest (and accordingly Telfer) in November 2023, Newmont reported those reserves as Mineral Resources, given the different gold and copper price assumptions used to support Newmont's Ore Reserves.

Newmont did not use short term mine life pricing, and a projected forward price curve from spot to reserve pricing to support financial evaluation was discounted. This Telfer Ore Reserve has considered the relevant historical Ore Reserves practices and modifying factors, as the Telfer mine is an ongoing operation, but has been re-estimated using Greatland's processes and assumptions since taking ownership and management of the Telfer mine in December 2024.

Further detail regarding the Ore Reserve estimate is set out in the JORC 2012 Table 1 Reporting Criteria contained in Appendix 1.

Material Information Summary: Telfer 2-Year Outlook

Relevant Proportions of Mineral Resources and Ore Reserves underpinning the Production Target

The Telfer 2-Year Outlook has Production Targets for FY26 - FY27 of:

| FY26 | FY27 | Average |

Production (koz Au) | 300 - 340 | 260 - 300 | 280 - 320 |

Production (kt Cu) | 9 - 13 | 5 - 9 | 7 - 11 |

AISC2 (A$/oz) | 2,400 - 2,600 | 2,750 - 2,950 | - |

In aggregate, the Production Target for FY26 - FY27 comprises 79% Measured / Indicated Resources, 16% Inferred Resources and 5% Exploration Target.

Material Assumptions

The material assumptions on which the Telfer 2-Year Outlook is based are provided below and in Appendix 1.

§ The Mineral Resources, Ore Reserves, and Exploration Target underpinning the Telfer 2-Year Outlook Production Target have been prepared by Competent Persons in accordance with the requirements of the JORC 2012 Code, and set out in the Table 1 Reporting Criteria contained in Appendix 1.

§ The Telfer 2-Year Outlook Production Target is underpinned by the Telfer December 2024 Mineral Resource and this Ore Reserve.

§ Gold prices of A$3,450/oz (West Dome Open Pit and Stockpiles) and A$3,000/oz (Main Dome Underground) were used for optimisations to develop the Production Target mine designs.

§ The West Dome Open Pit and Main Dome Underground are currently in production, meaning that the proposed Telfer 2-Year Outlook is a natural extension of the current operations and therefore matters affecting the modifying factors such as mining performance, mining and geotechnical modifying factors, processing throughput and metallurgical recoveries and cost structures are well understood.

§ Telfer 2-Year Outlook is a sub-set of a longer life mine plan for Telfer. Greatland expects Havieron production to begin during FY28, augmenting Telfer production. As the Havieron Feasibility Study remains in progress no allowance for production estimates or associated capital expenditure has been included in this Telfer 2-Year Outlook. After the Havieron Feasibility Study has been completed, Greatland will be in a position to update the market on the outlook for integrated Telfer and Havieron operations.

§ Financial modelling includes updated cost and metallurgical recoveries in line with those applied to the Ore Reserve estimate. For financial modelling, consensus forecast pricing (February 2025) was used as follows:

| FY26 | FY27 |

Gold Price (A$/oz) | 4,030 | 3,797 |

Copper Price (A$/lb) | 6.58 | 6.58 |

AUD:USD | 0.66 | 0.66 |

Gold price is further supported by put options Greatland has executed for a remaining 116koz at a strike price of A$3,905/oz in CY2025 and for 150koz at A$4,200/oz in CY2026.

§ 16% of the Production Target for FY26 - 27 is sourced from Inferred Mineral Resources. West Dome Open Pit cutbacks at Telfer have routinely contained a component of inferred material and reconciliation of similar material mined in CY2023 (the last full production year prior to Telfer processing disruptions in CY2024) indicated that this material reconciled well. Based on the historic performance and drill results to date Greatland considers it acceptable to include this Inferred material into the Production Target on an annualised basis. Greatland cannot however be certain that the Inferred material will convert to Indicated Mineral Resources or that the Production Target itself will be realised.

§ 5% of the Production Target is sourced from the Telfer Underground Exploration Target. This is discussed below in the 'Basis of Telfer Underground Exploration Target' section.

Cautionary Statement concerning the proportion of Inferred Mineral Resources

There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the Production Target itself will be realised.

Basis for Telfer Underground Exploration Target

Telfer Exploration Targets were first announced in Greatland's Admission Document dated 10 September 2024 as part of a combined Telfer Underground and Open Pit Exploration Target.

Since acquisition the Company has conducted a review of several of these areas of unclassified mineralisation, upgrading them to a Mineral Resource as announced in March 2024 (see announcement of 18 March 2025 titled '2024 Group Mineral Resource Statement').

An outcome of this review has been the decision to carry out an additional phase of drilling within the Eastern Stockwork Corridor (ESC) before considering it for classification as a Mineral Resource, this drilling is underway with 16 holes for 3,821 metres drilled by the end of March, with the program scheduled to be completed by June 2025.

As such the ESC is being restated as an Exploration Target, as follows:

Tonnes (Mt) | Au g/t | Cu % | Au (koz) | Cu (kt) |

1.0 - 2.0 | 1.2 - 1.8 | 0.1 - 0.4 | 40 - 115 | 1.5 - 7.0 |

Note: Grades are reported to one decimal place to reflect appropriate precision in the estimate, and this may cause apparent discrepancies in totals.

The ESC is a mineralised vein array occurring at the intersection of the monocline structure and a competent quartzite unit occurring between the M30 and M35 reefs. The ESC orebody is located adjacent to existing infrastructure in the upper section of the Main Dome underground, and similar to the A-Reef and M-Reefs, this orebody as a whole does not support the Telfer operation without additional ore sources.

The current drill spacing varies from 50m in the well-informed sections to >100m towards the northern and southern limits. Drilling is predominately diamond drilling. The supporting data for this Exploration Target spans a significant period, with most drilling being from 2020 onwards. All practices with respect to drilling, sampling and analysis were carried out to the industry standards at the time and the data is consider adequate to support the respective exploration targets.

Cautionary Statement concerning the Exploration Target

The potential quantity and grade of these Exploration Targets is considered conceptual in nature; as there has been insufficient work undertaken by the Company to date to determine whether they should be classified as Mineral Resources, and it is currently uncertain if further

work will result in the classification of a Mineral Resource.

Contact

For further information, please contact:

Greatland Gold plc

Shaun Day, Managing Director | Rowan Krasnoff, Head of Business Development [email protected]

Nominated Advisor

SPARK Advisory Partners

Andrew Emmott / James Keeshan / Neil Baldwin | +44 203 368 3550

Corporate Brokers

Canaccord Genuity | James Asensio / George Grainger | +44 207 523 8000

SI Capital Limited | Nick Emerson / Sam Lomanto | +44 148 341 3500

Media Relations

Australia - Fivemark Partners | Michael Vaughan | +61 422 602 720

UK - Gracechurch Group | Harry Chathli / Alexis Gore / Henry Gamble | +44 204 582 3500

About Greatland

Greatland is a gold and copper mining company listed on the London Stock Exchange's AIM Market (LSE:GGP) and operates its business from Western Australia.

The Greatland portfolio includes the 100% owned Telfer gold-copper mine, the adjacent 100% owned world class Havieron gold-copper project (under development), and a significant exploration portfolio within the surrounding region. The combination of Telfer and Havieron provides for a substantial and long life gold-copper operation in the Paterson Province of Western Australia.

Greatland is targeting a cross listing on the ASX in the June quarter 2025.

Forward Looking Statements

This document includes forward looking statements and forward looking information within the meaning of securities laws of applicable jurisdictions. Forward looking statements can generally be identified by the use of words such as "may", "will", "expect", "intend", "plan", "estimate", "anticipate", "believe", "continue", "objectives", "targets", "outlook" and "guidance", or other similar words and may include, without limitation, statements regarding estimated reserves and resources, certain plans, strategies, aspirations and objectives of management, anticipated production, study or construction dates, expected costs, cash flow or production outputs and anticipated productive lives of projects and mines.

These forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance and achievements or industry results to differ materially from any future results, performance or achievements, or industry results, expressed or implied by these forward-looking statements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which Greatland operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward looking statements are based on assumptions as to the financial, market, regulatory and other relevant environments that will exist and affect Greatland's business and operations in the future. Greatland does not give any assurance that the assumptions will prove to be correct. There may be other factors that could cause actual results or events not to be as anticipated, and many events are beyond the reasonable control of Greatland. Forward looking statements in this document speak only at the date of issue. Greatland does not undertake any obligation to update or revise any of the forward looking statements or to advise of any change in assumptions on which any such statement is based.

Non-GAAP measures

Some of the financial performance measures used in this announcement are non-IFRS financial measures, including "all-in sustaining cost", "total cash cost", "net cash", "free cash flow", "sustaining capital" and "growth capital". These measures are presented as they are considered to provide useful information to assist investors with their evaluation of the business's underlying performance. Since the non-IFRS performance measures listed herein do not have any standardised definition prescribed by IFRS, they may not be comparable to similar measures presented by other companies. Accordingly, they are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Competent Persons Statement

Exploration Targets

Information in the report pertaining to exploration results & exploration targets at Telfer is based on, and fairly reflects, information and supporting documentation compiled by Mr Michael Thomson, a member of the AIG (MAIG), who has more than 22 years of relevant industry experience. Mr Thomson is a full-time employee of the Company and has a financial interest in the Company. Mr Thomson has sufficient experience relevant to the style of mineralisation, type of deposit under consideration, and to the activity which he undertook, to qualify as a Competent Person as defined by the JORC Code (2012) and as a Qualified Person under the AIM Note for Mining, Oil and Gas Companies. Mr Thomson consents to the inclusion in this document of the Telfer Exploration Targets and references to them in the form and context in which they appear.

Ore Reserves

The information in this report that relates to the Ore Reserves estimation for Telfer Open Pit and Stockpiles is based on information, and fairly reflects information and supporting documentation compiled by Mr Otto Richter, Group Mining Engineer. Mr Richter is a full-time employee of the Company and has a financial interest in the Company. Mr Richter is a Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM 301723) and has over 25 years relevant industry experience. Mr Richter has sufficient experience that is relevant to the style of mineralisation and type of deposits under consideration and to the activity currently being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves'. Mr Richter consents to the inclusion of this announcement of the matters in the form and context in which it appears.

Appendix 1 - JORC Tables

JORC 2012 Table 1: Section 1 - Sampling Techniques and Data (Telfer)

Criteria | Commentary |

Sampling techniques | Resource definition drilling at Telfer involves a combination of reverse circulation (RC) and diamond drilling throughout the mining period. For diamond drilling, samples are taken according to lithological boundaries, with geologists defining sample intervals and selecting the assay methodology. Historically, high-grade reef samples were sent for screen fire assay, while other samples underwent fire assay for gold and additional elements. Core sizes for resource drilling usually range from NQ to PQ, while smaller sizes (NQ or LTK60) are used for grade control. Diamond drilling typically samples lithological units with lengths between 0.2 to 1.2 meters, with 1-meter intervals being most common and they are barcoded and submitted for laboratory analysis. Historically, RC drilling typically produces 1-meter samples, from which a 2-5 kg sub-sample is taken using a riffle splitter, then pulverised for gold assay. Earlier RC drilling involved samples from 0.5-meter to 2-meter intervals, with the small intervals were used to target reefs. Recent RC drilling for resource definition uses 1-meter intervals and split using cone splitter from which a 2-5 kg sub-sample is taken with bulk reject material stored temporarily. While grade control uses 2-meter intervals and split using cone splitter. All RC drilling has field duplicates conducted at a 1:20 ratio. Rock chip samples, collected manually from exposed development faces, are typically 2-3 kg, collected perpendicular to bedding, and include all relevant domains (reef, hanging wall, footwall). These samples are stored in pre-numbered bags for analysis. |

Drilling techniques | Drilling at the Telfer has evolved over time, following industry-standard protocols. Before 1998, drilling targeted mainly previously mined areas, while from 1998 to 2002, diamond drilling formed the primary data source for current Mineral Resource estimates, supplemented by RC drilling. Currently, RC drilling is the primary data source for the open pit resources and diamond drilling for underground resources. Currently, NQ2 is the dominant drill size for diamond drilling and RC Drilling is drilled with a pre-collar of 143mm then reduced to 134mm diameter. Additional core sizes, including NQ, HQ, HQ3, LTK60, and limited PQ and BQ, have also been used at Telfer. LTK60 and BQ have mainly been used for grade control. The Reflex orientation tool is used by drillers, with all core being oriented using Ezy-Mark to mark the bottom of the hole. The core is then re-constructed in V-Rail, where the orientation line is drawn along the core. |

Drill sample recovery | Core recovery data from diamond drilling is systematically recorded by comparing drillers' depth blocks with database records and is stored in the geological database. If excessive core loss occurs, a wedge hole is often drilled to recover the lost interval. A review in 2019 confirmed no significant relationship between sample recovery and grade for either core or RC samples, with high core recovery minimising potential loss effects. Following the review, weighing each RC sample at the rig was implemented to ensure consistent sample support in resource estimation. |

Logging | Geological logging is conducted for all diamond and reverse circulation (RC) drill holes, capturing lithology, alteration, mineralisation, veining, and structure (for diamond core). Diamond drill holes are also quantitatively logged for veining, vein percentage, and structure. All drill core is photographed before sampling, using either slide film or digital cameras. Logged data is validated before merging into the database, which contains over 1,000 km of logged geology, covering approximately 80% of total drilling. Rock Quality Designation (RQD) is routinely recorded, with around 900 diamond holes geotechnically assessed. The level of logging detail is appropriate for resource estimation and related studies. |

Sub-sampling techniques and sample preparation | Sampling and quality control procedures are designed for the material being tested. Geologists define sample intervals to avoid crossing key lithological contacts and select appropriate assay methods. Diamond core is typically sampled as half-core, while RC samples are collected dry, with conditions recorded. Since 2015, cone splitters have replaced riffle splitters for RC sampling, with field duplicates taken at a 1:20 ratio. Core samples are processed through drying, crushing, and pulverising, with historical standards requiring 90% passing 75 µm. Older RC drilling used 0.5-2 m intervals, while recent resource definition drilling follows 1 m intervals (2 m for grade control), with a 5 kg primary split collected. Samples are prepared at the Telfer lab, where they are crushed, sub-split, and pulverised to 95% passing 106 µm. Gold is analysed via 30 g fire assay, while base metals, sulphur, and arsenic are tested by ICP. Cyanide-soluble copper is determined by bottle roll leach with AAS analysis. To ensure accuracy, 1 in 20 samples undergo external lab verification. |

Quality of assay data and laboratory tests | Assay and quality control protocols at the Telfer deposit have evolved to align with industry standards. Before 1998, quality control procedures followed industry norms of the time, with no major concerns identified. From 1998 onwards, protocols were enhanced, particularly during prefeasibility and feasibility studies conducted between 1998 and 2002. Samples are primarily prepared at the Telfer laboratory and then sent to external commercial labs for analysis. Currently, all resource definition samples have been assayed through a combination of the Telfer Laboratory and the Bureau Veritas (BV) Commercial Lab in Perth and all grade control samples have been sent through Telfer Laboratory. Gold is analysed using fire assay, while multi-element analyses-including silver, arsenic, bismuth, copper, iron, nickel, lead, sulphur, and zinc-are conducted using ICP techniques. Cyanide-soluble copper is assessed via bottle roll leach with AAS analysis. Since 1998, comprehensive quality control measures have been in place, including the use of Certified Reference Materials (CRMs), blanks, duplicate assays, blind pulp re-submissions and checks at independent laboratories. Matrix-matched CRMs were introduced in 1999, and transition to multi-client CRMs in 2018. Since 2000, Telfer's laboratory was managed by commercial organisations until Telfer re-opening in 2002 has been managed by Newcrest and now, Greatland. Regular reviews of Quality Assurance and Quality Control (QAQC) procedures, including sample resubmissions and bias assessments, help ensure data accuracy and reliability. Monthly reports document any anomalies, with corrective actions taken as needed. Comparison studies, including analyses of duplicate pulp samples sent to external laboratories, confirm data precision, with a 90% repeatability rate. The QAQC protocols and assay techniques used are considered reliable for Mineral Resource estimation. During the 2002 feasibility study, 13,570 pulp duplicate samples were dispatched from the Telfer preparation laboratory for analysis at a check laboratory. Insignificant bias was identified between the original and check laboratories for gold (-0.8%) and copper (0.5%). |

Verification of sampling and assaying | Drill hole data is securely stored in an acQuire database, with stringent controls to ensure data integrity and prevent errors or duplication. Data collection, including collar coordinates, drill hole designation, logging, and assaying, follows strict protocols to maintain accuracy. Validation involves multiple stages, with input from geologists, surveyors, assay laboratories, and down-hole surveyors where applicable. Data entry has evolved from manual methods to direct digital input, incorporating automated validation checks. Internal and external reviews further enhance data quality before resource estimation. Resource data is managed daily by site geologists, with additional verification by a centralised resource team. Sampling details are recorded digitally, utilising barcode and tracking systems to monitor sample integrity throughout the process. Recent drilling programs employ numbered bags for tracking consistency. Regular audits of both internal and commercial laboratories ensure compliance with quality standards. No assay data adjustments have been made in the Mineral Resource estimate. |

Location of data points | Mining operations at Telfer Gold Mine adhere to periodic reporting requirements for the WA Department of Mines, Industry Regulation and Safety (DMIRS), using the MGA94/AHD coordinate system for official submissions. However, site operations utilise the Telfer Mine Grid (TMG) and Telfer Height Datum (THD), requiring coordinate transformations between the national and operational coordinate systems. This has been supplied by AAM Surveys in 1995 (AMG84 to Telfer Mine Grid) and AAMHATCH in February 2007 (Telfer Mine Grid to MGA Transformation). Both reports also addressed the height datum and in 2007 established the THD=AHD + 5193.7m. A local grid covers the whole of the Telfer mine area (Telfer Mine Grid 2002). It is oriented with grid north at 44o03'12' west of magnetic north. Topographic control is maintained through a combination of surface and aerial surveys, with routine updates for pits and underground voids. Drill hole collars are surveyed upon completion by mine surveyors. The natural surface topography, along with current pit surveys and underground voids (development, stopes and vertical openings) are used to deplete the resources and account for changes in mining areas at Telfer. Downhole survey methods have evolved over time, progressing from early single-shot cameras to modern electronic tools. Currently, drilling programs include multi-shot surveys at regular intervals, with post-completion surveys conducted at finer resolutions. Specific drilling campaigns may incorporate gyroscopic surveys where required. Routine in-pit drilling, particularly for pre-production and grade control, typically excludes downhole surveys, relying on collar surveys for accuracy. |

Data spacing and distribution | The drill hole spacing is sufficient to demonstrate geological continuity appropriate for the Mineral Resource and the classifications applied under the 2012 JORC Code. The drill spacing applied to specific domains within the overall resource is variable and is considered suitable for the style of mineralisation and mineral resource estimation requirements. |

Orientation of data in relation to geological structure | The Telfer mine site topography is dominated by two large scale asymmetric dome structures with steep west dipping axial planes. Main Dome is in the southeast portion of the mine and is exposed over a strike distance of 3 km north-south and 2 km east-west before plunging under transported cover. West Dome forms the topographical high in the northwest quadrant of the mine and has similar dimensions to Main Dome. Both fold structures have shallow to moderately dipping western limbs and moderate to steep dipping eastern limbs. Surface drilling is orientated to ensure optimal intersection angle for the reefs. Underground drilling orientation may be limited by available collar locations, but acceptable intersection angles are considered during the drill hole planning process. No orientation bias has been indicated in the drilling data. |

Sample security | Sample security is maintained through a tracking system from drilling to database entry. While barcoding was previously used, it has been replaced with pre-numbered calico bags for resource development and underground drilling samples. All sample movements, including dispatch details, drill hole identification, sample ranges, and analytical requests, are recorded in a database. Any discrepancies identified upon receipt by the laboratory are validated to ensure data integrity. |

Audits or reviews | In-house reviews of data, QAQC results, sampling protocols and compliance with corporate and site protocols are carried out at various frequencies by company employees not closely associated with the Telfer projects. Procedure audits and reviews are carried out by corporate employees during site visits. |

JORC 2012 Table 1: Section 2- Reporting of Exploration Results (Telfer)

Criteria | Commentary |

Mineral tenement and land tenure status | Mining and ore processing at Telfer operate under granted leases and licenses covering all key infrastructure, including open pits, underground resources, processing facilities, waste storage, and support services. The Telfer Main Dome Underground Mineral Resource is within mining leases M45/6 and M45/8, while the West Dome Mineral Resource, approximately 3km northwest of the Main Dome open pit, lies within leases M45/7 and M45/33. These leases are currently under renewal. An Indigenous Land Use Agreement (ILUA) has been in place since December 2015, covering all operational aspects of the site. Telfer operations also remain compliant with the Mining Rehabilitation Fund (MRF) levy. |

Exploration done by other parties | The Telfer district was first geologically mapped by the Bureau of Mineral Resources in 1959, though no gold or copper mineralization was identified. In 1971, regional sampling by Day Dawn Minerals NL detected anomalous copper and gold at Main Dome. From 1972 to 1975, Newmont Pty Ltd conducted extensive exploration and drilling, defining an open pit reserve primarily in the Middle Vale Reef. In 1975, BHP Gold acquired a 30% stake in the project, and in 1990, Newmont and BHP Gold merged their Australian assets to form Newcrest Mining Limited. Newcrest managed exploration and resource drilling from 1990 until its acquisition by Newmont Corp on November 6, 2023. Newmont later divested Telfer, selling it to Greatland Gold on December 4, 2024, which now oversees exploration and drilling activities. |

Geology | Telfer is located within the northwestern Paterson Orogen and is hosted by the Yeneena Supergroup, a 9 km thick sequence of marine sedimentary rocks. Gold and copper mineralization occurs in stratiform reefs and stockworks within the Malu Formation of the Lamil Group, controlled by both structure and lithology. Mineralisation styles include high-grade narrow reefs, reef stockwork corridors, sheeted vein sets, and extensive low-grade stockwork, which forms most of the sulphide resource. Sulphide mineralisation consists mainly of pyrite and chalcopyrite, with copper minerals including chalcopyrite, chalcocite, and bornite. Gold is primarily free-grained or associated with sulphides and quartz/dolomite gangue, with a correlation between vein density and gold grade. The highest gold and copper grades occur within bedding sub-parallel reef systems, including multiple reef structures in Main Dome, such as E-Reefs, MVR, M10-M70 reefs, A-Reef, and B-Reefs (notably B30). Additional mineralisation occurs in northwest-trending and north-dipping veins. Stockwork mineralisation, found in open pits, Telfer Deeps, and the Vertical Stockwork Corridor (VSC), is best developed in the axial zones of Main Dome and West Dome, often extending over large areas (0.1 km to 1.5 km). It can include brecciated zones filled with quartz, carbonate, and sulphides |

Drill hole Information | Not applicable to the mineral resource estimate. |

Data aggregation methods | Significant assay intercepts are reported using length-weighted averages based on predefined thresholds, with a maximum allowable internal dilution. For Mineral Resource estimates, data aggregation methods are aligned with sampling, drilling, and recovery techniques. No exploration results are included in this report, as it focuses on Ore Reserves and Mineral Resources. |

Relationship between mineralisation widths and intercept lengths | No exploration has been reported in this release, therefore there are no relationships between mineralisation widths and intercept lengths to report. This section is not relevant to this report on Ore Reserves and Mineral Resources. |

Diagrams | As provided |

Balanced reporting | Significant assay intervals represent apparent widths, as drilling is not always perpendicular to the dip of mineralisation. True widths are typically less than downhole widths and can only be estimated once all results are received and final geological interpretations are completed. No exploration results are included in this report, so relationships between mineralisation widths and intercept lengths are not applicable to the Ore Reserves and Mineral Resources report. |

Other substantive exploration data | Not applicable to the mineral resource estimate. |

Further work | Further work is planned to evaluate exploration opportunities that extend the known mineralisation and to improve confidence of the model. |

JORC 2012 Table 1: Section 3 - Estimation and Reporting of Mineral Resources (Telfer)

Criteria | Commentary |

Database integrity | Data is stored in a SQL Server database known as acQuire. Assay data and geological data are electronically loaded into acQuire and the database is replicated in Greatlands centralised database system. Regular reviews of data quality are conducted by site and corporate teams prior to resource estimation. Validation checks include but are not limited to: · Duplicate drill hole identifier. · Overlapping FROM and TO intervals values in the geology, oxidation state, assay, density, core size, and recovery tables. · Duplicate records. · Other checks made outside the SQL environment include but are not limited to: · Down hole survey dip and bearing angles appear reasonable. · All collar co-ordinates were within the permit area. · Any anomalous assay, density or sample recovery values. |

Site visits | The Competent Person for Telfer Mineral Resources regularly visits the site. |

Geological interpretation | All interpretations were undertaken by site-based geologists. MDU Block Model The MDU Block Model wireframe interpretations were constructed in Leapfrog software using implicit modelling interpolations from primary logging codes extracted from the Acquire database. The Main Dome Underground model includes the Lower M-Reef horizons (from M52 downward), the A Reefs horizons, Kylo, B30 Reef, LLU, Rey LLU and Rey AR, Oakover Vein, Wedge, North Finn and intervening Stockwork mineralisation. The Lower M Reefs comprise both intermittent reef but more significantly zones of stockwork mineralisation, as such each of these are modelled as mineralised corridors. The same approach has been applied to the A Reef interpretation with multiple corridors of reef and stockwork mineralisation defined. Kylo also comprise high-grade mineralised breccia\stockwork and is stratabound. The LLU is a mineralised stratigraphic layer that is guided by the well know dome-shaped stratigraphy in Main Dome and monocline structure. The western limb of the LLU has been the target of bulk stoping in mining areas called Western Flanks. In the south-eastern of the lower mine, thrust structures have been identified that offset and dilate the eastern limb stratigraphy. High-grade veining has formed in the dilation zone and two domains have been interpreted to capture this mineralisation Rey LLU and Rey A-Reefs. M-Reef Block Model The Upper M Reefs (M20 to M50) are largely strataform, interpretation is guided by the well-known dome shape stratigraphy. The Upper M-Reef mineral resource consists of discrete reef wireframes constructed in Vulcan using Sirovision mapping, wall mapping and sampling data from development drives, and from drill hole intercepts. The thickness of the reef is honoured as far as practicable in the interpretation process. West Dome Block Model The Telfer West Dome Deposit consists of a repeat of the Main Dome geological units. Mineralisation styles include high-grade narrow reefs, reef stockwork corridors, sheeted vein sets, and extensive low-grade stockwork, which forms most of the sulphide resource. The primary estimation domains are based on stratigraphy. The estimates refrained from detailed interpretations of E-Reefs as they are discontinuous and complex to interpret. The estimate relies on an E-Reef corridor within the appropriate stratigraphy to constrain grade estimation. The M-Reefs domains in West Dome they have been interpreted as reef/stockwork corridors from drill hole intercepts. The thickness of the reef is honoured as far as practicable in the interpretation process and within the database, defined by intercept domains. The M-Reefs are largely strataform, interpretation is guided by the well-known dome shape stratigraphy. The Leeder Hill Veins are sub-vertical veins sets that run west to east across the West Dome Resource. They vary in thickness from 1 -10cm in thickness and can appear as individual veins or vein sets. Stockwork mineralisation is best developed in the axial zones of West Dome, often extending over large areas (0.1 km to 1.5 km). It can include brecciated zones filled with quartz, carbonate, and sulphides

|

Dimensions | The maximum extent of the Telfer Mineral Resource is approximately 5 km x 1.5 km x 1.8km over the two dome complexes. |