10th Nov 2025 07:00

10 November 2025

SolGold plc

("SolGold" or the "Company")

Reports Strong, Near-Surface Drilling Results at Tandayama-América, Cascabel-

160.5 m of 0.77% CuEq from 11.5m in depth at TAD-25-074

Results further confirm open-pit potential and strengthen early-mining

development financing optionality within the Cascabel Project area

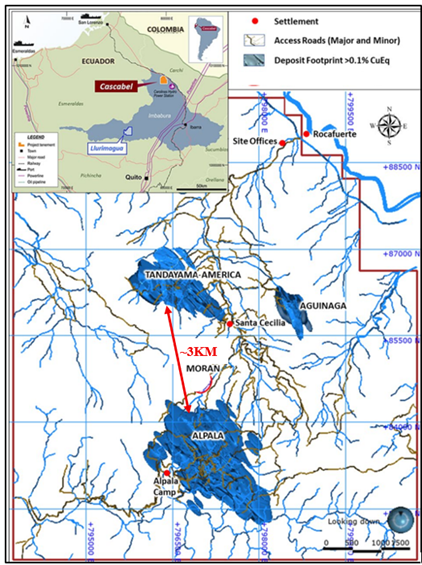

SolGold plc (LSE: SOLG) is pleased to report additional strong assay results from diamond drilling at the Tandayama-América ("Tandayama") deposit, located 3 km north of the Alpala resource and reserves ("Alpala") on the Company's 100% owned Cascabel porphyry copper-gold project ("Cascabel" or the "Project") in northern Ecuador. (Figure 1)

Tandayama-América plays a significant role in the Company's revised strategy, implemented earlier this year, focusing on an accelerated, smoother production profile at Cascabel, which, in turn, will assist in unlocking critical financing. The Company, with the assistance of leading independent technical expert, Mining Plus, aims to release an indication of the initial resource endowment at Tandayama in the coming weeks. As part of this mineral resource estimate, the work will also include conceptual pit definition and initial project parameters. Further optimisation work will soon follow, providing the Company with a clear plan for execution.

Highlights

· Hole 74 intersected:

o 160.50 m @ 0.77% CuEq (0.38% Cu, 0.46 g/t Au) from 11.5 m, containing

o 92 m @ 0.93% CuEq (0.40% Cu, 0.52 g/t Au) from 11.5 m, including

o 14 m @ 1.58% CuEq (0.71% Cu, 1.02 g/t Au) from 42m, and

o 17.82 m @ 1.22% CuEq (0.43% Cu, 0.92 g/t Au) from 70m.

· Hole 73 intersected:

o 130.00 m @ 0.54% CuEq (0.31% Cu, 0.27 g/t Au) from 16 m, containing

o 42.00 m @ 0.78% CuEq (0.40% Cu, 0.44 g/t Au) from 52 m.

· Hole 72 intersected:

o 151.37 m @ 0.42% CuEq (0.19% Cu, 0.27 g/t Au) from 18.63 m, containing

o 83.37 m @ 0.55% CuEq (0.25% Cu, 0.35 g/t Au) from 18.63 m.

The results from holes 72, 73, and 74 continue to demonstrate broad, near-surface copper-gold mineralisation at near true widths within intrusive breccia units that extend across the planned Pit 1 and 2 footprints and remain open in several directions. The results further confirm Tandayama-América as an increasingly important component of the larger Cascabel copper-gold project.

CEO Dan Vujcic commented,

"Tandayama-América continues to deliver consistent near-surface copper-gold grades over substantial intervals. These results strengthen our confidence that Tandayama will soon be validated to have sufficient mineral resources to support open pit mine development, enabling production within two to three years of receiving approvals.

Tandayama gives us not only real optionality, but also significantly accelerates and de-risks our Cascabel project with two sources of ore in the critical early years. The ability to develop the two operations allows SolGold to create value faster, with less risk and, most importantly, earlier with reduced start-up capital. It is the kind of plan that makes Cascabel unique amongst development-stage copper-gold projects not only in Ecuador but globally. The approach is a key driver of shareholder value and will create jobs and opportunities for local communities while putting Northern Ecuador at the forefront as the next major copper- gold mining province for generations to come."

Figure 1. Project Location and Cascabel Tenement

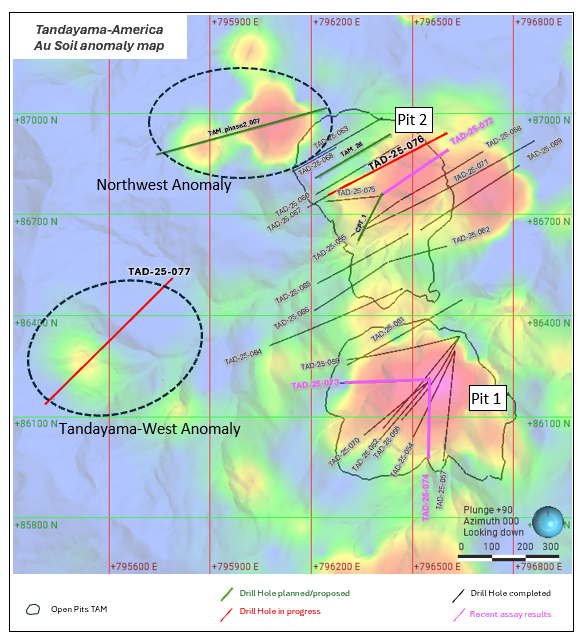

Figure 2. Au soil anomaly map of the Tandayama América deposit showing the preliminary designed Pits 1 and 2, the holes drilled to date, holes underway, and planned/proposed holes for the Phase 2 drilling program. The map indicates where high gold anomalies coincide with Pits 1 and 2 and highlights additional resource extension targets to the NW of Pit 2, and to the W of Pits 1 and 2 (Tandayama-Central and Tandayama-West).

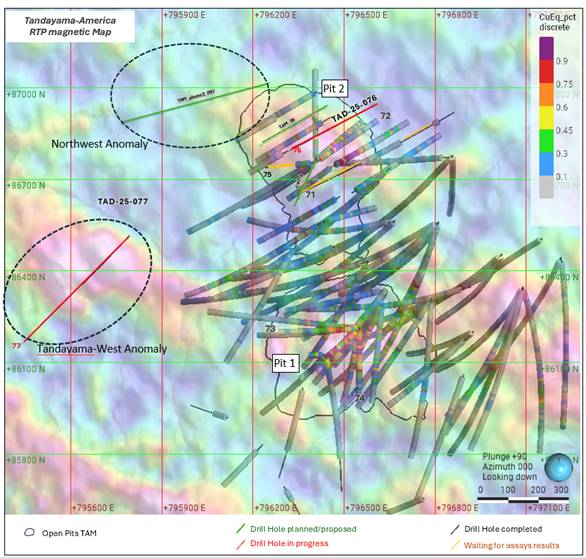

Figure 3. Reduced to pole magnetic map of the Tandayama América deposit showing the preliminary designed Pits 1 and 2, the holes drilled to date, holes underway, and planned or proposed holes of the Phase 2 drilling program. The map indicates high magnetic anomalies coinciding with Pits 1 and 2, as well as another similar high magnetic anomaly towards the west of Pits 1 and 2, named Tandayama-West. This anomaly shows porphyry-style mineralization at the surface in the rock channel samples, as previously reported. These anomalies will be tested during the Phase 2 drilling program.

Strategic Significance

Tandayama-América is becoming a key element of SolGold's district-scale Cascabel Project, which also hosts the world-class Alpala underground deposit located just 3 km to the south and is emerging as one of the most significant undeveloped copper-gold districts globally.

While Alpala represents a large-scale, long-life underground operation, Tandayama provides the potential for a low-strip-ratio, lower-capex, near-surface open pit capable of supplying early-stage mill feed and cash flow to support Cascabel's broader development and future for underground resource potential. The combination of both deposits provides SolGold with strategic flexibility - enabling phased development, accelerated value realization, and enhanced overall project economics.

Recent drilling success at Tandayama continues to reinforce this strategy, demonstrating that Cascabel could ultimately host multiple mining centres within a single, integrated infrastructure complex.

District Context

The Cascabel concession, covering over 50 square kilometres (see Figure 1), lies in Ecuador's highly prospective Imbabura province, an emerging copper-gold region in which SolGold holds a substantial interest of 85-100% in five other highly prospective large copper-gold porphyry targets, underpinned by strong municipal and federal government support for responsible mining.

SolGold's ongoing work at Tandayama complements the Company's feasibility study and execution plan. Together, these initiatives advance SolGold's vision for an intergenerational mine-life over a multi-source copper-gold operation aligned with the world's growing demand for critical energy-transition metals.

The consistency of recent Tandayama drill results highlights the district's geological strength, the scale of its mineral systems, and Cascabel as a Tier 1 copper-gold asset of global significance.

Exploration Update

The Phase 2 drill program has now completed over 2,400 metres across 8 holes. Assays from holes TAD-25-071 and TAD-25-075 are pending, and drilling is ongoing in holes TAD-25-076 and TAD-25-077, with results expected later in November. Holes 75 and 76 aim to identify potential extensions between the two pits. Hole 77 at Tandayama West, above a modelled magnetic intrusive source, is showing promising to strong visual mineralisation. (Figure 3)

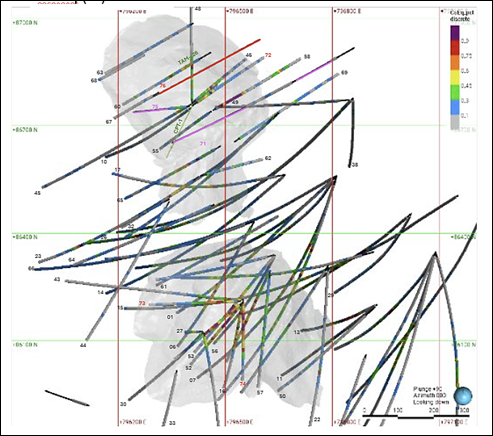

Figure 4. Preliminary pit design outlines (Pits 1 and 2), including all completed drill holes with CuEq (%) grade intervals displayed along the traces. Drill holes with pending assay results are highlighted in magenta, and ongoing drilling is indicated in red.

Table 1. Assay Results Summary

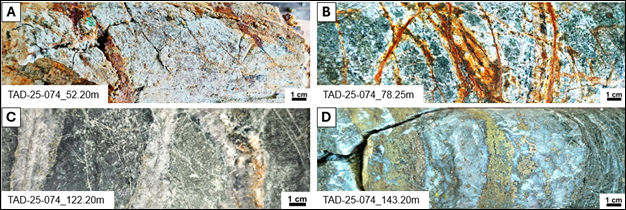

Figure 5.

A) Magmatic Intrusive Matrix Breccia (IBX), hosting magnetite, chalcopyrite and pyrite bearing-B1 vein (0.53 % Cu, 0.73 g/t Au).

B) Magmatic Intrusive Matrix Breccia (IBX), hosting pyrite and chalcopyrite-bearing B2 vein (0.53 % Cu, 0.87 g/t Au).

C) Magmatic Intrusive Matrix Breccia (IBX), hosting chalcopyrite and pyrite-bearing - B2 veins overprinted by chalcopyrite veins (0.14 % Cu, 0.31 g/t Au).

D) Magmatic Intrusive Matrix Breccia (IBX), hosting chalcopyrite and pyrite-bearing B2 veins reopened by carbonate vein (0.25 % Cu, 0.27 g/t Au).

E) Magmatic Intrusive Matrix Breccia (IBX), hosting magnetite, chalcopyrite and pyrite bearing-B1 vein (0.52 % Cu, 0.43 g/t Au).

F) Magmatic Intrusive Matrix Breccia (IBX), hosting magnetite, chalcopyrite and pyrite-bearing B1 veins cut by chalcopyrite veins (0.57 % Cu, 0.91 g/t Au).

G) Magmatic Intrusive Matrix Breccia (IBX), hosting chalcopyrite and pyrite-bearing B2 veins reopened by chalcopyrite vein (0.84 % Cu, 0.90 g/t Au).

H) Magmatic Intrusive Matrix Breccia (IBX), hosting chalcopyrite and pyrite-bearing B2 veins overprinted by chalcopyrite vein (0.65 % Cu, 0.68 g/t Au).

Figure 6.

A) Magmatic Intrusive Matrix Breccia (IBX), hosting malachite in fractures (1.26 % Cu, 3.98 g/t Au).

B) Magmatic Intrusive Matrix Breccia (IBX), hosting neotocite and malachite in fractures (0.38 % Cu, 0.85 g/t Au).

C) Magmatic Intrusive Matrix Breccia (IBX), hosting pyrite and chalcopyrite-bearing B2 veins (0.29 % Cu, 0.36 g/t Au).

D) Magmatic Intrusive Matrix Breccia (IBX), hosting chalcopyrite and pyrite-bearing B2 vein reopened by chalcopyrite C vein 1.31 % Cu, 0.85 g/t Au).

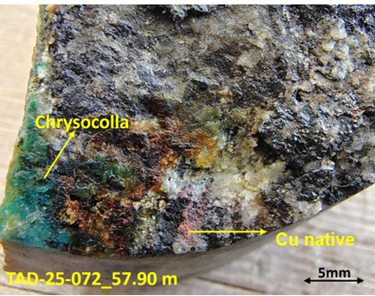

Figure 7. Quartz diorite (QD15) hosting secondary copper mineral in fractures (0.22% Cu, 0.46 g/t Au) from hole TAD-72.

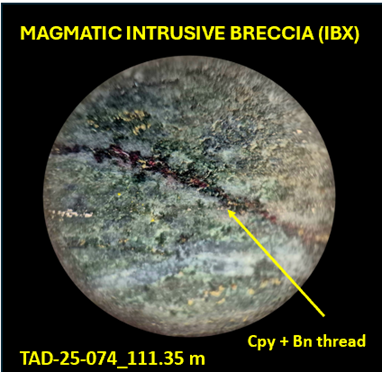

Figure 8. Magmatic Intrusive Matrix Breccia (IBX) hosting chalcopite and bornite threads, 20x zoom (0.23 % Cu, 0.36 g/t Au) from hole TAD-74

Copper Equivalent Calculation

Copper equivalent (CuEq) values have been calculated using the following formula:

CuEq (%) = Cu (%) + [Au (g/t) × 0.858]

Copper equivalent (CuEq) values are calculated using a gold price of US$2,500/oz and a copper price of US$4.25/lb, and do not account for metallurgical recoveries. Recoveries will be updated as metallurgical test work advances.

CONTACTS

Dan Vujcic Chief Executive Officer

|

Tel: +44 (0) 20 3807 6996

|

Canaccord Genuity Limited James Asensio / Charlie Hammond Broker |

Tel: +44 (0) 20 7523 8000 |

ABOUT SOLGOLD

SolGold is a leading resources company focused on the discovery, definition, and development of world-class copper and gold deposits, and continues to strive to deliver objectives efficiently in the interests of its shareholders.

The Company operates with transparency and in accordance with international best practices. SolGold is committed to delivering value to its shareholders while simultaneously providing economic and social benefits to impacted communities, fostering a healthy and safe workplace, and minimizing environmental impact.

SolGold is listed on the London Stock Exchange (LSE: SOLG).

See www.solgold.com for more information. Follow us on X @SolGold_plc.

QUALIFIED PERSON

The scientific and technical disclosure included in this news release has been reviewed and approved by Mr. Santiago Vaca (M.Sc. P.Geo.), a Qualified Person as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

CAUTIONARY NOTICE

News releases, presentations and public commentary made by SolGold plc (the "Company") and its Officers may contain certain statements and expressions of belief, expectation or opinion which are forward looking statements, and which relate, inter alia, to interpretations of exploration results to date and the Company's proposed strategy, plans and objectives or to the expectations or intentions of the Company's Directors, including the plan for developing the Project currently being studied as well as the expectations of the Company as to the forward price of copper. Such forward-looking and interpretative statements involve known and unknown risks, uncertainties, and other important factors beyond the control of the Company that could cause the actual performance or achievements of the Company to be materially different from such interpretations and forward-looking statements.

Accordingly, the reader should not rely on any interpretations or forward-looking statements, and save as required by the exchange rules of the TSX and LSE or by applicable laws, the Company does not accept any obligation to disseminate any updates or revisions to such interpretations or forward-looking statements. The Company may reinterpret results to date as the status of its assets and projects changes with time, expenditure, metals prices, and other affecting circumstances.

This release may contain "forward-looking information". Forward-looking information includes, but is not limited to, statements regarding the Company's plans for developing its properties. Generally, forward looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward looking information, including but not limited to: transaction risks; general business, economic, competitive, political and social uncertainties; future prices of mineral prices; accidents, labour disputes and shortages and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, risks relating to the ability of exploration activities (including assay results) to accurately predict mineralization; errors in management's geological modelling and/or mine development plan; capital and operating costs varying significantly from estimates; the preliminary nature of visual assessments; delays in obtaining or failures to obtain required governmental, environmental or other required approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; the global economic climate; fluctuations in commodity prices; the ability of the Company to complete further exploration activities, including drilling; delays in the development of projects; environmental risks; community and non-governmental actions; other risks involved in the mineral exploration and development industry; the ability of the Company to retain its key management employees and skilled and experienced personnel; and those risks set out in the Company's public documents filed on SEDAR+ at www.sedarplus.ca. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

The Company and its officers do not endorse, or reject or otherwise comment on the conclusions, interpretations or views expressed in press articles or third-party analysis.

Related Shares:

SolGold