19th Feb 2026 07:00

This announcement contains inside information

19 February 2026

88 Energy Limited

SOUTH PRUDHOE Prospective RESOURCE UPDATEMAJOR NEW AND UPDATED ESTIMATES ACROSS MULTIPLE RESERVOIRS

88 Energy Limited (ASX: 88E, AIM: 88E, OTC: EEENF) (88 Energy or the Company) is pleased to announce the results of its internal Prospective Resource assessment across its consolidated South Prudhoe acreage on Alaska's North Slope (100% working interest, 16.7% royalty).

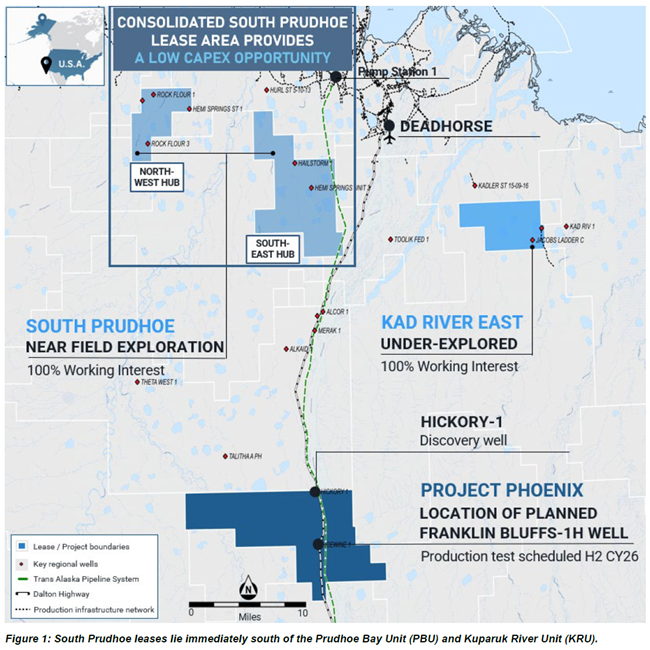

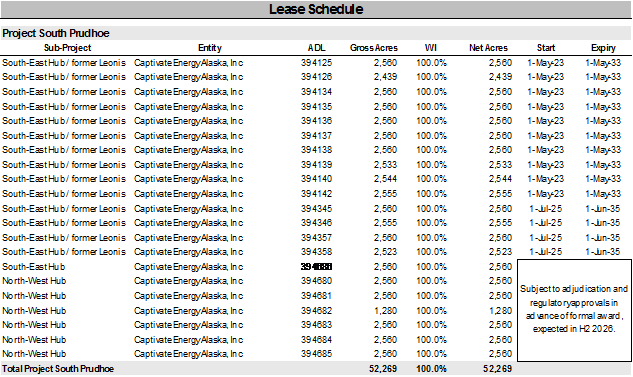

The South Prudhoe lease position covers approximately 52,269 acres within one of the most prolific hydrocarbon fairways on the North Slope, immediately south of the Prudhoe Bay Unit and Kuparuk River Unit. This acreage incorporates newly secured leases together with the former Project Leonis area, consolidating a highly strategic corridor of stacked reservoirs with direct access to existing infrastructure.

Highlights

· The update confirms material multi‑million‑barrel potential across multiple mapped prospects within five independent reservoir intervals, including maiden estimates for the Ivishak and Kuparuk reservoirs.

· All prospects are covered by modern 3D seismic data.

· The combined internal Prospective Resource estimate Gross (2U) Best Estimate of 507 million barrels (MMbbls) of oil and natural gas liquids (NGLs) (422 MMbbls net)[1] [2]

· Additional Brookian Resource upside expected to be defined within the North-West Hub, with multiple targets identified on the newly purchased Schrader Bluff 3D seismic data.

· Farm-out discussions and well planning underway targeting the multi-zone Augusta Prospect, which is adjacent to the Hemi Springs State-1 discovery well.

· Resources estimated for the N-W and S-E hubs support satellite development potential through existing third-party infrastructure.

South Prudhoe Total | Hub | Reservoir 2 | Unrisked Prospective Oil and NGLs Resources (MMbbls) 1 2 | |||||||

Probabilistic Method |

|

| Low (1U) | Best (2U) | High (3U) | MEAN | GCOS |

| ||

Augusta | N-W | Iv, Kup | 45.2 | 64.4 | 91.3 | 66.7 | 48% |

| ||

Augusta North Cluster | N-W | Iv, Kup | 16.4 | 23.1 | 32.4 | 23.9 | 62% |

| ||

Lasso | N-W | Iv, Kup | 7.8 | 11.0 | 15.2 | 11.3 | 39% |

| ||

Greater Spurr Cluster | S-E | Iv | 11.5 | 23.6 | 49.9 | 28.0 | 43% |

| ||

Eaglecrest | S-E | Iv, SB | 4.9 | 9.1 | 17.2 | 10.3 | 47% |

| ||

Donoho O and N sands | S-E | SB | 68.4 | 160.7 | 370.2 | 196.8 | 22% |

| ||

Tressler | S-E | SB | 44.9 | 106.0 | 251.2 | 132.2 | 23% |

| ||

Hunter | S-E | SB | 6.4 | 17.4 | 45.8 | 22.8 | 24% |

| ||

Cooper Canyon | S-E | SB | 39.6 | 91.3 | 211.3 | 112.6 | 26% |

| ||

Total (100% Gross) |

|

| 245.1 | 506.6 | 1,084.5 | 604.6 |

|

| ||

Total (83.33% Net Entitlement) | 204.2 | 422.2 | 903.7 | 503.8 |

|

| ||||

Managing Director, Ashley Gilbert, commented:

"This updated internal Prospective Resource assessment highlights the significant scale and quality of our South Prudhoe acreage position, with material multi-million-barrel potential now defined across seventeen mapped prospects and five independent reservoir intervals. We can now clearly see a multi-zone, multi-million-barrel opportunity with additional potential growth to come.

The Ivishak and Kuparuk prospects are positioned immediately adjacent to two of North America's largest oil fields which have been producing since 1977. This creates low-risk potential for a fast-track and low-cost development upon success through existing, third-party infrastructure.

Importantly, we see further upside ahead. The refined Brookian Formation update, incorporating the Canning and Schrader Bluff reservoirs, is just the beginning with additional upside in our North-West Hub area expected from within the West Sak and Price Creek reservoirs.

Our focus is now firmly on upgrading these current resource estimates while at the same time advancing farm-out discussions and well planning to unlock the full value of this exciting asset."

South Prudhoe Overview

Unlocking Low-Risk Barrels in a World-Class Petroleum System

88 Energy's South Prudhoe acreage lies immediately south of the giant Prudhoe Bay and Kuparuk River Units, representing two of North America's largest and most productive oil fields. This strategic position directly overlies a proven petroleum system anchored by the Ivishak and Kuparuk reservoirs, with additional upside expected to be delineated within the Brookian sequence.

Mapping of historical Storms and Schrader Bluff 3D seismic data, integrated with petrophysical analysis and offset well data, has confirmed multiple fault-block closures. Oil shows, flow tests and production in offset wells such as Hemi Springs State-1 and PBU P-27 demonstrate commercial reservoir properties and strong charge potential.

This combination of proven deep conventional reservoirs and shallower plays provides stacked-pay potential with near-term drilling objectives and long-term growth upside.

Ivishak Formation

Maiden Prospective Resource Declared

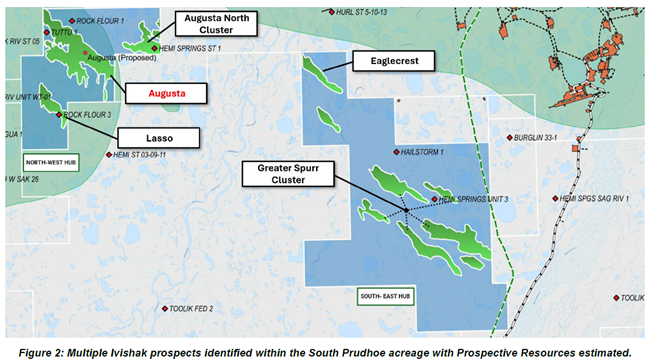

The Ivishak Formation is one of the world's most prolific conventional reservoirs, having produced more than 13 billion barrels of oil from the Prudhoe Bay Unit (PBU) (Source: DNR and AOGCC). At South Prudhoe, multiple independent, well-defined Ivishak prospects (see Figure 2 and refer to Table 1) have been delineated using modern 3D seismic interpretation, supported by petrophysical analysis and oil shows in key regional wells.

Collectively, these prospects contain an Estimated Best (2U) Gross Prospective Resource of approximately 77.2 MMbbls[3] [4] [5] of oil and NGLs (unrisked). Reservoir quality is consistent with producing Ivishak analogues, characterised by clean sandstones with average porosity of ~20% and permeability typically in the range of 50-100 millidarcies.

Hydrocarbon presence and deliverability are further validated by offset well control. Hemi Springs State-1 and Hurl St 5-10-13 successfully recovered oil from the Ivishak, while the adjacent PBU P-27 production well, located immediately adjacent to South Prudhoe's Eaglecrest Prospect, has produced more than 4.1 MMbbls to date (Source: DNR Alaska and AOGCC), confirming long-term productivity from the reservoir.

Table 1: Ivishak Formation Prospective Resources Estimate by Prospect Area

South Prudhoe: Ivishak Prospects | Unrisked Prospective Oil and NGL's Resources (MMbbls)3, 4, 5, [6] | ||||||

Probabilistic Method Estimation | Hub | Low (1U) | Best (2U) | High (3U) | MEAN | GCOS | |

Augusta | N-W | 27.5 | 40.9 | 60.1 | 42.6 | 48% | |

Augusta North Cluster | N-W | 3.6 | 5.7 | 8.9 | 6.0 | 62% | |

Lasso | N-W | 1.1 | 2.0 | 3.2 | 2.1 | 39% | |

Greater Spurr Cluster | S-E | 11.5 | 23.6 | 49.9 | 28.0 | 43% | |

Eaglecrest | S-E | 3.1 | 5.0 | 7.9 | 5.3 | 53% | |

Total (100% Gross) | 46.8 | 77.2 | 130.0 | 84.0 |

| ||

Total (83.3% Net Entitlement) |

| 39.0 | 64.3 | 108.3 | 70.0 |

| |

Kuparuk Formation

Maiden Prospective Resource Declared

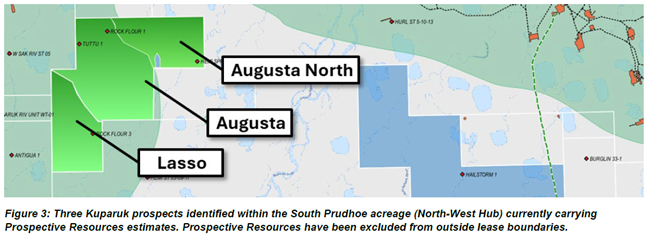

The Kuparuk Formation is one of Alaska's most significant conventional oil reservoirs, forming the backbone of the Kuparuk River Unit, which has produced over 2.5 billion barrels of oil (Source: DNR Alaska and AOGCC). At South Prudhoe, three (3) independent Kuparuk prospects have been mapped on 3D seismic and are supported by oil shows and flow tests in offset wells including Hemi Springs State-1 and KRU 1M-17. These prospects represent a combined Estimated Best (2U) Gross Prospective Resource of 49.9 MMbbls3, 4, 5, [7] oil and NGL's (unrisked) offering stacked pay potential alongside Ivishak and Brookian intervals.

Primary Kuparuk Prospects: The Kuparuk reservoir at the Augusta Prospect is a robust, low‑risk appraisal target supported by strong nearby well performance, proven high‑quality reservoir sands, and clear evidence of reservoir continuity between offset producers.

The Augusta North prospect was intersected by the Hemi Springs State‑1 well, drilled in 1984 by Arco Alaska, Inc. The Company is assessing the opportunity to reclassify the Augusta North prospective resources as a discovered Contingent Resource, supported by the successful flow test of Hemi Springs State‑1 well. Importantly, the Hemi Springs State‑1 discovery has been formally recognised by the State of Alaska as capable of producing in paying quantities, providing regulatory confirmation of the commercial hydrocarbon potential within both the Augusta and Augusta North areas

Table 2: Kuparuk Formation Prospective Resources Estimates by Prospect Area

South Prudhoe: Kuparuk Prospects | Unrisked Prospective Oil and NGL's Resources (MMbbls)3 4 5 7 | ||||||

Probabilistic Method Estimation | Hub | Low (1U) | Best (2U) | High (3U) | MEAN | GCOS | |

Augusta | N-W | 17.7 | 23.5 | 31.2 | 24.1 | 39% | |

Augusta North | N-W | 12.8 | 17.4 | 23.5 | 17.9 | 51% | |

Lasso | N-W | 6.7 | 9.0 | 12.0 | 9.2 | 31% | |

Total (100% Gross) |

| 37.2 | 49.9 | 66.7 | 51.2 | ||

Total (83.33% Net Entitlement) |

| 31.0 | 41.6 | 55.6 | 42.7 | ||

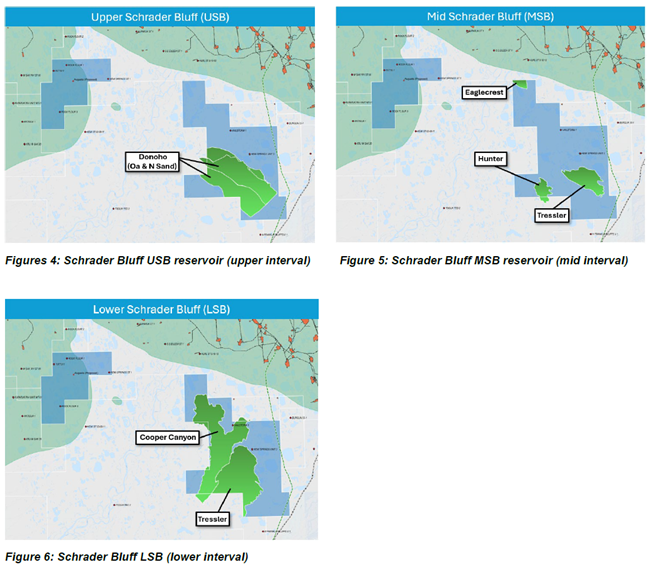

Brookian Formation (Schrader Bluff Reservoirs)

88 Energy has completed a comprehensive review of the Brookian sequence within its South Prudhoe acreage, resulting in a significant refinement of prospective resource estimates previously published in ASX releases dated 4 June 2024 and 30 January 2025. The updated interpretation, leveraging the reassessment of the Storms 3D seismic and advanced structural mapping, has consolidated the Brookian potential into six (6) structurally defined prospects, primarily within the South-East Hub. The former Canning interval is now classified as Lower Schrader Bluff, alongside Upper and Mid Schrader Bluff targets.

Collectively, these prospects carry an Estimated Best (2U) Gross Prospective Resource of 439.0 MMbbls 3, 4, 5, [8] of oil (unrisked), adding to the primary exploration opportunity. While Ivishak and Kuparuk remain the near-term focus, the Brookian sequence provides material secondary upside and reinforces the long-term growth potential of the South Prudhoe acreage position.

The South-East Hub now hosts the majority of the clearly defined Brookian prospects however, upside remains in the North-West Hub, where significant potential is yet to be fully delineated within the West Sak and Price Creek reservoirs. This ongoing work underscores the multi-zone nature of South Prudhoe and positions Brookian targets as valuable secondary opportunities complementing the near-term focus on Ivishak and Kuparuk.

Table 3: Schrader Bluff (SB) Prospective Resources Estimates by Prospect Area (South-East Hub only)

South Prudhoe: SB Prospects | Unrisked Prospective Oil and NGLs Resources (MMbbls)3 4 5 8 | ||||

Probabilistic Method Estimation | Low (1U) | Best (2U) | High (3U) | MEAN | GCOS |

Donoho O and N sands (USB) | 68.4 | 160.7 | 370.2 | 196.8 | 22% |

Tressler (MSB) | 5.3 | 14.7 | 39.9 | 19.6 | 23% |

Hunter (MSB) | 6.4 | 17.4 | 45.8 | 22.8 | 24% |

Eaglecrest (MSB) | 1.8 | 4.1 | 9.3 | 5.0 | 23% |

Cooper Canyon (Canning - LSB) | 83.3 | 150.8 | 269.3 | 166.8 | 26% |

Tressler (Canning - LSB) | 39.6 | 91.3 | 211.3 | 112.6 | 21% |

Total (100% Gross) | 204.8 | 439.0 | 945.8 | 523.6 |

|

Total (83.33% Net Entitlement - 88E) | 170.7 | 365.8 | 788.2 | 436.3 | |

South Prudhoe Advancement Schedule

Workstreams Set to Further Build Value

88 Energy's near-term focus is on progressing the planning for drilling of the Augusta-1 Prospect. Targeting a spud in Q1 2027, Augusta-1 is a priority multi-zone exploration and appraisal opportunity, providing the most direct pathway to establishing a discovered resource base capable of underpinning a future satellite development.

Key next steps include:

· Fast-track remaining resource estimation: Having only recently purchasing the Schrader Bluff 3D, the Company focused on the deeper Ivishak and Kuparuk reservoirs. However, 88 Energy has identified further potential prospects in the Brookian formation within the North-west hub and will prioritise fully-defining the remaining prospectivity and resource estimation in Q2 2026. In addition, the Company will investigate resources within the North-West Hub which are associated with the Hemi Springs State-1 discovery well and determine whether reclassification to Contingent Resources is appropriate. This will provide the foundation for definition of a formal development concept and economic assessment.

· Augusta Prospect well planning and appraisal focus: Progress detailed well design and planning for a multi-zone exploration and appraisal well at the priority Augusta Prospect, targeting stacked Ivishak, Kuparuk, and Brookian reservoirs.

· Integrated economic and development screening: Undertake early-stage development concept studies to assess potential tie-back options, capital intensity, and commercial thresholds, leveraging proximity to existing infrastructure and proven producing systems across both South Prudhoe areas.

· Farm-out and strategic partnering: Continue to progress farm-out discussions with the objective of securing funding support for drilling and appraisal activity while retaining meaningful exposure to upside across a potentially material development opportunity.

· Portfolio-wide opportunity ranking: Continue to apply a disciplined screening process across all mapped prospects to prioritise follow-up opportunities based on size, risk profile, development optionality, and alignment with near-infrastructure monetisation pathways.

Estimation Methodology - Prospective Resources Estimate

88 Energy estimated Prospective Resources using a probabilistic Monte Carlo simulation approach. Gross Rock Volumes (GRV) for each prospect were derived from detailed structural and stratigraphic mapping of the available 3D seismic data and associated geophysical attributes.

Key reservoir parameters-including porosity (ϕ), hydrocarbon saturation (HS), net-to-gross ratio (NTG), recovery factor (RF), and oil formation volume factor (Bo)-were defined based on comprehensive petrophysical evaluation of nearby offset well logs (porosity and NTG) and analysis of production data and performance from geologically analogous fields (HS, RF, and Bo).

Each input parameter was represented by an appropriate statistical distribution to reflect the inherent uncertainty associated with subsurface reservoir characterisation. The Prospective Resources estimates are reported on a gross basis and have not been risked for geological chance of success, phase risk, or chance of development. A qualitative assessment indicates a probable development outcome following geological success, supported by the project's proximity to existing infrastructure.

All Prospective Resource estimates included in this announcement adhere to the definitions and guidelines set forth in the Petroleum Resources Management System (PRMS) as revised in June 2018 by the Society of Petroleum Engineers. The PRMS cautions that Prospective Resources are estimated quantities of petroleum that may be potentially recovered by the application of a future development project and relate to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further exploration, appraisal and evaluation are required to determine the existence of a significant quantity of potentially recoverable hydrocarbons.

The evaluation date for the Prospective Resources stated within this document is 19 February 2026. Further details are available in the disclaimers attached as Schedule 1 of this ASX release.

South Prudhoe: Prospects Total | Hub | Reservoir[9] | Unrisked Prospective Oil and NGLs Resources (MMbbls)3 [10] [11] [12] [13] | ||||||

Probabilistic Method |

|

| Low (1U) | Best (2U) | High (3U) | MEAN | GCOS |

| |

Augusta | N-W | Iv, Kup | 45.2 | 64.4 | 91.3 | 66.7 | 48% |

| |

Augusta North Cluster | N-W | Iv, Kup | 16.4 | 23.1 | 32.4 | 23.9 | 62% |

| |

Lasso | N-W | Iv, Kup | 7.8 | 11.0 | 15.2 | 11.3 | 39% |

| |

Greater Spurr Cluster | S-E | Iv | 11.5 | 23.6 | 49.9 | 28.0 | 43% |

| |

Eaglecrest | S-E | Iv, SB | 4.9 | 9.1 | 17.2 | 10.3 | 47% |

| |

Donoho O and N sands | S-E | SB | 68.4 | 160.7 | 370.2 | 196.8 | 22% |

| |

Tressler | S-E | SB | 44.9 | 106.0 | 251.2 | 132.2 | 23% |

| |

Hunter | S-E | SB | 6.4 | 17.4 | 45.8 | 22.8 | 24% |

| |

Cooper Canyon | S-E | SB | 39.6 | 91.3 | 211.3 | 112.6 | 26% |

| |

Total (100% Gross) |

|

| 245.1 | 506.6 | 1,084.5 | 604.6 |

|

| |

Total (83.33% Net Entitlement) |

|

| 204.2 | 422.2 | 903.7 | 503.8 |

|

| |

This announcement has been authorised by the Board.

Media and Investor Relations:

88 Energy Ltd Ashley Gilbert, Managing Director Tel: +61 (0)8 9485 0990 Email: [email protected] | |

Fivemark Partners, Investor and Media Relations | |

Michael Vaughan | Tel: +61 (0)422 602 720 |

Euroz Hartleys Ltd | |

Chelsey Kidner | Tel: +61 (0)8 9268 2829 |

Cavendish Capital Markets Limited | |

Derrick Lee / Pearl Kellie | Tel: +44 (0)131 220 6939

|

Hannam & Partners Leif Powis / Neil Passmore |

Tel: +44 (0) 207 907 8500 |

SCHEDULE 1

Disclaimers:

Cautionary Statement for Prospective Resource Estimates - With respect to the Prospective Resource estimates contained within this report, it should be noted that the estimated quantities of gas that may potentially be recovered by the future application of a development project relate to undiscovered accumulations. These estimates have an associated risk of discovery and risk of development. Further exploration, appraisal and evaluation is required to determine the existence of a significant quantity of potentially recoverable hydrocarbons.

Hydrocarbon Resource Estimates - The Prospective Resource estimates for South Prudhoe (inclusive of the formerly named Project Leonis) presented in this report are prepared as at 19 February 2026. The Prospective Resource estimates are quoted on an unrisked basis together with the geological chance of success for the Ivishak, Kuparuk and Schrader Bluff prospects. 88 Energy has considered the chance of discovering oil over gas to be 100%. Chance of development has not been estimated. Quantifying the chance of development (COD) requires consideration of both economic contingencies and other contingencies, such as legal, regulatory, market access, political, social license, internal and external approvals and commitment to project finance and development timing. As many of these factors are outside the knowledge of 88 Energy they must be used with caution.

Government Royalty and Overriding Royalty Interests - The South Prudhoe leases ("Leases") are situated in the State Lands of the North Slope of Alaska and are administered by the Alaskan Department of Natural Resources - Oil and Gas Division (DNR). All leases issued by DNR are subject to a royalty and 88 Energy's Leases are subject to a 16.67% government royalty. The net economic interest to 88 Energy has therefore been calculated as 83.33% and the Net Entitlement Prospective Resources have been adjusted to reflect this.

Competent Person Statement Information - In this report information relating to hydrocarbon resource estimates have been prepared by Matt Fittal, Principal Subsurface Advisor at 88 Energy Limited, and reviewed by Dr Stephen Staley, who is a Non-Executive Director of the Company. This information is based on, and fairly represents, information and supporting documentation compiled by Matt Fittal, and the company has stated in the Report that it has been prepared in accordance with the definitions and guidelines set forth in the Petroleum Resources Management System, 2018, approved by the Society of Petroleum Engineers and have been prepared using probabilistic methods. Dr Stephen Staley, has more than 40 years' experience in the petroleum industry, is a Fellow of the Geological Society of London, and a qualified Geologist/Geophysicist who has sufficient experience that is relevant to the style and nature of the oil prospects under consideration and to the activities discussed in this document. Dr Staley has reviewed the information and supporting documentation referred to in this announcement and considers the prospective resource estimates to be fairly represented and consents to its release in the form and context in which it appears. His academic qualifications and industry memberships appear on the Company's website and both comply with the criteria for "Competence" under clause 3.1 of the Valmin Code 2015. Terminology and standards adopted by the Society of Petroleum Engineers "Petroleum Resources Management System" have been applied in producing this document.

Forward looking statements - This document may include forward looking statements. Forward looking statements include, are not necessarily limited to, statements concerning 88 Energy's planned operation program and other statements that are not historic facts. When used in this document, the words such as "could," "plan," "estimate," "expect," "intend," "may," "potential," "should" and similar expressions are forward looking statements. Although 88 Energy believes the expectations reflected in these are reasonable, such statements involve risks and uncertainties, and no assurance can be given that actual results will be consistent with these forward-looking statements. The entity confirms that it is not aware of any new information or data that materially affects the information included in this announcement and that all material assumptions and technical parameters underpinning this announcement continue to apply and have not materially changed.

SCHEDULE 2

Definitions and Glossary of Key Terms:

PRMS/SPE definition: Prospective Resource

Prospective resources are estimated volumes associated with undiscovered accumulations. These represent quantities of petroleum which are estimated, as of a given date, to be potentially recoverable from oil and gas deposits identified on the basis of indirect evidence, but which have not yet been drilled. This class represents a higher risk than contingent resources since the risk of discovery is also added. For prospective resources to become classified as contingent resources, hydrocarbons must be discovered, the accumulations must be further evaluated and an estimate of quantities that would be recoverable under appropriate development project(s) prepared.

Glossary of Key Terms

1U | Denotes the unrisked low estimate qualifying as Prospective Resources. |

2U | Denotes the unrisked best estimate qualifying as Prospective Resources |

3U | Denotes the unrisked high estimate qualifying as Prospective Resources |

BOE | Barrels of oil equivalent |

Chance | Chance equals 1-risk. Generally synonymous with likelihood. |

Chance of Development | The estimated probability that a known accumulation, once discovered, will be commercially developed. |

Entitlement | That portion of future production (and thus resources) legally accruing to an entity under the terms of the development and production contract or license. |

Mean | The sum of a set of numerical values divided by the number of values in the set. |

MMbbl | Million barrels of oil |

Prospect | A project associated with a potential accumulation that is sufficiently well defined to represent a viable drilling target. |

Prospective Resources | Those quantities of petroleum that are estimated, as of a given date, to be potentially recoverable from undiscovered accumulations. |

Reservoir | A subsurface rock formation that contains an individual and separate natural accumulation of petroleum that is confined by impermeable barriers, pressure systems, or fluid regimes (conventional reservoirs), or is confined by hydraulic fracture barriers or fluid regimes (unconventional reservoirs). |

Royalty | A type of entitlement interest in a resource that is free and clear of the costs and expenses of development and production to the royalty interest owner. A royalty is commonly retained by a resource's owner (lessor/host) when granting rights to a producer (lessee/contractor) to develop and produce that resource. Depending on the specific terms defining the royalty, the payment obligation may be expressed in monetary terms as a portion of the proceeds of production or as a right to take a portion of production in-kind. The royalty terms may also provide the option to switch between forms of payment at discretion of the royalty owner |

Working Interest | An entity's equity interest in a project before reduction for royalties or production share owed to others under the applicable fiscal terms. |

SCHEDULE 3

South Prudhoe - lease information:

Former Project Leonis acreage, now included within South Prudhoe comprises 14 leases covering approximately 35,629 contiguous acres and a further 7 leases covering approximately 16,640 acres:

On 10 November 2022, the Company announced Captivate Energy Alaska, Inc. [Captivate] (a wholly-owned subsidiary of the Company) had been declared the successful bidder on ten leases covering 25,430 contiguous acres as part of the North Slope Areawide 2022 Oil and Gas lease sale. On 20 April 2023 the Company announced that the Alaskan Department of Natural Resources (DNR), Oil and Gas Division, had completed its adjudication process and formally issued award notices to Captivate Energy Alaska, Inc.

On 12 December 2024, Captivate was declared the successful bidder on four additional lease blocks immediately adjacent to the existing 2023 acquired leases. The new leases cover 10,203 acres, expanding the lease footprint of Project Leonis to fourteen (14) leases covering approximately 35,634 contiguous acres. The DNR formally awarded the leases on 27 June 2025.

On 20 November 2025, Captivate was declared the successful bidder on seven additional lease blocks adjacent to the 14 existing owned leases covering 16,640 acres. Final lease issuance follows the State's standard adjudication and administrative process, which includes routine interest and title reviews conducted by the Alaska Department of Natural Resources. This process is expected to conclude in 1H 2026 with the final award is pending this standard procedure. Based on the company's established qualification history and the leasing history of these tracts, management views the likelihood of any non issuance or material acreage adjustment as very low. Prospective resources have been estimated within the South Prudhoe leases on the basis that Management expects the issuance to occur without complication.

The leases have an annual rental of $10/acre each year, and a royalty of 16.6667% payable to the State of Alaska. The Project Leonis leases have a ten-year term. The initial 10 leases expire on 1 May 2033, the four 2025 awarded leases expire on 1 June 2035.

[1] Cautionary Statement: Prospective Resources are estimated quantities of petroleum that may be potentially recovered by the application of a future development project and relate to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further exploration, appraisal and evaluation are required to determine the existence of a significant quantity of potentially recoverable hydrocarbons.

[2] Refer to pages 4, 5, 7 and 8 and Schedule 1,2 and 3 for further details. Summary table includes arithmetic totals for Ivishak (Iv), Kuparuk (Kup) and Schrader Bluff (SB) which includes Upper, Mid and Lower Schrader Bluff (USB, MSB & LSB respectively).

[3] Refer to Cautionary Statement on page 1 and 10.

[4] Refer to pages 8 and 9, and Schedules 1,2 and 3 for further information and disclosures required by ASX Listing Rules

[5] Gross unrisked Oil and NGL Prospective Resource. 88 Energy net resources have been calculated using a 100% working interest and a 16.6667% royalty. NGLs are converted to oil equivalent volumes on a constant ratio basis of 1:1

[6] Reported totals for each prospect and totals are an arithmetic sum of both Oil and NGL hydrocarbon types within the Ivishak reservoir.

[7] Reported totals for each prospect and totals are an arithmetic sum of both Oil and NGL hydrocarbon types within the Kuparuk reservoir. Kuparuk recovery factors assume a waterflood.

[8] Reported totals for each prospect and totals are an arithmetic sum of both Oil and NGL hydrocarbon types within the Schrader Bluff reservoirs.

[9] Summary table includes arithmetic totals for Ivishak (Iv), Kuparuk (Kup) and Schrader Bluff (SB) which includes Upper, Mid and Lower Schrader Bluff (USB, MSB & LSB respectively).

[10] 88 Energy net resources have been calculated using a 100% working interest and a 16.6667% royalty

[11] GCOS represents the geological chance of success as assessed by 88 Energy and relates to the primary objective, taking into account and risking of such factors as source, timing/migration, estimated reservoir and quality, mapped closures and seal effectiveness. The GCOS has been assessed as an average of the primary prospects identified within each formation. Individual prospect GCOS are noted on page 4 for the Ivishak, page 5 for the Kuparuk and page 7 for the Schrader Bluff.

[12] Prospects are subject to a phase risk (oil vs gas) with the chance of oil assessed as 100% in these prospects

[13] The Prospective Resources have not been adjusted for the chance of development. Quantifying the chance of development (COD) requires consideration of both economic and other contingencies, such as legal, regulatory, market access, political, social license, internal and external approvals and commitment to project finance and development timing. As many of these factors are not yet known, 88 Energy has qualitatively assessed the chance of development as "probable" upon geological success given the strategic location of the acreage position adjacent to TAPS and key infrastructure.

Related Shares:

88 Energy