14th Aug 2025 07:00

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

FOR IMMEDIATE RELEASE

14 August 2025

RECOMMENDED CASH AND SHARE ACQUISITION

of

EMPIRIC STUDENT PROPERTY PLC

by

THE UNITE GROUP PLC

to be effected by means of a Scheme of Arrangement

under Part 26 of the Companies Act 2006

Summary

The boards of directors of The Unite Group PLC ("Unite") and Empiric Student Property plc ("Empiric") are pleased to announce that they have reached agreement on the terms of a recommended cash and share offer pursuant to which Unite will acquire the entire issued and to be issued ordinary share capital of Empiric (the "Acquisition"). It is intended that the Acquisition will be effected by means of a scheme of arrangement under Part 26 of the Companies Act.

Key terms

Under the terms of the Acquisition, for each Empiric Share held, the Scheme Shareholders will be entitled to receive:

0.085 New Unite Shares and 32 pence in cash

Based on Unite's closing share price of 732.0 pence as at the Latest Practicable Date, and excluding the Empiric Q2, Q3 and Q4 dividends which are expected to be declared and paid to Empiric Shareholders prior to the Effective Date ("Empiric 2025 Dividends"), the Acquisition values each Empiric Share at approximately 94.2 pence and Empiric's entire issued and to be issued share capital at approximately £634 million. The terms of the Acquisition imply an EPRA NTA discount of 3.7 per cent. based on each of Unite's and Empiric's EPRA NTAs per share as at 30 June 2025 (excluding the Empiric 2025 Dividends).

Based on Unite's closing share price of 855.5 pence as at 4 June 2025 (being the last Business Day prior to the commencement of the Offer Period) (the "Last Undisturbed Trading Date"), and, in addition, the Empiric 2025 Dividends, the Acquisition values each Empiric Share at approximately 107.5 pence (the "Total Transaction Value") and Empiric's entire issued and to be issued share capital at approximately £723 million, representing:

· a premium of approximately 10 per cent. to Empiric's closing share price of 97.3 pence as at the Last Undisturbed Trading Date;

· a premium of approximately 22 per cent. to Empiric's three-month volume-weighted average price of 88.3 pence as at the Last Undisturbed Trading Date; and

· a premium of approximately 24 per cent. to Empiric's six-month volume-weighted average price of 86.6 pence as at the Last Undisturbed Trading Date.

Immediately following Completion, Empiric Shareholders will hold approximately 10 per cent. of the issued share capital of the Enlarged Group and existing Unite Shareholders will hold approximately 90 per cent. of the issued share capital of the Enlarged Group.

The Scheme Document will contain full details of the Acquisition and the Scheme.

Highlights of the Acquisition

The acquisition of Empiric's high quality, complementary portfolio provides Unite with greater scale and enhanced growth opportunities aligned to the UK's strongest universities. Empiric's differentiated customer proposition enables Unite to appeal to a broader customer base - at pace and at scale, and at a discount to estimated replacement cost - through increased exposure to the attractive segment for "returner" students (non-first year undergraduates and postgraduate students) which is largely unaddressed by "conventional" PBSA. With the benefit of substantial cost synergies, the Acquisition is expected to deliver earnings, and dividend accretion and enhanced returns for both companies' shareholders; while maintaining balance sheet strength. The Acquisition would result in:

· a £10.5 billion combined portfolio (Unite share: £7.4 billion) in the UK's strongest universities, with c.75,000 beds on a combined basis of which 92 per cent. are located in Russell Group cities;

· a platform for expansion in the attractive returner segment through a proven platform (representing c.11 per cent. of the Enlarged Group's portfolio value, with scope to increase to c.15-20 per cent. over time through conversions and future acquisitions) delivering a significant increase in Unite's addressable market, and enabling Unite to attract and retain students throughout their academic journey including the c.35,000 first-year students currently living with Unite;

· a dedicated high-quality product and service offering under the Hello Student brand, tailored to the needs of returner students and aligned with the UK's strongest universities;

· significant cost synergies of £13.7 million unlocked though Unite's best-in-class operating platform;

· earnings and dividend accretion for both sets of shareholders, from the first full year of ownership for Empiric Shareholders and in the second full year of ownership for Unite Shareholders (neutral in the first) as synergies are delivered;

· a low double-digit unlevered IRR ahead of Unite's cost of capital and supporting total accounting returns of c.10 per cent. p.a.; and

· the maintenance of a high-quality balance sheet, with pro forma net debt / EBITDA of 5.9x, net LTV of 29 per cent., a weighted average cost of debt of 4.1 per cent., a weighted average debt maturity of 3.6 years and £570 million of undrawn debt facilities, in each case as at 30 June 2025 adjusted for the impact of the cash consideration.

In arriving at its recommendation of the Acquisition, the Empiric Board also notes the specific benefits for Empiric Shareholders, including:

· based on Unite's closing share price as at the Last Undisturbed Trading Date, approximately 69 per cent. of the Acquisition consideration is payable in New Unite Shares, providing Empiric Shareholders with a tax-efficient means of remaining invested in the UK PBSA sector via the enlarged vehicle with exposure to the compelling strategic and financial benefits set out above;

· based on Unite's closing share price as at the Last Undisturbed Trading Date, approximately 31 per cent. of the Acquisition consideration is payable in cash, providing Empiric Shareholders with significant liquidity at a premium to Empiric's closing share price on the Last Undisturbed Trading Date, while underpinning the value of the Acquisition as a whole. In addition, on an EPRA NTA basis, the cash consideration allows Empiric Shareholders to realise the equivalent of approximately 27 per cent. of Empiric's EPRA NTA per Empiric Share of 120.2 pence as at 30 June 2025;

· the compelling financial effects of the combination in respect of the New Unite Shares, including:

§ participating in the synergy benefits arising from the Acquisition that Unite as an established, publicly listed PBSA operator of scale is uniquely qualified to deliver;

§ material earnings and dividend accretion, with an implied uplift of 36 per cent. and 30 per cent. in earnings and dividend per share, respectively based on 2024 earnings and dividends, prior to synergies; and

· the cost of capital benefits through holding shares in a FTSE 100 constituent with an investment grade credit rating, where the greater liquidity in the trading of Unite Shares compared with Empiric Shares would allow Empiric Shareholders to trade in and out of the Unite Shares should they wish to do so.

Recommendation

The Empiric Directors, who have been so advised by Peel Hunt and Jefferies as to the financial terms of the Acquisition, consider the terms of the Acquisition to be fair and reasonable. In providing their financial advice to the Empiric Directors, Peel Hunt and Jefferies have taken into account the commercial assessments of the Empiric Directors.

Accordingly, the Empiric Directors intend unanimously to recommend that Empiric Shareholders vote in favour of the Scheme at the Court Meeting and the Resolution to be proposed at the General Meeting, as the Empiric Directors have irrevocably undertaken to do in respect of their own holdings of Empiric Shares, representing approximately 0.06 per cent. of Empiric's issued share capital as at the Latest Practicable Date.

Pre-Completion dividends

In addition to the New Unite Shares and cash consideration received by Scheme Shareholders in connection with the Acquisition, the Empiric Board will be entitled to pay certain agreed ordinary course Empiric dividends to Empiric Shareholders prior to the Effective Date, full details of which are set out in this Announcement.

Following the Acquisition becoming Effective, the Unite Directors expect that dividends will continue to be paid in accordance with Unite's existing dividend timetable.

Transaction structure and timetable

It is intended that the Acquisition will be implemented by way of a court-sanctioned scheme of arrangement of Empiric under Part 26 of the Companies Act, further details of which are contained in the full text of this Announcement. Unite reserves the right to implement the Acquisition by way of a Takeover Offer, subject to the Panel's consent and the terms of the Co-operation Agreement.

The Acquisition will be made in accordance with the Code and on the terms and subject to the satisfaction or waiver (as applicable) of the Conditions and certain further terms set out in Appendix 1 to this Announcement and to the full terms and conditions which will be set out in the Scheme Document. These Conditions include, amongst others:

· the approval of the Scheme by a majority in number of Scheme Shareholders present and voting, either in person or by proxy, at the Court Meeting, representing at least 75 per cent. in value of the Scheme Shares voted by Scheme Shareholders of the Court Meeting. In addition, the Resolution must be passed by the requisite majority of Empiric Shareholders at the General Meeting;

· the CMA either:

o issuing a decision that it is not the CMA's intention to make a Phase 2 CMA Reference, with such a decision being issued unconditionally or else conditional on the CMA's acceptance of undertakings in lieu of a Phase 2 CMA Reference ("UILs") offered by Unite which are reasonably satisfactory to Unite, having regard to both the impact on overall portfolio value and the alignment of any assets subject to UILs to key universities, in particular Russell Group universities (or the applicable time period for the CMA to make a Phase 2 CMA Reference having expired without a Phase 2 CMA Reference having been made) ("CMA Phase 1 Clearance Condition"); or

o in the event that a Phase 2 Reference is made and the CMA Phase 1 Clearance condition cannot be invoked, confirming that the proposed acquisition of Empiric by Unite may proceed (i) without any undertakings or conditions or (ii) the CMA has decided to accept undertakings from, or imposed an order, on Empiric and/or Unite in order to allow the proposed acquisition of Empiric by Unite and any matter arising therefrom or relating thereto to proceed, provided such undertakings or orders are on terms reasonably satisfactory to Unite, having regard to both the impact on overall portfolio value and the alignment of any assets subject to UILs to key universities, in particular Russell Group universities ("CMA Phase 2 Clearance Condition");

(together, the "CMA Condition"); and

· the sanction of the Scheme by the Court.

The Scheme Document will contain full details of the Acquisition and the Scheme, together with notices of the Court Meeting and the General Meeting and the expected timetable of the Scheme and will specify the action to be taken by Empiric Shareholders. It is expected that the Scheme Document will be despatched to Empiric Shareholders (together with the Forms of Proxy) within 28 days of this Announcement (unless otherwise agreed by the Panel, Unite and Empiric).

The Scheme is expected to become Effective by the second quarter of 2026, subject to the satisfaction or waiver of (as applicable) the Conditions and certain further terms set out in Appendix 1 to this Announcement and to the full terms and conditions to be set out in the Scheme Document.

An expected timetable of the key events of the Acquisition will be set out in the Scheme Document.

Commenting on the Acquisition, Mark Pain, Chair of Empiric said:

"Over the last few years, the Board and management of Empiric has implemented a successful transformation strategy, aligning the company's portfolio to the best locations in the UK's strongest university cities. Unite has identified Empiric's differentiated proposition through its Hello Student brand, as well as its focus on returner and post graduate students, as clear strategic pillars through which to grow its business.

The Board of Empiric believes the firm and recommended offer from Unite is highly compelling for Empiric's shareholders as it will deliver material accretion to earnings and dividends per share, deliver synergy benefits and provide superior access to capital to drive growth, whilst enabling shareholders to remain invested in a portfolio of highly attractive UK student accommodation assets."

Commenting on the Acquisition, Richard Huntingford, Chair of Unite said:

"Acquiring Empiric's high-quality and complementary portfolio accelerates our growth into the attractive returner student segment, enabling us to better serve students throughout their academic journey.

Unite is uniquely positioned to unlock significant synergies and accelerate earnings growth for both sets of shareholders. Alongside university partnerships and our significant development pipeline, the acquisition provides a new growth driver to deliver enhanced scale and long-term value for shareholders."

Analyst and investor presentation

Unite will host a presentation for analysts and investors today at 8:30 am (London time) to discuss the Acquisition.

To watch via webcast, please register and log in at the following: brrmedia.news/UTG_Aug25

Subject to certain restrictions, the slides used in the presentation will be available to all interested parties at www.unitegroup.com/investors/possible-offer-for-empiric-student-property-plc.

This summary should be read in conjunction with, and is subject to, the full text of this Announcement including the Appendices.

The Acquisition is subject to the satisfaction or waiver (as applicable) of the Conditions and certain further terms set out in Appendix 1 to this Announcement and to the full terms and conditions to be set out in the Scheme Document. Appendix 2 contains sources and bases of certain information contained within this Announcement. Appendix 3 contains details of the irrevocable undertakings given to Unite in relation to the Acquisition.

Appendix 4 to this Announcement contains the Quantified Financial Benefits Statement, together with the reports from Grant Thornton, as reporting accountants to Unite for the purposes of the Quantified Financial Benefits Statement, and Lazard, as financial adviser to Unite for the purposes of the Quantified Financial Benefits Statement, as required under Rule 28.1(a) of the Code. Each of Grant Thornton and Lazard has given and not withdrawn its consent to the publication of its report in this Announcement in the form and context in which it is included. For the purposes of Rule 28 of the Takeover Code, the Quantified Financial Benefits Statement contained in this Announcement is the responsibility of Unite and the Unite Directors.

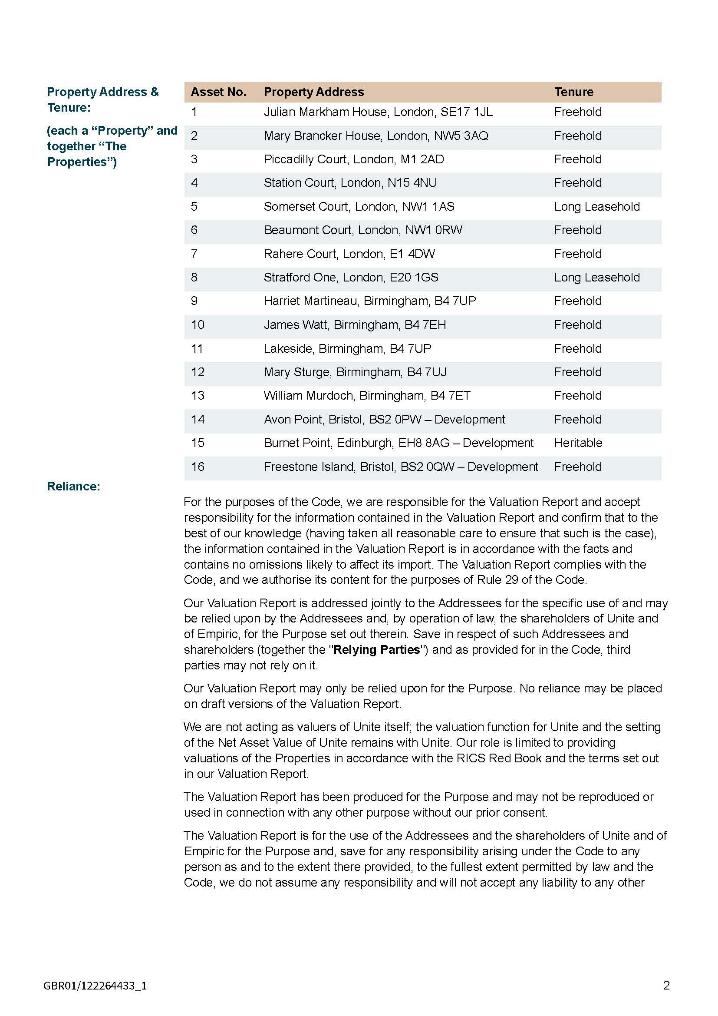

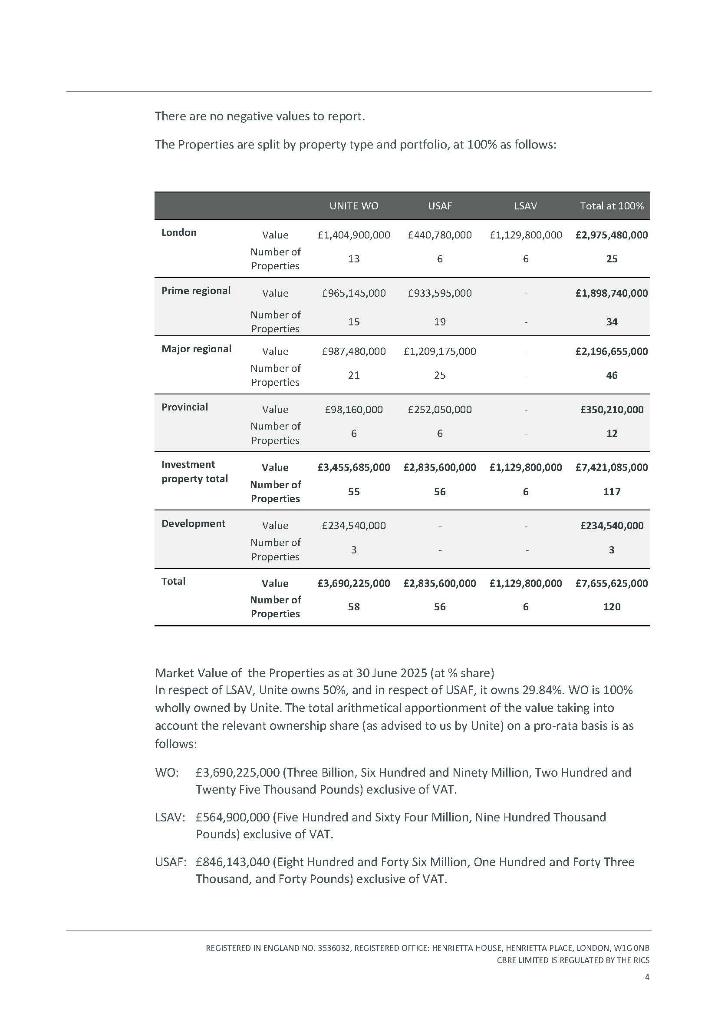

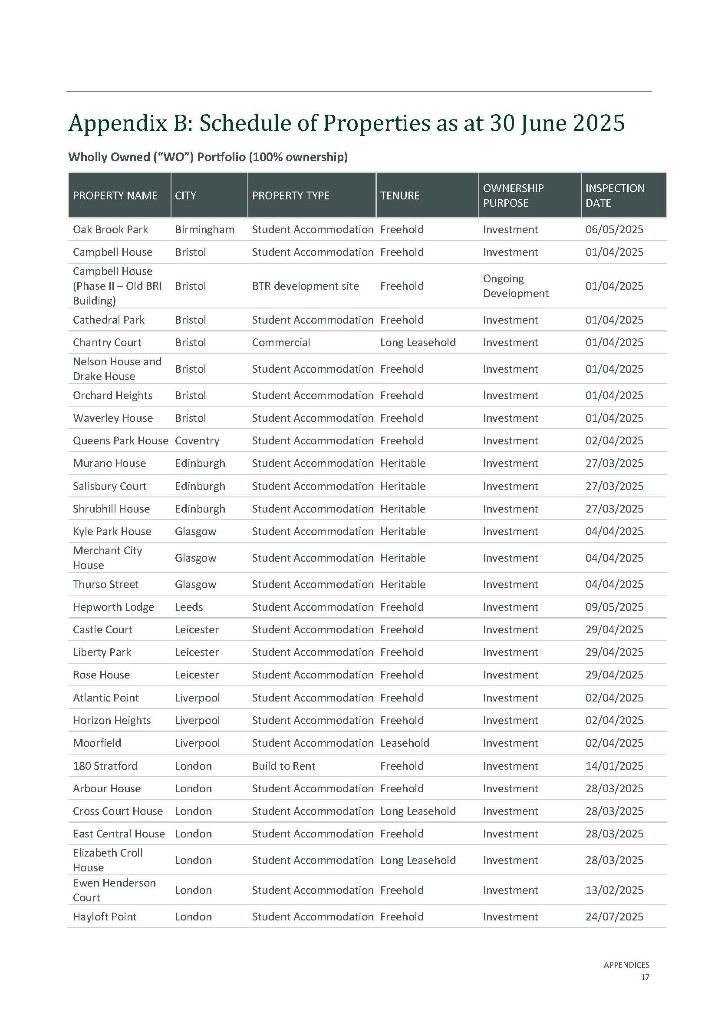

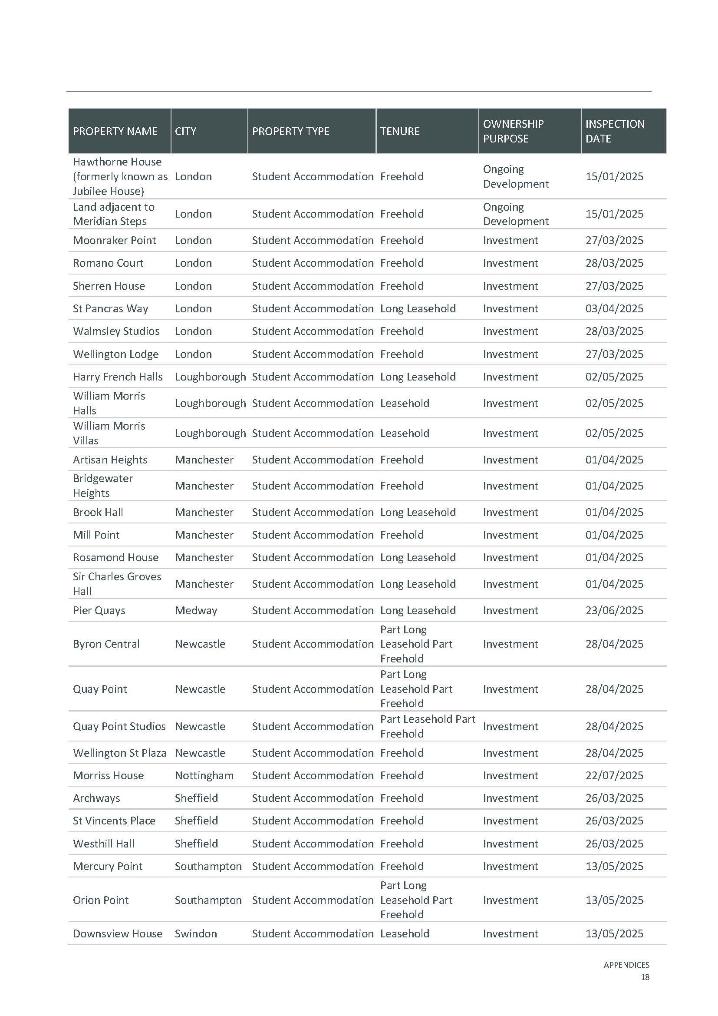

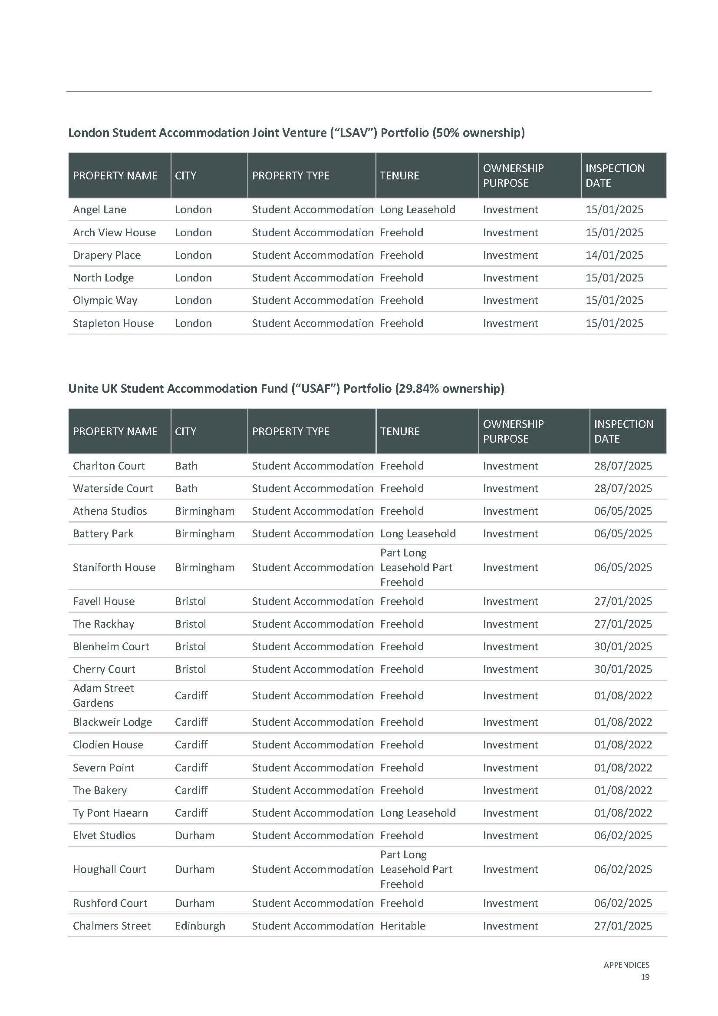

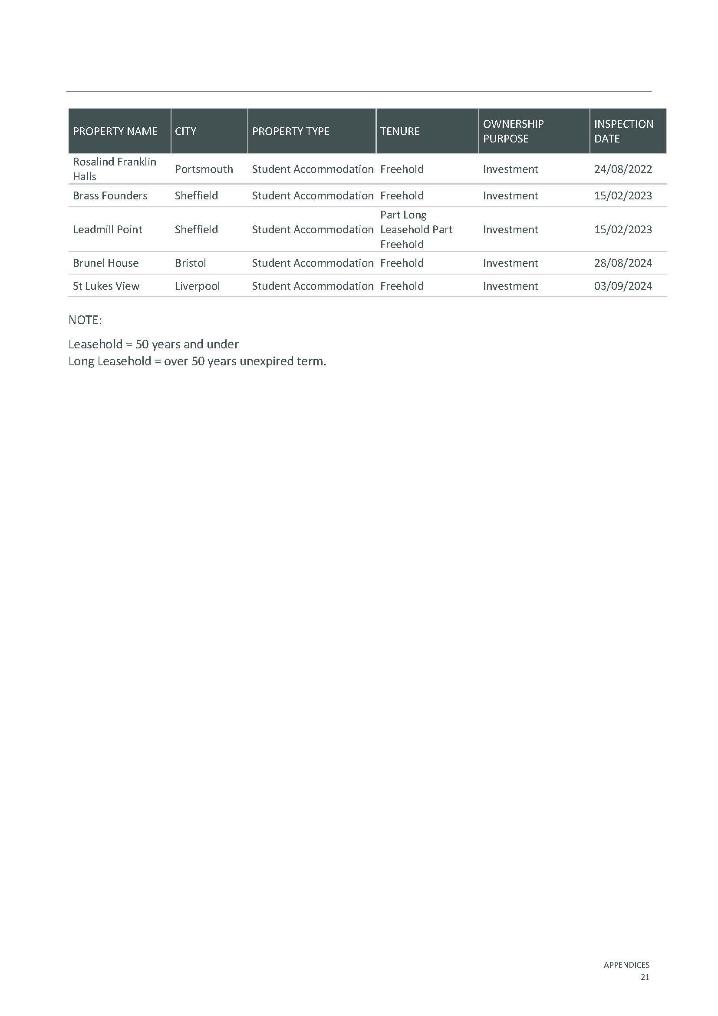

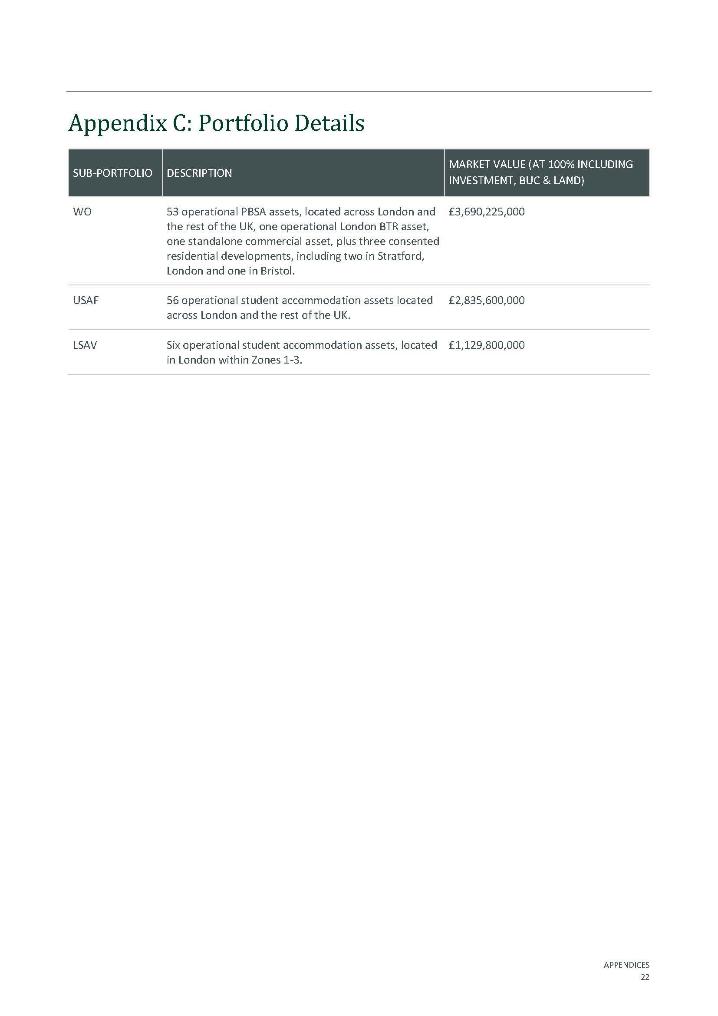

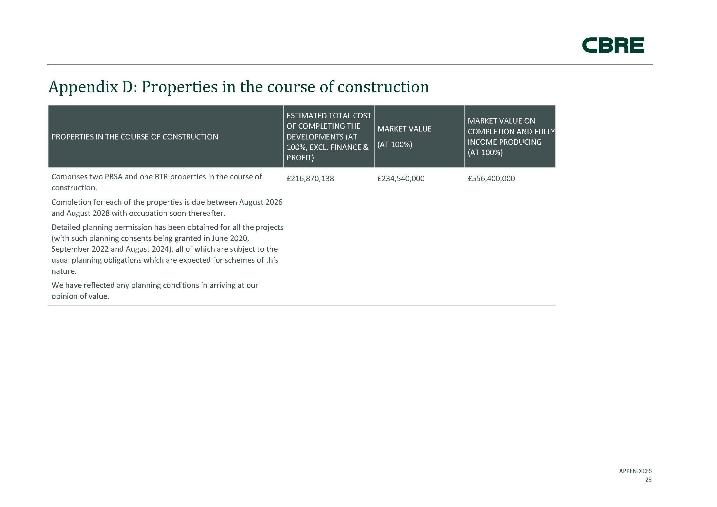

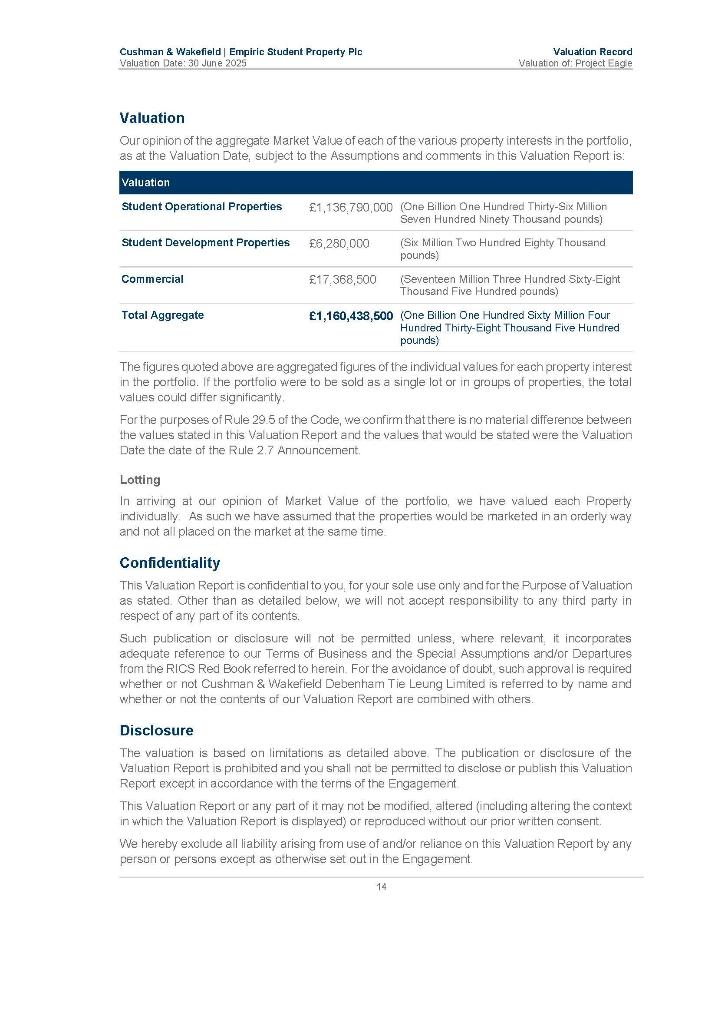

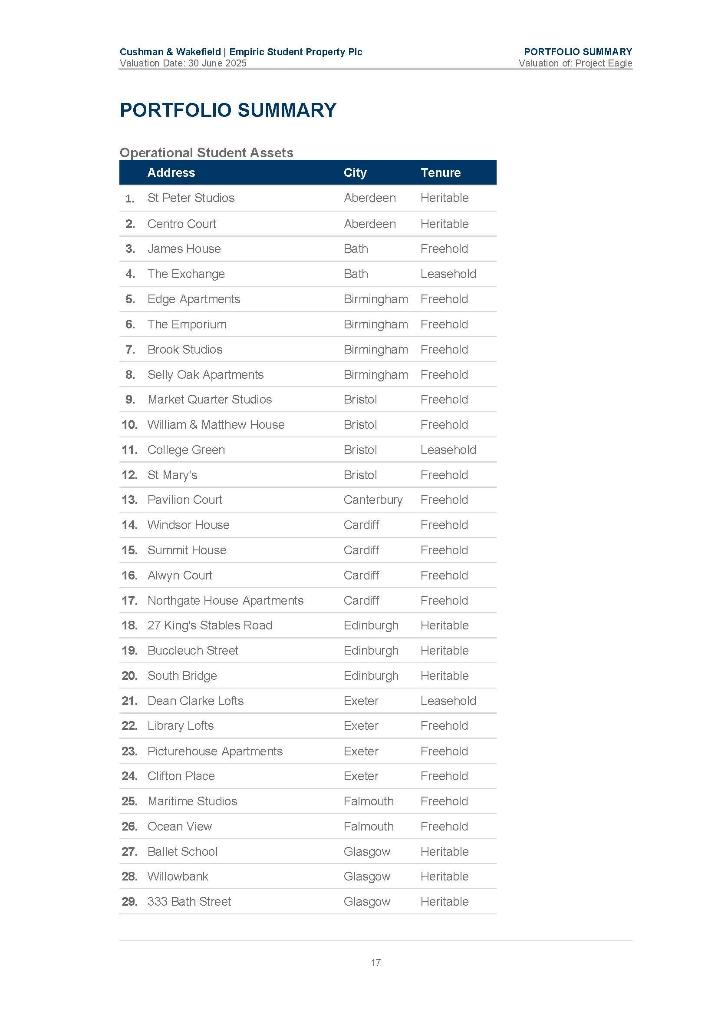

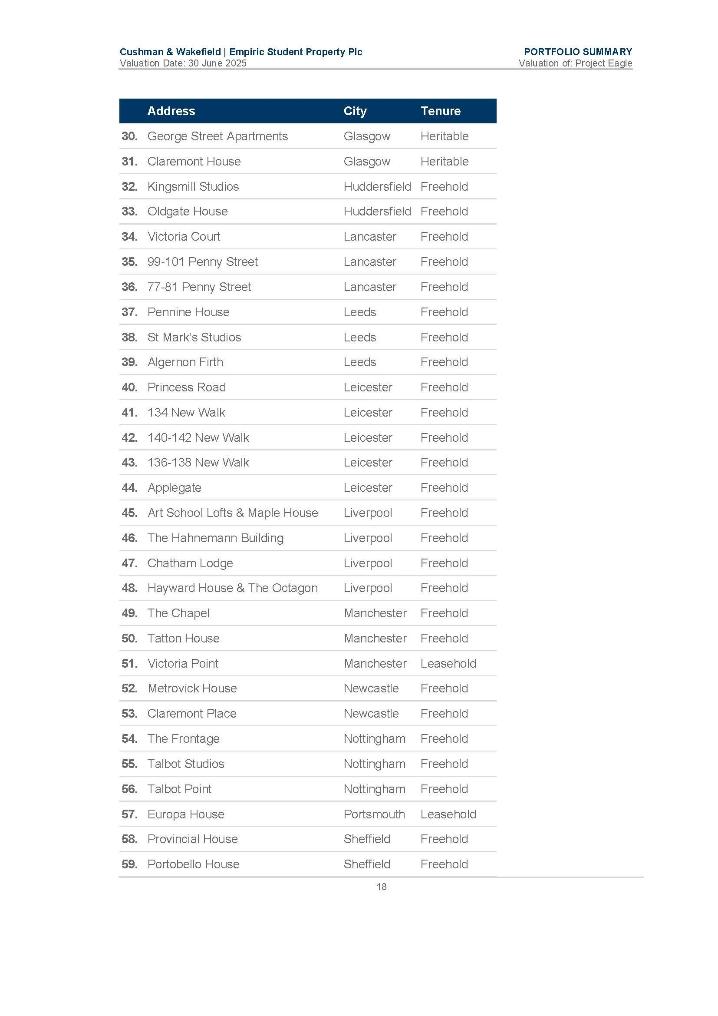

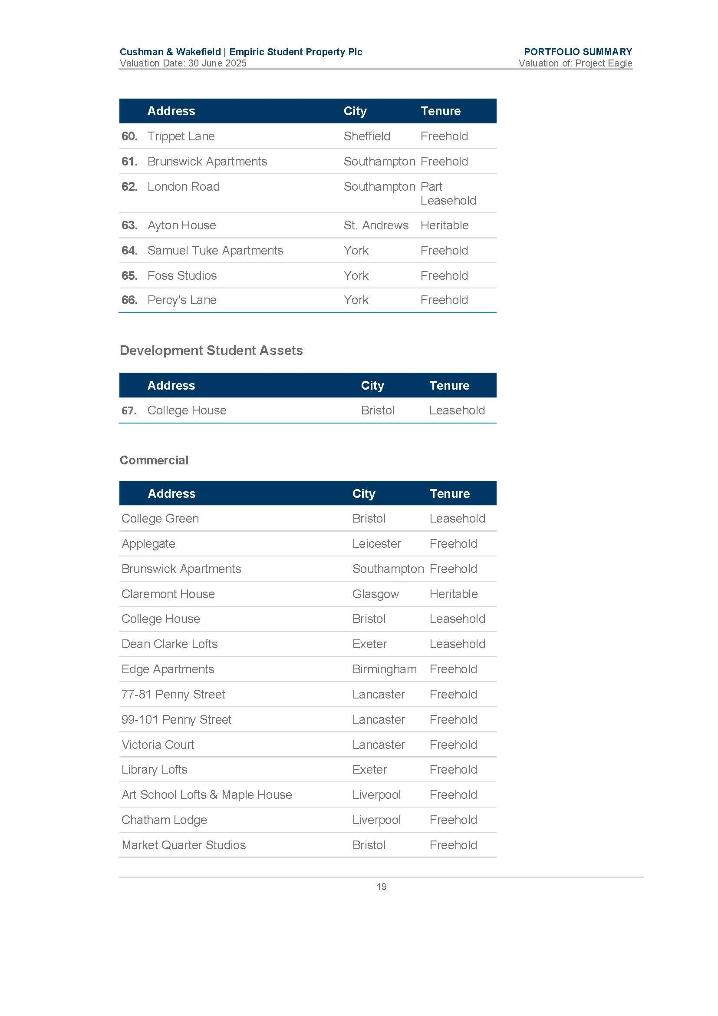

Appendix 5 to this Announcement contains property valuations supported by valuation reports for Unite and Empiric as at 30 June 2025 pursuant to the requirements of Rule 29 of the Code. These property valuation reports will, subject to the requirements of the Code, be reproduced in the Scheme Document. Each of Knight Frank, JLL, CBRE and Cushman & Wakefield has given and not withdrawn its consent to the publication of their respective valuation reports in this Announcement in the form and context in which it is included.

Appendix 6 contains details of the Unite 2025 Profit Forecast and Empiric 2025 Profit Forecast.

Appendix 7 contains the definitions of certain terms used in this Announcement.

Enquiries:

Unite +44 (0) 117 302 7005

Joe Lister (Chief Executive Officer)

Michael Burt (Chief Financial Officer)

Saxon Ridley (Head of IR and Investment Finance)

Lazard (Lead Financial Adviser to Unite) +44 (0) 20 7187 2000

Patrick Long

Jolyon Coates

Harriet Wedmore

Deutsche Numis

(Joint Financial Adviser and Corporate Broker to Unite) +44 (0) 20 7260 1000

Heraclis Economides

Oliver Hardy

Oliver Ives

J.P. Morgan Cazenove

(Joint Financial Adviser and Corporate Broker to Unite) +44 (0) 20 3493 8000

Matt Smith

Paul Pulze

Saul Leisegang

Sodali & Co (Communications Adviser to Unite) +44 (0) 20 7250 1446

Justin Griffiths

Victoria Heslop

Louisa Henry

Empiric (via FTI Consulting)

Mark Pain (Non-Executive Chairman)

Duncan Garrood (Chief Executive Officer)

Donald Grant (Chief Financial & Sustainability Officer)

Peel Hunt (Joint Financial Adviser and Corporate Broker to Empiric) +44 (0) 20 7418 8900

Capel Irwin

Michael Nicholson

Henry Nicholls

Jefferies (Joint Financial Adviser and Corporate Broker to Empiric) +44 (0) 20 7029 8000

Tom Yeadon

Philip Noblet

Harry Le May

FTI Consulting (Communications Adviser to Empiric) +44 (0) 20 3727 1000

Dido Laurimore

Eve Kirmatzis

Herbert Smith Freehills Kramer LLP is acting as legal adviser to Unite in connection with the Acquisition.

Gowling WLG (UK) LLP is acting as legal adviser to Empiric in connection with the Acquisition.

Further information

This Announcement is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase or otherwise acquire, subscribe for, sell, or otherwise dispose of, any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the Acquisition or otherwise, nor shall there be any sale, issuance or transfer of securities of Empiric in any jurisdiction in contravention of applicable laws. The Acquisition will be implemented solely pursuant to the terms of the Scheme Document (or, in the event that the Acquisition is to be implemented by means of a Takeover Offer, the Offer Document), which, together with the Forms of Proxy, will contain the full terms and conditions of the Acquisition, including details of how to vote in respect of the Acquisition. Any decision by Empiric Shareholders in respect of, or other response to, the Acquisition (including any vote in respect of the Resolution to approve the Acquisition, the Scheme or related matters), should be made only on the basis of the information contained in the Scheme Document (or, if the Acquisition is implemented by way of a Takeover Offer, the Offer Document).

This Announcement does not constitute a prospectus or prospectus equivalent document.

The person responsible for arranging for the release of this Announcement on behalf of Unite is Christopher Szpojnarowicz, Group Legal Director & Company Secretary, and on behalf of Empiric is Lisa Hibberd, Company Secretary.

The Acquisition will be subject to the applicable requirements of the Code, the Panel, the London Stock Exchange and the FCA.

Information relating to Empiric Shareholders

Please be aware that addresses, electronic addresses and certain other information provided by Empiric Shareholders, persons with information rights and other relevant persons in connection with the receipt of communications from Empiric may be provided to Unite during the offer period as required under Section 4 of Appendix 4 of the Code to comply with Rule 2.11(c) of the Code.

Important Notices relating to the Financial Advisers

Lazard & Co., Limited ("Lazard") which is authorised and regulated by the Financial Conduct Authority in the United Kingdom, is acting exclusively as financial adviser to Unite and no one else in connection with the Acquisition and will not be responsible to anyone other than Unite for providing the protections afforded to clients of Lazard nor for providing advice in connection with the Acquisition or any matter referred to herein. Neither Lazard nor any of its affiliates (nor any of their respective directors, officers, employees or agents), owes or accepts any duty, liability or responsibility whatsoever (whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of Lazard in connection with this Announcement, any statement contained herein or otherwise.

Deutsche Bank AG is a stock corporation (Aktiengesellschaft) incorporated under the laws of the Federal Republic of Germany with its principal office in Frankfurt am Main. It is registered with the local district court (Amtsgericht) in Frankfurt am Main under No HRB 30000 and licensed to carry on banking business and to provide financial services. The London branch of Deutsche Bank AG is registered as a branch office in the register of companies for England and Wales at Companies House (branch registration number BR000005) with its registered branch office address and principal place of business at 21, Moorfields, London EC2Y 9DB. Deutsche Bank AG is subject to supervision by the European Central Bank (ECB), Sonnemannstrasse 22, 60314 Frankfurt am Main, Germany, and the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht or BaFin), Graurheindorfer Strasse 108, 53117 Bonn and Marie-Curie-Strasse 24-28, 60439 Frankfurt am Main, Germany. With respect to activities undertaken in the United Kingdom, Deutsche Bank AG is authorised by the Prudential Regulation Authority. It is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of Deutsche Bank AG's authorisation and regulation by the Prudential Regulation Authority are available from Deutsche Bank AG on request. Deutsche Bank AG, London Branch (trading for these purposes as Deutsche Numis) ("Deutsche Numis") is acting exclusively for Unite and no one else in connection with the matters set out in this Announcement and will not regard any other person as its client in relation to the matters in this Announcement and will not be responsible to anyone other than Unite for providing the protections afforded to clients of Deutsche Numis, nor for providing advice in relation to any matter referred to herein. Neither Deutsche Numis nor any of its affiliates (nor any of their respective directors, officers, employees or agents), owes or accepts any duty, liability or responsibility whatsoever (whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of Deutsche Numis in connection with this Announcement, any statement contained herein or otherwise.

J.P. Morgan Securities PLC, which conducts its UK investment banking business as J.P. Morgan Cazenove ("J.P. Morgan Cazenove"), and which is authorised in the United Kingdom by the Prudential Regulation Authority (the "PRA") and regulated by the PRA and the Financial Conduct Authority, is acting exclusively for Unite and no one else in connection with the Acquisition and will not regard any other person as its client in relation to the Acquisition and will not be responsible to anyone other than Unite for providing the protections afforded to clients of J.P. Morgan Cazenove or its affiliates, nor for providing advice in relation to the Acquisition or any other matter or arrangement referred to in this Announcement.

Peel Hunt LLP ("Peel Hunt"), which is authorised and regulated in the United Kingdom by the Financial Conduct Authority, is acting exclusively as financial adviser and corporate broker to Empiric and no one else in connection with the Acquisition and will not be responsible to anyone other than Empiric for providing the protections afforded to clients of Peel Hunt, nor for providing advice in connection with the Acquisition or any matter referred to herein. Neither Peel Hunt nor any of its affiliates owes or accepts any duty, liability or responsibility whatsoever (whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of Peel Hunt in connection with this Announcement, any statement contained herein or otherwise.

Jefferies International Limited ("Jefferies"), which is authorised and regulated by the Financial Conduct Authority in the United Kingdom, is acting exclusively as financial adviser and corporate broker to Empiric and no one else in connection with the Acquisition and will not regard any other person as its client in relation to the matters in this Announcement and will not be responsible to any person other than Empiric for providing the protections afforded to clients of Jefferies nor for providing advice in connection with the Acquisition or in relation to any matter referred to in this Announcement. Neither Jefferies nor any of its affiliates (nor their respective directors, officers, employees or agents) owes or accepts any duty, liability or responsibility whatsoever (whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of Jefferies in connection with this Announcement, any statement contained herein or otherwise.

Overseas shareholders

The release, publication or distribution of this Announcement in or into jurisdictions other than the United Kingdom may be restricted by law. Any persons who are not resident in the United Kingdom should inform themselves about, and observe, any applicable legal or regulatory requirements. In particular, the ability of persons who are not resident in the United Kingdom to vote their Empiric Shares with respect to the Scheme at the Court Meeting, or to execute and deliver Forms of Proxy appointing another to vote at the Court Meeting on their behalf, may be affected by the laws of the relevant jurisdictions in which they are located. Any failure to comply with the applicable restrictions may constitute a violation of the securities laws of any such jurisdiction. To the fullest extent permitted by applicable law the companies and persons involved in the Acquisition disclaim any responsibility or liability for the violation of such restrictions by any person.

This Announcement has been prepared for the purpose of complying with English law, the Code, the Market Abuse Regulation and the Disclosure Guidance and Transparency Rules and the information disclosed may not be the same as that which would have been disclosed if this Announcement had been prepared in accordance with the laws of jurisdictions outside the United Kingdom.

Unless otherwise determined by Unite or required by the Code, and permitted by applicable law and regulation, the New Unite Shares to be issued pursuant to the Acquisition to Empiric Shareholders will not be made available, directly or indirectly, in, into or from a Restricted Jurisdiction where to do so would violate the laws in that jurisdiction and no person may vote in favour of the Acquisition by any such use, means, instrumentality or form (including, but not limited to, facsimile, e-mail or other electronic transmission or telephone) of interstate or foreign commerce of, or any facility of a national, state or other securities exchange of, any Restricted Jurisdiction or any other jurisdiction if to do so would constitute a violation of the laws of that jurisdiction. Accordingly, copies of this Announcement and any formal documentation relating to the Acquisition are not being, and must not be, directly or indirectly, mailed or otherwise forwarded, distributed or sent in or into or from any Restricted Jurisdiction or any other jurisdiction where to do so would constitute a violation of the laws of, or require registration thereof in, that jurisdiction. Persons (including without limitation nominees, trustees and custodians) receiving this Announcement or any formal documentation relating to the Acquisition must not mail or otherwise forward, distribute or send such documents in, into or from any Restricted Jurisdiction. Doing so may render invalid any related purported vote in respect of the Acquisition. If the Acquisition is implemented by way of a Takeover Offer (unless otherwise permitted by applicable law and regulation), the Takeover Offer may not be made directly or indirectly, in or into, or by the use of mails or any means or instrumentality (including, but not limited to, facsimile, e-mail or other electronic transmission or telephone) of interstate or foreign commerce of, or of any facility of a national, state or other securities exchange of any Restricted Jurisdiction and the Acquisition will not be capable of acceptance by any such use, means, instrumentality or facilities or from within any Restricted Jurisdiction.

The availability of New Unite Shares pursuant to the Acquisition to Empiric Shareholders who are not resident in the United Kingdom or the ability of those persons to hold such shares may be affected by the laws or regulatory requirements of the relevant jurisdictions in which they are resident. Persons who are not resident in the United Kingdom should inform themselves of, and observe, any applicable legal or regulatory requirements. Empiric Shareholders who are in any doubt about such matters should consult an appropriate independent professional adviser in the relevant jurisdiction without delay.

Further details in relation to Empiric Shareholders in overseas jurisdictions will be contained in the Scheme Document.

Notes to US investors in Empiric

Empiric Shareholders in the United States should note that the Acquisition relates to the shares of an English company and is proposed to be made by means of a scheme of arrangement provided for under, and governed by, English law. Neither the proxy solicitation nor the tender offer rules under the US Securities Exchange Act of 1934, as amended, will apply to the Scheme. Moreover the Scheme will be subject to the disclosure requirements and practices applicable in the UK to schemes of arrangement, which differ from the disclosure requirements of the US proxy solicitation rules and tender offer rules. However, if Unite were to elect to implement the Acquisition by means of a Takeover Offer, such Takeover Offer would be made in compliance with all applicable laws and regulations, including Section 14(e) of the US Exchange Act and Regulation 14E thereunder. Any such Takeover Offer would be made in the United States by Unite and no one else. In addition to any such Takeover Offer, Unite, certain affiliated companies and the nominees or brokers (acting as agents) may make certain purchases of, or arrangements to purchase, shares in Empiric outside any such Takeover Offer during the period in which such Takeover Offer would remain open for acceptance. If such purchases or arrangements to purchase were to be made they would be made outside the United States and would comply with applicable law, including the US Exchange Act. Any information about any such purchases would be disclosed as required in the UK and, if relevant, would be reported to a Regulatory Information Service and would be available on the London Stock Exchange website at www.londonstockexchange.com.

Financial information included in this Announcement and the Scheme Document has been or will be prepared in accordance with International Financial Reporting Standards ("IFRS") and may not be comparable to financial information of US companies or companies whose financial statements are prepared in accordance with generally accepted accounting principles in the United States. If Unite exercises its right to implement the Acquisition by way of a Takeover Offer in accordance with the terms of the Co-operation Agreement and determines to extend the offer into the United States, such offer will be made in compliance with applicable United States securities laws and regulations.

Unite and Empiric are each organised under the laws of England and Wales. All of the officers and directors of Unite and Empiric are residents of countries other than the United States. It may therefore be difficult for US investors to enforce their rights and any claim arising out of US securities law. It may not be possible to sue Unite and Empiric (or their officers and directors) in a non-US court for violations of US securities laws. It may be difficult to compel Unite, Empiric and their respective affiliates to subject themselves to the jurisdiction and judgment of a US court.

US holders of Empiric Shares also should be aware that the transaction contemplated herein may have tax consequences in the United States and that such consequences, if any, are not described herein. US holders of Empiric Shares are urged to consult with independent professional advisors regarding the legal, tax, and financial consequences of the Acquisition applicable to them.

In accordance with the Code, normal UK market practice and pursuant to Rule 14e-5(b) of the US Exchange Act, Unite or its nominees, or its brokers (acting as agents), may from time to time make certain purchases of, or arrangements to purchase Empiric Shares outside of the United States, other than pursuant to the Acquisition, until the date on which the Acquisition becomes Effective, lapses or is otherwise withdrawn. These purchases may occur either in the open market at prevailing prices or in private transactions at negotiated prices. Any information about such purchases will be disclosed as required by law or regulation in the UK, will be reported to a Regulatory Information Service and will be available on the London Stock Exchange website at www.londonstockexchange.com/exchange/news/market-news/market-news-home.

This Announcement does not constitute or form a part of any offer to sell or issue, or any solicitation of any offer to purchase, subscribe for or otherwise acquire, any securities in the United States.

Neither the US Securities and Exchange Commission nor any securities commission of any state or other jurisdiction of the United States has approved the Acquisition, passed upon the fairness of the Acquisition, or passed upon the adequacy or accuracy of this document. Any representation to the contrary is a criminal offence in the United States.

Notes regarding New Unite Shares

The New Unite Shares to be issued pursuant to the Scheme have not been and will not be registered under the US Securities Act of 1933 (as amended) or under the relevant securities laws of any state or territory or other jurisdiction of the United States or the relevant securities laws of Japan and the relevant clearances have not been, and will not be, obtained from the securities commission of any province of Canada. No prospectus in relation to the New Unite Shares has been, or will be, lodged with, or registered by, the Australian Securities and Investments Commission. Accordingly, the New Unite Shares are not being, and may not be, offered, sold, resold, delivered or distributed, directly or indirectly in or into a Restricted Jurisdiction or any other jurisdiction if to do so would constitute a violation of relevant laws of, or require registration thereof in, such jurisdiction (except pursuant to an exemption, if available, from any applicable registration requirements or otherwise in compliance with all applicable laws).

The New Unite Shares have not been and will not be registered under the US Securities Act, or under the securities laws of any state or other jurisdiction of the United States, and may not be offered or sold in the United States absent registration under the US Securities Act, or pursuant to an exemption from, or in a transaction not subject to, such registration requirements and in compliance with any applicable securities laws of any state or other jurisdiction of the United States. It is expected that the New Unite Shares will be issued in reliance upon the exemption from the registration requirements of the US Securities Act of 1933 (as amended) provided by Section 3(a)(10) thereof. For the purpose of qualifying for the exemption provided by Section 3(a)(10) of the US Securities Act, Unite will advise the Court that its sanctioning of the Scheme will be relied on by Unite for the purposes of a Section 3(a)(10) exemption following a hearing on the fairness of the Scheme to Empiric Shareholders.

Disclosure requirements

Under Rule 8.3(a) of the Code, any person who is interested in 1 per cent. or more of any class of relevant securities of an offeree company or of any securities exchange offeror (being any offeror other than an offeror in respect of which it has been announced that its offer is, or is likely to be, solely in cash) must make an Opening Position Disclosure following the commencement of the offer period and, if later, following the Announcement in which any securities exchange offeror is first identified. An Opening Position Disclosure must contain details of the person's interests and short positions in, and rights to subscribe for, any relevant securities of each of (i) the offeree company and (ii) any securities exchange offeror(s). An Opening Position Disclosure by a person to whom Rule 8.3(a) applies must be made by no later than 3.30 pm (London time) on the 10th Business Day following the commencement of the offer period and, if appropriate, by no later than 3.30 pm (London time) on the 10th Business Day following the Announcement in which any securities exchange offeror is first identified. Relevant persons who deal in the relevant securities of the offeree company or of a securities exchange offeror prior to the deadline for making an Opening Position Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes, interested in 1 per cent. or more of any class of relevant securities of the offeree company or of any securities exchange offeror must make a Dealing Disclosure if the person deals in any relevant securities of the offeree company or of any securities exchange offeror. A Dealing Disclosure must contain details of the dealing concerned and of the person's interests and short positions in, and rights to subscribe for, any relevant securities of each of (i) the offeree company and (ii) any securities exchange offeror(s), save to the extent that these details have previously been disclosed under Rule 8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies must be made by no later than 3.30 pm (London time) on the Business Day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or understanding, whether formal or informal, to acquire or control an interest in relevant securities of an offeree company or a securities exchange offeror, they will be deemed to be a single person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree company and by any offeror and Dealing Disclosures must also be made by the offeree company, by any offeror and by any persons acting in concert with any of them (see Rules 8.1, 8.2 and 8.4).

Details of the offeree and offeror companies in respect of whose relevant securities Opening Position Disclosures and Dealing Disclosures must be made can be found in the Disclosure Table on the Takeover Panel's website at www.thetakeoverpanel.org.uk, including details of the number of relevant securities in issue, when the offer period commenced and when any offeror was first identified. You should contact the Panel's Market Surveillance Unit on +44 (0)20 7638 0129 if you are in any doubt as to whether you are required to make an Opening Position Disclosure or a Dealing Disclosure.

Forward-looking statements

This Announcement (including information incorporated by reference in this Announcement), oral statements made regarding the Acquisition and other information published by Unite and Empiric contain statements which are, or may be deemed to be, "forward-looking statements". These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements are prospective in nature and are not based on historical facts, but rather on current expectations and projections of the management of Unite and Empiric about future events and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. The forward-looking statements contained in this Announcement may include statements relating to the expected effects of the Acquisition on Unite and Empiric, the expected timing of the Acquisition and other statements other than historical facts. Often, but not always, forward-looking statements can be identified by the use of forward-looking words such as "plans", "expects" or "does not expect", "is expected", "is subject to", "budget", "scheduled", "estimates", "targets", "hopes", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases of similar meaning or statements that certain actions, events or results "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. These statements are based on assumptions and assessments made by Empiric, and/or Unite in light of their experience and their perception of historical trends, current conditions, future developments and other factors they believe appropriate. Although Unite and Empiric believe that the expectations reflected in such forward-looking statements are reasonable, Unite and Empiric can give no assurance that such expectations will prove to be correct. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There are a number of factors which could cause actual results and developments to differ materially from those expressed or implied by such forward looking statements, including, among others the enactment of legislation or regulation that may impose costs or restrict activities; the renegotiation of contracts or licences; fluctuations in demand and pricing in the commercial property industry; changes in government policy and taxations; changes in political conditions, economies and markets in which Unite and Empiric operate; changes in the markets from which Unite and Empiric raise finance; the impact of legal or other proceedings; changes in accounting practices and interpretation of accounting standards under IFRS; changes in interest and exchange rates; industrial disputes; war and terrorism. These forward-looking statements speak only as at the date of this document.

Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Such forward-looking statements should therefore be construed in the light of such factors. Neither Unite nor Empiric, nor any of their respective associates or directors, officers or advisers, provides any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements in this Announcement will actually occur. You are cautioned not to place undue reliance on these forward-looking statements. Other than in accordance with their legal or regulatory obligations (including under the UK Listing Rules and the Disclosure Guidance and Transparency Rules of the FCA), neither Unite or Empiric is under any obligation, and Unite and Empiric expressly disclaim any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

No profit forecasts or estimates

Other than the Unite 2025 Profit Forecast and Empiric 2025 Profit Forecast set out in Appendix 6 of this Announcement, no statement in this Announcement is intended as a profit forecast, profit estimate for any period and no statement in this Announcement should be interpreted to mean that earnings or earnings per share for Empiric or Unite for the current or future financial years would necessarily match or exceed the historical published earnings or earnings per share for Empiric or Unite respectively.

Quantified Financial Benefits Statement

The statements in the Quantified Financial Benefits Statement relate to future actions and circumstances which, by their nature, involve risks, uncertainties and contingencies and which may in some cases be subject to consultation with employees or their representatives. The synergies and cost savings referred to may not be achieved, or may be achieved later or sooner than estimated, or those achieved could be materially different from those estimated. For the purposes of Rule 28 of the Code, the Quantified Financial Benefits Statement contained in this Announcement is the responsibility of Unite and the Unite Directors.

Publication of this Announcement

A copy of this Announcement and the documents required to be published pursuant to Rules 26.1 and 26.2 of the Code will be available, free of charge, subject to certain restrictions relating to persons resident in Restricted Jurisdictions on Unite's website at www.unitegroup.com/possible-offer-for-empiric-student-property-plc and Empiric's website at www.empiric.co.uk/investors/unite-offer by no later than 12 noon (London time) on the Business Day following this Announcement.

The contents of Unite's website and Empiric's website, and any websites accessible from hyperlinks on those websites, are not incorporated into and do not form part of this Announcement.

Requesting hard copy documents

In accordance with Rule 30.3 of the Code, Empiric Shareholders and persons with information rights may request a hard copy of this Announcement by contacting Empiric's registrars, Computershare Investor Services PLC by writing to them at The Pavilions, Bridgewater Road, Bristol BS99 6ZZ, or by calling them on +44 (0) 370 703 6003. Calls are charged at the standard geographical rate and will vary by provider. Calls outside the United Kingdom will be charged at the applicable international rate. Lines are open between 9.30 a.m. to 5.30 p.m. (London time), Monday to Friday (except public holidays in England and Wales). Please note that Computershare Investor Services PLC cannot provide any financial, legal or tax advice. Calls may be recorded and monitored for security and training purposes.

For persons who receive a copy of this Announcement in electronic form or via a website notification, a hard copy of this Announcement will not be sent unless so requested. Such persons may also request that all future documents, announcements and information to be sent to them in relation to the Acquisition should be in hard copy form.

If you are in any doubt about the contents of this Announcement or the action you should take, you are recommended to seek your own independent financial advice immediately from your stockbroker, bank manager, solicitor, accountant or from an independent financial adviser duly authorised under the Financial Services and Markets Act 2000 (as amended) if you are resident in the United Kingdom or, if not, from another appropriately authorised independent financial adviser.

Rounding

Certain figures included in this Announcement have been subjected to rounding adjustments. Accordingly, figures shown for the same category presented in different tables may vary slightly and figures shown as totals in certain tables may not be an arithmetic aggregation of figures that precede them.

Rule 2.9 of the Code

For the purposes of Rule 2.9 of the Code, Empiric confirms that, as at the Latest Practicable Date it had in issue 664,122,535 ordinary shares of one penny each. The ordinary shares are voting shares (each such ordinary share carries one vote per ordinary share) and are admitted to trading on the Main Market of the London Stock Exchange under the ISIN code GB00BLWDVR75.

For the purposes of Rule 2.9 of the Code, Unite confirms that, as at the Latest Practicable Date it had in issue 489,383,360 ordinary shares of 25 pence per share, each with voting rights and admitted to trading on the Main Market of the London Stock Exchange under the ISIN code GB0006928617.

Unite's LEI is 213800BBUUWVDH9YI827.

Empiric's LEI is 213800FPF38IBPRFPU87.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

FOR IMMEDIATE RELEASE

14 August 2025

RECOMMENDED CASH AND SHARE ACQUISITION

of

EMPIRIC STUDENT PROPERTY PLC

by

THE UNITE GROUP PLC

to be effected by means of a Scheme of Arrangement

under Part 26 of the Companies Act 2006

Introduction

The boards of directors of The Unite Group PLC ("Unite") and Empiric Student Property plc ("Empiric") are pleased to announce that they have reached agreement on the terms of a recommended cash and share offer pursuant to which Unite will acquire the entire issued and to be issued ordinary share capital of Empiric (the "Acquisition"). It is intended that the Acquisition will be effected by means of a scheme of arrangement under Part 26 of the Companies Act.

The Acquisition

Under the terms of the Acquisition, which will be conditional on the Conditions and certain further terms set out in Appendix 1 to this Announcement, and subject to the full terms and conditions which will be set out in the Scheme Document, for each Empiric Share held, the Scheme Shareholders will be entitled to receive:

0.085 New Unite Shares and 32 pence in cash

Based on Unite's closing share price of 732.0 pence as at the Latest Practicable Date, and excluding the Empiric Q2, Q3 and Q4 dividends which are expected to be declared and paid to Empiric Shareholders prior to the Effective Date (the "Empiric 2025 Dividends"), the Acquisition values each Empiric Share at approximately 94.2 pence and Empiric's entire issued and to be issued share capital at approximately £634 million. The terms of the Acquisition imply an EPRA NTA discount of 3.7 per cent. based on each of Unite's and Empiric's EPRA NTAs per share as at 30 June 2025 (excluding the Empiric 2025 Dividends).

Based on Unite's closing share price of 855.5 pence as at the Last Undisturbed Trading Date, and, in addition, the Empiric 2025 Dividends, the Acquisition values each Empiric Share at approximately 107.5 pence (the "Total Transaction Value") and Empiric's entire issued and to be issued share capital at approximately £723 million, representing:

· a premium of approximately 10 per cent. to Empiric's closing share price of 97.3 pence as at the Last Undisturbed Trading Date;

· a premium of approximately 22 per cent. to Empiric's three-month volume-weighted average price of 88.3 pence as at the Last Undisturbed Trading Date; and

· a premium of approximately 24 per cent. to Empiric's six-month volume-weighted average price of 86.6 pence as at the Last Undisturbed Trading Date.

Immediately following Completion, Empiric Shareholders will hold approximately 10 per cent. of the issued share capital of the Enlarged Group and existing Unite Shareholders will hold approximately 90 per cent. of the issued share capital of the Enlarged Group.

Background to and reasons for the Acquisition

Unite's strategy is to align its portfolio to high-quality universities (notably Russell Group universities) where it sees the strongest prospects for future growth in student demand and, therefore, sustainable prospects for rental growth. Unite's capital allocation aims to enhance this strategic alignment and therefore earnings growth and returns while maintaining balance sheet strength.

The long-term outlook for student numbers in the UK is strong, with the domestic 18-year-old population forecast to grow by 11 per cent. by 2030, and growth in international demand for higher education from which the UK's world-class higher education sector is well positioned to benefit.

The "returner" market of non-first year undergraduate and postgraduate students represents a large, attractive and generally unrealised growth opportunity which Unite has been tracking for some time. "Conventional" PBSA is well suited to first-year undergraduate student needs, but approximately one million students live in traditional houses of multiple occupation ("HMOs"), representing more than the entire first-year student population living away from home. Unite believes that a tailored product and service, offering greater independence and a more personal feel, while retaining the PBSA hallmarks of a high-quality, all-inclusive offer, would be highly attractive to returner students.

Unite has begun to adapt its PBSA offering to target the returner segment through a number of initiatives, including the 271-bed scheme at Bromley Place, Nottingham, tailored to second-year and third-year students as well as postgraduates, which completed in 2024, and the build-to-rent ("BTR") block at Burnet Point in Edinburgh which will be completed this summer.

Unite has tracked Empiric's progress in recent years and has been impressed by the way it has developed a high-quality, differentiated product offering for returner students under the Hello Student brand, with high NPS rankings. Empiric's product is more closely aligned with the preferences of returner students for smaller, characterful assets, offering single occupancy rooms or smaller cluster sizes, longer tenancies and increased independence. In addition, Unite notes the Empiric management team's successful execution of the portfolio transformation strategy, through which Empiric has aligned itself to some of the best locations in the UK's strongest university cities, where Unite also seeks to operate. A key attraction of the Empiric portfolio for Unite is the quality of assets in these key cities, which account for an outsized proportion of the value of the transaction.

Unite has considered a development-led strategy for increasing its exposure to the attractive segment for returner students. However, the Acquisition provides Unite with a more efficient route to scale, and at an entry price below estimated replacement cost. In addition, Unite is uniquely positioned to accelerate the growth of Empiric's returner focused portfolio through Unite's superior access to capital, its own highly experienced development team and platform, and the possible repositioning of 18 existing Unite assets on to the Empiric operating model and the Hello Student brand.

Besides the strategic benefits, the Acquisition provides scope for substantial cost synergies of £13.7 million on a risk-weighted basis. This consists of two parts. Increased scale in the 16 cities where the Unite and Empiric portfolios overlap, and combining front-line operations from each company, is expected to deliver £2.2 million of net operating cost synergies. The Enlarged Group will also benefit from a single corporate overhead structure with an additional £11.5 million of cost synergies expected to be realised through the streamlining and removal of duplicated group functions and public company costs. Unite expects to realise 55 per cent. of synergies in the first full year with the remainder in the second full year. Unite is confident in its ability to deliver these savings and has a successful track record of integration through its acquisition of Liberty Living in 2019, delivering £18 million of synergies.

In acquiring Empiric, Unite will retain all of Empiric's existing debt facilities on existing terms, and will retain a strong balance sheet by virtue of the majority share-based consideration.

In summary, the Board of Unite believes that the Acquisition has a compelling strategic and financial rationale for Unite and Empiric Shareholders, resulting in:

· a £10.5 billion combined portfolio (Unite share: £7.4 billion) in the UK's strongest universities, with c.75,000 beds on a combined basis of which 92 per cent. are located in Russell Group cities;

· a platform for expansion in the attractive returner segment through a proven platform (representing c.11 per cent. of the Enlarged Group's portfolio value, with scope to increase to c.15-20 per cent. over time through conversions and future acquisitions) delivering a significant increase in Unite's addressable market, and enabling Unite to attract and retain students throughout their academic journey including the c.35,000 first-year students currently living with Unite;

· a dedicated high-quality product and service offering under the Hello Student brand, tailored to the needs of returner students and aligned with the UK's strongest universities;

· significant cost synergies of £13.7 million unlocked though Unite's best-in-class operating platform;

· earnings and dividend accretion for both sets of shareholders, from the first full year of ownership for Empiric Shareholders and in the second full year of ownership for Unite Shareholders (neutral in the first) as synergies are delivered;

· a low double-digit unlevered IRR ahead of Unite's cost of capital and supporting total accounting returns of c.10 per cent. p.a.; and

· the maintenance of a high-quality balance sheet, with pro forma net debt / EBITDA of 5.9x, net LTV of 29 per cent., a weighted average cost of debt of 4.1 per cent., a weighted average debt maturity of 3.6 years and £570 million of undrawn debt facilities, in each case as at 30 June 2025 adjusted for the impact of the cash consideration.

Recommendation

The Empiric Directors, who have been so advised by Peel Hunt and Jefferies as to the financial terms of the Acquisition, consider the terms of the Acquisition to be fair and reasonable. In providing their financial advice to the Empiric Directors, Peel Hunt and Jefferies have taken into account the commercial assessments of the Empiric Directors.

Accordingly, the Empiric Directors intend unanimously to recommend that Empiric Shareholders vote in favour of the Scheme at the Court Meeting and the Resolution to be proposed at the General Meeting, as the Empiric Directors have irrevocably undertaken to do in respect of their own holdings of Empiric Shares, representing approximately 0.06 per cent. of Empiric's issued share capital as at the Latest Practicable Date).

Background to and reasons for the Recommendation

Background to the Acquisition

Empiric listed in June 2014 raising £85 million to invest in and develop high-quality student residential accommodation let on direct tenancy agreements with a focus on upper quartile rental values, primarily servicing postgraduate and international students. During the period to December 2017, Empiric raised a further £547 million to expand its portfolio of PBSA assets and grew its portfolio from 350 beds at the time of the IPO to 9,158 beds as at 31 December 2017.

Since 2020, Empiric's management team has undertaken a successful rationalisation of the Empiric business by disposing of approximately £155 million of non-core assets and increasing Empiric's geographical presence in prime regional cities aligned with higher-tariff and predominantly Russell Group universities. Furthermore, Empiric has transformed the capabilities of its differentiated business model, combining a refined and high-quality portfolio of PBSA with an in-house operational platform focused on offering its students a customer first philosophy through the Empiric Group's award-winning brand, Hello Student. The Empiric Board believes that Empiric continues to represent a compelling investment proposition for Empiric Shareholders, with a business model targeting investment in prime regional cities which attract students from the pools of international, postgraduate and returning undergraduates, whose premium accommodation requirements are relatively under-served by the wider PBSA market.

In the last three financial years, Empiric has benefitted from strong sales cycles which were enhanced by students resuming study programmes which they had postponed as a result of the Covid-19 pandemic. As the catch-up effects of the pandemic have now largely passed, Empiric and other PBSA operators, including Unite, have reported a normalisation of the sales cycle for academic year 2025/26 and hence a later booking profile. Based on market data available from StuRents, Empiric's occupancy rate continues to outperform the wider market month-on-month and therefore the Empiric Board continues to anticipate achieving an occupancy rate of 97 per cent. or better by end of the year.

Despite this robust performance, the Empiric Board notes some increasing market caution due to the normalisation of the sales cycle for academic year 2025/26 and a changing competitive and regulatory background due to new legislation such as the UK Government's policy updates to its student visa programmes and the Renters' Rights Bill. This is reflected in the Empiric share price which has traded at an average discount of 26 per cent. to its last reported EPRA NTA per share over the last 12 months to the Last Undisturbed Trading Date.

In the context of the Acquisition, the Empiric Board has considered the medium and long-term prospects for Empiric, and particularly the opportunities to increase the scale of the business materially in an accretive way to generate long-term, sustainable returns for Empiric Shareholders. Whilst the Empiric Board remains confident in its strategy, it acknowledges the macro-economic headwinds impacting the broader UK listed REIT market. These include, inter alia:

· dislocation of share prices from underlying operational and financial fundamentals;

· shareholders' desire for higher returns given the significant increase in risk free rates; and

· reduced access to capital, particularly for companies which are deemed to be "sub-scale" and/or trade at a persistent discount to net asset value.

This dynamic will increasingly hinder Empiric's ability to grow materially and exploit the opportunities presented by economies of scale and the corresponding ability to spread the fixed proportion of Empiric's administrative costs across a larger portfolio and revenue base. The Empiric Board believes that there are few near or medium-term catalysts to address these systemic challenges, which the Empiric Board believes could continue to weigh on Empiric's share price and to impede its access to capital. In this context, Empiric undertook an extensive process in 2024 to identify a joint venture partner to accelerate its strategic plans, which involved extensive discussions with a wide range of institutional capital providers, but ultimately did not result in a joint venture on acceptable terms being formed.

In response, Empiric undertook a successful equity raise in October 2024 at a price of 93 pence per share with strong support from existing and new Empiric Shareholders. As part of that process, the Empiric Board received a wide range of views from material Empiric Shareholders some of which, while acknowledging the benefits of increased scale for Empiric, noted that there may be limited appetite to support future fundraises if they were to be conducted at significant discounts to Empiric's prevailing net asset value. Given this dynamic, the price at which Empiric Shares have historically traded and the fact that Empiric has now completed its disposal programme of non-core assets, the Empiric Board believes that Empiric's options to fund its next stage of growth are likely to be limited in the near and medium-term.

Engagement with Unite

On 5 June 2025, in response to press speculation, the Empiric Board confirmed that, following a period of engagement with Unite, it had received a proposal from Unite on 29 May 2025 comprising 30 pence in cash and 0.09 new Unite Shares per Empiric Share (the "Original Proposal"). Based on Unite's closing share price of 855.5 pence on 4 June 2025, being the Last Undisturbed Trading Date, the Original Proposal valued each Empiric Share at 107.0 pence. On the basis of the Original Proposal, the Empiric Board agreed with Unite to enter an initial period of due diligence.

Following a period of due diligence, engagement with Unite Shareholders and extensive discussion with the Empiric Board, on 23 July 2025, Unite submitted a revised proposal comprising 32 pence in cash and 0.085 new Unite Shares with further clarity also provided on dividend entitlements prior to Completion (the "Revised Proposal"). The Revised Proposal (excluding dividends) therefore valued each Empiric Share at 104.7 pence, as at the Last Undisturbed Trading Date - a 2.1 per cent. reduction on the Original Proposal. It was made clear to Empiric that Unite, in finalising its view on valuation in the light of the due diligence exercise, was focused on, inter alia, delivering sufficient earnings accretion for the Enlarged Group, the operating margin for the current financial year, the slower pace of the 2025/26 booking cycle that has affected the UK PBSA sector as a whole, and the incremental costs of integrating the businesses, including - for example - to harmonise fire safety procedures and standards across the enlarged portfolio.

While the Empiric Board notes the lower value of the Revised Proposal, in forming its view, it has considered the following:

· the Total Transaction Value of 107.5 pence values Empiric's entire issued, and to be issued, ordinary share capital at approximately £723 million, representing:

o a premium of 10 per cent. to Empiric's closing share price of 97.3 pence on the Last Undisturbed Trading Date;

o a premium of 22 per cent. to Empiric's three-month volume weighted average closing share price of 88.3 pence as at the Last Undisturbed Trading Date;

o a premium of 16 per cent to the issue price for Empiric's October 2024 equity raise of 93 pence per Empiric Share;

o based on Unite's last reported EPRA NTA per Unite Share of 986 pence as at 30 June 2025, the terms of the Acquisition imply an EPRA NTA discount of 3.7. per cent. to Empiric's EPRA NTA per Empiric Share of 120.2 pence as at 30 June 2025 (excluding the Empiric 2025 Dividends);

· based on Unite's closing share price as at the Last Undisturbed Trading Date, approximately 69 per cent. of the Acquisition consideration is payable in New Unite Shares, providing Empiric Shareholders with a tax-efficient means of remaining invested in the UK PBSA sector via the enlarged vehicle with exposure to the expected strategic and financial benefits set out below;

· based on Unite's closing share price as at the Last Undisturbed Trading Date, approximately 31 per cent. of the Acquisition consideration is payable in cash, providing Empiric Shareholders with significant liquidity at a premium to Empiric's closing share price on the Last Undisturbed Trading Date, while underpinning the value of the Acquisition as a whole. In addition, on an EPRA NTA basis, the cash consideration allows Empiric Shareholders to realise the equivalent of approximately 27 per cent. of Empiric's EPRA NTA per Empiric Share of 120.2 pence as at 30 June 2025;

· Empiric Shareholders will be entitled to receive and retain the Empiric 2025 Dividends, retaining income through the offer period until Completion, and then will be expected to be eligible for the Unite dividend payable in respect of H1 2026 (further details regarding dividend entitlements are set out in paragraph 12 of this Announcement);

· the compelling financial effects of the combination for Empiric shareholders in respect of the New Unite Shares, including:

o participating in the synergy benefits arising from the Acquisition that Unite as an established, publicly listed PBSA operator of scale is uniquely qualified to deliver (as set out in further detail in Appendix 4 of this Announcement);

o material earnings and dividend accretion, with an implied uplift of 36 per cent. and 30 per cent. in earnings and dividends per share, respectively based on 2024 earnings and dividends, and prior to synergies;

· the significant enhancement in scale delivered through a £10.5 billion combined portfolio, comprising c.75,000 beds, in locations aligned with the UK's strongest universities, including meaningful exposure to the London PBSA market;

· the compelling strategic rationale for the combination of the two portfolios, creating a platform for expansion in the attractive returner segment through a proven platform (representing 11 per cent. of the Enlarged Group's portfolio value, with scope for further expansion over time through conversions and future acquisitions) delivering a significant increase in Unite's addressable market, and enabling Unite to attract and retain students throughout their academic journey including the c.35,000 first-year students currently living with Unite; and

· through holding shares in a FTSE 100 constituent with an investment grade credit rating, where the greater liquidity in the trading of Unite Shares compared with Empiric Shares would allow Empiric Shareholders to trade in and out of the Unite Shares should they wish to do so.

The Empiric Board has also reflected on the following:

· Unite's share price has reduced by 14 per cent. over the duration of the offer period and, based on Unite's closing share price as at the Latest Practicable Date, the implied value of the Acquisition is 94.2 pence for each Empiric Share, excluding dividends; and

· based on Unite's closing share price on the Latest Practicable Date, the Acquisition implies an absolute discount of 22 per cent. to Empiric's EPRA NTA per Empiric Share of 120.2 pence as at 30 June 2025.

The Empiric Board recognises the medium and long-term financial benefits of Empiric Shareholders becoming shareholders in Unite which, supported by the strategic merits of the combination, might reasonably be expected to drive appreciation in the Unite share price above the level at which the Unite Shares currently trade (near the five-year low), allowing Empiric Shareholders to capture anticipated future value in the student accommodation sector whilst reducing many of the associated uncertainties arising from a smaller operating platform and increasing liquidity. In addition, the Empiric Board assesses that on an EPRA NTA basis the cash portion of the consideration effectively enables Empiric Shareholders to realise approximately 27 per cent. of their holding at Empiric's EPRA NTA per Empiric Share of 120.2 pence as at 30 June 2025.

Taking all the above factors fully into consideration, the Empiric Board intends to recommend unanimously that Empiric Shareholders vote in favour of the Scheme at the Court Meeting and the Resolution to be proposed at the General Meeting.

Information on Unite

Unite was founded in 1991 in Bristol and has grown to become the UK's largest owner, manager, and developer of PBSA serving the country's world-leading higher education sector. Unite provides homes to 68,000 students across 152 properties in 23 leading university towns and cities. Unite also partners with over 60 universities across the UK, with 93 per cent of the rental portfolio by value in Russell Group cities. It is the Empiric assets in certain high-value cities, mainly Russell Group, which form a key part of the commercial attraction of the transaction for Unite.

In addition to Unite's wholly-owned portfolio, Unite has partnered successfully with private capital and other investors, including via a London-focused JV with GIC, the multi-investor fund USAF, and recently university partnerships with Newcastle University and Manchester Metropolitan University. Acquisitions have also formed a key part of the growth of the Unite business, most notably with the acquisition and successful integration of Liberty Living for £1.4 billion in 2019, leveraging Unite's operating platform and delivering £18 million of annual cost synergies.

Unite has delivered attractive returns for shareholders over many years, including annualised EPS growth of 10.5 per cent. over the last ten years. Unite has also consistently traded at a premium relative to other companies in the sector, with an average nil discount to last reported EPRA NTA per share. over the last three years and an approximate 12 per cent. premium over the last ten years. Today, Unite is a constituent of the FTSE 100 index with a market capitalisation of £4.2 billion as at the Last Undisturbed Trading Date.

Property valuation reports for Unite's portfolio, prepared in accordance with Rule 29 of the Code, are set out in Appendix 5.

Information on Empiric

Empiric is a FTSE 250 UK REIT listed on the equity shares (commercial companies) category of the Official List. Empiric owns a portfolio of 74 attractive and characterful operational PBSA assets in prime regional cities, including in particular Russell Group cities, which attract students from the growing pool of affluent international, postgraduate and returning undergraduates, whose premium accommodation requirements are relatively under-served by conventional PBSA providers. Empiric operates its assets through its Hello Student brand which in the 2024 Global Student Living Index was awarded Gold Operator Certification, with an NPS score of +32, well exceeding the average for University and Private Halls (+12 and +19 respectively).

Since 2018, Empiric has developed an efficient, in-house operational platform which has been designed to grow and create long-term sustainable returns for shareholders. Together with its clustering strategy, this has allowed Empiric to exploit economies of scale and improve its gross margin to 70 per cent. in its financial year to 31 December 2024, up from 57 per cent. in the financial year to 31 December 2017 prior to the initiation of the business transformation. In 2022, Empiric launched its first postgraduate exclusive product in Edinburgh and has since identified a total of 18 assets suitable for conversion to postgraduate exclusive accommodation, 6 of which are expected to be operational in 2026.

As at 30 June 2025, Empiric's portfolio was valued at £1.2 billion and comprised 74 operational assets and 7,717 student beds. As at the Last Undisturbed Trading Date, Empiric had a market capitalisation of £654 million.

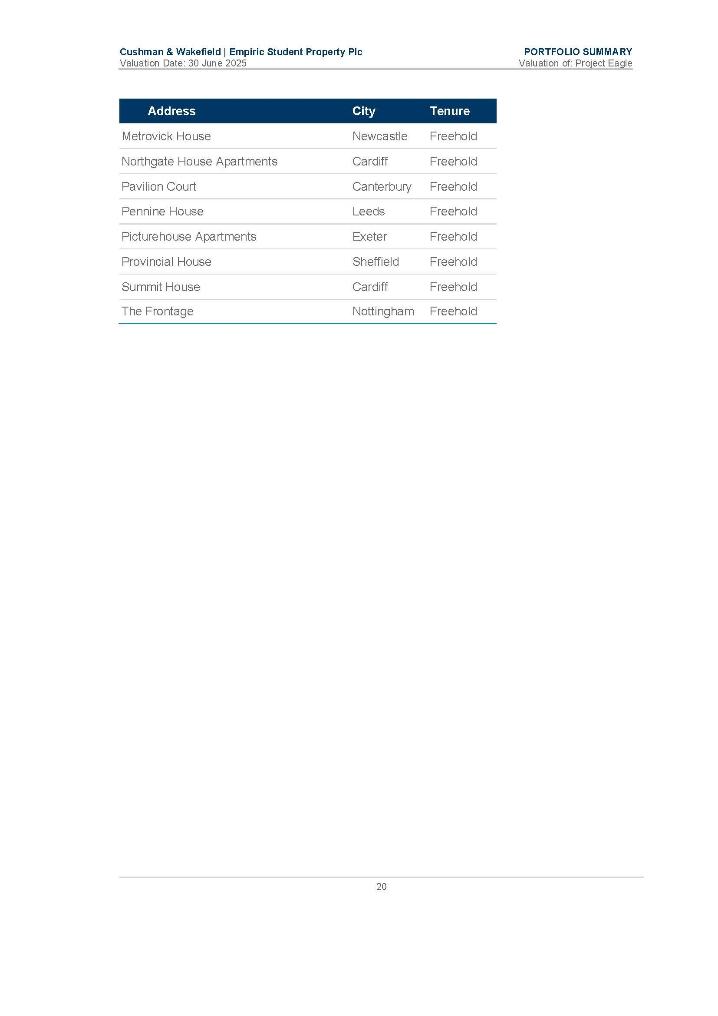

A property valuation report for Empiric's portfolio, prepared in accordance with Rule 29 of the Code, is set out in Appendix 5.

Empiric current trading

Like most PBSA operators, Empiric has continued to experience a normalisation of the reservation pattern with revenue occupancy for academic year 2025/26 currently at 77 per cent compared to 92 per cent in the prior year. Whilst the later booking cycle presents challenges, Empiric is encouraged that occupancy remains ahead of the wider sector, as evidenced from data provided by StuRents, and remains in line with the company's pre-pandemic experience.

Further, Empiric notes the continued growth in student applications, with applications from China and the United States having risen 10 and 14 per cent, respectively year-on-year. With a significant proportion of beds booked by postgraduates, Empiric's reservation period extends through the autumn until the start of the January term. This supports the Empiric Board's continued belief that revenue occupancy of 97 per cent or better will be achieved for the next academic year.

Given this later booking pattern, the impact of dynamic pricing has been more muted relative to this point last year; however, Empiric still expects like-for-like rental growth to exceed four per cent for academic year 2025/26.

Empiric's EPRA EPS for the six-month period to 30 June 2025 was 2.2 pence per share, a decrease of 4.3 per cent on 30 June 2024. The decline follows an anticipated weakening in operating margin this period, alongside the temporary effect of Empiric's equity raise in late 2024. Empiric expects to reconfirm its earlier dividend guidance.

Empiric's property portfolio was valued at approximately £1.2 billion as at 30 June 2025, a like-for-like increase of 0.8 per cent. on 31 December 2024. Empiric's EPRA NTA as at 30 June 2025 was 120.2 pence per share, up 0.5 per cent. from 31 December 2024.

Intentions of Unite with regard to the business of Empiric

Strategic Plans

As set out in paragraph 3 above, Unite believes there is significant potential to continue and grow Empiric's successful operating model which is particularly attractive to returning and postgraduate students.

In order to deliver on this potential, prior to this Announcement, consistent with market practice, Unite has been granted access to various materials and to key individuals for the purposes of confirmatory due diligence. Following the Effective Date, Unite intends to work with Empiric's management to undertake a more detailed evaluation of Empiric's portfolio and its operations to formulate a detailed strategy, which may include select asset disposals. Unite expects that this evaluation will be completed within approximately nine months of the Effective Date.

Board composition and governance arrangements

It is intended that the current executive and non-executive directors of Empiric will resign from their roles upon or shortly following Completion. The composition of the Board of Unite is not expected to change following Completion and is expected to continue to comply with the UK Corporate Governance Code.

Management, employees and head office

Unite attaches great importance and value to the skills, experience and commitment of Empiric's employees and recognises that the employees of Empiric will continue to be an important factor in maximising the success and growth of the enlarged business.

Unite expects Empiric employees to continue to contribute to the success of Empiric under Unite ownership following the Effective Date and anticipates that they will benefit from greater opportunities as a result of the Acquisition.