30th Oct 2025 07:02

30 October 2025

QUARTERLY ACTIVITIES REPORT

For the quarter ended 30 September 2025

88 Energy Limited (ASX: 88E, AIM: 88E, OTC: EEENF) (88 Energy, 88E or the Company) provides the following summary of activities for the quarter ended 30 September 2025

Alaskan Portfolio Highlights

Project Phoenix, Alaska (75% WI)

Farm-Out Activity and Work Program Progressing:

Ø Joint venture partner Burgundy Xploration LLC (Burgundy) advanced it's funding strategy and met all 2025 JV lease rental obligations.

Ø Planning for the Franklin Bluffs-1H horizontal well and extended flow test continued, targeting mid-CY2026 spud.

Ø The well will target the SMD-B reservoir, part of the Campanian sequence, the best-developed topset sandstone in the SMD series at Project Phoenix.

Ø Adjacent operator, Pantheon Resources confirmed a 565ft hydrocarbon column in the SMD-B reservoir at Dubhe-1, exceeding pre-drill expectations by 26%[1]. Additional hydrocarbon zones encountered in the SMD-C and two Slope Fan horizons highlighted the broader prospectivity.

Ø Licensing of the Great Bear 3D dataset enhanced planning and provided improved subsurface understanding across Project Leonis and Project Phoenix.

Project Leonis, Alaska (100% WI)

Planning Progressed for Tiri-1 Exploration Well:

Ø Planning and permitting advanced for the proposed Tiri-1 exploration well, to test the Canning and USB Prospects, with additional deeper reservoir potential under review.

Ø All key vendors submitted operational proposals, contributing to a robust well Authority for Expenditure (AFE).

Ø 88 Energy's 100% working interest positions the Company favourably to secure a material carry through the active farm-out process, with third party evaluation ongoing for a well in Q1'27.

Ø Permitting and operations planning remain in an advanced state, ready to resume in mid-CY26.

Namibian Portfolio Highlights

PEL93 Namibia (20% WI)

Licence Extension and Pre-Drill De-Risking Underway:

Ø The Namibian Ministry of Mines and Energy granted a 12-month extension to the PEL 93 First Renewal Exploration Period, now expiring in October 2026.

Ø A high-resolution gravity survey is planned for Q1 CY26, covering the southern area of PEL 93 where multiple structural leads have been identified.

Ø Regional activity continues to build, with nearby operator ReconAfrica drilling its Kavango West-1X exploration well that spud in July 2025. The well, which shares similar geological characteristics with Lead 9 in southern PEL 93.

Project Longhorn

Strategic Divestment Completed

Ø Divestment of 88E's 65% working interest in Project Longhorn completed, effective 1 July 2025, for US$3.25 million before adjustments.

Ø The divestment followed the Company's decision not to participate in the operator's multi-well program, avoiding exposure to estimated US$2 million per well development costs.

Corporate Activity

Ø Cash balance of A$8.3 million as at 30 September 2025.

Ø Small Holding Share Sale Facility closed on 1 August 2025. Sales of the parcels, (individually valued under A$500) remained in progress at quarter-end, with the proceeds to be distributed once all shares are sold, expected by year-end 2025.

Ø Mr. Philip Byrne retired as Non-Executive Chairman of 88 Energy Limited, effective 22 August 2025, succeeded by Ms. Joanne Williams.

Alaskan Portfolio Detail

Project Phoenix (~75% WI)

Joint Venture Partner Farm-Out Overview

Agreed terms with Burgundy to fully fund up to US$39 million (approx. A$60 million) of Project Phoenix's total gross future work program costs in exchange for up to an additional 50% Working Interest (WI) in Project Phoenix. Transaction provides the requisite funding pathway to advance Project Phoenix towards a final development decision via a two-phase farm-in arrangement:

Ø Phase 1: Burgundy to fund US$29 million (approx. A$45 million) for CY25/26 work program, including drilling of a horizontal well and production testing scheduled for mid-CY26 (88E fully carried; 88 Energy WI post Phase 1 farmout 35%).

Ø Phase 2: Upon Phase 1 Success; Burgundy to fund up to US$10 million (approx. A$15 million) for an additional well or other CAPEX program (88E carry up to US$7.5 million, based on current 75% WI; 88 Energy WI post Phase 2 farmout to 25%).

Franklin Bluffs-1H Horizontal Well and Extended Production Test

88 Energy continued to work with Burgundy to advance planning and permitting for the Franklin Bluffs-1H horizontal test well and flowback operation (FB-1H) scheduled for mid-CY26. FB-1H will target the SMD-B reservoir, one of the most promising zones identified at the Hickory-1 discovery well.

Burgundy appointed Fairweather LLC, a specialist Alaskan service provider, to manage permitting, well design, operations logistics, stimulation program and production test through the second half of 2025.

Completion of the Farm-out Participation Agreement remains subject to relevant government and other approvals, as well as customary conditions precent for farm-out transactions, and Burgundy securing Phase 1 funding by 31 December 2025, unless extended by mutual consent.

Geological Context of the SMD-B Reservoir

The SMD-B reservoir, part of the Campanian sequence, is the best-developed topset sandstone in the SMD series at Project Phoenix. The Hickory-1 well intersected 52 feet of net pay, with porosity ranging from 5-11%, while Icewine-1 intersected 69 ft net pay and showed higher porosity values ranging from to 8-14%, indicating improved reservoir quality in the Icewine-1 location.

Flow testing of the SMD-B at Hickory-1 in Q1 CY24 confirmed oil mobility with samples of 38.5-39.5 API gravity oil and a low gas-oil ratio. These results demonstrate reservoir deliverability and provide confidence that horizontal stimulation can enhance productivity. For full details, refer to the ASX announcement dated 15 April 2024.

Pantheon Resources' Dubhe-1 appraisal well represents a significant validation of the commercial potential of the SMD reservoirs. The well confirmed a 565 ft hydrocarbon column in the SMD-B topset horizon, exceeding pre-drill expectations by 26%, and also encountered hydrocarbon-bearing zones in the SMD-C and two Slope Fan intervals.

These results provide a compelling production analogue for 88 Energy's Franklin Bluffs-1H horizontal well. Together with the Hickory-1 flow test, Dubhe-1 confirms reservoir quality, hydrocarbon mobility and thickness across the SMD-B interval, supporting future commercial development potential for Project Phoenix.

Project Leonis (100% WI)

Tiri-1 Exploration Well Update

Planning and permitting for the Tiri-1 exploration well continued during the quarter, with all major vendors submitting operational proposals, resulting in a robust AFE and Major permitting C-Plan milestone approved by the State of Alaska.

Multiple parties continued technical due diligence on Project Leonis during the quarter. The proposed Tiri-1 well is currently positioned to intersect the Canning and USB reservoirs and to test deeper exploration potential. The final well location will be confirmed in consultation with prospective farm-in parties, with the well anticipated to be drilled in Q1'27. Preparations for the drilling of an exploration well at Leonis are advanced and will resume mid-2026.

Namibia PEL 93 (20% WI)

PEL 93 Forward Work Program

PEL 93 key milestones | ||||||||||||

Indicative PEL 93 timeline[2] | H1-24 | H2-24 | H1-25 | H2-25 | H1-26 | H2-26 | ||||||

Working Interest assigned to 88E | P | |||||||||||

Completion of ~200km 2D acquisition and processing | P | |||||||||||

Airborne Gravity and Magnetic survey | n | |||||||||||

Maiden Certified Prospective Resource Report | n | |||||||||||

Planning/permitting/design for potential exploration well | n | |||||||||||

The Joint Venture is preparing to commence the airborne gravity survey in Q1 2026, focusing on the southern portion of the license area in the heart of the Owambo Basin. This follows identification of Lead 9, a very large anticlinal structure, during the H2 2024 2D seismic program. Lead 9 is analogous to the structure currently being drilled by ReconAfrica's Kavango West 1X well. Both structures exhibit large, robust structural closures incorporating shallow clastic reservoirs, the deeper Otavi carbonate reservoir (seen in Naingopo-1) and the deeper source rocks. According to the Operator of PEL 93, Monitor, the regional structural model suggests the presence of a series of similar features extending across the southern Owambo Basin. Early gravity and radiometric data suggest even larger structural leads may be present in the southeast of the block.

Regional Catalysts Building: ReconAfrica's Kavango West 1X Well

88 Energy notes the ongoing drilling of the nearby Kavango West 1X exploration well by ReconAfrica (TSXV: RECO) in the adjacent Damara Fold Belt. This well is targeting a large fold structure approximately 20 km long and 5 km wide, anticipated to penetrate a thick Otavi carbonate reservoir with mature source rocks within the same closure.

ReconAfrica commenced drilling of its Kavango West 1X exploration well in July 2025, on a structure which has striking similarities to Lead 9 located in the southern area of PEL 93. Drilling is proceeding on schedule, and the final casing string has been set just above the targeted Otavi reservoir. ReconAfrica expect to reach TD of ~3,800m in 2nd half of November prior to commencing an extensive logging program with results around 2025 year-end.

This regional activity highlights growing industry interest in the broader Owambo Basin.

Project Longhorn

On 18 August 2025, the Company announced it executed a binding Securities Purchase Agreement (SPA) with Lonestar I, LLC (Lonestar), Operator of Project Longhorn, for the sale of its 65% non-operated working interest in the producing oil and gas assets located in the Permian Basin, Texas, USA (Project Longhorn), held through subsidiary Longhorn Energy Investments LLC (88E - Longhorn) with an effective date of 1 July 2025 for total consideration of US$3.25 million before customary working capital and completion adjustments. The Company elected not to participate in the proposed multi-well drill program by the Operator and relieved exposure to a development program of US$2 million per well.

Full for details refer to the ASX announcement on 18 August 2025.

Corporate

At 30 September 2025, the Company's cash balance was A$8.3 million (US$5.4 million). The attached ASX Appendix 5B sets out the Company's cash flow for the quarter.

Material cash flows for the period include:

· Exploration and Evaluation Expenditure: A$0.6 million (June 2025 quarter A$0.7 million) related to Leonis Tiri-1 permitting and planning and PEL 93 work program costs.

· Staff and Administration Costs: A$1.1 million (June 2025 quarter A$1.3 million), material costs included one-off share registry payments for share consolidation and establishment of the SHSF noted below as well as annual listing fees and half yearly audit costs, and includes fees and consulting fees paid to Directors of A$0.21 million.

· Leonis new lease costs including final bid bonus payment $A0.5 million. Phoenix lease costs payment of $A0.4 million was also made during the period of which was fully funded by Burgundy upon receipt of a cash call.

On 22 August 2025, 88 Energy Limited announced the retirement of Mr. Philip Byrne as Non-Executive Chairman, marking the conclusion of his tenure which began in August 2021. Mr. Byrne's leadership and extensive industry experience were instrumental during a pivotal period of transition for the Company. The Board appointed Ms. Joanne Williams to the role of Chair of 88 Energy. Ms. Williams, a petroleum engineer with over 25 years of global oil and gas experience, brings deep technical and strategic expertise. Her appointment as Chair follows four years on the Board as a Non-Executive Director and is expected to enhance the Company's focus on its core exploration growth pillars in Alaska and Namibia, and support its data-led approach to unlocking high-impact opportunities

Small Holding Sale Facility Update

Small Holding Share Sale Facility (SHSF) closed on 1 August 2025 for shareholders with parcels valued under A$500 (less than marketable parcels) that did not complete a notice of retention form. The sale facility remained ongoing at quarter end and upon the sale of all the less than marketable parcels, proceeds will be provided to participating shareholders as soon as sale of all shares is completed. Upon completion, the sale facility will streamline registry management and reduce Company administration costs by the reduced number of shareholders on the registry.

Information required by ASX Listing Rule 5.4.3

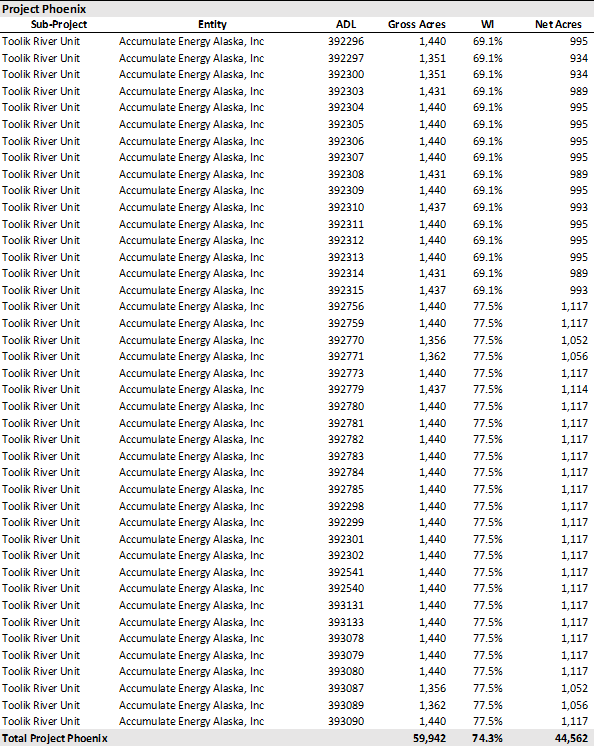

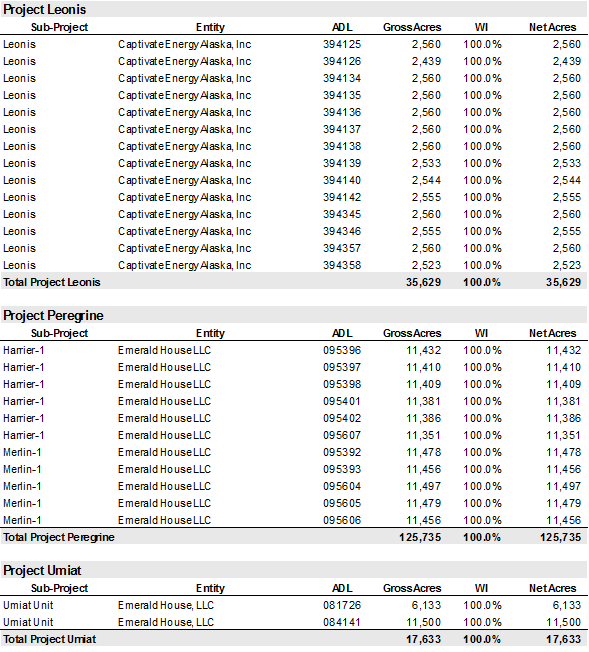

Project Name | Location |

Net Area (acres) | Interest at beginning of Quarter | Interest at end of Quarter |

Phoenix | Onshore, North Slope Alaska | 44,562 | ~75% | ~75% |

Leonis | Onshore, North Slope Alaska | 35,634 | 100% | 100% |

PEL 93 | Onshore, Owambo Basin, Namibia | 914,270 | 20% | 20% |

Peregrine[3] | Onshore, North Slope Alaska (NPR-A) | 125,735 | 100% | 100% |

Umiat[4] | Onshore, North Slope Alaska (NPR-A) | 17,633 | 100% | 100% |

Longhorn | Onshore, Permian Basin Texas | 2,830 | ~65% | 0% |

Pursuant to the requirements of the ASX Listing Rules Chapter 5 and the AIM Rules for Companies, the technical information and resource reporting contained in this announcement was prepared by, or under the supervision of, Dr Stephen Staley, who is a Non-Executive Director of the Company. Dr Staley has more than 40 years' experience in the petroleum industry, is a Fellow of the Geological Society of London, and a qualified Geologist / Geophysicist who has sufficient experience that is relevant to the style and nature of the oil prospects under consideration and to the activities discussed in this document. Dr Staley has reviewed the information and supporting documentation referred to in this announcement and considers the prospective resource estimates to be fairly represented and consents to its release in the form and context in which it appears. His academic qualifications and industry memberships appear on the Company's website, and both comply with the criteria for "Competence" under clause 3.1 of the Valmin Code 2015. Terminology and standards adopted by the Society of Petroleum Engineers "Petroleum Resources Management System" have been applied in producing this document.

This announcement has been authorised by the Board.

Media and Investor Relations:

88 Energy Ltd Ashley Gilbert, Managing Director Tel: +61 (0)8 9485 0990 Email: [email protected] | |

Fivemark Partners, Investor and Media Relations | |

Michael Vaughan | Tel: +61 (0)422 602 720 |

Euroz Hartleys Ltd | |

Chelsey Kidner | Tel: +61 (0)8 9268 2829 |

Cavendish Capital Markets Limited | |

Derrick Lee / Pearl Kellie | Tel: +44 (0)131 220 6939

|

Hannam & Partners Leif Powis / Neil Passmore

|

Tel: +44 (0) 207 907 8500 |

Information required by ASX Listing Rule 5.4.3 - Lease Schedules as at 30 September 2025

Note: Project Peregrine and Umiat leases positions are currently under suspension. The Board considers the acreage positions non-core and will look to relinquish or dispose of these acreage positions in the near-term.

Appendix 5B

Mining exploration entity or oil and gas exploration entityquarterly cash flow report

Name of entity | ||

88 Energy Limited | ||

ABN |

| Quarter ended ("current quarter") |

80 072 964 179 | 30 September 2025 | |

Consolidated statement of cash flows | Current quarter$A'000 | Year to date (9 months)$A'000 |

| |

1. | Cash flows from operating activities | - | - |

|

1.1 | Receipts from customers |

| ||

1.2 | Payments for | - | - |

|

(a) exploration & evaluation |

| |||

(b) development | - | - |

| |

(c) production | - | - |

| |

(d) staff costs | (451) | (1,436) |

| |

(e) administration and corporate costs | (646) | (1,888) |

| |

1.3 | Dividends received (see note 3) | - | - |

|

1.4 | Interest received | 26 | 81 |

|

1.5 | Interest and other costs of finance paid | - | - |

|

1.6 | Income taxes paid | - | - |

|

1.7 | Government grants and tax incentives | - | - |

|

1.8 | Other | - | - |

|

1.9 | Net cash from / (used in) operating activities | (1,071) | (3,243) |

|

| ||||

2. | Cash flows from investing activities | - | - |

|

2.1 | Payments to acquire or for: |

| ||

(a) entities |

| |||

(b) tenements | (963) | (1,850) |

| |

(c) property, plant and equipment | - | - |

| |

(d) exploration & evaluation | (593) | (2,284) |

| |

(e) investments | - | - |

| |

(f) other non-current assets | - | - |

| |

2.2 | Proceeds from the disposal of: | - | - |

|

(a) entities |

| |||

(b) tenements | - | - | ||

(c) property, plant and equipment | - | - |

| |

(d) investments | - | - |

| |

(e) other non-current assets | - | - |

| |

2.3 | Cash flows from loans to other entities | - | - |

|

2.4 | Dividends received (see note 3) | - | - |

|

2.5 | Other - Joint Venture Contributions Other - Distribution from Project Longhorn Other - Proceeds from sale Investments | 449 - 2,492 | 6,193 262 2,492 |

|

2.6 | Net cash from / (used in) investing activities | 1,385 | 4,813 |

|

| ||||

3. | Cash flows from financing activities | - | - |

|

3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) |

| ||

3.2 | Proceeds from issue of convertible debt securities | - | - |

|

3.3 | Proceeds from exercise of options | - | - |

|

3.4 | Transaction costs related to issues of equity securities or convertible debt securities | - | - |

|

3.5 | Proceeds from borrowings | - | - |

|

3.6 | Repayment of borrowings | - | - |

|

3.7 | Transaction costs related to loans and borrowings | - | - |

|

3.8 | Dividends paid | - | - |

|

3.9 | Other (provide details if material) | - | - |

|

3.10 | Net cash from / (used in) financing activities | - | - |

|

| ||||

4. | Net increase / (decrease) in cash and cash equivalents for the period |

| ||

4.1 | Cash and cash equivalents at beginning of period | 8,047 | 7,198 |

|

4.2 | Net cash from / (used in) operating activities (item 1.9 above) | (1,071) | (3,243) |

|

4.3 | Net cash from / (used in) investing activities (item 2.6 above) | 1,385 | 4,813 |

|

4.4 | Net cash from / (used in) financing activities (item 3.10 above) | - | - |

|

4.5 | Effect of movement in exchange rates on cash held | (41) | (448) |

|

4.6 | Cash and cash equivalents at end of period | 8,320 | 8,320 |

|

5. | Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts | Current quarter$A'000 | Previous quarter$A'000 |

5.1 | Bank balances | 8,320 | 8,047 |

5.2 | Call deposits | - | - |

5.3 | Bank overdrafts | - | - |

5.4 | Other (provide details) | - | - |

5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 8,320 | 8,047 |

(a)

6. | Payments to related parties of the entity and their associates | Current quarter$A'000 |

6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | 210 |

6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | - |

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. | ||

6.1 Payments relate to Director and consulting fees paid to Directors. All transactions involving directors and associates were on normal commercial terms.

7. | Financing facilities Note: the term "facility' includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. | Total facility amount at quarter end$US'000 | Amount drawn at quarter end$US'000 |

7.1 | Loan facilities | - | - |

7.2 | Credit standby arrangements | - | - |

7.3 | Other (please specify) | - | - |

7.4 | Total financing facilities | - | - |

| |||

7.5 | Unused financing facilities available at quarter end | - | |

7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. | ||

8. | Estimated cash available for future operating activities | $A'000 |

8.1 | Net cash from / (used in) operating activities (item 1.9) | (1,071) |

8.2 | (Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) | (593) |

8.3 | Total relevant outgoings (item 8.1 + item 8.2) | (1,664) |

8.4 | Cash and cash equivalents at quarter end (item 4.6) | 8,320 |

8.5 | Unused finance facilities available at quarter end (item 7.5) | - |

8.6 | Total available funding (item 8.4 + item 8.5) | 8,320 |

8.7 | Estimated quarters of funding available (item 8.6 divided by item 8.3) | 5.00 |

Note: if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as "N/A". Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. | ||

8.8 | If item 8.7 is less than 2 quarters, please provide answers to the following questions: | |

8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | ||

Answer: n/a | ||

8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | ||

Answer: n/a | ||

8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | ||

Answer: n/a | ||

Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. | ||

Compliance statement

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 30 October 2025

Authorised by: By the Board

(Name of body or officer authorising release - see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity's activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: "By the board". If it has been authorised for release to the market by a committee of your board of directors, you can insert here: "By the [name of board committee - eg Audit and Risk Committee]". If it has been authorised for release to the market by a disclosure committee, you can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council's Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

[1] Refer to Pantheon Resources (AIM: PANR) release on 18 August 2025 for further details

[2] This timeline is indicative and subject to change. The Company reserves the right to alter this timetable at any time

[3] Refer announcement released to ASX on 21 December 2023 regarding Project Peregrine initial suspension, which was extended by the BLM until 30 November 2025

[4] Refer 2024 Half Yearly announcement released to ASX on 2 September 2024, regarding Umiat 12-month suspension until 30 September 2025. The Company requested and was granted an additional 12-month suspension until 30 June 2026

Related Shares:

88 Energy