27th Oct 2025 08:05

Greatland Resources Limited

Greatland Resources Limited

W: https://greatland.com.au

: x.com/greatlandgold

: x.com/greatlandgold

NEWS RELEASE | 27 October 2025

Quarterly Activities Report - September Quarter 2025

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED UNDER THE UK MARKET ABUSE REGULATIONS. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

Strong start to FY26

Quarterly production of 80,890 ounces of gold at AISC of $2,155/oz, $284 million cash flow from operations and closing cash of $750 million

Highlights

Operations

§ September quarter production of 80,890oz Au and 3,366t Cu at an AISC of $2,155/oz Au.

§ Exceptional gold recovery of 88.6% for the September quarter, Telfer's highest quarterly gold recovery since FY2010.

§ No Lost Time Injuries during the quarter. 12-month moving average lost time injury frequency rate (LTIFR) is 0 and Total Recordable Injury Frequency Rate (TRIFR) is 6.5, consolidating the significant improvements made since Greatland's acquisition of Telfer.

Financial & Corporate

§ September quarter sales of 82,199oz Au and 3,277t Cu at weighted average realised prices of $5,277/oz gold and $12,552/t copper, generating net revenue of $476 million.

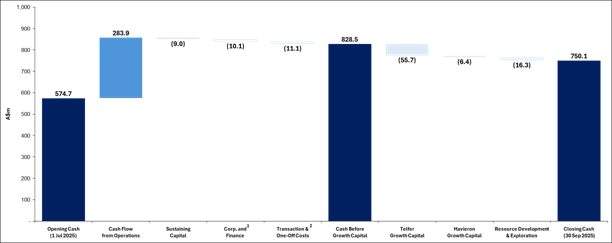

§ Operating cash flow of $284 million for the quarter delivered a closing cash balance of $750 million (from $575 million at 30 June 2025), debt free.

§ $885 million cumulative cash flow from operations generated since acquisition completion in December 2024 more than exceeds the acquisition upfront consideration paid of ~ $541 million.

§ Full upside exposure to the gold price with downside protection provided from gold put options at $3,905/oz (CY25) and $4,200/oz (CY26).

Growth

§ $69.8 million in Telfer growth capex invested across tailings expansion, open pit pre-stripping, underground development and open pit fleet renewal.

§ Record 240,000 metre annual Telfer resource development drilling program underway, with eight drill rigs expected to be operating by the end of October. A total 53,543 metres was drilled in the quarter (June quarter: 27,840 metres), with good progress made and an exciting new high grade zone identified at the West Dome Underground.

§ Havieron Feasibility Study and early works continue to progress, study completion targeted for December 2025.

Greatland Managing Director, Shaun Day, commented:

"We are pleased to have delivered a strong operational performance in the first quarter, with AISC of $2,155 per ounce very pleasing, and highlights of the quarter being Telfer gold recoveries and underground production. Cash generation was again tremendous with $284 million cash flow from operations and cash build of $175 million for the quarter, at an average realised gold price of $5,277 per ounce.

This cash build was achieved notwithstanding $87 million cash outflows for Telfer and Havieron growth capex and exploration for the quarter. The exploration and resource development drilling at Telfer has progressed well and yielded encouraging results across the West Dome Open Pit, Main Dome Underground and in particular the new West Dome Underground project where a new high grade zone has been identified.

We look forward to finalising and sharing the results of the Havieron Feasibility Study, targeted during December 2025. At quarter end, Greatland held $750 million of cash and remains debt free whilst generating strong operating cash flows from Telfer, which provides significant flexibility and de-risking for Havieron's development funding."

Overview

Greatland Resources Limited (Greatland) is pleased to report operating (unaudited) results for the 3-month period from 1 July 2025 to 30 September 2025 (September quarter).

Greatland produced 80,890oz Au and 3,366t Cu at AISC of $2,155/oz Au in the September quarter.

FY26 production is expected to be slightly weighted towards the first half of FY26, and full-year guidance remains 260,000 - 310,000oz Au at an AISC of $2,400 - $2,800/oz Au.

Table 1: September quarter results, June and March quarter results for comparison

Operations |

| Unit | Sep Q 2025 | Jun Q 2025 | Mar Q 2025 |

Mill production | |||||

Ore milled |

| kt | 4,680 | 4,917 | 4,584 |

Mill head grade | Au | g/t Au | 0.58 | 0.58 | 0.68 |

Cu | % Cu | 0.09% | 0.09% | 0.10% | |

Recovery | Au | % | 88.6% | 82.4% | 86.7% |

Cu | % | 81.3% | 81.1% | 80.0% | |

Metal produced 1 | Au | oz | 80,890 | 78,283 | 90,172 |

Cu | t | 3,366 | 3,729 | 3,511 | |

Sales | |||||

Sales | Au | oz | 82,199 | 87,529 | 89,125 |

Cu | t | 3,277 | 3,740 | 3,705 | |

Average price received 2 | Au | A$/oz | 5,277 | 5,014 | 4,585 |

Cu | A$/t | 12,552 | 12,718 | 13,140 | |

Net revenue 2 | Au | A$m | 434 | 439 | 409 |

Cu | A$m | 41 | 48 | 49 | |

Total | A$m | 476 | 487 | 458 | |

Open pit mining | |||||

Total material mined | kt | 5,915 | 4,889 | 4,398 | |

Ore mined (mill feed) | kt | 1,789 | 1,566 | 2,611 | |

Mined grade | Au | g/t Au | 0.60 | 0.59 | 0.64 |

Cu | % Cu | 0.07% | 0.07% | 0.05% | |

Contained metal | Au | oz | 34,303 | 29,864 | 53,527 |

Cu | t | 1,174 | 1,172 | 1,266 | |

Ore mined (dump leach) | kt | 274 | 99 | 26 | |

Underground mining | |||||

Ore mined | kt | 283 | 298 | 278 | |

Mined grade | Au | g/t Au | 1.89 | 1.62 | 1.72 |

Cu | % Cu | 0.58% | 0.58% | 0.70% | |

Contained metal | Au | oz | 17,138 | 15,452 | 15,361 |

Cu | t | 1,648 | 1,726 | 1,945 | |

Costs | |||||

Mining | A$m | 65.4 | 42.7 | 84.2 | |

Processing | A$m | 80.0 | 64.9 | 65.5 | |

Site services | A$m | 29.1 | 22.9 | 16.8 | |

TC/RC and freight | A$m | 6.2 | 5.2 | 6.4 | |

Royalties | A$m | 14.8 | 18.8 | 12.2 | |

Sustaining capex | A$m | 17.9 | 28.6 | 49.9 | |

Rehabilitation | A$m | 3.2 | 0.2 | 2.9 | |

By-product credits | A$m | (42.3) | (47.4) | (46.1) | |

AISC | A$m | 174.5 | 135.9 | 191.7 | |

AISC/oz Au produced 3 | A$/oz | 2,155 | 1,736 | 2,126 | |

Telfer growth capex | A$m | 69.8 | 58.3 | 8.7 | |

Inventory movements 3 | A$m | 18.2 | 54.2 | 16.1 | |

Depreciation & amortisation 4 | A$m | 19.6 | 19.4 | 19.1 | |

Notes:

1. Metal produced for gold includes dump leach ounces which are recovered separately to the processing plant circuit.

2. Net revenue includes adjustments for treatment and refining charges and payability deductions. Average price received is calculated by dividing net revenue by sales (i.e. average price received is also adjusted for payability deductions).

3. AISC is stated per ounce of gold produced, net of by-products (copper) credits. AISC excludes inventory movements which relate to utilisation of stockpiles acquired as part of the Telfer acquisition at 4 December 2024 (expense of $30.0 million) and positive finished goods movements of $11.8 million, impacting EBIT by a net expense of $18.2 million for the quarter.

4. Depreciation and amortisation is expected to be approximately $140 - 160 million for FY26, weighted towards H2. See further explanation in the Corporate & Finance section.

Mining

Open Pit

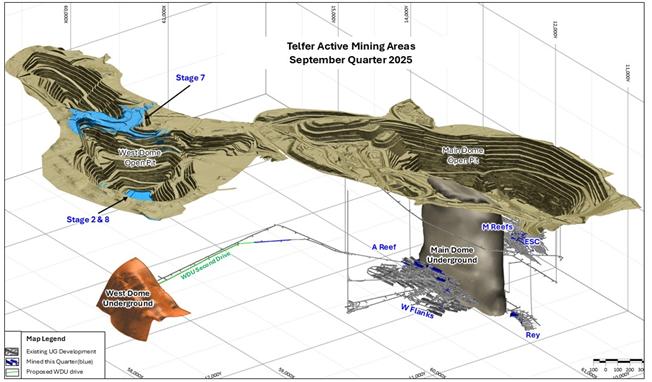

Mill feed ore mined during the September quarter was from Stage 2, Stage 7 and Stage 8 (refer Figure 1), totalling 1.79Mt at 0.60g/t Au and 0.07% Cu. Dump leach ore mined was 0.27Mt.

Total material mined was 5.91Mt including approximately 3.85Mt of waste. A focus on increasing open pit productivities and a return to a two-digger plan has seen quarter on quarter increases in total material mined.

Strip ratio (waste:ore) for the Stage 7 development during the quarter was 7.2. Stage 7 mining is currently predominantly waste mining, with 3.7Mt waste mined in the September quarter, and 7.0Mt total waste mined cumulatively to the end of September. The overall Stage 7 design strip ratio is approximately 1.1.

Orders for a Caterpillar 6060 Hydraulic Mining Shovel, two Komatsu WA1200 wheel loaders, and two Caterpillar 793 dump trucks have been placed under the open pit fleet renewal program. The first two of a planned 12 Caterpillar 793 truck rebuilds are complete. The open pit fleet renewal program is expected to support continued increase in open pit productivity.

A short term metal pricing strategy review has identified up to 2Mt of additional lower grade material within the current pit designs in FY26, that provides optionality for mill feed.

West Dome Open Pit optimisation work continued during the quarter to guide ongoing resource drilling in preparation for the next Telfer Mineral Resource Estimate update, planned for the March 2026 quarter.

Resource growth drilling has now completed the shift to a tighter 25m x 25m spacing for all open pit areas, while conversion drilling practices are in the process of moving from blast hole sampling to 12.5m x 12.5m spaced reverse circulation drilling. This will significantly improve the resolution of ore definition in grade control modelling process.

Underground

Ore mined during the September quarter was ahead of plan and predominantly from A-reef, Rey and the Eastern Stockwork Corridor (ESC) areas of the Main Dome Underground (MDU) (refer Figure 1), totalling 0.28Mt at 1.89g/t Au and 0.58% Cu.

Development metres totalled 1,325m for the quarter, with 908m growth capital development including extension opportunities at West Dome Underground (WDU) and ESC. The second development drive from the MDU to the WDU progressed 368 metres.

the MDU to the WDU progressed 368 metres.

Figure 1: September quarter mining areas

Processing

September quarter delivered processed tonnes of 4.68Mt with average head grade of 0.58g/t Au and 0.09% Cu, in line with plan. September quarter recoveries were 88.6% for gold and 81.3% for copper, ahead of plan and represented Telfer's highest quarterly gold recovery since FY2010.

Higher gold recoveries were driven by an operational focus on the pyrite flotation and leaching circuit performance, where maximising the sulphur flotation recovery directly relates to increased gold recovery. Elution circuit performance is now consistently at the required levels. Copper recoveries continue to outperform against historical recovery model performance, having been maintained above 80% for the last three quarters.

Dump leach is a small but efficient contributor to the overall site ounces. A project to replace the main piping infrastructure is underway to ensure the long-term productivity of dump leach ounces.

The TSF8 Stage 3 lift is progressing to schedule and is expected to be completed in the December quarter, providing tailings capacity until the March 2027 quarter. TSF8 Stage 4 lift construction is expected to commence in the June 2026 quarter.

Costs

Mining costs of $65.4 million were below plan, with the increase relative to the previous quarter largely due to a higher proportion of ore mined relative to Stage 7 waste mined (growth capex).

Processing costs of $80 million were in line with plan, with the increase relative to the previous quarter partially due to the costs of the planned maintenance program in the processing plant and power station.

Sustaining capex of $17.9 million was below plan due to slow ramp up of planned expenditures, and lower than the previous quarter due to the completion of TSF8 Stage 2 lift and allocation of Stage 3 lift to growth capex.

Site services costs of $29 million were in line with plan.

Stockpiles

Closing run-of-mine (ROM) ore stockpiles at 30 September 2025 are estimated at 4.5Mt at average grade of 0.63g/t Au and 0.07% Cu for contained metal of 92koz Au and 3.2kt Cu.

The ROM stockpile grade increase relative to the June quarter is due to an increased proportion of higher-grade underground ore in stockpile.

A detailed reconciliation review is ongoing in respect of the ROM stockpiles, assessing the accuracy of the geological model, grade control model, impacts of mining dilution and the robustness of existing processes. Encouragingly the September quarter performance aligned closely to expectations.

Low grade stockpiles at 30 September 2025 are estimated at 20.8Mt at average grade of 0.33g/t Au and 0.04% Cu for contained metal of 221koz Au and 9.1kt Cu.

Stockpiles |

| Unit | Sep Q 2025 | Jun Q 2025 | Mar Q 2025 |

Closing ore stockpiles (ROM) - estimated | |||||

Ore |

| Mt | 4.5 | 7.0 | 9.2 |

Average grade | Au | g/t Au | 0.63 | 0.57 | 0.64 |

Cu | % Cu | 0.07 | 0.06 | 0.06 | |

Contained metal | Au | koz | 92 | 129 | 188 |

Cu | kt | 3.2 | 4.5 | 5.9 | |

Closing ore stockpiles (low grade) - estimated | |||||

Ore |

| Mt | 20.8 | 20.7 | 20.7 |

Average grade | Au | g/t Au | 0.33 | 0.33 | 0.33 |

Cu | % Cu | 0.04 | 0.04 | 0.04 | |

Contained metal | Au | koz | 221 | 220 | 220 |

Cu | kt | 9.1 | 9.0 | 9.0 | |

Growth

A total of $86.7m was spent on growth capex during the quarter, comprising:

§ Telfer: $69.8m across TSF8 Stage 3 lift construction, West Dome Open Pit Stage 7 growth stripping, underground growth development (primarily across A-Reef, ESC and West Dome Underground) and deposits paid for new open pit fleet equipment. Full year Telfer growth capital guidance remains $230 - 260 million, weighted towards H1 FY26.

§ Havieron: $10.3m for Feasibility Study costs and early works (refer below).

§ Exploration & resource development: $6.6m capitalised for resource development from 34,407m of resource growth drilling (with a further $4.8m expensed).

Havieron

The Havieron Feasibility Study continues to progress and is targeted for completion in December 2025. Updates from the September 2025 quarter include:

§ Permitting and Approvals: The permitting process continues to progress, with requests for information under consideration and positive engagement with the relevant departments.

§ Decline tunnel: Commenced installation and backfill works for reinforced concrete tunnel connecting the existing decline portal to surface level, which will mitigate the flow of surface water to the Havieron decline during periods of rainfall.

§ Blind bores: Preliminary works are progressing in line with schedule. Custom designed and fabricated cutter heads were completed during the quarter and are ready for shipment to site (refer Figure 2).

§ Development mining: Planning for development mining restart is complete, with minor works commencing.

§ Decline ventilation: Geotechnical drilling, raise boring and spraying to extend decline ventilation circuit were completed during the quarter.

Figure 2: Blind bore cutter head ready for shipment

Telfer Resource Development & Exploration

The FY26 drill program has started well, exceeding planned metres drilled with a total of 53,543m (resource growth and resource conversion drilling) from 711 holes across West Dome Open Pit, West Dome Underground and Main Dome Underground.

Greatland remains on track to complete the targeted 240,000m of drilling in FY26, with a third reverse circulation (RC) rig mobilised during the quarter and a fifth underground diamond drilling rig mobilising in October.

In the West Dome Open Pit, 41,296m of drilling was completed, targeting resource growth and conversion of the Stage 7 and Stage 2 extensions. September quarter drilling metres exceeded plan, resulting in Stage 7 extension drilling to be completed ahead of schedule, allowing a pivot to Stage 2 extension for the balance of FY26.

In the West Dome Underground, 4,862m of resource growth drilling was completed in the quarter across nine holes from the second phase drilling campaign. Results from the first two holes were returned during the quarter, with a new high-grade zone identified on the Eastern Limb returning the following promising results:

§ 35m @ 2.9g/t Au & 0.19% Cu from 234m (WUC4550099)

§ 30m @ 5.6g/t Au & 0.25% Cu from 281m (WUC4550099)

§ 26.6m @ 2.7g/t Au & 0.30% Cu from 302m (WUC4550111)

Two drill rigs are allocated to the West Dome Underground for the remainder of FY26, and a maiden Mineral Resource Estimate is targeted in the March 2026 quarter.

In the Main Dome Underground, the ESC Central and Tarkin areas were successfully delivered to the operations team during the quarter. Resource growth drilling successfully extended both ESC South and Kylo zones, and these are targeted for delivery to operations in the December quarter, providing significant optionality to further improve underground operations productivity.

Regional exploration activities focused around several known satellite deposits on granted mining leases and within trucking distance of the Telfer processing plant which have potential to provide future ore feed. The FY26 regional exploration program is seeking to extend these known deposits, with the main targets tested to date being the South-East Hub and the Thomsons deposit.

Detailed information is contained in the September quarter Resource Development & Exploration Activities Report released on 22 October 2025.

Corporate & Finance

Sales and revenue

Full upside exposure to the gold price and sales of 82,199oz Au and 3,277t Cu, at average realised prices of $5,277/oz Au and $12,552/t Cu, generated net sales revenues of $476 million.

Cash and liquidity

Cash flow from operations for the quarter was $284 million, with cash build of $175 million, for a closing cash balance on 30 September 2025 of $750 million.

Greatland remains debt free with an undrawn $75 million working capital facility for total available liquidity of $825 million.

Figure 3: September 2025 quarter cash movements

Notes:

1. Corporate and finance includes corporate overheads, finance costs / interest, and premiums paid for gold put options.

2. Transaction and One-Off Costs relate to the remaining transitional services costs and SAP implementation costs.

The Duties Assessment from the Department of Treasury and Finance Revenue WA of $46 million for stamp duty associated with the Telfer-Havieron acquisition was paid subsequent to quarter end in October 2025 (previously expected to be paid during the September 2025 quarter).

For tax purposes, Greatland's accumulated losses were fully utilised during FY25, with a tax liability for the FY25 period estimated to be $76 million that is expected to be payable in the March 2026 quarter, following which tax is expected to be paid in regular monthly instalments.

Depreciation and amortisation (D&A) for the quarter was $19.6 million. Full year FY26 D&A is expected to be $120 - 140 million, weighted towards H2. The increase in D&A from FY25 ($40.5 million) to FY26 results from the depreciation of capital expenditure by Greatland since acquisition of Telfer, particularly in respect of tailings storage facility construction costs.

Rapid payback of total acquisition consideration

Since acquisition completion of Telfer-Havieron in December 2024, Greatland has generated cumulative cash flow from operations of $885 million which more than exceeds the Telfer-Havieron acquisition consideration of $541 million plus contingent consideration of up to US$100 million1.

Note 1: Total acquisition consideration comprised upfront cash of $281 million, upfront scrip of $261 million (at face value) and US$100 million in deferred contingent payments (yet to be paid) on Havieron gold production on the first five years of commercial production, where the average market gold price for the year as published by the LBMA exceeds US$1,850 (Hurdle Price) by way of payment by Greatland equal to: 50% x (Market Price - Hurdle Price) x Havieron gold sold for the year. Capped at US$50 million p.a. and US$100 million in aggregate.

Hedging profile - downside price protection with full upside exposure

Greatland continues to maintain full upside exposure to the gold price, while achieving downside price protection through gold put options. Greatland's current gold put options comprise the following:

Table 3: Gold put option program

Quarter end date | Gold volumes under put options (oz) | Weighted Average Strike Price (A$/oz) |

31-Dec-2025 | 30,792 | 3,905 |

31-Mar-2026 | 37,502 | 4,200 |

30-Jun-2026 | 37,502 | 4,200 |

30-Sep-2026 | 37,502 | 4,200 |

31-Dec-2026 | 37,498 | 4,200 |

Total | 180,796 | 4,150 |

Sustainability

There were no Lost Time Injuries during the September 2025 quarter, and the 12-month moving average lost time injury frequency rate (LTIFR) is 0. There were no environmental non-compliances or significant incidents reported during the quarter. Greatland's TRIFR at quarter end was 6.5 (30 June 2025: 6.0).

Corporate Structure

Category | Metric |

Ordinary shares on issue (#) | 670,751,673 |

Unquoted securities (#) | 5,815,561 Performance Rights 1,355,000 Employee Options 250,000 Managing Director Options 17,631,000 Warrants |

Market capitalisation ($ billion) | $5.1 billion (as at ASX close price, 24 October 2025) |

Cash balance ($ million) | $750 million (as at 30 September 2025) |

Conference Call

Greatland presented is Quarterly Activities Report via a webcast for shareholders, research analysts, media and other interested stakeholders on Monday, 27 October 2025, followed by a Q&A session.

To view the replay, please click on this link and register your details:

https://webcast.openbriefing.com/ggp-qtr1-2026/

This announcement is approved for release by Shaun Day, Greatland's Managing Director.

Contact

For further information, please contact:

Greatland Resources Limited

Shaun Day, Managing Director | Rowan Krasnoff, Chief Development Officer

Nominated Advisor

SPARK Advisory Partners

Andrew Emmott / James Keeshan / Neil Baldwin | +44 203 368 3550

Corporate Brokers

Canaccord Genuity | James Asensio / George Grainger | +44 207 523 8000

RBC Capital Markets | James Agnew / Jamil Miah | Scott Redwood | +44 207 029 0528

Media Relations

Australia - Fivemark Partners | Michael Vaughan | +61 422 602 720

About Greatland

Greatland is a gold and copper mining company listed on the Australian Securities Exchange and London Stock Exchange's AIM Market (ASX:GGP and AIM:GGP) and operates its business from Western Australia.

The Greatland portfolio includes the 100% owned Telfer mine, the adjacent 100% owned brownfield world-class Havieron gold-copper development project and a significant exploration portfolio within the surrounding region. The combination of Telfer and Havieron provides for a substantial and long life gold-copper operation in the Paterson Province in the East Pilbara region of Western Australia.

Forward Looking Statements

This document includes forward looking statements and forward looking information within the meaning of securities laws of applicable jurisdictions. Forward looking statements can generally be identified by the use of words such as "may", "will", "expect", "intend", "plan", "estimate", "anticipate", "believe", "continue", "objectives", "targets", "outlook" and "guidance", or other similar words and may include, without limitation, statements regarding estimated reserves and resources, certain plans, strategies, aspirations and objectives of management, anticipated production, study or construction dates, expected costs, cash flow or production outputs and anticipated productive lives of projects and mines.

These forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance and achievements or industry results to differ materially from any future results, performance or achievements, or industry results, expressed or implied by these forward-looking statements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which Greatland operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward looking statements are based on assumptions as to the financial, market, regulatory and other relevant environments that will exist and affect Greatland's business and operations in the future. Greatland does not give any assurance that the assumptions will prove to be correct. There may be other factors that could cause actual results or events not to be as anticipated, and many events are beyond the reasonable control of Greatland. Forward looking statements in this document speak only at the date of issue. Greatland does not undertake any obligation to update or revise any of the forward looking statements or to advise of any change in assumptions on which any such statement is based.

Non-GAAP measures

Some of the financial performance measures used in this announcement are non-IFRS financial measures, including "all-in sustaining cost", "total cash cost", "net cash", "free cash flow", "operating cash flow", "sustaining capital" and "growth capital". These measures are presented as they are considered to provide useful information to assist investors with their evaluation of the business's underlying performance. Since the non-IFRS performance measures listed herein do not have any standardised definition prescribed by IFRS, they may not be comparable to similar measures presented by other companies. Accordingly, they are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

ASX Listing Rule 5.23

This announcement contains references to Exploration Results which have been extracted from the Company's ASX announcement dated 22 October 2025 entitled September Quarter Resource Development & Exploration Activities Report. The Company confirms that it is not aware of any new information or data that materially affects the information included in the announcement dated 22 October 2025.

Related Shares:

Greatland Resources