28th Jul 2025 07:00

4 January 2025

4 January 2025

4 January 2025

28 July 2025

Adriatic Metals PLC

QUARTERLY ACTIVITIES REPORT

For the three months ended 30 June 2025

("Q2" or "Quarter")

Q2 HIGHLIGHTS

• Production increased 23% to 1.7Moz AgEq1 in Q2 2025 vs 1.4Moz AgEq in Q1 2025

• 99kt ore milled in Q2 2025 vs 66kt in Q1 2025, a 50% improvement

• Mine development increased 24% to 904m in Q2 vs 730m in Q1 2025

• Veovača Tailings Storage Facility ('TSF') construction was completed in March and first tailings deposited on 2 April. A dedicated access road linking the Vareš Processing Plant to the TSF was completed and has been operational since June.

• FY 2025 production guidance has been revised to 475-525kt ore milled (from 625-675kt) and 9.5-10.5Moz AgEq produced (from 12-13Moz AgEq).

• Second debt repayment of $19m made to Orion Mine Finance ('Orion') on 30 June 2025

• Debt repayment of $6m made to Trafigura in Q2 2025, with monthly payments of $3m going forward.

• Cash balance as at 30 June 2025 of $59m (Q1 2025: $76m).

• On 13 June 2025, the Adriatic Board and the Dundee Precious Metals ('DPM') Board announced the reaching of an agreement on the terms of a recommended acquisition of the entire issued ordinary share capital of Adriatic by DPM.

• Post-period, commercial production achieved on 1 July 2025.

Laura Tyler, Managing Director & CEO of Adriatic, commented:

"I am pleased to report another quarter of improving safety metrics and operational ramp up. Ore milled during Q2 totalled 99kt, a 50% increase compared to the previous quarter. On 1 July, we announced the achievement of commercial production - an important milestone for the Company.

As production during the first half of the year was below expectations due to tailings management, full-year 2025 guidance has been revised to be in the range of 475-525kt ore milled and 9.5-10.5Moz silver equivalent produced.

Following the Board's recommendation to accept the proposed acquisition of Adriatic by Dundee Precious Metals, we remain committed to maintaining positive operational momentum throughout this transactional period."

Adriatic Metals PLC (ASX:ADT, LSE:ADT1, OTCQX:ADMLF) ("Adriatic" or the "Company") is pleased to provide an update on mining and processing activities at the Vareš Silver Operation in Bosnia and Herzegovina over Q2 2025.

1. OPERATIONS

Health & Safety

At the end of Q2 2025, the 12-month rolling Lost Time Injury Frequency ('LTIF') and Total Recordable Injury Frequency ('TRIF') were 2.48 and 5.59 respectively, compared to Q1 2025 where LTIF and TRIF were 2.86 and 5.00 respectively (frequency = (LTI or RI) * 1,000,000 / total hours worked).

Q2 2025 Production

| FY 2024 | Q1 2025 | Q2 2025 |

Ore mined (t) | 145,755 | 67,390 | 77,913 |

Ore milled (t) | 76,402 | 65,991 | 99,062 |

Head grade - Ag (g/t) | 217 | 296 | 263 |

Head grade - Au (g/t) | 2.3 | 2.6 | 2.2 |

Head grade - Zn (%) | 7.1 | 6.4 | 5.1 |

Head grade - Pb (%) | 4.6 | 4.5 | 3.7 |

Recoveries - Ag (%) | 90 | 95 | 86 |

Recoveries - Au (%) | 71 | 71 | 69 |

Recoveries - Zn (%) | 60 | 57 | 64 |

Recoveries - Pb (%) | 64 | 74 | 72 |

Ag/Pb concentrate (kt) | 5.5 | 5.3 | 6.1 |

Grade - Ag (g/t) | 2,177 | 2,889 | 2,991 |

Grade - Au (g/t) | 13.7 | 15.1 | 16.1 |

Grade - Pb (%) | 40.8 | 41.4 | 42.6 |

Zn concentrate (kt) | 7.1 | 5.3 | 6.8 |

Grade - Ag (g/t) | 425 | 590 | 598 |

Grade - Au (g/t) | 6.8 | 8.3 | 7.6 |

Grade - Zn (%) | 45.7 | 45.8 | 47.1 |

Contained - Ag (oz) | 481,245 | 595,993 | 720,449 |

Contained - Au (oz) | 3,961 | 3,998 | 4,840 |

Contained - Zn (t) | 3,226 | 2,419 | 3,209 |

Contained - Pb (t) | 2,240 | 2,211 | 2,613 |

* Recoveries and contained metal are only into payable concentrates

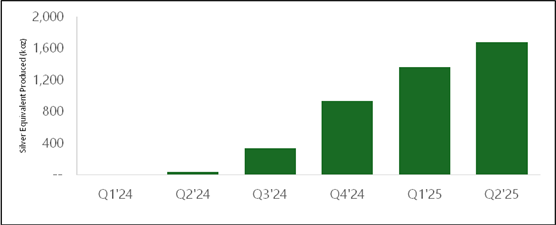

Figure 1: Silver equivalent produced (koz)

In Q2 2025, 78kt of ore was mined, 15% higher than 67kt ore mined in Q1 2025. This was aligned with processing rates which were constrained due to limited access to the Veovaca TSF.

Underground development totalled 904m in Q2 2025, an 24% increase compared to 730m in Q1 2025.

At the Vares Processing Plant there was a record quarter of processing with 99kt of ore milled in Q2 2025 vs 66kt ore milled in Q1 2025, an increase of 50%. This resulted in production of 1.7Moz AgEq1 in Q2 2025 vs 1.4Moz AgEq in Q1 2025 (a 23% increase).

Milled tonnage was lower than expected due to tailings management and some mechanical problems with the crusher. In Q2 an alternative route to haul tailings from Vareš Processing Plant to the Veovača TSF was in use, which limited tails deposition. The dedicated access road linking the Vareš Processing Plant to the TSF was completed during the quarter and has been operational over the past six weeks, thus removing the bottleneck that prevented the operation running at rates required for commercial production.

At the Vares Processing Plant, mechanical issues with the crusher limited processing rates in June; however, these issues have now been resolved. In addition, the timing sequencing delays with the tailings filter has been addressed and five new filter plates are expected to arrive in August. Their installation will bring the filter press to its full design capacity.

At Rupice the backfill paste plant pad has been completed and construction has commenced, the emulsion plant steelwork has been erected, and the final loader and ancillary equipment has been commissioned. In addition, the contract for the additional Water Treatment Plant has been awarded.

The expansion study to increase processing capacity to 1Mtpa is progressing on schedule. Ausenco has completed both the site visit and the initial design phase, and the tendering process for the new tailings press is underway. Mine design and scheduling efforts to support the higher milling rate are also on track, with completion expected in Q4. Preliminary work indicates that the mine can supply the required ore with minimal capital investment.

On 1 July commercial production was declared based on maintaining plant throughput levels of 75% capacity over 14 days, including 80% over 7 days, and reaching 2,000tpd (90%) in late June.

FY 2025 production guidance has been revised to 475-525kt ore milled (from 625-675kt) and 9.5-10.5Moz AgEq produced (from 12-13Moz).

2. CORPORATE

On 13 June 2025, the Adriatic Board and the Dundee Precious Metals ('DPM') Board announced that they had reached agreement on the terms of a recommended acquisition of the entire issued ordinary share capital of Adriatic by DPM (the "Acquisition"). It is intended that the Acquisition will be effected by means of a Court-sanctioned scheme of arrangement under Part 26 of the Companies Act 2006 (the "Scheme"). Further details can be found in the announcement: 20e5537a-6b2.pdf

The full details of the Scheme and expected timetable were published on 14 July 2025, the announcement can be found here: 7fbb5016-81c.pdf

3. FINANCE

The second debt quarterly repayment to Orion of $19m was made at the end of June 2025.

During the quarter debt repayment of $6m were made to Trafigura, with ongoing monthly payments of $3m going forward.

Cash balance as at 30 June 2025 was $59m (Q1 2025: $76m).

Summary of Cash flow

A summary of operating, investing and financing cash flows during the Quarter, before movements in exchange rates, as reported in the Appendix 5B Cash Flow Report, is as follows:

| USD'000 |

Net cash from operating activities | 15,428 |

Net cash used in investing activities | (7,669) |

Net cash used in financing activities | (24,961) |

Effects of movement in exchange rates | (17) |

Net decrease in cash and cash equivalents | (17,219) |

|

|

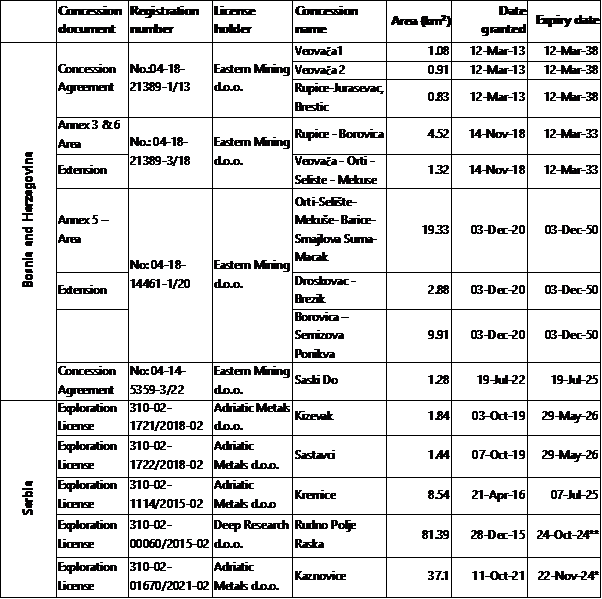

4. TENEMENT HOLDINGS

In accordance with ASX Listing Rule 5.3.3, the Company's tenements as at 30 June 2025 are set out below. The Company holds a 100% interest in all concession agreements and licences via its wholly owned subsidiaries with the exception of the Raska (Suva Ruda) licence held by Deep Research d.o.o., which is subject to changes that occurred during 2024.

Adriatic Metals PLC has entered into a sale and purchase agreement with Deep Research d.o.o. and its shareholders, which provides for the transfer of the Raska (Suva Ruda) licence to a newly established company owned 100% by Adriatic Metals PLC. It has also been agreed that the previous option agreement over Deep Research d.o.o. will be terminated as part of the licence transfer.

*Request for 1st extension submitted on time. Pending approval.

**Pending Ministry decision on a two-year extension for preparation of reserves elaborate which excludes any geological exploration work. Upon approval, plan is to split the exploration area into two new areas and continue exploration work.

Notes:

Note 1: Formula for Silver Equivalent (AgEq) = ((Ag Produced x Ag $/oz) + (Au Produced x Au $/oz) + (Zn Produced x Zn $/t) + (Pb Produced x Pb $/t) + (Cu Produced x Cu $/t) + (Sb Produced x Sb $/t)) / (Ag $/oz). Produced quantities are after recovery. Commodity prices: $25/oz Ag, $2,000/oz Au, $2,500/t Zn, $2,000/t Pb, $2,000/t Cu, $2,000/t Sb.

Note 2: Unless otherwise stated, all dollar figures are United States dollars ($).

- ends -

Authorised by Laura Tyler, CEO and Managing Director of Adriatic Metals.

For further information please visit: www.adriaticmetals.com; email: [email protected], @AdriaticMetals on Twitter; or contact:

Adriatic Metals PLC | |

Klara Kaczmarek GM - Corporate Development | Tel: +44 (0) 7859 048228 |

Burson Buchanan | Tel: +44 (0) 20 7466 5000 |

Bobby Morse / Oonagh Reidy | |

RBC Capital Markets |

|

Farid Dadashev / James Agnew / Jamil Miah | Tel: +44 (0) 20 7653 4000 |

Stifel Nicolaus Europe Limited | |

Ashton Clanfield / Callum Stewart / Varun Talwar | Tel: +44 (0) 20 7710 7600 |

Morrow Sodali | |

Cameron Gilenko | Tel: +61 466 984 953 |

MARKET ABUSE REGULATION DISCLOSURE

The information contained within this announcement is deemed by the Company (LEI: 549300OHAH2GL1DP0L61) to constitute inside information for the purpose of Article 7 of EU Market Abuse Regulation (EU) No. 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) ACT 2018, as amended. The person responsible for arranging and authorising the release of this announcement on behalf of the Company is Laura Tyler, CEO and Managing Director.

Appendix 5B

Mining exploration entity or oil and gas exploration entity quarterly cash flow report

Name of entity | ||

ADRIATIC METALS PLC | ||

ABN | Quarter ended ("current quarter") | |

624 403 163 | 30 JUNE 2025 | |

Consolidated statement of cash flows | Current quarter USD'000 | Year to date (6 months) USD'000 | |

1. | Cash flows from operating activities | ||

1.1 | Receipts from customers | 50,964 | 84,936 |

1.2 | Payments for | ||

a) exploration & evaluation (if expensed) | (1,377) | (2,309) | |

b) development | (3,933) | (6,982) | |

c) production | (12,757) | (24,197) | |

d) staff costs | (8,206) | (17,382) | |

e) administration and corporate costs | (10,355) | (16,220) | |

1.3 | Dividends received (see note 3) | - | - |

1.4 | Interest received | 409 | 559 |

1.5 | Interest and other costs of finance paid | (442) | (1,132) |

1.6 | Income taxes paid | - | - |

1.7 | Government grants and tax incentives | - | - |

1.8 | Other - VAT refund | 1,125 | 5,653 |

1.9 | Net cash from operating activities | 15,428 | 22,926 |

| |||

2. | Cash flows from investing activities | ||

2.1 | Payments to acquire: | ||

a) entities | - | - | |

b) tenements | - | - | |

c) property, plant and equipment | (7,669) | (12,723) | |

d) exploration & evaluation (if capitalised) | - | - | |

e) investments | - | - | |

f) other non-current assets | - | - | |

2.2 | Proceeds from the disposal of: | ||

a) entities | - | - | |

b) tenements | - | - | |

c) property, plant and equipment | - | - | |

d) investments | - | - | |

e) other non-current assets | - | - | |

2.3 | Cash flows from loans to other entities | - | - |

2.4 | Dividends received (see note 3) | - | - |

2.5 | Other | - | - |

2.6 | Net cash used in investing activities | (7,669) | (12,723) |

3. | Cash flows from financing activities | ||

3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) | - | 50,000 |

3.2 | Proceeds from issue of convertible debt securities | - | - |

3.3 | Proceeds from exercise of options and warrants | - | - |

3.4 | Transaction costs related to issues of equity securities or convertible debt securities | - | (1,796) |

3.5 | Proceeds from borrowings | - | - |

3.6 | Repayment of borrowings | (24,961) | (45,188) |

3.7 | Transaction costs related to loans and borrowings | - | - |

3.8 | Dividends paid | - | - |

3.9 | Other - concentrate prepayment net of fees | - | 25,000 |

3.10 | Net cash used in financing activities | (24,961) | 28,016 |

4. | Net increase / (decrease) in cash and cash equivalents for the period | ||

4.1 | Cash and cash equivalents at beginning of period | 75,917 | 20,698 |

4.2 | Net cash from / (used in) operating activities (item 1.9 above) | 15,428 | 22,926 |

4.3 | Net cash from / (used in) investing activities (item 2.6 above) | (7,669) | (12,723) |

4.4 | Net cash from / (used in) financing activities (item 3.10 above) | (24,961) | 28,016 |

4.5 | Effect of movement in exchange rates on cash held | (17) | (219) |

4.6 | Cash and cash equivalents at end of period | 58,698 | 58,698 |

5. | Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts | Current quarterUSD'000 | Previous quarterUSD'000 |

5.1 | Bank balances | 58,642 | 75,144 |

5.2 | Call deposits | - | - |

5.3 | Bank overdrafts | - | - |

5.4 | Other - brokerage cash | 56 | 774 |

5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 58,698 | 75,918 |

6. | Payments to related parties of the entity and their associates | Current quarter USD'000 |

6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | (296) |

6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | - |

During the Quarter, Adriatic paid an aggregate total of $296k to Directors, or companies controlled by them, consisting of salaries and fees. | ||

7. | Financing facilities Note: the term "facility' includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. | Total facility amount at quarter end USD'000 | Amount drawn at quarter end USD'000 |

7.1 | Loan facilities | 142,500 | 142,500 |

7.2 | Credit standby arrangements | - | - |

7.3 | Other (please specify) | 25,000 | 25,000 |

7.4 | Total financing facilities | 167,500 | 167,500 |

| |||

7.5 | Unused financing facilities available at quarter end | - | |

7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. | ||

The $142.5m Orion Debt Financing package consists of $120m Senior Secured Debt and $22.5m Copper Stream arrangement. The first two tranches of $30m of the $120m Senior Secured Debt were drawn down in December 2022 and February 2023 and the third tranche was drawn down in April 2023. The $22.5m Copper Stream deposit was received in February 2023. The remaining fourth $30m tranche of the Senior Secured Debt was drawn down in January 2024.

In January 2025 the Company completed a $25m concentrate prepayment agreement with Trafigura with funds drawn down in the same month. | |||

8. | Estimated cash available for future operating activities | USD'000 |

8.1 | Net cash from operating activities (Item 1.9) | 15,428 |

8.2 | Net cash (used in) investing activities (Item 2.6) | (7,669) |

8.3 | Total relevant earnings (Item 8.1 + Item 8.2) | 7,759 |

8.4 | Cash and cash equivalents at quarter end (Item 4.6) | 58,698 |

8.5 | Unused finance facilities available at quarter end (Item 7.5) | - |

8.6 | Total available funding (Item 8.4 + Item 8.5) | 58,698 |

8.7 | Estimated quarters of funding available (Item 8.6 divided by Item 8.3) | 7.6 |

8.8 | If Item 8.7 is less than 2 quarters, please provide answers to the following questions: | |

1. Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | ||

Answer: N/A

| ||

2. Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | ||

Answer: N/A

| ||

3. Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | ||

Answer: N/A

| ||

Compliance statement

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 27 July 2025

Authorised by: Audit and Risk Committee

(Name of body or officer authorising release - see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity's activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: "By the board". If it has been authorised for release to the market by a committee of your board of directors, you can insert here: "By the [name of board committee - e.g. Audit and Risk Committee]". If it has been authorised for release to the market by a disclosure committee, you can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council's Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

Related Shares:

Adriatic Metal.