29th Jan 2026 07:00

29 January 2026

Quarterly Activities and Cash Flow Reportfor the quarter ended 31 December 2025

Atlantic Lithium awaits parliamentary ratification of the revised Ewoyaa Mining Lease

Atlantic Lithium Limited (AIM: ALL, ASX: A11, GSE: ALLGH, "Atlantic Lithium" or the "Company"), the Africa-focused lithium exploration and development company targeting the delivery of Ghana's first lithium mine, is pleased to release its Quarterly Activities and Cash Flow Report for the period ended 31 December 2025.

Highlights

Project Development:

- A revised version of the Mining Lease in respect of the Company's flagship Ewoyaa Lithium Project ("Ewoyaa" or the "Project") in Ghana has been submitted to the Parliament of Ghana and referred to the Select Committee, per the necessary process for ratification.

- The Mining Lease includes fiscal terms that were incorporated following a period of consultation undertaken by the Minister of Lands and Natural Resources and relevant local and industry stakeholders.

o The revised terms comprise the alignment of the Project's royalty rate and Growth and Sustainability Levy to current legislated rates in Ghana.

o Concurrently, the Ministry of Lands and Natural Resources has submitted a Legislative Instrument proposing a sliding scale for royalty rates for lithium projects for parliamentary approval.

- The Company understands that Parliament has been called to reconvene on Tuesday, 3 February 2026, following which the Select Committee is expected to provide its recommendation to Parliament.

- With all the necessary regulatory approvals secured, parliamentary ratification of the Mining Lease represents the final step in the Project's permitting process.

Exploration:

- New spodumene pegmatite occurrences discovered in rock float from further mapping completed within the Company's Rubino licence in Côte d'Ivoire, in addition to the previously reported outcrop.

- Impressive lithium-in-soil results returned from soil sampling completed across both of the Company's 100%-owned Rubino and Agboville exploration licences in Côte d'Ivoire.

o Results delineate pronounced lithium-in-soil anomalies, extending over several kilometres, across both licences.

o Phase 2 results at Agboville have defined a pronounced linear anomaly >5km in length, as well as other anomalous linear features.

o Phase 3 soil sampling at Rubino has extended the anomalous zone reported previously to an increased area of approximately 6.0km by 2.5km.

- Phase 4 soil geochemical sampling now underway within the Agboville licence, with 984 samples collected from the 1,054 sample sites planned.

Corporate:

- Under its Share Placement Agreement with Long State Investments Ltd ("Long State")1, the Company is undertaking a placement to raise £2m (A$4.1m) through the placement of 19,417,475 shares ("Second Placement").

o The Second Placement follows an Initial Placement completed under the Share Placement Agreement, raising proceeds of £2,005,156.

- Cash on hand at end of quarter was A$5.4m.

Commenting, Keith Muller, Chief Executive Officer of Atlantic Lithium, said:

"Following a temporary period of consultation, we are pleased that the revised Ewoyaa Mining Lease was submitted to Parliament before its adjournment for the festive period. With Parliament set to reconvene on 3 February, and with the Project's royalty rate and the Growth and Sustainability Levy now aligned to current legislation in Ghana, we remain confident that ratification of the Mining Lease will be forthcoming in accordance with due process.

"Concurrently, we have noted the marked improvement in sentiment across the lithium market over recent months, with spodumene concentrate prices rising from c. US$800/tonne in mid-October 2025 to current levels of c. US$2,200/tonne, indicating a robust demand profile for lithium products as we look ahead to the completion of permitting at Ewoyaa. At these prices, we believe that the Project can attract improved funding options at a crucial period in the Project's development.

"Building upon the encouraging results that have been returned from the Company's initial exploration programmes in Côte d'Ivoire, we are also now progressing Phase 4 soil sampling within the Agboville licence, while mapping continues across both licences to assist in defining follow-up auger programmes. The Company's Agboville and Rubino licences remain highly prospective for lithium discovery. Accordingly, we continue to advance our exploration programmes across the two licences to enhance the Company's future growth potential beyond its flagship Ewoyaa Lithium Project.

"We look ahead to the rest of 2026 with excitement, with the hope that ratification can occur in a timely manner.

"We look forward to providing further updates in due course."

1 By way of Long State Investments Ltd nominated entity Patras Capital Pte Ltd.

Authorised for release by Amanda Harsas, Finance Director and Company Secretary, Atlantic Lithium Limited.

Figures and Tables referred to in this release can be viewed in the PDF version available via this link:

http://www.rns-pdf.londonstockexchange.com/rns/8569Q_1-2026-1-29.pdf

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

December Quarter Activities

During the period, the Company continued to advance its flagship project, the Ewoyaa Lithium Project, through the permitting phase towards production. The Definitive Feasibility Study ("DFS") for the Project outlines a low capital and operating cost profile, with near-term production potential.2 The Project is on track to become Ghana's first operating lithium mine.

Ewoyaa, located in the pro-mining jurisdiction of Ghana, West Africa, approximately 100km southwest of the capital of Accra, comprises eight main deposits, including Ewoyaa, Okwesikrom, Anokyi, Grasscutter, Abonko, Kaampakrom, Sill and Bypass. The Project is well located to operational infrastructure, including being within 1km of the Takoradi - Accra N1 highway, 110km from the Takoradi deep-sea port and adjacent to grid power (refer Figure 1).

Figure 1: Location of the Ewoyaa Lithium Project, Ghana

Concurrent to its activities at Ewoyaa, the Company continues to undertake low-cost exploration across the contiguous Agboville and Rubino exploration licences, which are 100% owned through its wholly-owned Ivorian subsidiary Khaleesi Resources SARL ("Khaleesi"), in the mining-friendly jurisdiction of Côte d'Ivoire in West Africa.

The Agboville and Rubino licences, which cover 396.89 km² and 374.18 km² respectively, provide the Company with exclusive rights to conduct lithium exploration over highly prospective tenure for lithium discovery.

Leveraging synergies with its existing operations in Ghana, the Company is applying its proven track record of lithium exploration, discovery and evaluation in tropical weathering environments, as demonstrated at Ewoyaa, to its exploration portfolio in Côte d'Ivoire.

Project Development

Ewoyaa Mining Lease

During the period, the Mining Lease for the Project was submitted to Parliament and referred to the Select Committee for consideration, in line with due process for parliamentary ratification in Ghana (refer announcement of 12 November 2025).

Following a temporary withdrawal of the Mining Lease from consideration, during which additional consultation took place between the Minister of Lands and Natural Resources and relevant in-country stakeholders in relation to Ghana's current mining code and the application of royalties, which was supported by the Company, certain fiscal terms of the Mining Lease were amended. The revised Mining Lease was subsequently re-submitted for consideration prior to Parliament's adjournment for the festive period (refer announcement of 22 December 2025).

The revised terms comprised the alignment of the Project's royalty rate and Growth and Sustainability Levy to current legislated rates in Ghana.

Concurrently, the Company noted the submission by the Minister to Parliament of a new Legislative Instrument, Minerals and Mining (Royalty) Regulations, 2025, which outlines the following proposed sliding scale in relation to royalty rates for lithium projects in Ghana:

Spodumene Price, US$/tonne | Royalty Applicable |

Up to US$1,500/tonne | 5.0% |

Between US$1,501 - US$2,500 | 7.0% |

Between US$2,501 - US$3,000 | 10.0% |

Above US$3,000 | 12.0% |

The Legislative Instrument will be considered in line with due parliamentary process.

All other fiscal terms outlined in the Mining Lease granted in October 2023 remain unchanged (refer announcement of 20 October 2023).

The Company understands that Parliament has been called to reconvene on Tuesday, 3 February, following which the Select Committee will undertake its review of the revised Mining Lease and provide its recommendation to Parliament.

With all the necessary regulatory approvals secured, the ratification of the Mining Lease serves as the final step of the permitting process and will enable the Company to advance the financing of the Project.

The Company remains confident that ratification of the Mining Lease will be forthcoming in accordance with due parliamentary process. Shareholders should note, however, that there can be no certainty that the proposed terms of the Legislative Instrument will not change or that Parliament will indeed ratify the Mining Lease.

Exploration

Côte d'Ivoire

The Company is undertaking low-cost exploration at its Agboville and Rubino exploration licences in Côte d'Ivoire concurrent to its advancement of the Project. The licences, which are located c. 80km north of Abidjan, the port and commercial capital of Côte d'Ivoire, are well-serviced with existing infrastructure, including excellent paved highways and an operating railway linking Burkina Faso's capital city of Ouagadougou and the port of Abidjan (refer Figure 2).

Figure 2: Location of the Agboville and Rubino licences held 100% by the Company's wholly-owned subsidiary Khaleesi Resources SARL in Côte d'Ivoire and existing operational infrastructure.

Soil Sampling

During the period, the Company reported the results of Phase 3 soil geochemical sampling completed at Rubino and Phase 2 and Phase 3 soil sampling conducted at Agboville. Soil sampling was undertaken using 100m by 100m spaced grid over the most prospective areas identified by mapping and rock-chip sampling and also over historical mineral occurrences in both licences. Sampling was completed in two phases in each tenement: Phase 2 consisting of 3,235 sample sites (1,594 sites sampled at Agboville and 1,641 sites sampled at Rubino) and Phase 3 consisting of 1,512 sample sites (442 sites sampled at Agboville and 1,070 sites sampled at Rubino). The Phase 1 soil sampling programme was a baseline soil programme undertaken along selected sections during reconnaissance mapping, where different sample depths and sieve fractions were tested and the results of which helped set the best parameters for the subsequent grid soil programmes.

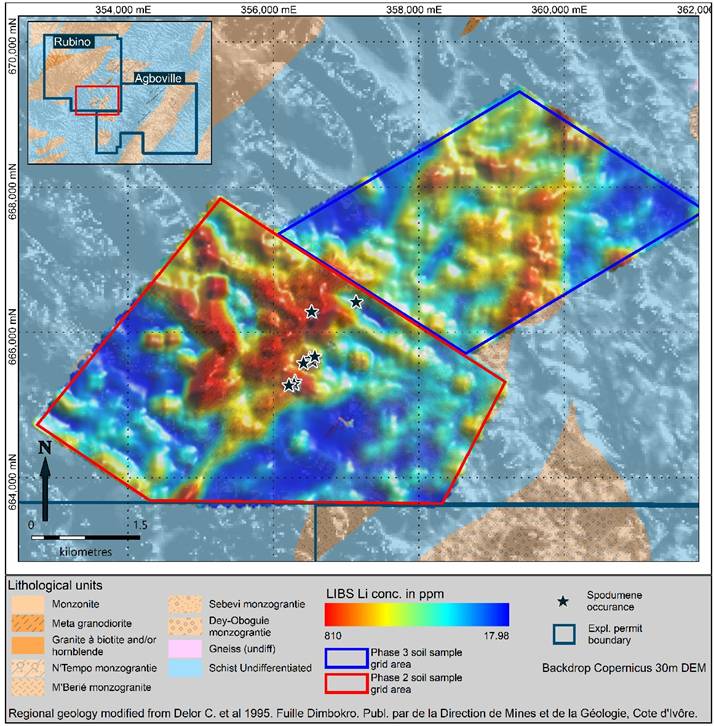

Rubino Licence

Phase 3 lithium-in-soil results have extended the anomalism identified from the previously announced Phase 2 soil grid 3.5km towards the NE, delineating a pronounced lithium-in-soil anomalous zone extending NE-SW continuously across the surveyed area, extending over an area of approximately 6.0km by 2.5km (refer Figure 3).

Within the anomalous zone, the results define a long NNE-SSW orientated linear anomaly, which could be associated with the interpreted lithological contact between metasediment and granodiorite; a similar lithological contact relationship that is observed in the distribution of anomalies from the Phase 2 soil grid. Similar, but less well defined, NNE-SSW to N-S trending soil anomalies are evident in the Rubino Phase 2 soil grid. These may be related to N-S to NNE-SSW orientated structural features concealed by the laterite cover and could also host pegmatite intrusions at depth. Several of the linear trends identified from the Phase 2 and Phase 3 soil results warrant immediate ground follow-up and subsequent sub-surface evaluation.

Figure 3: Consolidated Rubino Phase 2 and Phase 3 Li (ppm) in soil grid results with spodumene pegmatite discovery sites. Pronounced anomalies are defined by lithium values between 200ppm and a peak value of 806ppm.

Phase 4 soil geochemical sampling has been planned at Rubino, using an initial 400m by 100m spaced grid with localised infill sampling where warranted.

Agboville Licence

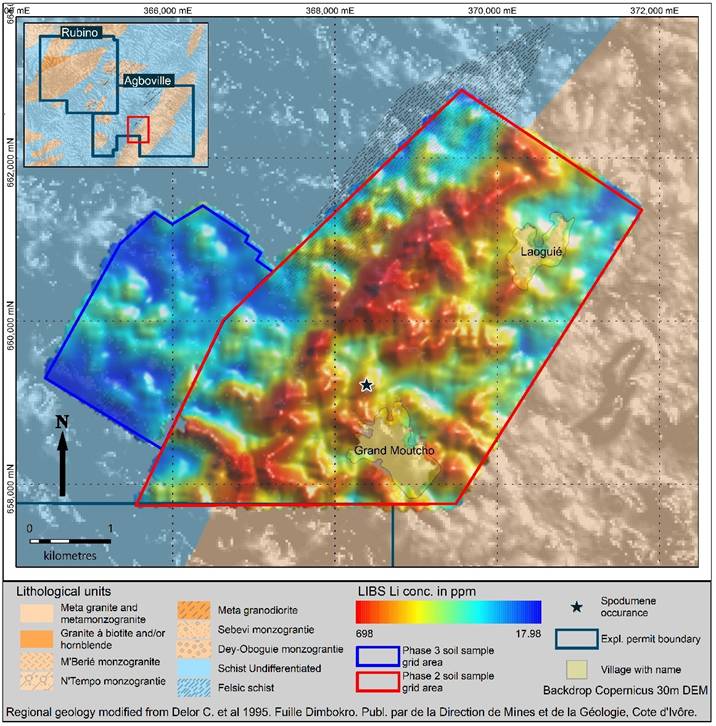

Lithium-in-soil results from the Phase 2 soil grid reported during the period have defined a pronounced linear anomaly >5km in length trending NE-SW. The anomaly follows the interpreted contact between metasediments to the NW and granodiorite intrusive to the SE (refer Figure 4). Other less well-defined anomalous linear features are developed over the granodiorite; one of which is associated with spodumene pegmatite float discovered by the mapping team (refer announcement of 22 May 2025). The lithium-in-soil geochemical response is more subdued in the Phase 3 soil grid; likely to be related to interpreted metasediment host exhibiting deeper weathering and laterite development and some alluvial cover with rice cultivation invalidating certain survey points.

The NE-SW-orientated lithological contacts in both the Rubino and Agboville licences follow the dominant regional tectonic trend in the Birimian of this part of West Africa, which is NE-SW, and a possible structural displacement across these potentially faulted or sheared contacts could host dilatant zones where pegmatite intrusion could be focused in either the schists of the metasediment or within more competent lithology such as the granodiorite.

The Company's geological team also commenced Phase 4 soil geochemical sampling at Agboville during the period, with 984 sites sampled from the 1,054 planned sites. Evaluation of the results from the Phase 2 and 3 soil grids, where 100m by 100m grid spacing was used, showed that the scale and tenor of the geochemical anomalies encountered would still be detectable using a wider sample traverse spacing. Accordingly, the Phase 4 soil grid has been adjusted to a 400m by 100m grid, allowing the team to evaluate a larger area more quickly and at lower cost. Any anomalies identified in the initial Phase 4 soil geochemical results can be followed up with localised infill soil sampling on 200m by 100m or 100m by 100m grids as warranted.

Figure 4: Agboville Phase 2 and 3 Li (ppm) in soil grid results. Prominent lithium soil anomalies are defined by values above 200ppm and a peak value of 698ppm.

Mapping and Rock-chip Sampling

Additional geological mapping undertaken by the Company's geologists, continued along reconnaissance traverses and in support of soil sampling and in ground truthing Rubino Phase 2 soil anomalies, has discovered several additional spodumene pegmatite occurrences in the Rubino licence as rock float, with spodumene visually observed in hand specimen despite varying degrees of weathering exhibited.

Rock-chip samples were collected during mapping and submitted for assay. The elevated assay values of lithium and other elements from these pegmatite rock-chip samples confirm the Company's visual spodumene observations and the prospectivity of the licences.

Mapping continues within both the Agboville and Rubino licences, in parallel with the soil sampling and as traverse and anomaly follow-up mapping, as part of the exploration programme. This additional mapping will assist in defining follow-up auger drill programmes to map the source of the anomalies below the laterite at surface, intended to support the definition of potential reverse circulation and diamond drill targets.

Funding to Accelerate Côte d'Ivoire Exploration

Through the period and subsequently, the Company has continued the formal process to source funding options to accelerate the exploration of its Côte d'Ivoire licences. The process is focused on minority, project-level investment or partnerships that offer funding that is non-dilutive to the Company's existing shareholders.

Interest in Tenements

At the end of the quarter ending 31 December 2025, the Company had an interest in the following tenements:

Tenement Number | TenementName | PrincipalHolder | Grant Date/Application Date | Expiry Date | Term | Change during Quarter | |

Ghana |

| ||||||

PL3/67 | Apam East | Obotan Minerals Company Limited(JV MODA Minerals Limited) | 06.11.23 | 05.11.26 | 3 years | None | |

PL3/92 | Apam West | Obotan Minerals Company Limited(JV MODA Minerals Limited) | 06.11.23 | 05.11.26 | 3 years | None | |

RL 3/55 | Mankessim | Barari DV Ghana Limited(90% Atlantic) | 27.07.21 | 26.07.24* | 3 years | None | |

PL3/102 | Saltpond | Joy Transporters Limited(100% Atlantic) | 06.11.23 | 05.11.26 | 3 years | None | |

PL3/109 | Mankessim South | Green Metals Resources Limited(100% Atlantic) | 06.11.23 | 05.11.26 | 3 years | None | |

PL3/106 | Cape Coast | Joy Transporters Limited(100% Atlantic) | 15.11.21 | 14.11.24* | 3 years | None | |

RML-N-3/181 | Senya Beraku | Green Metals Resources Limited (100% Atlantic) | 09.11.23 | 08.11.26 | 3 years | None | |

PL-I-3/15 | Bewadze | Green Metals Resources Limited(100% Atlantic) | 09.11.23 | 08.11.26 | 3 years | None | |

ML-3/239 | Mankessim Mining Lease | Barari DV Ghana Limited (90% Atlantic) | 20.10.23 | 19.10.38 | 15 years | None | |

Ekrubaadze PL | Green Metals Resources Limited(100% Atlantic) | 03.10.23 | Application | None | |||

Asebu (Winneba North) | Green Metals Resources Limited (100% Atlantic) | 28.06.21 | Application | None | |||

Mankwadze (Winneba South) | Green Metals Resources Limited (100% Atlantic) | 28.06.21 | Application | None | |||

Mankwadzi | Obotan Minerals Company Limited(JV MODA Minerals Limited) | 15.03.18 | Application | None | |||

Onyadze | Green Metals Resources Limited(100% Atlantic) | 23.08.21 | Application | None | |||

Ivory Coast |

| ||||||

PR695 | Rubino | Khaleesi Resources SARL(100% Atlantic) | 22.05.24 | 21.05.28 | 4 years | None | |

PR694 | Agboville | Khaleesi Resources SARL(100% Atlantic) | 08.05.24 | 07.05.28 | 4 years | None | |

* A renewal application has been submitted to the relevant Government mining department and the Group has no reason to believe the renewal will not be granted.

Corporate

Long State Corporate Funding

Receipt of Deferred Proceeds from the Initial Placement

During the period, the Company announced the receipt of £1,005,156 (A$2.0m) from global investment company Long State Investments Ltd1 ("Long State"), being the deferred proceeds of the Initial Placement undertaken under the Share Placement Agreement ("Share Placement Agreement") with Long State, as announced on 3 September 2025.

The Pricing Period of the Initial Placement was concluded early, at a premium due to the Company's positive share price movement through the Pricing Period, through mutual agreement with Long State. Accordingly, proceeds from the Initial Placement totalled £2,005,156, compared to the £2m intended.

Second Placement

Subsequent to the completion of the Initial Placement, the Company notified Long State to undertake a second placement under the Share Placement Agreement ("Second Placement") to raise an additional £2m (A$4.1m) through the issue of 19,417,475 shares to Long State at an issue price of £0.103 per share ("Second Placement Price") (refer announcement of 26 November 2026).

The process in respect of the Second Placement aligns with the process of the Initial Placement. Accordingly, 50% of the proceeds of the Second Placement (i.e. £1m / A$2.0m) were paid on the issue of shares, with the remainder to be deferred until the Trading Day immediately after the Pricing Period ("Swap Payment Date").

Equity Placement Facility Agreement

Per the terms of the Equity Placement Facility Agreement with Long State to raise up to £20m (A$41.1m) over a period of 24 months ("Equity Placement Facility Agreement" or "the Facility") (refer announcement of 3 September 2025), and following shareholder approval at the Extraordinary General Meeting ("EGM"), held on 6 November 2025, the Company has issued warrants to Long State1 to acquire 10 million shares in the Company, exercisable during the 5-year period from 13 November 2025 at a price of £0.128.

In line with the terms of the Equity Placement Facility Agreement and following shareholder approval at the EGM, the Company has also issued 10 million fully paid ordinary shares of nil value ("Security Shares") to Long State1. The Security Shares have been issued prior to undertaking the first placement under the Facility.

1 By way of Long State Investments Ltd nominated entity Patras Capital Pte Ltd.

OTCID Listing

During the period, the Company withdrew its ordinary shares from trading on the OTCID Basic Market. The decision was taken as part of the Company's ongoing cost rationalisation programme, with Management believing that the low trading volumes of the Company's shares on the market no longer justified the cost of maintaining the listing. Following the withdrawal from the OTCID, quotation will be maintained on the OTC market by broker-dealers on an unsponsored basis (Pink Limited Market), without the Company's ongoing sponsorship or active engagement with the OTC Markets Group.

The Company continues to trade its shares on AIM, the ASX and the GSE. The Company's withdrawal from the OTCID has no impact on shareholders' ability to trade the Company's shares on its principal markets, nor does it impact the Company's ongoing operations or ability to achieve its strategic objectives.

Any investors holding the Company's shares that are currently trading on the OTC are encouraged to consult their financial advisors if they require further information.

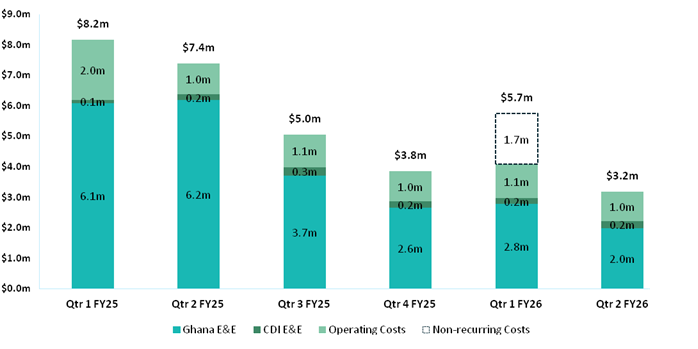

Cash Conservation

Through the quarter, in light of the delay to the ratification of the Mining Lease for the Project, the Company has continued to reduce its spending on activities that are not currently considered critical to the advancement of Ewoyaa towards a Project Final Investment Decision ("Project FID") (refer Figure 6). This excludes the Company's low-cost exploration of its Agboville and Rubino licences in Côte d'Ivoire, which is to ensure the terms of the licences are met.

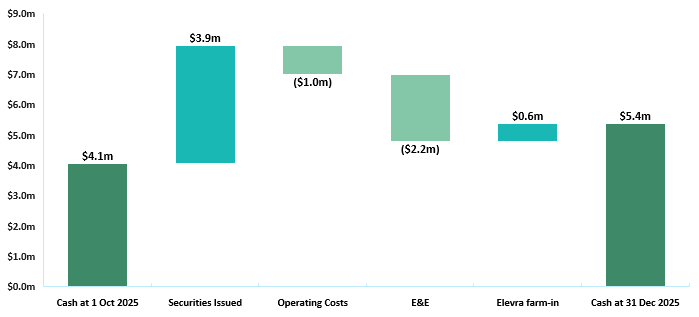

Cash Flow

Figure 5: Net cash flows for December 2025 quarter (A$)

Note: Exploration & Evaluation ("E&E") refers to spend of A$2.0m in Ghana and A$0.2m in Côte d'Ivoire. Operating Costs refers to corporate costs that are not directly related to Exploration and Evaluation activities.

Figure 6: Total cash outflows per quarter for FY2025 (A$)

Note: Exploration & Evaluation ("E&E") refers to activities in both Ghana and Côte d'Ivoire ("CDI"). Operating Costs refers to corporate costs that are not directly related to Exploration and Evaluation activities. Refer to item 2.5 in Appendix 5B for information on Elevra's reimbursements for funding of the Project and the Company's Ghana portfolio.

Project Joint Venture Arrangements

Under the Project's current funding and joint venture arrangements, Elevra Lithium Limited ("Elevra"), formerly Piedmont Lithium Inc, has completed Stage 2 of its investment in the Project, entitling Elevra to an initial 22.5% interest of the Company's Project ownership. From 1 October 2025, Elevra reduced its funding to 22.5%, with all costs currently being funded by the Company (77.5%) and Elevra (22.5%).

At the time of this report, the Company is in dispute regarding expenditure for the Project as defined under the Project Agreement with Elevra. The Company remains engaged in discussions with Elevra concerning the amounts under dispute and an established process exists within the Project Agreement for resolution including good faith negotiations and referral to arbitration.

During the period of October 2025 to December 2025, Elevra contributed a total of c. US$398,000 (A$607,000) towards the funding of the Project and the Company's Ghana portfolio.

Stakeholder Engagement

The Company attended the following conferences and industry events during the period:

· Ghana Mining Industry Awards, Accra (5 December)

· Swiss Mining Institute, Zurich (20 - 21 November)

Sustainability

Ewoyaa Water Treatment Plant and Storage System

Responding to residents' calls to address a lengthy water shortage, the Company proudly commissioned a Reverse Osmosis (R.O.) Water Treatment Plant and Storage System in Ewoyaa during the period. The facility, which comprises a mechanised borehole, an R.O. water treatment plant with a capacity of delivering 2,000 litres per hour, and a 20,000-litre capacity storage tank, is now in operation, providing clean and potable water to over 500 people.

The initiative intends to significantly reduce the community's reliance on unsafe water sources and the risk of catching water-borne diseases. At the commissioning of the facility, Nana Kwesi Brebo III, Chief of Kuntu, representing the Omanhen of the Nkusukum Traditional Area, who presided over the event as Chairperson, praised the Company for enabling access to safe drinking water to improve the conditions of those living within the Project's catchment area.

Breast Cancer Sensitisation and Medical Screening Programme

In October, to mark Breast Cancer Awareness Month, the Company organised a breast cancer sensitisation programme and free medical screening for women across its host communities. Held under the theme "Screen Today, Live Tomorrow", the initiative was run in partnership with the Mfantseman Municipal Health Directorate, Assembly Members, and the Planned Parenthood Association of Ghana (PPAG-Cape Coast, Central Region) over the course of five days.

The event aimed to raise awareness of breast cancer, particularly among women in rural and less developed areas, to encourage early detection to save lives, and to empower women with the knowledge and confidence to take charge of their health. A total of 468 women participated.

Share Capital Changes - Ordinary Shares, Options and Performance Rights

Between 1 October 2025 and the date of this report, a total of 10,000,000 warrants exercisable at a price of £0.128 and 10,000,000 fully paid ordinary shares of nil value ("Security Shares") were issued to Long State in accordance with the terms of the Equity Placement Facility Agreement with Long State and following shareholder approval at the Extraordinary General Meeting, held on 6 November 2025. 19,417,475 new ordinary shares were issued under the Share Placement Agreement with Long State.

During the same period, 2,154,282 performance rights lapsed and 217,720 vested performance rights were exercised.

A summary of movement and balances of equity securities between 1 October 2025 and the date of this report is as follows:

| OrdinaryShares | UnquotedWarrants | Unquoted performance rights |

On issue at start of quarter | 719,108,127 | - | 14,856,065 |

Performance Rights lapsed (21 November 2025) | (2,154,282) | ||

Issue of Warrants under the Equity Placement Facility Agreement (27 November 2025) | 10,000,000 | ||

Securities issued under the Equity Placement Facility Agreement (27 November 2025) | 10,000,000 | ||

Securities issued under Share Placement Agreement (27 November 2025) | 19,417,475 | ||

Exercise of Performance Rights (11 December 2025) | 217,720 | (217,720) | |

Total securities on issue at date of this report | 748,743,322 | 10,000,000 | 12,484,063 |

Compliance

During the quarter, the Company spent A$2.0m on its exploration, feasibility, and development activities in Ghana. The Company spent A$0.2m on exploration in Côte d'Ivoire during the quarter.

Under the Company's Share Placement Agreement with Long State, 19,417,475 ordinary shares were issued at an issue price of £0.103 (A$0.21) per share on 27 November 2025 for the second placement of shares. Proceeds of £1m (A$2.0m) have been received, with payment of the remaining £1m deferred until the trading day immediately after an 80-trading day pricing period. On this date, Atlantic Lithium will also receive or pay a swap amount depending on the movement in the market price of the shares compared to the issue price.

During the quarter, deferred proceeds of £1.05m (A$2.0m) were received from Long State for the Initial Placement undertaken under the Share Placement Agreement.

Following shareholder approval at the Extraordinary General Meeting, held on 6 November 2025, and in line with the terms of the Equity Placement Facility Agreement with Long State, the Company issued 10 million warrants exercisable at a price of £0.128 and 10 million Security Shares for nil consideration to Long State.

Payments to Related Parties of the Entity and their Associates

Appendix 5B includes amounts in items 6.1 and 6.2. The amounts represent salaries (including superannuation) and fees paid to directors.

Appendix 5B expenditure disclosure

As at 31 December 2025, the Company had cash resources of A$5.4m and no debt. Exploration, feasibility, and development activities cash expenditure during the quarter was A$2.2m. Elevra funded A$0.6m in the quarter.

Appendix 5B

Mining exploration entity or oil and gas exploration entityquarterly cash flow report

Name of entity: ATLANTIC LITHIUM LIMITED | ||

ABN: 17 127 215 132 | Quarter ended ("current quarter"): 31 December 2025 | |

Consolidated statement of cash flows | Current quarter$A'000 | Year to date (6 months)$A'000 | |

1. | Cash flows from operating activities | - | - |

1.1 | Receipts from customers | ||

1.2 | Payments for | - | - |

(a) exploration & evaluation | |||

(b) development | - | - | |

(c) production | - | - | |

(d) staff costs | (322) | (467) | |

(e) administration and corporate costs | (608) | (1,640) | |

1.3 | Dividends received (see note 3) | - | - |

1.4 | Interest received | - | 1 |

1.5 | Interest and other costs of finance paid | (37) | (149) |

1.6 | Income taxes paid | - | - |

1.7 | Government grants and tax incentives | - | - |

1.8 | Other Income | - | - |

1.9 | Net cash from / (used in) operating activities | (967) | (2,255) |

2. | Cash flows from investing activities | - | - |

2.1 | Payments to acquire or for: | ||

(a) entities | |||

(b) tenements | - | - | |

(c) property, plant and equipment | (2) | (10) | |

(d) exploration, feasibility, and development | (2,207) | (6,649) | |

(e) investments | - | - | |

(f) other non-current assets | (7) | (7) | |

2.2 | Proceeds from the disposal of: | - | - |

(a) entities | |||

(b) tenements | - | - | |

(c) property, plant and equipment | - | - | |

(d) Investments (Proceeds from Term Deposit) | - | 154 | |

(e) other non-current assets | - | - | |

2.3 | Cash flows from loans to other entities | - | - |

2.4 | Dividends received (see note 3) | - | |

2.5 | Other - Elevra Contributions from farm-in arrangement | 607 | 2,901 |

2.6 | Other - Contribution from lessor for Lease Fit Out | - | - |

2.7 | Net cash from / (used in) investing activities | (1,609) | (3,611) |

3. | Cash flows from financing activities | 4,002 | 6,035 |

3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) | ||

3.2 | Proceeds from issue of convertible debt securities | - | - |

3.3 | Proceeds from exercise of options | - | - |

3.4 | Transaction costs related to issues of equity securities or convertible debt securities | (122) | - |

3.5 | Proceeds from borrowings | - | - |

3.6 | Repayment of borrowings | - | - |

3.7 | Transaction costs related to loans and borrowings | - | - |

3.8 | Dividends paid | - | - |

3.9 | Other (provide details if material) | - | - |

3.10 | Net cash from / (used in) financing activities | 3,880 | 5,912 |

4. | Net increase / (decrease) in cash and cash equivalents for the period | ||

4.1 | Cash and cash equivalents at beginning of period | 4,071 | 5,387 |

4.2 | Net cash from / (used in) operating activities (item 1.9 above) | (967) | (2,255) |

4.3 | Net cash from / (used in) investing activities (item 2.7 above) | (1,609) | (3,611) |

4.4 | Net cash from / (used in) financing activities (item 3.10 above) | 3,880 | 5,912 |

4.5 | Effect of movement in exchange rates on cash held | 25 | (33) |

4.6 | Cash and cash equivalents at end of period | 5,400 | 5,400 |

5. | Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts | Current quarter$A'000 | Previous quarter$A'000 |

5.1 | Bank balances | 5,381 | 4,043 |

5.2 | Call deposits | - | - |

5.3 | Bank overdrafts | - | - |

5.4 | Other - Petty Cash | 19 | 28 |

5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 5,400 | 4,071 |

6. | Payments to related parties of the entity and their associates | Current quarter$A'000 |

6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | 184 |

6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | 100 |

7. | Financing facilities NOTE: the term "facility' includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. | Total facility amount at quarter end$A'000 | Amount drawn at quarter end$A'000 |

7.1 | Loan facilities | - | - |

7.2 | Credit standby arrangements | - | - |

7.3 | Other (please specify) | 56,451 | 6,048 |

7.4 | Total financing facilities | 56,451 | 6,048 |

| |||

7.5 | Unused financing facilities available at quarter end | 50,402 | |

7.6 | On 3 September 2025, Atlantic Lithium entered into the following agreements with Patras Capital Pte Ltd, the nominated entity of Long State Investments Ltd ("Long State"), a global investment company specialising in funding growth-orientated companies: · A Share Placement Agreement to raise up to £8m over a period of two years. o The Company completed an Initial Placement under the Share Placement Agreement, raising £2,005,156. o Under the Second Placement to raise an additional £2m (A$4.1m), the Company has received £1m (A$2.02m), with payment of the remaining £1m deferred until the trading day immediately after an 80-trading day pricing period. On this date, Atlantic Lithium will also receive or pay a swap amount depending on the movement in the market price of the shares compared to the issue price. o Upon completion of the Second Placement, the Company can, at its sole discretion, undertake two additional placements of £2m each, provided that the maximum aggregate amount raised under the Share Placement Agreement shall not exceed £8m. · A Committed Equity Facility to raise up to a total aggregate placement amount of £20m over a period of two years. o Under the terms of the agreement, other than the first placement of £500,000, the Company may draw in tranches of up to £500,000 at its full discretion, and up to £5 million with mutual consent. o The utilisation of this equity facility is at Atlantic Lithium's sole discretion. | ||

The unused amount available under the agreements at 31 December 2025 is £25m (A$50.4m). This includes the remaining £1m yet to be received under the Second Placement of the Share Placement Agreement. Any future placements completed under the agreements will be pursuant to the Company's Listing Rule 7.1 capacity. | |||

8. | Estimated cash available for future operating activities | $A'000 |

8.1 | Net cash from / (used in) operating activities (item 1.9) | (967) |

8.2 | (Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) | (2,207) |

8.3 | Total relevant outgoings (item 8.1 + item 8.2) | (3,174) |

8.4 | Cash and cash equivalents at quarter end (item 4.6) | 5,400 |

8.5 | Unused finance facilities available at quarter end (item 7.5) | 50,402 |

8.6 | Total available funding (item 8.4 + item 8.5) | 55,802 |

8.7 | Estimated quarters of funding available (item 8.6 divided by item 8.3) | 17.6 |

NOTE: if the entity has reported positive relevant outgoings (i.e. a net cash inflow) in item 8.3, answer item 8.7 as "N/A". Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. | ||

8.8 | If item 8.7 is less than 2 quarters, please provide answers to the following questions: | |

8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | ||

Answer: N/A | ||

8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | ||

Answer: N/A

| ||

8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | ||

Answer: N/A | ||

NOTE: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. | ||

Compliance statement

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 29 January 2026

Authorised by: Authorised by the Board of Atlantic Lithium Limited

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity's activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: "By the board". If it has been authorised for release to the market by a committee of your board of directors, you can insert here: "By the [name of board committee - e.g. Audit and Risk Committee]". If it has been authorised for release to the market by a disclosure committee, you can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council's Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

For any further information, please contact:

Atlantic Lithium Limited

Keith Muller (Chief Executive Officer)

Amanda Harsas (Finance Director and Company Secretary)

| www.atlanticlithium.com.au | |||

| ||||

| Tel: +61 2 8072 0640

| |||

SP Angel Corporate Finance LLP Nominated Adviser Jeff Keating Charlie Bouverat Tel: +44 (0)20 3470 0470 |

Yellow Jersey PR Limited Charles Goodwin Annie Williams [email protected] Tel: +44 (0)20 3004 9512

|

Canaccord Genuity Limited Financial Adviser: Raj Khatri (UK) / Duncan St John, Christian Calabrese (Australia)

Corporate Broking: James Asensio Tel: +44 (0) 20 7523 4500 |

| |

Notes to Editors:

About Atlantic Lithium

www.atlanticlithium.com.au

Atlantic Lithium is an AIM, ASX and GSE-listed lithium company advancing its flagship project, the Ewoyaa Lithium Project, a lithium spodumene pegmatite discovery in Ghana, through to production to become the country's first lithium-producing mine.

The Company published a Definitive Feasibility Study in respect of the Project in July 2023, indicating Ewoyaa's strong commercial viability.2 The Project was awarded a Mining Lease in October 2023, an Environmental Protection Authority ("EPA") Permit in September 2024, and a Mine Operating Permit in October 2024 and is being developed under an earn-in agreement with Elevra Lithium Limited.

The Ewoyaa Mineral Resource Estimate (JORC) totals 36.8Mt at 1.24% Li2O and includes 3.7Mt at 1.37% Li₂O in the Measured category, 26.1Mt at 1.24% Li₂O in the Indicated category and 7.0Mt at 1.15% Li₂O in the Inferred category.2 Ore Reserves (Probable) of 25.6Mt at 1.22% Li2O have been reported for the Project.2

Atlantic Lithium holds a portfolio of lithium projects within 509km2 and 771km2 of granted and under-application tenure across Ghana and Côte d'Ivoire respectively, which, in addition to the Project, comprises significantly under-explored, highly prospective licences.

End Note

2 Ore Reserves, Mineral Resources and Production Targets

The information in this report that relates to Exploration Results, Ore Reserves, Mineral Resources and Production Targets complies with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code). The information in this report relating to exploration results is extracted from the Company's announcement entitled, "Pronounced Lithium-in-soil Anomalies within Agboville and Rubino Licences, Côte d'Ivoire", dated 20 October 2025. The information in this report relating to the Mineral Resource Estimate ("MRE") of 36.8Mt at 1.24% Li₂O for the Ewoyaa Lithium Project ("Ewoyaa" or the "Project") is extracted from the Company's announcement entitled "New Dog-Leg Target Delivers Increase to Ewoyaa MRE", dated 30 July 2024. The MRE includes a total of 3.7Mt at 1.37% Li₂O in the Measured category, 26.1Mt at 1.24% Li₂O in the Indicated category and 7.0Mt at 1.15% Li₂O in the Inferred category. The information in this report relating to Ore Reserves (Probable) of 25.6Mt at 1.22% Li2O is extracted from the Company's announcement entitled "Ewoyaa Lithium Project Definitive Feasibility Study", dated 29 June 2023. The Company confirms, in the case of Mineral Resources, Ore Reserves and Production Targets, that all material assumptions and technical parameters underpinning the estimates continue to apply. Material assumptions for the Project have been revised on grant of the Mining Lease for the Project, announced by the Company on 20 October 2023 in the announcement entitled, "Mining Lease Granted for Ewoyaa Lithium Project". On 22 December 2025, the Company announced that a revised version of the Mining Lease for the Project had been submitted to the Parliament of Ghana, per the necessary process for ratification. There can be no certainty that the proposed terms of the Mining Lease will not change, nor that the Parliament of Ghana will indeed ratify the Mining Lease. The Company is not aware of any new information or data that materially affects the information included in this report or the announcements dated 22 December 2025, 20 October 2025, 30 July 2024, 20 October 2023 and 29 June 2023, which are all available at www.atlanticlithium.com.au.

Competent Persons

Information in this report relating to exploration results is based on data reviewed by Mr I. Iwan Williams (BSc. Hons Geology), General Manager - Exploration of the Company, and reported in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (The Joint Ore Reserves Committee Code - JORC 2012 Edition). Mr Williams is a Member of the Australian Institute of Geoscientists (#9088) who has in excess of 30 years' experience in mineral exploration and is a Qualified Person under the AIM Rules and as a Competent Person as defined in the JORC Code. Mr Williams consents to the inclusion of the information in the form and context in which it appears.

Information in this report relating to Mineral Resources was compiled by Shaun Searle, a Member of the Australian Institute of Geoscientists. Mr Searle has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' and is a Qualified Person under the AIM Rules. Mr Searle is a director of Ashmore. Ashmore and the Competent Person are independent of the Company and other than being paid fees for services in compiling this report, neither has any financial interest (direct or contingent) in the Company. Mr Searle consents to the inclusion in this report of the matters based upon the information in the form and context in which it appears.

Information in this report relating to Ore Reserves was compiled by Mr Harry Warries. All stated Ore Reserves are completely included within the quoted Mineral Resources and are quoted in dry tonnes. Mr Warries is a Fellow of the Australasian Institute of Mining and Metallurgy and an employee of Mining Focus Consultants Pty Ltd. He has sufficient experience, relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking, to qualify as a Competent Person as defined in the 'Australasian Code for Reporting of Mineral Resources and Ore Reserves' of December 2012 ("JORC Code") as prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, the Australian Institute of Geoscientists and the Minerals Council of Australia. Mr Warries gives Atlantic Lithium Limited consent to use this reserve estimate in reports.

The Company confirms that the form and context in which the Competent Persons' findings are presented have not been materially modified from the original market announcement.

Related Shares:

Atlantic Lithium