26th Nov 2025 07:00

This announcement contains insider information

26 November 2025

88 Energy Limited

Project Phoenix UPDATE

2026 production test program

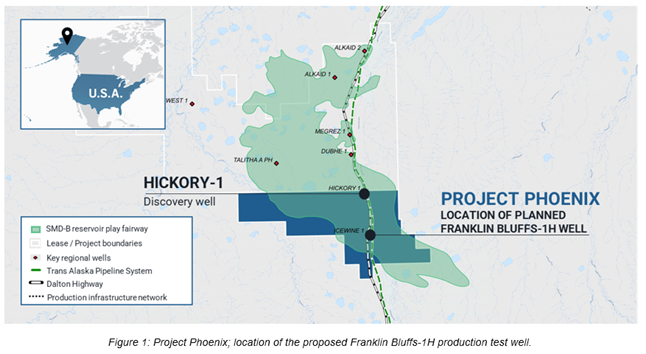

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) (88 Energy or the Company) is pleased to provide an update on Project Phoenix (~75% working interest), its advanced conventional oil and gas project located on the North Slope of Alaska.

Project Phoenix is subject to a Farmout Participation Agreement, entered into with Burgundy Xploration LLC (Burgundy) in February 2025. Under the terms of this agreement, 88 Energy is fully carried for all costs associated with the upcoming horizontal well and extended flow test.

Highlights

· Franklin Bluffs-1H horizontal well and extended flow test planned for Q3 2026.

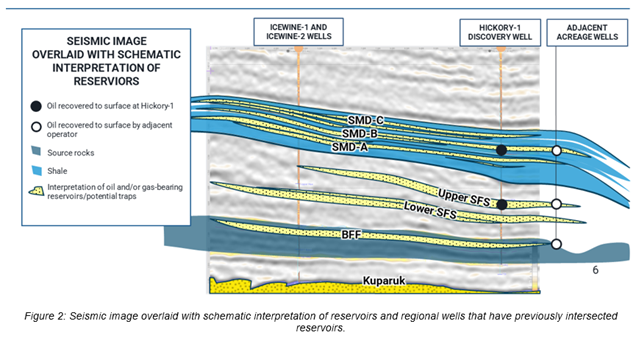

o An initial pilot hole is planned to test the SMD, SFS and BFF reservoir zones, followed by wireline logging, before suspending the well.

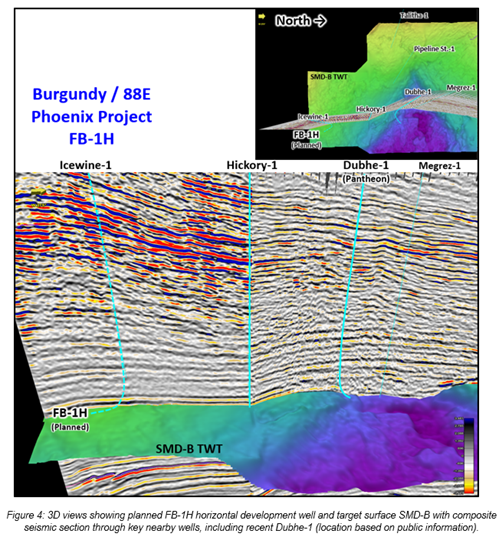

o Production test in horizontal section to target the SMD-B reservoir, the best-developed topset sandstone within the Campanian sequence.

o Icewine-1 intersected a 71ft net sandstone sequence in the SMD-B with up to 14% effective porosity, while Hickory-1 recorded up to 11% porosity in the same interval.

o Analysis of pilot hole and logging results to guide horizontal well planning and design, prior to drilling the horizontal production well and commence the extended production test.

o Operational readiness is advancing, with Fairweather LLC appointed for execution support and key staffing and operational enhancements underway, including the appointment of an Alaska-based representative.

· Burgundy advancing funding initiatives and commencing operational spend to support a 2026 spud.

o Draft registration statement for Burgundy's proposed IPO confidentially lodged with the U.S. Securities and Exchange Commission (SEC).

o The prolonged United States government shutdown in 2H 2025 has delayed SEC review timelines. Consequently, 88 Energy has granted Burgundy an extension under the Participation Agreement until 30 April 2026 to complete its obligations in the farm-out agreement.

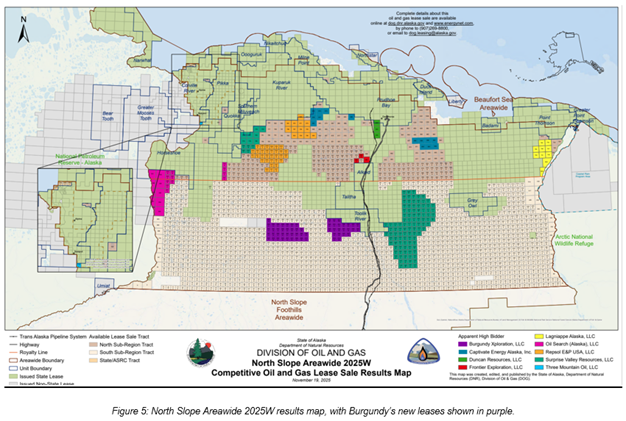

· Burgundy declared the successful bidder in the recent North Slope Fall 2025 Bid Round for a further 82,080 acres adjacent to the Toolik River Unit, with 88E securing the right to participate up to 25% working interest until 1 October 2026 at cost (bid bonus and rentals paid only).

· Burgundy to pay US$2,400,000 to 88 Energy for access to the Icewine 3D seismic data which covers a portion of the new leases recently secured by Burgundy, with US$150,000 due by 1 December 2025, and the balance within 60 days of a successful IPO.

Burgundy Joint Venture Update

Burgundy continues to progress its funding program for the Franklin Bluffs-1H horizontal well and extended production test. Supported by sophisticated energy investors, Burgundy has invested more than US$26 million into Project Phoenix and has met all cash call requirements since the Farmout Participation Agreement was executed in February 2025.

On 15 October 2025 Burgundy announced that it had confidentially submitted a draft registration statement on Form S-1 with the SEC relating to the proposed initial public offering (IPO) of common stock. The IPO is expected to occur after the SEC completes its review process, subject to market and other conditions. With the prolonged United States government shutdown in 2H 2025, this has extended usual SEC review timelines. Consequently, 88 Energy has granted Burgundy an extension under the Participation Agreement until 30 April 2026 to complete its obligations in the farm-out agreement.

Burgundy's operational readiness to drill has also advanced. Fairweather LLC has been appointed to support execution, planning is underway to secure the Franklin Bluffs 3D seismic dataset, and Burgundy has strengthened its in state presence through the appointment of a dedicated Alaska-based engineer. The Burgundy team has recently undertaken meetings in Anchorage with Government agencies, key vendors and other stakeholders to advance permitting and logistical preparations.

Together, these activities place Burgundy in a strong position to meet its joint venture commitments and support the Franklin Bluffs 1H drilling and production test programme in 2026.

Note: This announcement does not constitute an offer to sell or the solicitation of an offer to buy any securities. Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended.

Joint Venture Partner Farm-Out Recap

Under the Farmout Participation Agreement, Burgundy intends to fully fund up to US$39 million (approx. A$60 million) of Project Phoenix's total gross future work program costs in exchange for up to an additional 50% Working Interest (WI) in Project Phoenix from 88 Energy. This agreement provides a clear stage funding pathway towards a final development:

· Phase 1: Burgundy to fund US$29 million (approx. A$45 million) for the CY25/26 work programme, including drilling of a horizontal well and production testing scheduled for Q3-CY26. 88 Energy is fully carried during this phase, resulting in a 35% WI on completion.

· Phase 2: Upon Phase 1 Success; Burgundy to fund up to US$10 million (approx. A$15 million) for an additional well or other CAPEX program (88E carry up to US$7.5 million (based on its current 75% WI), resulting in a 25% WI post-Phase 2.

Project Phoenix Pilot Hole, Horizontal Well and Production Test

Following execution of the farm-out agreement with Burgundy in February 2025, planning has progressed for the Franklin Bluffs-1H horizontal well and extended production test scheduled to spud in Q3-CY26. The well will be drilled from the existing Franklin Bluffs gravel pad and will target the SMD-B reservoir, one of the most promising zones identified at the Hickory-1 discovery well.

Burgundy has proposed an initial pilot hole designed to intersect multiple reservoir intervals, including the SMD and the deeper SFS and BFF. A full wireline logging and coring programme will be completed, with plans to utilise reservoir sampling tools such as an MDT to test and recover hydrocarbons to surface if possible.

The pilot hole will be suspended while results are analyzed and incorporated into the detailed design of the Franklin Bluffs -1H horizontal well section. Key parameters include:

· Target Zone: SMD-B

· Lateral Length: ~3,500ft to ~5,200 feet

· Test Duration: ~90 days flow back and production test.

· Spud Date: 2H-CY26.

SMD-B Reservoir: Geological Context

The SMD-B reservoir forms part of the Campanian sequence and is the best-developed topset sandstone in the SMD series at Project Phoenix. Hickory-1 intersected 52 feet of net pay with porosity ranging from 5-11%, while Icewine-1 intersected a 71ft net sandstone sequence and showed higher porosity values ranging from to 8-14%, indicating improved reservoir quality in the Icewine-1 location.

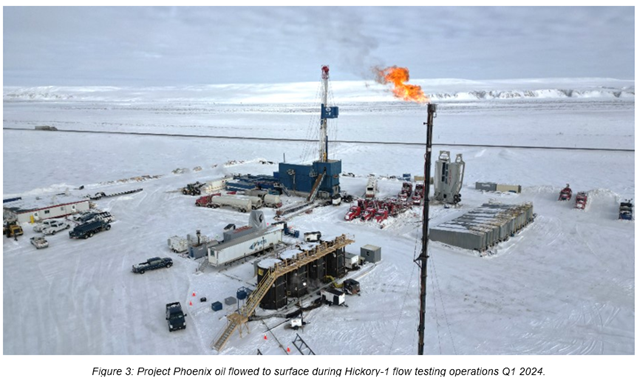

Flow testing of the SMD-B at Hickory-1 in Q1 CY24 confirmed oil mobility with samples of 38.5-39.5 API gravity oil and a low gas-oil ratio. These results demonstrate reservoir deliverability and provide confidence that a horizontal section with stimulation can enhance productivity.

For full details, refer to the ASX announcement dated 15 April 2024.

Regionally, Pantheon Resources confirmed a 565 ft hydrocarbon column in the SMD-B topset at Dubhe1, exceeding pre-drill expectations by 26%. Additional hydrocarbon-bearing zones were intersected in the SMD-C and two Slope Fan intervals, with initial flowback operations now underway.

Five-Year Pathway: From Seismic to Target Production

Project Phoenix demonstrates 88 Energy's ability to de-risk and advance high-potential acreage. Within five years, the Company has moved from seismic licensing to farm-out, positioning for first production as early as 2027.

· 2022: Licensing and interpretation of the Franklin Bluffs 3D seismic dataset, enabling precise mapping and well planning.

· 2023: Formation of the Toolik River Unit, consolidating lease position and streamlining regulatory approvals. Drilling of Hickory-1 confirmed multi-reservoir oil discoveries across the SMD-B, SFS and BFF intervals.

· 2024: Flow testing of Hickory-1 confirmed oil mobility and deliverability. Independent certification established 239 MMBOE of net 2C contingent resources (refer to Figure 7 & Table 1 for further details).

· 2025: Farm-out to Burgundy secured a full carry on a two-year work program, including the upcoming Franklin Bluffs-1H well and production test.

· 2026: Planned spud of Franklin Bluffs-1H and extended production test (~90 days).

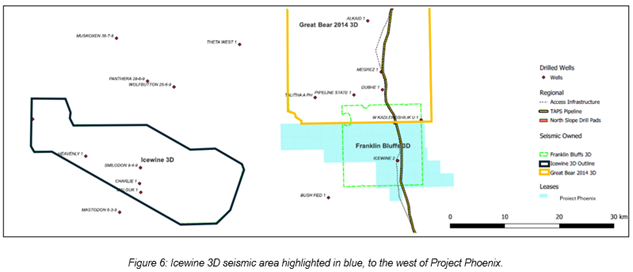

Option to acquire 25% WI in Burgundy's Leases Secured in latest bid round

Burgundy has agreed to provide 88 Energy the right to acquire a 25% WI, at cost, in the 57 new leases awarded in the North Slope Fall 2025 Bid Round. Importantly, several of the western leases lie within the Icewine 3D seismic boundary, where significant prospectivity remains. The opportunity is currently under evaluation by 88 Energy's new technical team. 88 Energy may elect to participate in these leases at any time until 1 October 2026.

Burgundy to pay for historical Icewine 3D

Burgundy has agreed to pay US$2,400,000 to 88 Energy for access to the Icewine 3D seismic data, acquired solely by 88 Energy in 2018, with US$150,000 due by 1 December 2025 and the balance within 60 days of a successful IPO. This seismic data will be key to Burgundy's assessment of the western lease block secured by Burgundy in the recent bid round.

Resurgence of the North Slope, Alaska

The Alaskan North Slope is experiencing renewed oil and gas exploration and development momentum, driven by supportive government policy, successful exploration activity, and new infrastructure projects.

· Policy support: Federal and State agencies continue to streamline permitting, promote the strategic importance of Alaskan energy resources, and actively encourage new investment in domestic energy production.

· Exploration success: In early 2025, APA Corporation, Armstrong Oil & Gas, and Santos Limited announced a major oil discovery at the Sockeye-2 well, delivered 25 ft of high-quality oil pay with porosity of 20% and average flow of 2,700 barrels of oil per day without stimulation.

· Infrastructure development: Santos' Pikka Phase 1 development is nearing completion, with first oil expected in 2026 and production ramping up in 2027. In parallel, the Alaska gas pipeline and LNG projects continues to gain traction, with the proposed 42-inch pipeline to enable large-scale gas exports from the North Slope.

· Fall 2025 North Slope Bid Round: A total of 271 leases were bid on and won by 9 different companies, representing a total of 466,764 acres. This signifies a significant investment (US$17 million) and resurgence of interest in the North Slope as an attractive oil and gas destination.

Together, these developments reinforce the basin's growing strategic importance and highlight the commercial potential of assets like Project Phoenix.

This announcement has been authorised by the Board.

Media and Investor Relations | |

88 Energy Ltd Ashley Gilbert, Managing Director Tel: +61 (0)8 9485 0990 Email:[email protected]

| |

Fivemark Partners | |

Michael Vaughan | Tel: +61 (0)422 602 720 |

EurozHartleys Ltd | |

Chelsey Kidner | Tel: +61 (0)8 9268 2829 |

Cavendish Capital Markets Limited | |

Derrick Lee / Pearl Kellie | Tel: +44 (0) 131 220 6939 |

Hannam & Partners | |

Leif Powis / Neil Passmore | Tel: +44 (0) 207 907 8500 |

About Project Phoenix (currently ~74.3% WI) and the Hickory-1 Discovery Well

The Hickory-1 discovery well was drilled in February 2023 and flow tested during the Alaskan winter season in Q1/Q2 CY24. Testing focused on the two shallower primary targets, the Upper SFS (USFS) reservoir, previously untested, and the SMD-B (SMD) reservoir. Each zone was independently isolated, stimulated, and flowed oil to the surface either naturally or using nitrogen lift to facilitate efficient well clean-up. On the 18th of September, a contingent resource for the SMD-B, Upper SFS and Lower SFS reservoirs was issued by ERCE. This contingent resource is now added to the pre-existing contingent resource in the BFF reservoir, issued by NSAI in 2023. The total net 2C contingent resource at Project Phoenix is 239 MMBOE (refer to Figure 7 & Table 1).

Table 1: Project Phoenix net entitlement to 88 Energy (63.3%) Contingent Resources estimates by NSAI and ERCE

Project Phoenix | NET (~63.3%) Contingent Resources 4,6 | ||||

Reservoir | Auditor | UoM | Low (1C) | Best (2C) | High (3C) |

SMD-B | ERCE1,3 | MMBOE | 7 | 24 | 79 |

Upper SFS | ERCE1,3 | MMBOE | 6 | 21 | 72 |

Lower SFS | ERCE1,3 | MMBOE | 8 | 35 | 123 |

BFF | NSAI2,5 | MMBOE | 62 | 158 | 367 |

Total7 | 83 | 239 | 640 | ||

Notes to table 1:

1. ERCE: ERCE Australia Pty Ltd

2. NSAI: Netherland, Sewell & Associates Inc.

3. Refer to page 6, Appendix 2 and disclaimers for further details.

4. Million Barrels of Oil Equivalent (MMBOE) of estimate contingent resource. NGLs are converted to oil equivalent volumes on a constant ratio basis of 1:1. Gas is converted to oil equivalent volumes on a constant ratio basis of 5.5 BCF per 1 MMBOE.

5. Please refer to page 7 and ASX announcement dated 6 November 2023 for further details in relation to the BFF Contingent Resource estimate. Note the Basin Floor Fan (BFF) reservoir was drilled and tested on adjacent acreage by Pantheon Resources

6. 88 Energy net resource entitlement of ~63.3% has been calculated using an average 74.3% working interest net of a 12.5% government royalty and a 4% Overriding Royalty on 18 leases.

7. Totals by reservoir rounded and project total may not sum due to rounding.

Pursuant to the requirements of the ASX Listing Rules Chapter 5 and the AIM Rules for Companies, the technical information and resource reporting contained in this announcement was prepared by, or under the supervision of, Dr Stephen Staley, who is a Non-Executive Director of the Company. Dr Staley has more than 40 years' experience in the petroleum industry, is a Fellow of the Geological Society of London, and a qualified Geologist / Geophysicist who has sufficient experience that is relevant to the style and nature of the oil prospects under consideration and to the activities discussed in this document. Dr Staley has reviewed the information and supporting documentation referred to in this announcement and considers the prospective resource estimates to be fairly represented and consents to its release in the form and context in which it appears. His academic qualifications and industry memberships appear on the Company's website, and both comply with the criteria for "Competence" under clause 3.1 of the Valmin Code 2015. Terminology and standards adopted by the Society of Petroleum Engineers "Petroleum Resources Management System" have been applied in producing this document.

Related Shares:

88 Energy