17th Jul 2025 07:00

17 July 2025

SolGold plc

("SolGold" or the "Company")

Releases Execution Plan

· Project Execution Plan Completed & Approved

· G Mining Services Engineering Team prepares for early works mobilisation

· Independent Geotechnical Assessments confirm no fatal flaws for on-concession tailings storage sites

· ExploreCo Defined: The Company's highly prospective southern concessions to be put in a separate company, creating a NorthCo (Cascabel + Concessions) and SouthCo (Porvenir + Concessions)

· Tandayama Ameríca drilling continues with another rig added in the coming week to accelerate finalization of the drilling and allow for assessment of the economics of any potential pit(s)

SolGold (LSE: SOLG) is pleased to provide an update on progress for its flagship Cascabel Copper-Gold Project ("Cascabel" or the "Project") in northern Ecuador. The Company is advancing early development activities, including securing project funding, drilling at Tandayama-Ameríca ("TAM"), and preparing for the commencement of long-lead construction works.

SolGold has outlined a clear, staged development pathway for the Cascabel Project, with first production scheduled to begin in 2028-positioning Cascabel as a cornerstone copper asset for Ecuador and a strategic contributor to the global energy transition. This marks the beginning of a multi-decade mine life, unlocking sustained value for stakeholders across generations. The optimised project schedule prioritizes near-term cash flow through the phased development of the TAM open pit and Alpala Sub-Level Cave ("SLC"). Construction of the processing plant and an on-concession tailings storage facility is expected to be completed by Q4 2028, enabling ore processing shortly thereafter.

Key enabling activities-including the relocation of the Santa Cecilia community, early works on surface infrastructure, and development of the Alpala portal and decline system-are expected to be completed over the next 24 months. These efforts are running in parallel with feasibility-stage engineering and permitting work and are designed to shorten the path to production and enhance project readiness.

Throughout these development efforts, sustainability, safety, and community benefit have remained at the forefront of SolGold's approach. SolGold is not only developing a world-class copper-gold project-it is building a legacy. The Company integrates ESG principles into every phase of its development strategy, from environmental protection and water management to health, safety, nature, and community partnerships. As always, SolGold remains focused on delivering long-term value for all stakeholders: shareholders, host communities, and the nation of Ecuador.

PROGRESS HIGHLIGHTS

· Initial ore will be sourced from the TAM open pit (targeted for January 2028), followed by underground ore from the Alpala SLC in Q4 2028.

· Construction of the processing plant and on-concession tailings storage facility is expected to conclude in Q4 2028, enabling ore processing shortly thereafter.

· All critical early works-including Santa Cecilia community relocation, surface preparation, and decline access-are expected to be completed within 24 months.

· The full-scale Alpala Block Cave, which underpins long-term production, is scheduled to deliver first ore by year-end 2031.

Dan Vujcic, Chief Executive Officer of SolGold, commented:

"We are now in execution mode - we have a plan that prioritizes momentum, risk management, and early returns. By fast-tracking development declines, tailings, and the process plant-and using permitted infrastructure within the concession - Cascabel is now firmly on a path to production in late 2028, hopefully sooner.

This optimised schedule brings forward first ore, strengthens our financing outlook, and highlights the value of the resource. We're moving faster-and we believe the project's economics will surpass earlier expectations. We will always tweak and optimise and if need be, pivot or add, but the critical focus now is delivering a project for the country and for our shareholders."

PROJECT EXECUTION PLAN

The optimised development plan for the Cascabel Project reflects SolGold's disciplined approach to project execution and capital allocation. With first production from the TAM open pit targeted for Q1 2028, and underground ore from the Alpala Sub-Level Cave scheduled by year-end 2028, the Company is focused on delivering near-term value while building toward full-scale, long-life production. The revised schedule incorporates critical infrastructure such as on-site tailings, process plant commissioning, and access development-executed within a tightly integrated timeline that prioritizes readiness, revenue, and risk mitigation.

Phase one of the G Mining Services ("GMS") scope of work is complete, culminating in the delivery of a Project Execution Plan ("PEP") for the Cascabel Project. The plan includes the following subsections: Scopes of Work for Major Areas, Engineering, Procurement, Construction, Health, Safety and Loss Prevention, Human Resources, and Risk and Opportunity Management plans. The PEP provides the foundation and definition for the Project to move forward into a feasibility study and the subsequent phases of development. The PEP has been reviewed and approved by Franco-Nevada (Barbados) Corporation and OR Royalties International Ltd. (formerly Osisko Bermuda Limited) (the "Streamers"), as one of the conditions of the second advance of US$33.3 million under the US$100 million initial deposit component of its US$750 million syndicated gold stream agreement.1

A key component of the PEP is the updated Project Schedule, which outlines a streamlined and accelerated path to production. By sequencing workstreams such as portal development, underground access, and surface infrastructure, the Company anticipates initiating ore processing in Q4 2028.

Optimised Project Schedule and Acceleration Highlights

· GMS has undertaken a rigorous schedule optimization process, identifying opportunities to accelerate the path to production while reducing risk.

· Through strategic sequencing and concurrent execution of critical activities-such as portal works, underground development, and surface infrastructure-the Company has compressed the development timeline without compromising safety or permitting integrity.

· Early works on the Alpala portal and decline system are expected to enable underground access by Q4 2027, several months ahead of the original plan.

· The construction timeline for the concentrator has been optimised from 24 to approximately 18-21 months by implementing modular build strategies and early procurement of long-lead items.

· An on-concession tailings facility will be fast-tracked to ensure tailings storage readiness aligns with mill commissioning-eliminating dependence on the longer-lead coastal infrastructure.

· Together, these optimizations are expected to bring forward the start of copper and gold production by several months, positioning Cascabel as a significant new contributor to global copper supply in 2028.

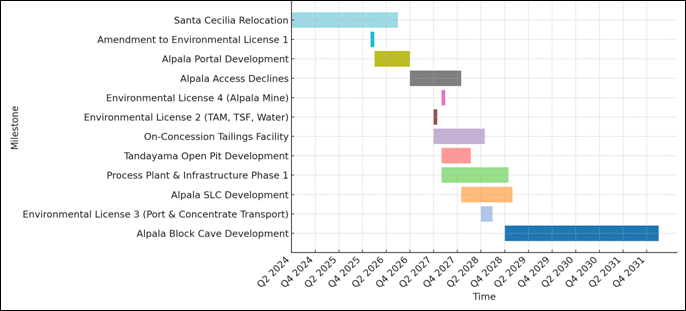

Optimised Development Milestones

Milestone / Key Activity | Optimised Schedule (Start - Finish or Milestone) |

Santa Cecilia Community Relocation - New town completed | Q2 2024 - Q2 2026 |

Amendment to Environmental License 1 (Concession Infrastructure) | End of Q4 2025 |

Alpala Portal Development - Surface preparation and access setup | Q1 2026 - Q3 2026 |

Alpala Access Declines - Underground access ready for SLC | Q4 2026 - Q4 2027 (complete ~Q4 2027 with parallel headings) |

Environmental License 4 (Alpala Mine) | End of Q2 2027 |

Environmental License 2 (TAM, TSF, Water) | Early Q2 2027 |

On-Concession Tailings Facility - Ready for operations | Early Q2 2027 - Early 2Q 2028 |

Tandayama Open Pit Development - First ore to stockpile | Q2 2027 - Q1 2028 (First ore ~Q4 2028) |

Process Plant & Infrastructure Phase 1 - First ore processed | Q2 2027 - Q3 2028 (Ore processed by ~Q4 2028) |

Alpala SLC Development - First Alpala underground ore | Q4 2027 - Q4 2028 (First ore ~Q4 2028) |

Environmental License 3 (Port & Concentrate Transport) | Q2 2028 |

Alpala Block Cave Development - First block cave ore | Q4 2028 - Q4 2031 (First ore ~late 2031) |

Figure 1: Accelerated Cascabel Project Timeline

Together, the optimizations are expected to bring forward the first ore from TAM to January 2028 and underground ore from Alpala SLC to late 2028. This represents a material acceleration of revenue generation and strengthens the Company's financing position.

EARLY WORKS PREPARATION

· Mobilisation Planning in Progress

SolGold and its project manager, G Mining Services, have completed site visits to plan for early works mobilisation in Q3 2025. These include permitted surface infrastructure.

· Expanded Early Works Scope

The broader scope of early works includes upgrading the access road, installing surface water management structures, and expanding camp capacity to support both early works construction teams and feasibility work. Contract negotiations are underway with key contractors for civil works.

· Advancing Project Readiness

While feasibility study activities continue, SolGold remains focused on advancing executable scopes that shorten the path to production. These early developments significantly de-risk critical path items and deliver Project momentum on the ground. These efforts are supported by engagement with debt, mezzanine, and strategic financing partners.

In parallel, the Company is also prioritizing land acquisition, permitting activities, and the relocation of the Santa Cecilia community-each of which is critical to advancing the Project.

TAILINGS AND PERMITTING

These early construction scopes have been sequenced to align with mill commissioning in Q4 2028, ensuring no delays from tailings readiness.

· Onsite TSF Solutions Advance

Independent geotechnical assessments by Knight Piésold Pty Ltd for the Cachaco and Parambas tailings storage facilities ("TSFs") confirmed the absence of fatal flaws, supporting designs that accommodate tailings for approximately the first ten years of operations. The sites are located entirely within the Cascabel concession and feature zoned earth and rockfill embankments, as well as diversion channels, to manage surface water.

· Permitting Advantages

The TSF locations within the mining concession are expected to streamline the permitting process. Stripping of soft foundation materials and installation of basal drainage systems are already factored into the design. Additional drilling will be undertaken in parallel to finalize geotechnical and hydrogeological data for the feasibility study and to refine designs.

ENVIRONMENTAL IMPACT ASSESSMENT UNDERWAY

Work continues on the Environmental Impact Assessment ("EIA") to support full construction approvals. SolGold is leveraging lessons learned from the exploitation agreement process and actively engaging with local and national stakeholders to ensure alignment with regulatory expectations and community needs. The collection of required baseline data, a major contributor to the EIA and permitting process, is ongoing.

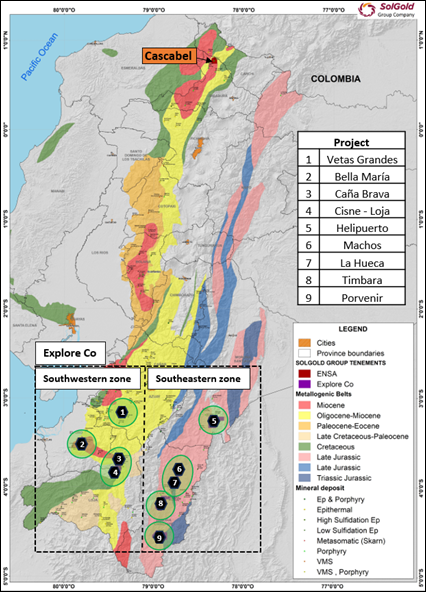

EXPLORATION ("EXPLORECO") NEW COMPANY STRATEGY

Multiple parties have recently visited SolGold's regional exploration assets, reflecting continued strong interest from third parties. SolGold plans to launch a standalone exploration vehicle focused on early-stage copper-gold discoveries in Southern Ecuador.

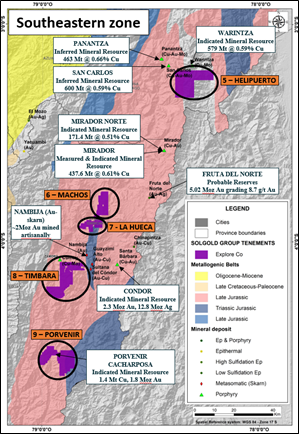

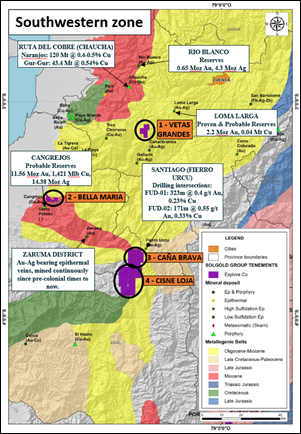

The portfolio includes the highly prospective Porvenir project, as well as additional high-priority concessions situated in a district that hosts two producing mines: Fruta del Norte and Mirador. The southern portfolio provides strong peer comparisons and valuation benchmarks, particularly for an eventual listing on either the Australian or Canadian market.

SolGold is working closely with brokers and potential cornerstone investors to evaluate transaction structures and capital pathways. A more detailed update is expected in the coming week(s).

Figure 2: ExploreCo Planned Portfolio

Figures 3 & 4: Planned ExploreCo Southwest and Southeast Zone Property Maps

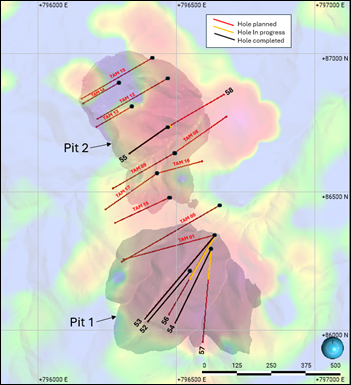

TANDAYAMA-AMERICA DRILLING

Diamond drilling is actively progressing with three rigs at the TAM deposit, targeting near-surface zones that may support a phased production strategy. Samples have been shipped for assay, with initial assays showing materially improved grades and widths. When the full drill program is completed and all assays are received, the Company expects to gain a more comprehensive understanding of the potential of this orebody, in terms of scale, quality, mining method, and place in the overall Cascabel mine plan.

Figure 2: Tandayama Ameríca Drilling Program

CONTACTS

Dan Vujcic Chief Executive Officer

|

Tel: +61 461 304 393 |

ENDNOTES:

1. Refer to News Release: Dated 15 July 2024, SolGold plc Announces US$750 Million Financing Package for the Cascabel Project: Stream News Release

ABOUT SOLGOLD

SolGold is a leading resources company focused on the discovery, definition, and development of world-class copper and gold deposits, and continues to strive to deliver objectives efficiently in the interests of its shareholders.

SolGold completed and released a staged development plan, including a Pre-Feasibility Study, on 16 February 2024. The study, completed at US$1,750/oz gold, US$3.85/lb copper, and US$22.50/oz for silver, delivered an NPV (based on a discount rate of 8%) of US$3.22bn on a capex of US$1.55bn for an initial 12 Mtpa underground block caving operation. The evaluation also showed an after-tax IRR of 24% and a first 10-year free cash flow generation of US$7.1bn. The PFS assessed Mineral Resources 539.7 Mt tonnes, which represents only 18% of the total resource over an initial 28-year project life.

On 15 July 2024, SolGold announced a gold stream agreement with Franco-Nevada (Barbados) Corporation and OR Royalties International Ltd. (formerly Osisko Bermuda Limited) (the "Streamers"), pursuant to which the Streamers would pay US$100 million as pre-development funding in three tranches, conditional upon achieving various technical and permitting milestones. The first US$33.3 million was received upon signing, with a further US$33.3 million approved by the Streamers on 9 July 2025. A further US$650m contribution to development expenditure will be provided on completion of the feasibility study, permitting and financing, subject to CPs, acceptable financing packages for the balance funding required. SolGold has agreed, in consideration for this funding, a life-of-mine stream priced at 20% of the spot gold price at the time, for 20% of gold production for the first 10 years and 12% thereafter. The stream represents approximately 5% of total revenue for the project and provides some 42% of currently estimated capital development costs. SolGold retains change of control buyback options on the stream to the extent of 50% within 3 years and 33 1/3 % for a further two years.

SolGold continues to advance de-risking programs, permitting and financing discussions, and to reevaluate the Project at recent consensus prices for copper and gold.

On 28 October 2024, SolGold appointed G Mining Services to be the Project Manager for the Feasibility Study.

The Company operates with transparency and in accordance with international best practices. SolGold is committed to delivering value to its shareholders while simultaneously providing economic and social benefits to impacted communities, fostering a healthy and safe workplace, and minimizing environmental impact.

SolGold is listed on the London Stock Exchange (LSE: SOLG).

See www.solgold.com.au for more information. Follow us on X @SolGold_plc.

Qualified Person

The scientific and technical disclosure included in this news release has been reviewed and approved by Mr. Santiago Vaca (M.Sc. P.Geo.), a Qualified Person as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

The basis for the scientific and technical information included in this news release is a technical report Porvenir Property NI 43-101 Technical Report, Mineral Resource Estimate, October 2021, effective date 26 October 2021 ("Porvenir Technical Report"), which can be found on SEDAR+ under the Company's issuer profile at www.sedarplus.ca. Readers are encouraged to read the Porvenir Technical Report in its entirety. The Porvenir Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

CAUTIONARY NOTICE

News releases, presentations and public commentary made by SolGold plc (the "Company") and its Officers may contain certain statements and expressions of belief, expectation or opinion which are forward looking statements, and which relate, inter alia, to interpretations of exploration results to date and the Company's proposed strategy, plans and objectives or to the expectations or intentions of the Company's Directors, including the plan for developing the Project currently being studied as well as the expectations of the Company as to the forward price of copper. Such forward-looking and interpretative statements involve known and unknown risks, uncertainties, and other important factors beyond the control of the Company that could cause the actual performance or achievements of the Company to be materially different from such interpretations and forward-looking statements.

Accordingly, the reader should not rely on any interpretations or forward-looking statements, and save as required by the exchange rules of the TSX and LSE or by applicable laws, the Company does not accept any obligation to disseminate any updates or revisions to such interpretations or forward-looking statements. The Company may reinterpret results to date as the status of its assets and projects changes with time, expenditure, metals prices, and other affecting circumstances.

This release may contain "forward-looking information". Forward-looking information includes, but is not limited to, statements regarding the Company's plans for developing its properties. Generally, forward looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward looking information, including but not limited to: transaction risks; general business, economic, competitive, political and social uncertainties; future prices of mineral prices; accidents, labour disputes and shortages and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, risks relating to the ability of exploration activities (including assay results) to accurately predict mineralization; errors in management's geological modelling and/or mine development plan; capital and operating costs varying significantly from estimates; the preliminary nature of visual assessments; delays in obtaining or failures to obtain required governmental, environmental or other required approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; the global economic climate; fluctuations in commodity prices; the ability of the Company to complete further exploration activities, including drilling; delays in the development of projects; environmental risks; community and non-governmental actions; other risks involved in the mineral exploration and development industry; the ability of the Company to retain its key management employees and skilled and experienced personnel; and those risks set out in the Company's public documents filed on SEDAR+ at www.sedarplus.ca. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

The Company and its officers do not endorse, or reject or otherwise comment on the conclusions, interpretations or views expressed in press articles or third-party analysis.

SolGold plc UK Company No. 5449516 ARBN 117 169 856 Email: [email protected] Website: www.solgold.com.au

Head office: Level Level 5/191 St Georges Terrace, Perth WA 6000Australia Postal address: PO Box 7059, Cloisters Square PO Perth WA 6850 Australia

Registered office: 1 Cornhill, London, EC3V 3ND, UK Phone: +44 (0) 20 3807 6996

Related Shares:

SolGold