10th Nov 2025 07:00

10 November 2025

Rainbow Rare Earths Limited

("Rainbow" or "the Company")

LSE: RBW

Phalaborwa Resource Update to include Yttrium further Enhances the Value of Rainbow's proposed SEG+ mixed Medium and Heavy Rare Earth Product

· Rainbow has updated the Mineral Resource Estimate ("MRE") at Phalaborwa to include yttrium, one of the heavy rare earth elements ("REE") that has been subject to Chinese export controls since April 2025

· Rainbow's Phalaborwa project is now confirmed as a strategic and near-term source of all the economically important medium and heavy REE, being dysprosium, terbium, samarium, europium, gadolinium and yttrium, as well as the critical light REE, being neodymium and praseodymium

· The above REE have been confirmed as critical minerals by the latest USGS 2025 List of Critical Minerals, released on 6 November 2025; of all the 60 critical minerals included in this list, these REE were deemed to be those amongst the highest risk of supply chain disruption (with the exception of europium)

· Rainbow currently only includes value for neodymium, praseodymium, dysprosium and terbium in its economic models, but will look to update this to include the ancillary metals for Phalaborwa's Definitive Feasibility Study ("DFS") to reflect the strong and growing market demand for the full range of economic REE in the project's basket

· The Uberaba project in Brazil is also expected to produce positive amounts of these SEG+ REE and this will be included in the project's Economic Assessment which is currently underway

NEWS ANNOUNCEMENT

Rainbow Rare Earths is pleased to announce that it has updated the Phalaborwa MRE to include yttrium, one of the heavy rare earths that has been subject to Chinese export controls since April 2025. The decision to update the MRE has been driven by Rainbow's test work which has demonstrated that Phalaborwa will produce the full range of critical medium and heavy rare earths in its proposed SEG+ product. The Company has noted a significant pick-up in demand for yttrium and gadolinium since the export controls were imposed, based on incoming off-take enquiries.

George Bennett, CEO, commented: "Since the imposition of export controls by China in April 2025, we have seen growing interest in securing supply of the full range of restricted REE, where shortages have already developed in the market. This includes yttrium and gadolinium, which are increasingly recognised as key REE required by the U.S. and other aligned nations for important strategic uses, including for defence applications.

Phalaborwa is a unique project in that it hosts commercial quantities of the full gamut of economically important rare earths, including the medium and heavy REE. We will therefore look to incorporate the value of the full range of strategic REE into our economic model for the project as part of the DFS."

About the Chinese export controls

In April 2025, China announced export controls on seven REE: samarium, gadolinium, terbium, dysprosium, lutetium, scandium and yttrium, as well as the rare earth permanent magnets that contain them. These measures have caused shortages and severe supply chain disruption around the world, especially to the industries that rely on REE and REE magnets, such as automotive, drones, robotics and defence.

The controls on these seven REE have hit Western nations particularly hard with regards to the build-out of new defence capabilities, which is a core macro theme for the U.S. and the E.U., amongst other territories.

In October 2025, China proposed a significant expansion of its export controls on REE, adding five new elements to the initial list of seven, and requiring foreign companies to get approval to export magnets that contain even trace amounts of Chinese-sourced REE. While these proposed new controls have been suspended for at least a year, the West has been further galvanised to act now to build new alternative supply chains for both light and heavy REE.

Rainbow expects that Phalaborwa, and the Uberaba project at a later date, can play an important role in providing secure supply of the full gamut of strategic REE.

About Phalaborwa's production profile

Phalaborwa is expected to produce ca. 1,817 tonnes per annum of neodymium / praseodymium oxide at 99.5% purity and ca. 1,159 tpa of a SEG+ MREC product of 99.5% purity containing 719 tpa TREO.

The SEG+ product is expected to allow for the following annual production of the important medium and heavy REE:

REE | tpa1 |

samarium (Sm2O3) | 258 |

europium (Eu2O3) | 51 |

gadolinium (Gd2O3) | 241 |

terbium (Tb4O7) | 19 |

dysprosium (Dy2O3) | 50 |

yttrium (Y2O3) | 213 |

Note:

1. Based on overall REE recoveries of ca. 65%

Each of the above REE is included in the U.S. Geological Survey ("USGS") 2025 List of Critical Minerals, as published on 6 November 2025. Minerals included in this list are deemed to be at high risk of supply chain disruption to the U.S. Of the 60 minerals included in the new list, terbium, dysprosium, samarium, gadolinium and yttrium are those considered to have the very highest risk of supply chain disruption, demonstrating the strategic importance of Phalaborwa's proposed output. The USGS 2025 Critical Minerals List can be accessed here:

https://www.usgs.gov/programs/mineral-resources-program/science/about-2025-list-critical-minerals

Rainbow's SEG+ product is therefore deemed to be highly sought-after by industry, especially as currently Lynas Rare Earths is the world's only commercial producer of heavy rare earths outside of China. With the inclusion of potential future production from the Uberaba project in Brazil, where Rainbow is currently carrying out an Economic Assessment with the Mosaic Company, it is expected that Rainbow will be an important and strategic source of the medium and heavy rare earths so vital to high tech industries and defence applications.

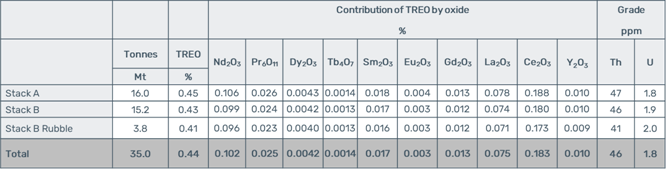

Updated Phalaborwa MRE

Phalaborwa's MRE has been updated to include yttrium, as presented in the summary table below. The MRE will be available on Rainbow's website in due course.

Notes:

1. TREO = Total Rare Earth Oxide; ppm = parts per million

2. Resource figures are reported gross; Rainbow owns an 85% interest in the Phalaborwa project, with an option to increase ownership to 100%

3. The Mineral Resource is reported at a nominal 0.2% TREO cut-off grade

4. No constraining shell is required as stacks are above ground level and no selective reclamation is required

5. Mineral resources are not mineral reserves and do not have demonstrated economic viability

6. The 'Total' rows do not always tally due to rounding

7. The full Resource tables are set out in the Appendix

Competent Persons Statement

The information in this report that relates to the Mineral Resources for the Phalaborwa project is based on, and fairly represents, information compiled or reviewed by Mr Malcolm Titley, a Competent Person who is a Member of the Australasian Institute of Mining and Metallurgy and the Australian Institute of Geoscientists. Mr Titley is employed by Maja Mining Limited, an independent consulting company.

Mr Titley has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". Mr Titley consents to the inclusion of information from this report in Rainbow public releases using his information in the form and context in which it appears.

For further information, please contact:

Rainbow Rare Earths Ltd | Company | George Bennett Pete Gardner | +27 (0) 82 652 8526

|

| IR | Cathy Malins | +44 (0) 7876 796 629 |

Tavistock Communications | PR/IR | Charles Vivian Eliza Logan | +44 (0) 20 7920 3150 |

Berenberg | Broker | Matthew Armitt Jennifer Lee

| +44 (0) 20 3207 7800 |

Stifel

| Broker | Ashton Clanfield Varun Talwar

| +44 (0) 20 7710 7600 |

Notes to Editors:

About Rainbow:

Rainbow Rare Earths aims to be a forerunner in the establishment of an independent and ethical supply chain of the rare earth elements that are driving the green energy transition. It is doing this successfully via pioneering the first commercial recovery of rare earth elements from phosphogypsum that occurs as the by-product of phosphoric acid production. These projects eliminate the cost and risk of typical rare earth projects, which involve mining and the production of a rare earth concentrate that must be chemically cracked to form a mixed rare earth carbonate before further downstream processing. As such, Rainbow's projects can be brought into production quicker and at a lower cost than traditional hard rock mining projects.

The Company is focused on the development of the Phalaborwa Project in South Africa and the earlier stage Uberaba Project in Brazil. Rainbow's process will deliver separated rare earth oxides through a single hydrometallurgical plant on site, with a focus on the recovery of neodymium, praseodymium, dysprosium and terbium. These are critical components of the high-performance permanent magnets used in electric vehicles, wind turbines, defence and exciting new markets such as robotics and advanced air mobility.

The Phalaborwa updated interim economic study released in December 2024 has confirmed strong base line economics for the project, which has a base case NPV10 of US$611 million. Given Phalaborwa is a chemical processing operation, with its resource sitting at surface in a chemically cracked form, it has a much lower operating cost than traditional rare earth mining projects, and it is therefore estimated to be one of the highest margin rare earth projects in development today outside of China.

More information is available at www.rainbowrareearths.com or by visiting the Rainbow Rare Earths Curation Showcase at: Curation Connect - Rainbow Rare Earths Showcase or https://app.curationconnect.com/company/Rainbow-Rare-Earths-90903

www.curationconnect.com

Related Shares:

Rainbow Rare Earths