5th Feb 2026 07:00

5 February 2026

Mining Permit Awarded for Doropo Gold Project

Resolute Mining Limited ("Resolute" or "the Company") (ASX/LSE: RSG), the Africa-focused gold miner, is pleased to announce that the Council of Ministers have officially announced the award of the mining permit for the Doropo Gold Project in Côte d'Ivoire. The mining permit is valid for 14 years with the ability to extend.

The Doropo mining permit advances Resolute's goal of becoming a leading multi-asset gold producer in West Africa. This milestone underpins the Company's strategy to grow annual gold production above 500 koz by the end of 2028 and validates our commitment to disciplined growth and shareholder value.

The development of Doropo not only supports Resolute's ambition to deliver strong financial returns but also positions the Company to unlock further opportunities for expansion and value creation throughout the region.

Chris Eger, Managing Director and CEO commented:

"We are very pleased to be awarded the mining permit, which marks a significant milestone in the development of the Doropo Gold Project and reflects the strong support we have received from local and government stakeholders.

We look forward to unlocking value for our stakeholders by progressing the Doropo Gold Project towards construction in H1 2026. The recent DFS outlined the extremely strong economics of the Doropo Project with a post-tax project NPV5% (100% basis) of US$2.5 bn at a gold price assumption of US$4,000/oz with significant upside potential.

We are excited by the Company's path to becoming a highly diversified gold producer across multiple assets and countries. The addition of Doropo is a key part in being able to reach the target annual production of over 500 koz per annum by the end of 2028."

The award of the mining permit represents the final governmental approval required to launch the development and operation of the Doropo Gold Project, with the official Presidential Decree expected in the weeks following the Council of Ministers' meeting.

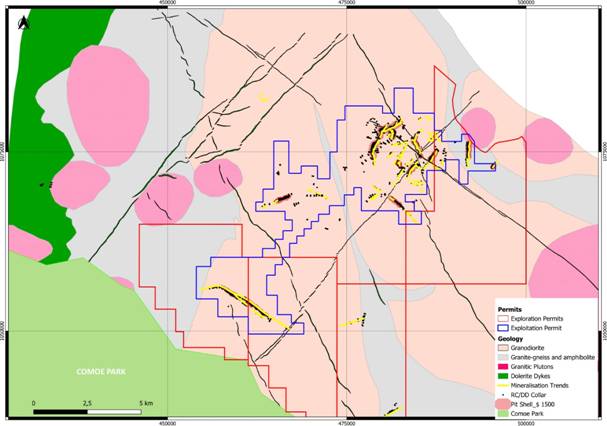

As illustrated in Figure 1 below the mining permit covers a substantial area of 400km², encompassing the main Doropo deposits and several drill-tested mineralised trends. Additionally, within the mining permit there are multiple coherent soil geochemical anomalies and identified geophysical structures that remain untested by drilling.

Figure 1: Mining permit area (blue) with mineralised trends

Next Steps

Receiving the mining permit is an important milestone for the Final Investment Decision (FID) which is expected shortly.

Resolute intends to use its existing balance sheet to progress Doropo into construction which is expected in H1 2026 followed by first gold in H1 2028.

Doropo DFS Highlights

The Doropo Gold Project is situated in the Bounkani Region of Côte d'Ivoire, approximately 480 km northeast of Abidjan and 50 km north of Bouna, near the Burkina Faso border.

Table 1 includes operational and financial highlights for the updated DFS released in December 2025.

At US$3,000/oz gold price | Units | Value |

Mine Life | Years | 13 |

LOM ore processed | kt | 59,102 |

LOM strip ratio | w:o | 4.9 |

LOM feed grade processed | Au g/t | 1.31 |

LOM gold recovery | % | 88% |

LOM gold production | koz | 2,196 |

Upfront capital cost | US$M | 516 |

Life of Mine average: | ||

Gold, average annual production | koz | 169 |

Cash costs per ounce | US$/oz | 1,123 |

AISC per ounce | US$/oz | 1,406 |

EBITDA | US$M | 294 |

Free Cash Flow (post-tax) | US$M | 214 |

Project years 1 to 5: | ||

Gold, average annual production | koz | 204 |

Cash costs per ounce | US$/oz | 1,005 |

AISC per ounce | US$/oz | 1,294 |

EBITDA | US$M | 364 |

Free Cash Flow (post-tax) | US$M | 268 |

Post-Tax Economics | ||

Net present value - 5% | US$M | 1,457 |

Internal Rate of Return | % | 49% |

Payback period (from first production) | Years | 1.7 |

Table 1: Economic Summary

The post-tax NPV sensitivity comparing varying discount rate percentages and gold price is presented in Table 2. The base case result for the Project is highlighted in bold.

3,000 | 3,500 | 4,000 | 4,500 | |

5% | 1,457 | 2,000 | 2,543 | 3,086 |

7% | 1,245 | 1,723 | 2,202 | 2,680 |

10% | 988 | 1,388 | 1,789 | 2,189 |

Table 2: Sensitivity of post-tax NPV5% (US$M) to Discount Rate and Gold Price (US$/oz)

Contact

Resolute Matthias O'Toole-Howes [email protected] +44 203 3017 620 | Public Relations Jos Simson, Tavistock [email protected] +44 207 920 3150

Corporate Brokers Jennifer Lee, Berenberg +44 20 3753 3040 Tom Rider, BMO Capital Markets +44 20 7236 1010 |

Authorised by Mr Chris Eger, Managing Director and Chief Executive Officer

Related Shares:

Resolute Mining