8th Sep 2025 09:32

FOR DISTRIBUTION ONLY (A) IN THE UNITED STATES, TO QUALIFIED INSTITUTIONAL BUYERS (QIBs) (AS DEFINED IN RULE 144A UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT")), AND (B) OUTSIDE THE UNITED STATES TO PERSONS OTHER THAN "U.S. PERSONS" (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT). NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO, OR TO ANY PERSON LOCATED OR RESIDENT IN, ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT (SEE "DISTRIBUTION RESTRICTIONS" BELOW)

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT QUALIFIED OR MAY HAVE QUALIFIED AS INSIDE INFORMATION WITHIN THE MEANING OF ARTICLE 7(1) OF THE MARKET ABUSE REGULATION (EU) 596/2014, AS IT FORMS PART OF UNITED KINGDOM DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018.

8 SEPTEMBER 2025

ECOBANK TRANSNATIONAL INCORPORATED ANNOUNCES CONSENT SOLICITATIONS

to holders of its outstanding

US$525,000,000 10.125% Notes due 15 October 2029

(the "2029 Notes")

- and -

US$350,000,000 Fixed Rate Reset Tier 2 Sustainability Notes due 2031

(the "2031 Notes" and together with the 2029 Notes, the "Notes")

Ecobank Transnational Incorporated (the "Bank") invites holders of the relevant Notes (the "Noteholders") to consent to certain modifications of the terms and conditions of the relevant Notes (the "Conditions") and the documents relating to the relevant Notes pursuant to the proposed Supplemental Trust Deeds, by approving and implementing certain extraordinary resolutions of the Noteholders (the "Extraordinary Resolutions") at relevant Meetings, for approval of the relevant modifications of the Conditions, all as further described in the consent solicitation memorandum dated 8 September 2025 (the "Memorandum" and such invitation in respect of relevant Notes, the "Consent Solicitations"). Capitalised terms used in this notice and not otherwise defined shall have the meanings given to them in the Memorandum, which is available, subject to eligibility confirmation and registration, on the transaction website (the "Transaction Website"): https://projects.sodali.com/ETI.

The following table summarises key details of the Consent Solicitations:

Description of the Notes | Outstanding Principal Amount[1] | Early Consent Fee[2] | Late Consent Fee[3] |

US$525,000,000 10.125 per cent Notes due 15 October 2029 (Rule 144A ISIN: US27889PAC77 / CUSIP: 27889PAC7; Reg S ISIN: XS2879056534) | US$525,000,000 | US$1.25 per US$1,000 in principal amount of Notes | US$0.25 per US$1,000 in principal amount of Notes |

US$350,000,000 Fixed Rate Reset Tier 2 Sustainability Notes due 2031 (Rule 144A ISIN: US27889PAB94 / CUSIP: 27889PAB9; Reg S ISIN: XS2348420303) | US$350,000,000 | US$1.25 per US$1,000 in principal amount of Notes | US$0.25 per US$1,000 in principal amount of Notes |

The Proposals

The Bank invites Noteholders (on the terms and subject to the conditions contained in the Memorandum) to consent to the following proposals (the "Proposals"):

2029 Proposals (in respect of the 2029 Notes)

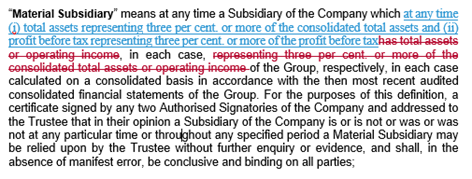

Condition | Proposed Changes (in blackline) |

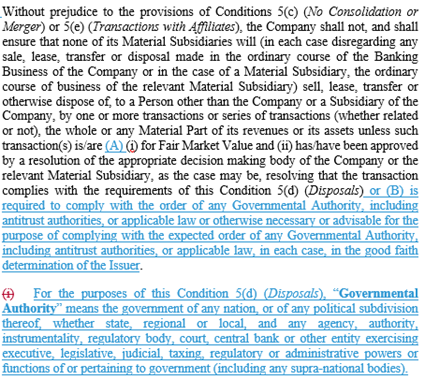

5(d) |

|

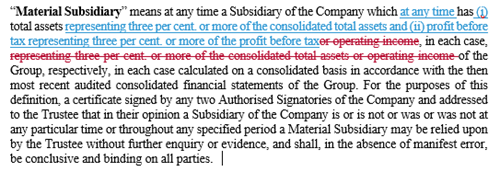

6 |

|

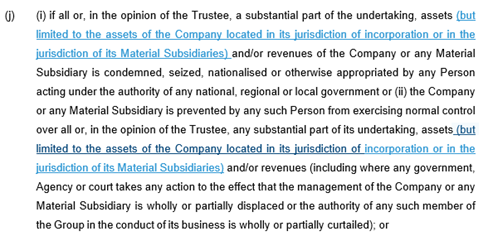

14(j) | |

2031 Proposals (in respect of the 2031 Notes)

Condition | Proposed Changes (in blackline) |

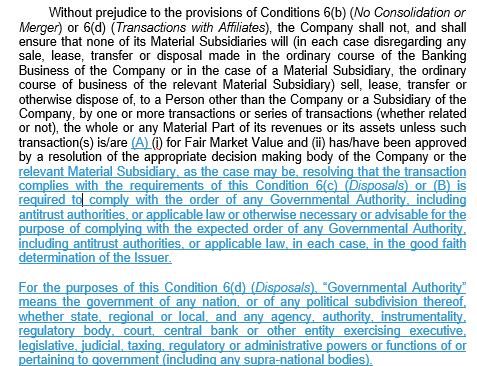

6(d) |

|

6(f) |

|

Background

The Proposals are designed to provide the Bank with greater flexibility in light of the evolving financial and operational performance of its Subsidiaries (as defined in the Trust Deeds). The Proposals aim to streamline covenant compliance by focusing reporting obligations on those Subsidiaries that have a material impact on the Bank group's financial position and its ability to meet debt obligations. The African banking landscape continues to evolve and the Proposals enhance the credit position of the Bank whilst mitigating any envisaged risk factors.

Meetings of the Noteholders are being convened for the purpose of obtaining their approval of the Proposals, being effected through the Extraordinary Resolutions being put to Noteholders.

None of the Financial Adviser / Dealer Manager, the Bank, the Trustee, the Principal Paying Agent, the Registrar, the Information and Tabulation Agent or any other person makes any recommendation to Noteholders as to whether or not to agree to the Proposals and how to vote on the Extraordinary Resolutions. Before making any decisions in respect of the Proposals, Noteholders should carefully consider all of the information contained in the Memorandum and in particular the Risk Factors set out in the Memorandum.

Early Consent Fees

In respect of each Series of Notes, if valid Voting Instructions in favour of the Extraordinary Resolution are received on or prior to the Early Participation Deadline, and are not withdrawn or revoked, subject to the Extraordinary Resolution being duly passed and being implemented in accordance with its terms, the Bank will pay to each such Noteholder who has delivered (and not withdrawn or revoked as aforesaid) such Voting Instruction: (i) the 2029 Early Consent Fee (in the case of the 2029 Notes); or (ii) the 2031 Early Consent Fee (in the case of the 2031 Notes), in each case on the Settlement Date.

Late Consent Fees

In respect of each Series of Notes, if valid Voting Instructions in favour of the Extraordinary Resolution are received after the Early Participation Deadline but on or prior to the Expiration Deadline, and are not withdrawn or revoked, subject to the Extraordinary Resolution being duly passed and being implemented in accordance with its terms, the Bank will pay to each such Noteholder who has delivered (and not withdrawn or revoked as aforesaid) such Voting Instruction: (i) the 2029 Late Consent Fee (in the case of the 2029 Notes); or (ii) the 2031 Late Consent Fee (in the case of the 2031 Notes), in each case on the Settlement Date.

Quorum

The quorum required at each Meeting shall be one or more persons validly (in accordance with the provisions of the Trust Deeds) present (each a "voter") holding, or being proxies and representing or holding, more than two-thirds of the aggregate principal amount of the outstanding Notes.

If within 30 minutes after the time fixed for a Meeting a quorum is not present, the Meeting shall be adjourned for such period, being not less than 14 days nor more than 42 days, and to such time and place as may be approved by the chairman (with the approval of the Trustee) either at or subsequent to the Meeting. At any adjourned Meeting, the quorum shall be one or more persons validly (in accordance with the provisions of the Trust Deeds) present holding or representing in the aggregate not less than one quarter in principal amount of the Notes for the time being outstanding.

If a Meeting is adjourned for lack of quorum, it is the intention of the Bank to arrange for a notice convening the adjourned Meeting to be sent to the Noteholders as soon as reasonably practicable following such adjournment.

Any Voting Instructions submitted in respect of the original Meeting shall (unless revoked) apply to, and be valid for the purposes of, any adjourned Meeting and there shall be no need to submit new Voting Instructions in respect of any adjourned Noteholders' Meeting.

Required Majority

The Extraordinary Resolutions require a majority of not less than three-quarters of the votes cast to be passed at a Meeting (or, if applicable, any adjourned Meeting). If passed, the Extraordinary Resolutions shall be binding on all the relevant Noteholders, whether or not present at the relevant Meeting (or any adjourned such meeting), and each of them shall be bound to give effect to it accordingly.

Voting Procedures

Voting Instructions may only be delivered through Direct Participants in accordance with the customary procedures of the Clearing Systems or DTC Direct Participants. Beneficial Owners of Notes who are not Direct Participants must arrange through their broker, dealer, bank, custodian, trust company or other nominee to contact the Direct Participant through which they hold their Notes in the relevant Clearing System or DTC Direct Participants so that Voting Instructions may be delivered in respect of such Notes.

Voting Instructions must be submitted in respect of denominations of no less than US$1,000 and in integral multiples of US$1,000 thereafter.

Revocation of Voting Instructions

Noteholders who have validly submitted Voting Instructions prior to the Expiration Deadline shall not be entitled to revoke such instruction, unless such revocation is otherwise required by law or permitted by the relevant Trust Deed.

General

Set out below is an indicative timetable showing one possible outcome for the timing of the Consent Solicitations, based on the dates set out in the Memorandum. This timetable is subject to change and dates may be extended or changed by the Bank, in its discretion, in accordance with the terms and conditions set out in the Memorandum. This timetable assumes that the Meetings are quorate on the date on which they are first convened and, accordingly, no adjourned Meeting is required. The actual timetable may differ significantly from the expected timetable set out below.

Event | Date and Time |

Record Date For the Restricted Notes, only Noteholders holding Restricted Notes as of the Record Date are entitled to exercise voting rights with respect to the Proposals in respect of the relevant Notes. | 22 September 2025

|

Early Participation Deadline | 5.00 p.m. (London time) on 24 September 2025 |

Deadline for Noteholders to deliver or procure delivery to the Information and Tabulation Agent of Voting Instructions in favour of the Extraordinary Resolutions to be eligible to receive the Early Consent Fee. | |

Expiration Deadline | |

Deadline for Noteholders to deliver or procure delivery to the Information and Tabulation Agent of Voting Instructions in favour of the relevant Extraordinary Resolution to be eligible to receive the Late Consent Fee. | 5.00 p.m. (London time) on 26 September 2025 |

Meeting to be held by way of teleconference | 10.00 a.m. (London time) on 30 September 2025

|

Announcement of results | 30 September 2025 (or as soon as reasonably practicable after the Meetings) |

After the Meetings, the Bank shall announce the results of the Meetings. | |

Effective Date | |

The date when the Proposals become effective. | The date on which the Supplemental Trust Deeds are executed, which is expected to be as soon as reasonably practicable after the Meetings. |

Settlement Date | On or about 2 October 2025 |

Subject to the Extraordinary Resolutions being approved at the relevant Meeting, settlement in respect of the relevant Consent Fee. |

If a Meeting is adjourned, the relevant times and dates set out above will be modified accordingly and will be set out in the notice convening such adjourned Meeting.

Noteholders are advised to check with any broker, dealer, bank, custodian, trust company or other trustee through which they hold Notes whether such broker, dealer, bank, custodian, trust company or other trustee would require receipt of any notice or instructions prior to the deadlines set out above. The deadlines set by DTC Direct Participants and the relevant Clearing System for the submission of Voting Instructions will also be earlier than the relevant deadlines specified in the Memorandum.

Further detail about the Consent Solicitations can be obtained from:

The Financial Adviser / Dealer Manager:

RENAISSANCE CAPITAL AFRICA (RENAISSANCE SECURITIES (NIGERIA) LIMITED)

6th floor, East Tower

The Wings Office Complex

17A Ozumba Mbadiwe Avenue

Victoria Island

Lagos, Nigeria

Email: [email protected]

Attention: Liability Management

Telephone: +44 7940766996; +234 706 406 4488

The Information and Tabulation Agent:

SODALI & CO LIMITED

Email: [email protected]

Transaction Website: https://projects.sodali.com/ETI

In London: The Leadenhall Building 122 Leadenhall Street London, EC3V 4AB United Kingdom | In Stamford: 333 Ludlow Street 5th Floor South Tower Stamford, CT 06902 United States of America | In Hong Kong: 1401, 14/F 90 Connaught Road Central Sheung Wan Hong Kong |

Telephone: +44 20 4513 6933 | Telephone: +1 203 658 9457 | Telephone: +852 2319 4130 |

Distribution Restrictions

This announcement and the Memorandum do not constitute an offer or an invitation to participate in the Consent Solicitations in any jurisdiction in or from which, or to or from any person to or from whom, it is unlawful to make such offer or invitation under applicable securities laws. The distribution of the Memorandum in certain jurisdictions may be restricted by law. Persons into whose possession the Memorandum comes are required by each of the Financial Adviser / Dealer Manager, the Bank, the Trustee, the Principal Paying Agent, the Registrar, the Information and Tabulation Agent to inform themselves about, and to observe, any such restrictions.

[1] As at the date of this Memorandum.

[2] Payable to Noteholders who consent on or prior to the Early Participation Deadline.

[3] Payable to Noteholders who consent after the Early Participation Deadline but on or prior to the Expiration Deadline.

Related Shares:

Ecobank 31 R