30th Jan 2026 07:00

LONDON BTC COMPANY LIMITED

Launch of Bitcoin and Gold Hedging Strategy

Call Option to Buy the Chance Gold Mine in Western Australia

London, New York, 30 January 2026 - London BTC Company Limited ("Company") (BTC: LSE, VINZF: OTCQB), the London Stock Exchange Main Market-listed bitcoin mining and treasury company with mining operations across North America, is pleased to announce that following on from statements made in its latest Interim Results, it has signed a call option to acquire a 100% interest in the Chance Gold Mine in Western Australia as part of the Company's strategy to hedge against Bitcoin volatility.

In the Company's Interim Results published in November last year, the Company advised shareholders that, given the volatility of Bitcoin, the board has been investigating potential hedging strategies. As stated in the Interims, the Company had identified certain gold assets that may act as a hedge against Bitcoin volatility, and the Company may therefore make investments in certain gold assets from time to time.

Stage One of this hedging strategy has now taken effect with the signing of a 30-day exclusive Call Option to acquire the tenements that contain the historic Chance Gold Mine, which is located about 4km south of the 2.6Moz Copperhead Gold Mine near the town of Bullfinch in the Western Australian Goldfields. The Chance Mine reported historic production in the 1930's of gold ore grading 9.4 grams per tonne of gold (g/t Au). Limited drilling by Troy Resources Ltd in the 1980's reported grades up to 2m grading 6.9 g/t Au with numerous drill holes reporting grades over 1 g/t Au. The board considers that modern exploration targeting techniques have the potential for delivering drilling results that could add value in the short to medium term.

David Lenigas, Chairman of London BTC Company Limited, comments:

"Your board has extensive experience in gold exploration and mining, and we are leveraging off this experience. We like Bitcoin and we like gold and by linking the two we feel we could create a very exciting platform for growth and one that could see our Bitcoin operations grow faster. I believe that Gold is the hottest financial sector globally now and our view is that holding exciting gold assets and, indeed, potentially holding physical gold in treasury, is a sound hedging strategy in these volatile times. I'm also very excited about the possibility of expanding this hedge into the US gold areas we are currently assessing. Great gold tenements can be run up the value curve and either developed or sold, and these funds could be used to make us bigger in Bitcoin much quicker."

"The Company is also investigating with our USA hosting partners in Iowa, Indiana, Nebraska and Texas the possibility of expanding our US Bitcoin mining fleet to 1,500 miners through 2026 and we will update the markets as these plans mature and are deployed."

The Company will be undertaking legal and geological due diligence on the ground at the Chance Gold Mine's tenements during the month of February and we expect to report findings as results become available.

The Company has a strong balance sheet, no external debt and 1,048 Bitcoin miners producing Bitcoin in North America at hosting centres in the US in Indiana, Iowa, Nebraska, Texas and Labrador (Canada). The revenues from our miners and our balance sheet will be used to fund gold exploration to add value to this gold asset so that any realised increased value can be returned to the Company's Bitcoin treasury and continued increase in our Bitcoin mining fleet.

In addition to this initial gold hedge deal in Australia, the Company advises that it is also in the process of setting up a special purpose subsidiary in the USA to explore the possibility of staking areas over highly prospective gold ground in known gold provinces. The board is in the process of identifying and investigating various opportunities in the US. These potential US gold sites will also be assessed for suitability to host new stand-alone data centres to house Bitcoin mining operations.

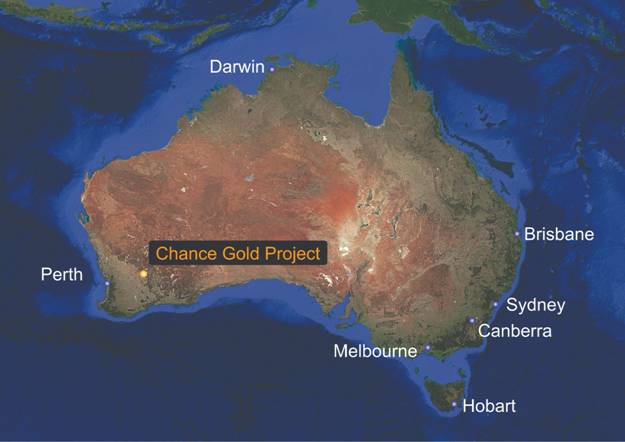

Figure 1: Location of the Chance Gold Mine and Project and Copperhead Gold Mine

Transaction terms:

This is a small transaction by financial quantum that nevertheless has the potential to have a very significant positive impact for the Company.

The Company has signed a Call Option to acquire a 100% interest in 2 granted tenements (P77/4569 and P77/4570) called the "Chance Mine Project" in Western Australia for an initial cost of AUD$5,000 paid to the vendor. The Call Option has a 30-day exercise period and can be exercised in full by paying an additional AUD$5,000. During this Call Option period, the Company will be conducting the necessary due diligence to determine whether this project might be appropriate for the Company's objectives.

This transaction is fully funded by internal reserves, and it is intended that any exploration activities will also be funded from the Company's internal reserves. This transaction is being conducted on an arm's-length basis with an unrelated party to the Company.

Figure 2: Location of the Chance Gold Mine Project in Australia

The directors of London BTC Company Limited accept responsibility for this announcement.

For further information please contact:

London BTC Company Limited

| Hewie Rattray, CEO [email protected] David Lenigas, [email protected] Rob Scott, Finance Director, [email protected] Jeremy Edelman, [email protected]

| |

First Sentinel (Corporate Adviser)

| Brian Stockbridge T: +44 (0) 20 3855 5551

| |

Clear Capital Markets (Broker)

| Bob Roberts T: +44 (0) 20 3869 6080

| |

Marex Financial (Joint Broker and Advisor) | Angelo Sofocleous / Keith Swann / Matt Bailey (Broking)

|

About London BTC Company Limited

The Company's primary listing is on the London Stock Exchange (United Kingdom) under the ticker "BTC.L" and it trades in the USA on the OTCQB under the ticker "VINZF". The Company is building up a strategic Bitcoin holding through acquiring Bitcoin as a treasury and currency management tool and through adding Bitcoin generated from its mining operations in North America. The Company currently operates Bitcoin miners hosted across multiple third-party facilities in Indiana, Iowa, Nebraska and Texas (USA) and Labrador (Canada).

References for Chance Gold Mine and Copperhead Mine statistics quoted in this Release:

· Western Australian Government open file document on the Chance Gold Mine: Reynolds Yilgarn Gold Operations - Annual Report for the Period 31 October 1992 - 30 October 1993 - Dated November 1993

o https://urldefense.proofpoint.com/v2/url?u=https-3A__uploads.dmp.wa.gov.au_uploads__Download_WAMEX_Reports_f14812fc-2Dc037-2D4534-2Db9a6-2Ded6b3f70b955-2Drgrofyp83hhk8sf7waarq5d1xrgyk1q2qfwbpe8v_39847-3FgroupAccessToken-3DgqMe1oUgaFYnuIO-5FZS54BZ95Igwewl06HB-2D805lVqPlA88eQpPNNvADwOdtzSjfBX9kiR7zaz3iOI9RZNaGIIg2-26mode-3DDefault&d=DwMFaQ&c=euGZstcaTDllvimEN8b7jXrwqOf-v5A_CdpgnVfiiMM&r=5CSEot5qcQx6R6anJyoD1VYYRwYDREhfCZ0FKVyMk58&m=9rjo2R8SzO-awInsN0LHVwFj2Un6QCTsjhtXBRNsTNmIoncedkujwOAzp7bsRZOW&s=f8RiJKgTn5e6VUPQLpgNRDLCMKLrSODZaJFR5Zhp1B0&e=

· Western Australian Government open file document -

o https://minedex.dmirs.wa.gov.au/Web/sites/details/3A4D4678-4CB8-49C5-B5A6-601C63FB1AF6

· https://www.hankingmining.com/static/upload/file/20251229/1767009428875356.pdf

Related Shares:

London Btc