2nd Feb 2026 07:00

AIX: KAP, KAP.Y (GDR)

AIX: KAP, KAP.Y (GDR)

LSE: KAP (GDR)

2 February 2026, Astana, Kazakhstan

Kazatomprom 4Q25 Operations and Trading Update

National Atomic Company "Kazatomprom" JSC ("Kazatomprom", "KAP" or "the Company") announces the following operations and trading update for the fourth quarter and year ended 31 December 2025.

This update provides a summary of recent developments in the uranium industry, as well as provisional information related to the Company's key fourth quarter and full year 2025 operating and trading results. The information contained in this Operations and Trading Update may be subject to change.

Market Overview

During the reporting period, several strategic initiatives and legislative actions in the U.S. saw significant progress. Discussions resumed on the Sanctioning Russia Act of 2025 (S.1241), which proposes imposing a 500% tariff on imports from countries that continue trading strategic resources, including uranium, with Russia. The U.S. House of Representatives passed a bill providing "historic investments" in small modular reactor (SMR) projects, while the Efficient Nuclear Licensing Hearings Act (H.R. 5549) and Executive Order No. 14299 were aimed at streamlining the licensing process and promoting the export of U.S. nuclear technologies. In addition, uranium was officially reinstated on the 2025 List of Critical Minerals, considered vital to the American economy and national security, which face potential risks from supply chain disruption.

After reviewing the Section 232 investigation findings, the U.S. President signed on 14 January 2026 a Proclamation to implement measures addressing national security risks associated with imports of processed critical minerals, including uranium, and their derivatives. The Proclamation directs the Department of Commerce and U.S. Trade Representative to pursue negotiations with trading partners, including potential negotiations of price floors for trade in critical minerals, if needed, and report back on the status of such negotiations within 180 days (by 13 July 2026). If the President determines that the negotiations are not progressing in a timely manner or are insufficient to address the risks, he may implement additional measures, including import restrictions.

Following the World Bank's updated policy on nuclear energy, an amended energy policy of the Asian Development Bank (ADB) also supports financing for developing member countries that chose to pursue nuclear power. In accordance with its new policy framework, ADB has entered into a Memorandum of Understanding with the International Atomic Energy Agency (IAEA) to deepen cooperation on the peaceful, safe, and sustainable use of nuclear energy in Asia and the Pacific.

The U.S. Government signed an $80 billion deal with Brookfield Asset Management and Cameco Corp. to construct Westinghouse-designed nuclear reactors in order to meet rising electricity requirements for the AI economy's datacenter compute needs. Earlier, Westinghouse has already announced plans to commence the construction of 10 new reactors in the U.S. by 2030.

The Republic of Niger has allegedly intended to put uranium produced from the SOMAÏR mine on the international market, according to the state media outlet. Days earlier Orano, which owns a 63.4% share in the SOMAÏR mine, reported that a shipment of uranium had left the mining site in Arlit, in breach of the decision by the World Bank's International Centre for Settlement of Investment Disputes, which had ordered Niger not to sell, transfer, or facilitate the transfer of uranium produced at SOMAÏR to third parties. According to international news outlets, a batch of uranium is held at the Niamey international airport.

On 22 January 2026, Sprott Physical Uranium Fund submitted a prospectus for an issue of up to $2 billion units over the next 25 months. The funds will be used to purchase up to 9 million pounds (~3,450 tU) of physical uranium in the forms of U3O8 and UF6 on the spot market during any calendar year throughout the validity period of the updated prospectus.

India's Parliament passed the Sustainable Harnessing and Advancement of Nuclear Energy for Transforming India (SHANTI) Bill that would introduce its nuclear industry to private investments, unlocking $214 billion worth of investment opportunities. The change in legislation is part of an ambitious government plan to increase India's nuclear capacity from the current 8.1 GW to 100 GW by 2047.

Under the U.S. Department of State's Foundational Infrastructure for Responsible Use of Small Modular Reactor (SMR) Technology (FIRST), the Institute of Nuclear Physics under the Agency for Atomic Energy of the Republic of Kazakhstan will receive a SMR classroom simulator from the U.S. vendors Holtec International and WSC Inc. The simulator will serve as a regional training hub to facilitate safe and secure SMR deployment across Central Asia. Additionally, the FIRST program launched SMR feasibility study to identify a shortlist of U.S. SMR options suitable for deployment at potential sites in Kazakhstan.

The following events underscored key developments on the demand side during the reporting period:

· Unit 2 of the Zhangzhou NPP, featuring the Hualong One reactor, has entered commercial operation. This marks a significant milestone in the mass deployment of China's domestic third-generation reactor technology.

· Shortly after its restart, Tokyo Electric Power Co. suspended operations at Kashiwazaki-Kariwa Unit 6. An in-depth technical investigation is currently underway to determine the cause.

· Rostechnadzor, Russia's nuclear regulator, has issued a decommissioning license for Leningrad Unit 1, valid until 2055, establishing a framework for the decommissioning of RBMK-1000 reactors.

· The U.S. Nuclear Regulatory Commission granted 20-year license renewals for Constellation Energy's Clinton Unit 1 and Dresden Units 2 and 3, extending their operations until 2047, 2049 and 2051, respectively.

· South Korea's Nuclear Safety and Security Commission approved the continued operation of Kori Unit 2 until 2033; the reactor had been offline since its original 40-year permit expired in April 2023.

· South Africa's National Nuclear Regulator has authorised a 20-year operational extension for the 930 MWe Koeberg Unit 2, allowing it to run until 2045.

· The UK's Office for Nuclear Regulation granted formal consent to EDF Energy to decommission the Hinkley Point B plant and its two Advanced Gas-cooled Reactors, which are scheduled for shutdown by 2028.

· In accordance with Belgium's nuclear phase-out policy, Doel Unit 2 was disconnected from the grid and taken offline after 50 years of operation.

On the supply side:

· Paladin Energy's Langer Heinrich mine in Namibia produced 3 million pounds of U3O8 (1,150 tU) in 2025, putting it on track to increase output to between 4.0 and 4.4 million pounds (1,540-1,690 tU) for 2026.

· The first blast at Lotus Resources' Kayelekera mine in Malawi marked the resumption of mining operations at the restarted site. The company stated to be on track with the mine's ramp up plan to a production level of 200,000 pounds of U3O8 per month (~77 tU) for the first quarter of 2026.

· Anfield Energy broke ground at its Velvet-Wood uranium-vanadium mine in Utah, targeting initial ore production in 2026. Additionally, the company applied for local authorization to restart its past-producing JD-8 mine in Colorado, aiming for an operational restart in the second half of 2026.

· The Swedish Parliament passed legislation lifting the national ban on uranium mining and extraction, effective 1 January 2026. Industry estimates suggest that ~27% of Europe's proven uranium reserves are concentrated in Sweden.

· The Canadian and Indian governments held bilateral trade talks regarding a potential 10-year uranium supply agreement; the deal, reportedly involving Cameco and the Indian Department of Atomic Energy, is valued at $2.8 billion.

Market Pricing and Activity

* Average of UxC and TradeTech reported prices

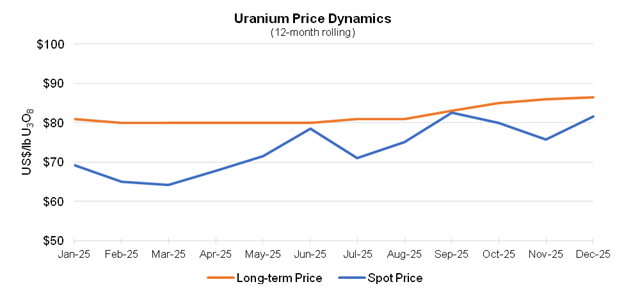

The price opened at $81.15/lb U3O8 during the first week of October, declining to $77.25 in the middle of the month and recovering to the $81.00/lb U3O8 level. In November, increased seller activity exerted downward pressure, driving the price to a quarterly low of $75.80/lb U3O8 during the last week of the month. Market stability returned in December, supported by renewed transactional momentum, with prices rising to $81.00/lb U3O8 before the holiday season. The last month of 2025 concluded at $81.55/lb U3O8 following Sprott Physical Uranium Trust's successful capital raise, which bolstered market confidence.

According to third-party assessments, in 2025 a total of 55.3 million pounds of U3O8 (~21,270 tU) were transacted in the spot market at an average weekly spot price of $72.75/lb of U3O8 compared to 36.75 million pounds (~14,135 tU) of U3O8 at an average weekly spot price of $86.28/lb U3O8 reported in 2024. This represented a 50% year-on-year growth in total spot transaction volumes. A 16% year-on-year decrease in the average weekly spot price was primarily due to the higher-level prices in the first months of 2024, which were largely spurred by concerns of the U.S. Senate passing a bill that would ban the import of Russian nuclear fuel into the U.S.

The long-term uranium price maintained the upward trend in Q4 2025, supported by utility contracting and news about future reactor expansions. As a result, 2025 closed at $86.50/lb U3O8, 7% higher year-on-year. Total long-term transaction volumes for the 12 months of 2025 amounted to 104 million pounds U3O8 (~40,000 tU), which was comparable to 2024 volumes of 106.2 million pounds U3O8 (~40,850 tU).

Company Developments

S&P Global improves Kazatomprom's ESG score

On 13 November 2025, S&P Global, an international rating agency, assigned Kazatomprom a Corporate Sustainability Assessment (CSA) score of 50/100, resulting in a total ESG score of 51 points. Kazatomprom's score is two points higher compared to the previous year and significantly exceeds the industry average. This result confirms the Company's leadership position and highlights the success of its sustainable development strategy.

The full ESG evaluation report from S&P Global is available at the following link.

EGM Results

As announced on 22 December 2025, Kazatomprom's Extraordinary General Meeting of Shareholders approved the new edition of the Company's Corporate Governance Code ("the Code"), which reflects best corporate governance practices, including the following: introduction of a competitive selection process for independent directors, gender quota for the Company's governing bodies, principles aimed at further reduction of involvement of the majority shareholder Samruk-Kazyna in the Company's operations, and other amendments aimed at improving corporate governance.

The new edition of Kazatomprom's Corporate Governance Code of is available on the Company's website.

Kazatomprom Group and Kansai Agree on Uranium Supply for Japanese NPPs

As announced on 22 December 2025 Kazatomprom group of companies and the Japanese utility Kansai Electric Power Co., Inc. ("Kansai") have signed an agreement for the supply of Kazakh uranium products (U3O8) for the Japanese nuclear power plants.

The agreement marks a significant milestone in establishing a sustainable supply chain for the Japanese nuclear industry, as the country continues the gradual restart of its nuclear fleet and its integration into to the national energy balance.

Kansai is one of Japan's leading utilities operating seven nuclear reactors across three power stations - Mihama, Takahama, and Ohi - recognised as some of the most robust and safe facilities in the country. Kansai has been a partner of Kazatomprom since 2006 through the "APPAK" LLP joint venture (Kazatomprom - 65%, Sumitomo - 25%, Kansai - 10%).

Amendments to the Subsoil Use Code of the Republic of Kazakhstan

Kazatomprom announced that on 26 December 2025, the President of the Republic of Kazakhstan signed a law on the "Amendments and Additions to the Code of the Republic of Kazakhstan 'On Subsoil and Subsoil Use' regarding the improvement of subsoil use in the hydrocarbon and uranium sectors" (the "Law").

Kazatomprom highlights the following key uranium-related changes introduced in the Law that impact its operations as the national company in the uranium sector (the "National Company").

Uranium Exploration at Prospective Areas

In accordance with the Law, the National Company is granted an option to reserve blocks containing uranium mineralisation and/or deposits, exploration licences for which are exclusively available to the National Company.

If uranium mineralisation and/or deposits are discovered on solid mineral blocks held by other subsoil users, license extensions for such areas are contingent upon the subsoil users relinquishing the relevant blocks to the State. Furthermore, should other subsoil users discover a uranium deposit within solid mineral formation, they do not acquire a right to uranium production.

Production Rights under New Subsoil Use Agreements

Should the National Company be awarded a new subsoil use agreement ("SUA") for uranium production, any subsequent transfer of the SUA is permitted only to a legal entity in which the National Company directly or indirectly holds an interest of more than 75%. The previous version of the Code allowed for such transfers to entities where the National Company held an interest of more than 50%. These new requirements apply exclusively to new SUAs and do not affect existing SUAs.

Extensions of SUA's Expiration Periods and Increases in Production/Reserve Volumes

The extension of the SUA's expiration periods, as well as increases in production volumes and/or uranium reserves beyond currently approved obligations (or levels) under the existing SUAs for uranium production, are permitted only if one of the following conditions is introduced to such SUA: the National Company's direct or indirect ownership interest in the joint venture holding such a SUA (JV) is at least 90%, or the foreign partner (shareholder) of a JV transfers uranium conversion and enrichment technologies to the National Company or to a jointly established legal entity under the terms specified in the Law. These terms include the construction of a plant and a guaranteed contract for at least 50% of the output of such a plant for the entire duration of the SUA extension.

Additional Regulatory Provisions

The amendments introduced by the Law also clarify the grounds for the early termination of SUAs. Specifically, these grounds now include cases involving the full depletion and/or development of uranium reserves under existing SUAs as of 1 January 2024, as well as the failure to fulfil obligations regarding the increase of the National Company's ownership interest or the transfer of conversion and enrichment technologies specified above.

Furthermore, the right to conduct additional exploration at producing uranium deposits is reserved exclusively for the National Company or entities in which the National Company holds at least a 90% interest. If additional exploration was conducted by another subsoil user after 1 January 2024 and resulted in an increase in uranium reserves, the right to such incremental reserves is not transferred to that subsoil user. Under such circumstances, the National Company is required to reimburse the actual exploration costs incurred, provided they are substantiated and verified by an independent auditor.

Kazatomprom emphasises that the regulatory changes do not entail revisions or changes of ownership interests in existing JVs within the parameters established under current SUAs.

Upcoming Transfer of the Akdala Deposit into Trust Management of Kazatomprom

State regulator has notified Kazatomprom on the upcoming termination of the subsoil use rights for the Akdala deposit due to expiration of its SUA term, and its further transfer to the trust management of Kazatomprom. SUA for exploration and production at Akdala deposit dated 28 March 2001 (the "Contract") is set to expire on 28 March 2026. In accordance with Article 164 of the Code of the Republic of Kazakhstan "On Subsoil and Subsoil Use", following the expiration of the Contract, the deposit shall be transferred under a trust management agreement to Kazatomprom as the National company. The subsoil use rights under this Contract belong to JV "SMCC" LLP (Kazatomprom - 30%, Uranium One - 70%).

It is estimated that upon expiration of the SUA, Akdala deposit is expected to have about 1,500 tonnes of remaining reserves that will require continued development. Based on current production rates, continuous mining is required until 2030 to prevent suspension or disruption of technological process. Therefore, the Company is exploring the possibility of securing a new SUA for production at Akdala deposit to maintain production capacity and ensure continuity of operations. It is worth mentioning that the terms of the initial Contract have been fully performed and settled, and all rights of JV "SMCC" LLP as the subsoil user under the initial Contract have been satisfied.

Throughout this transition, Kazatomprom remains committed to its key priorities: maintaining social stability, preserving highly qualified human capital, and ensuring operational continuity at the Akdala mine.

Kazatomprom's 2025 Fourth-Quarter and Full-Year Operational Results1

| Three months ended 31 December |

| Year ended 31 December |

| |||

|

| 2025 | 2024 | Change | 2025 | 2024 | Change |

Production volume U3O8 (100% basis)2 | tU | 7,130 | 6,519 | 9% | 25,839 | 23,270 | 11% |

Mlbs | 18.54 | 16.95 | 67.18 | 60.50 | |||

Production volume U3O8(attributable basis)3 | tU | 3,707 | 3,378 | 10% | 13,519 | 12,286 | 10% |

Mlbs | 9.64 | 8.78 | 35.15 | 31,94 | |||

Group U3O8 sales volume4 | tU | 5,719 | 5,030 | 14% | 18,495 | 16,670 | 11% |

Mlbs | 14.87 | 13.08 | 48.08 | 43.34 | |||

KAP U3O8 sales volume(incl. in Group)5 | tU | 2,588 | 2,918 | (11%) | 13,700 | 12,769 | 7% |

Mlbs | 6.73 | 7.59 | 35.62 | 33.20 | |||

Group average realized price6 | USD/lb U3O8 | 68.85 | 74.92 | (8%) | 65.10 | 69.48 | (6%) |

KAP average realized price7 | USD/lb U3O8 | 64.18 | 73.31 | (12%) | 62.01 | 65.78 | (6%) |

Average month-end spot price8 | USD/lb U3O8 | 79.12 | 76.75 | 3% | 73.54 | 85.14 | (14%) |

1 All values are preliminary.

2 Production volume U3O8 (100% basis): amounts represent the entirety of production of an entity in which the Company has an interest; it therefore disregards the fact that some portion of that production may be attributable to the Group's joint venture partners or other third party shareholders. Precise actual production volumes remain subject to converter adjustments and adjustments for in-process material.

3 Production volume U3O8 (tU) (attributable basis): production volumes are not equal to the volumes purchased by KAP. Amounts represent the portion of production of an entity in which the Company has an interest, which corresponds only to the size of such interest; it excludes the portion attributable to the JV partners or other third party shareholders, except for production from JV Inkai LLP, where the annual share of production and distribution is determined as per the Implementation Agreement, concluded between participants of the entity. Actual drummed production volumes remain subject to converter adjustments and adjustments for in-process material.

4 Group U3O8 sales volume: includes the sales of U3O8 by Kazatomprom and those of its consolidated subsidiaries (companies that KAP controls by having (i) the power to direct their relevant activities that significantly affect their returns, (ii) exposure, or rights, to variable returns from its involvement with these entities, and (iii) the ability to use its power over these entities to affect the amount of the Group's returns. The existence and effect of substantive rights, including substantive potential voting rights, are considered when assessing whether KAP has power to control another entity). For consistency, Group U3O8 sales volumes do not include other forms of uranium products (including, but not limited to the sales of fuel pellets and enriched uranium product (EUP)). Yet, some part of Group U3O8 production may go to the production of EUP, fuel pellets and fuel assemblies (FA) at Ulba-FA LLP.

5 KAP U3O8 sales volume (incl. in Group): includes only the total external sales of U3O8 of KAP HQ and TH Kazakatom AG (THK). Intercompany transactions between KAP HQ and THK are not included.

6 Group average realized price (USD/lb U3O8): average includes Kazatomprom's sales and those of its consolidated subsidiaries, as defined in parenthesis in footnote 4 above.

7 KAP average realized price (USD/lb U3O8): the weighted average price per pound for the total external sales of KAP HQ and THK. The pricing of intercompany transactions between KAP HQ and THK are not included.

8 Source: UxC LLC, TradeTech. Values provided are the average of the month-end uranium spot prices quoted by UxC and TradeTech, and not the average of each weekly quoted spot price throughout the month. Contract price terms generally refer to a month-end price.

* For some JVs, the Company has a right to purchase additional volumes beyond its attributable share if the JV partner chooses to forgo its entitled share.

** For JV Budenovskoye LLP, 100% of the 2024-2026 annual production is fully committed for supplying the needs of the Russian civil nuclear energy industry, under an offtake contract at market-related terms.

*** Please note the conversion of kgU to pounds U3O8 is 2.5998.

Production volumes in 2025, both on a 100% basis and on an attributable basis, increased compared to 2024 due to a higher 2025 production plan as per the Company's initial guidance.

In line with the Company's guidance and production plans, in 2025 Group and KAP sales volumes showed a noticeable increase compared to 2024. At the same time, KAP's sales volumes for the fourth quarter of 2025 were slightly lower relative to prior period due to timing of scheduled deliveries as per customer requests. Sales volumes can vary substantially each quarter, and quarterly sales volumes vary year to year due to variable timing of customer delivery requests during the year, and physical delivery activity.

Average realized prices for both the fourth quarter and the full-year were lower compared to the same periods in 2024 due to higher uranium spot prices as reported above. However, the 14% decline in the spot price during the reporting period had a limited effect on the Group's and KAP's average realized prices, with them decreasing only by 6% compared to the same period in 2024. The Company's current sales portfolio includes long-term contracts linked to the uranium spot prices, however certain deliveries under long-term contracts in 2025 incorporated a portion of fixed pricing components, including price ceilings that were negotiated during a different price environment.

Kazatomprom's 2026 Production and Sales Guidance

|

| 2026 | 2025 | |||

Production volume U3O8 (100% basis)1 | tU | 27,500 - 29,000 | 25,000 - 26,500 | |||

Mlbs | 71.49 - 75.39 | 64.99 - 68.89 | ||||

Production volume U3O8 (attributable basis)2 | tU | 14,500 - 15,500 | 13,000 - 14,000 | |||

Mlbs | 37.70 - 40.30 | 33.80 - 36.40 | ||||

Group U3O8 sales volume (consolidated)3 | tU | 19,500 - 20,500 | 17,500 - 18,500 | |||

Mlbs | 50.70 - 53.30 | 45.50 - 48.10 | ||||

Incl. KAP U3O8 sales volume (incl. in Group)4 | tU | 13,100 - 14,100 | 13,500 - 14,500 | |||

Mlbs | 34.06 - 36.66 | 35.10 - 37.70 | ||||

1 Production volume U3O8 (100% basis): Amounts represent the entirety of production of an entity in which the Company has an interest; it disregards that some portion of production may be attributable to the Group's JV partners or other third-party shareholders. Precise actual production volumes remain subject to converter adjustments and adjustments for in-process material.

2 Production volume U3O8 (attributable basis): Amounts represent the portion of production of an entity in which the Company has an interest, corresponding only to the size of such interest; it excludes the portion attributable to the JV partners or other third-party shareholders, except for JV Inkai LLP, where the annual share of production is determined as per Implementation Agreement. Precise actual production volumes remain subject to converter adjustments and adjustments for in-process material.

3 Group sales volume: includes the sales of U3O8 by Kazatomprom's sales and those of its consolidated subsidiaries (companies that KAP controls by having (i) the power to direct their relevant activities that significantly affect their returns, (ii) exposure, or rights, to variable returns from its involvement with these entities, and (iii) the ability to use its power over these entities to affect the amount of the Group's returns. The existence and effect of substantive rights, including substantive potential voting rights, are considered when assessing whether KAP has power to control another entity). For consistency, Group U3O8 sales volumes do not include other forms of uranium products (including, but not limited to, the sales of fuel pellets and EUP).

4 KAP sales volume: includes only the total external sales of U3O8 of KAP HQ and THK. Intercompany transactions between KAP HQ and THK are not included.

* For some JVs, the Company has a right to purchase additional volumes beyond its attributable share if the JV partner chooses to forgo its entitled share.

** For JV Budenovskoye LLP, 100% of the 2024-2026 annual production is fully committed for supplying the needs of the Russian civil nuclear energy industry, under an offtake contract at market-related terms.

*** Please note that the conversion of kgU to pounds U3O8 is 2.5998.

As was disclosed in the latest Competent Person's Report (CPR), published in August last year, Kazatomprom's 2026 nominal production levels (on a 100% basis) were revised from 32,777 tU (85.21 Mlbs) to 29,697 tU (77.21 Mlbs), representing about 3,000 tonnes (~8 Mlbs) or roughly a 10% decrease.

Kazatomprom's production volumes for 2026 are expected within the 27,500 - 29,000 tU (71.49 - 75.39 Mlbs) range on a 100% basis. Attributable to the Company, 2026 production volumes are expected at 14,500 - 15,500 tU (37.70 - 40.30 Mlbs). The 2026 production guidance remains subject to sulphuric acid availability.

For 2026, the Group's sales volume is expected to be in the range of 19,500 - 20,500 tU (50.70 - 53.30 Mlbs), including KAP sales volume of 13,100 - 14,100 tU (34.06 - 36.66 Mlbs).

The year-on-year increase in production is primarily driven by the planned JV Budenovskoye ramp-up and corresponding growth of its output, 100% of which is fully reserved under an offtake contract for the period from 2024 to 2026 as was previously disclosed. Increase in production from other mines is aimed at building up and maintaining a comfortable level of the Company's inventories. Such a strategic approach enables the Company to ensure uninterrupted fulfillment of its contractual obligations to clients, including in the event of possible production constraints, and to capture additional value amid the widening gap between supply and demand.

Kazatomprom remains fully committed to its value-over-volume strategy and the disciplined market approach.

The Company's financial guidance for 2026 will be provided with the FY2025 Operating and Financial Review.

Conference Call Notification - FY2025 Operating and Financial Review

Kazatomprom expects to schedule a conference call to discuss the FY2025 financial results after they are released on Friday, 20 March 2026. Further details will be provided closer to the date of the event.

For more information, please contact:

Investor Relations Inquiries

Botagoz Muldagaliyeva, Director, Investor Relations

Tel: +7 7172 45 81 80 / 69

Email: [email protected]

Public Relations and Media Inquiries

Daniyar Oralov, Director, Public Relations

Tel: +7 7172 45 80 63

Email: [email protected]

A copy of this announcement is available at www.kazatomprom.kz.

About Kazatomprom

Kazatomprom is the world's largest producer of uranium with the Company's attributable production representing approximately 21% of global primary uranium production in 2024. The Group benefits from the largest reserve base in the industry and operates, through its subsidiaries, JVs and Associates, 27 deposits grouped into 14 mining assets. All of the Company's mining operations are located in Kazakhstan and extract uranium using ISR technology with a focus on maintaining industry-leading health, safety and environment standards.

Kazatomprom securities are listed on the London Stock Exchange and Astana International Exchange. Kazatomprom is the national atomic company in the Republic of Kazakhstan. The Group's primary customers are operators of nuclear generation capacity, the principal export markets for the Group's products are Asia, Europe, and North America. The Group sells uranium and uranium products under long-term contracts, short-term contracts, as well as in the spot market, directly from its headquarters in Astana, Kazakhstan, and through its Switzerland-based trading subsidiary, TH Kazakatom AG (THK).

For more information, please see the Company website at www.kazatomprom.kz.

Forward-looking statements

All statements other than statements of historical fact included in this communication or document are forward-looking statements. Forward-looking statements give the Company's current expectations and projections relating to its financial condition, results of operations, plans, objectives, future performance and business. These statements may include, without limitation, any statements preceded by, followed by or including words such as "target," "believe," "expect," "aim," "intend," "may," "anticipate," "estimate," "plan," "project," "will," "can have," "likely," "should," "would," "could" and other words and terms of similar meaning or the negative thereof. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors beyond the Company's control that could cause the Company's actual results, performance or achievements to be materially different from the expected results, performance or achievements expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding the Company's present and future business strategies and the environment in which it will operate in the future.

THE INFORMATION WITH RESPECT TO ANY PROJECTIONS PRESENTED HEREIN IS BASED ON A NUMBER OF ASSUMPTIONS ABOUT FUTURE EVENTS AND IS SUBJECT TO SIGNIFICANT ECONOMIC AND COMPETITIVE UNCERTAINTY AND OTHER CONTINGENCIES, NONE OF WHICH CAN BE PREDICTED WITH ANY CERTAINTY AND SOME OF WHICH ARE BEYOND THE CONTROL OF THE COMPANY. THERE CAN BE NO ASSURANCES THAT THE PROJECTIONS WILL BE REALISED, AND ACTUAL RESULTS MAY BE HIGHER OR LOWER THAN THOSE INDICATED. NONE OF THE COMPANY NOR ITS SHAREHOLDERS, DIRECTORS, OFFICERS, EMPLOYEES, ADVISORS OR AFFILIATES, OR ANY REPRESENTATIVES OR AFFILIATES OF THE FOREGOING, ASSUMES RESPONSIBILITY FOR THE ACCURACY OF THE PROJECTIONS PRESENTED HEREIN.

The information contained in this communication or document, including but not limited to forward-looking statements, applies only as of the date hereof and is not intended to give any assurances as to future results. The Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to such information, including any financial data or forward-looking statements, and will not publicly release any revisions it may make to the Information that may result from any change in the Company's expectations, any change in events, conditions or circumstances on which these forward-looking statements are based, or other events or circumstances arising after the date hereof.

Related Shares:

Kazatomprom S