3rd Nov 2025 07:00

AIX: KAP, KAP.Y (GDR)

AIX: KAP, KAP.Y (GDR)

LSE: KAP (GDR)

3 November 2025, Astana, Kazakhstan

Kazatomprom 3Q25 Operations and Trading Update

National Atomic Company "Kazatomprom" JSC ("Kazatomprom", "KAP" or "the Company") announces the following operations and trading update for the third quarter and nine months ended 30 September 2025.

This update provides a summary of recent developments in the uranium industry, as well as provisional information related to the Company's key third-quarter and nine-months operating and trading results. The information contained in this Operations and Trading Update may be subject to change.

Market Overview

The 50th anniversary World Nuclear Symposium, held 3-5 September in London, brought together over a thousand experts, policymakers, finance leaders, as well as tech and energy decision-makers. The event demonstrated an unprecedented level of support for the nuclear industry. The World Nuclear Fuel Report 2025, published at the event, reinforced forecasts of a long-term demand growth, which is projected to reach 150,525 tU (~391 million pounds U3O8) by 2040, up from current requirements of 68,920 tU (~179 million pounds U3O8). However, the global uranium supply may halve between 2030 and 2040 due to resource depletion unless significant investments in greenfield projects are made, according to the World Nuclear Fuel Report 2025.

During another industry gathering, the World Atomic Week held 25-28 September in Moscow, a series of major deals and announcements were made, including:

· Russian President highlighted the proximity of the future uranium supply shortage, with 8 million tonnes (21 billion pounds) of uranium resources to be potentially exhausted by 2090, or as early as 2060, under the future demand projections, depending on the OECD estimates scenario;

· Rosatom and the Ethiopian Electric Power Corporation signed an action plan for developing a nuclear power plant (NPP) project in Ethiopia, including the establishment of working group and preparation of a roadmap for a feasibility study and intergovernmental agreement;

· Uzbekistan and Russia signed two agreements: first, to expand on the earlier arrangements and define the integrated NPP's layout, combining two VVER‑1000 units and two small modular reactors (SMRs) RITM‑200N. The second agreement covers the key terms for future fuel supply contracts;

· Rosatom and Iran's Atomic Energy Organization signed a Memorandum of Understanding for cooperation in the building of SMRs in Iran.

Yellow Cake PLC initiated a raise of US$125 million to exercise its 2025 purchase option of up to US$100 million worth of U3O8 from Kazatomprom, under the existing Framework Agreement. Due to strong investor demand, the share placement was upsized to US$175 million. Additional proceeds are intended to be used for identified value accretive purchase opportunities.

Following the adoption of four Executive Orders in May aimed at accelerating the expansion of nuclear energy in the United States, several downstream producers announced major development milestones:

· Urenco USA received authorisation from U.S. regulators to enrich uranium up to 10%, potentially becoming the first commercial enricher to produce LEU+. The milestone is a part of Urenco USA's broader expansion plans to add 700,000 Separative Work Units (SWU) of new capacity between 2025-2027 and increase the plant's capacity by 15%. In the Netherlands, Urenco announced plans to bring online additional 1.5 million SWU by 2030;

· Global Laser Enrichment's Test Loop facility in Wilmington, North Carolina, demonstrated the commercial viability of laser enrichment as a result of a large-scale technology testing campaign. The company is set to begin commercial enrichment operations in early 2030s;

· Uranium Energy Corp (UEC), a uranium producer with projects' combined licensed annual capacity of 12.1 million pounds U3O8 (~4,654 tU), launched a new subsidiary, United States Uranium Refining & Conversion. The proposed facility has a planned capacity of 10,000 tU per year as UF6. This represents a "substantial share" of the U.S. demand of 18,000 tU per year, according to the UEC statement;

· U.S. Department of Energy selected four producers - Terrestrial Energy, TRISO-X, Valar Atomics, and Oklo - to build advanced nuclear fuel lines under the state Fuel Line Pilot Program, which addresses the shortage of domestic nuclear fuel resources.

Following the selection of Rosatom as the leader of the consortium to build Kazakhstan's first NPP, the potential site survey works commenced to determine the exact plant location. Furthermore, Kazakhstan's First Deputy Prime Minister announced that China National Nuclear Corporation (CNNC), or other Chinese companies, would potentially build Kazakhstan's second and third NPPs.

The SMR market, which is projected to reach the capacity of 49 GWe by 2040, according to the Nuclear Fuel Report 2025, was also marked by major developments around the world in the latest quarter:

· Amazon released a statement on the progress of the Cascade Advanced Energy Facility, a complex which is to feature up to 12 X-energy's SMRs and supply from 320 to 960 MWe for Amazon's data centers in Washington state in cooperation with Energy Northwest;

· CNNC completed the cold testing of its 125 MWe ACP100, the world's first land-based commercial SMR, a key step before the final stages of testing to begin commercial operation;

· The study by X-energy Canada confirmed the feasibility of repurposing an existing thermal generation site in Alberta with X-energy's SMRs;

· Tennessee Valley Authority (TVA) and Kairos Power, the developer of Hermes 2 SMR, signed a Power Purchase Agreement to deliver up to 50 MW to power Google data centers in Tennessee and Alabama by 2030;

· Korea Hydro & Nuclear Power signed an agreement with Zimbabwe's Centre for Education, Innovation Research and Development (CEIRD) to cooperate on a preliminary feasibility study for the deployment of a 150 MWe i-SMR.

During the reporting period, events impacting the demand market included:

· UK's Heysham and Hartlepool NPPs, operated by EDF Energy, received extensions to continue operating until March 2028;

· In Belgium, Unit 1 of Tihange NPP, with a 962 MWe pressurised water reactor, was taken offline and disconnected from the grid after 50 years of operation;

· U.S. Nuclear Regulatory Commission approved the Subsequent License Renewal applications filed by operator NextEra Energy for Units 1 and 2 of the Point Beach NPP for an additional 20 years, with Unit 1 now licensed through October 2050 and Unit 2 - through March 2053;

· Japan's Nuclear Regulation Authority concluded that Unit 3 of Hokkaido Electric Power Company's Tomari NPP meets revised safety standards, which allows the operator to progress toward the unit restart planned for 2027;

· The Canadian Nuclear Safety Commission renewed the license for the Darlington NPP for a 20-year term, authorizing Ontario Power Generation to operate the facility until 2045. The plant has four CANDU units, supplying 20% of Ontario's electricity needs.

On the supply side:

· Denison Mines Corp. received Canada's Ministerial approval under the Environment Assessment Act to proceed with the development of the Wheeler River's Phoenix ISR mine, which is scheduled to begin production in 2029. The producer also released the results of the Preliminary Economic Assessment for its 25.17%-owned Midwest Main uranium deposit, outlining total ISR mine production (on a 100% basis) of 37.4 million pounds U3O8 (14,386 tU) over a 6 year mine life;

· Rosatom commenced development of the Shirondukuyskoye uranium deposit in eastern Siberia, with plans to start production in 2028. The deposit has estimated reserves of 8,000 tU (~20.8 million pounds U3O8);

· Peninsula Energy Ltd. announced the production of the first dried yellowcake from its recent restart of the Lance Central Processing Plant in Wyoming. The plant is designed to process uranium from Peninsula's satellite projects, with a goal towards the nameplate capacity of ~2 million pounds U3O8 (~770 tU) per year;

· Lotus Resources' Kayelekera mine in Malawi produced its first yellowcake since 2014, when it was put into care and maintenance by the previous owner. The mine's production is scheduled to ramp up to 2.4 million pounds U3O8 (~923 tU) per year at the beginning of 2026;

· The pilot uranium processing plant was commissioned at the Mkuju River project in Tanzania. Partially owned by Rosatom's subsidiary, Mantra Tanzania Ltd, it will be used to test uranium processing technologies for the main processing complex, with a nameplate capacity of 3,000 tU (~7.6 million pounds U3O8) per year, which is scheduled to be commissioned in 2029;

· World Bank's International Centre for Settlement of Investment Disputes ordered Niger to halt the sale or transfer of uranium mined at SOMAÏR joint mining venture before Orano suspended operations. According to the French producer 1,500 tU (~3.9 million pounds U3O8) are stockpiled at SOMAÏR now.

Market Pricing and Activity

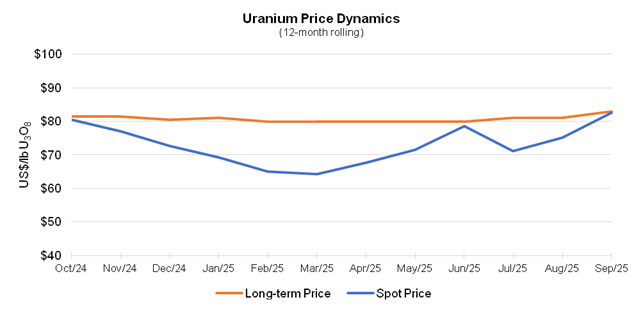

* Average of UxC and TradeTech reported prices

The first weeks of July demonstrated low buying interest. The activity picked up in the second half of the month, but the price remained at the US$70.85/lb U3O8 level. As of the beginning of August, the spot price was in the upper US$72/lb U3O8 range rising to $74.48/lb U3O8by the end of the month. Commonly low activity in the beginning of September due to the WNA Symposium reflected at the price levels remaining at the US$75/lb. Following Yellow Cake's placement and increased buying activity of Sprott Physical Uranium Fund, which purchased over 5.8 million pounds U3O8 (~2,230 tU) after its US$200 million raise in June, the spot price jumped to $82.38/lb U3O8 at the end of September.

According to third-party assessments, during the first nine months of 2025 spot market participants purchased 31.4 million pounds U3O8 (~12,077 tU) at an average weekly spot price of $70.91/lb U3O8, compared to 27.3 million pounds U3O8 (~10,480 tU) at an average weekly spot price of $88.92/lb U3O8 for the same reporting period last year. Thus, the volume of spot transactions for the nine months of 2025 increased by 15% year-on-year, whilst the average weekly spot price declined by 20% for the same reporting period.

An increase in long-term market activity in Q3 2025, primarily driven by the U.S. utilities, resulted in a moderate price rise in term price to $83/lb U3O8 (published by third-party sources on a monthly basis). Although total transaction volumes for the 9 months 2025 amounted to 44 million pounds U3O8 (~15,270 tU) - a 17% decline compared to 53 million pounds U3O8 (~17,000 tU) for the same period in 2024 - this recent upward change in the long-term price reflected the continued dynamics of growing uncovered demand and supply-side constraints.

Company Developments

Kazatomprom Mine Tour

The Company hosted its regular mine tour on 8-9 September, bringing together interested stakeholders from all over the world. The mine tour included visits to the sites of Kazatomprom-SaUran LLP and JV KATCO LLP in Turkestan region providing an opportunity for the participants to see the full cycle of ISR uranium production and processing. Participants had a chance to witness the highest level of compliance of all operations and activities to the leading environmental and social standards.

Participants expressed their highest consideration and appreciation to the level of professionalism and expertise of site workers and its management team. Analysts were able to verify that Kazatomprom as an ESG-compliant and low-risk jurisdiction is fully capable of keeping its leadership position as a reliable supplier of natural uranium.

Credit Rating

On 10 September, Moody's published a periodic review of the Company's credit rating. Kazatomprom's rating ("Baa1", outlook - "Stable") remains unchanged.

The Company's rating reflects its strong financial and low-cost positions, leading share of about 20% in the global uranium production and second-largest uranium reserve base globally, strong business fundamentals, solid operational diversification, and a wide sales geography.

Corresponding Moody's press release can be accessed at the following link.

EGM results

On 21 October, Kazatomprom announced the results of its absentee Extraordinary General Meeting of Shareholders. The EGM has approved the conclusion of the Letter Agreement No. 3 to the Long-term contract with CNNC Overseas Limited for the sale and purchase of natural uranium concentrates as well as the updated version of the Long-term agreement for the sale and purchase of natural uranium concentrates with China National Uranium Corporation Limited.

Detailed information on the EGM voting results is available on the Company's website.

EGM notice on approval of a new version of the Corporate Governance Code

On 31 October 2025, the Company announced the Board of Directors decision to convene an EGM in order to approve a new edition of the Corporate Governance Code of National Atomic Company "Kazatomprom" Joint Stock Company, which reflects best corporate governance practices and mirrors the updated Corporate Governance Code of the majority shareholder - Samruk-Kazyna JSC ("the Fund"). The key new provisions of the Code include introduction of a competitive selection process for independent directors, gender quota for the Company's governing bodies, principles aimed at further reduction of the Fund's interference in the Company's operations, and other amendments aimed at bringing the current edition of the Code up to date.

The notice of the upcoming EGM, scheduled on 19 December 2025, is available on the Company's website, www.kazatomprom.kz.

Kazatomprom's 2025 Third-Quarter and Nine-Months Operational Results1

| Three months ended 30 September |

| Nine months ended 30 September |

| |||

|

| 2025 | 2024 | Change | 2025 | 2024 | Change |

Production volume U3O8 (100% basis)2 | tU | 6,467 | 5,894 | 10% | 18,709 | 16,751 | 12% |

Mlbs | 16.81 | 15.32 | 48.64 | 43.55 | |||

Production volume U3O8(attributable basis)3 | tU | 3,375 | 3,130 | 8% | 9,806 | 8,908 | 10% |

Mlbs | 8.78 | 8.14 | 25.49 | 23.16 | |||

Group U3O8 sales volume4 | tU | 5,151 | 3,860 | 33% | 12,776 | 11,639 | 10% |

Mlbs | 13.39 | 10.04 | 33.22 | 30.26 | |||

KAP U3O8 sales volume(incl. in Group)5 | tU | 4,124 | 3,133 | 32% | 11,111 | 9,850 | 13% |

Mlbs | 10.72 | 8.15 | 28.89 | 25.61 | |||

Group average realized price6 | USD/lb U3O8 | 68.78 | 68.05 | 1% | 62.97 | 66.81 | -6% |

KAP average realized price7 | USD/lb U3O8 | 67.75 | 65.64 | 3% | 61.37 | 63.46 | -3% |

Average month-end spot price8 | USD/lb U3O8 | 76.28 | 81.58 | -6% | 71.68 | 87.93 | -18% |

1 All values are preliminary.

2 Production volume U3O8 (100% basis): amounts represent the entirety of production of an entity in which the Company has an interest; it therefore disregards the fact that some portion of that production may be attributable to the Group's joint venture partners or other third party shareholders. Precise actual production volumes remain subject to converter adjustments and adjustments for in-process material.

3 Production volume U3O8 (tU) (attributable basis): are is not equal to the volumes purchased by KAP. Amounts represent the portion of production of an entity in which the Company has an interest, which corresponds only to the size of such interest; it excludes the portion attributable to the JV partners or other third party shareholders, except for production from JV Inkai LLP, where the annual share of production is determined as per the Implementation Agreement, concluded between participants of the entity, according to which the share of the second shareholder of JV Inkai LLP was recalculated based on 2024 production results. Actual drummed production volumes remain subject to converter adjustments and adjustments for in-process material.

4 Group U3O8 sales volume: includes the sales of U3O8 by Kazatomprom and those of its consolidated subsidiaries (companies that KAP controls by having (i) the power to direct their relevant activities that significantly affect their returns, (ii) exposure, or rights, to variable returns from its involvement with these entities, and (iii) the ability to use its power over these entities to affect the amount of the Group's returns. The existence and effect of substantive rights, including substantive potential voting rights, are considered when assessing whether KAP has power to control another entity). For consistency, Group U3O8 sales volumes do not include other forms of uranium products (including, but not limited to the sales of fuel pellets and enriched uranium product (EUP)). Yet, some part of Group U3O8 production may go to the production of EUP, fuel pellets and fuel assemblies (FA) at Ulba-FA LLP.

5 KAP U3O8 sales volume (incl. in Group): includes only the total external sales of U3O8 of KAP HQ and Trade House KazakAtom AG (THK). Intercompany transactions between KAP HQ and THK are not included.

6 Group average realized price (USD/lb U3O8): average includes Kazatomprom's sales and those of its consolidated subsidiaries, as defined in parenthesis in footnote 4 above.

7 KAP average realized price (USD/lb U3O8): the weighted average price per pound for the total external sales of KAP HQ and THK. The pricing of intercompany transactions between KAP HQ and THK are not included.

8 Source: UxC LLC, TradeTech. Values provided are the average of the month-end uranium spot prices quoted by UxC and TradeTech, and not the average of each weekly quoted spot price throughout the month. Contract price terms generally refer to a month-end price.

* For some JVs, the Company has a right to purchase additional volumes beyond its attributable share if the JV partner chooses to forgo its entitled share.

** For JV Budenovskoye LLP, 100% of the 2024-2026 annual production is fully committed for supplying the needs of the Russian civil nuclear energy industry, under an offtake contract at market-related terms.

*** Please note the conversion of kgU to pounds U3O8 is 2.5998.

Production on both a 100% basis and an attributable basis was higher in the first nine months of 2025 compared to the same period in 2024, due to an increase in 2025 production plan in line with the Company's guidance for 2025 compared to 2024.

For the nine months of 2025, sales volume for the Group and KAP saw a noticeable increase compared to the same period in 2024. The variation in sales volumes at both the Group and KAP levels is due to the timing of customers' requests of scheduled deliveries. Sales volumes can vary substantially each quarter, and quarterly sales volumes vary year to year due to variable timing of customer delivery requests during the year, and physical delivery activity.

The 18% decline in the spot price during the reporting period had a limited effect on the Group's and Kazatomprom's average realized prices, with them decreasing by 6% and 3%, respectively, compared to the same period in 2024. The Company's current sales portfolio includes long-term contracts linked to the uranium spot prices. Certain deliveries under long-term contracts in 2025 incorporated a portion of fixed pricing components, including price ceilings that were negotiated during a different price environment.

In the uranium market, the trends in quarterly metrics and interim results are rarely representative of annual expectations; for annual expectations, please see the Company's guidance metrics, as well as its price sensitivity table from section 10.1 Uranium sales price sensitivity analysis, in the Company's Operating and Financial Review six months ended 30 June 2025.

Kazatomprom's 2025 Updated Guidance

|

| Updated Guidance for 2025 | Previous Guidance for 2025 |

|

| 525 KZT/1 USD | 520 KZT/1 USD |

Production volume U3O8(100% basis)1, 2 | tU | 25,000 - 26,500 | 25,000 - 26,500 |

Mlbs | 64.99 - 68.89 | 64.99 - 68.89 | |

Production volume U3O8(attributable basis)2,3 | tU | 13,000 - 14,000 | 13,000 - 14,000 |

Mlbs | 33.79 - 36.40 | 33.79 - 36.40 | |

Group sales volume(consolidated)4 | tU | 17,500 - 18,500 | 17,500 - 18,500 |

Mlbs | 45.50 - 48.10 | 45.50 - 48.10 | |

Incl. KAP sales volume(included in Group sales volume)5 | tU | 13,500 - 14,500 | 13,500 - 14,500 |

Mlbs | 35.10 - 37.70 | 35.10 - 37.70 | |

Revenue - consolidated6 | KZT bln | 1,750 - 1,850 | 1,600 - 1,700 |

Revenue from Group U3O8 sales6 | KZT bln | 1,550 - 1,650 | 1,400 - 1,500 |

C1 cash cost (attributable basis)* | USD/lb | 17.00 - 18.50 | 16.50 - 18.00 |

All-in sustaining cash cost(attributable C1 + capital cost)* | USD/lb | 29.00 - 30.50 | 29.00 - 30.50 |

Total capital expenditures of mining entities(100% basis)7 | KZT bln | 385 - 415 | 385 - 415 |

1 Production volume U3O8 (tU) (100% basis): amounts represent the entirety of production of an entity in which the Company has an interest; it disregards that some portion of production may be attributable to the Group's JV partners or other third-party shareholders. Precise actual production volumes remain subject to converter adjustments and adjustments for in-process material.

2 The duration and full impact including, but not limited to sanctions pressure due to the Russian-Ukrainian conflict and limited access to some key materials are not known. As a result, annual production volumes may differ from internal expectations.

3 Production volume U3O8 (tU) (attributable basis): amounts represent the portion of production of an entity in which the Company has an interest, corresponding only to the size of such interest; it excludes the portion attributable to the JV partners or other third-party shareholders, except for JV Inkai LLP, where annual share of production on attributable basis is determined by the Implementation Agreement, concluded between participants of the entity. For JV Budenovskoye LLP, 100% of the 2024-2026 annual production is fully committed for supplying the needs of the Russian civil nuclear energy industry, under an offtake contract at market-related terms.

4 Group sales volume: includes Kazatomprom's sales and those of its consolidated subsidiaries - companies that KAP controls by having (i) the power to direct their relevant activities that significantly affect their returns, (ii) exposure, or rights, to variable returns from its involvement with these entities, and (iii) the ability to use its power over these entities to affect the amount of the Group's returns. The existence and effect of substantive rights, including substantive potential voting rights, are considered when assessing whether KAP has power to control another entity). Group U3O8 sales volumes do not include other forms of uranium products (including, but not limited to, the sales of fuel pellets and enriched uranium).

5 KAP sales volume (included in Group sales volume): includes only the total external sales of KAP HQ and THK. Intercompany transactions between KAP HQ and THK are not included.

6 Revenue expectations are based on uranium prices and KZT/USD exchange rate taken at a single point in time from third-party sources. The prices and KZT/USD exchange rate used do not reflect any internal estimate from Kazatomprom, and 2025 revenue could be materially impacted by how actual uranium prices and KZT/USD exchange rates vary from the third-party estimates.

7 Total capital expenditures (100% basis): represents only capital expenditures of the mining entities, including significant CAPEX for investment and expansion projects. For 2025 total development costs for mining infrastructure of JV Budenovskoye LLP, JV Katco LLP (South Tortkuduk) and MC Ortalyk LLP (Zhalpak) amount to approximately KZT 153 billion. Excludes liquidation funds and closure costs.

* For some JVs, the Company has a right to purchase additional volumes beyond its attributable share if the JV partner chooses to forgo its entitled share of production (beyond the production volume attributable to Company).

** Please note that the conversion ratio of kgU to pounds U3O8 is 2.5998.

Taking into account how the actual spot and exchange rate metrics for the nine months of 2025 resulted and the Company's expectations for the fourth quarter, certain forecasts such as Consolidated revenue, Revenue from Group U3O8 sales, and C1 сash сost are expected to be higher than initially guided for the year (as disclosed in FY2024 Operating and Financial Review). Increases in the spot price and the KZT/USD exchange rate (compared to the initially used assumptions) impact both revenue and C1 cash cost, where Mineral Extraction Tax is a significant component. As a result, the Company is increasing Guidance ranges for these indicators based on updated spot price and exchange rate assumptions compared to the originally budgeted forecast estimates.

The Company only intends to update annual guidance in relation to operational factors and internal changes that are within its control. Key assumptions used for external metrics, such as exchange rates and uranium prices, are established using third-party sources during the Company's annual budget process in the previous year; such assumptions will only be updated on an interim basis in exceptional circumstances.

For more information, please contact:

Investor Relations Inquiries

Botagoz Muldagaliyeva, Director, Investor Relations

Tel: +7 7172 45 81 80 / 69

Email: [email protected]

Public Relations and Media Inquiries

Daniyar Oralov, Director, Public Relations

Tel: +7 7172 45 80 63

Email: [email protected]

About Kazatomprom

Kazatomprom is the world's largest producer of uranium with the Company's attributable production representing approximately 21% of global primary uranium production in 2024. The Group benefits from the largest reserve base in the industry and operates, through its subsidiaries, JVs and Associates, 27 deposits grouped into 14 mining assets. All of the Company's mining operations are located in Kazakhstan and extract uranium using ISR technology with a focus on maintaining industry-leading health, safety and environment standards.

Kazatomprom securities are listed on the London Stock Exchange and Astana International Exchange. Kazatomprom is the national atomic company in the Republic of Kazakhstan. The Group's primary customers are operators of nuclear generation capacity, the principal export markets for the Group's products are Asia, Europe, and North America. The Group sells uranium and uranium products under long-term contracts, short-term contracts, as well as in the spot market, directly from its headquarters in Astana, Kazakhstan, and through its Switzerland-based trading subsidiary, Trade House KazakAtom AG (THK).

For more information, please see the Company website at www.kazatomprom.kz.

Forward-looking statements

All statements other than statements of historical fact included in this communication or document are forward-looking statements. Forward-looking statements give the Company's current expectations and projections relating to its financial condition, results of operations, plans, objectives, future performance and business. These statements may include, without limitation, any statements preceded by, followed by or including words such as "target," "believe," "expect," "aim," "intend," "may," "anticipate," "estimate," "plan," "project," "will," "can have," "likely," "should," "would," "could" and other words and terms of similar meaning or the negative thereof. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors beyond the Company's control that could cause the Company's actual results, performance or achievements to be materially different from the expected results, performance or achievements expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding the Company's present and future business strategies and the environment in which it will operate in the future.

THE INFORMATION WITH RESPECT TO ANY PROJECTIONS PRESENTED HEREIN IS BASED ON A NUMBER OF ASSUMPTIONS ABOUT FUTURE EVENTS AND IS SUBJECT TO SIGNIFICANT ECONOMIC AND COMPETITIVE UNCERTAINTY AND OTHER CONTINGENCIES, NONE OF WHICH CAN BE PREDICTED WITH ANY CERTAINTY AND SOME OF WHICH ARE BEYOND THE CONTROL OF THE COMPANY. THERE CAN BE NO ASSURANCES THAT THE PROJECTIONS WILL BE REALISED, AND ACTUAL RESULTS MAY BE HIGHER OR LOWER THAN THOSE INDICATED. NONE OF THE COMPANY NOR ITS SHAREHOLDERS, DIRECTORS, OFFICERS, EMPLOYEES, ADVISORS OR AFFILIATES, OR ANY REPRESENTATIVES OR AFFILIATES OF THE FOREGOING, ASSUMES RESPONSIBILITY FOR THE ACCURACY OF THE PROJECTIONS PRESENTED HEREIN.

The information contained in this communication or document, including but not limited to forward-looking statements, applies only as of the date hereof and is not intended to give any assurances as to future results. The Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to such information, including any financial data or forward-looking statements, and will not publicly release any revisions it may make to the Information that may result from any change in the Company's expectations, any change in events, conditions or circumstances on which these forward-looking statements are based, or other events or circumstances arising after the date hereof.

Related Shares:

Kazatomprom S