21st Nov 2025 07:00

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the UK Market Abuse Regulation

21 November 2025

Panthera Resources Plc

("Panthera" or "the Company")

Kalaka Metallurgical Study Results

Gold exploration and development company Panthera Resources Plc (AIM:PAT), with gold assets in West Africa and India, is pleased to advise that positive results have been returned for CIL bottle roll tests and Column leach tests that have been carried out on bulk composite samples from the Kalaka deposit in Mali.

Highlights

Results achieved indicate that:

· The ores are amenable to cyanide leaching.

· CIL extractions can achieve excellent results - recovery average of 93.4%.

· Column leach tests confirm the ore is amenable to heap leaching - recovery average of 76.3%.

Commenting on the results, Mark Bolton, Managing Director of Panthera said:

"The positive results from this metallurgical testing together with the previously reported favourable Bottle Roll and Leachwell test results further underpin our growing confidence in the potential at Kalaka, which is a significant mineralised gold system.

Albeit preliminary in nature, this test programme was expansive, and represents an important milestone towards assessing the potential for Kalaka mineralisation to be developed."

Metallurgical Test Work - Results

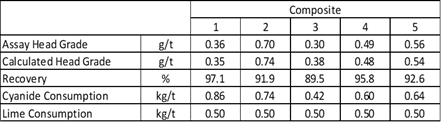

Bottle roll tests for CIL leaching Tests incorporating a 2-hour Oxygen Conditioning have achieved excellent results (Table 1):

TABLE 1

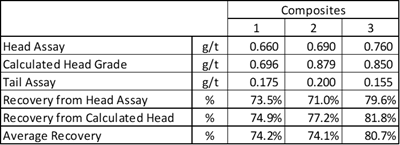

The Column Leach Test Results Completed by Intertek on bulk samples of plus 30kg 10mm crush size samples leached over a 90-day period (Table 2) showed an overall performance of:

TABLE 2

These are reasonable results and suitable for heap leaching.

The metallurgical test work was carried out by Intertek, Tarkwa, Ghana. Intertek Group plc is publicly listed on the London Stock exchange and is a FTSE 100 company. Intertek is a leading Total Quality Assurance provider to industries worldwide. The Tarkwa laboratory is accredited ISO17025 standard by SANAS.

Sample Selection and Collection

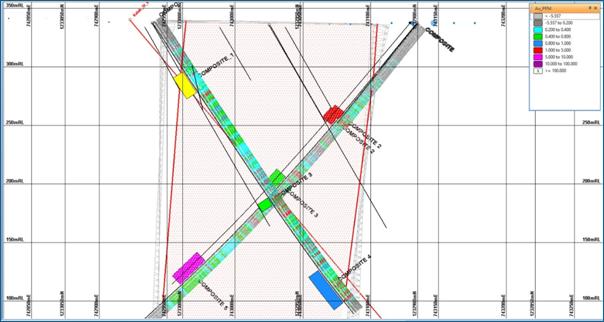

The Company collected five composite core samples from recently drilled diamond drill holes. These were selected based on geological similarities and to provide comparisons for different areas of the deposit. A section showing locations is shown in Figure 1. The bulk samples were collected under supervision of the company's Manager Mali and shipped to Intertek in Ghana via DHL.

Figure 1: Location of Kalaka Section showing Metallurgical sample locations

TABLE 3

*Note that the column "ESTIMATED GRADE g/t Au" refers to arithmetic average of the original drill core sampling completed by 50g Fire Assay for gold at SGS Laboratory Bamako

Intertek Process Methodology

The samples upon receipt were registered into Intertek Laboratory management system (MinLims) and sorted. The wet weight of each sample is accurately weighed and recorded, and the samples dried individually at 105°C. After drying, the dry weight of each sample is recorded. The samples were coarse crushed to 10mm using the Boyd crusher and split into 10Kg lots. A 10Kg split will be further crushed to 2mm and subjected to subsequent head grade and CIL bottle roll processes. The 10mm splits will be utilized for the column leach test.

Head Grade

A 1Kg aliquot is assayed for gold by duplicate 50g fire assay.

Standard CIL Test

A 1Kg portion of each portion was milled to 80% passing 75μm and leached for 24 hours under the following conditions

• Intertek tap water 50% solids

• pH 10.5 maintain >10 with quicklime

• 20g/L carbon

• 500ppm NaCN

A subsequent test was completed where the CIL leaching Tests incorporated a 2-hour Oxygen Conditioning.

Head Sample size by size assay

One of the 5Kg sub splits is taken and split into 1kg lots and subjected to head grade and size by size assay analysis on a 10mm,6.3mm,2.5mm,1mm,300μm,212μm and 150μm screen arrangement.

10-day coarse bottle roll

A kilo of the crushed sample is subjected to a 10-day coarse bottle roll to ascertain the leach kinetics and reagent consumption of the sample prior to the column leach.

Column Leach

30kg of the crushed 10mm sample is agglomerated if required using 10kg/t cement, tumbled in a cement mixer, and allowed to cure for 5 days. The cured sample is loaded into a column gently, with the column at an angle to prevent packing. The initial height is marked and recorded. Photo below showing the test leach columns:

Photo of Kalaka sample testing.

An NaCN lixiviant at 500ppm concentration is dosed at the application rate unto the ore and the volume measured together with the pregnant solution every twenty-four hours.

The pH of the pregnant solution is recorded every twenty-four hours and the solution assayed for gold. The final height is marked and recorded, and the column washed thoroughly with water for three days when the leaching is complete (test run for appropriate number of days). The residue is spread and allowed to dry.

The residue after the test is assayed for the mineral of interest content and a size-by-size analysis conducted as well.

The initial response up to 30 days was poor at which point the dissolved oxygen (DO) was increased to 10 - 15 ppm and the leach rate immediately increased. The DO was later increased to >15 at 40 days.

CIC

The pregnant solution was contacted with carbon in a column (CIC) to remove the Au from solution. After a 4-hour contact with carbon, the barren solution was removed. The volume, pH, Au and NaCN concentration was measured.

Tail sample size by size assay

The residue after the test is completed and thoroughly washed is assayed for the mineral of interest and a size-by-size assay is conducted on the same set of screens as the head sample.

Kalaka Project Background

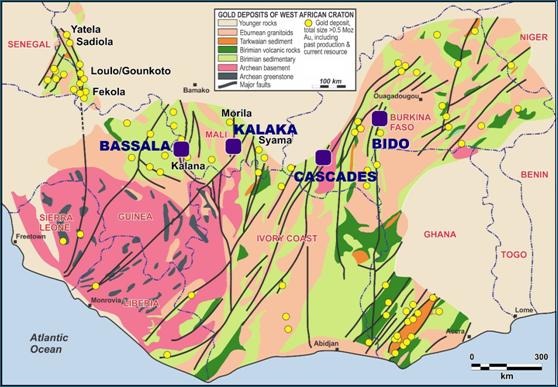

The Company has assembled an extensive and diverse portfolio of gold projects in West Africa (Figure 2), a region that is now the largest gold producing region globally. In Mali, the Company operates the Kalaka and the Bassala projects.

The project is located in southeast Mali, between Morila and Syama gold mines and is approximately 260 km southeast of Bamako. It lies approximately 80 km south of the Morila gold mine (8m oz) and 85 km northwest of Resolute's Syama gold mine (6m oz) and is situated adjacent and to the east of the regional Banifin Shear Zone.

Figure 2: West Africa Regional Geology Plan showing Panthera Project Areas

The primary mineralisation at the K1A deposit, is associated with an intrusive tonalite / micro granodiorite in contact with altered metasediments. The alteration envelope is dominantly characterized by silica-feldspar flooding and sulphide mineralisation.

Mineral Resources Estimate

A considerable gold system has been identified at the K1A deposit at the Kalaka Project and an announcement reported (RNS 4 February 2025) on the publication of the maiden MRE (JORC 2012).

The Inferred Mineral Resource Estimate (MRE) as reported in the table below has been reported at a 0.3 g/t Au cut-off:

Statement of Kalaka K1A Deposit Mineral Resources

Category | Domain | Tonnage | Au | |

Mt | g/t | Koz | ||

Inferred | Oxide and transitional | 6.8 | 0.50 | 109 |

Sulphide | 43.1 | 0.50 | 693 | |

Total | 49.9 | 0.50 | 803 | |

Notes: |

| |||

· The Mineral Resources are reported in accordance with the JORC code, 2012 Edition · Mineral Resources stated using a cut-off of 0.3 g/t Au · Mineral Resources have not been constrained within an Economical Pit Shell · Figures have been rounded to the appropriate level of precision for the reporting Mineral Resources · Due to rounding, some columns or rows may not compute exactly as shown | ||||

Contacts

Panthera Resources PLC

Mark Bolton (Managing Director) +61 411 220 942

Allenby Capital Limited (Nominated Adviser & Joint Broker) +44 (0) 20 3328 5656

John Depasquale / Vivek Bhardwaj (Corporate Finance)

Kelly Gardiner

VSA Capital Limited (Joint Broker) +44 (0) 20 3005 5000

Andrew Monk / Andrew Raca

AlbR Capital Limited (Joint Broker) +44 (0) 20 7399 9400

Colin Rowbury

Subscribe for Regular Updates

Follow the Company on Twitter at @PantheraPLC

For more information and to subscribe to updates visit: pantheraresources.com

Qualified Persons

The technical information contained in this disclosure has been read and approved by Ian S Cooper (BSc, ARSM, FAusIMM, FGS), who is a qualified geologist and acts as the Qualified Person under the AIM Rules - Note for Mining and Oil & Gas Companies. Mr Cooper is a geological consultant to Panthera Resources PLC.

The technical information contained in this disclosure relating to the metallurgical test work has been read and approved by Ray Burring. Ray is the owner and principal engineer of the Consulting Company, 4 Dragons Gold Pty Ltd, that has operated since 1989. Ray has a degree in Mineral Processing from Leeds University and is a Member of the Australian Institute of Mining and Metallurgy, Member of the Institute of Materials, Minerals and Mining and a Chartered Engineer. Ray is a Metallurgist with extensive experience of Gold and Base Metal operations, both operating and design. This work has been carried out in Australia, Vietnam, Laos, New Zealand, France, Iran, Mauritania, Russia and Eritrea. Ray Burring acts as the Qualified Person under the AIM Rules - Note for Mining and Oil & Gas Companies. Mr Burring is a Metallurgical consultant to Panthera Resources PLC.

Glossary

Au:

| The chemical element for Gold |

Diamond CoreDrilling

| Diamond core drilling uses a diamond cutting bit, which rotates at the end of a steel rod (tube) allowing for a solid column of rock to be recovered from the tube at the surface. |

g/t:

| Grammes per Tonne (Metric) |

JORC: | Australasian Code for Reporting of Mineral Resources and Ore Reserves' of December 2012 ("JORC Code") as prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy. Terms including Measured, Indicated and Inferred Resources as defined therein

|

CIL | Carbon in Leach metallurgical process

|

Moz: | Million Ounces (Troy)

|

Mt:

| Million Tonnes (Metric) |

Column Leach Test: | A metallurgical testing process commonly used to test for heap leach properties of gold deposits

|

RC | Reverse Circulation drilling, or RC drilling, uses rods with inner and outer tubes, the drill cuttings are returned to surface inside the rods. The drilling mechanism is a pneumatic reciprocating piston known as a hammer driving a tungsten-steel drill bit. |

NaCN | A Sodium Cyanide compound |

UK Market Abuse Regulation (UK MAR) Disclosure

The information contained within this announcement is deemed by the Company to constitute inside information for the purposes of Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations 2019/310. Upon the publication of this announcement via a Regulatory Information Service ("RIS"), this inside information is now considered to be in the public domain.

Forward-looking Statements

This news release contains forward-looking statements that are based on the Company's current expectations and estimates. Forward-looking statements are frequently characterised by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; possible variations in ore grade or recovery rates; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly, undue reliance should not be put on such statements due to the inherent uncertainty therein.

**ENDS**

Related Shares:

Panthera Res.