16th Feb 2026 12:45

16 February 2026

Metals One Plc

("Metals One" or the "Company")

Issue of EBT Shares, Share Incentive Plan & TVR

Metals One (AIM: MET1, OTCQB: MTOPF), a critical and precious metals project developer and investor, announces that, further to shareholder approval granted at the General Meeting held on 30 January 2026 ("GM"), the Company is issuing 100,000,000 new Ordinary shares to the Metals One Plc Employee Benefit Trust established in January 2024 (the "EBT").

Metals One also announces the establishment of a long-term Share Incentive Plan for executive management.

Award of Historical EBT Shares

Pursuant to historical milestones in relation to the 2023 IPO of the Company and implementation of certain Company strategic objectives, the EBT will award 7,500,000 Ordinary shares to each of Jonathan Owen, the Company's former Chief Executive Officer, and Daniel Maling, the Company's current Managing Director. These awards will be satisfied from shares already held in the EBT and are intended to align the recipients' shareholdings proportionately with the original percentage of issued share capital set out in the Admission Document at the time of the IPO, taking into account dilution since listing. In determining the award, the Remuneration Committee gave significant weight to the substantial work undertaken by the two recipients since the IPO, including their contributions to the Company's strategic development, operational execution and delivery against key objectives during the period.

Share Incentive Plan

On 30 January 2026, shareholders approved the issue of the 100,000,000 Ordinary Shares to the EBT. The Remuneration Committee and subsequently the Board have now approved the structure and performance conditions of the long-term Share Incentive Plan for executive management to be satisfied using shares held by the Company's EBT going forward. The Board believes that the Share Incentive Plan aligns management and employee incentives with long-term shareholder value creation and provides reasonable commercial protections for the Company and its shareholders as a whole.

Following the issue of the 100,000,000 Ordinary shares, and after deducting the awards granted to Mr Owen and Mr Maling detailed above, the EBT will hold a total of 105,112,743 Ordinary shares, which equates to approximately 9.06% of the issued share capital of the Company.

As outlined in the Notice of GM, awards from the EBT under the Share Incentive Plan will vest in three equal tranches over a three-year period and are scheduled to vest upon the achievement of the following key performance indicators ("KPIs") set for that tranche:

· Tranche 1 - 2025

Successful implementation of the Company's project diversification strategy, conditional upon the completion of equity financing at a price of not less than 2 pence per share (or equivalent) during the 12-month period ended 31 December 2025, assessed by reference to the KPI established by the previous Remuneration Committee being the successful delivery of the Preliminary Economic Assessment of the Black Schist Project (as announced on 31 January 2025).

· Tranche 2 - 2026

Achievement of a Company market capitalisation as at 31 December 2026 that is at least 50% higher than the market capitalisation as at 2 January 2026. This shall be calculated based on either the closing share price on 31 December 2026, or the volume-weighted average price ("VWAP") of the Company's shares for the trading days in 2026 and shall exclude the impact of any Equity Issues in the period.

· Tranche 3 - 2027

Achievement of a Company market capitalisation as at 31 December 2027 that is at least 50% higher than the market capitalisation as at 4 January 2026 using the same alternative formulas as for Tranche 2.

Craig Moulton and Daniel Maling, being the executive directors of the Company, will be entitled to awards under the Share Incentive Plan over an aggregate of 78,834,556 shares held by the EBT over the next two years. The number of shares each Director will be allocated under the Share Incentive Plan, subject to achievement of the KPIs, will be determined by the Remuneration Committee, within six months of the Company's year-end. It is the intention of the Board that the remaining 25% of the shares held in the EBT shall be utilised to attract and retain key staff.

All awards and performance conditions will be subject to annual review by the Remuneration Committee, which will retain discretion to determine vesting in accordance with the rules of the Share Incentive Plan. Should any recipient of awards under the Share Incentive Plan leave the Company they will retain any already earned awards but forfeit any right to future awards.

Issue of EBT Shares & TVR

Application has been made to the London Stock Exchange for the 100,000,000 Ordinary shares to be admitted to trading on AIM (the "Admission"). Admission is expected to occur at 8.00 a.m. on 23 February 2026.

Following Admission, the Company's total issued share capital will consist of 1,159,946,460 Ordinary shares with voting rights attached. The Company does not hold any Ordinary Shares in treasury. This figure may be used by shareholders in the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change in their interest in, the Company under the FCA's Disclosure Guidance and Transparency Rules.

Enquiries:

Metals One Plc Daniel Maling, Managing Director Craig Moulton, Chairman

| +44 (0)20 7981 2576

|

Beaumont Cornish Limited (Nominated Adviser) James Biddle / Roland Cornish | +44 (0)20 7628 3396 |

Oak Securities (Joint Broker) Jerry Keen / Calvin Man | +44 (0)20 3973 3678 |

Capital Plus Partners Limited (Joint Broker) Jonathan Critchley | +44 (0)207 432 0501 |

Vigo Consulting (UK Investor Relations) Ben Simons / Fiona Hetherington / Safia Colebrook | +44 (0)20 7390 0230

|

About Metals One

Metals One is pursuing a strategic portfolio of critical and precious metals projects and investments underpinned by the Western World's urgent need for reliably and responsibly sourced raw materials - and record high gold prices. Metals One's shares are listed on the London Stock Exchange's AIM Market (MET1) and on the OTCQB Venture Market in the United States (MTOPF).

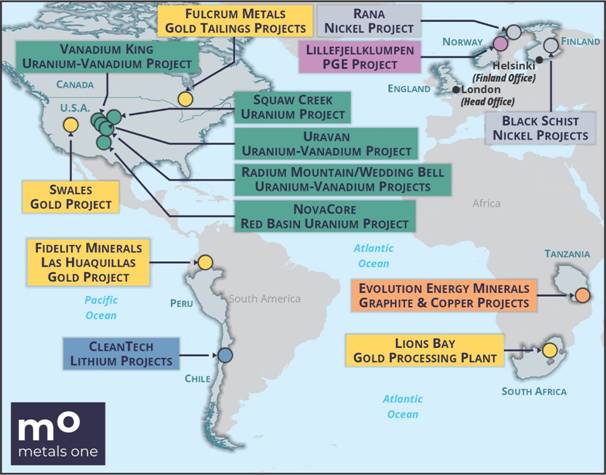

Map of Metals One projects/investments

Follow us on social media:

LinkedIn: https://www.linkedin.com/company/metals-one-plc/

X: https://x.com/metals_one_PLC

Subscribe to our news alert service on the Investors page of our website at: https://metals-one.com

Market Abuse Regulation (MAR) Disclosure

The information set out herein is provided in accordance with the requirements of Article 19(3) of the Market Abuse Regulations (EU) No. 596/2014 which forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ('MAR').

Nominated Adviser

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

APPENDIX

Set out below is the information required by Article 19(3) of the EU Market Abuse Regulation No 596/2014:

1 | Details of the person discharging managerial responsibilities/person closely associated | |

a) | Name | Daniel Maling |

2 | Reason for the notification | |

a) | Position/status | Managing Director |

b) | Initial notification/Amendment | Initial notification |

3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | |

a) | Name | Metals One Plc |

b) | LEI | 213800WGPHJ5MC5QLJ19 |

4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | |

a) | Description of the financial instrument, type of instrument

Identification code | Ordinary Shares of £0.01 each

GB00BSY1D385 |

b) | Nature of the transaction | Issue of EBT Shares |

c) | Price(s) and volume(s)

| 7,500,000 at par value |

d) | Aggregated information

| 7,500,000 at par value |

e) | Date of the transaction | 16 February 2026 |

f) | Place of the transaction | London Stock Exchange (XLON) |

Related Shares:

Metals One