6th Feb 2026 14:30

6 February 2026

Metals One Plc

("Metals One" or the "Company")

Investee Company Update: Lions Bay

Lions Bay Capital announces updates re South African gold opportunities

Metals One (AIM: MET1, OTCQB: MTOPF), a critical and precious metals exploration and development company, notes updates announced on 6 February 2026 by Lions Bay Capital Inc. ("Lions Bay Capital") (TSX-V: LBI) (Metals One: 19.1%) regarding both the offer for all the assets of Vantage Goldfields Ltd by its 47.4% owned associate Lions Bay Resources Pty Ltd ("LBR") (Metals One: 5%), and the extension of LBR's option to acquire the cogeneration plant. This follows the LBR update of 29 December 2025. Whilst Metals One is assisting Lions Bay Capital and LBR in progressing the offer, the final terms remain subject to agreement with the Court and other stakeholders, at which time a further announcement is expected.

Daniel Maling, Managing Director of Metals One, commented:

"Metals One is encouraged by the progress of the Vantage offer which remains in play and the broader strategy to create a vertically integrated South African gold business."

The full text of Lions Bay Capital's announcement is reproduced below.

Vancouver, BC - February 6, 2026 - Lions Bay Capital Inc. (TSX‑V: LBI) ("Lions Bay" or the "Company") Further to the announcement made on December 24, 2025, the Company announces that the Vantage Business Rescue ("Vantage") process is ongoing with the High Court of South Africa which is due to meet on March 2, 2026 to consider final proposals from the Business Rescue Practitioner ("BRP"), including the offer made by Lions Bay Resources Pty Ltd ("LBR"), and other interested parties.

LBR representatives are actively engaging with the local community, regulatory bodies, and various stakeholders to help facilitate and agree a plan to finance the safe and timely reopening of the mining operations.

LBR now expects to finalise the CPR and leaseholder negotiations relating to its cogeneration power plant in the coming weeks and has, by mutual agreement, extended the option to acquire the plant to the end of February 2026.

John Byrne, Chairman of Lions Bay Capital, commented:

"Lions Bay continues to play an active role in moving LBR's bid for the Vantage assets forward. In parallel, we have a great opportunity with the cogeneration power plant due to the potential to modify the plant to produce power and treat pyritic gold concentrates, providing a dual revenue stream as we move to create a vertically integrated gold business in South Africa."

Details of the extension to the Cogeneration Power Plant in South Africa

Lions Bay announces that its 47.4%‑owned associate, LBR, has entered into an agreement dated January 27, 2026, to extend the expiry date of its option to purchase a cogeneration power plant to February 28, 2026.

This represents the second extension of the option. LBR has paid USD $10,000 for each extension, with these amounts credited toward the total purchase price. To date, LBR has paid an aggregate of USD $85,000, with USD $1,305,000 remaining payable upon exercise of the option prior to expiry.

LBR holds the option to acquire a cogeneration power plant located in KwaZulu‑Natal, South Africa, which it intends to modify to support the roasting and recovery of gold from concentrate. The plant is capable of producing both electricity and steam and was constructed and commissioned in 2020 at an original cost of approximately USD $19.4 million. The facility operated for approximately one year before being placed on care and maintenance in 2021.

LBR's Bid for Vantage Goldfields Ltd

On December 24, 2025, LBR, which is owned 47.4% by Lions Bay, 47.6% by its management team, and 5% by Metals One Plc (LSE: MET1) ("Metals One"), made an offer to acquire the assets of Vantage Goldfields Ltd, Makhonjwaan Imperial Mines (Pty) Ltd and Barbrook Mines (Pty) Ltd, all in business rescue. This offer comprised cash and shares to be issued to creditors in both Metals One and Lions Bay, as well as certain rehabilitation undertakings, in particular relating to the flooding of the Lily Mine.

This offer was predicated upon the collapse of a prior business rescue plan, put forward by Ultra Concepts Limited, and in the face of a liquidation application of the group. The business rescue practitioner elected not to put the LBR offer to creditors, and on the return date of the liquidation application, which was heard on January 28, 2026 in the High Court of South Africa, advised the court that he was entertaining other offers; none of which were disclosed. In the interim, a further intervening application to remove the business rescue practitioner has been brought by a creditor, namely Goldstream (Pty) Ltd.

The Court has set the final hearing date for March 2, 2026, with set deadlines for submission of answers, replying affidavits and heads of argument.

LBR has paid the security costs of the Vantage assets for the past five months, and is of the view its plan has de facto been implemented, and will argue this in court. Despite the complexity of the issues before the court, LBR is confident that the High Court has the jurisdiction to finally resolve these issues, and provide a clear direction for the future of the mines.

About Lions Bay Capital Inc.

Lions Bay Capital Inc. is a mining finance and investment company focused on unlocking the value of overlooked or underperforming resource assets, with a strategic emphasis on gold and copper. Unlike traditional exploration companies, Lions Bay raises capital to invest in compelling opportunities rather than deploying funds on high-risk exploration or excessive executive overhead. The company specializes in identifying resource projects that have been neglected due to lack of funding or poor management execution. By leveraging deep industry expertise, Lions Bay provides both capital and strategic support to enhance project value and investor returns.

Lions Bay is led by Executive Chairman John Byrne, a veteran of the mining sector with over 50 years of experience as an analyst, investor, and operator. Under his leadership, the company brings a disciplined, value-driven approach to mining investment.

On behalf of the Board of Lions Bay.

John Byrne

Executive Chairman

Tel: +61 3 9236 2800

Email: [email protected]

Ryan Batros

Managing Director

Tel: +61 472 658 777

Email: [email protected]

For more information, please visit the corporate website at www.lionsbaycapital.com or contact the above.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

Disclaimer & Forward-Looking Statements: This news release includes "forward-looking statements" and "forward-looking information" within the meaning of Canadian securities laws and United States securities laws (together, "forward-looking statements"). All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the closing of option to purchase and the approval of the share consolidation and convertible debt by the TSX Venture Exchange. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "anticipate", "believe", "plan", "estimate", "expect", "potential", "target", "budget", "propose" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which the Company operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. These include assumptions regarding, among other things: general business and economic conditions. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include those described under the heading "Risks and Uncertainties" in the Company's most recently filed MD&A (a copy of which is available under the Company's SEDAR profile at www.sedarplus.ca). The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law.

Enquiries:

Metals One Plc Daniel Maling, Managing Director Craig Moulton, Chairman

| +44 (0)20 7981 2576

|

Beaumont Cornish Limited (Nominated Adviser) James Biddle / Roland Cornish | +44 (0)20 7628 3396 |

Oak Securities (Joint Broker) Jerry Keen / Calvin Man | +44 (0)20 3973 3678 |

Capital Plus Partners Limited (Joint Broker) Jonathan Critchley | +44 (0)207 432 0501 |

Vigo Consulting (UK Investor Relations) Ben Simons / Fiona Hetherington / Safia Colebrook | [email protected] +44 (0)20 7390 0230

|

About Metals One

Metals One is pursuing a strategic portfolio of critical and precious metals projects and investments underpinned by the Western World's urgent need for reliably and responsibly sourced raw materials - and record high gold prices. Metals One's shares are listed on the London Stock Exchange's AIM Market (MET1) and on the OTCQB Venture Market in the United States (MTOPF).

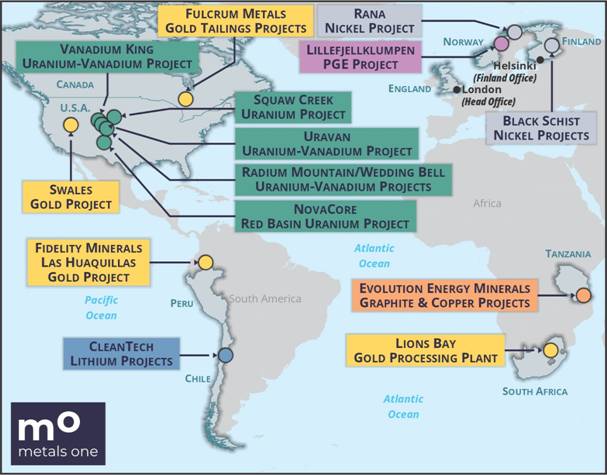

Map of Metals One projects/investments

Follow us on social media:

LinkedIn: https://www.linkedin.com/company/metals-one-plc/

X: https://x.com/metals_one_PLC

Subscribe to our news alert service on the Investors page of our website at: https://metals-one.com

Market Abuse Regulation (MAR) Disclosure

The information set out herein is provided in accordance with the requirements of Article 19(3) of the Market Abuse Regulations (EU) No. 596/2014 which forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ('MAR').

Nominated Adviser

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

Related Shares:

Metals One