4th Aug 2025 07:00

4 August 2025

Strip Tinning Holdings plc

("Strip Tinning", "Group" or the "Company")

Interim Results

Strip Tinning Holdings plc (AIM: STG), a leading supplier of specialist connection systems to the automotive sector, is pleased to announce its unaudited results for the six months ended 30 June 2025.

The three major nominations have given the Company great confidence in its market and investment strategy and provide a strong underpinning to our expectation of a doubling in sales between 2024 and the end of 2027. The immediate focus is on delivering the current nominations into production.

Key Financials:

· Total Revenues of £4.5 million (H1 2024: £4.8 million)

· Battery Technologies ("BT") sales of £1.2 million (H1 2024: £0.3 million)

· Glazing sales of £3.3 million (H1 2024: £4.5 million)

· Gross Margin of £2.0 million / 44.1% (H1 2024: £1.7 million / 35.4%)

· Adjusted1 EBITDA of -£0.3 million (H1 2024: -£0.8 million)

· Cash generation from operations of £0.4 million (H1 2024: -£1.9 million); cash balance of £0.1 million (H1 2024: £2.0 million) with a further £0.4 million availability on the CID facility

· Basic EPS2 of (8.04)p versus H1 2024 (14.58)p

Operational updates:

· The three nominations received in H1 2024 are progressing positively to be delivered from late 2025 onwards

· BT division has successfully delivered the C Sample order for its Zoox Cell Contact System nomination

· The Glazing division is beginning to deliver on the two "smart glass" PDLC nominations, together worth £18.6 million (Total lifetime sales)

· Short-term challenges from customer launch delays, weak European car production and cost pressures from customers remain

· Management have continued to focus on further reducing costs where possible

· Award of APC26 grant worth £850k over the next three years

· The Company received its R&D tax credit from HMRC for 2022 in April 2025 ££0.7m

Outlook:

· The Board remains confident of meeting market expectations for Adjusted EBITDA in FY253

· Long-term growth drivers remain despite near-term automotive market challenges, which are expected to continue into 2026

· Total lifetime sales value of all nominations remains at £105.4 million

· ATF grant will now proceed to the detailed application phase which will be submitted during Q3 2025 with a likely outcome decision in Q4 25 / Q1 26

1Adjusted for FX impacts, share based payments and restructuring

2Based on weighted average number of shares in the period

3Strip Tinning understands that as at the date of this announcement, market expectations for the year ended 31 December 2025 are for Adjusted EBITDA of (£0.9m) (Source: Factset)

Mark Perrins, Chief Executive Officer of Strip Tinning, commented:

"This has been a challenging period with the Company working to deliver on its three significant nominations while under significant cost and cash pressures. Despite experiencing short-term trading challenges consistent with the automotive sector as a whole, the Company has worked to stabilise its cash position and deliver the programmes that it has won.

"Our new business nominations have given us great confidence in our market and investment strategy and provide a strong underpinning to our expectation of a doubling in sales between 2024 and the end of 2027. Our immediate focus is on delivering the current nominations into production."

Enquiries: |

|

Strip Tinning Holdings plc Mark Perrins, Chief Executive Officer Kevin Edwards, Chief Financial Officer

|

|

Singer Capital Markets (Nominated Adviser and Sole Broker) Rick Thompson James Fischer | +44 (0) 20 7496 3000

|

|

|

A copy of this announcement will be available to view on the Company's website at www.striptinning.com.

Paul George, Non Executive Chairman of Strip Tinning

I am pleased to present the unaudited results of Strip Tinning for the six months ended 30 June 2025, my first since taking over as non-executive Chairman.

It is less than two months since we published our 2024 Annual Report and Accounts and these results reflect the commentary included therein. In particular, they reflect the impact of actions taken to manage costs and limit cash outflows. Further, as outlined by our CEO below, they provide an update on progress on delivering on the three major nominations won in 2024.

Our 2024 Annual Report and Accounts set out that the Board, as a result of actions taken by the Directors, were confident that the Company had sufficient working capital through to the end of the first half of 2026. This remains the case particularly in view of the recent APC26 grant award. We will however continue to explore options for further funding to both cover the working capital requirements as the three major nominations reach serial production and to ensure adequate resources are available to secure value enhancing contracts in the sales pipeline.

Chief Executive Officer's Review

The market

Trading in the first half of the year (H1) has benefited from our ongoing cost reduction programme which has been successful in removing the need for immediate external funding with the additional working capital now likely needed by mid-2026.

Naturally, the market environment has become more complex with the uncertainty caused by tariffs and the extent to which this has impacted global supply chains and customer demand profiles. In response to these macro uncertainties management has been working on near-shoring with over 90% of our Copper supply now sourced locally instead of from China. Moreover, our inventory reductions have strongly supported cash flow during H1.

Our Glazing division which currently is mainly exposed to the automotive light vehicle sector saw revenue fall from £4.5m (H1 2024) to £3.3m (H1 2025). 2025 is a pivotal year for Strip Tinning as we transition away from simple, high volume low content connectors to more complex Flexible Printed Circuit (FPC) connectors serving enhanced vehicle functions such as Polymer Dispersed Liquid Crystal (PDLC) smart roofing systems. We therefore forecast these reductions, albeit we have been additionally impacted by the general softening of automotive light vehicle volumes due to the well-publicised effects of geopolitical uncertainties.

In terms of a progress update on the three major nominations won during 2024 which more than double the size of the business by the end of 2027, two are within the Glazing division. Our PDLC project with one of the largest global Tier one glazing businesses is on schedule through the pre-serial production phases with serial production in H2 2026. The other PDLC project with another Tier one glazing business is planned to be fitted to three SUV vehicles across two OEMs. The start of production for the first vehicle which had been scheduled for May 2025 is now September 2025, and the other two vehicles will be April 2026. The result of these launch delays is likely to reduce sales in H2 by between £100k - £150k. However, our FY2025 Adjusted EBITDA guidance remains unchanged.

Our business strategy to concentrate on supporting clients with complex engineered solutions in the Glazing division and within our BT division, where we are adding value by leveraging our product & process "know-how" to aid clients with their design choices at an early stage, is progressing well. Revenue increased 333% from £274k (H1 2024) to £1,188k (H1 2025).

The third major nominations won during 2024 was the £57 million contract to supply Cell Contact Systems (CCS) for the Zoox Autonomous Taxi. C phase ("Off tool") which was due for completion in May 2025 has now been extended with additional part quantities taking C phase into September 2025. This means D phase ("off process") is now going to be later than our initial forecast. Timing and volume impacts are still being confirmed by our customer but SoP remains April 2026. Zoox opened its first full scale production facility in May 2025 to enable ramp up plans in 2026.

Sales pipeline

2025 is a year of execution where our clear focus is on delivering the three major nominations with a lifetime value of £77m. However, we are continuing to see strong interest in our glazing PDLC and BT FPC and CCS product offerings. We have a number of projects where we are working with customers to provide early stage prototypes for generic scalable battery packs, e-bikes, premium vehicles, buses and many other mobility solutions. Our customers tell us they value working with European suppliers such as Strip Tinning that can provide local, highly responsive, full service, engineered solutions for their battery pack developments.

Review of Operations

We have continued to progress our lean journey with productivity and quality improvements. Examples being the continued evolution of our factory layouts to accommodate the additional equipment needed for the new projects. These lean manufacturing cells have enhanced quality controls with laser etching of parts to enable full traceability throughout our digitally enhanced Manufacturing Execution System (MES) controlled processes.

Notwithstanding the aforementioned cost and sales pressures, we are pleased that gross margins in H1 improved year-on-year from 35.4% to 44.4%, primarily driven by the new project pre-production phases and the elimination of loss-making products and increased productivity.

Our key operational focus is to ensure the successful delivery of our growth plans.

Successfully securing additional new business opportunities in our sales pipeline is likely to require new production processes, lines, and factory space. With this in mind, we are applying to the government's Automotive Transformation Fund for a multi-million-pound grant to support additional capacity. So far we have successfully closed the pre-cursor feasibility grant that demonstrated there is a business case for wider investment, passed the Expression of Interest stage, and passed the pre-application stage. We will now proceed to the detailed application phase which will be submitted during Q3 2025 with a likely outcome decision in Q4 25 / Q1 26.

KPIs

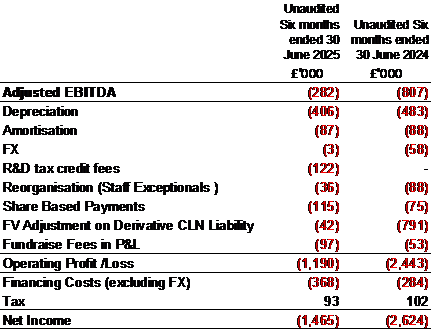

The Company uses Adjusted EBITDA as a key metric, below is a reconciliation to the Statement of Consolidated Comprehensive Income.

Principal Risks & Uncertainties

The principal risks and uncertainties faced by the Company remain unchanged from those elaborated in detail in our full financial reports. The current results highlight that of all of these, the most significant today are the risks of automotive market downturns reducing sales from our Glazing division, availability of working capital and new product launch slippage delaying sales of both prototype/sample parts and eventually production parts in our BT division.

Outlook

The Company remains confident in its medium-term prospects, underpinned by the new business pipeline, and the improving margins in the core Glazing division.

This year has seen us demonstrate our ability to begin to deliver on the transformational nominations won in both BT and Glazing. We remain focused on delivering existing projects and are selectively working on further nominations which can build the business after the current nominations are delivered to serial production.

Statement of Consolidated Comprehensive Income for the six months ended 30 June 2025

| Note | Unaudited Six months ended 30 June 2025 |

|

| Unaudited Six months ended 30 June 2024 |

|

|

| £'000 |

|

| £'000 |

|

|

| |||||

Revenue | 3 | 4,532 | 4,780 | |||

| ||||||

Cost of sales |

| (2,533) | (3,086) | |||

| ||||||

Gross profit |

| 1,999 | 1,694 | |||

|

| |||||

Other operating income | 4 | 8 | 150 | |||

| ||||||

Administrative expenses |

| (3,155) | (3,437) | |||

| ||||||

Operating loss |

| (1,148) | (1,593) | |||

|

| |||||

Finance costs |

| (368) | (342) | |||

Revaluation of derivative liability |

| (42) | (791) | |||

| ||||||

Loss before taxation |

| (1,558) | (2,726) | |||

| ||||||

Taxation | 5 | 93 | 102 | |||

| ||||||

Loss and total comprehensive expense for the period |

|

(1,465) |

(2,624) | |||

|

| |||||

Loss per share (pence) |

| |||||

Basic and diluted | 6 | (8.05) | (14.58) | |||

|

Consolidated statement of Financial Position as at 30 June 2025

| Notes | Unaudited 30 June 2025 |

| Audited 31 December 2024 | Unaudited 30 June 2024 | |||

|

|

| £'000 |

| £'000 |

|

| £'000 |

ASSETS |

|

|

|

|

|

|

|

|

Non-current assets | ||||||||

Intangible assets |

| 2,505 | 2,230 | 1,791 | ||||

Right-of-use assets |

| 788 | 873 | 979 | ||||

Property, plant and equipment |

| 3,231 | 3,410 | 2,948 | ||||

| 6,525 | 6,513 | 5,718 | |||||

| ||||||||

Current assets |

| |||||||

Inventories |

| 1,020 | 1,310 | 1,333 | ||||

Trade and other receivables |

| 2,160 | 2,143 | 2,427 | ||||

Corporation tax receivable |

| 572 | 1,177 | 1,093 | ||||

Cash and cash equivalents |

| 84 | 512 | 2,030 | ||||

| 3,836 | 5,142 | 6,928 | |||||

| ||||||||

Total assets |

|

| 10,361 |

| 11,655 |

|

| 12,646 |

| ||||||||

LIABILITIES |

|

|

|

|

|

| ||

Current liabilities |

| |||||||

Trade and other payables |

| (1,643) | (1,630) | (1,445) | ||||

Borrowings |

| (586) | (652) | (362) | ||||

Lease liabilities |

| (164) | (164) | (196) | ||||

| (2,393) | (2,446) | (2,003) | |||||

| ||||||||

Non-current liabilities |

| |||||||

Accruals and deferred income |

| - | - | (16) | ||||

Borrowings |

| (4,596) | (4,494) | (3,915) | ||||

Derivative liability |

| (1,548) | (1,506) | (1,392) | ||||

Lease liabilities |

| (731) | (772) | (835) | ||||

Provisions |

| (257) | (251) | (245) | ||||

| (7,132) | (7,023) | (6,403) | |||||

| ||||||||

Total liabilities |

|

| (9,525) |

| (9,469) |

|

| (8,406) |

| ||||||||

Net assets |

|

| 836 |

| 2,186 |

|

| 4,240 |

| ||||||||

EQUITY |

|

|

|

|

|

| ||

|

| |||||||

Share capital | 8 | 182 | 182 | 182 | ||||

Share premium account |

| 7,931 | 7,931 | 7,931 | ||||

Merger reserve |

| (100) | (100) | (100) | ||||

Other reserve |

| (3) | (3) | (3) | ||||

Retained earnings |

| (7,174) | (5,824) | (3,770) | ||||

Total equity |

| 836 |

| 2,186 |

|

| 4,240 |

Consolidated statement of changes in equity

|

|

|

|

|

|

| ||||||

| Share capital | Share premium | Merger reserve | Other reserve | Retained earnings | Total equity |

|

| ||||

| £'000 | £'000 | £'000 | £'000 | £'000 | £'000 |

|

| ||||

| ||||||||||||

At 1 January 2024 | 154 | 6,966 | (100) | (3) | (1,221) | 5,796 | ||||||

Loss and total comprehensive expense for the period | - | - | - | - | (2,624) | (2,624) | ||||||

Shares issued in the period | 28 | 965 | - | - | - | 993 | ||||||

Share based payment | - | - | - | - | 75 | 75 | ||||||

At 30 June 2024 | 182 | 7,931 | (100) | (3) | (3,770) | 4,240 | ||||||

| ||||||||||||

Loss and total comprehensive expense for the period | - | - | - | - | (2,076) | (2,076) | ||||||

Shares issued in the period | ||||||||||||

Share based payment | - | - | - | - | 22 | 22 | ||||||

At 31 December 2024 | 182 | 7,931 | (100) | (3) | (5,824) | 2,186 | ||||||

Loss and total comprehensive expense for the period | - | - | - | - | (1,465) | (1,465) | ||||||

Share based payment | - | - | - | - | 115 | 115 | ||||||

At 30 June 2025 | 182 | 7,931 | (100) | (3) | (7,174) | 836 | ||||||

Consolidated statement of cash flows for the six months ended 30 June 2025

|

|

| Unaudited Six months ended 30 June 2025 |

| Unaudited Six months ended 30 June 2024 | |

|

|

| £'000 |

| £'000 | |

Cash flow from operating activities | ||||||

Loss for the financial period | (1,465) | (2,624) | ||||

Adjustment for: |

|

| ||||

Depreciation of property, plant and equipment |

| 321 | 371 | |||

Depreciation of right-of-use assets |

| 85 | 111 | |||

Amortisation of intangible assets |

| 87 | 88 | |||

Amortisation of government grants |

| (8) | (150) | |||

Share based payment |

| 115 | 75 | |||

Derivative liability fair value revaluation |

| 42 | 791 | |||

Finance costs |

| 368 | 342 | |||

Taxation credit |

| (93) | (102) | |||

Changes in working capital: |

| |||||

Decrease/(increase) in inventories |

| 290 | (46) | |||

Decrease in trade and other receivables |

| (17) | 82 | |||

Decrease in trade and other payables |

| 8 | (847) | |||

Cash generated from/(used in) operations |

| (267) | (1,909) | |||

Income tax received |

| 698 | - | |||

Net cash from/(used in) operating activities |

| 431 | (1,909) | |||

|

| |||||

Cash flow from investing activities |

| |||||

Purchase of property, plant and equipment |

| (142) | (86) | |||

Purchase of intangible assets |

| (362) | (236) | |||

Net cash used in investing activities | (504) | (322) | ||||

Cash flow from financing activities | |||

Shares issued (net of issue costs) | - | 993 | |

Convertible loan note (net of share issue costs) | - | 3,699 | |

Interest paid | (112) | (142) | |

Grants received | 12 | 266 | |

Payment of lease liabilities | (41) | (106) | |

Repayment of bank loans | (106) | (537) | |

Repayment of capital element of hire purchase contracts | (108) | (255) | |

Net cash generated from/(used in) financing activities | (355) | 3,918 | |

| |||

(Decrease)/increase in cash and cash equivalents |

(428) |

1,687 | |

Net cash and cash equivalents at beginning of the period | 512 | 343 | |

Net cash and cash equivalents at end of the period (all cash balances) |

84 |

2,030 | |

Notes to the interim consolidated financial statements for the six months ended 30 June 2025

1. Corporate information

Strip Tinning Holdings plc is a public company incorporated in the United Kingdom. The registered address of the Company is Arden Business Park, Arden Road, Frankley Birmingham, West Midlands, B45 0JA.

The principal activity of the Company and its subsidiary (the 'Group') is the manufacture of automotive busbar, ancillary connectors and flexible printed circuits.

2. Accounting policies

Basis of preparation

This unaudited condensed consolidated interim financial statements for the six months ended 30 June 2025 and 30 June 2024 have been prepared in accordance with UK adopted international accounting standards ("IFRS") including IAS 34 'Interim Financial Reporting'.

The accounting policies applied by the Group include those as set out in the financial statements for the year ended 31 December 2024 and are consistent with those to be used by the Group in its next financial statements for the year ending 31 December 2025. There are no new standards, interpretations and amendments which are not yet effective in these financial statements, expected to have a material effect on the Group's future financial statements.

The financial information does not contain all of the information that is required to be disclosed in a full set of IFRS financial statements. The financial information for the six months ended 30 June 2025 and 30 June 2024 is unreviewed and unaudited and does not constitute the Group's statutory financial statements for those periods.

The comparative financial information for the full year ended 31 December 2024 has, however, been derived from the audited statutory financial statements for Strip Tinning Holdings plc for that period. A copy of those statutory financial statements has been delivered to the Registrar of Companies. The auditor's report on those accounts was unqualified and did not contain a statement under section 498(2)-(3) of the Companies Act 2006.

These policies have been applied consistently to all periods presented, unless otherwise stated.

The interim financial information has been prepared under the historical cost convention with the exception of fair value calculations applied in accounting for share based payments and Convertible Loan Note derivative. The financial information and the notes to the historical financial information are presented in thousands of pounds sterling ('£'000'), the functional and presentation currency of the Group, except where otherwise indicated.

Going concern

After making appropriate enquiries, the directors have a reasonable expectation that the Group has adequate resources to continue in operational existence for at least twelve months from the date of approval of the interim financial statements. In adopting the going concern basis for preparing the financial statements, the Directors have considered the budgets, which relate to the facilities available for the Group, for the period up to December 2026, routinely updated forward forecasts for revenue, costs and cash flows, the impact of cost cutting already completed or planned and sensitivities applied to these. The Directors remain optimistic of securing additional resources to fund in particular the ramp up in sales in the latter half of 2026 from nominations already won and announced. The Directors also believe that further resources would improve the Group's ability to accelerate growth beyond 2026. These resources may include funding from the Government's Export Credit Guarantee Scheme, and/or from other grants for which we have two applications in hand. In order to support further growth opportunities over and above those included within the forecasting exercise, the directors also remain open to equity funding from investors and/or strategic partners to support the ultimate production ramp.

3. Segmental and geographical destination reporting

IFRS 8, Operating Segments, requires operating segments to be identified on the basis of internal reports that are regularly reviewed by the company's chief operating decision maker. The chief operating decision maker is considered to be the executive Directors.

The Group comprises two operating segments for the sale of automotive circuit components for glazing products and the Battery Technology (BT ) division. The operating segments are monitored by the chief operating decision maker and strategic decisions are made on the basis of adjusted segment operating results. All assets, liabilities and revenues are located in, or derived in, the United Kingdom. Separate management reporting and information is now prepared at a revenue and gross profit level for the Glazing segment (sale of glazing circuits for petrol/diesel vehicles) and BT division as follows.

| Glazing | BT | Total |

6 months ended 30 June 2025 | £'000 | £'000 | £'000 |

Revenue | 3,344 | 1,188 | 4,532 |

Cost of sales | (2,200) | (334) | (2,533) |

Gross profit | 1,144 | 854 | 1,998 |

| Glazing | BT | Total |

6 months ended 30 June 2024 | £'000 | £'000 | £'000 |

Revenue | 4,506 | 274 | 4,780 |

Cost of sales | (2,854) | (232) | (3,086) |

Gross profit | 1,652 | 42 | 1,694 |

Turnover with the largest customers (including customer groups) representing in excess of 10% of total revenue in the period for 2 customers (2024: 3 customers) has been as follows:

|

|

| Six months ended 30 June 2025 |

| Six months ended 30 June 2024 |

|

|

| £'000 |

| £'000 |

Customer A | 344 | 1,030 | |||

Customer B | 467 | 523 | |||

Customer C | 419 | 594 | |||

Customer D | 647 | - |

All revenue arises at a point in time and relates to the sale of automotive busbar, ancillary connectors and flexible printed circuit product. Turnover by geographical destination is as follows:

| Six months ended 30 June 2025 |

|

| Six months ended 30 June 2024 |

|

|

| £'000 |

|

| £'000 |

|

|

UK | 625 | 300 | ||||

Rest of Europe | 1,891 | 3,331 | ||||

Rest of the World | 2,015 | 1,149 | ||||

4,532 | 4,780 |

4. Other operating income

| Six months ended 30 June 2025 |

|

| Six months ended 30 June 2024 |

| £'000 |

|

| £'000 |

Government revenue development grants | - | 136 | ||

Amortisation of capital grants | 8 | 14 | ||

8 | 150 |

The Group was awarded a £1.48m UK innovation development grant in 2022. Revenue expenditure of £0.02m recognised in first half of 2024, £1.09m in 2023 and £0.37m was recognised in 2022. |

A second grant in respect of revenue expenditure was awarded in 2023, totalling £0.17m. £0.05m of this was recognised in the second half of 2023, with the remaining £0.12m recognised in the first half of 2024. |

.

5. Income tax

|

|

|

|

|

|

| Six months ended 30 June 2025 |

|

| Six months ended 30 June 2024 |

|

| £'000 |

|

| £'000 |

|

|

|

|

|

|

|

Current tax: | |||||

UK corporation tax | 93 | 78 | |||

Adjustments in respect of prior periods | - | 279 | |||

Total current tax credit | 93 | 357 | |||

Deferred tax: | |||||

Origination and reversal of temporary differences | - | - | |||

Total deferred tax credit | - | - | |||

Total tax credit | 93 | 357 | |||

The credit for the period can be reconciled to the loss for the period as follows:

|

|

| Six months ended 30 June 2025 |

| Six months ended 30 June 2024 |

|

|

| £'000 |

| £'000 |

|

|

|

|

|

|

Loss before taxation | (1,558) | (2,726) | |||

Income tax calculated at 25% (2023: 22%) | (390) | (682) | |||

Expenses not deductible including derivative liability fair value movements | 40 | 280 | |||

Enhanced research and development allowances |

(108) |

(118) | |||

Deferred tax not recognised | 225 | 265 | |||

Surrender of losses for R&D credit at a lower rate | 140 | 153 | |||

Effect of differing deferred tax and current period tax rates |

- |

- | |||

Total tax credit | (93) | (102) |

The tax rate used to calculate deferred tax is 25% at 30 June 2025 (2024: 25%), being the rate at which the timing differences were expected to unwind based on enacted UK corporate tax legislation at each balance sheet date.

A deferred tax asset has not been recognised for losses carried forward as, the key accounting judgement made is that it is not yet considered sufficiently probable that the losses will be utilised in the short term.

6. Earnings per share

The calculation of the basic and diluted earnings per share is based on the following data:

|

|

|

|

|

| |||

Earnings | Six months ended 30 June 2025 | Six months ended 30 June 2024 |

| |||||

| £'000 |

|

| £'000 |

| |||

|

|

|

|

| ||||

Loss for the purpose of basic and diluted earnings per share being net loss attributable to the shareholders |

(1,558) |

(2,624) |

| |||||

|

|

|

|

| ||||

| Six months ended 30 June 2024 |

|

| Six months ended 30 June 2024 |

| |||

Number of shares |

|

| ||||||

|

|

|

|

| ||||

Weighted average number of ordinary £0.01 shares for the purposes of basic and diluted loss per share |

18,225,089 |

17,997,174 | ||||||

|

|

|

|

| ||||

There were options in place over 1,214,959 shares at 30 June 2025 (2024: 734,505) that were anti-dilutive at the period end but which may dilute future earnings per share.

7. Share capital

There have been no movements in share capital in the period or comparative period.

| Number of £0.01 shares |

|

| Nominal |

| Share premium |

|

|

|

| £'000 |

| £'000 |

|

|

|

|

|

|

|

At 1 January 2024 and at 30 June 2024 and 2025 | 18,225,089 | 182 | 7,931 | |||

Related Shares:

Strip Tinning