6th Aug 2025 07:00

6 August 2025

Ferrexpo plc

("Ferrexpo", the "Group" or the "Company")

Interim Results for the six months ended 30 June 2025

Ferrexpo plc (LSE: FXPO), a producer and exporter of premium iron ore products to the global steel industry, is pleased to report interim results for the six months ended 30 June 2025 ("the period" or "first half" or "first six months" or "1H 2025").

Commenting on the results, Lucio Genovese, Interim Executive Chair, said:

"The first six months of 2025 have been a tale of two halves. We started the year on a strong footing, with the best quarterly production since the full-scale invasion of Ukraine in February 2022. This momentum, was, however, significantly curtailed in the second quarter as we were forced to downscale our activities due to the decision by the Ukrainian tax authorities' to suspend the refund of VAT to our Ukrainian subsidiaries. This is reflected in a 40% drop in production in the second quarter compared to the first quarter.

We moved quickly to lower our costs. It is regrettable that at present we have had to place approximately 40% of our workforce on reduced working hours or furlough. We have also implemented programmes to optimise stripping rates, repairs and maintenance, and cut non-essential spending across the business. The effects of these measures are difficult to absorb, yet they have been necessary and lessened the severe and negative impact of the suspension of VAT refunds. We have been able to lower our costs as much as possible in order to be competitive in a weak iron ore price environment.

During the first half, we were able to respond to strong demand from Chinese customers for our high-grade low-alumina iron ore concentrate. As a result, during the first six months of 2025, concentrate represented 36% of our production mix, three times more than in the same period a year ago. Once again, we have shown that the flexibility we have built into our business has enabled us to be more responsive to short-term changes in iron ore markets and take advantage of opportunities that present themselves. I anticipate that we will be able to continue benefiting, as we shift away from being a pellet only producer to a producer of different high-grade iron ore products, including a variety of concentrate and pellet feed as well as pellets.

Since the full-scale invasion of Ukraine in February 2022, Ferrexpo has continued to operate and export its products despite the immense challenges posed by the war. By remaining operational we have been able to remain relevant - maintaining a workforce, continuing to supply our customers, and supporting our local communities and Ukraine as a whole. Our calculations indicate that since February 2022 to the end of the reporting period, we have paid more than US$180 million in salaries and US$340 million in taxes, while investing more than US$400 million in capital expenditure, and procuring more than US$1.9 billion in goods and services from within Ukraine.

However, these contributions are at risk. Since the start of 2025, the Ukrainian tax authorities have suspended VAT refunds to our Ukrainian subsidiaries, resulting in lower liquidity and forcing us to downscale production to one pellet line. The tax authority's decision has also forced us to make deep cost cuts, including placing more than a third of our workforce on furlough or reduced working hours, resulting in knock on effects for families and the local community.

If we had been able to continue producing at the same levels as in the first quarter throughout the remainder of 2025, we calculate that we would have paid US$8 million more to our employees, US$23 million more in taxes, and US$150 million more for goods and services to our Ukrainian suppliers. This means that a broader US$180 million will instead be lost in economic contributions to Ukraine.

It is with great sadness that during the first six months of 2025 one more colleague was killed in action, whilst in early July we received notice that a further colleague was killed, bringing the total to 48.Our thoughts are with them and their families during this extremely difficult period. During the first half of this year, 58 more colleagues were mobilised to serve in the Armed Forces of Ukraine, whereas 26 colleagues were demobilised. This means that at the end of June a total of 738 colleagues were serving, more than at any time since the start of the full-scale invasion."

Production and financial summary

· Total commercial production for the first six months of 3.4 million tonnes, a 7% increase compared to the previous six months to 31 December 2024, and a 9% decrease compared to the first six months of 2024.

· Production mix comprised 64% pellets and 36% concentrates for the first six months, compared to 88% pellets and 12% concentrates in the same period last year, demonstrating an ability to be flexible depending on market demand for different high grade iron ore products.

· Total sales for the first six months of 2025 of 3.8 million tonnes (marginally lower compared to the same period last year) of which 60% was exported through Ukrainian Black Sea ports, 35% by rail and 5% by river barge.

· Revenues decreased by 17% to US$453 million (1H 2024: US$549 million) due to lower realised prices and marginally lower sales volumes.

· C1 Cash Cost of Production ("C1 costs") decreased to US$77.1 per tonne in the half year (1H 2024: US$78.8 per tonne), due to reduced mining activities, the effects from lower fuel prices, lower maintenance and a reduction in personnel costs.

· Underlying EBITDA decreased by 95% to US$4 million (1H 2024: US$79 million), reflecting the net effects of lower sales volumes and realised prices and higher production costs.

· Impairment loss of US$154 million.

· Loss after tax of US$196 million (1H 2024: profit US$55 million).

· The Group ended the period with a Net Cash position of US$50 million (31 December 2024: US$101 million), comprising US$52 million of cash and cash equivalents, and minimal financial debt of US$2 million.

· US$28 million capital investment for the period (1H 2024: US$55 million), comprising 55% in sustaining and 45% development capital.

· Formal written notifications of decisions not to refund VAT from the Ukrainian tax authorities are being received on a monthly basis, typically two months after the reporting month. From January to April 2025, the amount of VAT refunds refused is US$31.1 million and for the period until the end of June, the cumulative amount is $38.3 million.

· Due to the ongoing suspension of VAT refunds and the resulting reduction in financial liquidity, the Group has been forced to downscale operations to one pelletising line.

· The Group has worked extensively to lower its costs to remain financially viable. This includes reducing working time for employees, cuts in the procurement of goods services and a suspension of all non-essential CapEx, overheads and Corporate & Social Responsibility ("CSR") spending.

Commenting on the financial results, Nikolay Kladiev, CFO, said:

"The refusal of the Ukrainian tax authorities to refund the VAT owed to us since the start of 2025 has had a major impact on the operational and financial performance of the Group. At the end of March, we received the first notification that the VAT for the month of January would not be refunded, and as of the date of these interim results we have subsequently received similar notifications for the months up to April. Although we have made representations to the relevant authorities in Ukraine to resume refunds, the severe future effects are already clear. If one assumes that the refunds for June are also denied, the total unpaid refunds for the first six months of 2025 will be US$38.3 million.

In our results, we book the VAT as a receivable because it is money owed to us. Consequently, adding this to the net cash position of US$50 million as at 30 June, it is clear to see that the Group performed with resilience during the first half of the year, given factors outside of our control such as weaker iron ore prices and higher input costs. This resilience is, in part, due to the cost cutting measures that we have implemented, including decisions to cut non-essential capital expenditure which are easily made, though placing part of our workforce on furlough or reduced hours are decisions that we do not take lightly, and so I am grateful to colleagues for their understanding and commitment.

As Lucio details in his statement, the broader economic impact of denying the VAT refunds is significantly greater than the VAT amounts being withheld and this will only shrink Ukrainian industry and the fiscal and economic contributions that we collectively provide.

Looking to our results for the first half in more detail, although sales volumes were relatively flat reflecting the strong first quarter, revenues decreased 17% to US$453 million, reflecting lower realised market prices and concentrate taking up a bigger portion of the product mix. The deep cost-cutting measures that we implemented helped to drive down our costs on a unit basis, buoyed by improvements in freight rates. As we guided when we released our annual results, the Group recorded a non-cash impairment loss, totalling US$154 million. The impairment relates to the suspension of VAT refunds and the impact on the Group's long-term model to reflect the lower expected cash flow generation which, in turn, has a negative impact on the carrying value of the Group's assets in the future. Adjusting for the impairment, the underlying EBITDA for the period was US$3.9 million, which, in the face of so many challenges, is a resilient outcome. During the period, we significantly reduced our CapEx programmes, with investments decreasing to US$28 million, compared to US$55 million in the same period in 2024. The significantly lower operating cash flow generation could, however, only be partially offset by this and as a result, the closing balance of cash and cash equivalents decreased from US$101 million at the end of 2024 to US$52 million as at 30 June 2025."

Summary financial performance

US$ million (unless otherwise stated) | 1H 2025 | 2H 2024 | Change | 1H 2024 | Change | FY 2024 |

Total commercial production (kt) | 3,393 | 3,163 | 7% | 3,727 | (9)% | 6,890 |

Total pellet production (kt) | 2,170 | 2,774 | (22)% | 3,297 | (34)% | 6,071 |

Total commercial concentrate production (kt) | 1,223 | 389 | 214% | 430 | 184% | 819 |

Total sales volumes (pellets and concentrates) (kt) | 3,807 | 2,981 | 28% | 3,849 | (1)% | 6,830 |

Average 65% Fe iron ore fines price (US$/t) | 113 | 116 | (3)% | 131 | (14)% | 123 |

Revenue | 453 | 384 | 18% | 549 | (17)% | 933 |

C1 Cash Cost of production (US$/t) | 77.1 | 89.9 | (14)% | 78.8 | (2)% | 83.9 |

Underlying EBITDA | 4 | -10 | (140)% | 79 | (95)% | 69 |

Net cash flow from operating activities | (24) | 36 | (166)% | 56 | (143)% | 92 |

Capital investment | 28 | 47 | (39)% | 55 | (49)% | 102 |

Closing Net Cash | 50 | 101 | (51)% | 112 | (56)% | 101 |

Health, safety and wellbeing

· The safety and wellbeing of the Group's workforce is the highest priority, and the Group continues to take extensive measures to protect its workforce, their families and local communities.

· During the first half, the Group reported a Lost Time Injury Frequency Rate ("LTIFR") of 0.56, marginally above the historic five-year trailing average of 0.52. The Group is proud to report zero fatalities for the period, and over a total of 58 months.

Iron ore markets

· The benchmark 65% grade iron ore price weakened throughout the first half of 2025 to close US$11 lower at US$104 per tonne.

· With continued access to Ukrainian Black Sea ports, 16 vessels were loaded in the first half permitting 60% of all sales to seaborne customers, with the balance of sales transported 35% by rail and 5% by river barge. Ongoing geopolitical disruption in the Middle East however has kept freight rates both volatile and high.

Operations and marketing

· During the first half of the year, the Group operated two out of four pelletising lines in the first quarter, and one line in the second quarter, in addition to a dedicated concentrate line.

· Total commercial production of 3,393 thousand tonnes was achieved, 7% higher than the preceding six months and 9% lower than the same period last year.

· The combined production of a range of Ferrexpo pellets totalled 2,170 thousand tonnes, combined with concentrate production of 1,223 thousand tonnes, the majority of which were produced in the first quarter.

· Focus on higher-grade iron ore production continued during the first half, with all pellets and concentrates grading 65% iron ore content or above. Production and sales of FDP pellets also resumed.

· Sales volumes totalled 3,807 thousand tonnes, comprised of pellets and commercial concentrate. This represents a 28% increase compared to the previous six months to December 2024 and flat compared to the first six months of 2024.

· The Group's C1 Costs decreased to US$77.1 per tonne in 1H 2025, due to reduced mining activities, the effects from lower fuel prices and consumption, as well as from lower maintenance and the reduction in personnel costs.

· CapEx was deliberately reduced by limiting spend on development projects and only funding necessary sustaining capital projects. Total CapEx reduced to US$28 million (1H 2024: US$55 million).

Environment, social and governance

· During the first half, the Company was forced to cut back on its humanitarian and CSR efforts due to limited funds. The Group does however continue to keep employment open for returning veterans.

· Scope 1 and 2 absolute and unit emissions fell reflecting a decrease in diesel consumption from the mining fleet and less natural gas in the pelletising facilities as concentrates made a bigger part of the Group's product mix.

· Later in the year, the Group intends to release its annual 'Responsible Business Report' for 2024.

Corporate governance

On 22 May 2025, Ferrexpo held its 2025 Annual General Meeting ("AGM"), at which the majority of the resolutions were passed. However, more than 50% of the independent shareholder votes were cast against the re-election of one of the Company's Independent Non-Executive Directors. Consequently, Ferrexpo announced that the Board intends to consult and engage with shareholders to better understand the reasons behind these votes and put the matter to a second vote of all shareholders within 120 days of the AGM.

On 11 January 2025, Non-executive Director Natalie Polischuk resigned from the Board of Ferrexpo Plc with immediate effect. Natalie was Chair of the Health, Safety, Environment and Communities ("HSEC") Committee, a member of the Audit Committee and a member of the Committee of Independent Directors.

On an interim basis, Fiona MacAulay, Senior Independent Non-executive Director was appointed a member of the Audit Committee and also appointed as a member of and will Chair the HSEC Committee.

Following Ms Polischuk's resignation, the Board continues to have a majority of independent Non-executive Directors. As previously announced, the Company has an ongoing process to search for a new independent Non-executive Director and as part of this search, the Company will also take into account ethnic and gender diversity on the Board.

For further information please contact:

Ferrexpo: | ||

Nick Bias | +44 (0)7733 177 831 | |

Tavistock: | ||

Jos Simson | +44 (0)20 7920 3150 | |

Gareth Tredway | +44 (0)7899 870450 | |

About Ferrexpo:

About Ferrexpo: Ferrexpo is a Swiss headquartered iron ore company with assets in Ukraine and a listing in the equity shares commercial companies category on the London Stock Exchange (ticker FXPO) and a constituent of the FTSE All-Share index. The Group produces high grade iron ore products, which are premium products for the global steel industry and enable reduced carbon emissions and increased productivity for steelmakers when converted into steel, compared to more commonly traded forms of iron ore. Ferrexpo's operations have been supplying the global steel industry for over 50 years. Before Russia's full-scale invasion of Ukraine in February 2022, the Group was the world's third largest exporter of pellets. The Group has a global customer base comprising of premium steel mills around the world. For further information, please visit www.ferrexpo.com.

Notes:

Please note that numbers may not add up due to rounding. In reporting financial performance, financial position and cash flows, reference is made to Alternative Performance Measures ("APMs") that are not defined or specified under International Financial Reporting Standards ("IFRSs"). APMs are not uniformly defined by all companies, including those in the Group's industry. Accordingly, the APMs used by the Group may not be comparable with similarly titled measures and disclosures made by other companies. APMs should be considered in addition to, and not as a substitute for or as superior to, measures of financial performance, financial position or cash flows reported in accordance with IFRSs. Ferrexpo refers to the following APMs in the Group's Interim Results: C1 Cash cost of production, Underlying EBITDA, Net cash/(debt), Capital investment, and Total Liquidity. Full definitions of the Company's APMs can be found in the Annual Report & Accounts.

Introduction

The war in Ukraine, now in its fourth year, continues to dominate Ferrexpo's workforce and operations.

At the end of June 2025, 738 colleagues were serving in the Armed Forces of Ukraine, more than at any time since the start of the full-scale war. Tragically, as at the end of June 2025, 47 of our colleagues have been killed serving in the Armed Forces since the start of the full-scale invasion in February 2022. We mourn their passing and honour their selfless and brave strength. As at the end of June 2025, 186 colleagues had been demobilised from the Armed Forces, of whom 98 have completed the veteran rehabilitation programme of whom 78 have returned to work.

It is important to recognise that our workforce is operating in extremely challenging conditions. Loved ones, friends and colleagues are serving in the Armed Forces, whilst they are living and working under a constant threat of aerial attack. The number of drone and missile attacks have escalated sharply in frequency and intensity in the Poltava region this year.

The health and safety of our workforce is paramount, as is the social contribution that we can offer in our communities, and to Ukraine as a whole. Sustaining employment in as safe a manner as possible supports livelihoods and helps foster more resilient communities better weather the challenges of a prolonged war.

Since the full-scale invasion of Ukraine in February 2022, Ferrexpo has significantly changed the way it operates. The lack of access to Ukrainian Black Sea ports until the end of last year forced us to pivot our sales towards European customers via rail. Concurrently, the business was right sized to operate at lower production levels due to logistics constraints. The business also had to adapt to constant new challenges, including conscription, establishing alternative procurement channels for important inputs and interruptions to energy supplies. Rising to the challenges has resulted in a business that is adaptive to change and flexible in how it can meet its customers' needs. It is in itself a demonstration of resilience that is testament to the hard work and determination of our people.

Sales volumes totalled 3.8 million tonnes, comprised of pellets, commercial concentrate and pellet feed. This represents a 28% increase compared to the previous six months to December 2024 and an 1% decrease compared to the first six months to June 2024.

The Group continued to benefit from access to Ukrainian Black Sea ports to export its products by sea to customers in Asia and the MENA region, and to customers in Europe who prefer deliveries by sea instead of by rail or river barge. In total 60% of the sales were exported by sea during the period compared to 53% in the previous six months and 47% in the same period last year.

In total, 16 vessels were loaded with Ferrexpo cargoes from Ukrainian ports during the period under review. Of total sales, 50% were to Asian customers, 38% to European customers and the balancing 12% to customers in the MENA region.

Sales volumes increased compared to the previous six months though were flat compared to the same period last year. However, the 65% Fe iron ore index fell 10% over the period resulting in revenue of US$453 million, an 18% increase compared to previous six months, and a 17% decrease compared to the same period last year when iron ore prices were significantly higher. As published in the Annual Report and Accounts in April 2025, the Group recorded a non-cash impairment loss, which totalled US$154 million. Adding back the impairment, the underlying EBITDA for the period was US$3.9 million, which is considered a resilient performance. The Group's result for the first half of 2025 amounts to a loss of US$196 million, mostly attributable to the impairment loss. This compares to a profit of US$55 million in the same period in 2024.

For a detailed review of iron ore markets, see the section 'Sales and Marketing Review' below and for the Group financials, see the 'Financial Review' section.

Outlook

The outlook for the second half of 2025 is challenging. During the second quarter of the year, management moved hard and fast to streamline the business to a sustainable basis by building operational resilience and preserving cash. This strategy has resulted in a situation where the business is performing financially on a marginally positive EBITDA basis. In July iron ore prices staged a small recovery, with the 65% Fe benchmark averaging US$116 per tonne in the final week of July 2025, 12% higher than the price at the start of the month. These prices provide some comfort; however, without the refund on VAT that is owed to us, the business will need to continue operating at reduced levels. Representations are being made to the Ukrainian authorities to restore VAT refunds, in addition to other international stakeholders.

Should this be secured, the ambition is to add back capacity, return those on reduced hours and furlough back to the workplace, and increase the social and economic contributions to Ukraine.

Shareholder returns

Given the reduced financial liquidity of the Group, the Board of Directors have elected not to declare an interim dividend for 2025 at this time because this would affect the Group's ability to continue as a going concern as disclosed in Note 2 Summary of material accounting policies and Note 19 Commitments, contingencies and legal disputes to these interim condensed consolidated financial statements.

Sales and Marketing Review

Iron ore supply, demand and prices

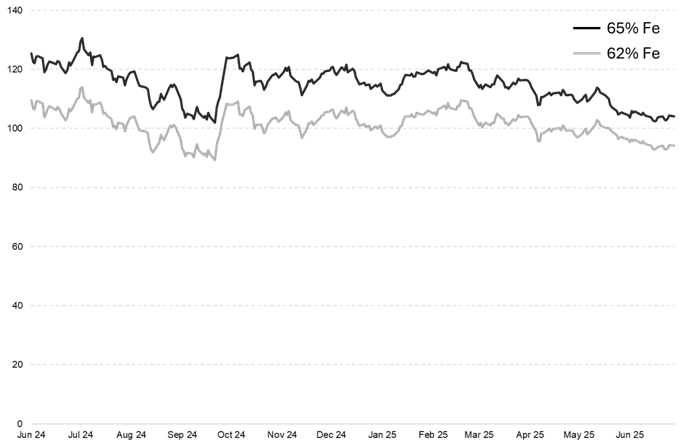

Following the seasonal rally in iron ore prices towards the end of last year, prices drifted lower through the first half of 2025, with the benchmark 65% Fe price closing 10% lower at the end of the period.

Iron ore prices (US$/t)

The first quarter of 2025 saw a moderately elevated price environment for iron ore due to weather-related supply disruptions from major exporting countries, Australia and Brazil. This resulted in some tightening of supplies at a time when seasonal restocking in China ahead of the Chinese New Year holiday was underway. This was also supported by mid-to-high grade price spreads on iron ore averaging US$13 per tonne at the time.

In the second quarter of 2025 however, the major iron ore producers ramped up exports, incentivised by favourable weather conditions and a relatively subdued freight market. Despite good demand and higher levels of steel production levels in China as the peak construction season approached, the growth in supply outweighed the seasonal demand peak, putting pressure on prices, evidenced in a 7% fall in the benchmark 65% Fe price and the 62 - 65% Fe spreads narrowing by 20%.

Industry commentators have been quick to note signs of improvement in July, which is reflected in our continued sales to China, however, the outlook remains uncertain.

Pellet premiums

Pellet premiums remained suppressed in the first half of 2025 as idled capacity from large pellet exporters globally came back online, resulting in increased supply pressure on the market. Combined with relatively lacklustre demand in the Atlantic blast furnace markets, the Atlantic pellet premium in the first half of 2025 fell to five-year lows; while suppressed steel margins in China failed to support pellet premiums in Asian markets.

Following a sustained period of lower pellet premiums, a reduction in pellet exports is expected in the second half following announcements of capacity cuts by some large players which could result in tighter supply and lend some support to pellet premiums.

Customer development

The Group has continued to export via Ukrainian Black Sea ports since access was restored in late 2023. Responding to relatively stronger demand for high-grade pellet feed concentrate in Asia, the Group once again demonstrated flexibility by increasing concentrate production and fixing 11 capesize vessels to Asia (out of a total 16 vessels) during the period, compared to just four in the same period last year.

Improvements in product specifications enabled by quality improvement projects at site has also allowed the Group to continue expanding its sales of FDP to new customers in the Middle East region in the first half of 2025, further developing its footprint in the low-emissions direct reduction steelmaking sector.

Freight

The C3 freight rate (Capesize freight rate from Brazil to China), is used as a reference when pricing the Group's sales. C3 rates in the first half 2025 remained relatively low at US$20 per tonne (1H 2024: US$26 per tonne) due to weather-related supply disruptions in Brazil. It is also interesting to note that as the perceived risks around shipping from Ukraine ease, the Group has observed a material decrease in freight rates shipping from Ukraine relative to international freight benchmarks, as more ship owners express interest to operate this route.

FINANCIAL REVIEW

Ongoing legal disputes and new adverse actions in Ukraine with significant impact on the Group's business activities and cash flow generation in the first half of 2025

Summary

Despite the unpredictable situation in Ukraine due to the ongoing war, the Group showed strong momentum at the beginning of the year, resulting in the Group's best quarterly production in the first quarter since the full-scale invasion in February 2022. This strong momentum was, however, significantly curtailed in the second quarter as the Group started to experience the full impact of the Ukrainian tax authorities' decisions to suspend the refund of VAT to the Group's Ukrainian subsidiaries.

In response to the rejection of VAT refunds, the Group adjusted its production volumes in the second quarter to minimise the negative impact on the Group's cash flow and available cash equivalents. Lower production volumes resulted in lower sales volumes, which has an adverse effect on the Group's profitability and cash flow generation.

The Group reported a loss for the first half of 2025 of US$196 million, which includes an impairment in the amount of US$154 million on the Group's non-current operating assets recorded as at 30 June 2025. The impairment primarily results from a non-adjusting post balance sheet event, which was disclosed in the Group's 2024 Annual Report & Accounts.

In the first quarter of 2025, the Group operated an average of two pellet lines, reducing to a single pellet line for reasons described above in the second quarter. This affected the Group's production costs on a per tonne basis. Throughout the second quarter, the Group worked extensively to lower its cost base to remain financially viable. This included placing approximately 37% of employees on reduced working time or on furlough, further cuts in procurement of goods and services and a suspension of all non-essential capital expenditures.

The index prices for 65% Fe iron ore fines averaged US$113 per tonne in the first quarter on a similar level as in the fourth quarter 2024, before weakening by approximately 8% in the second quarter, due to increased supply and concerns about global trade. This ultimately affected realised margins and cash flow generation.

The Group ended the first half of 2025 with a net cash position of US$50 million (31 December 2024: US$101 million). The capital expenditures for the first half of 2025 totalled US$28 million, significantly less than the US$55 million in the same period last year.

Key Financial Performance Indicators

US$ million (unless stated otherwise) | 1H 2025 | 1H 2024 | Change | FY 2024 |

Total pellet production (kt) | 2,170 | 3,297 | (34%) | 6,071 |

Total pellet and concentrate production (kt) | 3,393 | 3,727 | (9%) | 6,890 |

Total sales volumes (kt) | 3,807 | 3,849 | (1%) | 6,830 |

Iron ore price (65% Fe Index, US$/t)1 | 113 | 131 | (14%) | 123 |

Revenue | 453 | 549 | (17%) | 933 |

C1 cash cost of production (US$/t) | 77.1 | 78.8 | (2%) | 83.9 |

Underlying EBITDAA | 4 | 79 | (95%) | 69 |

Underlying EBITDAA margin | 1% | 14% | (13pp) | 7% |

Capital investmentA | 28 | 55 | (49%) | 102 |

Closing net cash | 50 | 112 | (56%) | 101 |

Revenue

Revenue decreased by 17% to US$453 million in the first half of 2025 (1H 2024: US$549 million), primarily due to lower realised prices and marginally lower sales volumes. Whilst total sales volumes were 42 thousand tonnes lower at 3.8 million tonnes, there was a significant shift in the ratio of pellets to concentrate produced as the Group responded to strong Chinese demand for its high-grade low-alumina iron ore concentrate. As a result, concentrates represented 32% of the Group's sales in the first half of 2025, three times more than in the same period a year ago. Revenue in the first half of 2025 was therefore primarily affected by a 14% decline in the average benchmark iron ore price (65% Fe) and a 15% drop in the average Atlantic pellet premium. At the same time, the average index rates for international freight decreased by 22% to US$20.1 per tonne compared to US$25.8 per tonne in the same period in 2024. The net effect of changes index prices, pellet premiums and freight rates lowered the Group's net back realised prices for sales under the International Commercial Terms ("Incoterms") of FOB ("Free on Board").

The Group continued to benefit from the availability of the Ukrainian Black Sea ports and seaborne sales remained stable at 2.1 million tonnes.

Iron ore prices

US$ per tonne | 1H 2025 | 1H 2024 | Change | FY 2024 | Change |

Average 62% Fe iron ore fines price | 100.8 | 117.3 | (14%) | 109.4 | (8%) |

Average 65% Fe iron ore fines price | 112.6 | 130.7 | (14%) | 123.4 | (9%) |

Average 62%/65% spread | 11.8 | 13.4 | (12%) | 14.0 | (16%) |

The changes of iron ore fines prices in the first half of 2025, compared to the same period in 2024, are reflecting a balance between cautious demand and ample supply. The demand is currently affected by ongoing trade tensions and increased barriers to trade on steel. This effect is exacerbated by high port stockpiles, reducing the urgency to restock, and increasing production volumes in Australia and Brazil ahead of new projects in other countries that will become operational soon. As a result, the overall supply growth outpaced the demand in the first half of 2025. This is also likely to be the case in the second half of 2025, as possible fiscal or economic measures will not be able to offset the ongoing structural weakness of the steel and property sector.

For more information on the market factors influencing pricing of the Group's products and logistics, please see the Market Review section.

C1 cash cost of production

Cost of sales in first half of 2025 totalled US$311 million, compared to US$314 million in the same period in 2024. The decrease is mainly due to the lower total production as result of the rejection of VAT refunds in Ukraine, so that the Group had to adjust its production volumes in the second quarter to minimise the negative impact on the Group's cash flow and available cash balance. The total production volume for pellets and concentrates decreased by 9% to 3.4 million tonnes, compared to 3.7 million tonnes in the comparative period last year. Because of the rejected VAT refunds and changing market conditions, the Group assessed and adjusted its production split to generate the best possible returns under the changed circumstances. This resulted in a decrease of the volume of pellets produced by 34% to 2.2 million tonnes (1H 2024: 3.3 million tonnes), and an increase of the volume of concentrate produced by 184% to 1.2 million tonnes (1H 2024: 0.4 million tonnes). As in previous years since the start of the full-scale invasion of Ukraine, the Group's production costs are still affected by higher prices for raw materials such as gas and electricity, whereas the Group benefited from lower fuel prices as well as an overall cost reduction programme.

In the first half of 2025, the Group continued focusing on lowering its cost base to remain financially viable. As a result, production was downscaled from an average of two pellet lines in the first quarter to a single line in the second quarter. As a result, approximately 37% of employees were placed on reduced working time or on furlough, and further cuts were made to the Group's repair and maintenance programme and its mining operations.

The C1 cash cost of production ("C1 costs") reflects the Group's operating costs for the production of iron ore pellets, with a breakdown of the different cost components shown in the table below.

The Group's average C1 costs decreased to US$77.1 per tonne in the first half of 2025, compared to US$78.8 per tonne in same period in 2024. The total costs per tonne were lower, principally due to reduced mining activities, the effects from lower fuel prices and consumption, as well as from lower maintenance and the reduction in personnel costs. These cost efficiencies were partially offset by higher prices for electricity, gas and materials, further affected by a slight appreciation of the local currency in Ukraine to the US dollar.

The main C1 costs drivers are the prices of electricity, natural gas and diesel, which are outside of the Group's control and still affected by the ongoing war in Ukraine. The Group continued to experience a sharp increase in electricity prices due to the currently weak power generation and distribution facilities in Ukraine as a result of continued Russian attacks. The decreased mining and maintenance activities in the first half of 2025 resulted in a lower proportion of diesel consumption and repair costs. Another important component of the Group's C1 costs that is also outside of the Group's control relates to royalties in Ukraine, which accrue and are paid based on a tiered system. According to this regime, royalties are calculated based on the benchmark index price for a medium-grade (62% Fe) iron ore fines price and computed based on the cost of different iron ore products. The rate varies between 3.5%, 5.0% and 10.0% depending on the benchmark index price for 62% Fe. The royalty expense totalled US$14 million in the first half of 2025, compared to US$20 million in the same period in 2024, driven mainly by the lower production volume and the effect of lower average index prices in the first half of 2025.

Group operating costs, denominated in Ukrainian hryvnia ("UAH"), account for approximately two thirds of the Group's C1 costs. Consequently, changes in hryvnia to dollar rates can have a significant impact on the Group's operating costs, including the C1 costs. Historically, the Group's C1 costs benefited from a devaluation to the US dollar, whereas in the first half of 2025, the UAH marginally appreciated to the US dollar, compared to a devaluation of 7% in the same period in 2024, putting additional pressure on the Group's C1 costs.

The Group's C1 costs per tonne represent the cash cost of the production of iron pellets from ore, divided by the production volume. The C1 costs exclude non-cash costs such as depreciation, pension costs and inventory movements. Following the sharp increase of the volume of concentrate produced in the first half of 2025, the computation of the C1 costs per tonne was amended so that only the costs related to the pellet production are divided by the volume of produced pellets, whereas the computation of C1 costs per tonne of the comparative period was based on the total costs divided by the volume of produced pellets. The C1 cash cost of production (US dollars per tonne) is regarded as an Alternative Performance Measure ("APM").

Breakdown of C1 costs

The Group's business is very energy intensive, and the main C1 costs components are electricity, natural gas and diesel, which collectively represent 49% (1H 2024: 45%) of the total cost base as presented in the chart below with changes and the proportions of the different cost components.

In the first half of 2025, the proportion of C1 costs per tonne for electricity increased by 7% to 34% (1H 2024: 27%), as the effect from higher electricity prices was exacerbated by the lower production volume. The average electricity price in Ukraine in the first half of 2025 increased by 28% in US dollar terms to an average of US$147 per megawatt-hour ("MWh"), peaking at US$173 per MWh in February 2025, then steadily decreasing in the second quarter to US$136 per MWh in June 2025. This compares to an average of US$115 per MWh in the first half of 2024. The proportion of natural gas increased to 9% (1H 2024: 7%) due to higher prices on the global markets, partially offset by lower consumption due to an increase in the production of concentrates resulting in less gas being required for pelletising, whereas the proportion of fuel decreased from 11% in the first half of 2024 to 6%, mainly due to the Group's decreased mining activities in the first half of 2025. The average prices for oil (Brent) and natural gas, both in US dollar terms, were 8% lower and 32% higher in the first half of 2025, compared to opposite effects of 4% higher and 23% lower in the first half of 2024.

The increase in the proportion for materials from 13% in the first half of 2024 to 17% in the first half of 2025 is mainly due to a higher volume of concentrate purchased from third party suppliers, as well as the effects of local inflation and the marginal appreciation of the Ukrainian currency. The slight decrease in the proportion of personnel expenses from 9% in the first half of 2024 to 8% in the first half of 2025 is largely driven by the increased proportion of employees placed on reduced working time or on furlough, partially offset by adjustments increases in salaries and the payment of bonuses made to the workforce in Ukraine.

Due to the ongoing war in Ukraine and the absence of VAT refunds, which have led to lower production volumes, the Group reduced its maintenance and repair programme for its mining and processing equipment compared to the first half of 2024. See section "C1 cash cost of production" for further information on the Group's production costs.

C1 Costs breakdown

US$ per tonne | 1H 2025 | 1H 2024 | Change | FY 2024 | Change |

Electricity | 34% | 27% | 7% | 32% | 2% |

Natural gas and sunflower husks | 9% | 7% | 2% | 7% | 2% |

Fuel (including diesel) | 6% | 11% | (5%) | 9% | (3%) |

Materials | 17% | 13% | 4% | 12% | 5% |

Personnel | 8% | 9% | (1%) | 8% | - |

Maintenance and repairs | 14% | 17% | (3%) | 17% | (3%) |

Grinding media | 5% | 6% | (1%) | 6% | (1%) |

Royalties | 6% | 8% | (2%) | 7% | (1%) |

Explosives | 1% | 2% | (1%) | 2% | (1%) |

The numbers above are rounded to full decimals

Selling and distribution costs

Total selling and distribution costs decreased to US$133 million in the first half of 2025, compared to US$148 million in the same period in 2024, primarily driven by lower freight tariffs on seaborne sales. Seaborne logistics routes are generally the lowest cost and most efficient way to deliver the Group's products to customers. During the first half of 2025, the index rates for international freight averaged 22% lower at US$20.1 per tonne compared to US$25.8 per tonne in the same period in 2024. The Group's seaborne sales, mainly under CFR ("Cost and Freight") and CIF ("Cost, Insurance and Freight") Incoterms, remained stable at 2.1 million tonnes, as the Group continued to benefit from access to Ukrainian Black Sea ports. However, in the first half of 2024, this volume included 0.3 million tonnes sold under FOB ("Free on Board") terms, where the customer bears responsibility for the freight (1H 2025: nil). As a result of the generally lower freight rates, partially offset by a higher proportion of shipments under CFR and CIF Incoterms, the Group's international freight costs decreased to US$70 million, compared to US$74 million during the same period in 2024. In addition to the international freight costs, the Group's selling and distribution costs are also dependent on the level of domestic Ukrainian logistics costs, such as railway tariffs and port charges. In general, the Group's logistics costs continue to be affected by the ongoing war in Ukraine, including higher insurance premiums than before the war. However, the Group benefited from a decrease of the insurance premiums in the first half of 2025, also due to rebates as a result of the volumes insured in 2024, resulting in a decrease of the freight insurance costs to US$1 million, compared to US$5 million in the same period in 2024.

The Ukrainian rail network is essential to delivering the Group's products to Black Sea ports and to the Western border of Ukraine. Following war-related congestions in 2022 and 2023, the situation continued to improve in 2024 and 2025 and rail tariffs in Ukraine remained unchanged during the first half of 2025, compared to the rates during the financial year 2024. A hefty 70% increase of the rail tariffs was imposed in July 2022, and a potential new increase are being touted, without a decision made as at the approval of these interim condensed consolidated financial statements.

General and administrative expenses

General and administrative expenses in the first half of 2025 decreased to US$31 million, compared to US$32 million in the same period in 2024. Following the rejection of the VAT refunds, the Group worked extensively throughout the second quarter of 2025 to lower its cost base. Measures taken include placing approximately 37% of employees in Ukraine on reduced working hours or furlough. General and administrative expenses also include legal and consulting costs totalling US$8 million (1H 2024: US$9 million), which are in connection with ongoing legal proceedings against the Group in Ukraine.

See Note 19 Commitments, contingencies and legal disputes to these interim condensed consolidated financial statements for the current environment in Ukraine facing the Group, and further information on the ongoing legal challenges and disputes of the Group in Ukraine.

Other operating expenses

Other operating expenses increased to US$166 million in the first of half 2025, compared to US$14 million in the comparative period in 2024. This increase is predominantly due to a non-cash impairment loss of US$154 million recorded as at 30 June 2025 on the Group's non-current operating assets, including property, plant and equipment, intangible assets and other non-current assets, which was allocated to various asset categories within property, plant and equipment. The recorded impairment loss was expected as disclosed in the Group's 2024 Annual Report & Accounts as a non-adjusting post balance sheet event in relation to the rejection of VAT refunds in Ukraine. As a result, the Group adjusted its production plan to mitigate the effect from VAT related working capital outflows and to preserve its available cash balance, affecting also the Group's cash flow generation, which forms the basis of the impairment test.

Currency

Ferrexpo prepares its accounts in US dollars. The functional currency of the Group's operations in Ukraine is the Ukrainian hryvnia, as approximately two thirds of the Group's operating costs are historically denominated in local currency.

The local currency appreciated marginally from 42.039 at the beginning of 2025 to 41.641 as at 30 June 2025, with an average exchange rate of 41.631 in the first half of 2025 (1H 2024: 39.009).

With the continuation of Martial Law in 2025, the National Bank of Ukraine ("NBU") has continued to maintain significant currency and capital controls to manage the local currency. As a result, there are limitations to converting balances in local currency into US dollars, and to transferring US dollars between onshore and offshore accounts of the Group.

See Note 19 Commitments, contingencies and legal disputes to these interim condensed consolidated financial statements for further information.

Ukrainian hryvnia : US dollar1 |

Spot 04.08.25 41.764 |

Opening rate 01.01.25 42.039 |

Closing rate 30.06.25 41.641 |

Average 1H 2025 41.631 |

Average 1H 2024 39.009 |

[1] Source: National Bank of Ukraine

Operating and non-operating foreign exchange losses/gains

The functional currency of the Ukrainian subsidiaries is the hryvnia. Historically, the devaluation of the hryvnia against the US dollar resulted in foreign exchange gains on the Group's Ukrainian subsidiaries' US dollar denominated receivable balances from the sale of iron ore products. In the first half of 2024 the local currency in Ukraine slightly appreciated against the US dollar resulting in operating foreign exchange losses of US$7 million, compared to gains of US$55 million in the same period in 2024, when the hryvnia depreciated.

Non-operating foreign exchange gains of US$8 million in the first half of 2025, compared to losses of US$25 million in the same period of 2024, also due to the appreciation of the hryvnia and primarily relating to the translation of US dollar denominated loan payable balances of the Group's Ukrainian subsidiaries.

For further information on the operating foreign exchange gains and the non-operating foreign exchange losses, please see Note 6 Foreign exchange gains and losses to these interim condensed consolidated financial statements.

Underlying EBITDA

The Group's underlying EBITDA remained positive at US$4 million for the first half of 2025, despite the loss for the period, although this is significantly lower than in the same period in 2024 (1H 2024: US$79 million). The sharp decline is mainly due to lower operating profits resulting from the adjusted lower production plan following the rejection of VAT refunds in Ukraine and lower realised prices, which could not be offset by the effects from lower C1 production costs and the further cost-cutting measures initiated by the Group during the second quarter of 2025.

Underlying EBITDA is an Alternative Performance Measure ("APM").

Net finance expense

The Group's finance expenses in the first half of 2025 remained stable at US$2 million, compared to the same period in 2024.

With the exception of lease liabilities, the Group does not have any outstanding interest-bearing loans and borrowings, therefore no interest expenses on finance facilities were incurred. As in the prior year, the majority of finance expense relates to the calculated interest on the Group's pension scheme, without any cash outflow effects, and to bank charges. At the same time, interest income decreased from US$2 million in the first half of 2024 to US$1 million in the first half of 2025. Interest income is derived from the available funds invested in deposits and depends on interest rates on the global financial markets and the funds invested.

Further details on finance expense are disclosed in Note 7 Net finance expense to these interim condensed consolidated financial statements.

Income tax

The Group's income tax expense decreased to US$9 million, compared to US$20 million in the same period in 2024. The lower income tax expense is due to the fact that some of the Group's subsidiaries realised losses in the first half of 2025. The income tax expense also includes the effect of an additional allowance of US$3m recorded on deferred tax assets recognised in Ukraine. The Group's overall loss position is due to a significant impairment loss recorded as at 30 June 2025 on the Group's non-current assets, which is mainly allocated to the Group's operations in Ukraine and required downscaling of the Group's operations. Both effects are the result of the adjusted production plan following the rejection of VAT refunds in Ukraine, affecting the Group's cash flow generation and profitability.

The effective tax rate as of 30 June 2025 is affected by the additional impairment loss of US$154 million on the Group's non-current operating assets, which is primarily allocated to the Group's operations in Ukraine, and the effect from extracted low grade ore totalling US$12 million, which are both not tax deductible in Ukraine. As a consequence, there is no deferred tax effect recognised as it was done in the past.

The effective tax rate for the first half of the 2025 financial year was positive at 4.9% and therefore not comparable to previous periods. The reason for the positive effective tax rate is that the Group is in a loss position even before the significant impairment charge and no deferred tax assets on the resulting tax loss carry forwards were recognised, as it is currently uncertain whether the Group's subsidiaries in the various countries will be able to benefit from them in the near future.

The lower production volumes affecting the Group's overall profitability also had an adverse impact on the taxes to be paid in the different jurisdictions, but mainly in Ukraine. As a result of the lower profitability in the different jurisdictions, the income tax paid by the Group decreased to US$3 million, compared to US$13 million in the same period in 2024, of which US$10 million was paid in Ukraine. The income tax paid in the first half of 2025 includes withholding tax on intercompany interest payments totalling US$1 million (1H 2024: US$2 million), to be considered as income tax payments and paid in Ukraine. Further details on taxation are disclosed in Note 8 Taxation to these interim condensed consolidated financial statements.

Items excluded from underlying earnings

In addition to the usual adjustments made to the underlying EBITDA, the figure for the first half of 2025 was adjusted as at 30 June 2025, considering the non-cash effect of the US$154 million impairment loss. The impairment loss was to be expected and results from a non-adjusting post balance sheet event, which was disclosed in Note 35 Events after the reporting period included in the Group's 2024 Annual Report & Accounts.

See Note 10 Property, plant and equipment to these interim condensed consolidated financial statements for further details.

Loss for the half year

The Group's result for the first half of 2025 amounts to a loss of US$196 million, mostly attributable to the US$154 impairment loss. This compares to a profit of US$55 million in the same period in 2024. The loss is also attributed to lower pellet sales volumes and lower iron ore prices and higher prices for energy and key consumables.

Cash flows and cash equivalents

Operating cash flow before changes in working capital decreased by 94% to US$5 million, compared to US$82 million in the same period in 2024. The lower operating cash flow generation is the result of the adjusted production plan following the rejection of VAT refunds by the Ukrainian tax authorities since March 2025. In terms of the working capital, there was an overall outflow of US$24 million, compared to US$12 million in the same period in 2024. The net outflow was largely driven by an increase in the trade receivables balance due to increased sales volumes in June 2025, whereas the decrease of inventories and the increase of taxes recoverable are linked to the adjusted production plan mentioned above. Since March 2025, the Group's subsidiaries in Ukraine did no longer receive VAT refunds, resulting in a sharp increase in the outstanding VAT balance as at 30 June 2025 and further increases are to be expected until VAT refunds resume.

The net cash flow from operating activities was negative at US$24 million, compared to positive at US$56 million in the same period in 2024. The effect from the lower operating cash flow was accentuated by working capital outflows as at 30 June 2025.

During the first half of 2025, the Group significantly reduced its capital expenditure programme, with investments decreasing to US$28 million, compared to US$55 million in the same period in 2024. See the Capital investment section below for further information.

The significantly lower operating cash flow generation could only be partially offset with the initiated decrease of capital expenditures. As a result, the closing balance of cash and cash equivalents decreased to US$52 million as at 30 June 2025, compared to US$106 million as of 31 December 2024.

The balance of cash and cash equivalents held in Ukraine amounts to US$2 million as at 30 June 2025 (31 December 2024: US$4 million). Following the adoption of Martial Law in Ukraine, currency and capital control restrictions were introduced in Ukraine by the NBU, which are still in place. Although these measures were softened by the regulator in 2024, they are still affecting the Group in terms of its ability to make cross-border payments, which may be carried out only in exceptional cases.

For further information see Note 19 Commitments, contingencies and legal disputes to these interim condensed consolidated financial statements.

Capital investment

Capital expenditure in the first half of 2025 totalled US$28 million compared to US$55 million in the same period in 2024. Of the total amount spent in the first half of 2025, sustaining and modernisation capital expenditure totalled US$15 million (1H 2024: US$19 million), covering the activities of all of the Group's major business units, and investments in strategic development projects totalled US$13 million (1H 2024: US$36 million). The significant decrease of the capital expenditures reflects the Group's extensive work to reduce all non-essential capital expenditures following the rejection of VAT refunds by the tax authorities in Ukraine since March 2025.

Since the beginning of the war, the Group continuously reviewed and optimised the level and timing of its capital expenditure programme to ensure the reliability of operations in Ukraine and to avoid unexpected downtimes. The recent rejection of VAT refunds required more extensive cuts, albeit primarily for strategic development projects, whereas the sustaining and modernisation capital expenditures remained on a similar level as in the comparative period in 2024.

Following the rejection of VAT refunds, the Group significantly reduced its investments in strategic development projects, which decreased to US$13 million, compared to US$36 million in the same period in 2024. The largest capital investments included additional funds for the new press filtration complex and a new concentrate conveyer line along the production circuit, which totalled US$5 million and US$3 million, respectively. The purpose of these projects is the increase of the production of high-grade iron ore products so that the business can build flexibility into its production mix and be more nimble adapting to short-term changes in demand for different products. The Group also funded US$2 million on stripping activities for future production and US$1 million on the development and exploration at the Belanovo Mine.

Considering the fall in cash flow generation, which is affected by the rejection of VAT refunds and continued effects from the ongoing war in Ukraine, no ordinary dividends were declared or paid during the first half of the financial years 2025 and 2024. The Group has a shareholder returns policy outlining the Group's intention to deliver up to 30% of free cash flows as dividends in respect of a given year. The Group's ability to make dividend payments also depends on developments in respect of the ongoing legal disputes in Ukraine.

For further information see Note 19 Commitments, contingencies and legal disputes to these interim condensed consolidated financial statements.

Debt and maturity profile

The Group is doing everything it can to maintain a robust balance sheet, being essentially debt free, with a net cash position of US$50 million as at 30 June 2025 (31 December 2024: US$101 million). With the exception of lease liabilities, the Group did not have any outstanding interest-bearing loans and borrowings as of 30 June 2025 and 31 December 2024.

As of 30 June 2025, the credit rating agency S&P had a corporate and debt rating for Ferrexpo of CCC, with a negative outlook. The credit ratings agency Moody's had a long-term corporate and debt rating for Ferrexpo of Caa3, with a negative outlook. The credit ratings agency Fitch maintains a CCC- with a negative outlook rating for the Group. While the credit rating of Ferrexpo is capped by the sovereign credit rating of Ukraine, the ceilings for credit ratings ascribed to Ferrexpo by S&P, Moody's and Fitch are higher (four notches above sovereign, SD, for S&P, one notch above sovereign, Ca, for Moody's and three notches above sovereign, RD, for Fitch).

Related party transactions

The Group enters into arm's length transactions with entities under the common control of Kostiantyn Zhevago and his associates. All these transactions are considered to be in the ordinary course of business.

During the first half of 2025, the Group made a bail payment of UAH5 million (approximately US$120,000) (1H 2024: US$1 million) on behalf of one member of the top management (1H 2024: one) of one of the Group's subsidiaries in Ukraine in respect of various legal actions and ongoing court proceedings initiated by certain governmental bodies against the Group's subsidiaries and members of the senior management in Ukraine.

See also section below, Note 19: Contingent liabilities and legal disputes and Note 21 Related party disclosures to these interim condensed consolidated financial statements for further details.

Contingent liabilities and legal disputes

The Group is exposed to risks associated with operating in a challenging environment in Ukraine during a time of war and the current circumstances facing Mr Zhevago. As a result, the Group is subject to various legal actions and ongoing court proceedings initiated by different government agencies in Ukraine. There is a continued risk that the independence of the judicial system, and its immunity from economic and political influences in Ukraine may not be upheld. Consequently, Ukrainian legislation might be applied inconsistently to resolve the same or similar disputes. As a result, the Group is exposed to a number of higher risk areas than those typically expected in a stable economy, which require a significant portion of critical judgements to be made by management.

In respect of the ongoing contested sureties claim before the Supreme Court of Ukraine, several court hearings took place in the first half of 2025 without a final Supreme Court ruling. As at the date of the approval of these interim condensed consolidated financial statements, the date of the next hearing is scheduled for 8 September 2025. If the final Supreme Court ruling is not in favour of Ferrexpo Poltava Mining ("FPM"), the claimant may take steps to appoint either a state or a private bailiff and request the commencement of enforcement procedures, which could have a material negative impact on the Group's business activities and its ability to continue as a going concern, as the assets of FPM could be seized or subject to a forced sale. In connection with the contested sureties claim, the counterparty filed an application for bankruptcy of FPM and a hearing scheduled for 24 July 2025 in respect of that application was postponed. A further hearing is yet to be scheduled. In the event of a possible negative decision by the court of first instance, the Group will appeal. In the meantime, it is currently not possible to assess the potential impact of such bankruptcy proceedings and their timing, as these depend on further court proceedings, which may extend over a considerable period of time.

As announced on 4 February 2025, the Group's subsidiary FPM has received information that a civil claim was filed seeking joint liability of FPM and its General Director for damages amounting to UAH157 billion (approximately US$3.8 billion as at 1 August 2025) in favour of the Ukrainian state. This claim is related to an initial accusation of the illegal sale of waste products, as disclosed in the Group 2023 Annual Report & Accounts, which have evolved into accusations that FPM is illegally mining and selling subsoil (minerals other than iron ore), which is said to have caused damage to the environment. FPM rejects these allegations in their entirety on the basis that there was no illegal extraction of the subsoil. Management is of the opinion that these accusations and the claim are without merit and FPM has started the vigorous defence of its position in the Ukrainian courts. Even if a court in Ukraine would conclude that there was illegal mining and sale of subsoil, the extent of this claim is in no way comprehensible, and it is the Group management's position that no reliable estimate can be made as at the date of approval of these interim condensed consolidated financial statements. As a result, and due to the absence of significant developments since the approval of the Group's 2024 annual financial statements, no provisions were recognised as at 30 June 2025 in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets.

Following the personal sanctions imposed on Mr Zhevago by Ukrainian authorities on 12 February 2025, local subsidiaries of the Group in Ukraine have not been receiving VAT refunds since March 2025. Although no sanctions have been imposed on any member of the Group, the personal sanctions on Mr Zhevago have implications on the Group's operation and, as a consequence, on its profitability and cash flow generation, which could have an impact on the Group's ability to continue as a going concern. In connection with the personal sanctions on Mr Zhevago, on 20 February 2025, the State Bureau of Investigation (the "SBI") made a media announcement regarding a potential claim to the High Anti-Corruption Court of Ukraine (the "HACC") to nationalise 49.5% of shares in FPM and certain of its assets.

In addition to the above cases, there is a risk of transfer of 49.5% of the corporate rights in a subsidiary of the Group in Ukraine to the Ukrainian Asset Recovery and Management Agency ("ARMA"); this is related to ongoing proceedings against Mr Zhevago.

See Note 2 Summary of material accounting policies and Note 19 Commitments, contingencies and legal disputes to these interim condensed consolidated financial statements as well as the Principal Risks section for further details.

Going concern

As at the date of the approval of these interim condensed consolidated financial statements, both the war and legal actions against the Group in Ukraine are ongoing and still pose a significant threat to the Group's mining, processing and logistics operations in Ukraine. This threat results in material uncertainties outside of the Group's control. In addition to the war-related material uncertainty, the Group is also exposed to the risks associated with operating in a challenging environment in Ukraine, which may or may not be exacerbated by the war and/or the current circumstances facing Mr Zhevago (see Ukraine country risk in the Update on Principal Risks section). As a result, the Group is exposed to a number of risk areas that are heightened compared to those expected in a stable economy, such as an environment of political, fiscal and legal uncertainties, which represents another material uncertainty as at the date of approval of these interim condensed consolidated financial statements. As mentioned in the section Contingent liabilities and legal disputes above, there are a number of legal actions against the Group in Ukraine, which had to be assessed by the management also in terms of the Group's ability to continue as a going concern and required critical judgements.

Detailed information on the Group's ability to continue as a going concern and material uncertainties are disclosed in Note 2 Summary of material accounting policies to these interim condensed consolidated financial statements.

Nikolay Kladiev

Chief Financial Officer, Ferrexpo plc

Operational review

Health and safety

Despite the ongoing war in Ukraine, Ferrexpo continues to maintain a good safety record, with zero fatalities since August 2020. The Group recorded a 6-month lost time injury frequency rate ("LTIFR") of 0.56, higher than the average 0.54 for 2024 due to a lost-time injury in January when an employee received a slight injury to his finger when holding a waste container.

Group and subsidiary six-month LTIFR

1H 2025 | 2H 2024 | FY 2024 | 1H 2024 | |

FPM | 0.77 | 0.50 | 0.42 | 0.34 |

FYM | 0 | 0.58 | 0.28 | 0 |

FBM | 0 | 0 | 0 | 0 |

Ukraine | 0.59 | 0.51 | 0.39 | 0.26 |

First-DDSG | 0 | 1.94 | 2.90 | 3.87 |

Group | 0.56 | 0.60 | 0.54 | 0.48 |

Otherwise, the Group has maintained a low incidence of safety incidents due to multi-year projects implementing a strong safety culture at its operations, including workforce engagement, safety training and regular monitoring of leading and lagging safety indicators. During the period, an additional bomb shelter was installed for administrative employees at FPM.

Pellet production and pellet quality

During the first six months of 2025, out of its four pelletiser lines, the Group has operated two in the first quarter and one in the second quarter in addition to a parallel concentrate line. The Group announced its production for the first half of 2025 in its second quarter 2025 production report on 7 July 2025. Total commercial production for the period was 3,393,135 tonnes, comprising concentrate production of 1,223,504 tonnes and pellet production of 2,169,631 tonnes, of which FDP accounted for 81,787 tonnes. The total production for the first half of 2025 was 9% lower than the same period last year, though 7% higher than the previous six months to the end of December 2024.

The Group has continued to focus on high-grade production, with 100% of production in the period being with an iron ore content of 65% or above. The Group demonstrated agility and flexibility however, as it continued to benefit from strong demand for its high-grade low-alumina concentrates from customers in China, representing over a third of its product mix during the first half.

Iron ore products production

tonnes | Fe Grade | 1H 2025 | 2H 2024 | Change | 1H 2024 | Change |

Direct Reduction Pellets ("FDP") | 67% | 81,787 | 327,075 | (75.0)% | 162,645 | (49.7)% |

Premium Pellets | 65% | 2,087,844 | 2,446,025 | (14.6)% | 3,134,796 | (33.4)% |

Total pellet production | 2,169,631 | 2,773,100 | (21.8)% | 3,297,441 | (34.2)% | |

Commercial concentrate | 67% | 1,223,504 | 389,473 | +214.1% | 429,865 | 184.6% |

Total commercial production | 3,393,135 | 3,162,543 | +7.3% | 3,727,306 | (9.0)% |

Marketing

With continued access to Ukrainian Black Sea ports during the first half of 2025, the Group was able to maintain exports to customers in Europe (in addition to the established rail and barge routes) and further afield to its customers in MENA and Asia.

The sales mix comprised of high-grade commercial concentrates and pellets, with concentrates predominantly sold to customers in China and pellets to customers in Europe and the Middle East.

Sales by region

Market regions | 1H 2025 | 2H 2024 | 1H 2024 |

Europe, including Turkey | 46% | 46% | 80% |

MENA | 4% | 4% | 2% |

Asia | 50% | 50% | 18% |

Totals may not sum due to rounding

Responsible business activities

Safety

The Group is pleased to report that there were no fatalities at its operations in 1H 2025. Regrettably, however, there was an increase in the number of minor injuries reported during the period and consequently the reported injury rate ("LTIFR") increased to 0.56 which is above the five-year trailing average rate at 0.54.

Community support

Since the early stages of Russia's invasion of Ukraine in 2022, the Group has sought to utilise its position as a business in Ukraine to source and provide support throughout the communities where the Group operates. In response to the humanitarian crisis in Ukraine, the Group established the dedicated Ferrexpo Humanitarian Fund, which combined with its regular CSR activities, has operated over 100 programmes and initiatives. Regrettably, due to the suspension of VAT refunds and the resulting lower financial liquidity of the Group, only essential humanitarian efforts are being continued at the present time.

Pathway to low carbon production

Since 2023 the Group has completed an external assurance process on its Scope 1 and Scope 2 emissions. For 2024 the Group also completed the process for Scope 3 emission. This was done to build confidence around the reporting of sustainability topics. In December 2024, the Group also published its second Climate Change Report. The report represented the culmination of extensive work conducted to map out the carbon footprint of Ferrexpo and its exposure to climate change risks and opportunities, as we strive to deliver Net Zero emissions production by 2050. Three potential war-ending scenarios were analysed: continuation of war, war ending and rapid or slow adoption. The modelling identified that under the first two scenarios absolute emissions reductions exceeded SBTi requirements and our own targets, whereas the scenario of slow adoption identified that Ferrexpo would fall short of SBTi requirements but surpass our internal goals.

Greenhouse gas emissions

| 1H 2025 | 1H 2024 | Change |

Absolute emissions (tonnes CO2e) | |||

Scope 1 (direct emissions, principally diesel and natural gas) | 137 | 193 | (29)% |

Scope 2 (indirect emissions, reflecting electricity consumption) | 145 | 111 | +30% |

Group total | 281 | 304 | (8)% |

| |||

Unit emissions (kg CO2e per tonne of production) |

| ||

Scope 1 | 39 | 54 | (28)% |

Scope 2 | 41 | 31 | +31% |

Group total | 80 | 85 | (7)% |

The principal effects on emissions include:

· Clean power purchasing. Since May 2024, the Group has been mandated to import up to 80% of its electricity, depending on domestic availability from neighbouring EU countries. This power is typically generated from carbon rich sources. Consequently, the Group's ability to locally source cleaner hydro and nuclear generated power has been reduced. This is reflected in a decreasing proportion of the Group's purchases of clean energy sources at 45% in 1H 2025 (1H 2024: 63%).

· Mining activities. Ferrexpo continues to operate its mining activities at a reduced capacity due to the war. The first quarter, however, was the best quarter for production volumes since the start of the full-scale invasion in February 2022. Operations have since downscaled in the second quarter, resulting in an overall decrease in diesel consumption by 33% compared to 1H 2024.

· Processing and beneficiation activities. With a decrease in pellet production in 1H 2025, natural gas consumption at the Group's pelletising facilities has fallen by 33% compared to 1H 2024.

The Group's Scope 3 emissions are dominated by the emissions generated by steelmakers in the conversion of iron ore to steel, with this activity representing 96% of Scope 3 emissions in 1H 2025 (1H 2024: 96%), and more than 90% of total emissions (Scopes 1, 2 and 3 combined). Ferrexpo's Scope 3 emissions footprint was 1.49 tonnes CO2 per tonne of production in 1H 2025, higher than 2024 due to a pivot toward increased pellet feed concentrate production and sales, a product which requires additional processing in the steelmaking process to produce steel, compared to pellets.

Responsible Business Report 2024

Later in the year, the Group will release its tenth annual Responsible Business Report.

Update on principal risks

Principal Risks are assessed on the basis of impact and probability and are considered to have the greatest potential effect on the business. Each Principal Risk is linked to aspects of the Group's strategy that could be affected if an event were to occur. The Group considers the Principal Risks facing the business, including the ongoing war in Ukraine since the full-scale invasion in February 2022, Ukraine country risk, counterparty risk, iron ore market and pricing risk, operating risks including health and safety, production, logistics and operating costs, information technology and cybersecurity, and climate change.

The principal risks detailed on pages 84 to 94 of the 2024 Annual Report and Accounts published in April 2025 remain relevant. An update on material developments that relate to the Group's Principal Risks since their publication in April 2025 is provided below.

In addition, the Board and management have identified three new principal risks: major shareholder risk, liquidity risk and taxation risk which are also included in the updated descriptions below.

Update since publication of Annual Report and Accounts in April 2025

Conflict risk and outlook

The primary consideration for Ferrexpo's risk profile at the present time is Russia's full-scale invasion of Ukraine, and the impact that this is having, and will continue to have, on Ferrexpo's business in Ukraine.

Since the Group published its Principal Risks in April 2025, Russian armed forces have made small advances and occupied more territories in Ukraine. Ukraine has also continued to suffer airborne attacks on civilians, energy and transport infrastructure. Attacks on civilian infrastructure in particular, have increased in frequency and intensity towards the end of the second half of 2025 and into July.

Ferrexpo's operations continue to operate, albeit with greater significant limitations on working hours due to air raid alerts and occasional disruption to power transmission. Access to Ukraine's Black Sea ports has been maintained and as long as the level of risk is acceptable, the Group will continue to use this export route.

The war in Ukraine continues to represent a significant threat to Ferrexpo's operations in Ukraine, should the war continue in its current configuration, or even escalate further. The outlook for Ukraine at present remains inherently unpredictable in the short to medium term, with a range of military, financial and other factors all having a significant influence on the outcome for the people of Ukraine and businesses deriving their revenues from Ukraine. In the near term, it is expected that the conflict will continue to put increasing strain on the economy of Ukraine, in particular, with regard to elevated electricity prices and railway tariffs.

For further information, see the sections titled Sales and Marketing Review and Financial Review in this report in addition to the Going Concern Statement above.

Ukraine country risk

It is over three years since the full-scale invasion of Ukraine. Ferrexpo's operations in the Poltava Region have not seen direct combat, however missile and drone attacks in the region are frequent. The business has remained relevant by adapting to the challenges it faces and continuing to produce and export.

At a national level, the war is placing a strain on the economy. Tax revenues have fallen while spending on the military has increased. Consequently, the government has sought to increase revenues from business. Examples include increasing railway tariffs and new laws on the repatriation of funds and currency controls.

The war places unique challenges on the business. At the end of June 2025, a total of 738 colleagues were serving in the Armed Forces of Ukraine, more than at any time since the start of the full-scale invasion. Those in the workplace are enduring psychological stress. The working day is frequently interrupted by air raid alerts. Damage to energy infrastructure has forced the need to import electricity at higher tariffs. Supply chain disruptions have limited the variety of suppliers and increased costs for key consumables. Access to logistics routes can be blocked or disrupted.

For more information, see the section titled "War Risk", as well as the Principal Risks section of the 2024 Annual Report and Accounts pages 84 to 94.

The Group is currently subject to legal proceedings in Ukraine, many of which relate to circumstances concerning Mr Zhevago and attempts by state agencies to recover funds from a collapsed bank he was associated with. These legal proceedings are ongoing in Ukrainian courts. The highest risk cases include: litigation with the Deposit Guarantee Fund in relation to corporate rights of three mining entities; a case brought by the Ministry of Justice to enforce and auction corporate rights in three mining entities; a claim on FPM to recover UAH4.7 billion (US$113 million) for contested sureties; litigation regarding share freezes in all Ukrainian subsidiaries related to the investigation in connection with Bank F&C and litigations on VAT refunds. Some other cases include claims related to royalties, ecology, waste products, transfer pricing disputes.