4th Feb 2026 07:00

4 February 2026

Tertiary Minerals plc

("Tertiary" or the "Company")

Highest grade silver-copper intersection to date at Target A1, Mushima North Project, Zambia: 97m at 85 g/t silver equivalent

Tertiary Minerals plc (AIM: TYM) is pleased to announce laboratory results for the four holes completed during the Phase 3 drilling programme at Target A1 at its Mushima North Project in Zambia ("Mushima North" or the "Project") prior to the programme being curtailed by the early start to the wet season. Preliminary results from portable X-Ray Fluorescence ("pXRF") analysis of drill samples were notified on 13 November 2025.

The laboratory analytical results indicate further high-grade silver and copper mineralisation in the north of Target A1, which has a mineralisation footprint of 450m by up to 400m wide area, and remains open to the northwest, south/southeast and at depth.

Mushima North is located in the prospective Iron-Oxide-Copper-Gold region of Zambia. Target A1 is a polymetallic, silver-copper-zinc prospect located 28km to the east of the historic Kalengwa copper-silver mine which is currently under redevelopment and is one of several targets to be evaluated at the Project.

Highlights:

Ø Drill intersections include (downhole widths, true widths unknown):

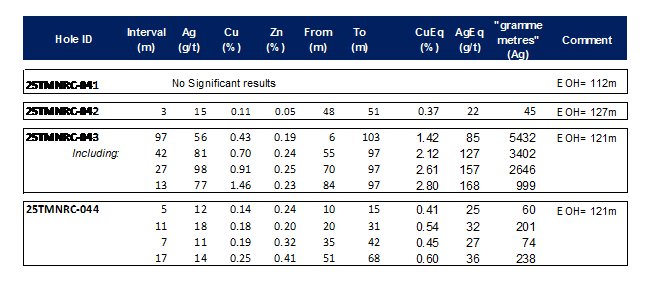

o 97m at 56 g/t Ag, 0.43% Cu and 0.19% Zn (85 g/t Ag equivalent or 1.42% Cu equivalent) from 6m downhole (hole 25TMNRC-043). Including:

§ 42m at 81 g/t Ag, 0.70% Cu and 0.24% Zn from 55m downhole, and

§ 27m at 98 g/t Ag, 0.91% Cu and 0.25% Zn from 70m downhole, and

§ 13m at 77 g/t Ag, 1.46% Cu and 0.23% Zn (168 g/t Ag equivalent or 2.80% Cu equivalent) from 84m downhole.

o 11m at 18 g/t Ag, 0.18% Cu and 0.20% Zn (32 g/t Ag equivalent or 0.54% Cu equivalent) from 20m downhole (hole 25TMNRC-044).

o 17m at 14 g/t Ag, 0.25% Cu and 0.41% Zn (36 g/t Ag equivalent or 0.60% Cu equivalent) from 51m downhole (hole 25TMNRC-044).

Ø Best copper drill intersection to date: 13m at 1.46% Cu (2.80% Cu equivalent) from 84m, with individual metre samples of up to 3.17% Cu (hole 25TMNRC-043).

Ø Silver mineralisation occurs over a 450m by 400m surface area and depth of mineralisation extended from 84m to 103m.

Ø Mineralisation footprint remains open to the northwest, south/southeast and at depth extent remains to be fully tested.

Ø JORC Exploration Target to be finalised in the coming weeks.

Richard Belcher, Managing Director of Tertiary Minerals plc, commented:

"We are delighted to report these results from the four holes of our Phase 3 drilling programme conducted at the start of the rainy season late last year. These results include our best intersection of silver-copper mineralisation to date on this project, with 97m at 85 g/t silver equivalent (1.42% copper equivalent) from only 6m depth. In addition, this also includes our best higher-grade copper intersection to date: 13m at 77 g/t silver and 1.46% copper (2.80% copper equivalent) from 84m downhole. These results have also further tested the depth extension of mineralisation, with our longest silver mineralisation intersect to date from 6m below surface to 103m depth (vertically).

"These results further support our bulk tonnage, open pit silver exploration model and the target area remains open to the northwest, south/southwest and at depth. These results will now be incorporated into the on-going JORC Exploration Target work to provide an estimation of the range of tonnages and grades for Target A1.

"The Exploration Target is planned to be released in the coming weeks and will form the basis of future planned programmes to commence at the start of the dry season this year and will support our aim of producing a Maiden Mineral Resource Estimate by the end of 2026.

"I look forward to updating shareholders on the Exploration Target in due course as well as providing updates on our wider exploration portfolio in Zambia and elsewhere."

Phase 3 Drill Programme

A programme of approximately 1,000m Reverse Circulation ("RC") drilling was planned as part of the Phase 3 Drill Programme before heavy and earlier than expected rains cut this short. Four vertical holes were completed to a maximum depth of 127m testing the northern extent of the mineralisation footprint.

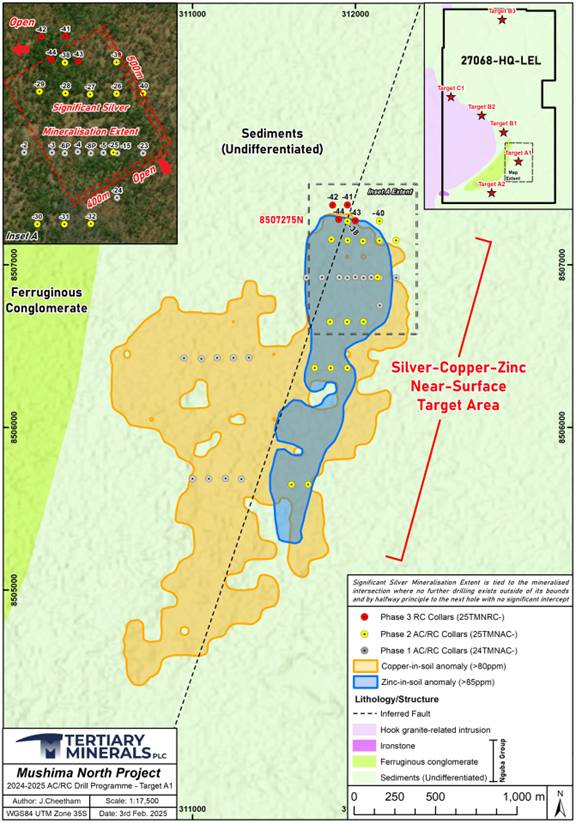

The four drill holes now being reported, and described below, are located on two 100m spaced east-west drill lines, 8507275N and 8507375N (see Figure 1 below). Drill line 8507375N represents the most northern drill traverse drilled to date.

· 25TMNRC-041: Located on a two drill-hole line with 25TMNRC-042. The drill hole was drilled vertically to a downhole depth of 112m. The hole was designed to test the continuation of the mineralisation to the north of drill line 8507275N.

· 25TMNRC-042: Located on a two drill-hole line with 25TMNRC-041. The drill hole was drilled vertically to a downhole depth of 127m. The hole was also designed to test the continuation of the mineralisation to the north of drill line 8507275N.

· 25TMNRC-043: Located on a four drill-hole line with 25TMNAC-038 and 25TMNRC-044 (drill line: 8507275N). The drill hole was drilled vertically to a downhole depth of 121m. The hole was designed to test the continuation of the mineralisation 50m to the east of drill hole 25TMNAC-038.

· 25TMNRC-044: Located on a four drill-hole line with 25TMNAC-038 and 25TMNRC-043 (drill line: 8507275N). The drill hole was drilled vertically to a downhole depth of 121m. The hole was designed to test the continuation of the mineralisation 50m to the west of drill hole 25TMNAC-038.

Figure 1. Location map of Target A1 showing soil sample results for copper and zinc, and the collar locations for the previous (Phase 1 and 2) and Phase 3 drilling programme (both planned holes: grey circles, and drilled holes: red circles).

Table 1. Analytical results from selected holes from Phase 3. Equivalency ("Eq") values are for illustrative purposes only.

Notes to Table 1:

· Reported intersections (downhole, true widths unknown) are based on a cut-off grade of 10 g/t Ag.

· Intervals start and end with ≥10 g/t Ag and up to 3m consecutive of internal dilution has been allowed. All grades are averages weighted by sample length.

· Silver values are rounded to whole numbers.

· CuEq (%) and AgEq (g/t) are the copper and silver equivalent grades, respectively, and were

calculated using average commodity prices over the previous 6 months: Cu: US$4.99 lb, Ag: US$57 oz, Zn: US$1.39 lb. This also assumes 100% recovery. No information on beneficiation recoveries is available at this stage. The metal equivalent values are for illustrative purposes only.

· Gram metres for silver are the silver values (g/t) multiplied by the intervals (m).

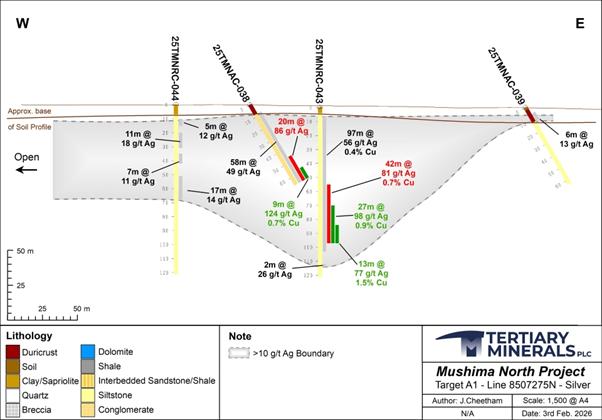

These independent laboratory analytical results provide further evidence for higher-grade copper mineralisation in the north of the target area and the continuation of the silver mineralisation. The current surface footprint of the mineralisation (approximately 450m by 400m) still remains open to the north/northwest and south/southeast, while the maximum vertical depth of oxide mineralisation has increased by an additional 21m, from 84m to 105m (Figure 2). The potential for primary sulphide mineralisation, underneath the near-surface oxide mineralisation is, as yet, largely untested.

Figure 2. Drill cross-section 8507275N (location shown on Figure 1) showing analytical results for silver and selected copper values for drill holes 25TMNRC-043 and 25TMNRC-044 (Phase 3) and previous released results from 25TMNAC-038 and 25TMNAC-039 (Phase 2). See Table 1 notes for further information.

Mineralogy

An additional two samples from mineralised intervals in Phase 2 drill holes were submitted to Petrolab Ltd in the UK for further mineralogical descriptions.

Mineralisation observed confirmed earlier mineralogical work, with copper observed primarily as copper oxide (cuprite: Cu2O) and trave native copper and silver as silver sulphide (argentite-acanthite: Ag₂S) and trace native silver. Both copper and silver mineralisation occur within the vugs or later infilling of fractures and are associated with other sulphide mineralisation: pyrite (FeS) along with trace amounts of chalcopyrite (CuFeS2), chalcocite (Cu2S), sphalerite ((Zn,Fe)S) and pyrrhotite (Fe(1-x)S).

Target A1

Target A1 is a large copper-in-soil anomaly (3.1km by 1.7km) with copper values up to 302ppm (per pXRF) associated with a 1.7km by 0.5km zinc- and coincidental 1.3km by 0.3km silver-in-soil anomaly.

Phase 1 drilling in 2024 (1,486m) targeted the copper-in-soil anomaly and returned broad but generally low-grade copper mineralisation as reported in the news release dated 28 October 2024 (e.g. 57m at 0.20% Cu from 14m downhole, hole 24TMNAC-004). Higher grade copper mineralisation within these broader zones was also returned (e.g. 6m at 0.58% Cu within 35m at 0.21% Cu, from 22m downhole, hole 24TMNAC-024). Drilling over the silver- and zinc-in-soil anomaly (drill line: 8506925N) identified wide and thick, near surface silver mineralisation associated with low-grade copper and/or zinc mineralisation.

The Phase 2 drill programme (1,116m) targeted the silver- and zinc-in soil anomaly. The silver mineralisation has now been confirmed to extend approximately 450m northwest-southeast and by 400m northeast-southwest and to a depth from near surface to 103m and it remains open-ended both to the northwest, south/southeast and at depth.

The mineralisation at Target A1 is associated with a massive, haematitic and carbonaceous silty-sandy conglomerate. Copper and silver mineralisation is associated with zinc mineralisation, along with elevated bismuth (up to 991 g/t), and the critical metals antimony (up to 0.21%), cobalt (up to 2,960 g/t) and gallium (up to 40 g/t) are also associated with the mineralisation in places.

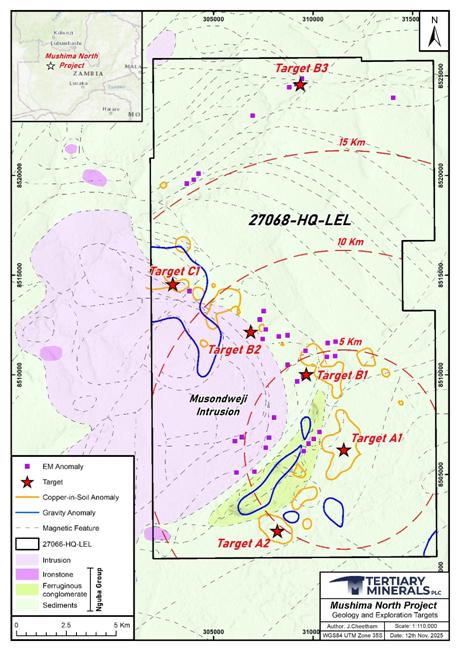

Mushima North Project

The Mushima North Copper Project (Licence 27068-HQ-LEL) is held through Group company Copernicus Minerals Limited ("Copernicus"), which is 90% owned by Tertiary Minerals (Zambia) Limited and 10% by local partner, Mwashia Resources Limited.

The Project lies 20km to the east of the Kalengwa copper mine in northwest Zambia, one of the highest-grade copper deposits ever to be mined in the country. In the 1970s, high-grade ore, average approximately 11% copper, was trucked for direct smelting at other mines in the Copperbelt. The Kalengwa mine is currently under redevelopment and is expected to produce 15,000 tonnes of copper annually. Numerous other geochemical and/or geophysical targets (A2, B1, B2, B3, C2) are yet to be drill tested. Many of these are located within 12km of Target A1.

Sampling, Analysis and QAQC

Sampling was undertaken at 1m intervals, and two subsamples were collected from each interval using a riffle splitter: one for potential laboratory analysis, the other for future reference.

Samples are initially analysed on site using a pXRF analyser for zinc and copper and, more recently, silver. Analysis protocol included multiple point (three) analyses per sample (unprepared sample analysed through a thin plastic sample bag) and the inclusion of Certified Reference Material, blanks and duplicate samples as part of an internal Quality Assurance procedure. Given the nature of the unprepared sample and point analysis, this method is used as a preliminary exploration technique to provide an approximate quantitative measure of copper and zinc mineralisation only.

Samples from selected drill holes based on the initial pXRF results are then sent to the independent laboratory ALS Global in South Africa for analysis for a range of elements using a four-acid digest, method code ME-ICP61 (including silver, copper, zinc, bismuth, antimony and gallium). Quality Assurance samples (Certified Reference Material, duplicates, blanks) will be inserted and monitored as part of the Quality Assurance-Quality Control protocol.

Reported drill hole intersection thicknesses are down-hole thicknesses and true thicknesses are unknown as the geology of the drill area is still uncertain. Intersections are weighted averages based on silver, using a 10 g/t Ag cut-off grade with up to 3m internal dilution and intersections starting and finishing with ≥10 g/t Ag.

Figure 3. Geological map of the Mushima North Project showing the locations of the priority targets within the licence and their distance out from Target A1 based on 5 km radius rings.

Figure 3. Geological map of the Mushima North Project showing the locations of the priority targets within the licence and their distance out from Target A1 based on 5 km radius rings.

Further Information:

Tertiary Minerals plc | |

Richard Belcher, Managing Director | +44 (0) 1625 838 679 |

SP Angel Corporate Finance LLP, Nominated Adviser and Broker | |

Richard Morrison/Jen Clarke | +44 (0) 203 470 0470 |

AlbR Capital Limited, Joint Broker | |

Lucy Williams/Duncan Vasey | +44 (0) 207 469 0930 |

Market Abuse Regulation

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ('MAR'). Upon the publication of this announcement via Regulatory Information Service ('RIS'), this inside information is now considered to be in the public domain.

Cautionary Note Regarding Forward-Looking Statements

The news release may contain certain statements and expressions of belief, expectation or opinion which are forward looking statements, and which relate, inter alia, to the Company's proposed strategy, plans and objectives or to the expectations or intentions of the Company's directors. Such forward-looking statements involve known and unknown risks, uncertainties, and other important factors beyond the control of the Company that could cause the actual performance or achievements of the Company to be materially different from such forward-looking statements. Accordingly, you should not rely on any forward-looking statements and, save as required by the AIM Rules for Companies or by law, the Company does not accept any obligation to disseminate any updates or revisions to such forward-looking statements.

Competent Persons Statement

The technical information in this release has been compiled and reviewed by Dr. Richard Belcher (CGeol, EurGeol) who is a qualified person for the purposes of the AIM Note for Mining and Oil & Gas Companies. Dr. Belcher is a chartered fellow of the Geological Society of London and holds the European Geologist title with the European Federation of Geologists.

About Tertiary Minerals plc

Tertiary Minerals plc (AIM: TYM) is an AIM-traded mineral exploration and development company whose strategic focus is on energy transition metals. The Company's projects are all located in stable and democratic, geologically prospective, mining-friendly jurisdictions. Tertiary's current principal activities are the discovery and development of copper and precious metal mineral resources in Zambia and Nevada, USA.

Related Shares:

Tertiary Minerals