15th Sep 2025 07:00

This announcement contains inside information for the purposes of Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations 2019/310. With the publication of this announcement via a Regulatory Information Service, this inside information is now considered to be in the public domain.

15 September 2025

Rome Resources plc

("Rome" or the "Company")

High-value Tin, Copper and Zinc identified ahead of maiden MRE

Rome Resources plc announces the latest assay results received from recent drilling at its Mont Agoma prospect, part of the Company's flagship Bisie North Project in eastern Democratic Republic of Congo. The drilling campaign has identified wide, high-value tin zones together with significant copper and zinc mineralisation. These results are expected to provide the final inputs to the Company's maiden mineral resource estimate ("MRE"), which is in the process of being finalised by the MSA Group and which remains targeted for publication by the end of September 2025.

Assays have been received for Mont Agoma drillholes MADD022, MADD025, MADD027 and MADD028, in the western mineralized zone and drillhole MADD030A in the newly identified eastern tin zone (Mont Agoma East), where a 23 metre wide tin zone has been identified from assayed core samples.

Within MADD030A at Mont Agoma East, the 23-metre assayed tin zone sits in a larger 40-metre-wide tin mineralised zone, core recovery being lower in the near-surface gossan material.

Highlights

· Significant tin intercepts in these drillholes include:

o MADD030A: 23.1m at 0.42% Sn from 3m, including 0.45m at 1.56% from 8.6m, 12.2m at 0.75% Sn from 12.3m, including, 1.6m at 1.42% from 13.5m and 5.0m at 0.92% Sn from 19.5m including 1m at 1.67% from 22m

o MADD022: 5.7m at 0.56% Sn from 19m, including 0.5m at 3.12% Sn

o MADD027: 19.0m at 0.38% Sn from 72m, including 0.40m at 1.10% Sn

o MADD028: 1.0m at 1.74% Sn from 109m, including 0.50m at 2.88% Sn

o MADD028: 13.0m at 0.24% Sn from surface, including 0.50m at 1.40% Sn

· The intersection in MADD030A lies within a broader tin zone of 35m at 0.35% Sn from 3m making the eastern zone a significant drilling target with a potential strike of more than 500 metres.

· Tin is currently trading at c. US$34,000 per tonne, underscoring the high value of these results.

· Additionally, exceptional zinc and strong copper intercepts have been recorded, the highlights being:

o MADD025: 56m at 4.86% Zn from 136m, including 42.0m at 5.90% Zn

o MADD025: 2.8m at 20.04% Zn from 131m and 9.5m at 3.3% Zn from 104m, including 0.8m at 30.00% Zn

o MADD027: 2.9m at 2.11% Cu from 67m, including 0.9m at 4.65% Cu

o MADD028: 0.5m at 28.40% Zn from 130m and 11m at 11.05% Zn from 132m

o MADD030A: 4.25m at 2.65% Cu from 71m, including 2.25m at 4.13%

Paul Barrett, Chief Executive Officer of Rome Resources, commented:

"These latest assay results underscore the high-value potential of Mont Agoma. The tin grades we are seeing are excellent, particularly with tin trading at around US$34,000 per tonne, while wide intercepts of high-grade zinc mineralisation provide valuable additional economic upside. Importantly, the confirmation of Mont Agoma East gives us a new growth prospect that is expected to be incorporated into a follow-up resource estimate after the maiden MRE, targeted to be announced by the end of this month.

Our immediate focus is to finalise the maiden MRE with MSA for both Mont Agoma and Kalayi. This is expected to set the foundation for the next phase of the project - drilling out the new eastern tin zone, undertaking deeper drilling in the main Mont Agoma zone, and stepout drilling at the Kalayi tin project.

The 23 metre tin intercept in hole MADD030A creates a compelling target for further drilling down-plunge to the southeast. We look forward to delivering the maiden resource estimate and moving quickly into the next phase of resource drilling to capture this upside potential."

Exploration Update

The Company also announces the formal naming of Mont Agoma East, a newly defined prospect where hole MADD030A (re-drill of abandoned hole MADD030) reported a 23m-wide tin zone from surface. Together with results from the western Mont Agoma zone, these assays indicate the system's scale and reinforces the structural model of fault repetition, which has displaced deeper mineralisation upwards into Mont Agoma East.

The tin results are particularly significant; while the main zone remains high in the system the grades are strengthening with depth. Drill hole MADD030A demonstrated intervals in excess of 2% Sn (measured by the XRF analyser), pointing to the potential for higher-grade shoots at depth, consistent with other granite-hosted tin-copper systems worldwide.

The significant zinc mineralisation intersected in drill hole MADD025 provides further encouragement, representing a potential economic by-product and a low-risk overburden as the tin zones are targeted at depth.

Maiden Mineral Resource Estimate

All assays from the western Mont Agoma zone are being incorporated into the maiden MRE, which is expected to be announced by the end of this month. Results from Mont Agoma East, including the 23 metres tin intercept in MADD030A and the significant copper, tin and zinc mineralisation intersected in MADD032 (Assays remain outstanding), are expected to be incorporated into a subsequent resource update following further drilling.

Rome is working closely with the MSA Group to deliver a technically robust maiden MRE that reflects the multi-metallic nature of Mont Agoma. This will mark the first key milestone in defining a resource base at Bisie North, with further upside to follow as Mont Agoma East is drilled out.

Further drilling detail

The assays from drillholes MADD022 through MADD028 in the western zone will be incorporated in the maiden MRE, currently being finalized by the MSA Group in South Africa. The assays from the eastern tin zone are expected be incorporated into a resource update once the additional drilling has been completed in the coming months.

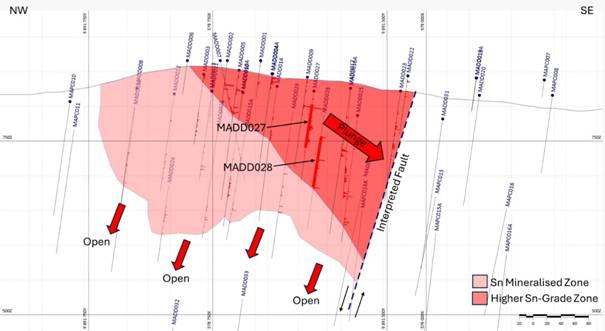

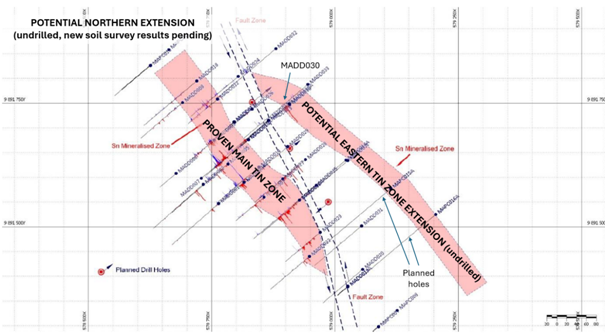

Drillholes MADD022, MADD027 and MADD028 together with near surface tin intersections in the early drill holes have defined a potentially higher tin grade plunging shoot which abuts against the broad quartz silica fault zone in the south (Figure 1). Tin grades in this ore shoot appear to increase with depth, in line with the common gradation in granite-sourced copper-tin deposits such as the Peruvian and Cornish plays. The same strike slip fault zone runs parallel to the strike of mineralization and is interpreted to have displaced the deeper mineralization to surface in MADD030A, creating the eastern tin zone (Figure 2).

Figure 1. Long Section N-S across main Mont Agoma mineralisation zone

Figure 2. Outline map of tin zones in Mont Agoma

The 23-metre-wide tin intercept of the eastern tin zone from surface combined with the absence of large amounts of copper indicates that the eastern zone is deeper in the system and is therefore likely to have higher tin grades as it plunges to the southeast. The forward programme to drill this plunging shoot at greater depths of up to 450 metres over a strike length of more than 500m is expected to establish the geometry of the grade progression at depth and is eagerly anticipated by management.

Looking ahead, additional step-out drilling targets are being developed with ongoing geochemical soil sampling. An extension of the existing survey has led to the identification of a northern extension of the copper anomaly and additional areas with anomalous tin concentrations in the vicinity of drillhole MADD030A in the eastern zone, tapering off southeastwards as the interpreted ore shoot increases in depth. The geochemical database now holds areas high-graded for step-out drilling for both tin and copper for to the north of Mont Agoma and tin to the north of Kalayi.

For further information, please contact:

Investor questions on this announcement We encourage all investors to share questions on this announcement via our investor hub | https://romeresources.com/s/5b5af1

|

Rome Resources Plc Paul Barrett, Chief Executive Officer Mark Gasson, Chief Operating Officer

| Tel. +44 (0)20 3143 6748 |

Allenby Capital Limited (Nominated Adviser and Joint Broker) John Depasquale / Vivek Bhardwaj / Lauren Wright (Corporate Finance) Joscelin Pinnington (Sales & Corporate Broking) | Tel. +44 (0)20 3328 5656

|

OAK Securities (Joint Broker) Jerry Keen, Head of Corporate Broking Henry Clarke, Head of Sales |

Tel. +44 (0)20 3973 3678 |

Camarco (Financial PR) Emily Hall / Gordon Poole / Sam Morris

| Tel. +44 (0)20 3757 4980

|

Subscribe to our news alert service: https://romeresources.com/auth/signup

Full List of Reported Assays

BHID | From | To | Width | Sn% | Cu% | Ag (ppm) | Zn% | Pb% |

MADD022 | 64.00 | 65.00 | 1.00 | 1.09 | ||||

103.00 | 106.00 | 3.00 | 1.43 | |||||

135.00 | 138.00 | 3.00 | 0.71 | |||||

179.00 | 180.00 | 1.00 | 1.88 | |||||

incl. | 179.00 | 179.50 | 0.50 | 3.09 | ||||

MADD022 | 189.00 | 189.50 | 0.50 | 0.92 | ||||

33.00 | 34.00 | 1.00 | 0.74 | |||||

19.00 | 24.70 | 5.70 | 0.56 | |||||

incl. | 23.00 | 23.50 | 0.50 | 3.12 | ||||

MADD022 | 36.00 | 45.30 | 9.30 | 0.39 | ||||

incl. | 42.00 | 43.00 | 1.00 | 1.40 | ||||

MADD022 | 73.00 | 74.00 | 1.00 | 0.14 | ||||

55.00 | 56.00 | 1.00 | 1.33 | |||||

141.00 | 166.00 | 25.00 | 1.21 | |||||

incl. | 148.00 | 153.00 | 5.00 | 2.89 | ||||

161.00 | 161.45 | 0.45 | 6.39 | |||||

MADD022 | 179.00 | 179.50 | 0.50 | 1.92 | ||||

MADD025 | 115.00 | 127.20 | 12.20 | 13 | ||||

152.00 | 154.00 | 2.00 | 15 | |||||

167.00 | 167.50 | 0.50 | 11 | |||||

171.00 | 172.00 | 1.00 | 13 | |||||

188.00 | 189.00 | 1.00 | 14 | |||||

83.00 | 84.00 | 1.00 | 0.50 | |||||

120.00 | 124.00 | 4.00 | 0.58 | |||||

198.00 | 199.00 | 1.00 | 0.51 | |||||

119.00 | 127.20 | 8.20 | 0.94 | |||||

138.00 | 138.50 | 0.50 | 0.51 | |||||

141.65 | 144.00 | 2.35 | 13 | 0.82 | ||||

151.00 | 154.00 | 3.00 | 1.00 | |||||

54.00 | 55.00 | 1.00 | 0.20 | |||||

118.00 | 137.50 | 19.50 | 0.14 | |||||

166.50 | 178.00 | 11.50 | 0.15 | |||||

104.00 | 113.50 | 9.50 | 3.33 | |||||

incl. | 106.00 | 106.80 | 0.80 | 2.40 | ||||

112.70 | 113.50 | 0.80 | 30.00 | |||||

MADD025 | 114.50 | 130.00 | 15.50 | 5.53 | ||||

incl. | 114.50 | 120.00 | 5.50 | 3.88 | ||||

124.00 | 130.00 | 6.00 | 9.95 | |||||

MADD025 | 130.50 | 131.00 | 0.50 | 16.70 | ||||

131.50 | 134.30 | 2.80 | 20.04 | |||||

136.00 | 192.00 | 56.00 | 4.86 | |||||

incl. | 136.00 | 178.00 | 42.00 | 5.90 | ||||

183.00 | 186.00 | 3.00 | 5.58 | |||||

191.00 | 192.00 | 1.00 | 2.05 | |||||

MADD027 | 66.80 | 68.50 | 1.70 | 21 | ||||

75.00 | 76.00 | 1.00 | 10 | |||||

82.60 | 105.50 | 22.90 | 20 | |||||

128.00 | 129.00 | 1.00 | 0.11 | |||||

67.60 | 70.50 | 2.90 | 2.11 | |||||

incl. | 67.60 | 68.50 | 0.90 | 4.65 | 6.09 | |||

MADD027 | 83.10 | 88.00 | 4.90 | 2.50 | ||||

96.40 | 99.00 | 2.60 | 0.52 | |||||

103.00 | 129.00 | 26.00 | 0.72 | |||||

incl. | 105.00 | 105.50 | 0.50 | 2.18 | ||||

121.00 | 121.60 | 0.60 | 2.31 | |||||

126.50 | 127.00 | 0.50 | 2.50 | |||||

MADD027 | 134.00 | 135.00 | 1.00 | 0.63 | ||||

50.00 | 50.80 | 0.80 | 10 | 1.65 | ||||

61.00 | 69.70 | 8.70 | 0.87 | |||||

incl. | 63.00 | 64.00 | 1.00 | 2.73 | ||||

MADD027 | 82.60 | 94.00 | 11.40 | 1.08 | ||||

98.00 | 109.00 | 11.00 | 1.30 | |||||

incl. | 98.00 | 98.60 | 0.60 | 125 | 4.09 | |||

102.00 | 106.00 | 4.00 | 1.57 | |||||

MADD027 | 49.00 | 56.00 | 7.00 | 0.10 | ||||

61.00 | 68.50 | 7.50 | 0.23 | |||||

72.20 | 91.20 | 19.00 | 0.38 | |||||

94.60 | 105.50 | 10.90 | 0.21 | |||||

incl. | 100.60 | 101.00 | 0.40 | 1.10 | ||||

MADD027 | 114.00 | 115.00 | 1.00 | 0.10 | ||||

67.60 | 109.00 | 41.40 | 4.07 | |||||

incl. | 82.60 | 84.00 | 1.40 | 3.99 | 3.13 | |||

88.00 | 105.00 | 17.00 | 7.83 | |||||

MADD028 | 89.00 | 101.00 | 12.00 | 13 | ||||

104.00 | 110.00 | 6.00 | 7 | |||||

136.50 | 139.50 | 3.00 | 15 | |||||

142.60 | 144.30 | 1.70 | 17 | |||||

129.00 | 130.00 | 1.00 | 0.50 | |||||

151.50 | 152.50 | 1.00 | 1.56 | |||||

incl. | 152.00 | 152.50 | 0.50 | 2.48 | ||||

MADD028 | 160.00 | 162.00 | 2.00 | 1.06 | ||||

28.00 | 29.00 | 1.00 | 0.72 | |||||

89.00 | 99.00 | 10.00 | 0.62 | |||||

134.55 | 139.50 | 4.95 | 1.05 | |||||

incl. | 138.50 | 139.00 | 0.50 | 5.72 | ||||

MADD028 | 143.00 | 144.30 | 1.30 | 0.91 | ||||

109.50 | 110.50 | 1.00 | 1.74 | |||||

incl. | 110.00 | 110.50 | 0.50 | 2.88 | ||||

MADD028 | 115.00 | 119.00 | 4.00 | 0.18 | ||||

125.00 | 126.00 | 1.00 | 0.13 | |||||

130.00 | 143.00 | 13.00 | 0.24 | |||||

incl. | 135.00 | 135.50 | 0.50 | 1.40 | ||||

MADD028 | 149.50 | 157.50 | 8.00 | 0.18 | ||||

162.50 | 163.50 | 1.00 | 0.24 | |||||

89.00 | 98.00 | 9.00 | 1.72 | |||||

incl. | 95.50 | 96.00 | 0.50 | 19.70 | ||||

MADD028 | 107.50 | 109.50 | 2.00 | 9.02 | ||||

incl. | 108.00 | 109.50 | 1.50 | 11.81 | ||||

MADD028 | 110.00 | 119.00 | 9.00 | 4.37 | ||||

125.00 | 130.50 | 5.50 | 2.94 | |||||

incl. | 130.00 | 130.50 | 0.50 | 28.40 | ||||

MADD028 | 132.50 | 143.45 | 10.95 | 11.05 | ||||

147.00 | 148.00 | 1.00 | 2.01 | |||||

156.00 | 156.50 | 0.50 | 1.85 | |||||

MADD030A | 0.00 | 3.60 | 3.60 | 20 | ||||

62.60 | 65.00 | 2.40 | 0.68 | |||||

64.60 | 68.10 | 3.50 | 0.53 | |||||

71.35 | 75.60 | 4.25 | 2.65 | |||||

incl. | 71.35 | 73.60 | 2.25 | 4.13 | ||||

MADD030A | 2.80 | 23.10 | 20.30 | 0.80 | ||||

incl. | 15.00 | 15.60 | 0.60 | 2.33 | ||||

43.50 | 44.10 | 0.60 | 2.41 | |||||

MADD030A | 61.30 | 62.60 | 1.30 | 0.80 | ||||

0.00 | 23.10 | 23.10 | 0.42 | |||||

incl. | 7.00 | 8.00 | 1.00 | 1.56 | ||||

14.00 | 15.60 | 1.60 | 1.42 | |||||

21.00 | 22.00 | 1.00 | 1.67 | |||||

MADD030A | 24.60 | 32.10 | 7.50 | 0.09 | 0.70 | |||

34.00 | 35.00 | 1.00 | 0.12 | 0.87 | ||||

36.00 | 38.50 | 2.50 | 0.02 | 0.47 | ||||

42.00 | 48.60 | 6.60 | 0.05 | 1.06 | ||||

49.00 | 50.00 | 1.00 | 0.03 | 0.66 | ||||

52.00 | 53.00 | 1.00 | 0.08 | |||||

53.85 | 54.60 | 0.75 | 0.01 | |||||

61.30 | 65.00 | 3.70 | 0.04 | |||||

64.60 | 75.60 | 11.00 | 0.02 |

Drill hole coordinates and details.

Drillhole | Easting | Northing | RL | Azimuth | Dip | Depth (m) |

MADD022 | 578948 | 9891440 | 804 | 230 | -60 | 206.3 |

MADD025 | 578960 | 9891584 | 804 | 230 | -63 | 31.5 |

MADD027 | 578894 | 9891597 | 807 | 230 | -60 | 155.7 |

MADD028 | 578940 | 9891636 | 790 | 230 | -60 | 191.2 |

MADD030A | 578907 | 9891749 | 774 | 230 | -60 | 113.0 |

Coordinates are handheld GPS and in UTM 35S format.

Qualified Person Statement

Dr Deon Vermaakt is a consultant of Rome Resources plc, a qualified geologist and a registered Professional Natural Scientist (Geological Science) with the South African Council for Natural Scientific Professions (SACNASP Reg. No. 400074/03). Dr Vermaakt is a qualified person (QP) under NI 43-101 and as defined by the AIM Note for Mining, Oil and Gas Companies and has reviewed and approved the scientific and technical information contained in this news release.

Four batches consisting of 756 samples were submitted to ALS laboratory for analysis. Of these 76 were QAQC samples inserted into the sampling stream at regular intervals. The QAQC samples consisted of 29 CRM's, 26 Blanks and 21 laboratory duplicates. The majority of QAQC samples returned satisfactory results consistent with industry standards, 1 CRM returned slightly lower and 3 Blanks slightly higher (above average) results, these are being investigated but are not considered material. The overall QAQC of the Mont Agoma drilling programme is acceptable and within standard norms.

Dr Vermaakt reviews all the sampling procedures on an on-going basis.

Glossary

Cu:

Gossan:

| The chemical element for copper

Weathered near-surface zone, generally presenting difficult drilling conditions

|

Km: | Kilometres (Metric)

|

m: | Metres (Metric)

|

XRF:

| A portable x-ray fluorescence analyser

|

Sn: | The chemical element for tin

|

Zn: | The chemical element for zinc

|

Related Shares:

Rome Resources PLC