2nd Sep 2025 07:00

Acuity RM Group Plc - Half-year ReportAcuity RM Group Plc - Half-year Report

PR Newswire

LONDON, United Kingdom, September 02

This announcement contains inside information for the purposes of Article 7 of the UK version of Regulation (EU) No 596/2014 which is part of UK law by virtue of the European Union (Withdrawal) Act 2018, as amended ("MAR"). Upon the publication of this announcement via a Regulatory Information Service, this inside information is now considered to be in the public domain.

2 September 2025

Acuity RM Group plc

(“Acuity” or the “Company” or the “Group”)

Interim Results for six months ended 30 June 2025

Acuity RM Group plc (AIM:ACRM), the provider of risk management products and services, today releases the interim results for the six months ended 30 June 2025 (“H1 2025” or the “Period”).

Highlights for the Group for the Period:

Revenues: up 10% to £1.1m (30 June 2024: £1.0m) Operating loss – reduced to £282,000 (30 June 2024: £586,000) a reduction of 52%Strategy: target market has been refocused on Cyber GRC, the business’s core strength New product: Vendor Management Hub, an entry level product to manage cyber security risks related to suppliersNextGen STREAM® – redeveloped incorporating features and functions to make it more attractive for users with benefits for AcuityNew marketing initiatives incorporating AI have been implemented to more accurately target prospective customers

David Rajakovich, Chief Executive, commented: “I believe we have now put in place the foundations of a leaner, more efficient and focused business. There is still much to do to achieve Acuity’s potential but we have started, the impact is beginning to show positively in the financials and I believe we are now much better placed to deliver in H2 and beyond. Our focus on operational efficiency and product innovation positions us well to capitalise on opportunities as they emerge.

In recent times with the economic uncertainty and the new Strategic Defence Review, we have seen companies and Government agencies act cautiously. Looking ahead, we're seeing encouraging signs in our pipeline development, particularly in the defence segment where decision-making appears poised to accelerate. While we remain cautious about the broader market conditions, there are significant sales opportunities for the Company, both measured by number and value, and I look forward to announcing new order wins as we begin to properly exploit our commercial opportunities.”

For further information please contact: |

|

Acuity RM Group plc | https://www.acuityrmgroup.com |

Angus Forrest / David Rajakovich | +44 (0) 20 3582 0566 |

Zeus Capital Limited (NOMAD & Broker) | https://www.zeuscapital.co.uk |

Mike Coe / James Bavister | +44 (0) 20 3829 5000 |

Peterhouse Capital (Joint broker) |

|

Lucy Williams / Duncan Vasey | +44 (0) 20 7469 0936 |

Clear Capital (Joint broker) |

|

Bob Roberts | +44 (0) 20 3869 6080 |

Note to Editors

Acuity RM Group plc

Acuity RM Group plc (AIM: ACRM), is an established provider of risk management products and services. Its award-winning STREAM® software platform which collects and analyses data to improve business decisions and management is used by clients operating in global markets including government, defence, broadcasting, utilities, manufacturing and healthcare.

The Company is focused on delivering long term, sustainable growth in shareholder value from organic growth and complementary acquisitions.

Chairman’s statement

Introduction

The directors are pleased to present the interim results for the six months ended 30 June 2025.

Acuity’s performance in the Period shows improvement compared with the previous year, with revenue up to £1.1m (30 June 2024: £1.0m) and operating loss reduced by 48% to £282,000 (30 June 2024: £586,000).

In the period, Acuity’s new Chief Executive, David Rajakovich has been actively making changes to focus the business, improve efficiencies and enhance competitiveness. Some of the benefits can be seen in these results but should be more evident as they are realised more fully over the next six months. Further detail on the changes and progress achieved is set out in the Chief Executive’s statement below.

Outlook

The objective to create shareholder value will be delivered from a combination of:

strong revenue growth through a new focus on the business’s strengths in the cyber security GRC market; the introduction of new products; andimproving the financial performance, moving to positive cash generation and profitable trading.

I would like to thank all shareholders for their patience over the Period, when significant changes have been made to strengthen the business for the long term.

Angus Forrest

Chairman

2 September 2025

Chief Executive’s statement

This is the first full reporting period since I became Chief Executive. In the Period there has been significant change in every area of the business in order to focus, strengthen and build the foundations for strong business growth. I identify the major and most important changes in the business review below.

Business review

Strategy – as previously reported, we made the strategic decision to focus exclusively on cyber Governance, Risk and Compliance ("GRC") management rather than attempting to address the enterprise risk management market as a whole. Cyber is the area where the directors believe Acuity has the greatest advantage over the competition while also offering major growth opportunities. This more focused approach allows us to deliver specialised solutions that address the challenges our clients face in identifying, assessing, and mitigating cyber risks.

In recent months several high profile cyber security breaches with costly disruption to business have increased awareness and highlighted the importance of addressing cyber security risks. This should drive demand for our products and services. Demand will also be driven by regulation such as (i) new ISO type standards (ii) the new EU AI Act and (iii) requirements of risk committees and corporate governance reports.

Sales and marketing - We have fundamentally transformed our go-to-market approach to better align with market opportunities and customer needs:

Direct sales efforts have been repositioned to focus primarily on mid-market clients where we see the highest conversion rates and fastest adoption. The team has been upgraded in capability as a result of training through H1 and we are negotiating several material deals.The partner network has been rationalised and refocused on those partners which fit with our strategy and really want to work with us bringing an advanced offering to blue-chip enterprise clients, leveraging our partners' established relationships and implementation capabilities with Acuity’s advanced software. Partners remain an important channel for us and we are committed to working with the selected strategic partners to increase the pace of growth.Sales processes have been optimised to reduce cycle times and improve conversion at every stage of the process.

Following a period of development we have launched a new AI led marketing programme which is designed to identify active buyers with demand suited to Acuity’s STREAM® product. It has begun to produce results, we expect shorter lead times and better conversion rates. As a side effect it has begun to identify new well qualified partners so improving our distribution channels. We have recently been mentioned in Gartner’s Market Guide to GRC Tools for Assurance Leaders, thus providing the recognition of our arrival as a top provider of Cyber GRC https://www.gartner.com/reviews/market/grc-tools-for-assurance-leaders.

We have reviewed and cleaned the sales pipeline and are now applying much stricter criteria for inclusion resulting in a reduction in number and value of opportunities. The pipeline is now realistically valued at £3.8 million with over 145 high quality opportunities where a decision from the customer is expected in the next 12 months and where we believe our offering should be very competitive.

Organisational transformation - to support our new direction, we have made several key changes to our organisational structure and leadership team. The focus has been on building a highly motivated and united team to deliver services of highest quality, in some cases this has meant outsourcing some specialist activities. These changes have been necessary to better align our resources with our strategic priorities, improve operational efficiency, and reduce costs. The changes have created a more agile, focused team that is better positioned to execute on our vision and deliver value to our customers and shareholders.

Product – There have been significant product developments in the Period which demonstrate our capability to modify existing products rapidly in respect of NextGen STREAM® and develop new ones such as Vendor Management Hub (“VMH”).

NextGen STREAM®In the Period our flagship product, NextGen STREAM®, was redeveloped and its relaunch was announced at the end of the Period. Following delivery from the software house a number of bugs have been identified. These are being resolved but it has delayed full scale implementation which will go ahead as soon as the product completes testing. This next-generation platform represents a significant investment in our product capabilities and user experience. Key improvements will include:

A revamped user interface with intuitive workflows based on extensive user research to give an easier and friendlier experience. By improving the customer experience it should ensure Acuity improves sales conversion and experiences better retention rates. Simplified integration capabilities with popular security and business tools such as AI, interoperability – allows easier, faster interactions with a wider range of other software.Enhanced dashboards and reporting features for greater visibility and insights. It should make upgrades easier and faster and reduce Acuity’s running costs.Vendor Management Hub (“VMH”)

In June a new entry level product, VMH was launched and the first order for it was received in August. VMH is available as stand-alone product or it can be incorporated in STREAM®. VMH provides a strong foundation for cyber risk oversight, without the complexity of a full GRC program. It enables users to better manage their cyber security risks relating to their suppliers' systems. VHM addresses the same market as Rizikon, the product acquired by the Group in November 2024.

The benefits of VMH include:

It is easy to understand, deploy and use It accelerates and standardises vendor onboarding - streamlines the process with automated workflows, standardised assessments and digital document management, also providing compliance records, automated monitoring and audit-ready documentation for better regulatory complianceIt automates prioritisation of third party risks based on the criticality of the supplier and potential impact of the vulnerability and risk visibility - real time monitoring of critical measures with automated risk scoring and alertsThe improvements directly support our strategic shift toward Product Led Growth (PLG) by making onboarding seamless and intuitive. The new platform has also been designed to dramatically reduce time-to-value for new customers, allowing them to experience the benefits of our solution faster and with minimal friction

Acuity is implementing optimised distribution channels to accelerate its uptake. If clients mandate their suppliers to use it, their own cyber security is better managed and it will drive the market opportunity for Acuity.

Financial overview

For the Period the Group reported revenue of £1.1m (30 June 2024: £1.0m), a much-reduced operating loss of £0.282m (30 June 2024: loss £0.586m) (52%) and a similarly reduced pre tax loss of £0.263m (30 June 2024: loss £0.634m) (58%). The administrative costs in the first 6 months of 2025 are down by £0.249m (16%) compared to the same period in 2024. The reduction in costs continued through the period and post period, as it takes time for some reductions to be realised because of notice periods, a greater impact should be seen in H2.

New orders won in the period were below that of the previous year because the business was refocussing onto Cyber GRC and other changes were made in order to achieve the future growth strategy. A key focus has been on reducing the cost base, improving efficiency and flexibility.

In May 2025, the Company successfully raised £0.421m (before expenses) from new investors and existing Shareholders. In addition, the Directors and the largest shareholder, Simon Marvell, announced their intention to subscribe for shares which raised an additional £0.105m, which was completed post the Period end. The Board thanks its shareholders for their support.

Outlook

I believe we have now put in place the foundations of a leaner, more efficient and focused business. There is still much to do to achieve Acuity’s potential but we have started, the impact is beginning to show positively in the financials and I believe we are now much better placed to deliver in H2 and beyond. Our focus on operational efficiency and product innovation positions us well to capitalise on opportunities as they emerge.

In recent times with the economic uncertainty and the new Strategic Defence Review, we have seen companies and Government agencies act cautiously. Looking ahead, we're seeing encouraging signs in our pipeline development, particularly in the defence segment where decision-making appears poised to accelerate. While we remain cautious about the broader market conditions, there are significant sales opportunities for the Company, both measured by number and value, and I look forward to announcing new order wins as we begin to properly exploit our commercial opportunities.

David Rajakovich

Chief Executive

2 September 2025

Condensed consolidated statement of comprehensive income

For the 6 months ended 30 June 2025

| Notes | Unaudited 6 months to 30 June 2025 | Unaudited 6 months to 30 June 2024 | Audited 12 months to December 2024 |

|

| £’000 | £’000 | £’000 |

|

|

|

|

|

Revenue | 5 | 1,145 | 1,049 | 2,132 |

Cost of sales |

| (143) | (103) | (201) |

Gross profit |

| 1,002 | 946 | 1,931 |

|

|

|

|

|

Administrative expenses |

| (1,284) | (1,533) | (3,007) |

|

|

|

|

|

Operating loss |

| (282) | (586) | (1,076) |

|

|

|

|

|

Finance - net expense |

| (16) | (11) | (38) |

Gain/(Loss) on investments |

| 73 | (36) | (43) |

Share based payments expense |

| (14) | - | (27) |

Exceptional costs |

| (24) | - | (141) |

Loss for the period before taxation |

| (263) | (634) | (1,325)

|

Tax |

| - | 44 | 58 |

Loss for the period after taxation |

| (263) | (590) | (1,267) |

|

|

|

|

|

Basic and diluted (loss) per share from loss for the period | 4 | (0.16)p | (0.48)p | (0.92)p |

Condensed consolidated statement of financial position

For the 6 months ended 30 June 2025

| Notes | Unaudited 6 months to 30 June 2025 | Unaudited 6 months to 30 June 2024 | Audited 12 months to December 2024 |

|

| £’000 | £’000 | £’000 |

Non current assets |

|

|

|

|

Intangible assets | 6 | 5,680 | 5,315 | 5,473 |

Tangible assets |

| 7 | 10 | 9 |

Investments at fair value through profit or loss | 8 | 280 | 207 | 207 |

Total non current assets |

| 5,967 | 5,532 | 5,689 |

|

|

|

|

|

Current assets |

|

|

|

|

Trade and other receivables |

| 193 | 324 | 672 |

Cash and cash equivalents |

| 418 | 1,855 | 606 |

Total current assets |

| 611 | 2,179 | 1,278 |

|

|

|

|

|

Total assets |

| 6,578 | 7,711 | 6,967 |

|

|

|

|

|

Current and long term liabilities |

|

|

|

|

Trade, other payables and loans |

| 729 | 858 | 714 |

Deferred income |

| 1,895 | 2,403 | 2,453 |

Total liabilities |

| 2,624 | 3,261 | 3,167 |

|

|

|

|

|

Net assets |

| 3,954 | 4,450 | 3,800 |

|

|

|

|

|

Equity |

|

|

|

|

Share capital | 7 | 2,840 | 2,796 | 2,796 |

Share premium |

| 13,729 | 13,370 | 13,370 |

Share based payment reserve |

| 153 | 112 | 139 |

Merger reserve |

| 1,012 | 1,012 | 1,012 |

Retained earnings |

| (13,780) | (12,840) | (13,517) |

Total equity |

| 3,954 | 4,450 | 3,800 |

Condensed consolidated statement of changes in equity

For the 6 months ended 30 June 2025

| Share capital | Share premium | Share based payments reserve | Merger reserve | Retained earnings | Total equity |

| £’000 | £’000 | £’000 | £’000 | £’000 | £’000 |

|

|

|

|

|

|

|

Balance at 1 January 2024 | 2,767 | 12,447 | 112 | 1,012 | (12,250) | 4,088 |

|

|

|

|

|

|

|

Loss for the year | - | - | - | - | (1,267) | (1,267) |

Total comprehensive expense for the year | - | - | - | - | (1,267) | (1,267) |

|

|

|

|

|

|

|

Contributions by and distributions to owners |

|

|

|

|

|

|

Issue of shares net of transaction costs | 29 | 923

| - | - | - | 952 |

Issue of share options | - | - | 27 | - | - | 27 |

Total contributions by and distributions to owners | 29 | 923 | 27 | - | - | 979 |

|

|

|

|

|

|

|

Balance at 31 December 2024 | 2,796 | 13,370 | 139 | 1,012 | (13,517) | 3,800 |

Loss for the year | - | - | - | - | (263) | (263) |

Issue of shares net of transaction costs | 44 | 359 | - | - | - | 403 |

Issue of share options | - | - | 14 | - | - | 14 |

Balance at 30 June 2025 | 2,840 | 13,729 | 153 | 1,012 | (13,780) | 3,954 |

Condensed consolidated statement of cash flows

For the 6 months ended 30 June 2025

| Unaudited 6 months to 30 June 2025 | Unaudited 6 months to 30 June 2024 | Audited 12 months to December 2024 |

| £’000 | £’000 | £’000 |

Cashflows from operating activities |

|

|

|

(Loss) before taxation | (263) | (634) | (1,267) |

Adjustments for: |

|

|

|

Depreciation and amortisation | 86 | 81 | 163 |

Fair value adjustments for listed investments | (73) | 37 | 37 |

Share based payments | 14 | - | 27 |

R&D tax rebate received | - | 44 |

|

Settlement of loan note and supplier invoice in shares not cash | 21 |

|

|

Decrease in trade and other receivables | 479 | 932 | 582 |

(Decrease)/Increase in trade and other payables | (543) | 355 | 262 |

Net cash (used in)/generated from operating activities | (279) | 815 | (196) |

|

|

|

|

Cashflows from investing activities |

|

|

|

Purchase of tangible fixed assets | - | (5) | (7) |

Additions to intangible fixed assets | (291) | (6) | (243) |

Net cash flows from investing activity | (291) | (11) | (250) |

|

|

|

|

Cash flows from financing activities |

|

|

|

Cash raised through issue of shares (net of transaction costs) | 382 | 951 | 952 |

Net cash flow from financing activity | 382 | 951 | 952 |

|

|

|

|

Net (decrease)/increase in cash and cash equivalents | (188) | 1,755 | 506 |

Cash and cash equivalents at beginning of financial year | 606 | 100 | 100 |

Cash and cash equivalents at the end of financial year | 418 | 1,855 | 606 |

General information

Acuity RM Group plc is a public limited company, which is listed on AIM of the London Stock Exchange, incorporated and domiciled in England and Wales. The address of the registered office is 2nd Floor, 80 Cheapside, London EC2V 6EE. The condensed consolidated interim financial report was approved for issue by the Board of Directors on 1 September 2025.

The principal activity of the Group is the provision of risk management software, STREAM® and related services.

The financial information set out in this interim financial report does not constitute statutory accounts as defined in Sections 434(3) and 435(3) of the Companies Act 2006. The Company’s statutory financial statements for the year ended 31 December 2024 have been filed with the Registrar of Companies and are available at www.acuityrmgroup.com. The auditor’s report on those financial statements was unqualified and did not contain any statement under Section 498(2) or Section 498(3) of the Companies Act 2006.

2. Basis of preparation

The condensed consolidated interim financial report has been prepared in accordance with the requirements of the AIM Rules for Companies using accounting polices expected to be adopted for the year ending 31 December 2025.

As permitted, the Company has chosen not to adopt IAS 34 “Interim Financial Statements” in preparing this interim financial information. The condensed consolidated interim financial statements should be read in conjunction with the annual financial statements for the year ended 31 December 2024. The interim financial statements have been prepared in accordance with International Financial Reporting Standards as adopted by the United Kingdom. (“UK adopted IFRS”) and those parts of the Companies Act 2006 applicable to companies reporting in accordance with UK adopted IFRS.

The comparative figures for the financial year ended 31 December 2024 set out in these interim statements are not the Group’s statutory accounts for that financial year. Those accounts have been reported on by the Company’s auditors and delivered to the Registrar of Companies. The report of the auditors was (i) unqualified, (ii) did not include a reference to any matters to which the auditors drew attention by way of emphasis without qualifying their report, and (iii) did not contain a statement under section 498 (2) or (3) of the Companies Act 2006.

Going concern

The Directors, having made appropriate enquiries, consider that adequate resources exist for the Company and Group to continue in operational existence for the foreseeable future and that, therefore, it is appropriate to adopt the going concern basis in preparing the condensed consolidated interim financial statements for the period ended 30 June 2025.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of the business. The key risks that could affect the Group’s medium-term performance and the factors that mitigate those risks have not substantially changed from those set out in the Company’s 2024 Annual Report and Financial Statements, a copy of which is available on the Company’s website: www.acuityrmgroup.com.

Critical accounting estimates

The preparation of condensed consolidated interim financial report requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the end of the reporting period. Significant items subject to such estimates are set out in the Company’s 2024 Annual Report and Financial Statements. The nature and amounts of such estimates have not changed significantly during the interim period.

3. Accounting policies

Except as described below, the same accounting policies, presentation and methods of computation have been followed in these condensed consolidated interim financial statements as were applied in the preparation of the Group’s annual financial statements for the year ended 31 December 2024.

3.1 Changes in accounting policy and disclosures

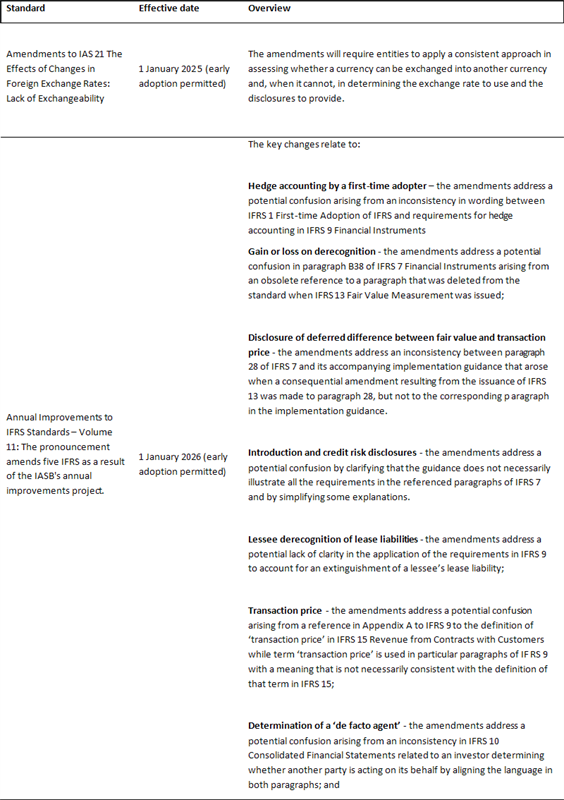

Accounting developments during 2025 and new standards, amendments and interpretations in issue but not yet effective or not yet endorsed and not early adopted

The International Accounting Standards Board (IASB) issued various amendments and revisions to International Financial Reporting Standards and IFRIC interpretations. The amendments and revisions which were applicable for the period ended 30 June 2025 did not result in any material changes to the financial statements of the Group or Company. The Group is evaluating the impact of the new and amended standards above which are not expected to have a material impact on the Group’s results or shareholders’ funds.

4. Loss per ordinary share

The loss per ordinary share is based on the weighted average number of ordinary shares in issue during the period of 159,516,908 ordinary shares of 0.1p (June 2024: 123,461,493 ordinary shares of 0.1p).

| Unaudited 6 months to 30 June 2025 | Unaudited 6 months to 30 June 2024 | Audited year to 31 December 2024 |

Loss attributable to equity shareholders £’000 | (263) | (590) | (1,267) |

Loss per ordinary share | (0.16)p | (0.48)p | (0.92)p |

Diluted loss per share is taken as equal to basic loss per share as the Company’s average share price during the period is lower than the exercise price and therefore the effect of including share options is anti-dilutive.

5. Revenue and segmental analysis

The following is an analysis of the Group’s revenue for the period from continuing operations:

| Unaudited 6 months to 30 June 2025 | Unaudited 6 months to 30 June 2024 | Audited year to 31 December 2024 |

| £’000 | £’000 | £’000 |

Provision of software licences and services consisting of: | 1,145 | 1,049 | 2,132 |

|

|

|

|

Revenue from subscriptions | 959 | 900 | 1,804 |

Revenue from services | 186 | 149 | 328 |

6. Intangible assets

| Software development | Goodwill Acquired on acquisition | Total |

| £’000 | £’000 | £’000 |

Cost or valuation |

|

|

|

B/F 1 January 2025 | 913 | 5,154 | 6,067 |

Additions | 290 | - | 290 |

C/F 30 June 2025 | 1,203 | 5,154 | 6,357 |

|

|

|

|

Accumulated amortisation |

|

|

|

B/F 1 January 2025 | 594 | - | 594 |

Charge for period | 83 | - | 83 |

C/F 30 June 2025 | 677 | - | 677 |

|

|

|

|

Net book value as 30 June 2025 | 526 | 5,154 | 5,680 |

|

|

|

|

Net book value as 30 June 2024 | 161 | 5,154 | 5,315 |

|

|

|

|

Net book value as 31 December 2024 | 319 | 5,154 | 5,473 |

7. Share capital

At the 30 June 2025 the Company’s share capital was as follows:

Allotted, issued and fully paid | Number | Value £’000 |

|

|

|

Ordinary shares of 0.1p each | 193,701,583 | 194 |

Deferred shares of 0.1p each | 2,645,954,765 | 2,646 |

|

|

|

Total |

| 2,840 |

As at 31 December 2024 the number of ordinary shares was 150,128,159. On 23 May 2025 the Company issued 42,107,143 ordinary 0.1p shares at a price of 1.0p each raising an additional £421,000 gross of costs.

In addition, on 23 May 2024, the Company issued 344,827 ordinary 0.1p shares at a price of 1.45p per share to settle £5,000 of deferred consideration for the purchase of a loan note, in accordance with the terms of the purchase, and it issued 1,121,454 ordinary 0.1p shares at a price of 1.45p per share to settle £16,261 of a supplier invoice, in accordance with the terms agreed with that supplier at the outset of that supplier being engaged.

The value of the deferred shares shown in note 7 is nominal, they are effectively valueless following the approval by Ordinary and Deferred shareholders of resolutions to adopt new articles of association in November 2022.

8. Investment

The Company acquired its legacy investment in KCR Residential REIT plc (“KCR”) at a price of £0.70 per share in 2018. KCR is an AIM listed real estate investment trust focused on the residential property market. The investment was classed as fair value through profit and loss in accordance with IFRS 9. The share price at 30 June 2025 was £0.115 per share and the closing value at 30 June 2025 was £280,107. (31 December 2024: £207,035 and 30 June 2024: £207,035). The investment was valued upwards at 30 June 2025 by £73,072 in accordance with IFRS 13.

As KCR is an AIM listed company, it is measured under level 1 of the fair value hierarchy in accordance with IFRS 13:

- Level 1: quoted prices in an active market for identical assets or liabilities. The fair value of financial instruments traded in active markets is based on quoted market prices at the balance sheet date. A market is regarded as active if quoted prices are readily and regularly available and those prices represent actual and regularly occurring market transactions on an arm’s-length basis. The quoted market price used for financial assets held by the Group is the closing price on the last day of the financial year of the Group. These instruments are included in level 1 and comprise FTSE and AIM-listed investments classified as held at fair value through profit or loss.

All assets held at fair value through profit or loss were designated as such upon initial recognition.

9. Post balance sheet event

On 4 July the Company announced the directors and one other had invested £105,000 for 10,500,000 new ordinary shares. This subscription is on the same terms as the subscription on 19 May 2025.

Related Shares:

Acuity RM Group plc