11th Feb 2026 07:00

11 February 2026

Metals One Plc

("Metals One" or the "Company")

Further Investment in Evolution Energy Minerals

Metals One (AIM: MET1, OTCQB: MTOPF), a critical and precious metals project developer and investor, announces it intends to participate in a fundraising by Evolution Energy Minerals Ltd (ASX: EV1) ("Evolution") (Metals One: 16.9%) by way of participation in a pro rata renounceable entitlement offer announced by Evolution this morning.

Evolution has confirmed eligible shareholders are able to subscribe for one new fully paid ordinary share in Evolution for every two existing fully paid ordinary shares held, at an issue price of A$0.015 per new share, with Evolution seeking to raise up to approximately A$4 million before costs. The issue price represents a premium to the Company's original investment price per share of A$0.011.

Metals One has agreed to invest up to A$1 million as part of the transaction (the "Metals One Subscription") although its final allocation will be determined by the take-up from other shareholders and therefore a further announcement will be made once this is finalised.

The proceeds from the fundraising will be applied to exploration of the Chikundo Copper Project, resource development activities at the Chilalo Graphite Project, costs associated with the fundraising, short term loan repayments and for general working capital.

Craig Moulton, the Company's Chairman, remains an executive director of Evolution and therefore the Metals One Subscription is considered a Related Party Transaction under the AIM Rules. The independent directors of Metals One, being Daniel Maling, Alex King and Fungai Ndoro, having consulted with the Company's Nominated Advisor, consider the terms of the Metals One Subscription to be fair and reasonable and in the best interests of the Company and its shareholders.

For the financial year ended 30 June 2025, Evolution reported a loss before tax of A$5,105,930 on nil revenue and, as at that date, had Net Assets of A$5,092,624.

Daniel Maling, Managing Director of Metals One, commented:

"We remain a highly supportive investor in Evolution and are pleased to participate in this fundraising. The additional capital has been raised to support the Company's advancement of the Chikundo Copper Project and Evolution's broader exploration and development activities."

The full text of Evolution's announcement is reproduced below and available on their website here:

https://evolutionenergyminerals.com.au/asx-announcements/

Renounceable Entitlement Offer to raise up to $4 million

· 1 for 2 renounceable rights issue to raise up to $4,032,830

· Attractively priced at $0.015 per share

· Discount of 25% to the 30-day VWAP of 2 cents

· With every two New Shares subscribed, shareholders receive one free attaching New Option

· New Options will have an exercise price of $0.02 and expiry on 17 September 2028, in the same class as EV1O and will be quoted on the ASX

· Shareholders can trade their rights and apply for additional shares and options under the Top Up Offer

· The Directors intend to participate by taking up their Entitlement

· Major shareholder Metals One Plc to invest $1 million and increase its holding

Evolution Energy Minerals Limited ("EV1" or the "Company") is pleased to announce that it is undertaking a pro-rata renounceable entitlement offer to eligible shareholders to subscribe for one new fully paid ordinary share in the Company ("New Share") for every two existing fully paid ordinary shares ("Shares") held as at 5:00pm (AWST) on the record date, being Monday, 16 February 2026 ("Record Date") ("Entitlement"), at an issue price of A$0.015 per New Share ("Offer Price") to raise up to approximately $4 million ("Entitlement Offer") before costs.

Shareholders will receive one free attaching option for every two New Shares acquired under the Entitlement Offer, with an exercise price of $0.02 and expiring on 17 September 2028, in the same class as the existing EV1O options ("New Options"). The New Options will be quoted under the ASX code EV1O.

The Entitlement Offer includes a top up offer ("Top Up Offer") under which eligible shareholders who have taken up their full entitlement under the Entitlement Offer can apply for additional New Shares and attaching New Options in excess of their Entitlement, subject to restrictions under Chapter 6 of the Corporations Act. Applications under the Top Up Offer will only be considered to the extent that there is a shortfall under the Entitlement Offer.

Assuming no options are exercised before the Record Date, up to approximately 268,855,338 New Shares and approximately 134,427,669 New Options will be issued under the Entitlement Offer. As the Entitlement Offer is renounceable, the rights will be tradeable on the ASX from the commencement of the rights trading on Friday, 13 February 2026, and are also otherwise transferable in accordance with the timetable for the Entitlement Offer.

New Shares will rank equally with the Company's existing Shares and the Company will apply for the quotation of the New Options.

The Entitlement Offer is lead managed and partly underwritten by Mahe Capital Pty Ltd for $1,500,000.

Directors of the Company intend to participate in the Entitlement Offer and EV1's major shareholder, Metals One Plc, has agreed to invest up to $1 million.

Eligible Shareholders

Only shareholders with a registered address in Australia, New Zealand, Germany, Singapore, Guernsey or the United Kingdom will be eligible to participate in the Entitlement Offer (Eligible Shareholders).

Purpose of Entitlement Offer

The proceeds of the Entitlement Offer will be applied to exploration of the Chikundo Copper Project, resource development activities at the Chilalo Graphite Project, costs associated with the Offers, repayment of the short-term loan and for general working capital.

Indicative Timetable

The timetable for the Entitlement Offer is as follows:

Event | Date* |

Announcement of Entitlement Offer on the ASX Lodgement of Prospectus with ASIC and ASX Lodgement of Appendix 3B on ASX |

Tuesday, 10 February 2026 |

Ex Date Rights trading commences on a deferred settlement basis | Friday, 13 February 2026 |

Record Date | Monday, 16 February 2026 |

Prospectus with Entitlement and Acceptance Form dispatched to Eligible Shareholders Opening Date |

Thursday, 19 February 2026 |

Rights trading ends | Thursday, 26 February 2026 |

Shares quoted on a deferred settlement basis | Friday, 27 February 2026 |

Last day to extend the Closing Date (before 12:00pm AEST) | Monday, 2 March 2026 |

Closing Date (5:00pm AWST) | Thursday, 5 March 2026 |

Announcement of results of the Entitlement Offer | Tuesday, 10 March 2026 |

New Shares and New Options under the Entitlement Offer issued Appendix 2A lodged with ASX applying for quotation of New Shares and New Options (before 12:00pm AEST) Holding statements sent |

Thursday, 12 March 2026 |

Trading in New Shares commences** | Friday, 13 March 2026 |

* All dates (other than the date of the Prospectus and the date of lodgement of the Prospectus with ASIC and ASX) are indicative only. The Directors may extend the Closing Date in respect of the Entitlement Offer and Top Up Offer by giving at least 3 Business Days' notice to ASX prior to the Closing Date. As such the date the Shares issued under the Offers are expected to commence trading on ASX may vary.

** Quotation of the New Options is subject to confirmation that ASX's spread requirements are satisfied and the exercise of ASX's discretion. If ASX refuses quotation, the New Options will be issued as unlisted.

Capital structure

The share capital structure of the Company on completion of the Entitlement Offer will be as follows:

Securities | Subscription |

Current capital structure | |

Existing Shares | 537,710,676 |

Existing Options | 112,462,207 |

Securities under the Offers | |

Maximum New Shares to be issued pursuant to the Offers | 268,855,338 |

Maximum New Options to be issued pursuant to the Offers | 134,427,669 |

Maximum Lead Manager Options to be issued pursuant to the Offers | 6,049,245 |

Maximum Securities on issue after the Offers | |

Shares | 806,566,014 |

Options | 252,939,121 |

Prospectus

The Entitlement Offer will be made by way of a Prospectus (Prospectus). The Prospectus will be available on the Company's website at http://www.evolutionenergyminerals.com.au and on the ASX website at http://www.asx.com.au from 10 February 2026 and sets out full details of Entitlement Offer and how to participate.

Eligible Shareholders should consider the Prospectus carefully before deciding whether to participate in the Entitlement Offer and consult with their professional advisors if they have any queries.

Yours sincerely

|

Craig Moulton

Managing Director

This announcement has been authorised for release by the Board of Directors of Evolution Energy Minerals Limited

for further information, please contact

Craig Moulton

Managing Director

Enquiries:

Metals One Plc Daniel Maling, Managing Director Craig Moulton, Chairman | +44 (0)20 7981 2576

|

Beaumont Cornish Limited (Nominated Adviser) James Biddle / Roland Cornish | +44 (0)20 7628 3396 |

Oak Securities (Joint Broker) Jerry Keen / Calvin Man | +44 (0)20 3973 3678 |

Capital Plus Partners Limited (Joint Broker) Jonathan Critchley | +44 (0)207 432 0501 |

Vigo Consulting (UK Investor Relations) Ben Simons / Fiona Hetherington / Safia Colebrook | +44 (0)20 7390 0230

|

About Metals One

Metals One is pursuing a strategic portfolio of critical and precious metals projects and investments underpinned by the Western World's urgent need for reliably and responsibly sourced raw materials - and record high gold prices. Metals One's shares are listed on the London Stock Exchange's AIM Market (MET1) and on the OTCQB Venture Market in the United States (MTOPF).

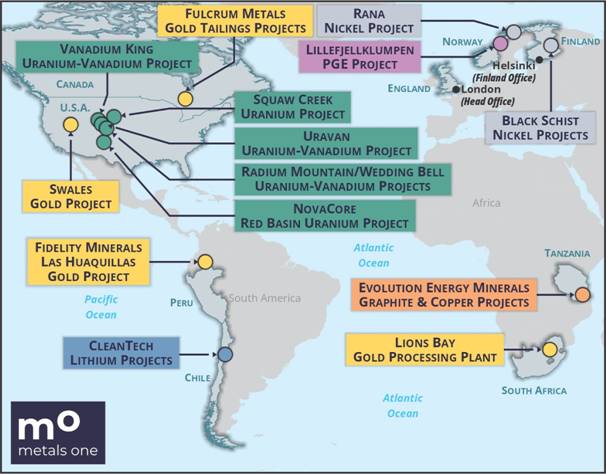

Map of Metals One projects/investments

Follow us on social media:

LinkedIn: https://www.linkedin.com/company/metals-one-plc/

X: https://x.com/metals_one_PLC

Subscribe to our news alert service on the Investors page of our website at: https://metals-one.com

Market Abuse Regulation (MAR) Disclosure

The information set out herein is provided in accordance with the requirements of Article 19(3) of the Market Abuse Regulations (EU) No. 596/2014 which forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ('MAR').

Nominated Adviser

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

Related Shares:

Metals One