19th Feb 2026 10:45

Taseko Announces Strong Fourth Quarter Financial Results and Commencement of Copper Production at Florence Copper

February 18, 2026, Vancouver, BC - Taseko Mines Limited (TSX: TKO; NYSE American: TGB; LSE: TKO) ("Taseko" or the "Company") reports full year 2025 Adjusted EBITDA* of $230 million and Earnings from mining operations before depletion and amortization and non-recurring items* of $251 million. Revenues for 2025 were $673 million from the sale of 99 million pounds of copper and 1.9 million pounds of molybdenum. For the year, a Net loss of $30 million ($0.09 loss per share) was recorded and Adjusted net income* was $27 million ($0.07 per share).

For the fourth quarter, Adjusted EBITDA* was $116 million, and cash flow from operations was $101 million. Net income of $4 million ($0.01 per share) was recorded for the quarter and Adjusted net income* was $42 million ($0.11 per share).

In the fourth quarter, Gibraltar produced 31 million pounds of copper and 830 thousand pounds of molybdenum at Total operating cost (C1)* of US$2.47 per pound of copper produced. For the year, Gibraltar produced 98 million pounds of copper and 1.9 million pounds of molybdenum at Total operating cost (C1) of US$2.66 per pound of copper produced. After mining through lower grade and lower quality ore in the first half of 2025, second half production increased by 46% and returned to more normal levels with copper grades of 0.24% and recoveries averaging 79% in the second half. Copper production in 2025 included 2.2 million pounds of copper cathode produced in Gibraltar's SX/EW plant, which was restarted in May. Molybdenum production for the fourth quarter and the year was significantly higher than previous periods, due to higher molybdenum grades in the Connector Pit.

At Florence Copper, production of copper cathode commenced earlier this week with the startup of the electrowinning circuit. The Florence SX/EW plant is fully operational and copper is now being plated. Injection of solutions commenced in the fourth quarter and wellfield performance to date has met or exceeded expectations. Expansion of the wellfield will be required to support the production ramp up to capacity, and drilling was restarted in the fourth quarter. There are currently three drill rigs operating and a fourth arriving to site in the next week.

Stuart McDonald, President & CEO of Taseko, commented, "2025 was a productive and highly successful year for Florence Copper. With construction and commissioning now behind us, we're looking forward to the first cathode harvest in the coming days. For the year ahead, the team's focus will be ramping up the operation to production capacity. Results from the initial wellfield operations are positive and we are targeting to produce 30 to 35 million pounds of copper in 2026. A key driver of the ramp up will be our ability to expand the wellfield and bring additional wells into production through the year."

"Gibraltar finished 2025 with strong production and cash flows in the fourth quarter. Looking ahead to 2026, we expect higher annual production and more consistent quarterly production, as mining activity is now well established in the Connector pit. Total copper production for 2026 is expected to be in the range of 110 to 115 million pounds. This includes the expected impact of supergene ore which has been affecting recoveries in previous pushbacks, as well as a more conservative forecast for head grade based on mining experience to-date in the Connector pit. With the anticipated production increase at Gibraltar and copper prices roughly 25% higher today than our average realized price in 2025, Gibraltar is positioned to generate significantly stronger cashflows in 2026.

*Non-GAAP performance measure. See end of news release.

"Bringing our second mine into production will be a major accomplishment for the Company, and we're looking forward to ramping up Florence and demonstrating the true value of this asset. At the same time, we will continue to work to unlock value from our other projects, Yellowhead and New Prosperity, which both achieved significant milestones in 2025," concluded Mr. McDonald.

2025 Annual Review

• Earnings from mining operations before depletion, amortization and non-recurring items* was $250.7 million, Adjusted EBITDA* was $230.4 million and cash flow from operations was $219.6 million;

• Net loss was $30.1 million ($0.09 loss per share) and Adjusted net income* was $27.1 million ($0.07 adjusted earnings per share);

• Gibraltar produced 98.1 million pounds of copper at a total operating cost (C1)* of US$2.66 per pound of copper produced. Copper head grades averaged 0.22% and recoveries averaged 73%;

• Copper production included 2.2 million pounds of copper cathode from the Gibraltar SX/EW plant which was restarted in May;

• Gibraltar sold 98.7 million pounds of copper at an average realized copper price of US$4.61 per pound contributing to revenues of $672.9 million for Taseko;

• Construction activities at Florence Copper continued throughout 2025, completing in the fourth quarter on time and largely on budget at US$275 million. During the 24-month construction period, there were approximately 1,000,000 project hours worked with no lost time injuries and no reportable incidents;

• In July, the Company filed an updated technical report for the Yellowhead project highlighting a 25 year mine life with an average annual copper production of 178 million pounds at a total cash cost (C1) of US$1.90 per pound, and a net present value of $2.0 billion (8% discount rate, US$4.25 per pound copper and US$2,400 per ounce gold). The Company also announced that it had formally commenced the Environmental Assessment process for the Yellowhead project; and

• In June, Taseko, Tŝilhqot'in Nation and the Province of BC reached an agreement concerning the New Prosperity project. Taseko received a payment of $75 million from the Province of BC upon closing of the transaction.

Fourth Quarter Review

• Earnings from mining operations before depletion, amortization and non-recurring items* was $124.1 million, Adjusted EBITDA* was $116.5 million and cash flow from operations was $101.2 million;

• Net income was $4.5 million ($0.01 earnings per share) and Adjusted net income* was $41.5 million ($0.11 adjusted earnings per share);

*Non-GAAP performance measure. See end of news release.

• Gibraltar produced 30.7 million pounds of copper, including 0.9 million pounds of copper cathode, at a total operating cost (C1)* of US$2.47 per pound of copper produced. Copper head grades averaged 0.26% and recoveries averaged 81%;

• Gibraltar sold 31.6 million pounds of copper at an average realized copper price of US$5.13 per pound contributing to revenues of $243.8 million for Taseko;

• In October 2025, the Company closed an equity financing (the "Offering") with a syndicate of underwriters pursuant to which the Company issued 42.7 million common shares at a price of US$4.05 per share for gross proceeds of US$172.8 million. Proceeds from the Offering were partially used to repay outstanding debt under the Company's revolving credit facility, with the remainder available for general corporate purposes; and

• The Company received the final approvals required to commence wellfield injection and recovery operations at Florence Copper in October. Commercial wellfield acidification commenced in early November, and by early December mining solutions were circulating in all the new production wells within the commercial wellfield. Production of copper cathode commenced mid-February with the startup of the electrowinning circuit, and the Florence Copper SX/EW plant is now fully operational with copper being plated.

*Non-GAAP performance measure. See end of news release.

Highlights

Operating data | Three months endedDecember 31, | Year endedDecember 31, | ||||

(Gibraltar - 100% basis) | 2025 | 2024 | Change | 2025 | 2024 | Change |

Tons mined (millions) | 28.0 | 24.0 | 4.0 | 110.9 | 88.3 | 22.6 |

Tons milled (millions) | 7.2 | 8.3 | (1.1) | 30.6 | 29.3 | 1.3 |

Production (million pounds Cu) | 30.7 | 28.6 | 2.1 | 98.1 | 105.6 | (7.5) |

Sales (million pounds Cu) | 31.6 | 27.4 | 4.2 | 98.7 | 108.0 | (9.3) |

Financial data (Cdn$ in thousands, except per share amounts) | Three months endedDecember 31, | Year endedDecember 31, | ||||

2025 | 2024 | Change | 2025 | 20241 | Change | |

Revenues | 243,767 | 167,799 | 75,968 | 672,904 | 608,093 | 64,811 |

Cash flows from operations | 101,234 | 73,292 | 27,942 | 219,558 | 232,615 | (13,057) |

Net income (loss) | 4,454 | (21,207) | 25,661 | (30,076) | (13,444) | (16,632) |

Per share - Basic ("EPS") | 0.01 | (0.07) | 0.08 | (0.09) | (0.05) | (0.04) |

Earnings from mining operations before depletion, amortization and non-recurring items* | 124,055 | 59,405 | 64,650 | 250,664 | 243,646 | 7,018 |

Adjusted EBITDA* | 116,464 | 55,602 | 60,862 | 230,424 | 223,991 | 6,433 |

Adjusted net income* | 41,525 | 10,468 | 31,057 | 27,141 | 56,927 | (29,786) |

Per share - Basic ("Adjusted EPS")* | 0.11 | 0.03 | 0.08 | 0.07 | 0.19 | (0.12) |

1 Amounts for the year ended December 31, 2024 reflect the impact from the March 25, 2024 acquisition of Cariboo from Dowa and Furukawa, which increased the Company's effective interest in the Gibraltar mine from 87.5% to 100%. | ||||||

*Non-GAAP performance measure. See end of news release.

Review of Operations

Gibraltar

Operating data (100% basis) | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 | 2025 | 2024 |

Tons mined (millions) | 28.0 | 29.3 | 30.4 | 23.2 | 24.0 | 110.9 | 88.3 |

Tons milled (millions) | 7.2 | 7.8 | 7.7 | 7.9 | 8.3 | 30.6 | 29.3 |

Strip ratio | 2.2 | 1.5 | 2.3 | 4.6 | 1.9 | 2.3 | 1.6 |

Site operating cost per ton milled* | $ 16.61 | $ 14.98 | $ 11.23 | $ 8.73 | $ 12.18 | $ 12.81 | $ 12.93 |

Copper concentrate |

|

|

|

|

|

|

|

Head grade (%) | 0.26 | 0.22 | 0.20 | 0.19 | 0.22 | 0.22 | 0.23 |

Recovery (%) | 80.9 | 77.2 | 63.2 | 67.5 | 78.2 | 72.8 | 78.5 |

Production (million pounds Cu) | 29.8 | 26.7 | 19.4 | 20.0 | 28.6 | 95.9 | 105.6 |

Sales (million pounds Cu) | 30.8 | 25.4 | 19.0 | 21.8 | 27.4 | 97.0 | 108.0 |

Inventory (million pounds Cu) | 2.9 | 4.0 | 2.7 | 2.3 | 4.1 | 2.9 | 4.1 |

Copper cathode |

|

|

|

|

|

|

|

Production (thousand pounds Cu) | 919 | 895 | 395 | - | - | 2,209 | - |

Sales (thousand pounds Cu) | 783 | 905 | - | - | - | 1,688 | - |

Molybdenum concentrate |

|

|

|

|

|

|

|

Production (thousand pounds Mo) | 830 | 558 | 180 | 336 | 578 | 1,902 | 1,432 |

Sales (thousand pounds Mo) | 953 | 421 | 178 | 364 | 607 | 1,916 | 1,434 |

Per unit data (US$ per Cu pound produced)1 |

|

|

|

|

|

|

|

Site operating cost* | $ 2.80 | $ 3.09 | $ 3.15 | $ 2.41 | $ 2.52 | $ 2.86 | $ 2.61 |

By-product credit* | (0.59) | (0.39) | (0.19) | (0.33) | (0.42) | (0.40) | (0.28) |

Site operating cost, net of by-product credit* | 2.21 | 2.70 | 2.96 | 2.08 | 2.10 | 2.46 | 2.33 |

Off-property cost* | 0.26 | 0.17 | 0.18 | 0.18 | 0.32 | 0.20 | 0.33 |

Total operating cost (C1)* | $ 2.47 | $ 2.87 | $ 3.14 | $ 2.26 | $ 2.42 | $ 2.66 | $ 2.66 |

1 Copper pounds produced includes copper in concentrate and copper cathode. | |||||||

Operations Analysis

Annual Results

Gibraltar mining operations were focused in the Connector pit during 2025, which is the primary source of mill feed for the next few years. Mining rates increased approximately 25% year-over-year to 110.9 million tons in 2025, compared to 88.3 million tons in 2024, with the higher mining rates attributable to increased operating hours and improved productivity of the haul truck fleet.

*Non-GAAP performance measure. See end of news release.

Operations Analysis - Continued

Copper production was 98.1 million pounds in 2025, including 2.2 million pounds of copper cathode from the Gibraltar solvent extraction and electrowinning ("SX/EW") plant that was restarted in May. Mill throughput was 30.6 million tons for the year with average copper head grades of 0.22% and copper recoveries of 73%, which steadily improved throughout the year as mining advanced beyond the oxidized and supergene zones encountered in the initial phases of Connector pit. Copper production in the second half of the year was a notable improvement over the first half of the year attributable to higher grades and better quality ore.

Total site costs* were $473.2 million (including capitalized stripping of $80.9 million) in 2025, compared to $400.2 million (including capitalized stripping of $32.5 million) in 2024. The increase in total site costs is a result of higher mining rates and costs to restart and operate the Gibraltar SX/EW plant, which processes stockpiled oxide ore to produce copper cathode.

Molybdenum production increased to 1.9 million pounds in 2025 from 1.4 million pounds in 2024 primarily due to higher molybdenum grades and improved recoveries. At an average molybdenum price of US$22.16 per pound for the year, molybdenum contributed to a by-product credit of US$0.40 per pound of copper produced.

Off-property costs were US$0.20 per pound of copper produced in 2025, compared to US$0.33 per pound of copper produced in 2024, and reflect Gibraltar's favorable offtake agreements with average treatment and refining charges ("TCRC") of around $nil for the year.

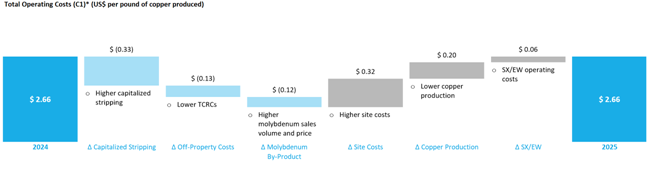

Total operating costs (C1)* were US$2.66 per pound of copper produced in 2025, consistent with US$2.66 per pound of copper produced in 2024. The impacts of higher capitalized stripping, lower TCRCs, and higher molybdenum sales were offset by higher site operating costs due to higher mining rates, lower copper production, and the recommissioning and initial operation of the Gibraltar SX/EW plant.

*Non-GAAP performance measure. See end of news release.

Operations Analysis - Continued

Fourth Quarter Results

Mining continues to advance deeper into the Connector pit and benefit from improved copper grades and ore quality. A total of 28.0 million tons were mined in the fourth quarter, comparable to the previous quarter. The average strip ratio was 2.2 in the fourth quarter, and in line with the life-of-mine average.

Mill throughput was 7.2 million tons in the fourth quarter and was impacted by unanticipated mill downtime due to unscheduled maintenance activities and a serious accident which resulted in a temporary site wide shutdown in November.

Copper production increased to 30.7 million pounds (including 0.9 million pounds of copper cathode) in the fourth quarter, compared to 27.6 million pounds (including 0.9 million pounds of copper cathode) in the previous quarter, driven by higher copper head grades averaging 0.26% and copper recoveries averaging 81%.

Total site costs* were $125.6 million (including capitalized stripping of $6.0 million) in the fourth quarter, comparable to the previous quarter.

Molybdenum production increased to 830 thousand pounds in the fourth quarter and reflects the higher molybdenum grades realized in Connector pit ore. At an average molybdenum price of US$22.89 per pound for the quarter, molybdenum provided a by-product credit of US$0.59 per pound of copper produced.

Off-property costs were US$0.26 per pound of copper produced and were higher than previous quarters due to the timing of shipments with higher TCRC terms.

Total operating costs (C1)* were US$2.47 per pound of copper produced for the fourth quarter, lower than the prior quarter and comparable to the prior year comparative quarter. Increased site operating costs from higher mining rates were offset by higher copper production, improved molybdenum by-product credits, higher capitalized stripping costs, and lower TCRCs.

*Non-GAAP performance measure. See end of news release.

Gibraltar Outlook

Mining activity over the last 18 months has been focused in the Connector Pit, which was the primary source of mill feed in 2025, and will continue to be the primary source of ore for the next three years (2026 through 2028). In recent months, head grades in the Connector Pit have been 5% to 10% lower than originally expected due to the impact of small higher grade zones that have not been realized through mining to date. In addition, oxide copper and metallurgically challenging supergene ore has been more abundant in the Connector Pit than previously estimated, and recoveries in 2026 are expected to average between 75% to 80% (similar to the second half of 2025). On a positive note, the additional oxide ore mined from Connector Pit has been stacked on leach pads and will be processed in the Gibraltar SX/EW plant in the coming years. Taking all of these factors into account, total copper production at Gibraltar for 2026 is expected to be in the range of 110 to 115 million pounds and is expected to continue at similar levels (± 5%) until completion of mining in the Connector pit in mid-2029.

Molybdenum production in 2026 is expected to remain at similar levels to 2025, and with molybdenum prices stabilizing above US$20.00 per pound we continue to expect strong molybdenum by-product credits.

The Company has offtake agreements covering substantially all of Gibraltar's copper concentrate production for 2026, which contain low and in certain cases negative TCRC rates reflecting the continued tight copper smelting market. Based on the contract terms, the Company expects average TCRCs to be similar to 2025.

The Company has a prudent hedging program in place to protect a minimum copper price and Gibraltar cash flow during the commissioning period and ramp-up of commercial operations at Florence Copper. Currently, the Company has copper collar contracts in place with a floor of US$4.00 per pound and a ceiling of US$5.40 per pound for 54 million pounds of copper production for the first half of 2026 and a floor of US$4.75 per pound and a ceiling of between US$7.50 and US$8.50 per pound for 24 million pounds of copper production for the third quarter of 2026 (refer to "Financial Condition Review-Hedging Strategy" for details).

Florence Copper

Florence Copper is an in-situ copper recovery ("ISCR") operation, located in Arizona, USA, that will produce LME Grade A copper metal without conventional open-pit mining or major surface disturbance. Florence Copper is projected to rank among the lowest greenhouse gas ("GHG") intensity primary copper producers in North America, delivering environmentally responsible copper to North American manufacturers and consumers. The project is expected to commence commercial production in early 2026, with production ramping up to 85 million pounds per year at full capacity.

Construction activities at Florence Copper were completed on time and largely on budget in the fourth quarter of 2025. The focus of the operating team has transitioned to wellfield operations, commissioning of the SX/EW plant and the startup of commercial production.

Commercial wellfield acidification commenced in early November, and by early December mining solutions were circulating in all the new production wells within the commercial wellfield. Initial injection flowrates were above expectations resulting in faster initial acidification of the wellfield. The grade of copper recovered in solution from the recovery wells continued to increase, and the average solution grade reached the level required for SX/EW plant operations. Commissioning of the SX/EW plant area advanced in parallel with initial wellfield operations, and plant operations commenced mid-February. Production of copper cathode commenced mid-February with the startup of the electrowinning circuit. The Florence Copper SX/EW plant is

Florence Copper - Continued

now fully operational and copper is being plated. The project team is focused on the successful ramp-up of operations in 2026, and total production in 2026 is expected to be in the range of 30 to 35 million pounds of copper cathode.

Wellfield drilling also re-commenced in late 2025 and by early 2026 there were three drill rigs operating on site with a fourth drill rig being mobilized at site. Continued expansion of the commercial wellfield will be required to support higher solution flows and increased copper production as the Florence Copper commercial operation progresses through the ramp-up in 2026.

Florence Copper capital spend (US$ in thousands) | Three months endedDecember 31, 2025 | Year endedDecember 31, 2025 |

Commercial facility construction costs | 8,016 | 119,644 |

Plant and site commissioning costs | 3,636 | 3,636 |

Site and PTF operations | 12,260 | 34,662 |

Total Florence Copper capital spend | 23,912 | 157,942 |

Florence Copper commercial facility construction costs were US$8.0 million in the fourth quarter and US$119.6 million in 2025. Total construction costs for the Florence Copper commercial facility were US$274.6 million.

Long-term Growth Strategy

Taseko's strategy has been to grow the Company by acquiring and developing a pipeline of projects focused on copper in North America. We continue to believe this will generate long-term returns for shareholders. Our other development projects are located in BC, Canada.

Yellowhead copper project

In July 2025, the Company published a new report titled "Technical Report Update on the Yellowhead Copper Project, British Columbia, Canada" (the "Yellowhead 2025 Technical Report"). Based on the Yellowhead 2025 Technical Report, the Yellowhead copper project is expected to produce 4.4 billion pounds of copper over a 25-year mine life at an average C1 cost, net of by-product credit, of US$1.90 per pound of copper produced. During the first 5 years of operation, the Yellowhead project is expected to produce an average of 206 million pounds of copper per year at an average C1 cost, net of by-product credit, of US$1.62 per pound of copper produced. The Yellowhead project also contains valuable precious metal by-products with 282,000 ounces of gold production and 19.4 million ounces of silver production over the life of mine.

The economic analysis in the Yellowhead 2025 Technical Report was prepared using a copper price of US$4.25 per pound, a gold price of US$2,400 per ounce, and a silver price of US$28.00 per ounce.

Long-term Growth Strategy - Continued

Project highlights based on the Yellowhead 2025 Technical Report are detailed below:

• Average annual copper production of 178 million pounds over a 25 year mine life at total cash costs (C1) of US$1.90 per pound of copper produced;

• Over the first 5 years of the mine life, copper grade is expected to average 0.32% producing an average of 206 million pounds of copper at total cash costs (C1) of US$1.62 per pound of copper produced;

• Concentrator designed to process 90,000 tonnes per day of ore with an expected copper recovery of 90%, and produce a clean copper concentrate with payable gold and silver by-products;

• Conventional open pit mining with a low strip ratio of 1.4;

• After-tax net present value of $2.0 billion (8% after-tax discount rate) and after-tax internal rate of return of 21%;

• Initial capital costs of $2.0 billion with a payback period of 3.3 years; and

• Expected to be eligible for the Canadian federal Clean Technology Manufacturing Investment Tax Credit, with 30% (approximately $540 million) of eligible initial capital costs reimbursed in year 1 of operation.

In June 2025, the Yellowhead project's Initial Project Description was filed and accepted by the British Columbia Environmental Assessment Office and Impact Assessment Agency of Canada, formally commencing the Environmental Assessment process. The Company will continue to engage with project stakeholders to ensure that the development of the Yellowhead Project is in line with environmental and social expectations. The Company opened a community office for the Yellowhead project in 2024 to support ongoing engagement with local communities including First Nations.

New Prosperity copper-gold project

In June 2025, Taseko, the Tŝilhqot'in Nation and the Province of BC reached a historic agreement concerning the New Prosperity project (the "Teẑtan Biny Agreement"). The Teẑtan Biny Agreement ends litigation among the parties while providing certainty with respect to how the significant copper-gold resource at New Prosperity may be developed in the future.

Key elements of the Teẑtan Biny Agreement include:

• Taseko received a payment of $75 million from the Province of BC upon closing of the agreement;

• Taseko contributed a 22.5% equity interest in the New Prosperity mineral tenures to a trust for the future benefit of the Tŝilhqot'in Nation. The trust will transfer the property interest to the Tŝilhqot'in Nation if and when it consents to a proposal to pursue mineral development in the project area;

• Taseko retains a majority interest (77.5%) in the New Prosperity mineral tenures and can divest some or all of its interest at any time, including to other mining companies that could advance a project with the consent of the Tŝilhqot'in Nation. However, Taseko has committed not to be the proponent (operator) of mineral exploration and development activities at New Prosperity, nor the owner of a future mine development;

• Taseko has entered into a consent agreement with the Tŝilhqot'in Nation, whereby no mineral exploration or development activity can proceed in the New Prosperity project area without the free, prior and informed consent of the Tŝilhqot'in Nation;

Long-term Growth Strategy - Continued

• The Province of BC and the Tŝilhqot'in Nation have agreed to negotiate the process by which the consent of the Tŝilhqot'in Nation will be sought for any proposed mining project to proceed through an environmental assessment process; and

• The Tŝilhqot'in Nation and the Province of BC have agreed to undertake a land-use planning process for the area of the mineral tenures and a broader area of land within Tŝilhqot'in territory.

Aley niobium project

The converter pilot test is ongoing to provide additional process data to support the design of commercial process facilities. In the fourth quarter, the Company produced on-spec ferro-niobium, and the process is now scaling up to provide product samples to support marketing initiatives. The Company is also conducting a scoping study to investigate the potential for Aley niobium oxide production to supply the growing market for niobium-based batteries.

Conference Call and Webcast

The Company will host a telephone conference call and live webcast on Thursday, February 19, 2026, at 11:00 a.m. Eastern Time (8:00 a.m. Pacific) to discuss these results. After opening remarks by management, there will be a question and answer session open to analysts and investors. The conference call may be accessed by dialing 800-715-9871 toll free or 646-307-1963, using the access code 4873075.The webcast may be accessed at tasekomines.com/investors/events and will be archived until February 19, 2027 for later playback.

For further information on Taseko, see the Company's website at tasekomines.com or contact:

· Investor enquiries Brian Bergot, Vice President, Investor Relations - 778-373-4554

Stuart McDonald

President and CEO

Non-GAAP Performance Measures

This MD&A includes certain non-GAAP performance measures that do not have a standardized meaning prescribed by IFRS Accounting Standards. These measures may differ from those used by, and may not be comparable to such measures as reported by, other issuers. The Company believes that these measures are commonly used by certain investors, in conjunction with conventional IFRS Accounting Standards measures, to enhance their understanding of the Company's performance. These measures have been derived from the Company's financial statements and applied on a consistent basis. The following tables below provide a reconciliation of these non-GAAP measures to the most directly comparable IFRS Accounting Standards measures.

Total operating cost and site operating cost, net of by-product credit

Total operating cost includes all costs absorbed into inventory, as well as transportation costs and insurance recoverable. Site operating cost is calculated by removing net changes in inventory, depletion and amortization, insurance recoverable, and transportation costs from cost of sales. Site operating cost, net of by-product credit is calculated by subtracting by-product credits from site operating cost. Site operating cost, net of by-product credit per pound is calculated by dividing the aggregate of the applicable costs by pounds of copper produced. Total operating cost per pound is the sum of site operating costs, net of by-product credits and off-property costs divided by pounds of copper produced. By-product credit is calculated based on actual sales of molybdenum (net of treatment costs), silver and gold during the period divided by the total pounds of copper produced during the period. These measures are calculated on a consistent basis for the periods presented.

(Cdn$ in thousands) | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 | 2025 |

Cost of sales | 146,919 | 134,664 | 120,592 | 122,783 | 524,958 |

Less: | |||||

Depletion and amortization | (27,207) | (27,876) | (25,210) | (22,425) | (102,718) |

Changes in inventories of finished goods | (2,611) | 1,425 | 2,123 | (2,710) | (1,773) |

Changes in inventories of ore stockpiles | 13,473 | 16,685 | (5,718) | (22,747) | 1,693 |

Transportation costs | (10,989) | (7,247) | (5,720) | (5,984) | (29,940) |

Site operating costs | 119,585 | 117,651 | 86,067 | 68,917 | 392,220 |

Less by-product credits: | |||||

Molybdenum, net of treatment costs | (25,095) | (13,903) | (4,814) | (8,774) | (52,586) |

Silver, excluding amortization of deferred revenue | 312 | (295) | (58) | (131) | (172) |

Gold | (619) | (761) | (351) | (389) | (2,120) |

Site operating costs, net of by-product credits | 94,183 | 102,692 | 80,844 | 59,623 | 337,342 |

Total copper produced (thousand pounds) | 30,712 | 27,593 | 19,813 | 19,959 | 98,077 |

Total costs per pound produced (US$ per pound) | 3.07 | 3.72 | 4.08 | 2.99 | 3.44 |

Average exchange rate for the period (CAD/USD) | 1.39 | 1.38 | 1.38 | 1.44 | 1.40 |

Site operating costs, net of by-product credits(US$ per pound) | 2.21 | 2.70 | 2.96 | 2.08 | 2.46 |

Site operating costs, net of by-product credits | 94,183 | 102,692 | 80,844 | 59,623 | 337,342 |

Add off-property costs: | |||||

Treatment and refining costs (premiums) | 394 | (512) | (837) | (510) | (1,465) |

Transportation costs | 10,989 | 7,247 | 5,720 | 5,984 | 29,940 |

Total operating costs | 105,566 | 109,427 | 85,727 | 65,097 | 365,817 |

Total operating costs (C1) (US$ per pound) | $ 2.47 | $ 2.87 | $ 3.14 | $ 2.26 | $ 2.66 |

Non-GAAP Performance Measures - Continued

(Cdn$ in thousands) | Q4 2024 | Q3 2024 | Q2 2024 | Q1 20241 | 2024 |

Cost of sales | 134,940 | 124,833 | 108,637 | 122,528 | 490,938 |

Less: | |||||

Depletion and amortization | (24,641) | (20,466) | (13,721) | (15,024) | (73,852) |

Changes in inventories of finished goods | 4,064 | 2,938 | (10,462) | (20,392) | (23,852) |

Changes in inventories of ore stockpiles | (3,698) | 9,089 | 1,758 | 2,719 | 9,868 |

Transportation costs | (10,170) | (8,682) | (6,408) | (10,153) | (35,413) |

Site operating costs | 100,495 | 107,712 | 79,804 | 79,678 | 367,689 |

Less by-product credits: | |||||

Molybdenum, net of treatment costs | (16,507) | (8,962) | (7,071) | (6,112) | (38,652) |

Silver, excluding amortization of deferred revenue | (139) | (241) | (144) | (137) | (661) |

Site operating costs, net of by-product credits | 83,849 | 98,509 | 72,589 | 73,429 | 328,376 |

Total copper produced (thousand pounds) | 28,595 | 27,101 | 20,225 | 26,694 | 102,615 |

Total costs per pound produced (US$ per pound) | 2.94 | 3.63 | 3.59 | 2.75 | 3.20 |

Average exchange rate for the period (CAD/USD) | 1.40 | 1.36 | 1.37 | 1.35 | 1.37 |

Site operating costs, net of by-product credits(US$ per pound) | 2.10 | 2.66 | 2.62 | 2.04 | 2.33 |

Site operating costs, net of by-product credits | 83,849 | 98,509 | 72,589 | 73,429 | 328,376 |

Add off-property costs: | |||||

Treatment and refining costs | 2,435 | 816 | 3,941 | 4,816 | 12,008 |

Transportation costs | 10,170 | 8,682 | 6,408 | 10,153 | 35,413 |

Total operating costs | 96,454 | 108,007 | 82,938 | 88,398 | 375,797 |

Total operating costs (C1) (US$ per pound) | $ 2.42 | $ 2.92 | $ 2.99 | $ 2.46 | $ 2.66 |

1 Amounts for Q1 2024 reflect the impact from the March 25, 2024 acquisition of Cariboo from Dowa and Furukawa, which increased the Company's effective interest in the Gibraltar mine from 87.5% to 100%. | |||||

Total site costs

Total site costs include site operating costs charged to cost of sales and mining costs capitalized to property, plant and equipment in the period. This measure is intended to capture total site operating costs incurred during the period calculated on a consistent basis for the periods presented.

(Cdn$ in thousands) | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 | 2025 |

Site operating costs (included in cost of sales) | 119,585 | 117,651 | 86,067 | 68,917 | 392,220 |

Capitalized stripping costs | 5,986 | 6,106 | 30,765 | 38,082 | 80,939 |

Total site costs | 125,571 | 123,757 | 116,832 | 106,999 | 473,159 |

(Cdn$ in thousands) | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 | 2024 |

Site operating costs (included in cost of sales) | 100,495 | 107,712 | 79,804 | 79,678 | 367,689 |

Capitalized stripping costs | 1,981 | 3,631 | 10,732 | 16,152 | 32,496 |

Total site costs | 102,476 | 111,343 | 90,536 | 95,830 | 400,185 |

Total site costs - 100% basis | 102,476 | 111,343 | 90,536 | 109,520 | 413,875 |

Non-GAAP Performance Measures - Continued

Adjusted net income (loss) and Adjusted EPS

Adjusted net income (loss) removes the effect of the following transactions from net income (loss) as reported under IFRS Accounting Standards:

• Unrealized foreign currency gains and losses;

• Unrealized gains and losses on derivatives;

• Other operating costs;

• Call premium on settlement of debt;

• Loss on settlement of debt, net of capitalized interest;

• Bargain purchase gains on Cariboo acquisition;

• Gain on acquisition of control of Gibraltar;

• Realized gain on sale of finished goods inventories;

• Realized gains on processing of ore stockpiles;

• Accretion on Florence royalty obligation;

• Accretion on Cariboo consideration payable;

• Tax effect of sale of non-controlling interest in New Prosperity; and

• Non-recurring other expenses for Cariboo acquisition.

Management believes that these transactions do not reflect the underlying operating performance of the Company's core mining business and are not necessarily indicative of future operating results. Furthermore, unrealized gains and losses on derivative instruments, changes in the fair value of financial instruments, and unrealized foreign currency gains and losses are not necessarily reflective of the underlying operating results for the periods presented.

Adjusted earnings per share ("Adjusted EPS") is Adjusted net income attributable to common shareholders of the Company divided by the weighted average number of common shares outstanding for the period.

(Cdn$ in thousands) | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 | 2025 |

Net income (loss) | 4,454 | (27,838) | 21,868 | (28,560) | (30,076) |

Unrealized foreign exchange (gain) loss | (9,000) | 14,287 | (40,335) | 2,074 | (32,974) |

Unrealized loss and fair value adjustments on derivatives | 37,676 | 14,977 | 9,489 | 23,536 | 85,678 |

Accretion on Cariboo consideration payable | 4,048 | 4,041 | 4,484 | 664 | 13,237 |

Accretion on Florence royalty obligation | 18,415 | 6,991 | 6,201 | 2,571 | 34,178 |

Tax effect of sale of non-controlling interest in New Prosperity | - | - | (9,285) | - | (9,285) |

Estimated tax effect of adjustments | (14,068) | (6,874) | (5,447) | (7,228) | (33,617) |

Adjusted net income (loss) | 41,525 | 5,584 | (13,025) | (6,943) | 27,141 |

Adjusted EPS | $ 0.11 | $ 0.02 | $ (0.04) | $ (0.02) | $ 0.07 |

Non-GAAP Performance Measures - Continued

(Cdn$ in thousands) | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 | 2024 |

Net (loss) income | (21,207) | (180) | (10,953) | 18,896 | (13,444) |

Unrealized foreign exchange loss (gain) | 40,462 | (7,259) | 5,408 | 13,688 | 52,299 |

Unrealized (gain) loss and fair value adjustments on derivatives | (25,514) | 1,821 | 10,033 | 3,519 | (10,141) |

Accretion on Cariboo consideration payable | 4,543 | 9,423 | 8,399 | 1,555 | 23,920 |

Accretion on Florence royalty obligation | 3,682 | 3,703 | 2,132 | 3,416 | 12,933 |

Other operating costs | 4,132 | 4,098 | 10,435 | - | 18,665 |

Gain on Cariboo acquisition | - | - | - | (47,426) | (47,426) |

Gain on acquisition of control of Gibraltar1 | - | - | - | (14,982) | (14,982) |

Realized gain on sale of inventory2 | - | - | 3,768 | 13,354 | 17,122 |

Realized gain on processing of ore stockpiles3 | 1,905 | 3,266 | 4,056 | - | 9,227 |

Non-recurring other expenses related to Cariboo acquisition | - | - | 394 | 138 | 532 |

Call premium on settlement of debt | - | - | 9,571 | - | 9,571 |

Loss on settlement of debt, net of capitalized interest | - | - | 2,904 | - | 2,904 |

Estimated tax effect of adjustments | 2,465 | (6,644) | (15,644) | 15,570 | (4,253) |

Adjusted net income | 10,468 | 8,228 | 30,503 | 7,728 | 56,927 |

Adjusted EPS | $ 0.03 | $ 0.03 | $ 0.10 | $ 0.03 | $ 0.19 |

1 Gain on acquisition of control of Gibraltar relates Taseko's 87.5% share of copper concentrate inventories held at March 25, 2024 that was written-up to fair value as part of the acquisition of control of Gibraltar. 2 Realized gain on sale of inventory relates to copper concentrate inventories held at March 25, 2024 that was written-up to fair value as part of the acquisition of control of Gibraltar and subsequently sold. The realized portion of these gains have been added back to Adjusted net income in the period the inventories were sold. 3 Realized gain on processing of ore stockpiles relates to ore stockpile inventories held at March 25, 2024 that was written-up to fair value as part of the acquisition of control of Gibraltar and subsequently processed. The realized portion of these gains have been added back to Adjusted net income in the period the inventories were processed. | |||||

Non-GAAP Performance Measures - Continued

Adjusted EBITDA

Adjusted earnings before interest, taxes, depreciation and amortization ("Adjusted EBITDA") is presented as a supplemental measure of the Company's performance and ability to service debt. Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the industry, many of which present adjusted EBITDA when reporting their results. Issuers of "high yield" securities also present adjusted EBITDA because investors, analysts and rating agencies considering it useful in measuring the ability of those issuers to meet debt service obligations.

Adjusted EBITDA represents net income before interest, income taxes, depreciation and amortization, and also eliminates the impact of a number of transactions that are not considered indicative of ongoing operating performance. Certain items of expense are added back and certain items of income are deducted from net income that are not likely to recur or are not indicative of the Company's underlying operating results for the reporting periods presented or for future operating performance and consist of:

• Unrealized foreign exchange gains and losses;

• Unrealized gains and losses on derivative;

• Amortization of share-based compensation expense;

• Other operating costs;

• Call premium on settlement of debt;

• Loss on settlement of debt;

• Bargain purchase gains on Cariboo acquisition;

• Gain on acquisition of control of Gibraltar;

• Realized gains on sale of finished goods inventories;

• Realized gains on processing of ore stockpiles; and

• Non-recurring other expenses for Cariboo acquisition.

(Cdn$ in thousands) | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 | 2025 |

Net income (loss) | 4,454 | (27,838) | 21,868 | (28,560) | (30,076) |

Depletion and amortization | 27,207 | 27,974 | 25,210 | 22,425 | 102,816 |

Finance and accretion expenses | 36,925 | 24,888 | 23,943 | 18,877 | 104,633 |

Finance income | (1,098) | (1,368) | (124) | (1,330) | (3,920) |

Income tax expense (recovery) | 13,096 | 2,918 | (27,439) | (7,980) | (19,405) |

Unrealized foreign exchange (gain) loss | (9,000) | 14,287 | (40,335) | 2,074 | (32,974) |

Unrealized loss on derivatives and fair value adjustments | 37,676 | 14,977 | 9,489 | 23,536 | 85,678 |

Share-based compensation expense | 7,204 | 6,299 | 4,820 | 5,349 | 23,672 |

Adjusted EBITDA | 116,464 | 62,137 | 17,432 | 34,391 | 230,424 |

Non-GAAP Performance Measures - Continued

(Cdn$ in thousands) | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 | 2024 |

Net (loss) income | (21,207) | (180) | (10,953) | 18,896 | (13,444) |

Depletion and amortization | 24,641 | 20,466 | 13,721 | 15,024 | 73,852 |

Finance and accretion expenses | 21,473 | 25,685 | 21,271 | 19,894 | 88,278 |

Finance income | (1,674) | (1,504) | (911) | (1,086) | (5,175) |

Income tax expense (recovery) | 11,707 | (200) | (3,247) | 23,282 | 31,542 |

Unrealized foreign exchange loss (gain) | 40,462 | (7,259) | 5,408 | 13,688 | 52,299 |

Unrealized (gain) loss on derivatives | (25,514) | 1,821 | 10,033 | 3,519 | (10,141) |

Amortization of share-based compensation (recovery) expense | (323) | 1,496 | 2,585 | 5,667 | 9,425 |

Other operating costs | 4,132 | 4,098 | 10,435 | - | 18,665 |

Call premium on settlement of debt | - | - | 9,571 | - | 9.571 |

Loss on settlement of debt | - | - | 4,646 | - | 4,646 |

Gain on Cariboo acquisition | - | - | - | (47,426) | (47,426) |

Gain on acquisition of control of Gibraltar1 | - | - | - | (14,982) | (14,982) |

Realized gain on sale of inventory2 | - | - | 3,768 | 13,354 | 17,122 |

Realized gain on processing of ore stockpiles3 | 1,905 | 3,266 | 4,056 | - | 9,227 |

Non-recurring other expenses for Cariboo acquisition | - | - | 394 | 138 | 532 |

Adjusted EBITDA | 55,602 | 47,689 | 70,777 | 49,923 | 223,991 |

1 Gain on acquisition of control of Gibraltar relates Taseko's 87.5% share of copper concentrate inventories held at March 25, 2024 that was written-up to fair value as part of the acquisition of control of Gibraltar. 2 Realized gain on sale of inventory relates to copper concentrate inventories held at March 25, 2024 that was written-up to fair value as part of the acquisition of control of Gibraltar and subsequently sold. The realized portion of these gains have been added back to Adjusted EBITDA in the period the inventories were sold. 3 Realized gain on processing of ore stockpiles relates to ore stockpile inventories held at March 25, 2024 that was written-up to fair value as part of the acquisition of control of Gibraltar and subsequently processed. The realized portion of these gains have been Adjusted EBITDA in the period the inventories were processed. | |||||

Non-GAAP Performance Measures - Continued

Earnings from mining operations before depletion, amortization and non-recurring items

Earnings from mining operations before depletion, amortization and non-recurring items is earnings from mining operations with depletion and amortization, and any items that are not considered indicative of ongoing operating performance added back. The Company discloses this measure, which has been derived from the Company's financial statements and applied on a consistent basis, to assist in understanding the results of the Company's operations and financial position, and it is meant to provide further information about the financial results to investors.

(Cdn$ in thousands) | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 | 2025 |

Earnings (loss) from mining operations | 96,848 | 39,242 | (502) | 16,366 | 151,954 |

Add: | |||||

Depletion and amortization | 27,207 | 27,876 | 25,210 | 22,425 | 102,718 |

Other operating income | - | - | (4,008) | - | (4,008) |

Earnings from mining operations before depletion, amortization and non-recurring items | 124,055 | 67,118 | 20,700 | 38,791 | 250,664 |

(Cdn$ in thousands) | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 | 2024 |

Earnings from mining operations | 28,727 | 26,686 | 44,948 | 24,419 | 124,780 |

Add: | |||||

Depletion and amortization | 24,641 | 20,466 | 13,721 | 15,024 | 73,852 |

Realized gain on sale of inventory1 | - | - | 3,768 | 13,354 | 17,122 |

Realized gain on processing of ore stockpiles2 | 1,905 | 3,266 | 4,056 | - | 9,227 |

Other operating costs | 4,132 | 4,098 | 10,435 | - | 18,665 |

Earnings from mining operations before depletion, amortization and non-recurring items | 59,405 | 54,516 | 76,928 | 52,797 | 243,646 |

1 Realized gain on sale of inventory relates to copper concentrate inventories held at March 25, 2024 that was written-up to fair value as part of the acquisition of control of Gibraltar and subsequently sold. The realized portion of these gains have been added back to earnings from mining operations before depletion, amortization and non-recurring items in the period the inventories were sold. 2 Realized gain on processing of ore stockpiles relates to ore stockpile inventories held at March 25, 2024 that was written-up to fair value as part of the acquisition of control of Gibraltar and subsequently processed. The realized portion of these gains have been added back to earnings from mining operations before depletion, amortization and non-recurring items in the period the inventories were processed. | |||||

Non-GAAP Performance Measures - Continued

Site operating costs per ton milled

The Company discloses this measure, which has been derived from the Company's financial statements and applied on a consistent basis, to assist in understanding the Company's site operations on a tons milled basis.

(Cdn$ in thousands) | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 | 2025 |

Site operating costs (included in cost of sales) | 119,585 | 117,651 | 86,067 | 68,917 | 392,220 |

Tons milled (thousand tons) | 7,200 | 7,852 | 7,663 | 7,898 | 30,613 |

Site operating costs per ton milled | $ 16.61 | $ 14.98 | $ 11.23 | $ 8.73 | $ 12.81 |

(Cdn$ in thousands) | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 | 2024 |

Site operating costs (included in cost of sales) | 100,495 | 107,712 | 79,804 | 90,040 | 378,050 |

Tons milled (thousand tons) | 8,250 | 7,572 | 5,728 | 7,677 | 29,227 |

Site operating costs per ton milled | $ 12.18 | $ 14.23 | $ 13.93 | $ 11.73 | $ 12.93 |

Technical Information

The technical information contained in this MD&A related to Florence Copper is based on the report titled "NI 43-101 Technical Report - Florence Copper Project, Pinal County, Arizona" issued on March 30, 2023 with an effective date of March 15, 2023 (the "Florence 2025 Technical Report"), which is available on SEDAR+. The Florence 2023 Technical Report was prepared under the supervision of Richard Tremblay, P. Eng., MBA, Richard Weymark, P. Eng., MBA, and Robert Rotzinger, P. Eng. Mr. Tremblay is employed by the Company as Chief Operating Officer, Mr. Weymark is employed by the Company as Vice President, Engineering, and Mr. Rotzinger is employed by the Company as Vice President, Capital Projects. All three are Qualified Persons as defined by NI 43-101.

The technical information contained in this MD&A related to Yellowhead is based on the report titled "Technical Report Update on the Yellowhead Copper Project, British Columbia, Canada" issued on July 10, 2025 with an effective date of June 15, 2025 (the "Yellowhead 2025 Technical Report"), which is available on SEDAR+. The Yellowhead 2025 Technical Report was prepared under the supervision of Richard Weymark, P. Eng., MBA. Mr. Weymark is employed by the Company as Vice President, Engineering and is a Qualified Person as defined by NI 43-101.

No regulatory authority has approved or disapproved of the information contained in this news release

Caution Regarding Forward-Looking Information

This document contains "forward-looking statements" that were based on Taseko's expectations, estimates and projections as of the dates as of which those statements were made. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "outlook", "anticipate", "project", "target", "believe", "estimate", "expect", "intend", "should" and similar expressions.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the Company's actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. These included but are not limited to:

• uncertainties about the future market price of copper and the other metals that we produce or may seek to produce;

• changes in general economic conditions, the financial markets and in the market price for our input costs including due to inflationary impacts, such as diesel fuel, acid, steel, concrete, electricity and other forms of energy, mining equipment, and fluctuations in exchange rates, particularly with respect to the value of the U.S. dollar and Canadian dollar, and the continued availability of capital and financing;

• inherent risks associated with mining operations, including our current mining operations at Gibraltar and our planned mining operations at Florence Copper, and their potential impact on our ability to achieve our production estimates;

• uncertainties as to our ability to achieve reduced costs for Gibraltar (as defined below) and to otherwise control our operating costs without impacting our planned copper production;

• our high level of indebtedness and its potential impact on our financial condition and the requirement to generate cash flow to service our indebtedness and refinance such indebtedness from time to time;

• the increases in interest rates, by central banks may increase our borrowing costs and impact the profitability of our operations;

• our ability to draw down on our financing arrangements for the construction of Florence Copper is subject to our meeting the required conditions for drawdown;

• the amounts we are required to pay for our acquisition of Cariboo will increase with higher copper prices;

• the risk of inadequate insurance or inability to obtain insurance to cover our business risks;

• uncertainties related to the accuracy of our estimates of Mineral Reserves (as defined below), Mineral Resources (as defined below), production rates and timing of production, future production and future cash and total costs of production and milling;

• the risk that we may not be able to expand or replace Mineral Reserves as our existing Mineral Reserves are mined;

• the risk that the results from our development of Florence Copper will not meet our estimates of remaining construction costs, operating expenses, revenue, rates of return and cash flows from operations which have been projected by the technical report for Florence;

• the risk of cost overruns or delays in our construction of the commercial facilities at Florence Copper, resulting in not commencing commercial production within our current projected timeline or within our current projected cost estimates;

• uncertainties related to the execution plan for the construction of Florence Copper and the commencement of commercial operations resulting from inflation risk, supply chain disruptions, material and labour shortages or other execution risks;

• our ability to comply with all conditions imposed under the APP and UIC permits for the construction and operation of Florence Copper;

• the availability of, and uncertainties relating to, any additional financing necessary for the continued operation and development of our projects, including with respect to our ability to obtain any additional construction financing, if needed, to complete the construction and commencement of commercial operations at Florence Copper;

• shortages of water supply, critical spare parts, maintenance service and new equipment and machinery or our ability to manage surplus water on our mine sites may materially and adversely affect our operations and development projects;

• our ability to comply with the extensive governmental regulation to which our business is subject;

• uncertainties related to our ability to obtain necessary title, licenses and permits for our development projects and project delays due to third party opposition;

• uncertainties related to Indigenous people's claims and rights, and legislation and government policies regarding the same;

• our reliance on the availability of infrastructure necessary for development and on operations, including on rail transportation and port terminals for shipping of our copper concentrate production from Gibraltar, and rail transportation and power for the feasibility of our other British Columbia development projects;

• uncertainties related to unexpected judicial or regulatory proceedings;

• changes in, and the effects of, the laws, regulations and government policies affecting our exploration and development activities and mining operations;

• potential changes to the mineral tenure system in British Columbia, which is undergoing reform for compliance with the Declaration Act (British Columbia);

• our dependence solely on our 100% interest in Gibraltar for our revenues and our operating cash flows;

• our ability to extend existing concentrate off-take agreements or enter into new agreements;

• environmental issues and liabilities associated with mining including processing and stockpiling ore;

• labour strikes, work stoppages, or other interruptions to, or difficulties in, the employment of labour in markets in which we operate mines, industrial accidents, equipment failure or other events or occurrences, including third party interference that interrupt the production of minerals in our mines;

• environmental hazards and risks associated with climate change, including the potential for damage to infrastructure and stoppages of operations due to extreme cold, forest fires, flooding, drought, earthquakes or other natural events in the vicinity of our operations;

• litigation risks and the inherent uncertainty of litigation;

• our actual costs of reclamation and mine closure may exceed our current estimates of these liabilities;

• our ability to renegotiate our existing union agreement for Gibraltar when it expires in May 2027;

• the capital intensive nature of our business both to sustain current mining operations and to develop any new projects including Florence Copper;

• our ability to develop new mining projects may be adversely impacted by potential indigenous joint decision-making and consent agreements being implemented by the Government of British Columbia under the B.C. Declaration on the Rights of Indigenous Peoples Act;

• our reliance upon key personnel;

• the competitive environment in which we operate;

• the effects of forward selling instruments to protect against fluctuations in copper prices and other input costs including diesel and acid;

• the risk of changes in accounting policies and methods we use to report our financial condition, including uncertainties associated with critical accounting assumptions and estimates;

• uncertainties relating to the war in Ukraine, the Israel-Hamas conflict and other future geopolitical events including social unrest, which could disrupt financial markets, supply chains, availability of materials and equipment and execution timelines for any project development;

• recent changes to U.S. trade policies and tariff risks may adversely impact overall economic conditions, copper markets, supply chains, metal prices and input costs; and

• other risks detailed from time-to-time in our annual information forms, annual reports, MD&A, quarterly reports and material change reports filed with and furnished to securities regulators, and those risks which are discussed under the heading "Risk Factors".

For further information on Taseko, investors should review the Company's annual Form 40-F filing with the United States Securities and Exchange Commission www.sec.gov and home jurisdiction filings that are available at www.sedarplus.ca, including the "Risk Factors" included in our Annual Information Form.

Related Shares:

Taseko Mines Limited