7th Jan 2026 07:00

The information contained within this announcement is deemed to constitute inside information as stipulated under the retained EU law version of the Market Abuse Regulation (EU) No. 596/2014 (the "UK MAR") which is part of UK law by virtue of the European Union (Withdrawal) Act 2018. The information is disclosed in accordance with the Company's obligations under Article 17 of the UK MAR. Upon the publication of this announcement, this inside information is now considered to be in the public domain.

Oriole Resources PLC

("Oriole Resources" or the "Company")

First Results from MB01-N Drilling

First two drill holes have both returned significant gold intersections

Oriole Resources PLC (AIM: ORR), the AIM quoted gold exploration company focused on West and Central Africa, is pleased to provide an update on its 90%[1] owned Mbe gold project in Cameroon ("Mbe" or the "Project"), where it has received the first results from the ongoing 2,950m maiden diamond drilling programme at the MB01-N target (the "Programme").

Highlights

· The first two drill holes at MB01-N have both returned significant gold intersections including:

MBDD026

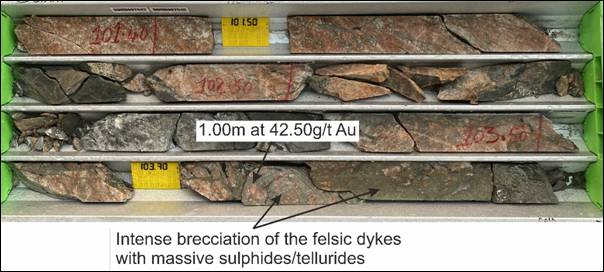

o 21.70m at 3.13g/t Au from 86.80m, including 7.20m at 8.19g/t Au and containing 1.00m at 42.50g/t Au

o 4.00m at 1.52g/t Au from 41.80m

MBDD025

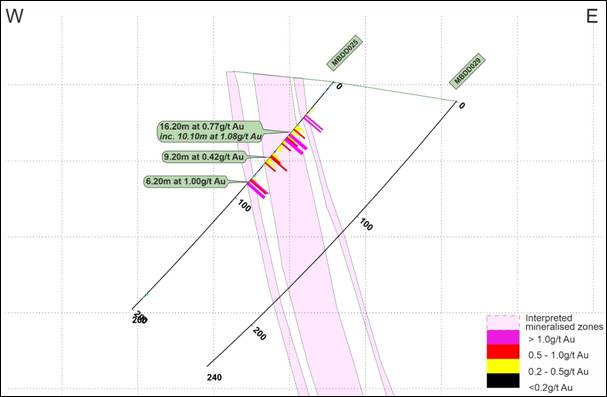

o 16.20m at 0.77g/t Au from 37.20m, including 10.10m at 1.08g/t Au

· The initial geological and structural interpretation indicates that MB01-N shows many similarities with MB01-S, further supported by the comparable mix of narrow high-grade intervals within wider lower-grade envelopes.

· The high-grade mineralisation is controlled by NNW-trending breccia zones formed by intersecting structures and therefore the mineralised zones within the two holes, which are located approximately 200m apart, may be linked and continuous along strike.

· The fully funded MB01-N drilling programme is approximately 46% complete, with six holes drilled, a seventh underway and is expected to be finished in Q1-2026.

Chief Executive Officer of Oriole Resources, Martin Rosser, said: "Results from the first two holes at the MB01-N target have delivered tremendous substantial widths of gold mineralisation and, as seen at the nearby MB01-S deposit, include some high-grade veins. It is an excellent start to 2026, and we eagerly look forward to reporting results from the next set of holes."

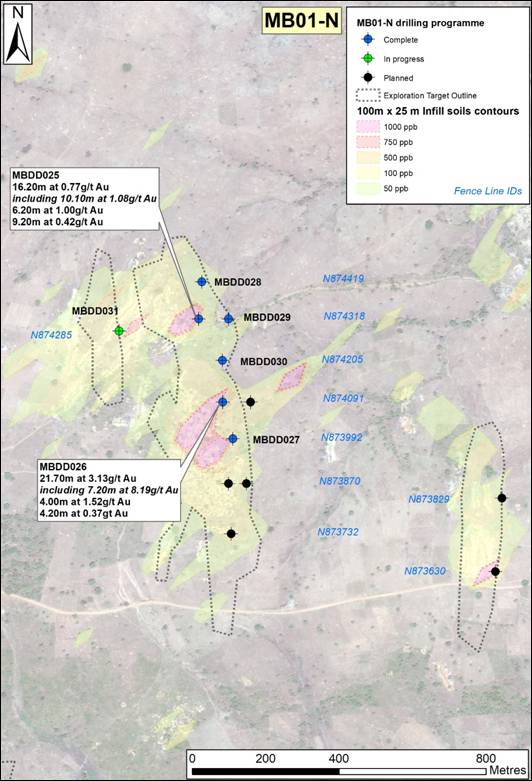

Figure 1. Diamond drilling progress at the MB01-N target with selected best results from MBDD025 and MBDD026. All holes are planned to be drilled towards 270˚ (bearing from grid north) and at an inclination of 50˚. Drilling fence line IDs are in blue text. The data is overlain on gold-in-soil contours, and the 2025 Exploration Target outline is delineated.

Further Details

The Programme, which commenced in November 2025, has been planned to test the MB01-N target, which is located 700m to the northeast of the MB01-S deposit, where the Company has previously reported a maiden JORC Inferred Mineral Resource Estimate of 24.8Mt at a grade of 1.09g/t Au for 870,000oz contained gold (see announcement dated 21 October 2025).

The programme is progressing well and is currently at 46% completion, with six holes (MBDD025-030) drilled and a seventh (MBDD031) underway. The Company today reports the results from the first two diamond drill holes from MB01-N (MBDD025 and MBDD026). A total of 13 mineralised intersections (Table 1) were returned, with narrow higher-grade zones and wider envelopes of pervasive, lower-grade material, as seen at the MB01-S target. The best example of this is from hole MBDD026, which returned the highest grading individual interval of 1.00m at 42.50g/t Au that sits within a broader zone of 21.70m at 3.13g/t Au from 86.80m downhole depth. In these first two holes at MB01-N, the discovery rate stands at more than one intersection every 15m and all mineralised intervals have been reported within 100m vertical depth from surface. A review of the QAQC samples has confirmed that the data falls within acceptable limits of error.

Table 1. Selected intersections from MBDD025 and MBDD026 using a 0.20g/t Au lower cut-off grade. Results > 1g/t Au are highlighted in bold.

Hole ID | From (m) | To (m) | Grade (g/t Au) | Intersection* |

MBDD025 | 28.20 | 31.20 | 0.94 | 3.00m at 0.94g/t Au |

and | 37.20 | 53.40 | 0.77 | 16.20m at 0.77g/t Au |

including | 40.20 | 50.30 | 1.08 | 10.10m at 1.08g/t Au |

and | 56.80 | 57.90 | 0.23 | 1.10m at 0.23g/t Au |

and | 61.00 | 70.20 | 0.42 | 9.20m at 0.42g/t Au |

and | 82.20 | 88.40 | 1.00 | 6.20m at 1.00g/t Au |

including | 83.30 | 84.40 | 2.45 | 1.10m at 2.45g/t Au |

MBDD026 | 41.80 | 45.80 | 1.52 | 4.00m at 1.52g/t Au |

including | 41.80 | 42.80 | 2.16 | 1.00m at 2.16g/t Au |

and | 67.60 | 69.70 | 0.56 | 2.10m at 0.56g/t Au |

and | 86.80 | 108.50 | 3.13 | 21.70m at 3.13g/t Au |

including | 100.30 | 107.50 | 8.19 | 7.20m at 8.19g/t Au |

including | 103.50 | 104.50 | 42.50 | 1.00m at 42.50g/t Au |

and | 112.70 | 115.70 | 0.26 | 3.00m at 0.26g/t Au |

and | 118.70 | 119.70 | 0.87 | 1.00m at 0.87g/t Au |

and | 123.70 | 127.90 | 0.37 | 4.20m at 0.37g/t Au |

and | 138.50 | 139.70 | 0.22 | 1.20m at 0.22g/t Au |

and | 145.90 | 146.90 | 0.42 | 1.00m at 0.42g/t Au |

* Intersections greater than 1.00m, calculated using a 0.20g/t Au lower cut-off grade and no more than 5.00m consecutive internal dilution or 35% total internal dilution. Stated as drilled widths - true widths are not currently known.

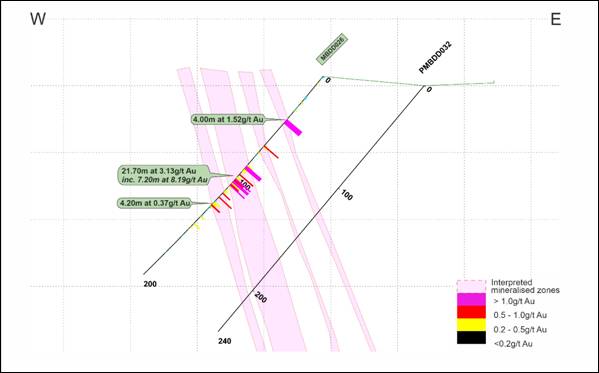

The overall geological and structural controls at MB01-N are similar to MB01-S, with the dominant lithologies consisting of the orthogneiss-amphibolite basement rock, which in turn has been intruded by numerous shear-hosted granitic felsic dykes and late mafic dykes.

The mineralisation is predominantly structurally controlled by post felsic intrusion, shear-related extension and brittle failure that has formed conjugate fracture sets and NNW-trending zones of brecciation, subsequently exploited by gold-rich hydrothermal fluids. The mineralisation typically occurs within steeply dipping shear corridors, with mineralisation enhanced by brittle failure of the felsic intrusions.

Figure 2. Simplified cross section of fence line N874091 with results from MBDD026 and interpreted mineralised zones. PMBDD032 is a planned hole that is yet to be drilled.

Figure 3. Drill core for the highest grading interval, 1.00m at 42.50g/t Au, showing intensely brecciated felsic dyke with sulphide/telluride mineralisation.

Figure 4. Simplified cross section of fence line N874318 with results from MBDD025 and interpreted mineralised zones. MBDD029 has been drilled but results are pending.

MB01-N has a JORC Exploration Target of 15Mt to 20Mt at 0.77 to 0.94g/t Au for 370,000oz to 605,000oz contained gold, and offers significant upside to the total JORC Resource potential of the Mbe project. The Programme has been designed to maximise conversion from an Exploration Target to JORC Resource.

Upon completion of the Programme, targeted for late Q1-2026, the Company's partner BCM International Limited will acquire a 50% interest in the Mbe licence.

Competent Persons Statement

The technical information in this release that relates to Exploration Results and any planned exploration programme has been compiled by Mrs Claire Bay (Executive Director). Claire Bay (MGeol, CGeol) is a Competent Person as defined in the JORC code and takes responsibility for the release of this information. Claire has reviewed the information in this announcement and confirms that she is not aware of any new information or data that materially affects the information reproduced here.

Enquiries:

Oriole Resources Plc | Tel: +44 (0)23 8065 1649 |

Martin Rosser / Bob Smeeton / Claire Bay | |

| |

Strand Hanson Limited (Nomad & Broker) | Tel: +44 (0)20 7409 3494 |

Christopher Raggett / James Spinney / Edward Foulkes

| |

IFC Advisory Ltd (Financial IR & PR) | Tel: +44 (0)20 3934 6632 |

Tim Metcalfe / Graham Herring / Florence Staton |

Glossary and Abbreviations

Au | Gold |

BCM | BCM International Limited |

Bibemi | Bibemi orogenic gold project |

Company | Oriole Resources PLC |

Forge | Forge International Limited |

g/t | Grammes per tonne |

JORC | Joint Ore Reserves Committee |

JORC Code | 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves |

km | Kilometre |

km2 | Square kilometre |

Mbe | Mbe orogenic gold project |

m | Metres |

MRE | Mineral Resource Estimate |

Mt | Million tonnes |

Oriole Resources | Oriole Resources PLC |

oz | Troy ounce of gold |

QAQC | Quality Assurance Quality Control |

t/m3 | Tonnes per cubic metre |

Notes to Editors:

Oriole Resources

Oriole Resources PLC is an AIM-quoted gold exploration company, with projects in West and Central Africa. It is focused on early-stage exploration in Cameroon.

At its district scale Central Licence Package, the Company has identified multi-kilometre long gold anomalies including at its flagship Mbe project. At Mbe, the Company has published a JORC Inferred MRE of 870,000oz at 1.09g/t Au for the MB01-S deposit, and an Exploration Target range of 15Mt to 20Mt at a grade of 0.77g/t to 0.94g/t Au for 370,000oz to 605,000oz contained gold for the MB01-N target. A fully funded maiden drilling programme commenced in November 2025 at MB01-N with the aim of converting the existing Exploration Target to a Resource. BCM is nearing completion of US$4 million in exploration expenditure at Mbe, which will see it earn a 50% interest.

The Company has also reported a Resource of 460,000oz contained gold at 2.06g/t Au in the JORC Indicated and Inferred categories at its 50% owned Bibemi project, where it has applied for an exploitation licence. In November 2025, BCM completed its earn-in to give it a 50% interest in Bibemi by meeting certain payment conditions including spending a further US$4 million on exploration.

At the Senala gold project in Senegal, AGEM Senegal Exploration Suarl ('AGEM'), a wholly owned subsidiary of Managem Group, has completed a six-year earn-in to acquire an approximate 59% beneficial interest in the Senala Exploration Licence by spending US$5.8 million. The Company has reported a Resource of 155,000oz contained gold at 1.26g/t Au in the JORC Inferred category for the Faré South prospect, and an additional, complementary Exploration Target range of 17Mt to 24Mt at a grade of 0.69g/t to 0.84g/t Au for 380,000oz to 650,000oz contained gold for all prospects at Senala. Best results to date include 20.00m grading 31.13 g/t Au including 10.00m grading 60.98 g/t Au from RC drilling and 59.60m grading 2.20 g/t Au from diamond drilling. Discussions on the formation of a joint venture company are currently underway.

The Company also has several interests and royalties in companies operating in East Africa and Turkey that could give future cash payments.

Background on Mbe

Mbe, with a licence area of 312km2, is an orogenic gold project located within the broader 2,266km2 'Eastern CLP' package of five contiguous gold focused exploration licences in the Adamawa Region of central Cameroon. Since 2022, the Company's systematic exploration programmes have identified four geochemical targets, MB01-MB04.

At the 3km long MB01 prospect, increased dilation at the sites of structural intersections (steeply dipping NNE and NNW trending shear structures) is believed to have resulted in enhanced levels of gold deposition at the northern target, MB01-N, and the southern deposit, MB01-S. Gold mineralisation at Mbe comprises high-grade, sulphide- and telluride-rich quartz veins, veinlets and breccias within wider envelopes of pervasive, lower-grade gold mineralisation.

After highly encouraging results from infill soil sampling, rock-chip sampling, and trench sampling, a fully funded maiden drilling programme commenced at the MB01-S target in late November 2024 and was completed in September 2025 for 6,828.40m in 24 holes. Best drilling results included 86.50m at 1.36g/t Au from 22.00m, including 39.40m at 2.00g/t Au (hole MBDD008), 21.30m at 1.61g/t Au from 2.40m (MBDD012) and 6.15m at 19.67g/t Au from 113.50m, including 1.00m at 119.10g/t Au (MBDD019). In October 2025, a maiden MRE was published for the MB01-S deposit of 870,000oz at 1.09g/t, using a US$3,200/oz gold price and a cut-off grade of 0.40g/t Au. Mineralisation at MB01-S remains open in all directions and at depth.

At the MB01-N target, approximately 700m to the northeast of MB01-S, an Exploration Target range of 15Mt to 20Mt at 0.77g/t to 0.94g/t Au for 370,000oz to 605,000oz contained Au was published in July 2025, based on trenching data and the interpretation of geophysical and geochemical anomaly maps. The Exploration Target remains open in all directions and at depth, and it is anticipated that drilling of the target will result in a conversion to Resource ounces. A planned 2,950m drilling programme was commenced in November 2025 and is scheduled for completion in late Q1 2026.

BCM has acquired an initial 10% interest in Mbe and upon completion of the 2,950m drilling programme at MB01-N will acquire a further 40% interest in the project.

For further information please visit www.orioleresources.com, @OrioleResources on X

[1] Oriole is currently undertaking a restructuring process that, once completed, will see it increase its holding from 80% to a 90% interest in the Project (announcement dated 17 October 2024). Upon completion of the earn-in by BCM International Limited, Oriole will then revert to a 50% interest in the Project.

Related Shares:

Oriole Resources