16th Apr 2025 07:00

FOR IMMEDIATE RELEASE

16 April 2025

Predator Oil & Gas Holdings Plc / Index: LSE / Epic: PRD / Sector: Oil & Gas

LEI 213800L7QXFURBFLDS54

Predator Oil & Gas Holdings Plc

("Predator" or the "Company" and together with its subsidiaries the "Group")

Financial Statements for the Year Ended 31 December 2024

Predator Oil & Gas Holdings Plc (PRD), the Jersey-based Oil and Gas Company with near-term hydrocarbon operations and production activities focussed on Morocco and Trinidad, is pleased to announce its audited financial statements for the year ended 31 December 2024, extracts of which are set out below.

The Company's Annual Report is available to shareholders to download from the Company's website at www.predatoroilandgas.com. In line with ESG best practice no hard copies of the Annual Report will be printed.

In addition, a copy of the 2024 Annual Report will be uploaded to the National Storage Mechanism and will be available for viewing at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

The financial information set out below does not constitute the Company's statutory accounts for the year ending 31 December 2024.

Highlights of Financial Results for 2024

· Loss from operations of GBP 2,062,390 (GBP 4,238,363 re-stated for the period to 31 December 2023). The decrease in operating loss is primarily due to decreased drilling activity in Morocco (which was focussed on preparations for the drilling of MOU-5).

· Administrative corporate expenses of GBP 1,652,862 (GBP 1,639,501 re-stated for the period to 31 December 2023).

· Corporate administrative expenses have been prudently managed despite inflationary pressures during 2024 and despite an increase in corporate activities related to the acquisition of 51% of the issued share capital of Caribbean Rex Limited.

· Executive directors' fees have decreased to GBP 578,292 (GBP604,506 for the period to 31 December 2023). Included are technical services consulting fees charged by the executive directors for providing technical support and reports that would otherwise be out-sourced to third parties at market rates.

· Decreased cash balance at period end of 2024 GBP 3,813,371 (GBP 6,484,034 re-stated for the period to 31 December 2023).

· Additional, restricted cash of USD1,500,000 (USD 1,500,000 for the period ended 31 December 2023).

· The Company has no debt.

· Placed 45,221,203 new ordinary shares of no par value in the Company to raise GBP2,304,474 (before expenses).

· No broker warrants or share options were exercised.

· 7,500,000, 7,855,486, 2,000,000, 2,650,000 share options at an exercise price of £0.10, £0.08, £0.08125 and £0.055 lapsed.

· 3,000,000 and 3,000,000 share options have been issued exercisable at £0.125 and £0.105 respectively.

· 2,400,000, 10,000,000 and 40,0000 broker warrants have been issued exercisable at £0.05, £0.055 and £0.08 respectively.

· 1,491,889 new ordinary shares were issued at a price of £0.0925 in lieu of advisor fees totalling £138,000.

· Following the admission of the above shares the issued share capital increased to 611,874,754 by the end of the period to 31 December 2024 (565,161,662) for the period ended 31 December 2023).

Highlights of key Operational Activities in 2024

· Two intervals in the MOU-1 and MOU-3 wells were selected for a first phase of rigless testing to assess formation damage caused by heavy drilling muds used whilst drilling and for potential gas flow.

Results using the available smaller perforating guns available in Morocco confirmed lack of penetration through the formation damage.

· Two intervals in the MOU-3 well were identified for a trial Sandjet rigless testing programme using a high pressure water jet to test its potential to penetrate the formation damage.

Sandjet proved successful in perforating both intervals through the formation damage leading to an initial pressure build-up at surface.

Flow from the two separately tested reservoirs could not be achieved due to insufficient build-up of pressure and possible failure of the reservoirs to clean up.

· Desk-top studies were initiated to better understand the interaction of the reservoir mineralogy, which was different to the reservoir sands of the gas-producing Rharb Basin, with the drilling mud used in well operations.

The objective of these studies are to determine the range of options available to safely increase drawdown pressure to potentially clean up the reservoirs to promote flow to surface.

· Whilst awaiting the results of the desk top studies near-term focus moved to how to safely perforate and potentially flow gas from the shallow, moderately over-pressured "A" Sand in MOU-3, where reservoir mineralogy is not an issue, and which represents the earliest opportunity to implement a pilot CNG development in a success case of even modest gas flow rates.

Independent third-party desk top studies by the services providers are directed at finding the optimum solution for perforating effectively through two strings of casing in the shallow hole with equipment that is available within a reasonable time framework.

· Gas samples collected whilst drilling MOU-3 confirmed the presence of biogenic gas. One sample analysis in the deeper Moulouya fan interval recorded helium.

· Planning for drilling MOU-5 was well advanced by the end of 2024. Preparations were modified to include the ability to measure for potential helium concentrations whilst drilling.

· In Trinidad, the acquisition of the remaining 16.2% interest in the Cory Moruga Exploration and Production Licence was completed.

· Acquisition of a 51% controlling shareholding in Caribbean Rex Resources (Trinidad) Limited was progressed and subsequently completed in early 2025.

The Bonasse field is being acquired through this transaction together with oil storage tanks.

Production was restored and the first well workovers completed in early 2025. An oil offtake agreement has been executed, to allow for sales revenues to be generated, and a Production and Services Agreement has also been executed with a local services company to retain initially 30% of sales revenues without any exposure to field operating costs.

· Jacobin-1 in the Cory Moruga exploration and Production Licence was added to the proposed programme of Snowcap-1 and Snowcap-2ST1 well workovers.

A Memorandum of Understanding was entered into for the application of a new wax mitigation treatment technology never tested in Trinidad before.

· Options for a sales offtake agreement for potential Cory Moruga production are being assessed together with developing oil storage capacity at Cory Moruga.

· Additional potential acquisitions of producing onshore Trinidad fields are being reviewed and evaluated and some opportunities may be progressed to completion in 2025.

· In Ireland the regulatory financial and technical criteria necessary to support the award of the Corrib South successor authorisation were satisfied. It remains the Company's firm intention only to accept the successor authorisation as part of a back-to-back farm-in transaction already proposed by a Corrib gas field stakeholder.

ESG

· In 2024 the Company spent 4,127,683 Dirhams in Morocco on local services in relation to its 2024 rigless testing and MOU-5 drilling preparations.

Beneficiaries included civil engineering contractors; field support activities including provision and mobilisation of cabins; provision of Guercif warehouse staff (renting of warehouse in Guercif city); provision of water and waste disposal; fuel supplies; transport and drivers; local hotel accommodation for rig and well services crews; heavy lifting equipment; internet services and provision of office equipment; and accounting and customs administration services. This was a significant boost for the local economy around the city of Guercif.

In Trinidad the Company provided sponsorship to a local soccer team and contributed to providing Christmas hampers to the most vulnerable local communities.

Local security and labour for the Bonasse field is sourced locally.

Highlights of Directorate Changes

· Dr. Stephen Boldy was appointed non-executive Chairman following the resignation of Lonny Baumgardner.

Post Period End:

· The Company announced that civil engineering work had commenced at the MOU-5 drilling location.

· The Company announced the completion of the acquisition of 51% of Caribbean Rex Resources (Trinidad) Limited and the Bonasse field.

· The Company announced the Placing of 50 million ordinary shares with Eva Pacific Pty of no par value at a price of £0.04 per share to raise £2 million before expenses. 10 million warrants exercisable at £0.06 per share were also granted.

· The Company announced that it had entered into a transaction to acquire the Challenger Energy Group's business, producing assets and operations in Trinidad and Tobago for an initial deposit of US$250,000 satisfied by the issue of 4,411,641 Predator shares. Consent for the acquisition is required to be given by Heritage Petroleum Trinidad Limited by 30 April 2025.

· The Company awarded 45 million unallocated share options, exercisable at £0.055 per share subject to certain operational milestones being met.

· The Company announced an operational update including the execution of a Bonasse field oil offtake agreement; a Bonasse field Production and Services Agreement; plans to perforate the shallow "A" Sand in MOU-3; and plans to prepare a farmout package for 3D seismic and a well to further evaluate the structure tested by MOU-5 with focus on the helium potential identified in MOU-5 and gas potential over the structure north of the MOU-5 well location.

Paul Griffiths, Executive Chairman of Predator Oil & Gas Holdings Plc commented:

"The extensive MOU-1 and MOU-3 rigless testing programme has made progress in identifying the extent of the reservoir formation damage and the range of potential options required to achieve reservoir clean up to facilitate potential gas flow. We remain confident that the selected option and/or options can eventually be successful.

Prioritising the shallow "A" Sand for rigless testing is driven by the need to demonstrate gas flow and accelerate monetisation through a simpler CNG pilot development option.

MOU-5 demonstrated the presence of our primary target and gave us the encouragement required to develop the helium exploration play and to focus on a large core area north of MOU-5 where reservoir development is predicted.

There is no doubt that the MOU-5 structure offers considerable potential, but unlocking this potential requires a large 3D seismic programme which the Company only wishes to fund through a farmout process given our immediate portfolio priorities to monetise our gas and oil assets in Morocco and Trinidad in 2025.

The Company continues to maintain adequate cash liquidity to fund all our work programmes over the next 12 months due largely to accessing funds in the equity market when the opportunity was presented to us and a very significant and material operational saving on the MOU-5 drilling costs through effective operational oversight.

2025 is already proving to be a year of great challenges due to the turmoil created in the financial and equity markets by uncontrollable political events. This has led to reduced availability of finance; volatile commodity prices; weakened investor sentiment and caused a dash to liquidate assets for cash. Frustratingly this has led to a write-down across the oil and gas sector in general in the public market valuation of companies irrespective of the value of oil and gas resources in the ground.

We are confident that market conditions will ameliorate during 2025. However we have taken steps to ensure that we prioritise revenue generation from our producing and near-production assets; maintain the ability to sell specific assets if attractive to do so; and, where prudent, acquire additional cash-generating assets.

Improving our cash liquidity through two Placings completed at an opportune time before the market was impacted by the above circumstances ensures that we are fully-funded to complete our programme to monetise over the next 12 months from a position of strength.

We continue to manage costs by moving towards the implementation of Production and Field Services costs to remove the burden of operating costs and administrative personnel and some capital costs whilst retaining adequate cash flow from a material percentage of sales revenues."

For further information visit www.predatoroilandgas.com

Follow the Company on X @PredatorOilGas.

This announcement contains inside information for the purposes of Article 7 of the Regulation (EU) No 596/2014 on market abuse.

Enquiries:

Predator Oil & Gas Holdings Plc Paul Griffiths Chief Executive Officer

| Tel: +44 (0) 1534 834 600 |

Novum Securities Limited David Coffman / Jon Belliss

Oak Securities Jerry Keen

|

Tel: +44 (0)207 399 9425

Tel: +44 (0)203 973 3678

|

Flagstaff Strategic and Investor Communications Tim Thompson Mark Edwards Fergus Mellon

| Tel: +44 (0)207 129 1474 |

Notes to Editors:

Predator is an oil & gas company with a diversified portfolio of assets including unique and highly prospective onshore Moroccan gas exposure and production, appraisal and exploration projects onshore Trinidad.

Morocco offers a potentially faster route to commercialisation of shallow biogenic gas through a CNG development. The MOU-3 well is currently the focus of rigless well testing activities. The next step will be to perforate the shallowest sand seen in this well that has yet to be evaluated. Moroccan gas prices are high, and the fiscal terms are some of the best in the world.

Trinidad offers the security of a mature onshore oil province that has been producing hydrocarbons for over 50 years. Predator is assembling a portfolio of onshore producing fields with opportunities for production enhancement and additional infill development and appraisal drilling. Significant legacy tax losses, economies of scale and the application of new low-cost technologies are factors that can improve profit margins per barrel of oil produced.

Predator has an experienced management team with particular knowledge of the Moroccan and Trinidad sub- surface and operations.

Predator Oil & Gas Holdings plc is listed on the Equity Shares (transition) category of the Official List of the London Stock Exchange's main market for listed securities (symbol: PRD).

For further information, visit www.predatoroilandgas.com

The accompanying accounting policies and notes on pages 92 to 122 form an integral part of these financial statements.

All items in the above statement derive from continuing operations.

* Please refer to note 27.

The accompanying accounting policies and notes on pages 92 to 122 form an integral part of these financial statements.

The Company has adopted the exemption under Companies (Jersey) Law 1991 Article 105 (11) not to prepare separate accounts. The Group reported a loss after taxation for the year of £2.1 million (2023: £4.2 million loss). The financial statements on pages 88 to 122 were approved and authorised for issue by the Board of Directors on 15 April 2025 and were signed on its behalf by:

* Please refer to note 27.

Paul Griffiths

Director

The accompanying accounting policies and notes on pages 92 to 122 form an integral part of these financial statements.

An Adjustment to the prior year intangible asset and retained deficit is it explained in note 27.

The accompanying accounting policies and notes on pages 92 to 122 form an integral part of these financial statements.

Significant non-cash transactions

The significant non-cash transactions during the year are detailed in notes 20 and 21.

Statement of accounting policies

For the year ended 31 December 2024

General information

Predator Oil & Gas Holdings Plc ("the Company") and its subsidiaries (together "the Group") are engaged principally in the operation of an oil and gas development business in the Republic of Trinidad and Tobago and an exploration and appraisal portfolio in Ireland and Morocco. The Company's ordinary shares are on the Official List of the UK Listing Authority in the standard listing section of the London Stock Exchange.

Predator Oil & Gas Holdings plc was incorporated in 2017 as a public limited company under Companies (Jersey) Law 1991 with registered number 125419. It is domiciled and registered at IFC5, 3rd Floor, Castle Street, St Helier, Jersey, JE2 3BY.

Basis for preparation and going concern assessment

The principal accounting policies adopted in the preparation of the financial information are set out below. The policies have been consistently applied throughout the current year and prior year, unless otherwise stated. These financial statements have been prepared in accordance with International Financial Reporting Standards (IFRSs and IFRIC interpretations) as adopted by the European Union and with those parts of the Companies (Jersey) Law, 1991 applicable to companies preparing their accounts under IFRS. The Company has adopted the exemption under Companies (Jersey) Law 1991 Article 105 (11) not to prepare separate accounts.

The consolidated financial statements incorporate the results of Predator Oil & Gas Holdings Plc and its subsidiary undertakings as at 31 December 2024.

The financial statements are prepared under the historical cost convention on a going concern basis. The financial statements of the subsidiaries are prepared for the same reporting period as the parent company, using consistent accounting policies. All intra-group balances, transactions, income and expenses and profits and losses resulting from intra-group transactions that are recognised in assets, are eliminated in full. Subsidiaries are fully consolidated from the date of acquisition, being the date on which the Group obtains control, and continue to be consolidated until the date that such control ceases.

The preparation of financial statements requires an assessment on the validity of the going concern assumption. At 31 December 2024 the Group held £3.8mil in unrestricted cash. In addition US$1.5 million was held as restricted cash. The unrestricted cash is sufficient to support a going concern. At the date of these financial statements the Directors do not expect that the Group will require further funding for the Group's corporate overheads, the Irish licence interest, the Trinidad licence and the Moroccan licence. The existing Trinidad licences are expected to become self-funding when production commences in the course of 2025. Pursuant to a placing in November 2024 total capital of £2.0mil before expenses, was raised. In 2025 a quantum of these funds will be applied to testing of MOU-3 and to drilling MOU-5 in Morocco and to a minimum programme of three well workovers in Trinidad to bring two wells into production and to enhance production from a third well. Two production forecasts for 2025 are presented. A Base Case and a conservative Upside Case, where production is enhanced by applying a new to Trinidad patented chemical wax treatment for waxy oil that has been applied in Saudi Arabia by Aramco and shown to increase production by up to 3 fold. The cash flow forecasts for Trinidad production are robust and use available tax losses to increase the net-back per barrel of oil. Cash flows are sufficient to cover any Going Concern Working Capital Forecast requirements from April 2025 onwards following the drilling of MOU-5. The Group also has announced an intention to pursue various incremental activities in Trinidad and Morocco. Any such activities in Morocco are likely to be funded through a farm down of some project equity interest. The Group intends to expand its footprint in Trinidad with the acquisition of additional producing field(s) in 2025. Acquisition will be for shares and not for a cash consideration. Costs in maintaining the operations in the fields will be funded from existing cash flows for the fields targeted for acquisition. There may be significant cost savings for the Group by apportioning operating costs and administrative costs over a larger portfolio of producing assets. Further exploration activity may be required in Morocco pursuant to the outcome of the MOU-5 well, but this would not be implemented during the next 12 months unless a farm down of project equity occurred. In Ireland, if awarded, the Corrib South licence will not require funding in 2025 due to a provisional

commitment reached with a farm-in partner. Progressing these discretionary activities will be dependent on a combination of potentially further equity and/or debt fund raises and in the case of Trinidad will be supported by the proceeds of oil production following the aforesaid workovers. Directors are confident that the Group will be able to meet requirements over the course of foreseeable future.

Change in Accounting Policies

At the date of approval of these financial statements, certain new standards, amendments and interpretations have been published by the International Accounting Standards Board but are not as yet effective and have not been adopted early by the Group. All relevant standards, amendments and interpretations will be adopted in the Group's accounting policies in the first period beginning on or after the effective date of the relevant pronouncement.

At the date of authorisation of these financial statements, a number of Standards and Interpretations were in issue but were not yet effective. The Directors do not anticipate that the adoption of these standards and interpretations, or any of the amendments made to existing standards as a result of the annual improvements cycle, will have a material effect on the financial statements in the year of initial application.

Standards and amendments to existing standards effective 1 January 2024

- Amendment to IAS 1 - Classifications of Liabilities as Current or Non-current

- Amendment to IFRS 16 - Lease Liability in a Sale and Leaseback

- Amendment to IAS 1 - Non-current Liabilities with Covenants

- Amendments to IAS 7 and IFRS 7 - Supplier Finance Arrangements

- Amendments to IAS 12 - International Tax Reform - Pillar Two Module Rules

New Standards, amendments and interpretations effective after 1 January 2024 and have not been early adopted

The Group does not believe that the standards not yet effective, will have a material impact on the consolidated financial statements.

Areas of estimates and judgement

The preparation of the group financial statements in conformity with International Financial Reporting Standards as adopted by the European Union requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Although these estimates are based on management's best knowledge of current events and actions, actual results may ultimately differ from those estimates.

a) Going concern

The Group's cash flow projections indicate that the Group should have sufficient resources to continue as a going concern. As at 31 December 2024 the Group had cash of £3.8 million, no debt and minimal licence commitments for the ensuing year. As a result, the Group's overheads will not require funding for a minimum of 12 months from the date of this review. In addition, the Group is fully funded for all firm operational commitments for 2025. Heretofore the Group has not generated revenues from operations. Going forward the Group will depend upon on raising equity, debt finance and licence and or joint venture partnerships to finance the Group's projects to maturity and revenue generation.

The Board have reviewed a range of potential cash flow forecasts for the period to 30 April 2026, including reasonable possible downside scenarios. This has included the following assumptions:

Trinidad - Cory Moruga licence

For Predator Oil & Gas Trinidad Ltd., where production revenues from its wholly Trinidad owned subsidiary, T-Rex Resources (Trinidad) Limited (TRex') and 51%-owned subsidiary, Caribbean Rex Resources (Trinidad) Limited ("CREX") are forecast to be generated in the Q2 2025 following a program of well workovers. The workovers will be funded partly out of existing cash resources but in some cases by a Production and Services Agreement with a local operator Nabi Construction. Leading into 2026, the Cory Moruga Production Licence provides the Group with the potential to generate strongly positive cashflows so as possibly to contribute organically towards further development of the Group's assets. Capital required for a staged field development in 2026 could be funded from operating profits generated from an increasing level of accrued gross production net profits following the well workovers. The Group may resort to the option of raising equity funding to accelerate this development if this proves to be advantageous. The Group also has the option to seek a partial or complete divestment of any producing asset to indigenous local companies, where the Group's ability to offer CO2 EOR services and expertise and the application of a patented chemical wax treatment new to Trinidad Enhances the value of the Group's assets.

The Initial Work Programme agreed by TRex with the MEEI will be conducted over the next two years without any fixed commitments to be met in the first year.

Morocco - Guercif licence

In the case of Predator Gas Ventures Ltd., cash flow is dependent upon the Guercif drilling and rigless testing programmes successfully recovering commercial quantities of gas and potentially helium that can be developed and brought to market. Following significant gas discoveries in 2021 and 2023 a programme of rigless testing was undertaken in 2024. Rigless testing will continue in 2025 with focus on stimulating the reservoirs in MOU-3 to generate gas flow. Priority will be given to perforating and flowing the as yet untested shallow over-pressured gas in MOU-3. This contains potentially sufficient volumes to allow an application for an Exploitation Concession to be made and an initial CNG development to be progressed. The Company is seeking to drill in Q1 2025 a Jurassic target, the extreme edge of which was penetrated in the MOU-4 downdip. This will be a high impact well enabling a gas to power project in the success case. In a success case the Group would seek to monetise the project immediately through a divestment process to, most likely, an indigenous Moroccan entity. Any potential for helium in MOU-5 will take longer for an assessment of commerciality to be made. These programmes are fully funded. The Company may drill an appraisal well, to add, if successful, incremental gas resources to support and extend the production profiles of a CNG project. Funding for this discretionary drilling programme in 2025 will be either through an equity placing or the Group's internal cash resources, including the availability of production revenues generated by Cory Moruga and the opportunity for partial monetisation of gas assets in Guercif through a divestment to an indigenous entity. The Group has received a second unsolicited approach from a downstream company in Morocco to market and distribute gas from a successful MOU-3 rigless testing programme.

Ireland

In the case of Predator Oil and Gas Ventures Ltd., cash commitments are insignificant and no substantive expenditures are anticipated going forward in 2025. The Group is awaiting the outcome of an applications for a successor authorisation to Licensing Option 16/26 (Corrib South) which is under active consideration as confirmed by the Department of the Environment, Climate and Communications ("DECC"). There are not likely to be any significant funding implications emerging from this process in 2025 as the Group has been notified by a potential farminee of an intention to farm into Corrib South upon award of a successor authorisation.. In the future, the potential exists for the Company, as promoters of a LNG project to receive introduction and service providers' fees and a free minority equity position in a joint venture vehicle to move to the project development stage. Under these circumstances the inter-company loan would constitute past costs contributing to the level of free equity. Recovery of the relatively modest inter-company loan therefore has a variety of ways of being repaid. A potential award of the Corrib South successor licence and a closing of a farm down to one of the Corrib gas field owners would potentially grant the Group access rights to the Corrib infrastructure with which to re-purpose the Mag Mell FSRU project to deliver LNG to the Corrib pipeline and for potential gas storage at Corrib South. The change in the Irish Government coalition and the deteriorating situation with relation to gas supplies and gas storage in Europe provides an incentive for a new government policy in relation to security of energy and gas supply. This is reflected in the increased level of communication between the DECC and the Group over the Corrib South application for a successor authorisation.

b) Share based payments

The Group has applied the requirements of IFRS 2 Share-based Payment for all grants of equity instruments.

The Group operates an equity settled share option scheme for directors. The increase in equity is measured by reference to the fair value of equity instruments at the date of grant. The liabilities incurred under these arrangements are assumed to be converted into shares in the parent company, under an option arrangement. The fair value of the service received in exchange for the grant of options and warrants is recognised as an expense. Equity-settled share-based payments are measured at fair value (excluding the effect of non-market based vesting conditions) at the date of grant. The fair value determined at the grant date of equity-settled share-based payment is expensed over the vesting period, based on the Group's estimate of shares that will eventually vest and adjusted for the effect of non-market based vesting conditions.

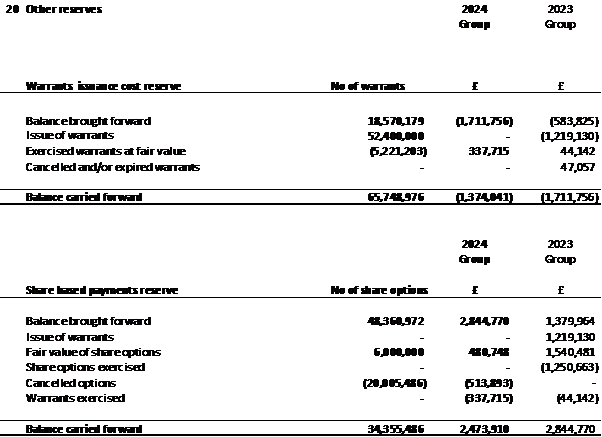

During the year, the Company issued warrants in lieu of fees to stockbrokers. The charge is recognised within the statement of changes in equity. The valuation of these warrants involves making a number of estimates relating to price volatility, future dividend yields and continuous growth rates (see Note 19).

The fair value of the share options is estimated by using the Black Scholes model on the date of grant based on certain assumptions. Those assumptions are described in note 21 and include, among others, the expected volatility and expected life of the options. The expected life used in the model is, based on management's best estimate, for the effects of non-transferability exercise restrictions and behavioural considerations. The market price used in the model is the market price at the date of the issue of the options. Where the terms and conditions of options are modified before they vest, the increase in the fair value of the warrants, measured immediately before and after the modification, is also charged to profit or loss over the remaining vesting period.

Where equity instruments are granted to persons or entities other than staff, the fair value of goods and services received is charged to profit or loss, except where it is in respect to costs associated with the issue of shares, in which case, it is charged to the share capital account.

The fair values calculated are inherently subjective and uncertain due to the assumptions made and the limitation of the calculations used. Further details of the specific amounts concerned are given in note 21.

c) Intangible assets - Project Guercif

All expenditure relating to oil and gas activities is capitalised in accordance with the "successful efforts" method of accounting, as described in IFRS 6 - "Exploration for and Evaluation of Mineral Resources". Under this standard, the Group's exploration and appraisal activities are capitalised as intangible assets.

The direct costs of exploration and appraisal are initially capitalised as intangible assets, pending determination of the existence of commercial reserves in the licence area. Such costs are classified as intangible assets based on the nature of the underlying asset, which does not yet have any proven physical substance. Exploration and appraisal costs are held, un-depreciated, until such a time as the exploration phase on the licence area is complete or commercial reserves have been discovered.

If no commercial reserves exist, then that particular exploration/appraisal effort was "unsuccessful" and the costs are written off to the income statement in the period in which the evaluation is made. The success or failure of each exploration/appraisal effort is judged on a field by field basis.

Net proceeds from any disposal of an exploration asset are initially credited against the previously capitalised costs. Any surplus proceeds are credited to the income statement. Net proceeds from any disposal of exploration assets are credited against the previously capitalised cost. A gain or loss on disposal of an exploration asset is recognised in the income statement to the extent that the net proceeds exceed or are less than the appropriate portion of the net capitalised costs of the asset.

Upon commencement of production, capitalised costs will be amortised on a unit of production basis which is calculated to write off the expected cost of each asset over its life in line with the depletion of proved and probable reserves.

For more information, please refer to note 12.

Business combinations

Business combinations are accounted for using the acquisition method. The cost of an acquisition is measured as the fair value of the assets given, equity instruments issued, and liabilities incurred or assumed at the acquisition date.

Identifiable assets acquired and liabilities assumed are measured and recognized at their fair value at the date of the acquisition, with the exception of income taxes, and lease liabilities. Any deferred tax asset or liability arising from a business combination is recognized at the acquisition date. Transaction costs associated with a business combination are expensed as incurred. Results of acquisitions are included in the financial statements from the closing date of the acquisition. If the consideration of the acquisition is less than the fair value of the net assets received, the difference is recognized immediately in the statements of comprehensive income. If the consideration of the acquisition is greater than the fair value of the net assets received, the difference is recognised as goodwill on the consolidated balance sheet.

The directors have included provisional fair values within the business combination note as presented above, which represent their best estimates using information available at the year end. Under IFRS 3, there is a measurement period which shall not exceed one year from the acquisition date, during which the company can, if necessary, retrospectively adjust the provisional amounts recognised at the acquisition date to reflect new information obtained about facts and circumstances that existed as of the acquisition date.

Basis of consolidation

Where the Group has control over an investee, it is classified as a subsidiary. The Group controls an investee if all three of the following elements are present: power over the investee, exposure to variable returns from the investee, and the ability of the investor to use its power to affect those variable returns. Control is reassessed whenever facts and circumstances indicate that there may be a change in any of these elements of control.

The consolidated financial statements present the results of the Company and its subsidiaries ("the Group") as if they formed a single entity. Inter-company transactions and balances between Group companies are therefore eliminated in full. Uniform accounting policies are applied across the Group.

The consolidated financial statements incorporate the results of business combinations using the acquisition method. In the statement of financial position, the acquirer's identifiable assets, liabilities and contingent liabilities are initially recognised at their fair values at the acquisition date. The results of acquired operations are included in the consolidated statement of comprehensive income from the date on which control is obtained. They are deconsolidated from the date on which control ceases.

Intangible assets

Mineral exploration and evaluation expenditure relates to costs incurred in the exploration and evaluation of potential mineral resources and includes exploration and mineral licences, researching and analysing historical exploration data, exploratory drilling, trenching, sampling and the costs of pre-feasibility studies.

Exploration and evaluation expenditure for each area of interest, other than that acquired from another entity, is charged to the consolidated statement of income as incurred except when the expenditure is expected to be recouped from future exploitation or sale of the area of interest and it is planned to continue with active and significant operations in relation to the area, or at the reporting period end, the activity has not reached a stage which permits a reasonable assessment of the existence of commercially recoverable reserves, in which case the expenditure is capitalised. Purchased exploration and evaluation assets are recognised at their fair value at acquisition. As the capitalised exploration and evaluation expenditure asset is not available for use, it is not depreciated.

Exploration and evaluation assets have an indefinite useful life and are assessed for impairment annually or when facts and circumstances suggest that the carrying amount of an asset may exceed its recoverable amount. The assessment is carried out by allocating exploration and evaluation assets to cash generating units, which are based on specific projects or geographical areas. IFRS 6 permits impairments of exploration and evaluation expenditure to be reversed should the conditions which led to the impairment improve. The Group continually monitors the position of the projects capitalised and impaired.

Whenever the exploration for and evaluation of mineral resources in cash generating units does not lead to the discovery of commercially viable quantities of mineral resources and the Group has decided to discontinue such activities of that unit, the associated expenditures are written off to the Statement of comprehensive income.

Financial assets

The Financial assets currently held by the Group and Company are classified as loans and receivables and cash and cash equivalents. These assets are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They are initially recognised at fair value plus transaction costs that are directly attributable to their acquisition or issue and are subsequently carried at amortised cost using the effective interest rate method less provision for impairment.

Impairment provisions are recognised when there is objective evidence (such as significant financial difficulties on the part of the counterparty or default or significant delay in payment) that the Group will be unable to collect all of the amounts due under the terms receivable, the amount of such a provision being the difference between the net carrying amount and the present value of the future expected cash flows associated with the impaired receivable. For receivables, which are reported net, such provisions are recorded in a separate allowance account with the loss being recognised within administrative expenses in the statement of comprehensive income. On confirmation that the receivable will not be collectable, the gross carrying value of the asset is written off against the associated provision.

Cash and cash equivalents

These amounts comprise cash on hand and balances with banks. Cash equivalents are short term, highly liquid accounts that are readily converted to known amounts of cash. They include short-term bank deposits and short-term investments.

Any cash or bank balances that are subject to any restrictive conditions, such as cash held in escrow pending the conclusion of conditions precedent to completion of a contract, are disclosed separately as "Restricted cash". The security deposit is recognised within trade and other receivables in note 16.

There is no significant difference between the carrying value and fair value of receivables.

Derecognition

The Group derecognises a financial asset when the contractual rights to the cash flow from the asset expire, or it transfers the asset and substantially all the risk and rewards of ownership of the asset to another entity.

Financial liabilities

The Group's financial liabilities consist of trade and other payables (including short terms loans) and long term secured borrowings. These are initially recognised at fair value and subsequently carried at amortised cost, using the effective interest method. All interest and other borrowing costs incurred in connection with the above are expensed as incurred and reported as part of financing costs in profit or loss. Where any liability carries a right to convertibility into shares in the Group, the fair value of the equity and liability portions of the liability is determined at the date that the convertible instrument is issued, by use of appropriate discount factors.

Derecognition

The Group derecognises a financial liability when the obligations are discharged, cancelled or they expire.

Foreign currency

The functional currency of the Group and all of its subsidiaries except for TRex, is the British Pound Sterling.

Th functional currency of TRex is the Trinidad Dollar.

Transactions entered into by the Group entities in a currency other than the currency of the primary economic environment in which it operates (the "functional currency") are recorded at the rates ruling when the transactions occur. Foreign currency monetary assets and liabilities are translated at the rates ruling at the date of the statement of financial position. Exchange differences arising on the retranslation of unsettled monetary assets and liabilities are similarly recognised immediately in profit or loss, except for foreign currency borrowings qualifying as a hedge of a net investment in a foreign operation.

The exchange rates applied at each reporting date were as follows:

31 December 2024 - £1: £1 : US$1.2548, £1 : Euro1.12059 , £1 : MAD12.6916 and £1: TT$ 8.53

31 December 2023 - £1: £1 : US$1.2731, £1 : Euro1.1505 , £1 : MAD12.5947 and £1: TT$ 8.34

Plant and equipment

Plant and equipment owned by the Group relates solely to computer equipment.

Depreciation is provided on equipment so as to write off the carrying value of items over their expected useful economic lives. It is applied at the following rates:

Computer equipment - 20% per annum, straight line

Share options and Equity Instruments

Where the terms and conditions of options are modified before they vest, the increase in the fair value of the options, measured immediately before and after the modification, is also charged to profit or loss over the remaining vesting period. Where equity instruments are granted to persons other than consultants, the fair value of goods and services received is charged to profit or loss, except where it is in respect to costs associated with the issue of shares, in which case, it is charged to the share capital or share premium account.

Equity instruments

Share capital represents the amount subscribed for shares at each of the placings.

The reconstruction reserve account represents premiums received on the share capital of subsidiaries and also includes directly related share issue costs.

Warrants issuance cost reserve includes any costs relating to warrants issued for services rendered accounted for in accordance with IFRS 2 - Equity-settled instruments.

The share-based payments reserve represents equity-settled shared-based employee remuneration for the fair value of the options issued.

Retained earnings include all current and prior period results as disclosed in the Statement of comprehensive income, less dividends paid to the owners of the Company.

Taxation

With the exception of TRex which is registered in Trinidad and Tobago, the Company and all subsidiaries ('the Group') are registered in Jersey, Channel Islands and are taxed at the Jersey company standard rate of 0%. However, the Group's projects are situated in jurisdictions where taxation may become applicable to local operations.

The major components of income tax on the profit or loss include current and deferred tax.

Current tax

Current tax is based on the profit or loss adjusted for items that are non-assessable or disallowed and is calculated using tax rates that have been enacted or substantively enacted by the reporting date.

Tax is charged or credited to the statement of comprehensive income, except when the tax relates to items credited or charged directly to equity, in which case the tax is also dealt with in equity.

Deferred tax

Deferred tax assets and liabilities are recognised where the carrying amount of an asset or liability in the statement of financial position differs to its tax base, except for differences arising on:

• The initial recognition of an asset or liability in a transaction which is not a business combination and at the time of the transaction affects neither accounting or taxable profit; and

• Investments in subsidiaries and jointly controlled entities where the Group is able to control the timing of the reversal of the difference and it is probable that the differences will not reverse in the foreseeable future.

Recognition of deferred tax assets is restricted to those instances where it is probable that taxable profit will be available against which the difference can be utilised.

The amount of the asset or liability is determined using tax rates that have been enacted or substantively enacted by the reporting date and are expected to apply when deferred tax liabilities/ (assets) are settled/ (recovered). Deferred tax balances are not discounted.

Predator Gas Ventures Limited has a Withholding Tax Liability in Morocco for all services that are carried out in in relation to wells. Withholding tax is charged at a rate of 10% on all services (excluding materials) and is capitalised to the relevant well. The withholding tax liability at 31 December 2024 was £593,923. (see note 17)

Notes to the financial statements

For the year ended 31 December 2024

1. Segmental analysis

The Group operates in one business segment, the exploration, appraisal and development of oil and gas assets. The Group has interests in three geographical segments being Africa (Morocco), Europe (Ireland) and the Caribbean (Trinidad and Tobago).

The Group's operations are reviewed by the Board (which is considered to be the Chief Operating Decision Maker ('CODM')) and split between oil and gas exploration and development and administration and corporate costs. Exploration and development are reported to the CODM only on the basis of those costs incurred directly on projects. Administration and corporate costs are further reviewed on the basis of spend across the Group.

Decisions are made about where to allocate cash resources based on the status of each project and according to the Group's strategy to develop the projects. Each project, if taken into commercial development, has the potential to be a separate operating segment. Operating segments are disclosed below on the basis of the split between exploration and development and administration and corporate.

No charge to taxation arises due to the losses incurred.

Predator Gas Ventures Limited is subject to tax in its operating jurisdiction of Morocco; however, the Company is loss making and has no taxable profits to date. There is a 10 year corporation tax holiday in Morocco commencing on the date of award of an Exploitation Concession.

TRex is subject to tax in its operating jurisdiction of Trinidad and Tobago during the year the Company incurred costs of £231,995 (TTD 1,978,325) which are available to be carried forward against future taxable profits.

No deferred tax asset has been recognised on accumulated tax losses because of uncertainty over the timing of future taxable profits against which the losses may be offset.

No deferred tax asset or liability has been recognised as the Standard Jersey corporate tax rate is 0%.

Four Directors at the end of the period have share options receivable under long term incentive schemes. The highest paid Director received an amount of £177,315.00 (2023: £321,622). The Group does not have employees. All personnel are engaged as service providers.

Dilutive loss per Ordinary Share equals basic loss per Ordinary Share as, due to the losses incurred in 2024 and 2023, there is no dilutive effect from the subsisting share options.

11 Loss for the financial year

The Group has adopted the exemption in terms of Companies (Jersey) law 1991 and has not presented its own income statement in these financial statements.

Project Guercif

The total carrying amount of Project Guercif at 31 December 2024 of £16,438,358 (2023: £13,029,095 (restated)) relates to costs incurred with wells MOU-1, MOU-2, MOU-3, MOU-4 and MOU-5. The prior year adjustments are explained in note 27.

A rigless testing programme in MOU-1 and MOU-3 in 2023 using conventional perforating guns was unsuccessful in perforating reservoirs due to the small size of the perforating guns. A follow-up programme later in 2023, focussed on MOU-3 using a high-pressure water/sand slurry mixture to perforate the reservoir formations did not produce pressure at the interpreted reservoir pressure.

An independent study of the results confirmed formation damage generated by over-balanced drilling and reactive drilling muds.

A programme for 2025 has been developed to facilitate increasing the drawdown pressure in MOU-3, using nitrogen lift, to a safe level in MOU-3 to overcome the impact of the over-balanced drilling to promote reservoir clean-up and stimulate gas flow to surface. Additional remedial stimulation measures can be considered following execution of this programme of work in Q2 2025.

Positive results will allow the same procedures to be deployed in MOU-1, MOU-2 (shallow zone only where gas samples were collected whilst drilling) and MOU-4.

The Board is of the view that once the above programme of work is concluded a CNG project will be a viable option and that it is too early to make an impairment provision for any of the wells drilled to date whilst there are still options to be pursued to overcome the formation damage caused by over-balanced drilling.

MOU-1

The MOU-1 well drilled in 2021 was completed for rigless well testing on the basis of the presence of formation gas and petrophysical wireline log interpretation by NuTech indicating gas in the primary pre-drill reservoir target.

The well is therefore a potential gas producer once the 2025 rigless testing reservoir stimulation program is complete for MOU-3 in 2025 and the lessons applied to the rigless testing of MOU-1.

MOU-2

The MOU-2 well was drilled in January 2023. The Company announced on 25 January 2023 that the MOU-2 well had been suspended at 1,260 metres measured depth above the primary pre-drill reservoir target. 3 gas samples collected whilst drilling MOU-2 above 700 metres in the shallow section determine that MOU-2 is potentially a gas producer subject to the comments made for MOU-1 above.

These intervals are correlated with an extension to the shallow formation gas shows seen in MOU-3.

A re-entry of MOU-2 will be fully evaluated at this time once a solution to optimising the perforating and reservoir stimulation strategy has been defined by the MOU-3 work programme in 2025. Re-evaluation of the penetrated MOU-2 interval now concludes that the primary target was penetrated but was unable to be logged. This has been based on incorporating the MOU-4 drilling results to provide a new seismic tie to MOU-2.

MOU-3

The MOU-3 well was drilled in June 2023 to a depth of 1,509 metres (TVD MD) and encountered gas shows in multiple zones including the primary target, the Moulouya Fan sands. Helium was subsequently detected in the Mouloya Fan gas sample following laboratory analysis. Two phases of rigless testing were undertaken, the second phase using Sandjet perforating technology. Rigless testing will continue in 2025, after the drilling of the MOU-5 well, but with a focus on stimulating the reservoirs in MOU-3 to generate gas flow.

MOU-4

The MOU-4 well was drilled in July 2023 and confirmed the extension of the Moulouya Fan further to the southeast than previously prognosed. Better reservoir quality was interpreted as a result of the NuTech petrophysical analysis of the wireline logs, which also interpreted the presence of gas (and potentially helium). The well also confirmed the presence of a separate Jurassic carbonate target at 1,135 metres. Site preparations are currently underway for the well to be drilled in Q1 2025 to test this Jurassic target.

MOU-5

The MOU-5 Jurassic prospect is underpinned by the two Scorpion Geoscience independent Technical Reports of January and September 2024. The reports have concluded that the extensive work programme that has been delivered by the Company 'with four wells delivered during the Initial Period, MOU-1, MOU-2, MOU-3 and MOU-4, each of which has resulted in substantial advancement of the understanding of the Guercif basin and resource potential'.

The Board determines that there is a 50% chance of success of finding gas in MOU-5 based on the fact that MOU-5 is immediately updip from MOU-4, where NuTech petrophysics interpreted the presence of gas at the base of the primary target in MOU-5. The chances of finding 4.4 Tcf net resources to the Group have been independently risked at 12%.

All costs relating to Project Guercif have been capitalised and will only be depreciated once gas discovery is declared commercial and a Plan of Development has been approved.

In accordance with IFRS 6, the Directors undertook an assessment of the following areas and circumstances which could indicate the existence of impairment:

• The Group's right to explore in an area has expired, or will expire in the near future without renewal

• No further exploration or evaluation is planned or budgeted for

• A decision has been taken by the Board to discontinue exploration and evaluation in an area due to the absence of a commercial level of reserves

• Sufficient data exists to indicate that the book value may not be fully recovered from future development and

Production

Trinidad - Cory Moruga Licence

The current capitalised value of the Cory Moruga licence is £5,185,035

The results of an independent Technical Report ("ITR") by Scorpion Geosciences Ltd, dated January 2024, for the Cory Moruga licence with project economics supporting a valuation of NPV @10% of US$85m. A work-over program for two to three wells scheduled for as early as possible in 2025. An appraisal well, Snowcap-3, will be scheduled for 2026.

The Company has considered the possible indicators of potential impairment under IFRS 6, and none of these applies to the Company's interest in the recently acquired Cory Moruga licence as at 31 December 2024, or currently. Specifically -

• The licence is current and not due to expire - The Initial Work Program has been agreed with the MEEI for a period of three years to November 2026.

• Well work-over work will be underway in early 2025. Up to three well workovers in Trinidad in Q1 2025 are expected to deliver enhanced production volumes following application of the patented chemical wax treatment technology. The Company has outlined a Field Development Plan to the MEEI which includes up to 20 development wells as well as a longer-term CO2 EOR scheme. This will not be considered for implementation until after the Snowcap-3 appraisal well results in 2026.

• The current carrying value is well supported by the Scorpion Geoscience Independent Technical Report ("ITR").

Accordingly, the Directors believe that there are no indicators of impairment of the Company's Cory Moruga assets at the current time, and no impairment adjustment is appropriate.

The Group has recognised £4,497,179 as an intangible asset on consolidation of TRex's balance sheet with POGT in respect of the valuation of Cory Moruga. This compares to an intangible asset of £5,251,939 recognised in the Group's consolidated balance sheet at 31 December 2023. The difference is accounted for by showing a US$1million part payment for the acquisition of the Cory Moruga licence as a loan due by TRex to POGT its parent company and not a cost of acquiring TRex. Accordingly, a prior adjustment of £775,224 has been recognised.

The amounts recognised in respect of the identifiable assets acquired and liabilities assumed are:

See note 27 on the prior year adjustments affecting the intangible assets arising on consolidation of TRex.

14. The principal subsidiaries of Predator Oil and Gas Holdings Plc, all of which are included in these consolidated Annual Financial Statements, are as follows:

The registered address of all of the Group's companies is at 3rd Floor, IFC5, Castle Street, St Helier, JE2 3BY, Channel Islands.

(i) A security deposit of USD1,500,000 (2023: USD1,500,000) is held by Barclays Bank in respect of a guarantee provided to Office National des Hydrocarbures et des Mines (ONHYM) as a condition of being granted the Guercif exploration licence. These funds are refundable on the completion of the Minimum Work Programme set out in the terms of the Guercif Petroleum Agreement and Association Contract. Subject to ratification by a Joint Ministerial Order, the Bank Guarantee is being rolled over into the First Extension Period of the Guercif Licence.

There are no material differences between the fair value of trade and other receivables and their carrying value at the year end.

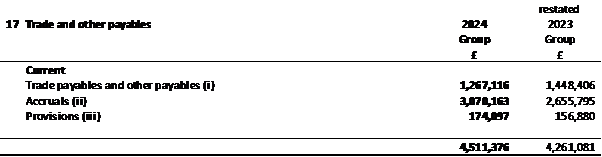

i) Included in trade and other payables are amounts due to Paul Griffiths and Lonny Baumgardner in respect of compensation for the capitalisation of the loans in the sum of £323,785 and £183,813 respectively. They will receive cash payments from the company upon either a) a flow rate of 1 million cfg/day being achieved from any well of Guercif petroleum or b) a flow rate of 100 bopd being achieved from any well in Trinidad.

Also included in trade and other payables is an amount of £593,923 in respect of Withholding Tax payable in Morrocco.

(ii) The amount of GBP3,069,789 recognised in accruals include an amount of USD2.7 million payable to the Trinidadian Ministry of Energy and Energy Industries in respect of past dues on the Cory Moruga licence.

(iii) The prior year provisions amount has been restated in accordance with note 12.

18. Financial instruments - risk management

Details of the significant accounting policies in respect of financial instruments are disclosed on pages 92 to 99. The Group's financial instruments comprise cash and items arising directly from its operations such as other receivables, trade payables and loans.

Financial risk management

The Board seeks to minimise its exposure to financial risk by reviewing and agreeing policies for managing each financial risk and monitoring them on a regular basis. No formal policies have been put in place in order to hedge the Group's activities to the exposure to currency risk or interest risk; however, the Board will consider this periodically.

The Group is exposed through its operations to the following financial risks:

• Credit risk

• Market risk (includes cash flow interest rate risk and foreign currency risk)

• Liquidity risk

The policy for each of the above risks is described in more detail below.

The principal financial instruments used by the Group, from which financial instruments risk arises are as follows:

• Receivables

• Cash and cash equivalents

• Trade and other payables (excluding other taxes and social security)

• Loans: payable within one year and payable in more than one year

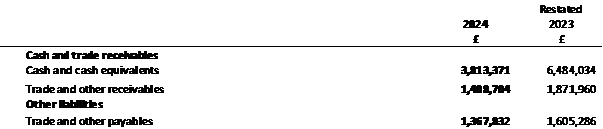

The table below sets out the carrying value of all financial instruments by category and where applicable shows the valuation level used to determine the fair value at each reporting date. The fair value of all financial assets and financial liabilities is not materially different to the book value.

Credit risk

Financial assets, which potentially subject the Group to concentrations of credit risk, consist principally of cash, short-term deposits and other receivables. Cash balances are all held at recognised financial institutions. Other receivables are presented net of allowances for doubtful receivables. Other receivables currently form an insignificant part of the Group's business and therefore the credit risks associated with them are also insignificant to the Group as a whole.

The Group has a credit risk in respect of inter-company loans to subsidiaries. The Company is owed £21,961,717 by its subsidiaries. The recoverability of these balances is dependent on the commercial viability of the exploration activities undertaken by the respective subsidiary companies. The credit risk of these loans is managed as the directors constantly monitor and assess the viability and quality of the respective subsidiary's investments in intangible oil & gas assets.

Maximum to credit risk

The Group's maximum exposure to credit risk by category of financial instrument is shown in the table below:

The holding company's maximum exposure to credit risk by class of financial instrument is shown in the table below:

Market risk

Cash flow interest rate risk

The Group has adopted a non-speculative policy on managing interest rate risk. Only approved financial institutions with sound capital bases are used to borrow funds and for the investments of surplus funds.

The Group seeks to obtain a favourable interest rate on its cash balances through the use of bank deposits. The Group's bank paid a total of £71,221 (2023: £32,143) interest on cash balances during the year. At 31 December 2024, the Group had a cash balance of £3.813 million (2023: £6.484 million) which was made up as follows:

Foreign currency risk

Foreign exchange risk is inherent in the Group's activities and is accepted as such. The majority of the Group's expenses are denominated in Sterling and therefore foreign currency exchange risk arises where any balance is held, or costs incurred, in currencies other than Sterling. At 31 December 2024 and 31 December 2023, the currency exposure of the Group was as follows:

Liquidity risk

Any borrowing facilities are negotiated with approved financial institutions at acceptable interest rates. All assets and liabilities are at fixed and floating interest rate. The Group seeks to manage its financial risk to ensure that sufficient liquidity is available to meet the foreseeable needs both in the short and long term. See also references to Going Concern disclosures in the Strategic Report.

Capital

The objective of the directors is to maximise shareholder returns and minimise risks by keeping a reasonable balance between debt and equity. At 31 December 2024 all the Group's debt balances which related to Directors was fully repaid.

(i) On the share placing dated 26 June 2024 for a total of 5,221,203 shares of no par value, the total shares of 5,221,203 were issued to Novum Securities Limited.

(ii) On the 31 October 2024, the company has issued 1,491,889 new ordinary shares at a price of 0.0925 pence per share in lieu of advisor fees totalling £138,000.

(iii) On the 11 November 2024 a total of 40,000,000 shares of no par value were issued to Novum Securities Limited for a consideration of £2,000,000.

Share Options

The Group operates a share option plan for directors. Details of share options granted and exercised during the year on a Director basis are noted below:

Paul Griffiths

Share options issued and exercised during the year:

No share options were issued or exercised in the year.

Share options held as at year end:

· Share options agreement dated 9 November 2022 - 4,171,881 share options at an exercise price of 10.0p. The share options are exercisable by 9 November 2029.

· Share options agreement dated 12 May 2023 - 3,328,119 share options at an exercise price of 10.0p. The share options are exercisable immediately.

· Share options agreement dated 12 May 2023 - 7,855,486 share options at an exercise price of 8.0p. The share options are exercisable by immediately.

Lonny Baumgardner

Share options issued and exercised during the year:

No share options were issued or exercised in the year.

Share options lapsed during the year:

On 02 October 2024, the following share options lapsed:

• Share options agreement dated 9 November 2022 - 7,427,042 share options at an exercise price of 10.0p.

• Share options agreement dated 12 May 2023 - 72,958 share options at an exercise price of 10.0p.

• Share options agreement dated 12 May 2023 - 7,855,486 share options at an exercise price of 8.0p.

Share options held at year end:

No share options were held at year end.

Alistair Jury

Share options issued and exercised during the year:

No share options were issued or exercised in the year.

Share options held at year end:

• Share options agreement dated 5 July 2022 - 2,000,000 share options at an exercise price of 8.125p. The share options are exercisable by 4 July 2029.

• Share options agreement dated 13 October 2023 - 3,000,000 share options at an exercise price of 12.5p. The share options are exercisable by 12 October 2030.

Carl Kindinger

Share options issued and exercised during the year:

No share options were issued or exercised in the year.

Share options held at year end:

• Share options agreement dated 9 November 2022 - 2,000,000 share options at an exercise price of 7.75p. The share options are exercisable by 8 November 2029.

• Share options agreement dated 13 October 2023 - 3,000,000 share options at an exercise price of 12.5p. The share options are exercisable by 12 October 2030.

Tom Evans

Share options issued and exercised during the year:

No share options were issued of exercised in the year.

Share options lapsed during the year:

Share options agreement dated 5 July 2022 - 2,000,000 share options at an exercise price of 8.125p.

Share options held at year end.

No share options held at year end.

Dr Steve Staley

Share options issued and exercised during the year:

No share options were issued of exercised in the year.

Share options lapsed during the year:

Share options agreement dated 27 October 2020 - 1,650,000 share options at an exercise price of 5.0p.

Share options held at year end:

No share options held at year end.

Louis Castro

Share options issued and exercised during the year:

No share options were issued of exercised in the year.

Share options lapsed during the year:

Share options agreement dated 31 January 2022 - 1,000,000 share options at an exercise price of 5.6p.

Share options held at year end:

No share options held at year end.

Moyra Scott

Share options issued and exercised during the year:

No share options were issued of exercised in the year.

Share options held at year end:

Share options agreement dated 29 March 2023 -3,000,000 share options at an exercise price of 10.0p. The share options are exercisable immediately.

Geoffrey Leid

Share options issued during the year:

• Share options agreement dated 17 April 2024 - 3,000,000 share options at an exercise price of 12.5p.

Share options exercised during the year:

No share options were exercised in the year.

Share options held at year end:

• Share options agreement dated 17 April 2024 -3,000,000 share options at an exercise price of 12.5p. The share options are exercisable by 18 April 2031.

Stephen Boldy

Share options issued during the year:

• Share options agreement dated 1 October 2024 - 3,000,000 share options at an exercise price of 10.5p.

Share options exercised during the year:

No share options were exercised in the year.

Share options held at year end:

• Share options agreement dated 1 October 2024 -3,000,000 share options at an exercise price of 10.5p. The share options are exercisable by 30 September 2031.

The Black Scholes model has been used to fair value the options, the inputs into the model were as follows:

The total share option reserve expense in respect of 2024 is £480,748 (2023: 1,540,481).

Warrants

During the year, the Company has granted the below warrants to an institutional investor via Novum Securities Limited ("Novum"):

• On 4 November 2024, 40,000,000 warrants were issued exercisable at 8.00p. The Warrants have an expiry date of 4 November 2027.

During the year, the Company has granted the below warrants to Novum Securities Limited ("Novum"):

• On 4 November 2024, 2,400,000 warrants were issued exercisable at 5.0p.

• On 19 December 2024, 10,000,000 warrants were issued exercisable at 5.5p. These warrants are part of a Convertible Loan Agreement "CLN" dated 20 December 2024 between Predator Oil and Gas Holdings Plc and Sanderson Capital Partners Limited "SCP". The CLN only comes into force upon the award of the South Corrib licence. The warrants will only be drawn down the earlier of a) the parties agree to terminate the CLN in accordance with terms b) written confirmation from the Company that SCP can subscribe for the Notes under the CLN.

The total warrant agreements for the aforesaid 52,400,000 warrants issued during the year ended 31 December 2024 do not contain vesting conditions and therefore the full share-based payment charge, being the fair value of the warrants using the Black-Scholes model, has been recorded immediately.

As at the year ended 31 December 2024, the total number of warrants in issue are:

The warrants issued during the year were issued solely to investors and have a fair value of Nil.

The weighted average exercise price of the warrants at the year end is £0.08 (2023: £0.09). The weighted average life of the warrants at the year end is 3.1 years (2023: 2.2 years).

22. Reserves

Details of the nature and purpose of each reserve within owners' equity are provided below:

• Share capital represents the nominal value each of the shares in issue.

• Share Based Payments Reserve are included in the Consolidated Statement of Changes in Equity and in the Consolidated Statement of Financial Position and represent the accumulated balance of share benefit charges recognised in respect of share options and warrants granted by the Company, less transfers to retained losses in respect of options exercised or lapsed.

• Warrants Issuance Cost Reserve are included in the Consolidated Statement of Changes in Equity and in the Consolidated Statement of Financial Position and represent the accumulated balance of charges recognised in respect of warrants granted by the Company less transfers to retained losses in respect of options exercised or lapsed.

• The Retained Deficit Reserve represents the cumulative net gains and losses recognised in the Group's statement of comprehensive income.

• The Reconstruction Reserve arose through the acquisition of Predator Oil & Gas Ventures Limited. This entity was under common control and therefore merger accounting was adopted.

23. Related party transactions

Directors and key management emoluments are disclosed in note 9 and 21 and in the Directors' remuneration report on pages 77 to 82.

In addition to the Directors and key management emoluments, the Executive Directors had various transactions that are disclosed in note 17.

During the year, the Company incurred costs of EUR42,000 (£35,832) (2023: EUR 63,000) relating to capitalised operations and logistic costs in Morocco, of which nil (2023: EUR NIL) remains outstanding at the year end. These costs are payable to Earthware Energy Inc a company owned by/related to Karima Absa, the wife of Lonny Baumgardner. These services were terminated in 2024.

As at year end, the balance owed to Directors for their services are as follows:

· Paul Griffiths - £27,938

· Alistair Jury - £2,316

· Carl Kindinger - £6,580

24. Contingent liabilities and capital commitments

The Group had at the reporting date no capital commitments or contingent liabilities.

25. Litigation

As at 31 December 2024, the Group is not currently involved in any litigation.

26. Events after the reporting date

20 January 2025

The Company announced that civil engineering work, to improve access roads and prepare the MOU-5 well pad, had commenced on its Guercif licence onshore Morocco at the MOU-5 drill site.

21 January 2025

The Company announced the completion by T-Rex Resources (Trinidad) Limited, the acquisition of 51% of the issued share capital of Caribbean Rex Limited ("CRL"). CRL'S sole asset is a 100% interest in and operatorship of the Bonasse Field in the SW Peninsular, Trinidad. The Bonasse field has a production licence expiring in 2039. There are no remaining work commitments. The consideration for the investment in CRL was US$170,000.

5 February 2025

The Company announced that it had placed 50 million new ordinary shares of no par value in the Company at a placing price of 4 pence each to raise £2 million (before expenses) with Eva Pacific Pty Ltd. The funds are to be applied to an accelerated drilling programme for the upcoming MOU-5 well in Morocco on the Titanosaurus prospect and to prepare for the development and appraisal drilling programme on Snowcap-3 in Cory Moruga, Trinidad. Pursuant to this placing 10mil warrants exercisable at 6p a share was granted to Eva Pacific Pty Ltd and Cynosure Capital Pty Ltd.

18 February 2025

The Company announced that T-Rex Resources (Trinidad) Limited's 51% owned subsidiary, Caribbean Rex Limited('CRL'), had entered into a transaction with Challenger Energy ("CEG") for the potential acquisition of its St Lucia domiciled subsidiary company, Columbus Energy (St. Lucia) Limited, which in turn holds various subsidiary entities collectively representing all of the CEG's business, producing assets and operations in Trinidad and Tobago. The three producing fields that are being acquired are Goudron, Inniss Trinity and Icacos and are currently averaging 272 bopd of production.

The total consideration of US$1,750,000 comprises an initial deposit of US$250,000 which has been satisfied via the issuance to CEG of 4,411,641 Predator shares; US$750,000 payable on completion comprising US$250,000 in cash and US$500,000 via the issuance of Predator shares and deferred unconditional consideration payments of US$750,000, payable in cash, in three instalments of US$250,000, at the end of 2025, 2026, and 2027. CRL will assume a total of US$4.25 million of legacy liabilities, provisions and potential exposures of the business, and the assets and operations in Trinidad and Tobago. The Company are in the process of assessing the fair values of the assets and liabilities acquired and will make use of the 12 months assessment period as presented within IFRS 3.

20 February 2025

The Company awarded 45,000,000 unallocated share options, exercisable at 5.5p per share, under the option scheme as follows:

a. Dr. Stephen Boldy: 7,500,000 options

b. Mr Paul Griffiths Chief Executive:18,500,000 options

c. Mr Alistair Jury:7,500,000 options

d. Mr Carl Kindinger:7,500,000 options

e. Mr Geoffrey Leid Director: 4,000,000 options

The vesting conditions and phased vesting dates are as follows:

• 25% of the award on commencement of MOU-5 drilling.

• 25% of the award after 9 months or on announcement of the completion of the acquisition of Challenger Energy Group Plc's Trinidad & Tobago companies, whichever occurs first.

• 25% of award after 6 months or announcement of positive MOU-3 testing results, whichever occurs first.

• 25% of award on announcement of achieving 500boe/pd net to Predator in Trinidad.

4 March 2025

The Company announced that the MOU-5 well had commenced drilling operations onshore Morocco on 3 March 2025.

17 March 2025

The Company announced that the results of the MOU-5 drilling programme have unlocked a new Jurassic play, opening a trend never before tested in the Guercif Basin. A helium show has provided the impetus to further assess the helium potential of the MOU-5 structure. There was confirmation of the pre-drill play concept and seismic inversion modelling work based on limited 2D seismic data. This allows for the acquisition of more focussed additional seismic data to clarify the updip potential. The way forward from this point on is to evaluate the data from the well and then to seek a farminee to join the Jurassic Project. The MOU-5 well has confirmed that the large MOU-5 structure has to be further investigated based on new 3D seismic data.

24 March 2025

The Company announced an operational update and commencement of oil sales:

· CEG Trinidad acquisition progressing on schedule through regulatory process. This acquisition will add 272

bopd on completion

· Bonasse oil off-take agreement executed and oil sales to commence

· Bonasse Production and Field Services Management Agreement executed

· Bonasse workover programme underway and building to 35 bopd initial target