16th Jul 2025 07:00

One Waterside Drive Arlington Business Park Reading Berks RG7 4SW

16 July 2025 |

|

COHORT PLC

UNAUDITED PRELIMINARY RESULTS

FOR THE YEAR ENDED 30 APRIL 2025

Record results, strong prospects

Cohort plc today announces its unaudited results for the financial year ended 30 April 2025.

2025

| 2024

| %

| |

Revenue | £270.0m | £202.5m | 33 |

Adjusted operating profit | £27.5m | £21.1m | 30 |

Adjusted earnings per share | 54.44p | 42.89p | 27 |

Net funds | £5.3m | £23.1m | (77) |

Order intake | £284.7m | £392.1m | (27) |

Order book (closing) | £616.4m | £518.7m | 19 |

Proposed final dividend per share | 11.05p | 10.10p | 9 |

Total dividend per share | 16.30p | 14.80p | 10 |

Statutory

| 2025

| 2024

| %

|

Statutory profit before tax | £25.6m | £19.8m | 29 |

Basic earnings per share | 45.07p | 37.87p | 19 |

Highlights include:

· Record revenue, adjusted operating profit, and closing order book. Adjusted EPS and net funds exceeded market expectations.

· Adjusted operating profit of £27.5m (2024: £21.1m) on revenue of £270.0m (2024: £202.5m).

· Underlying order intake up by 11% (excluding a large, long-term Royal Navy order of £135m secured in 2023/24).

· Record order book of £616.4m with deliveries extending out to mid-2030's.

· Dividend growth ahead of expectations at 10%; the dividend has been increased every year since the Group's IPO in 2006.

· Acquisition of EM Solutions for an enterprise value of £75m completed 31 January 2025, positive contribution in first three months of ownership.

Looking forward - Strong order book underpinning growth expectations:

· Record closing order book underpins 79% of current market revenue expectations for 2025/26.

· Significant opportunities arising from the UK Strategic Defence Review.

· Increasing demand for defence technology products and services as global tensions continue to evolve.

· Encouraging pipeline of order opportunities for the current year, providing a positive outlook for organic growth in the years ahead and supporting our mid-term aim to improve net margins to a low to mid-teens %.

· Adjusted 2025/26 EPS now likely to be ahead of our previous expectations.

1 Excludes amortisation of other intangible assets, research and development expenditure credits, exceptional costs and non-trading exchange differences, including marking forward exchange contracts to market.

2 Excludes amortisation of other intangible assets, exceptional costs and non-trading exchange differences, including marking forward exchange contracts to market.

3 Cash and cash equivalents less bank borrowings excluding IFRS 16 lease liabilities.

Commenting on the results, Nick Prest CBE, Chairman of Cohort plc, said:

"Cohort has reported another record revenue and profit performance, with robust operating cash generation and a record closing order book stretching out into the mid-2030s. This gives good visibility for the coming years, and along with our net funds and market position provides a robust foundation for future organic growth as well as the ability to make further strategic additions to the Group, as we did this year.

"Our performance is also a result of several strategic initiatives including the acquisition of EM Solutions, which has already contributed to the growth of our Communications and Intelligence division, as well as our investment in technologies to meet the challenges faced by global defence customers - initiatives underpinned by our strong balance sheet.

"Within the shifting landscape of global security, mid-tier defence and technology companies like those within the Cohort Group play an important role in creating and delivering advanced defence solutions at speed. Our businesses supply products and services that enhance the security of the UK's allies across the globe. In the UK, our capabilities support the UK Government's commitment to investing in a defence architecture that will make Britain safer and stronger.

"We are optimistic that the Group will continue to advance in the coming 2025/26 year as demand for our products and services continue to grow, and accordingly our adjusted EPS is now likely to be ahead of our previous expectations. Overall our longer term prospects remain strong."

A meeting is being held today for institutional analysts, hosted by Andy Thomis, Chief Executive, and Simon Walther, Finance Director, from 09.00 for a 09:30 start (UK times). Please contact MHP via [email protected] if you wish to attend.

For those unable to attend in person, there will be a recording of the presentation available on Cohort's website after the meeting: https://www.cohortplc.com/investors/results-reports-presentations

Investor Presentations

Chief Executive, Andy Thomis, and Finance Director, Simon Walther, will be presenting an investor webinar hosted by Equity Development on Friday, 18th July at 10:15. Registration is free and questions can be submitted during the presentation which will, if possible, be addressed at the end of it. A recording will also be made available afterwards.

To attend the event, please register at

https://us06web.zoom.us/webinar/register/WN_cwBwZAGgRWCBqsOA8crjJw#/registration

For further information please contact:

Cohort plc | 0118 909 0390 |

Andy Thomis, Chief Executive | |

Simon Walther, Finance Director

| |

Kellie Young, Head of Investor Communications | |

Investec Bank Plc (NOMAD and Broker) | 020 7597 5970 |

Carlton Nelson, Christopher Baird | |

MHP | 07817 458804 |

Reg Hoare, Ollie Hoare, Hugo Harris |

NOTES TO EDITORS

Company complied consensus analyst forecasts are available at www.cohortplc.com/investors/analyst-consensus

Cohort plc (www.cohortplc.com) is the parent company of seven innovative, agile and responsive businesses based in the UK, Australia, Germany and Portugal, providing a wide range of services and products for domestic and export customers in defence and related markets.

Cohort (AIM: CHRT) was admitted to London's Alternative Investment Market in March 2006. It has headquarters in Reading, Berkshire and employs in total over 1,500 core staff there and at its other operating company sites across the UK, Australia, Germany, and Portugal.

The Group is split into two divisions - Communications and Intelligence, and Sensors and Effectors:

Communications and Intelligence

· EID designs and manufactures advanced communications systems for naval and military customers. Cohort acquired a majority stake in June 2016. www.eid.pt

· EM Solutions designs, assembles, tests, and supports advanced mobile satellite communications terminals for naval and other customers. It also provides advanced radio frequency devices and subsystems for defence and commercial markets. Acquired by Cohort in January 2025. www.emsolutions.com.au

· MASS is a specialist data technology company serving the defence and security markets, focused on electronic warfare, digital services, and training support. Acquired by Cohort in August 2006. www.mass.co.uk

· MCL designs, sources, and supports advanced electronic and surveillance technology for UK end users including the MOD and other government agencies. MCL has been part of the Group since July 2014. www.marlboroughcomms.com

Sensors and Effectors

· Chess Dynamics offers multi-sensor surveillance, tracking and fire-control systems for defence customers. Chess has been part of the Group since December 2018. www.chess-dynamics.com

· ELAC SONAR supplies advanced sonar systems and underwater communications to global customers in the naval marketplace. Acquired by Cohort in December 2020. www.elac-sonar.de

· SEA designs, delivers and supports technology-based products for naval surface ships and submarines. Acquired by Cohort in October 2007. www.sea.co.uk

Chairman's statement

Another record year. Group set for higher performance going forward.

Nick Prest CBE

Chairman

"Another record revenue and profit performance, with robust operating cash generation and a record closing order book. The record order book stretching out into the mid-2030s gives Cohort good visibility for the coming years. Along with our net funds and market position this provides a robust foundation for future organic growth as well as the ability to make further strategic additions to the Group, as we did this year."

Key financials

The Group achieved a record adjusted operating profit of £27.5m (2024: £21.1m) on record revenue of £270.0m (2024: £202.5m), in line with market expectations, representing increases of 30% and 33% respectively on the prior year. The Group's IFRS operating profit of £26.1m (2024: £21.2m) is after amortisation of intangible assets, exceptional items, research and development credits and movements on foreign exchange, including marking foreign exchange contracts to market.

As I said last year, the continuing war in Ukraine and persistent tensions in the Asia-Pacific region have driven continuing impetus for defence spending across the globe. This impetus has been accelerated by the change of administration in the United States in November 2024 which has encouraged the members of NATO, especially in Eastern Europe, to announce that they intend to significantly increase their defence spending plans, with the NATO target set at the recent conference at 3.5% of GDP to be spent on defence by 2035 compared with the current target of 2.0%.

Against this background, the Group delivered another year of strong order intake, winning £284.7m of orders (2024: £392.1m), representing 1.1x full year revenue (2024: 1.9x) and has resulted in a record closing order book of £616.4m (2024: £518.7m). The 2023/24 order intake benefited from the large Royal Navy order of £135m. The closing order book included £80m secured with the acquisition of EM Solutions.

As well as growing in size, our order book has extended in duration, now stretching out to 2037. This reflects the significant naval orders the Group has secured over the last few years, which are typically long-term in nature. We expect our future order book to extend even further as naval investment around the world increases. In the Land domain, we are seeing increased demand for drone and counter-drone systems, driven by the Ukraine conflict. The attacks on shipping in the Red Sea show that drone defence is not only needed in the land environment. Other areas of increased demand include secure communications and electronic warfare.

The Group's year end cash position exceeded our expectation: net funds of £5.3m compared with expected net debt of £8m-£10m. This improvement is the result of strong working capital management, especially in the Sensors and Effectors division.

Strategic initiatives

On 31 January 2025 the Group completed the acquisition of EM Solutions for an enterprise value of A$144m (£75m). This was funded by a combination of a placing (£41m), debt from our existing facility (£20m) and the balance from our cash resources. EM Solutions is based in Brisbane, Australia and provides mobile satellite communications solutions, primarily for navy customers including the Royal Australian Navy, NATO members and Japan. The acquisition provides the Group with access to the growing Australian defence market as well as adding a very capable business to our portfolio. EM Solutions has had considerable success with export customers, some of which overlap with the existing group (see note 7).

As previously reported, our business MCL (within our Communications and Intelligence division) acquired 100% of Interactive Technical Solutions Ltd ("ITS") for a cash consideration of £3.0m paid from the Group's existing financial resources on 31 May 2024 (see note 6).

On 29 May 2025 the Group announced that its business SEA (within our Sensors and Effectors division) had sold its Transport undertaking for a gross cash consideration of just over £8m. The Transport undertaking was not a strategic part of the Group's primary defence offering. This sale completed on 30 June 2025 (see note 8).

The Group continues to review acquisition opportunities as they arise, in line with our investment criteria.

Shareholder returns

Adjusted earnings per share (EPS) were 54.44 pence (2024: 42.89 pence). The adjusted EPS figure was based on profit after tax, excluding amortisation of other intangible assets, exceptional items and net foreign exchange movements. Basic EPS were 45.07 pence (2024: 37.87 pence). The 27% growth in adjusted EPS was primarily due to the stronger adjusted operating profit (up 30%) and a lower tax rate on adjusted earnings of 12.6% (2024: 12.7%) These factors were partly offset by the diluting effects of the share placement undertaken during the year. The Board is recommending a final dividend of 11.05 pence per ordinary share (2024: 10.10 pence), making a total dividend of 16.30 pence per ordinary share (2024: 14.80 pence) for the year, a 10% increase. The dividend has been increased every year since the Group's IPO in 2006. The final dividend will be payable on 3 October 2025 to shareholders on the register at 22 August 2025, subject to approval at the Annual General Meeting on 25 September 2025.

Our people

As always, my thanks go to all employees within the Cohort businesses. Their hard work, skill and ability to satisfy our customers' needs are what continue to drive the performance of our Group.

I would like to welcome our new colleagues at EM Solutions and ITS to the Group. I would also like to thank the staff of the Transport division at SEA for their contribution to the Group over many years.

Andrew Thomis, Simon Walther and their senior executive colleagues have continued the dedicated and skilful work which has helped the Group continue its progress. I would like to thank Chris Stanley who retired as Managing Director of MASS in January of this year for his dedication to MASS over 17 years and welcome Keith Norton as the new Managing Director of MASS.

As we said at the time of the EM Solutions acquisition, we will increase the size of the Cohort team to support the larger and more geographically spread Group to ensure that the growth we have seen and expect to see is delivered. This investment will include a senior operational executive.

Governance

From 1 May 2024 we have applied the 2023 edition of the QCA Corporate Governance Code and we have reported against this in this year's Annual Report and Accounts. The Board regularly evaluates and reviews the Group's environmental, social and governance (ESG) activity and is committed to maintaining appropriate standards. The Group has disclosed climate-related financial information for the third year and has established governance mechanisms to oversee climate-related risks and opportunities. This year we continued to report in line with the mandatory climate-related financial disclosures under the Companies Act 2006 (CFD). The Group's values, stakeholder engagement principles and governance policies are all outlined on our website and in our Annual Report and Accounts.

Capital allocation

We have a proven strategy supported by an appropriate capital allocation policy. As a Board we use this to inform our decision making and it has been key to our progress. Our approach to capital allocation has three priorities: to deliver sustainable organic growth, through investment in our people, research and development, and the capital requirements of the business; to find value generating complementary acquisitions; and to provide a return to shareholders in the form of a growing dividend, with earnings cover of those dividends at around 3 times. Our strong balance sheet, with net cash, provides us with a range of options.

Outlook

Cohort continues to see good demand for our products and services from both our domestic customers, especially the UK and Australia, and from export customers. The geopolitical tensions driving increased investment in defence have persisted during the year, with conflict in Ukraine and tensions in the Asia-Pacific region leading to increased spending internationally.

The recently published UK Strategic Defence Review highlighted a need for investment in many of the areas in which we have strong capabilities, including systems for manned and unmanned naval platforms, electronic warfare, drones and counter-drone capabilities, and secure communications. This clear statement of priorities gives us a long-term platform from which to continue to grow the business, with nearly 50% of our revenue still coming directly or indirectly from the UK MOD.

The recent NATO conference reinforced the need for its members to implement a step change in defence spending and, although some will be slower than others to enact this, we see the direction of travel as being a positive one for the Group. We have operations in NATO countries Germany, Portugal and Canada as well as the UK.

In Australia, the increased investment by the Royal Australian Navy in its surface fleet provides a good market for both EM Solutions as well as other Group businesses. The AUKUS submarine project and associated technology programmes offer opportunities in both Australia and the UK.

Our opening order book underpins approximately £230m of current financial year revenue (2024: £180m), representing 79% of current expectations of £290m for the year. Following contract wins since the start of the financial year of over £25m, that cover now stands at 85%.

The sale of the Group's Transport business from Communications and Intelligence will remove annual revenue and adjusted operating profit of c.£8m and c.£2m respectively. We expect improved performance from our core defence business to compensate partly for this in 2025/26 and fully in 2026/27 and beyond.

The improved mix in the coming year, including a full year's contribution from EM Solutions will drive a higher net margin for the Group, and this should improve further from 2026/27 onwards.

The Group's tax rate in 2025/26 should be lower than previously expected, due to both one-off and longer-term savings, particularly in Australia.

These factors together mean that adjusted EPS are likely to be ahead of our previous expectations. Our longer term prospects remain strong, with the potential for c.10% earnings growth in the following two financial years.

The Group's net funds at 30 April 2025 were much better than expected and we do not expect to see such a strong cash performance in the coming year, which will see a reversal of some of the working capital inflow seen this year, and completion of ELAC's new facility in Kiel. We expect to close the 2025/26 year with net funds in the range of £10m to £15m.

Nick Prest CBE

Chairman

Chief Executive Officer's report

Growth in a global market with lots of potential

Andrew Thomis

Group Chief Executive

"2024/25 was yet another strong year of growth for the Group with increases in revenue and adjusted operating profit."

Overview

Following a strong 2023/24 the Group saw a further marked increase in performance for the year just finished, delivering record revenue and adjusted operating profit. Another year of strong order intake, a closing record order book and ending the year with net cash provides the Group with a solid platform to continue to accelerate its growth momentum.

Overall, the trading performance was in line with, and net funds ahead of, consensus market expectations. Earnings were ahead of expectations, primarily due to a lower tax rate. Communications and Intelligence performed very strongly whilst the Sensors and Effectors division performance was broadly flat.

Order intake was the second highest we have achieved following last year's record, and the resulting record order book of over six hundred million pounds gives us a solid base for 2025/26 and beyond. We see good prospects for further orders in the year ahead.

Financial performance

The Group's revenue of £270.0m (2024: £202.5m) was 33% higher than last year and delivered an adjusted operating profit of £27.5m (2024: £21.1m), 30% higher than last year.

Communications and Intelligence

The Communications and Intelligence division reported a much stronger year overall with revenue up by just over 50% including initial contributions from EM Solutions of £6.7m and ITS of £1.5m. The division's adjusted operating profit increased by nearly 65% including contributions of £1.9m and £0.5m from EM Solutions and ITS respectively. MASS again delivered the highest adjusted operating profit in the Group, though this was slightly down compared to last year due to the mix of revenue. The net margin of 16.9% (2024: 15.4%) reflects the return to profit of EID, a record performance at MCL, and the high margin contribution of the two acquired businesses. Looking forward, we expect this division to grow further as EM Solutions provides a full year contribution, more than offsetting the expected decline in MCL from its recent record peak, driven by urgent short term orders. With this growth in high quality revenue, we are expecting the division to achieve a percentage net margin in the high teens.

Sensors and Effectors

The Sensors and Effectors division saw an increase in revenue of 21% but its adjusted operating profit of £12.7m was broadly flat compared to last year (£12.8m). The lower net margin of 8.7% (2024: 10.7%) was due to a weaker mix at SEA and delays and one-off project costs at Chess. ELAC continued to make progress on its contract to supply complete sonar suites for the new fleet of Italian submarines and we remain on course to deliver the hardware for the first boat during 2025/26. SEA delivered a record level of revenue and trading profit, but the mix was such that its net margin was slightly down on last year. Chess continues to see a strong demand for its products and goes into 2025/26 with a high level of revenue on order (83%, increasing to over 90% since the period end). Cohort is working with Chess to ensure it delivers its order book and pipeline of prospects more reliably and at a higher net margin. We expect the net margin in this division to recover in the coming year back to at least the levels seen in 2024.

The Group's statutory operating profit of £26.1m (2024: £21.1m) reflects the amortisation of other intangible assets, a £3.0m non-cash charge in 2025 (2024: £3.1m charge), research and development credit (RDEC) of £3.2m.(2024: £2.9m) which in turn is offset by a higher tax charge and an exceptional charge of £1.7m (2024: £nil) in respect of acquisition costs. The Group also reported a non-cash foreign exchange gain of £0.1m (2024: £0.3m) arising from marking forward exchange contracts to market.

Adjusted earnings per share increased by 27% to 54.44p per share reflecting the improved performance.

The Group's net funds declined from £23.1m to £5.3m. The final cash position was much stronger than expected and reflected a strong working capital performance, across both divisions, especially Sensors and Effectors. This result was achieved despite capital expenditure of £13.2m (2024: £6.7m), most of which was in respect of ELAC's new facility in Kiel, Germany, together with the acquisitions of EM Solutions and ITS, which absorbed approximately £14m and £3m of our own cash, respectively.

Strategic progress

The Group has continued to make progress this year, achieving organic growth of 29% in revenue and 19% in adjusted operating profit, materially above our target for double digit growth. On top of this the Group acquired EM Solutions, our largest acquisition to date which made an initial contribution for its three months within the Group. The strong order intake exceeded revenue again and when added to the EM solutions acquired order book, resulted in the Group closing with a record high order book of over six hundred million pounds. We continue to see a good pipeline of prospects, both in our domestic and export markets. Key developments have included:

· Following extended procedural delays, we received significant orders from the Portuguese Army and Navy. We expect further significant orders.

· An agreement between SEA and Terma to provide Ancilia as part of the Terma ship-defence system. Terma's solution, which could be upgraded with the addition of Ancilia, is currently fitted to 120 ships across numerous navies.

· Follow on orders from Italy. All four new submarines will now have the ELAC sonar solution.

· Chess has secured a number of orders from Rheinmetall as part of its counter-drone system. The pipeline for further such orders is good.

· MCL has designed a drone controller subsystem in order to overcome supply chain constraints and to provide an improved capability in support of urgent operational requirements.

The proportion of the Group's revenue derived from maritime customers, 53% in 2025 (2024: 47%), continues to grow. The combination of land- and maritime-derived sales now accounts for over 80% of the Group revenue (2024: 78%). The proportions of revenue contributed from other domains have either remained flat or reduced as the maritime/land contribution has grown. We expect our non-defence revenue, which has been around 6% for the last few years, to drop to around 3-4% in the coming year following the sale of our Transport business.

The closing order book and pipeline provide a firm base for us to continue to pursue our operating strategy and to also push our overall net margin for the Group from its current 10-11% towards our target of low to mid-teens percent within the next three to five years. In addition, the Group's net funds and available banking facilities provide resources for us to continue to look for suitable businesses to add to the Group, either within an existing Group business or as a new stand-alone business, further accelerating the growth in revenue and profit.

Our people

All the Group's capabilities and customer relationships ultimately derive from our people, and the success we have enjoyed is a result of their efforts. They have risen to the challenge of the stronger demand we have seen this year, and in doing so have made a meaningful contribution to the security and defence of our nations and allies as well to the performance of the Group. I would like to take this opportunity to express my sincere thanks to all employees of Cohort and its businesses.

Chris Stanley retired as Managing Director of MASS in January of this year. His successor Keith Norton has many years of experience in defence and related technology businesses. Like many high-skill businesses, we are facing challenges in recruiting qualified and experienced people to meet our customer demands and our own investment strategies. As our order book has grown, so have our employee numbers and the Group now has over 1,500 employees compared with nearly 1,300 this time last year, a 19% increase. We will continue to increase our human resources in the coming year, especially within Sensors and Effectors, although we expect at a slower rate.

Capital allocation

The three elements of our capital allocation policy are set out in the Chairman's statement. In 2025 we implemented these as follows:

· Continuous investment in research and development, maintaining product offerings at the forefront of demanding environments and developing new technologies within the Group's core competencies. Increasing by 35% to £20m in year.

· Complementary acquisitions driving growth in core areas where the Group can leverage industry knowledge. ITS was acquired in May 2024 and EM Solutions in January 2025.

· A progressive dividend policy. An increase of 10% has been delivered this year, subject to approval of the final dividend at the Group's AGM. The Group has increased its dividend every year since IPO in 2006.

Andrew Thomis

Group Chief Executive

Operating Review

In this review the focus is on the adjusted operating profit of each division, which we consider to be a more appropriate measure of performance year on year. The adjusted operating profit is reconciled to the operating profit in the Consolidated Income Statement, and this is broken down by reporting segment in note 2.

The adjusted operating profit margin (net margin) of the Group was 10.2%, slightly below that achieved in 2023/24. The net margin was higher in Communications and Intelligence at 16.9% (2024: 15.4%) with a return to profitability at EID, a record performance from MCL (including a small initial contribution from ITS) and an initial contribution from EM Solutions all contributing to the upside, especially the higher net margin new businesses. In Sensors and Effectors, the net margin was lower at 8.7% (2024: 10.7%). This was mostly driven by a slightly weaker mix at SEA, despite a record performance, and delivery delays and one-off costs at Chess.

As we have indicated previously, we are expecting these net margins to increase over the mid-term. We expect Sensors and Effectors to be able to yield net margin percentages in the mid-teens. This should be achieved from the delivery of the strong order book, especially at SEA, with the overhead footprint of the SEA and Chess businesses now established at a suitable level to deliver their current order books for the next few years. We expect SEA to complete the large majority of a low margin export order during 2025/26 and for its margins to start to move up from 2026/27 onwards. At Chess we have seen a challenging year as it struggled to deliver operationally and incurred one-off costs to close out some older projects. Chess enters 2025/26 with a record level of revenue cover (83%, increasing to over 90% post yearend) and we are working to ensure it achieves an improved level of performance and delivers on its contractual obligations. This will enable Chess to achieve low teen margins on a sustainable basis. At ELAC, the last few years have seen cautious trading on the Italian sonar project as it progresses through its development phases, holding ELAC's net margins down. We expect to deliver the hardware to the first submarine during 2025/26. We will review the approach to project margin as major milestones are achieved.

In the Communications and Intelligence division, MCL delivered a record performance, driven by short term operational requirements and achieved a net margin of close to 17%, significantly better than its usual run rate of low double digits. We do not expect this level of activity to be repeated in the coming year. EID returned to a welcome profit, following significant order wins in the year, mostly from its domestic customer. The net margin for EID remains lower than our aim of mid-teens, and we expect to move towards this higher target in the next few years as its mix of work strengthens with more export opportunities in its pipeline. MASS continued to be our most profitable business, delivering a net margin close to 20%, and we expect that net margin level to continue. EM Solutions and ITS both made small, but strongly profitable contributions to the performance of the division.

When the above are combined with the central costs, we are targeting an overall net margin for the Group of low to mid-teens percent in the next three to five years. The higher central costs are a result of one-off savings in 2023/24 not repeated this year. Going forward, we expect the central costs to rise further as we invest to manage the larger and more geographically spread Group and also look to introduce some more operational expertise into the central team.

Adjusted operating profit by reporting segments:

Adjusted operating profit | Adjusted operating margin | ||||

| 2025 £m | 2024 £m |

| 2025 % | 2024 % |

Communications and Intelligence | 21.1 | 12.8 | 16.9 | 15.4 | |

Sensors and Effectors | 12.7 | 12.8 | 8.7 | 10.7 | |

Central costs | (6.3) | (4.5) |

| - | - |

| 27.5 | 21.1 |

| 10.2 | 10.4 |

Communications and Intelligence

· Revenue - £124.9m (2024: £82.9m)

· Adjusted operating profit - £21.1m (2024: £12.8m)

· Net cash flow generated from operations - £23.3m (2024: £3.2m)

· Headcount - 641 (2024: 484)

Communications and Intelligence delivered a much stronger performance on a 50% increase in revenue. This was due to more intense activity with the UK MOD, primarily through MCL where we saw a record performance this year. Elsewhere in this division, EID returned to profit with a net margin of just under 9% and MASS continued to be the largest contributor to Group profit delivering a net margin of 19.7% (2024: 22.5%) on 10% higher revenue. EM Solutions also made an initial contribution with a net margin of 28%.

The Communications and Intelligence division enters 2025/26 with £104.7m (2024: £63.2m) of its revenue on order. This is significantly higher than last year following good order intake in Portugal and the inclusion of the EM Solutions order book though, as expected, the MCL order book is lower than last year's record high. We expect this division to deliver a much stronger performance in 2025/26.

Sensors and Effectors

· Revenue - £145.1m (2024: £119.6m)

· Adjusted operating profit - £12.7m (2024: £12.8m)

· Net cash flow generated from operations - £43.1m (2024: £21.5m)

· Headcount - 959 (2024: 805)

The Sensors and Effectors division delivered a broadly flat operating performance on higher revenue. Revenue growth was most significant at SEA, which achieved record levels of both revenue and profit. ELAC's revenue performance was also improved, but at Chess delivery delays resulted in a weaker revenue performance.

The revenue performance in this division did not translate through to improved net profit. This was due to three underlying factors, none of which are expected to persist beyond 2025/26.

1. In SEA, a higher proportion of revenue was delivered on an export contract where the margin remains low. We expect to complete the large majority of this project in 2025/26.

2. At ELAC, the development phase of the sonar suite for new Italian submarines continued. We expect to deliver the first boat systems during 2025/26 and may at that stage be able to retire risk.

3. Chess faced challenges to deliver on its orders and saw one-off costs on some older programmes. The order book for the coming year at Chess covers 83% (now over 90% with orders secured post yearend) of its revenue target and we are putting in place changes to improve the delivery performance. The projects where we have seen cost increases are now close to completion although several are not contracted to close until 2026/27.

Looking forward, this division is well underpinned for 2025/26 with £124.6m (2024: £120.9m) of revenue on order at 30 April 2025. The significant order book and good prospects some of which have already been secured at the beginning of the new year, gives us confidence that this division will grow in the coming few years.

The higher level of activity involving more than one of our businesses has continued in the year, a good example being SEA and Chess's collaboration on the Ancilia product. We have also seen SEA supporting ELAC on its Italian programme, and ELAC providing sonar integration software for SEA. We will carefully monitor these projects to ensure the necessary coordination and oversight to ensure that we are able to meet customer requirements while maintaining the autonomy and agility that are so important for our operating businesses.

Andrew Thomis

Group Chief Executive

FINANCIAL REVIEW

Revenue analysis

The Group reports its segmental revenue through its two divisions, Communications and Intelligence and Sensors and Effectors.

The revenue for the Group is also broken down by three separate categorisations - market, product or service, and domain.

The Group revenue continues to be dominated by defence and security customers with £255.6m (2024: £191.6m) delivered to these markets, 95% of Group revenue (2024: 95%).

Overall, the increase in Group revenue has been driven by an increase in both export and activity with our domestic customers in the UK and Portugal and the introduction of Australia as a domestic customer. UK MOD revenue increased to £134.0m (2024: £96.8m), and as a proportion of Group revenue rose slightly to 50% (2024: 48%).

Export defence revenue grew by 22% (2024: 23%) but decreased slightly as a proportion of overall revenue from 35% last year to 32% this year. The decrease in percentage terms was due to revenue growth from our domestic markets in the UK, Portugal, which increased by 70%, and Australia.

Revenue derived from Germany slipped back as ELAC completed deliveries to its domestic customer last year. We continue to support ELAC in delivering to its domestic customer. EM Solutions brings a pipeline of European opportunities which includes Germany.

Non-defence revenue includes transport and legacy hydroacoustic products which are both reported within Sensors and Effectors, and sensors used in the mining industry within Communications and Intelligence. The Transport business was sold after the year end, the transaction completed on 30 June 2025. As a result of this disposal, the non-defence revenue of the Group going forward is expected to fall to around 3% per annum from its current 5%.

The Group continues to see the larger proportion of its revenue from product (hardware and/or software). The increase in the absolute revenue this year was driven by higher urgent operational requirement orders for the UK MOD through MCL, a welcome return to higher revenue from our Portuguese domestic customer following strong order intake at EID, and deliveries of naval systems to customers in South America and Canada. The services proportion of the Group's revenue decreased from last year due to the marked increase in product sales. In absolute terms, we saw an increase in support work to the Royal Navy at SEA and the initial contribution of ITS acquired in May 2024. In the past, the service revenue has typically been around 40%, this has continued to fall as a proportion of the Group revenue as the product and systems activity, especially at Chess, ELAC and SEA has increased. Going forward, we continue to work on increasing the support and services work across the Group, which does include spares (which are reported as part of product). The addition of EM Solutions will drive the product proportion of the Group's revenue in percentage terms even higher, and the service proportion is expected to reduce to around 20%.

The change in mix of the Group's revenue has seen a decrease in statutory gross margin percentage from just under 38% to just over 33%. The main cause of the decrease in statutory reported gross margin was a weaker mix in Sensors and Effectors, particularly at Chess where one-off costs on some projects were incurred. ELAC's gross margin was slightly weaker due to higher proportion of revenue on the Italy sonar contract. SEA's gross margin was also slightly weaker due to the mix of work, especially an export contract containing a large element of sub-contractor effort which we expect to mostly complete in 2025/26.

In Communications and Intelligence, the gross margin at EID was weaker due to the higher proportion of domestic work but more than offset by higher revenue, which was double last year. At MASS the margin was slightly down due to mix, whilst MCL was constant. The impact of EM solutions was a higher gross margin compared with the other businesses in the Group.

The analysis of the Group's revenue by domain shows that the Group's revenue is dominated by Maritime and Land, a combined 81% of Group revenue (2024: 78%). The growth in Maritime is due to increase in exports in Sensors and Effectors, mainly SEA, higher domestic sales at EID and the initial contribution of EM Solutions. Land domain revenue also increased in absolute terms, mostly at MCL. Joint and Strategic at 5% (2024: 10%) was lower in absolute and percentage terms as MCL work switched to shorter term urgent operational work. The majority of the revenue in this domain is support to the UK's Joint Warfare capability which was constant. Going forward, we expect the Maritime domain to remain dominant and grow further in absolute and percentage terms with the addition of EM Solutions.

Revenue by market and geography

Communications and Intelligence | Sensors and Effectors | Group | ||||||||

| 2025 £m | 2024 £m |

| 2025 £m | 2024 £m |

| 2025 £m | % | 2024 £m | % |

Direct to UK MOD | 77.5 | 58.0 | 17.8 | 10.7 | 95.3 | 36 | 68.7 | 34 | ||

Indirect to UK MOD where the Group acts as a sub-contractor or partner | 6.6 | 5.0 |

| 32.1 | 23.1 |

| 38.7 | 14 | 28.1 | 14 |

Total UK defence | 84.1 | 63.0 | 49.9 | 33.8 | 134.0 | 50 | 96.8 | 48 | ||

UK security | 5.9 | 3.6 | - | - | 5.9 | 2 | 3.6 | 2 | ||

UK other (non-defence and security) | 0.1 | 0.1 |

| 7.9 | 8.2 |

| 8.0 |

| 8.3 |

|

Total UK | 90.1 | 66.7 |

| 57.8 | 42.0 |

| 147.9 |

| 108.7 |

|

Australia defence and security | 4.8 | 0.5 | 3.0 | 1.1 | 7.8 | 3 | 1.6 | 1 | ||

Portuguese defence and security | 17.6 | 10.3 | - | - | 17.6 | 7 | 10.3 | 5 | ||

German defence and security | 0.1 | 0.3 |

| 2.9 | 8.7 |

| 3.0 | 1 | 9.0 | 4 |

Total non-UK domestic defence and security | 22.5 | 11.1 |

| 5.9 | 9.8 |

| 28.4 | 11 | 20.9 | 10 |

Export defence and security | ||||||||||

- Other European countries | 3.2 | 1.1 | 34.9 | 36.4 | 38.1 | 37.5 | ||||

- Asia Pacific and Africa | 5.9 | 3.9 | 27.9 | 23.2 | 33.8 | 27.2 | ||||

- North and South America | 2.7 | 0.1 |

| 12.7 | 5.5 |

| 15.4 |

| 5.6 |

|

Total export defence and security | 11.8 | 5.1 |

| 75.5 | 65.1 |

| 87.3 | 33 | 70.3 | 35 |

Non-UK other (non-defence and security) | 0.5 | - |

| 5.9 | 2.6 |

| 6.4 |

| 2.6 |

|

| 124.9 | 82.9 |

| 145.1 | 119.6 |

| 270.0 | 100 | 202.5 | 100 |

Revenue by type of deliverable

Year ended 30 April 2025 | Year ended 30 April 2024 | ||||

| £m | % |

| £m | % |

Product | 207.4 | 77 |

| 148.4 | 73 |

Communications and Intelligence | 80.4 | 30 | 45.1 | 22 | |

Sensors and Effectors | 127.0 | 47 |

| 103.3 | 51 |

Services | 62.6 | 23 |

| 54.1 | 27 |

Communications and Intelligence | 44.5 | 16 | 37.8 | 19 | |

Sensors and Effectors | 18.1 | 7 |

| 16.3 | 8 |

|

|

|

|

|

|

Total revenue | 270.0 | 100 |

| 202.5 | 100 |

Operational outlook

Order intake and order book

Order intake | Order book | ||||

| 2025 £m | 2024 £m |

| 2025 £m | 2024 £m |

Communications and Intelligence | 136.3 | 64.3 | 202.4 | 108.0 | |

Sensors and Effectors | 148.4 | 327.8 |

| 414.0 | 410.7 |

| 284.7 | 392.1 |

| 616.4 | 518.7 |

The increase in the Group's order book reflects the surplus of orders over revenue (just under 1.1x) and the addition of EM Solutions order book of approximately £80m.

The 2024/25 order intake was 105% (2024: 194%) of the Group's revenue for the year.

The revenue on order (order cover) for the coming year was 79% (2024: 90%) at 30 April 2025. This had risen to 85% in July.

The Group's order intake and order book are the contracted values with customers and do not include any value attributable to frameworks or other arrangements where no enforceable contract exists. The order intake and order book take account of contractual changes to existing orders including extensions, variations and cancellations.

Communications and Intelligence

Order intake at Communications and Intelligence was double last year's and represented 109% of its annual revenue for 2024/25 (2024: 78%). This improvement was a result of strong contract wins at MCL for the UK MOD, nearly three times last year's figure at over £50m. EID's order intake was significantly stronger, at over £50m compared with £10m in 2023/24. MASS's order intake was broadly similar to last year's. EM Solutions order intake was not material in the quarter to 30 April 2025.

This division is dominated by activity with the UK MOD where £81.6m of its order intake (2024: £41.1m) was ultimately intended for that customer. This included the MCL order intake and a two-year extension to MASS's Joint Forces order out to July 2027. The other significant order intake in this division was from Portugal of £45.2m (2024: £6.5m) at EID.

Sensors and Effectors

Order intake at Sensors and Effectors was £148.4m (2024: £327.8), representing 102% of its 2024/25 annual revenue (2024: 272%). The comparison reflects the very strong performance in 2023/24 which included a £135m order for the Royal Navy.

In Europe we continued to win work, including a follow-on order for the Italian submarine sonar suite (Boat 4, the last of the current batch) received by ELAC. Chess also won significant orders for European customers, both for counter drone systems and naval control systems.

We continue to see good prospects in the Maritime domain for our products, both in export markets as well as our domestic markets.

In the Land domain, Chess has seen a marked increase in demand for its stabilised fire-control and tracking systems, particularly in countering drones as part of ground-based air defence solutions, as seen this year. The source of this demand is mostly European. Chess secured around £28m (2024: £17m) of orders with good prospects for the coming year and beyond.

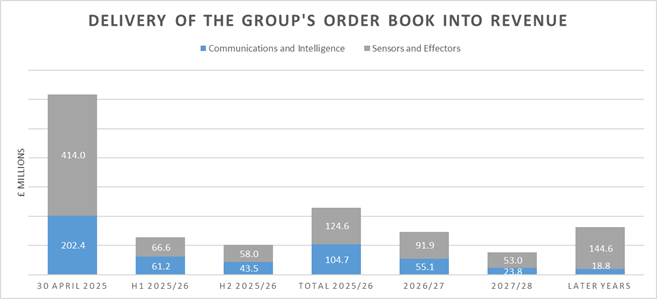

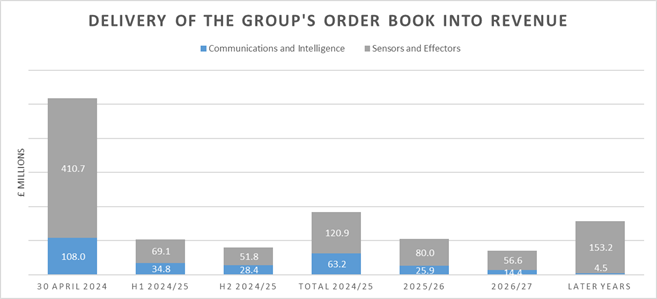

Delivery of the Group's order book into revenue

The table below shows the expected delivery of future revenue from the current order book, together with a similar analysis from 2024/25 for comparison. The growth in on-order revenue for the current year and two following years in the Communications and Intelligence division is notable, reflecting the impact of the EM Solutions acquisition.

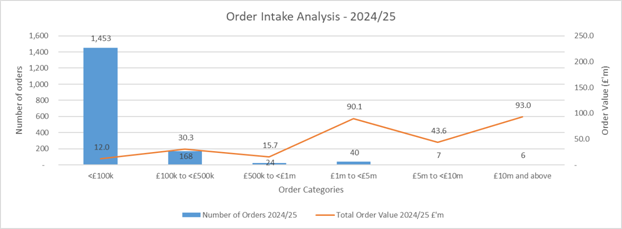

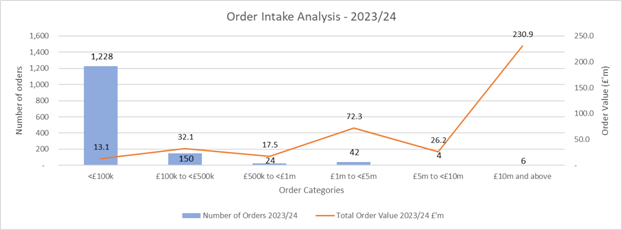

Order intake analysis

Cohort's order book has again grown materially. We already have on order for delivery in 2025/26 85% of the revenue expectations for the year of c£290m. The order book for Sensors and Effectors is both larger and longer than for Communications and Intelligence, in line with the division's greater proportion of long-term projects for naval customers. In Communications and Intelligence, the longevity of the order book is dominated by the multi-year support contracts for the UK MOD at MASS and the order for satellite communications terminals for the Royal Australian Navy at EM Solutions.

The shorter-term nature of some of the business in Communications and Intelligence, especially the product delivery of MCL and MASS's shorter duration contracts in training and cyber, mean that this division will typically enter a financial year with less revenue on order. We do expect to see some increase in the longevity of this division's order book in the coming year with prospects of long-term orders for EID and EM Solutions.

Sensors and Effectors has a number of large multi-year programmes, both for delivery and support, with work now stretching out to 2037. The prospects for this division in the coming year to further increase the size of the order book are good, both in the UK and export markets.

The Group's businesses are not dependent upon a single critical order to achieve their respective revenue targets for 2025/26. The Group revenue infill for the coming year of 21% was higher than last year but in line with historical levels and had further reduced to 15% in July 2025.

We continue to report an analysis of the number of orders secured by a range of order size. This is shown in the "Order intake analysis" above. This shows that 95% (2024: 95%) of the Group's orders (by number) secured are of less than £0.5m in value, accounting for 15% (2024: 11%) of the Group's total order intake value. The remaining 5% of orders account for 85% (2024: 90%) of the Group's total order value. The Ancilia order secured by SEA in March 2024 (announced at £135m) has distorted some of the value comparatives and taking this out, the order number of >£1m was 53 (2024: 51) and a value of £226.7m (2024: £194.4m).

This year we have won thirteen orders larger than £5m (2024: ten) with a total order value of £136.6m (2024: £257.1m). As a policy, we usually only announce individual orders with a value of over £10m.

Funding resource and policy

On 30 April 2025, the Group's cash and readily available credit was £55.3m (2024: £58.1m) which followed acquisitions in the period of EM Solutions (£75m) and ITS (£3m). A very high proportion of our ultimate customers are government agencies, with a clear need to invest in defence and security. The international and domestic security environment still calls for greater resources to be devoted to defence and counterterrorism in the UK and many other countries, especially in the light of continuing events in Ukraine and rising tensions in the Middle East and Indo Pacific. As already mentioned, 79% of our revenue expectation of c£290m for 2025/26 was on contract at 30 April 2025, providing further assurance, and this has since increased to 85%. Having regard to these considerations, the Board considers the Group to be a going concern.

As set out in our Capital allocation policy, the Group retains a robust financial position and continues to be cash generative, enabling it to invest in internal R&D and other value-adding projects on a carefully considered basis as well as maintaining its progressive dividend policy. The Group's cash position and banking facility also provide it with the resources to conduct its acquisition strategy.

The Group completed a renewal of its banking facility on 18 July 2022. The facility was initially for three years to July 2025, and this has been extended, following exercise of an option, to July 2027. The revolving credit facility (RCF) was for an initial £35m with an option (accordion) which was exercised in November 2024 as part of the acquisition of EM Solutions to draw a further £15m, making a total facility available to the Group of £50m of which £33.3m was drawn as at 30 April 2025 and leaving £16.7m available to be drawn. The facility is provided by three banks. There are no further options to extend this current facility. We have already started discussions with our banks regarding a new facility; including the possible inclusion of a fourth bank in the syndicate, and a potential increase in the size of the facility.

The Group's bank borrowings have been reported as due after one year, as the facility in place as at 30 April 2025 is due to expire in July 2027.

The facility provides the Group with a flexible arrangement to draw down for acquisitions and overdraft. The Group's banking covenants were all passed for the year ended 30 April 2025. Looking forward, we expect this to continue out to 31 July 2026 and beyond.

The facility is available to the UK and German members of the Group and is fully secured over the Group's assets, including those in Australia. The renewed facility will ensure that our Australian operations participate fully in the Group's facility.

In the UK, the Group has separate bilateral facilities with two banks for instruments such as forward exchange rate contracts, bank guarantees and letters of credit and in Germany similar banking instruments with one other bank.

The Group takes a prudent approach to treasury policy with its overriding objective being protection of capital. In implementing this policy, deposits are usually held with institutions with credit ratings of at least Baa3. Deposits are generally held on short (less than three months) duration to maturity on commencement. This matches the Group's cash resources with its internal monthly 13-week cash forecasts, retaining flexibility whilst trying to ensure an acceptable return on its cash.

Most of the Group's UK cash (that is not on short-term deposit) is managed through a set-off arrangement, enabling the most efficient use of the Group's cash from day to day, under the supervision of the Group's finance function.

EID's bank facilities are managed locally in Portugal. The cash is spread across a number of institutions to minimise capital risk.

EID provides no security over its assets and its wide range of banks enable it to be well supported in executing export business, specifically in respect of foreign exchange contracts, guarantees and letters of credit.

The Group regularly reviews the ratings of the institutions with which it holds cash and always considers this when placing a new deposit.

The Group's net funds at 30 April 2025 were £5.3m (30 April 2024: £23.1m). This position was much better than expected and reflected a marked improvement in working capital management in Sensors and Effectors, and trading in Communications and Intelligence. The increase in activity and order book has resulted in a marked increase in both the Group's trade and other receivables and trade and other payables. There has been an increase of £28.6m in net trade related liabilities since last year, primarily contract advances that will be consumed as orders are fulfilled.

Looking forward, we expect the Group's net funds at 30 April 2026 to be higher, as the capital investment at ELAC comes to an end in the early Autumn of 2025 and working capital positions at EID and Chess recover, more than offsetting expected unwinds elsewhere and the net impact of the Transport business disposal.

The Group expects to see a further increase in net funds by 30 April 2027, if there is no further corporate activity.

In addition to its cash resources, the Group has in issue 46.7m ordinary shares of 10 pence each. Of these shares 1.2m (2024: 0.9m) are owned by the Cohort plc Employee Benefit Trust (EBT), which waives its rights to dividends. In addition, the Group has issued options over ordinary shares through Key Employee Share Option and SAYE schemes to the level of 2.1m at 30 April 2025 (2024: 1.9m).

The Group's exposure to foreign exchange risk arises from two sources:

1. the reporting of overseas subsidiaries' earnings (currently EM Solutions, EID and ELAC) and net assets in sterling; and

2. transactions in currencies other than our Group reporting currency (£) or subsidiary reporting currency where different (currently € at EID and ELAC and A$ at EM Solutions).

The first risk is a translation, rather than a transaction risk and we do not hedge the translation of earnings.

In terms of reporting asset values, we have in place a natural hedge of borrowing in euros to acquire a euro asset (ELAC) but over time, as the asset grows and the loan diminishes, this hedge will wane.

We have as yet not put in place a natural hedge for the acquisition of EM Solutions but once the new bank facility is in place we will consider swapping some of our current £ sterling debt into A$ for this purpose.

We take a prudent approach to transactional foreign exchange risk requiring all significant sales and purchases to be hedged at the point in time when we consider the transaction to be certain, usually on contract award. We mark these forward contracts to market at each reporting date, recognising any gain or loss in the income statement.

The Group has maintained its progressive dividend policy, increasing its dividend this year by 10% to a total dividend paid and payable of 16.30 pence per share (2024: 14.80 pence), ahead of external expectations.

The last five years' annual dividends, growth rate, earnings cover and cash cover are as follows:

| Dividend Pence | Growth over previous year % | Earnings cover (based upon adjusted earnings per share) | Cash cover (based upon net cash inflow from operations) |

2025 | 16.3 | 10 | 3.3 | 6.9 |

2024 | 14.8 | 10 | 2.9 | 3.7 |

2023 | 13.4 | 10 | 2.7 | 3.0 |

2022 | 12.2 | 10 | 2.6 | 3.9 |

2021 | 11.1 | 10 | 3.0 | 3.6 |

In summary, the Group's cash performance in 2024/25 was as follows:

| 2025 £m | 2024 £m |

Adjusted operating profit | 27.5 | 21.1 |

Depreciation and other non-cash operating movements | 4.2 | 3.4 |

Working capital movement | 20.1 | 1.8 |

| 51.8 | 26.3 |

Acquisition of ITS (including costs) | (3.1) | - |

Acquisition of EM Solutions (including costs) | (80.9) | - |

Placing | 41.0 | - |

Tax, dividends, capital expenditure, interest and other investments | (26.6) | (18.8) |

(Decrease)/increase in net funds | (17.8) | 7.5 |

The higher cash outflow in tax and dividends, etc. was mostly due to capital expenditure (£6.5m higher), mostly at ELAC on its new facility, tax paid (£0.6m higher) and net investment in own shares of £3.1m, £2.0m higher than last year. The balance was higher dividends and net interest paid. We expect the capital expenditure in the coming year on this facility build to be around £9.5m with the building due to complete in the Autumn of 2025.

Looking forward, we retain the flexibility to use newly issued shares as well as EBT shares to satisfy employee share options.

The Group's customer base of governments, major prime contractors and international agencies makes its debtor risk low. The year-end debtor days in sales were 29 days (2024: 55 days). This calculation is based upon dividing the revenue by month, working backwards from April, into the trade debtors balance (excluding revenue recognised not invoiced) at the year end. This is a more appropriate measure than calculating based upon the annual revenue as it takes into account the heavier weighting of the Group's revenue in the last quarter of each year. The decrease has been mostly in Sensors and Effectors due to strong collections in year.

Tax

The Group's tax charge for the year ended 30 April 2025 of £6.0m (2024: charge of £4.5m) was at a rate of 23.4% (2024: 22.9%) of profit before tax. This includes a current year corporation tax charge of £7.1m (2024: £6.4m), a prior year corporation tax credit of £0.4m (2024: £0.6m) and a deferred tax credit of £0.7m (2024: £1.3m credit), mostly in respect of the prior year.

The Group's overall tax rate of 23.4% was below the standard UK corporation tax rate of 25.0% (2024: 25.0%). The decrease is due to both R&D credits and losses brought forward in Portugal partly offset by a higher contribution from Germany (at 31.6%) and Australia (at 30%).

The Group has reported research and development expenditure credits (RDEC) for the UK in accordance with IAS 20 and shown the credit of £3.2m (2024: £2.9m) in cost of sales and adjusted the tax charge accordingly. The RDEC has been reversed in reporting the adjusted operating profit for the Group to ensure comparability of operating performance year on year.

Looking forward, the Group's effective current tax rate (excluding the impact of RDEC reporting) for 2025/26 is estimated at 17% compared with 13% of the pre-RDEC adjusted operating profit less interest for 2024/25. The Group maintains a cautious approach to previous R&D tax credit claims for tax periods that are still open, currently 2023/24 and 2024/25 as well as the potential outcome of a tax audit in Portugal.

Adjusted earnings per share

The adjusted earnings per share (EPS) of 54.44 pence (2024: 42.89 pence) are reported in addition to the basic earnings per share and exclude the effect of amortisation of intangible assets, exceptional items and foreign exchange movements, including marking forward exchange contracts to market, all net of tax.

The adjusted earnings per share exclude non-controlling interest of EID (20%). The reconciliation from last year to this year is as follows:

| Adjusted operating profit £m | Adjusted earnings per share Pence |

Year ended 30 April 2024 | 21.1 | 42.89 |

100% owned businesses throughout the year ended 30 April 2025 | 1.7 | 3.48 |

Impact of businesses with minority holding | 2.3 | 3.77 |

Impact of acquired businesses | 2.4 | 4.91 |

Change in tax rate (excluding RDEC): 12.6% (2024: 12.7%) | - | 0.07 |

Other movements including interest and higher weighted average share capital | - | (0.68) |

Year ended 30 April 2025 | 27.5 | 54.44 |

Increase from 2024 to 2025 | 30% | 27% |

The adjustments to the basic EPS in respect of exchange movements and other intangible asset amortisation of EID only reflect that proportion of the adjustment that is applicable to the equity holders of the parent.

Accounting policies

There were no significant accounting policy changes in 2024/25.

Simon Walther

Financial Director

UNAUDITED CONSOLIDATED INCOME STATEMENT

For the year ended 30 April 2025

| Notes | 2025 £'000 | 2024 £'000 | ||

Revenue | 2 | 270,043 | 202,533 | ||

Cost of sales |

| (179,618) | (126,260) | ||

Gross profit | 90,425 | 76,273 | |||

Administrative expenses | (64,323) | (55,086) | |||

Operating profit | 26,102 | 21,187 | |||

Comprising: |

| ||||

Adjusted operating profit | 2 | 27,475 | 21,141 | ||

Amortisation of other intangible assets (included in administrative expenses) | (3,032) | (3,121) | |||

Cost of acquisition of EMS | (1,635) | - | |||

Cost of acquisition of ITS | (99) | - | |||

Research and development expenditure credits (RDEC) (included in cost of sales) | 3,255 | 2,870 | |||

Credit on forward exchange contracts and loans (included in cost of sales) | 138 | 297 | |||

| 2 | 26,102 | 21,187 | ||

Finance income | 1,125 | 500 | |||

Finance costs |

| (1,599) | (1,863) | ||

Profit before tax | 25,628 | 19,824 | |||

Income tax charge | 3 | (6,008) | (4,532) | ||

Profit for the year |

| 19,620 | 15,292 | ||

Attributable to: |

| ||||

Equity shareholders of the parent | 19,249 | 15,316 | |||

Non-controlling interests |

| 371 | (24) | ||

|

| 19,620 | 15,292 |

| Notes |

Pence | Pence |

Earnings per share |

| ||

Basic | 4 | 45.07 | 37.87 |

Diluted | 4 | 44.25 | 37.72 |

|

| ||

Adjusted earnings per share |

| ||

Basic | 4 | 54.44 | 42.89 |

Diluted | 4 | 53.46 | 42.72 |

|

| ||

Dividends per share paid and proposed in respect of the year |

|

| |

Interim | 5.25 | 4.70 | |

Final | 11.05 | 10.10 | |

16.30 | 14.80 |

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 April 2025

|

| 2025 £'000 | 2024 £'000 |

Assets |

| ||

Non-current assets |

| ||

Goodwill | 76,600 | 50,145 | |

Other intangible assets | 49,087 | 2,848 | |

Right of use asset | 9,688 | 7,818 | |

Property, plant and equipment | 31,009 | 19,370 | |

Deferred tax asset | 4,745 | 2,543 | |

Restricted cash | 7 | 3,198 | - |

|

| 174,327 | 82,724 |

Current assets |

| ||

Inventories | 52,081 | 33,310 | |

Trade and other receivables | 88,984 | 79,377 | |

Current tax assets | 6,495 | 1,823 | |

Derivative financial instruments | 45 | 105 | |

Cash and cash equivalents |

| 74,646 | 55,157 |

|

| 222,251 | 169,772 |

Total assets |

| 396,578 | 252,496 |

Liabilities |

| ||

Current liabilities |

| ||

Trade and other payables | (126,579) | (80,967) | |

Current tax liabilities | (3,708) | (2,150) | |

Derivative financial instruments | (190) | (399) | |

Lease liability | (2,313) | (1,781) | |

Bank borrowings | (36,986) | (15,490) | |

Provisions | (6,441) | (8,914) | |

|

| (176,217) | (109,701) |

Non-current liabilities |

| ||

Deferred tax liability | (13,450) | (887) | |

Lease liability | (7,166) | (6,708) | |

Bank borrowings | (32,410) | (16,530) | |

Provisions | (4,054) | (3,204) | |

Retirement benefit obligations | (3,189) | (5,626) | |

|

| (60,269) | (32,955) |

Total liabilities |

| (236,486) | (142,656) |

Net assets |

| 160,092 | 109,840 |

Equity |

| ||

Share capital | 4,668 | 4,161 | |

Share premium account | 72,954 | 32,157 | |

Own shares | (7,411) | (4,569) | |

Share option reserve | 4,663 | 2,859 | |

Retained earnings |

| 83,732 | 74,066 |

Total equity attributable to the equity shareholders of the parent | 158,606 | 108,674 | |

Non-controlling interests |

| 1,486 | 1,166 |

Total equity |

| 160,092 | 109,840 |

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 30 April 2025

Attributable to the equity shareholders of the parent

| ||||||||

Group | Share capital £'000 | Share premium account £'000 | Own shares £'000 | Share option reserve £'000 | Retained earnings £'000 | Total £'000 | Non- controlling interests £'000 | Total equity £'000 |

At 1 May 2023 | 4,146 | 31,484 | (3,601) | 2,116 | 62,876 | 97,021 | 2,757 | 99,778 |

Profit for the year | - | - | - | - | 15,316 | 15,316 | (24) | 15,292 |

Other comprehensive income for the year | - | - | - | - | (853) | (853) | (23) | (876) |

Total comprehensive income/(expense) for the year | - | - | - | - | 14,463 | 14,463 | (47) | 14,416 |

Transactions with owners of Group and non-controlling interests, recognised directly in equity | ||||||||

Issue of new shares | 15 | 673 | - | - | - | 688 | - | 688 |

Equity dividends | - | - | - | - | (5,598) | (5,598) | - | (5,598) |

Vesting of Restricted Shares | - | - | - | - | 209 | 209 | - | 209 |

Own shares purchased | - | - | (1,917) | - | - | (1,917) | - | (1,917) |

Own shares settled | - | - | 802 | - | - | 802 | - | 802 |

Net loss on settling own shares | - | - | 147 | - | (147) | - | - | - |

Adjustment to non-controlling interest | - | - | - | - | 1,544 | 1,544 | (1,544) | - |

Share-based payments | - | - | - | 1,278 | - | 1,278 | - | 1,278 |

Deferred tax adjustment in respect of share-based payments | - | - | - | 184 | - | 184 | - | 184 |

Transfer of share option reserve on vesting of options | - | - | - | (719) | 719 | - | - | - |

At 30 April 2024 | 4,161 | 32,157 | (4,569) | 2,859 | 74,066 | 108,674 | 1,166 | 109,840 |

Profit for the year | - | - | - | - | 19,249 | 19,249 | 371 | 19,620 |

Other comprehensive expense for the year | - | - | - | - | (3,624) | (3,624) | (51) | (3,675) |

Total comprehensive income/(expense) for the year | - | - | - | - | 15,625 | 15,625 | 320 | 15,945 |

Transactions with owners of Group and non-controlling interests, recognised directly in equity | ||||||||

Issue of new shares | 507 | 40,797 | - | - | - | 41,304 | - | 41,304 |

Equity dividends | - | - | - | - | (6,476) | (6,476) | - | (6,476) |

Vesting of Restricted Shares | - | - | - | - | 133 | 133 | - | 133 |

Own shares purchased | - | - | (3,998) | - | - | (3,998) | - | (3,998) |

Own shares settled | - | - | 889 | - | - | 889 | - | 889 |

Net loss on settling own shares | - | - | 267 | - | (267) | - | - | - |

Share-based payments | - | - | - | 1,375 | - | 1,375 | - | 1,375 |

Deferred tax adjustment in respect of share-based payments | - | - | - | 1,080 | - | 1,080 | - | 1,080 |

Transfer of share option reserve on vesting of options | - | - | - | (651) | 651 | - | - | - |

At 30 April 2025 | 4,668 | 72,954 | (7,411) | 4,663 | 83,732 | 158,606 | 1,486 | 160,092 |

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 30 April 2025

Group | |||

| Notes | 2025 £'000 | 2024 £'000 |

Net cash from operating activities | 5 | 51,184 | 23,017 |

Cash flow from investing activities | |||

Interest received | 1,125 | 500 | |

Purchases of property, plant and equipment | (13,182) | (6,659) | |

Payment for acquisition of subsidiaries, net of cash acquired | (81,589) | - | |

Net cash used in investing activities |

| (93,646) | (6,159) |

Cash flow from financing activities | |||

Issue of new shares | 2,058 | 688 | |

Share placement | 39,246 | - | |

Dividends paid | (6,476) | (5,598) | |

Purchase of own shares | (3,998) | (1,917) | |

Settlement of own shares | 889 | 802 | |

Drawdown of borrowings | 16,780 | - | |

Repayment of borrowings | - | (9,000) | |

Repayment of lease liabilities |

| (2,317) | (1,892) |

Net cash from/(used in) financing activities |

| 46,182 | (16,917) |

Net increase/(decrease) in cash and cash equivalents |

| 3,720 | (59) |

Represented by: |

| ||

Cash and cash equivalents brought forward | 39,667 | 41,454 | |

Net increase/(decrease) in cash and cash equivalents | 3,720 | (59) | |

Foreign exchange loss |

| (4,876) | (1,728) |

Cash and cash equivalents carried forward |

| 38,511 | 39,667 |

| At 30 April 2024 £'000 | Effect of foreign exchange rate changes £'000 | Cash flow £'000 | At 30 April 2025 £'000 |

Net funds reconciliation |

| |||

Cash and bank | 55,157 | (4,876) | 24,365 | 74,646 |

Bank overdrafts | (15,490) | - | (20,645) | (36,135) |

Cash and cash equivalents | 39,667 | (4,876) | 3,720 | 38,511 |

Loan | (16,530) | 49 | (16,780) | (33,261) |

Net funds | 23,137 | (4,827) | (13,060) | 5,250 |

NOTES TO THE PRELIMINARY RESULTS ANNOUNCEMENT

1. BASIS OF PREPARATION

The unaudited summary financial information contained within this preliminary report has been prepared using accounting policies consistent with UK Adopted International Accounting Standards. The financial information contained in this announcement does not constitute statutory accounts as defined in Section 434 of the Companies Act 2006. The results for the year ended 30 April 2025 are unaudited. The financial statements for the year ended 30 April 2025 will be finalised on the basis of the financial information presented by the Board of Directors in this preliminary announcement and will be delivered to the Registrar of Companies after the Annual General Meeting. The financial statements are subject to completion of the audit and may also change should a significant adjusting event occur before the approval of the statutory accounts.

At 30 April 2025, the Group's cash and readily available credit was £55.3m (2024: £58.1m). A very high proportion of our ultimate customers are governments or government agencies, with a clear need to invest in defence and security.

The Directors have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future. Thus, they continue to adopt the going concern basis in preparing the annual financial statements.

The preliminary announcement was approved by the Board and authorised for issue on 16 July 2025.

Copies of the Annual Report and accounts for the year ended 30 April 2025 will be posted to shareholders on 20 August 2025 and will be available on the Company's website (www.cohortplc.com) from that date.

2. SEGMENTAL ANALYSIS OF REVENUE AND OPERATING PROFIT

Year ended 30 April 2025 £000 |

Year ended 30 April 2024 £000 | |

Revenue |

| |

| ||

Communications and Intelligence | 124,891 | 82,929 |

Sensors and Effectors | 145,152 | 119,604 |

270,043 | 202,533 | |

| ||

Adjusted Operating Profit |

| |

| ||

Communications and Intelligence | 21,095 | 12,842 |

Sensors and Effectors | 12,654 | 12,787 |

Central costs | (6,274) | (4,488) |

Adjusted operating profit | 27,475 | 21,141 |

| ||

Amortisation of other intangible assets | (3,032) | (3,121) |

Research and development expenditure credit (RDEC) | 3,255 | 2,870 |

Cost on acquisition of EM Solutions | (1,635) | - |

Cost on acquisition of ITS | (99) | - |

Credit on forward exchange contracts and loans | 138 | 297 |

Operating Profit | 26,102 | 21,187 |

The above segmental analysis is the primary segmental analysis of the Group.

The operating profit as reported under IFRS is reconciled to the adjusted operating profit as reported above by the exclusion of amortisation of other intangible assets, RDEC, exceptional items and changes on marking forward exchange contracts to market value at the year end.

The adjusted operating profit is presented in addition to the operating profit to provide the trading performance of the Group, as derived from its constituent elements on a consistent basis from year to year.

3. TAX CHARGE

| Year ended 30 April 2025 £000 | Year ended 30 April 2024 £000 |

UK corporation tax: in respect of this year | 6,587 | 6,388 |

UK corporation tax: in respect of prior years | (377) | (252) |

Australia corporation tax: in respect of this year | 448 | - |

German corporation tax: in respect of this year | 351 | 528 |

German corporation tax: in respect of prior years | - | (354) |

Portugal corporation tax: in respect of this year | (298) | (442) |

Portugal corporation tax: in respect of prior years | (10) | - |

Other foreign corporation tax: in respect of this year | (4) | - |

| 6,697 | 5,868 |

Deferred tax: in respect of this year | 270 | (1,292) |

Deferred tax: in respect of prior years | (959) | (44) |

| (689) | (1,336) |

| 6,008 | 4,532 |

The current year deferred tax credit includes a credit of £647,000 (2024: credit of £852,000) in respect of the amortisation of other intangible assets and a current year charge of £16,000 (2024: £74,000) in respect of marking forward exchange contracts to market value at the year end.

4. EARNINGS PER SHARE

The earnings per share are calculated by dividing the earnings for the year by the weighted average number of ordinary shares in issue as follows:

Year ended 30 April 2025 £000 |

Year ended 30 April 2024 £000 | |

Earnings |

| |

Basic and diluted earnings | 19,249 | 15,316 |

Credit on marking forward exchange contracts at the year end (net of tax charge of £35,000 (2024: £74,000)) | (103) | (223) |

Cost of acquisition of EM Solutions | 1,635 | |

Cost of acquisition of ITS | 99 | |

Amortisation of other intangible assets (net of tax of £647,000 (2024: £852,000) | 2,374 | 2,254 |

Adjusted basic and diluted earnings | 23,254 | 17,347 |

| Year ended 30 April 2025 Number | Year ended 30 April 2024 Number | |

Weighted average number of shares |

|

| |

For the purposes of basic earnings per share | 42,712,549 | 40,445,297 | |

Share options | 784,652 | 156,639 | |

| |||

For the purposes of diluted earnings per share | 43,497,201 | 40,601,936 |

Year ended 30 April 2025 Pence |

Year ended 30 April 2024 Pence | |

Earnings per share |

| |

Basic | 45.07 | 37.87 |

Diluted | 44.25 | 37.72 |

| ||

Adjusted earnings per share |

| |

Basic | 54.44 | 42.89 |

Diluted | 53.46 | 42.72 |

5. NET CASH GENERATED FROM OPERATING ACTIVITIES

Year ended 30 April 2025 £000 |

Year ended 30 April 2024 £000 | |

| ||

Profit for the year | 19,620 | 15,292 |

Adjustments for: |

| |

Tax charge | 6,008 | 4,532 |

Depreciation of property, plant and equipment | 3,199 | 2,648 |

Depreciation of right of use assets | 2,272 | 1,952 |

Amortisation of goodwill and other intangible assets | 3,032 | 3,121 |

Net finance expense | 474 | 1,363 |

Derivative financial instruments and other non-trading exchange movements | (138) | (297) |

Share-based payment | 698 | 1,106 |

Movement in provisions | 3,857 | 2,213 |

Operating cash inflows before movements in working capital | 39,022 | 31,930 |

| ||

Increase in inventories | (7,133) | (1,371) |

Increase in receivables | (8,851) | (24,726) |

Increase in payables | 35,203 | 23,769 |

19,219 | (2,328) | |

Cash generated by operations | 58,240 | 29,602 |

Tax paid | (5,459) | (4,722) |

Interest paid | (1,598) | (1,863) |

Net cash generated from operating activities | 51,184 | 23,017 |

Interest paid includes the interest element of lease liabilities under IFRS 16 of £334,000 (2024: £284,000).

6. ACQUISITION OF INTERACTIVE TECHNICAL SOLUTIONS LIMITED

On 31 May 2024 Cohort plc acquired 100% of Interactive Technical Solutions Limited (ITS) through its wholly owned subsidiary Marlborough Communications Limited (MCL). This business has been integrated within MCL where it will continue to provide technical support and services to both MCL and external customers, including other members of the Group. No further payments are due.

|

| Final fair value £'000 |

Recognised amounts of identifiable assets and liabilities assumed: | ||

Property, plant and equipment | 31 | |

Other intangible assets | 2,717 | |

Trade and other receivables | 308 | |

Cash | 777 | |

Trade and other payables | (114) | |

Deferred tax liability |

| (687) |

3,032 | ||

Goodwill |

| 734 |

Total consideration (all satisfied by cash) transferred |

| 3,766 |

Net cash outflow arising on acquisition: | ||

Cash consideration paid | 3,766 | |

Cash acquired |

| (777) |

|

| 2,989 |

The fair value adjustments reflect adjustments arising out of Cohort's due diligence work on the acquisition. The fair value adjustment is in respect of the other intangible assets and is analysed, including their estimated useful lives, as follows:

|

| Final fair value £'000 | Estimated life Years |

Contracts | 709 | 2 | |

Customer relationships |

| 2,008 | 8 |

Other intangible assets |

| 2,717 |

|

The other intangible assets acquired are based upon the following:

Contracts

| The estimated profit in the acquired order book of ITS, discounted at an appropriate WACC over the expected life of the order book. This other intangible asset will be amortised over the estimated order book life at a rate to reflect the expected generation of profit from the order book. |

Customer relationships