18th Mar 2025 07:00

This announcement contains inside information for the purposes of Article 7 of Regulation (EU) No 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018. The person responsible for this announcement is Emilie McCarthy, CFO.

18 March 2025

Mortgage Advice Bureau (Holdings) plc

("MAB" or the "Group")

Final Results for the year ended 31 December 2024

Mortgage Advice Bureau (Holdings) plc (AIM: MAB1), a leading technology-driven UK mortgage network and broker, is pleased to announce its final results for the year ended 31 December 2024.

Financial summary

2024 | 2023 | Change | |

Revenue | £266.5m | £239.5m | +11.3% |

Gross profit / Margin | £81.9m / 30.7% | £70.2m / 29.3% | +16.7% / 1.4pp |

Admin expenses / Admin expenses ratio* expenses | £50.5m / 19.0% | £46.7m / 19.5% | +2.7% / -0.5pp |

Adjusted PBT* / Adjusted PBT Margin* | £32.0m / 12.0% | £23.2m / 9.7% | +38.0% / +2.3pp |

Statutory PBT / Statutory PBT Margin | £22.9m / 8.6% | £16.2m / 6.8% | +41.5% / +2.2pp |

Adjusted diluted EPS* | 39.2p | 29.6p | +32.4% / +9.6p |

Basic EPS | 27.6p | 23.6p | +17.0% / +4.0p |

Adjusted cash conversion* | 120% | 119% | +1.0pp |

Net debt* / Leverage* | (£9.7m) / 0.3x | (£15.2m) / 0.6x | +£5.5m / -0.3x |

Proposed final dividend | 14.8p | 14.7p | +0.4% / +0.1p |

Performance highlights

· Adjusted profit before tax (PBT) up 38.0% to £32.0m (2023: £23.2m)

· Gross mortgage completions1 (including Product Transfers) up 3.9% to £26.1bn (2023: £25.1bn)

· Market share of new mortgage lending1 up to 8.4% (2023: 8.3%)

· Closing mainstream advisers2 up 1.2% to 1,941 (2023: 1,918). The number of mainstream advisers2 at 14 March 2025 was 1,985

· Revenue per mainstream adviser2 up 12.3% to £138.7k (2023: £123.5k)

* In addition to statutory reporting, MAB reports alternative performance measures (APMs) which are not defined or specified under the requirements of International Financial Reporting Standards (IFRS). The Group uses these APMs to improve the comparability of information between reporting periods, by adjusting for certain items which impact upon IFRS measures, to aid the user in understanding the activity taking place across the Group's businesses. APMs are used by the Directors and management for performance analysis, planning, reporting and incentive purposes. A summary of APMs used and their closest equivalent statutory measures is given in the Glossary of Alternative Performance Measures.

Peter Brodnicki, Founder and Chief Executive, commented:

"MAB achieved strong financial growth in 2024 and, by doing so, maintained its long track record of outperformance and market share growth in all market conditions.

Strategic spend on technology and digital marketing continued to increase, supporting our plans to deliver a higher level of sustainable growth and futureproof our operations. Aligning our business model to evolving customer preferences for research, advice and seamless transactions will enable advisers to access more potential customers and retain an increasing number of existing ones.

In February, we hosted a Capital Markets Day, during which my team and I set out MAB's vision to become our customers' leading financial partner through life's key moments and demonstrated the significant progress we have made in adapting and evolving our business model to achieve a far wider consumer reach, drive greater lead flows, and increase productivity, efficiency, and margins.

MAB has been listed on AIM for just over a decade. During that time, we have built a market-leading, specialist network for mortgage advisers while returning over £125m in dividends to shareholders - greater than our market capitalisation at IPO. The Board is now evaluating the potential transition to the Main Market of the London Stock Exchange, which should provide access to a broader investor base and further enhance the Group's market profile.

2025 has begun strongly and in line with expectations, with many AR firms anticipating growth in adviser numbers this year while maintaining a focus on increasing profitability through higher productivity. We also have the opportunity to scale our invested businesses and build upon the impressive adviser productivity levels they are already achieving to deliver strong and sustainable shareholder returns over the long term."

Enquiries:

Mortgage Advice Bureau (Holdings) plc | Via Camarco |

Peter Brodnicki, Chief Executive Officer Ben Thompson, Deputy Chief Executive Officer Emilie McCarthy, Chief Financial Officer

| |

Nominated Adviser and Joint Broker Keefe, Bruyette & Woods, a Stifel Company Erik Anderson / Nick Harland / Francis North / Harry Billen

|

+44 (0)20 7710 7600 |

Joint Broker Peel Hunt LLP Andrew Buchanan / Oliver Jackson

|

+44 (0) 20 7418 8900 |

Financial PR Camarco Tom Huddart / Louise Dolan / Letaba Rimell

|

+44 (0) 203 757 4980 |

Investor Relations |

About Mortgage Advice Bureau:

MAB is one of the UK's leading consumer intermediary brands and specialist networks for mortgage advisers.

Through its partner firms known as Appointed Representatives (ARs), MAB has approximately 2,000 advisers providing expert advice to customers on a range of mortgage, specialist lending, protection, and general insurance products. MAB supports its AR firms with proprietary technology and services, including adviser recruitment and lead generation, learning and development, compliance auditing and supervision, and digital marketing and website solutions.

For more information, visit www.mortgageadvicebureau.com

Chief Executive's Review

Overview of 2024

2024 started positively, with lower mortgage rates fuelling optimism and expectations of rate cuts through the year. However, delays in these cuts slowed the anticipated rebound in house purchase and refinance activity during the first half of the year. Following the General Election in July, swap rates and mortgage pricing eased, only to climb again towards the year-end as markets digested Labour's first budget in 14 years, set against a backdrop of global uncertainty around US trade policy and inflation.

Despite these challenges, MAB achieved strong financial growth in 2024. Revenue for the year rose by 11.3% to £266.5m (2023: £239.5m), outpacing the 7.3% growth in UK gross lending over the same period1. Profitability, as measured by adjusted PBT, also saw a significant increase of 38.0%, rising from £23.2m in 2023 to £32.0m in 2024.

In 2024, MAB continued to invest in technology and digital marketing ('strategic spend') to drive organic growth. MAB remains well-positioned for sustainable growth and has proved to be resilient in adverse and subdued market conditions. We have a strong focus on futureproofing our business model to align with evolving customer preferences in how they research, receive advice and conduct transactions seamlessly. For us, how we grow is just as important as how fast we grow, and our deliberate strategy positions us uniquely to capitalise on the significant and growing opportunities we generate.

We maintain our focus on adviser productivity, achieving significant improvements in 2024. Productivity, as measured by revenue per adviser, increased by 12.3% from £123.5k to £138.7k over the period. Enhancing productivity remains a key priority, with technology and lead generation playing a crucial role in driving further operational efficiency and revenue growth.

Lead generation and lifetime customer value

MAB has been built on a foundation of providing exceptional service for introducer lead sources and their customers. We have further strengthened this commitment by investing in early customer engagement, data analytics and profiling, to gain deeper insights into the needs of both existing and future customers. These enhancements not only improve the customer experience but also drive greater lifetime value.

We have added digital lead generation to drive additional lead flow from existing lead sources, including early-stage researchers that are not yet ready to speak to an adviser. This enables us to guide customers on their journey to become mortgage-ready, enhancing early engagement and converting a greater percentage of opportunities into completed business. Through our proprietary technology ('MIDAS Platform'), we track the effectiveness of this approach. Customer referrals from existing lead channels have increased, and we continue to optimise this engagement strategy to maximise lead conversion.

Customer retention remains a key priority, with approximately 40% of our annual mortgage applications coming from returning customers who have transacted previously with MAB ARs. As the client bank continues to expand, so do retention opportunities, enabling our ARs to strengthen long-term relationships with customers and drive sustainable growth. To support this, in 2024, MAB invested in a 'Mortgage Monitoring' tool, which is primarily designed to help ARs be more successful at communicating with, and retaining, more customers. This has been rolled out across all our ARs and is particularly timely given the high volume of mortgage maturities forecast in 2025. This tool provides monthly updates to clients and continuously scans the market, alerting customers as to when securing a new mortgage deal would be beneficial. This innovation is expected to enhance retention while delivering a superior customer experience at minimal cost.

National, local and organic lead sources

The acquisition of Fluent strengthened MAB's market position, providing access to national lead sources and new digital channels, including strategic partnerships with MoneySuperMarket and Compare the Market. Building on that foundation, we have continued to expand and enhance our national lead sources. Together, these partnerships enable us to engage with customers early in their research process, leveraging data-driven insights to tailor our services and enhance lead conversion.

Lead generation - acquiring new customers, retaining existing ones, and increasing customer lifetime value - remains a key point of differentiation for MAB. Combined with our 'MIDAS Platform' technology, lead generation is a critical driver of adviser productivity and AR growth, performance, and retention. As technology and Artificial Intelligence (AI) continue to evolve, they will play a pivotal role in how our partner firms acquire, retain, and maximise value for their customers.

We plan to continue investing in these areas, ensuring MAB's business remains futureproofed and continues to deliver strong, sustainable, and profitable growth over the long term.

Contribution from our associates and subsidiaries

MAB operates a capital-light AR platform model, maintaining a consistently modest net debt position and low leverage. This financial strength enables us to make selective equity investments in top-performing companies. We collectively refer to these subsidiaries and associates as our 'invested businesses'.

Returns from these investments have been reinvested to enhance our value proposition, including advancements in technology and best practices, which significantly benefit our AR platform model. This hybrid model fosters a virtuous circle, driving operational efficiencies, synergies, and scalability while strengthening MAB's operating leverage.

MAB has built a strong portfolio of associates and subsidiaries, having acquired minority and majority stakes as well as making full acquisitions. These strategic investments enhance our market position in key specialist areas, including new-build mortgages and digital customer lead generation, reinforcing our leadership and expanding our capabilities. These investments are complementary to, and supported by, the growth of our core platform AR model.

The contribution to Group revenue and profit from our invested businesses has grown significantly since 2019 and is expected to continue increasing. On 29 May 2024, MAB acquired the remaining 20% stake in our subsidiary First Mortgage Direct (FMD) for £9.3m.

Each acquisition is carefully aligned with a strategic objective. In 2022, our investment in Fluent marked a deliberate strategic move towards acquiring new customers through national and digital lead sources, including via Price Comparison Websites (PCW)... The acquisition of Fluent was immediately followed by a very challenging macroeconomic period triggered by the Truss mini budget. However, by focusing on returning the business to growth, we are pleased to report that Fluent delivered £4.4m in adjusted profit before tax (PBT) in 2024, an encouraging turnaround from a £1.1m loss in 2023. Fluent is now well-positioned for continued growth and plays a fundamental role in the Group's strategy for national lead sources

We also plan to scale organically our invested businesses, increase our shareholdings, and streamline operations by consolidating them under unified brands where it is strategically beneficial to do so. The productivity and profitability of our invested businesses significantly exceeds those of our AR network, and we expect them to make an increasing contribution to the Group's overall performance and long-term growth.

Technology and AI

While many industry players are shifting away from in-house solutions, proprietary technology remains central to our strategy. Our continued investment in 'MIDAS Platform', our proprietary technology platform, strengthens our ability to optimise operational efficiency and drive revenue growth from new lead flow, lead nurture, customer retention, adviser productivity and customer lifetime value.

We firmly believe that technological advancement and AI will revolutionise our industry. By retaining control of our technology, we can innovate freely, develop tailored solutions, and seamlessly integrate with our chosen partners, ensuring we stay ahead in a rapidly evolving market.

MAB recognises the growing importance of early customer engagement, which often starts well before they are ready to transact. A key focus area of 'MIDAS Platform' is enhancing the technology experience for both Advisers and customers. We have already achieved significant time savings through innovations such as automated disclosures, document sharing, direct decision-in-principle, and a customer-facing fact find that enables pre-filled data. Our goal is to cut the time required to complete a house purchase mortgage in half by the end of 2025 and achieve a further meaningful reduction in the medium term, leveraging the additional benefits of AI.

Upcoming upgrades will further enhance AR efficiency and have the potential to boost adviser productivity, reinforcing our commitment to a faster, smarter, and more seamless mortgage process.

Our roadmap incorporates greater automation and AI functionality to drive growth and enhance operational efficiency across the business. These advancements will futureproof our model and reinforce our leadership position in the intermediary sector.

We see AI making a significant impact in four core areas:

1. Lead triage and nurturing - improving customer engagement and conversion.

2. Advice - leveraging a "guardian angel" tool to support both advisers and customers.

3. Operational efficiency - streamlining central processes to enhance productivity.

4. Compliance and audit - ensuring accuracy, consistency, and regulatory adherence.

By embracing these innovations, we are shaping the future of mortgage advice and customer experience.

Adviser productivity and growth

Adviser numbers and adviser productivity are key drivers of MAB's organic growth. Now that the housing and mortgage markets have stabilised and show signs of sustainable recovery, AR confidence is returning. As a result, we anticipate recruiting new ARs into our network, while existing ARs are expected to fill more adviser vacancies, driving overall adviser growth. We are also forecasting stronger adviser productivity.

Additionally, our invested businesses have significantly higher adviser productivity than the average of our AR network and by sharing best practices and enhancing AR productivity through improvements in the 'MIDAS Platform' and AI, we expect to elevate performance levels across the Group.

FCA Regulation

Consumer Duty

MAB is committed to delivering the right outcomes for customers in accordance with the FCA Consumer Duty rules. These regulations, which emphasise customer-centric practices, are embedded in our operations and actively overseen by senior leadership. This ensures we consistently uphold the highest standards of consumer protection, reinforcing trust and long-term customer relationships.

Pure Protection - Market Study

In August 2024, the FCA announced a market study into the Distribution of Pure Protection Products to Retail Customers. Delivering good customer outcomes has always been at the heart of MAB's strategy and culture. We view this as a positive initiative for the market, as clearer governance aligns with, and supports, our commitment to high standards, transparency, and customer-centric practices across the Group.

As with Consumer Duty, we fully support elevating industry standards. We believe that raising the bar will drive market consolidation, presenting a strategic opportunity for MAB.

Simplifying responsible lending and advice rules for mortgages

The FCA is taking steps to improve access and flexibility for mortgage borrowers. The regulator has reminded firms of the flexibility within its rules, particularly regarding affordability stress testing. Currently the stress testing applied by lenders prevents a significant number of renters from becoming First Time Buyers (FTBs). The FCA will very shortly launch a Call for Evidence on current and alternative approaches to stress testing.

In a pro-growth environment, and especially in a falling interest rate environment, we believe that any changes in this area will lead to more successful FTB applications. We welcome this move by the FCA.

Additionally, the FCA will soon consult on ways to make it easier for customers to:

- Remortgage with a new lender

- Reduce their overall cost of borrowing through term reductions

- Discuss their options with a firm outside of a regulated advice process

Throughout this work, the FCA will work closely with HM Treasury, the Bank of England, the Financial Policy Committee, and the Prudential Regulatory Authority. For a variety of reasons, we strongly welcome the FCA's focus on these matters and will closely monitor developments with interest.

Advancing MAB's sustainability strategy

MAB continues to enhance its sustainability approach, with a focus on:

· Environmental Leadership and Advocacy

· Social Responsibility and

· Strong Governance and Oversight.

In 2024, our key activities included:

· Supporting energy-efficient homes through tailored advice and funding solutions

· Promoting the adoption of 'Green Mortgages', by collaborating with lenders and advisers to increase accessibility and awareness

· Enhancing internal climate risk governance by embedding ESG considerations into decision-making at all levels.

Resilient Homes

In 2024, MAB launched Resilient Homes, a pioneering initiative that connects homeowners with solutions to improve their homes' energy efficiency. Through MAB's Resilient Homes proposition, we provide our ARs with the means to help customers explore upgrade opportunities via trusted and fully vetted partners, assess the associated costs, secure financing solutions, and access mortgage and protection advice. With 11.5 million owner-occupied homes across England and Wales - representing 72% of all households - there is a significant opportunity to support energy efficiency improvements. Resilient Homes strengthens our AR proposition while positioning MAB as a key player in advancing the UK's net-zero ambitions.

Approximately 50% of MAB mortgage customers acquire or remortgage properties with an EPC rating of D or below. If just 2% of these customers chose to implement energy improvements such as solar panels with battery storage, MAB advisers would facilitate greenhouse gas reductions of approximately 868 tCO₂ annually. This impact equates to planting approximately 34,720 mature trees each year or eliminating four million miles of standard car travel.

While the Green Mortgage market is still maturing, and many customers have yet to fully engage or afford home energy improvements, we firmly believe this market will scale significantly as environmental concerns, energy costs, and climate change pressures become increasingly compelling.

MAB is already well-positioned for this shift, offering a comprehensive end-to-end solution while actively engaging customers and providing tailored mortgage advice on this important topic.

Green Mortgage growth

Green Mortgages are lender-defined products that include an incentive for borrowers to either purchase an energy-efficient property or improve the energy efficiency of an existing property. After a challenging 2023, green mortgage lending rebounded strongly in 2024, accounting for 7.6% of total lending - a 75% increase in value compared to the previous year. Growth was particularly strong in Q4, driven by greater lender innovation and rising consumer demand. Notably, Green Mortgages are increasingly being used for both new-build and older properties, indicating a market shift towards retrofit-focused lending solutions.

ESG performance monitoring

MAB has strengthened its ESG reporting framework by introducing a refined set of sustainability key performance indicators (KPIs). These KPIs include energy efficiency metrics related to mortgages, community engagement measures, and social impact related measures, ensuring greater transparency and accountability. A baseline was established in 2024, with improvement targets to be defined in 2025.

Climate risk integration

MAB has strengthened its climate risk management approach by embedding sustainability within its governance structure and risk framework. The Sustainability Committee, which includes senior leadership and executive directors, provides oversight on ESG matters and reports directly to the Board. In addition, climate-linked performance incentives have been introduced for senior leadership, reinforcing MAB's commitment to long-term sustainability goals.

2024 sustainability highlights:

· Customer Experience: Feefo rating increased to 5 stars, with Trustpilot at 4.7, reflecting consistently high satisfaction levels.

· Community Engagement: Expanded social impact initiatives from 13 to 17, with increased funding of £50,000 directed towards charitable and community-led projects.

· Total carbon emissions increased marginally from 335 tCO₂e to 340 tCO₂e (market basis), driven by higher gas consumption for office heating. However, electricity consumption decreased by 11%, and zero waste to landfill was maintained at HQ.

· Green Mortgage growth: Green lending rebounded strongly in 2024, now representing 7.6% of total lending volume - a 75% year-on-year increase, with the strongest growth in Q4 2024. Uptake is more evenly split between new-build and older properties, and 73% of Green Mortgages now support house purchases.

· Through our Resilient Homes proposition, we continue to integrate certified retrofit services into mortgage advice, helping customers explore energy efficiency improvements.

MAB remains dedicated to embedding sustainability across all areas of the business, ensuring alignment with evolving regulations, industry standards, and market expectations. Looking ahead, we will continue to refine our ESG strategy to enhance impact and accountability while collaborating with industry partners to drive innovation in sustainable home financing.

Medium-term growth targets

The Board has set medium-term growth targets that reflect our ambition to scale MAB and deliver significant value for stakeholders:

· Double revenue from that achieved in 2024

· Adjusted PBT margin of >15%

· Adjusted cash conversion of >100%

· Double market share (new mortgage lending)

Capital Markets Day

In February 2025 we hosted a Capital Markets Day at the London Stock Exchange for shareholders, prospective investors and analysts. Founder and Chief Executive Officer (CEO) Peter Brodnicki, Deputy CEO Ben Thompson, Chief Financial Officer (CFO) Emilie McCarthy and Chief Risk Officer (CRO) Paul Gill led the presentations of MAB's vision, business model and strategy and medium-term growth targets.

The event included presentations on:

· Mortgage innovation opportunities,

· Customer acquisition and lifetime value,

· Platform model, scalability and performance,

· Regulation and Consumer Duty,

· Growth and capital allocation, and

· Insights from our ARs.

Consideration of move to Main Market

The Board continues to evaluate a potential transition to the Main Market, with the ambition of securing inclusion in the FTSE 250 index. This step should open access to a broader investor base and further enhance the Group's market profile. We are committed to ensuring that any transition is both strategic and responsible, with timing dependent on continued strong performance. Further updates will be provided as appropriate.

Current trading and outlook

We experienced increased mortgage activity through much of the second half of 2024, a trend we expect to continue through 2025. During this period, the cost of borrowing and mortgage rates declined from recent highs, as the Bank of England Base Rate began to fall - from 5.25% to 4.75% at the end of the year and to 4.5% in February this year.

While inflation remains lower, it remains a factor to watch. However, when combined with real wage increases, we anticipate an improvement in mortgage affordability for all borrowers.

The release of pent-up demand became evident in Q4 2024, with mortgage applications rising by 15% compared to Q4 2023. According to UK Finance, gross mortgage lending is forecast to grow by 11% in 2025, while Product Transfers are projected to rise by 13%.

Re-financing will be a key driver of activity in the second half of2025 and into 2026, fuelled by a large volume of maturing mortgage deals during this period. This surge is driven by 5-year fixed mortgages from the post-pandemic boom, and 2-year fixed deals from 2022/23, which saw high volumes immediately following the Truss mini budget. Many of these mortgages were secured at higher rates, prompting borrowers to seek better terms as rates continue to decline.

The housing market is showing signs of recovery as affordability improves, driven by increased buyer activity and a higher volume of new properties coming onto the market in late 2024 and into 2025. If mortgage rates remain stable or decline further, and market confidence continues to grow, we anticipate stronger purchase activity in 2025. While housing transactions are still below long-term averages, a recovery from current lows appears increasingly likely.

We support the Government's growth agenda and its push to increase new housing development in the UK. MAB has a strong track record in new-build mortgages, and as this sector gains momentum - potentially in late 2025 - it should provide a significant tailwind for the Group. Additionally, we welcome ongoing discussions by the Government and UK regulators on reviewing mortgage lending policies to help more renters transition into First-Time Buyers. MAB has long supported this initiative, and we are eager to see how it develops.

Finally, the rollout of new technology enhancements and lead-generation initiatives is set to drive further growth in 2025. Many AR firms anticipate an increase in adviser numbers, alongside a continued focus on profitability through higher productivity levels.

We are well placed to deliver another year of strong revenue and profit growth.

Financial Review

Revenue

The Group delivered strong growth in the year. Revenue was up 11.3% to £266.5m (2023: £239.5m) and continued to be generated from three core areas, as follows:

Income source (£m) | 2024 | 2023 | Change |

Mortgage procuration fees | 105.8 | 98.0 | +7.9% |

Protection and General insurance (GI) commission | 104.7 | 93.1 | +12.4% |

Client fees | 51.2 | 43.4 | +18.1% |

Other income | 4.8 | 5.0 | -3.4% |

Total | 266.5 | 239.5 | +11.3% |

The business mix by lending value is set out below.

Business mix (%) | 2024 | 2023 | Change |

Purchase | 53% | 47% | +6pp |

Remortgage | 25% | 27% | -2pp |

Product transfer | 22% | 26% | -4pp |

Total | 100% | 100% |

This performance was driven by increases in all income areas and reflects a favorable shift in mortgage mix and continued focus on delivering great customer outcomes.

· Mortgage procuration fees rose by 7.9% to £105.8m, underpinned by a strong second-half performance and a higher proportion of house purchase transactions. The average mortgage size increased by 5.1% outpacing the average 1.3% rise in house prices between 2023 and 2024.

· Protection and General insurance commission grew by 12.4% to £104.7m, reflecting the key role that advisers play in enhancing customer outcomes and helping clients safeguard their homes - typically their most significant financial commitment. In 2024, the Protection attachment on approved mortgages remained at c38%.

· Client fees increased by 18.1% to £51.2m. This was driven by an increase in second charge mortgages within Fluent and greater house purchasing activity, which has a higher Client Fee attachment rate.

The proportion of revenue from each income stream remained broadly consistent:

Income source | 2024 | 2023 |

Mortgage procuration fees | 40% | 41% |

Protection and General insurance (GI) commission | 39% | 39% |

Client fees | 19% | 18% |

Other income | 2% | 2% |

Total | 100% | 100% |

Revenue per mainstream adviser (productivity)

Revenue per mainstream adviser grew 12.3% in 2024 from £123,500 to £138,700 driven by an increase in the proportion of advisers within our invested AR firms (who generate significantly above average revenue per adviser) - greater adoption of technology; and a reduction in the number of new advisers, who typically take 6-9 months to reach full productivity.

The productivity dynamic between invested and non-invested firms, particularly for first-charge mortgage products, is noteworthy.

In 2024, the first charge mortgage revenue (including procuration fee, protection and GI commission, and client fees) per average mainstream adviser was c80% higher in invested firms than non-invested ARs.

| Average number of advisers | Productivity per adviser (£000s) |

Invested AR firms | 426 | 178.3 |

Non - invested AR firms | 1,442 | 98.9 |

Gross profit and gross profit margin

Gross profit increased 16.7% to £81.9m (2023: £70.2m) with a gross margin improving 30.7% (2023: 29.3%). This growth was driven by a combination of operational efficiencies, an improved business mix, and contributions from high-margin subsidiaries.

The shift towards house purchases - where protection attachment rates are typically higher -further supported gross profit growth.

Margin expansion was also driven by the strong performance of MAB's higher-margin subsidiaries - FMD, Auxilium, and Vita. In these consolidated businesses, adviser employment costs are offset by retaining all revenue within the Group, resulting in gross profit margins well above our Group average. This emphasis on higher-margin subsidiaries is a core pillar of MAB's growth strategy, enabling continued investment in innovation, particularly in technology.

Fluent and FMD together contributed to a total margin improvement of £7.0m, Fluent accounting for £4.8m (c.41%) of the £11.7m increase, benefiting from the rightsizing of its cost base in H1 2023 and a higher lead conversion rate, with FMD accounting for £2.2m driven by a higher volume of Protection.

Administrative expenses

Administrative expenses increased by £3.8m (+8.2%) to £50.5m in 2024, reflecting ongoing investment in the Group's capabilities to support long-term organic growth.

During the year, £1.3m of software development costs relating to the 'MIDAS Platform' were capitalised for the first time, ensuring alignment between investment and future economic benefits. Adjusting for this capitalisation, the underlying administrative expense ratio remained broadly stable at 19.4%, compared to 19.5% in 2023.

The Group continues to invest strategically in technology and digital marketing, leveraging a combination of in-house expertise and third-party resources. These investments are expected to drive enhanced lead generation opportunities, greater operational efficiencies and therefore future revenue growth and future productivity.

The Group benefits from a relatively fixed cost base, where cost increases typically lag revenue growth, creating opportunities for operating leverage as the Group continues to scale.

Adjusted Profit Before Tax (PBT) and margin

Adjusted PBT increased by 38.0% to £32.0m (2023: £23.2m), with the adjusted PBT margin improving to 12.0% (2023: 9.7%). Excluding the capitalisation of 'MIDAS Platform' Capex, adjusted PBT was £30.7m, representing a 32.5% increase, with a corresponding margin of 11.5%.

The significant improvement in adjusted PBT margin was driven by a higher gross profit margin, combined with a broadly stable administrative expense ratio, reflecting the Group's ability to scale efficiently.

All areas of the business contributed to profit growth, with Fluent delivering a particularly strong performance, contributing £5.5m to the increase-clear evidence of the required business turnaround.

Adjusted profit before tax excludes costs associated with acquisitions and investments, including amortisation of acquired intangibles, non-cash operating expenses associated with the put and call option agreements on the Fluent and Auxilium acquisitions and non-recurring restructuring costs.

Statutory profit before tax

Statutory profit before tax was £22.9m (2023: £16.2m), with £2.9m higher costs relating to acquisitions and investments offset by £0.5m of non-recurring restructuring costs in 2023. As a result, the margin on statutory profit before tax was 8.6% (2023: 6.8%).

Taxation

The effective tax rate on adjusted profit before tax is 25.3% (2023: 21.8%), primarily reflecting the full year impact of the increase in the prevailing UK corporation tax rate. The adjusted effective rate is broadly in line with the headline UK tax rate with non-deductible expenses being offset by untaxed profit from associates.

The tax charge of £6.8m (2023: £3.7m) represents an effective tax rate on statutory profit before tax of 29.7% (2023: 23.0%), which is higher than the headline UK corporation tax rate of 25% mainly due to disallowable acquisition related costs.

Earnings per share

In 2024, adjusted diluted earnings per share* was 39.2p (2023: 29.6p) and basic earnings per share increased to 27.6p (2023: 23.6p). In 2024 the 11.6p difference between adjusted and basic EPS is mainly due to £6.9m of acquisition related costs net of any tax impact attributable to the parent.

Dividend

The Board is pleased to propose a final dividend of 14.8.p per share (2023: 14.7p). This makes a proposed total dividend for the year of 28.2p per share (2023: 28.1p). This represents a cash outlay of £8.6m (2023: £8.4m). Following payment of the dividend, the Group will continue to maintain significant surplus regulatory reserves.

The record date for the final dividend will be 25 April 2025 and the payment date 27 May 2025. The ex-dividend date will be 24 April 2025.

As previously announced, the Board expects to pay a dividend of approximately 50% of adjusted post-tax and minority interest profits in 2025 and is committed to a progressive dividend policy thereafter.

Adjusted cash conversion

The Group's operations generate strong positive cash flow, as evidenced by the net cash from operating activities of £38.6m (2023: £29.7m). Adjusted cash conversion* was 120% (2023: 119%), which supports our expectation that adjusted cash conversion will continue to exceed 100%.

Capital adequacy

The Group enjoys significant headroom on the regulatory requirements of its regulated entities. The Group's regulatory capital requirement represents 2.5% of regulated revenue in regulated entities within the Group and increased to £6.2m at 31 December 2024 (2023: £5.5m) as a result of further growth in regulated activity. At 31 December 2024 the Group had headroom of £43.0m (2023: £28.0m) on its regulatory capital requirement, a 690% surplus

Capital allocation

In February 2025 the Board approved a new capital allocation framework, transitioning from the previous payout-based dividend policy to a progressive dividend policy that has no specific payout ratio target. This revised approach reflects our desire to optimise the mechanism by which capital is returned to shareholders and ensure sufficient capital is available to fund growth opportunities.

The Group actively monitors its capital position, strategically allocating resources based on defined return criteria. Our capital allocation framework strikes a balance between funding growth initiatives and delivering returns to shareholders, as outlined below:

Financial resilience. Ensuring our regulated entities meet their capital requirements while maintaining a low level of Group leverage. In 2024 our surplus regulatory capital was £43.0m (2023: £28.0m) and our net debt was £9.7m (2023: £15.2m) equating to leverage of 0.3x (2023: 0.6x).

Organic growth investment. We define this as 'strategic spend', which we commit to future-proof MAB, including technology, AI, digital marketing and personnel. In 2024 the Group had a combined strategic spend of £8.4m, comprising £6.3m of technology spend (including £2.0m of Dashly minority acquisition investment), £1.6m of digital marketing spend and £0.5m spent on recruitment of new personnel.

Ordinary dividends. We expect to pay a combined £16.3m of dividends to shareholders in respect of 2024, with the final dividend payment expected on 27 May 2025.

M&A. In 2024 we exercised the option to purchase the remaining 20% of FMD for a total cash consideration of £2.3m (plus £7.0m of shares issued) and £0.5m of deferred cash consideration paid to Fluent.

Surplus capital. In 2024 there were no additional distributions beyond ordinary dividends.

Corporate Information

The financial information for the year ended 31 December 2024 and the year ended 31 December 2023 does not constitute the company's statutory accounts for those years.

The statutory accounts for the year ended 31 December 2023 have been delivered to the Registrar of Companies. The statutory accounts for the year ended 31 December 2024 will be delivered to the Registrar of Companies in due course.

The auditor's report on the accounts for the year ended 31 December 2024 and 31 December 2023 were unqualified, did not draw attention to any matters by way of emphasis, and did not contain a statement under sections 498(2) or 498(3) of the Companies Act 2006.

Consolidated statement of comprehensive income for the year ended 31 December 2024

2024 | 2023 | ||

Note | £'000 | £'000 | |

Revenue | 3 | 266,537 | 239,533 |

Cost of sales | 4 | (184,636) | (169,371) |

Gross profit | 81,901 | 70,162 | |

Administrative expenses | (50,511) | (46,674) | |

Share of profit from associates | 15 | 1,315 | 848 |

Costs relating to First Mortgage, Fluent and Auxilium options | 5 | (2,732) | (4,277) |

Amortisation of acquired intangibles | 5 | (5,160) | (5,160) |

Acquisition costs | 5 | (89) | (159) |

Restructuring costs | - | (539) | |

Gain/(Loss) on fair value measurement of derivative financial instruments | 15 | 21 | (190) |

Operating profit | 6 | 24,745 | 14,011 |

Finance income | 8 | 585 | 291 |

Finance expense | 8 | (1,267) | (1,427) |

Unwinding of redemption liability | 5 | (626) | (1,183) |

(Loss)/Gain on remeasurement of redemption liability | 5 | (551) | 4,486 |

Profit before tax | 22,886 | 16,178 | |

Tax expense | 9 | (6,804) | (3,719) |

Profit for the year | 16,082 | 12,459 | |

Total comprehensive income | 16,082 | 12,459 | |

Profit is attributable to: | ||

Equity owners of the Parent Company | 15,896 | 13,467 |

Non-controlling interests | 186 | (1,008) |

16,082 | 12,459 | |

Earnings per share attributable to the owners of the Parent Company

Basic | 10 | 27.6p | 23.6p |

Diluted | 10 | 27.4p | 23.5p |

Adjusted measures | ||

Adjusted EBITDA | 35,103 | 26,728 |

Adjusted profit before tax | 32,023 | 23,200 |

Adjusted diluted earnings per share | 39.2p | 29.6p |

Adjusted profit before tax (exc. software capex) | 30,745 | 23,200 |

Adjusted diluted earnings per share (exc. software capex) | 37.6p | 29.6p |

Further details of adjusted measures are provided within the Glossary of Alternative Performance Measures.

Consolidated statement of financial position as at 31 December 2024

|

| 2024 | 2023 | |||

| Note | £'000 | £'000 | |||

Assets |

|

|

| |||

Non-current assets | ||||||

Property, plant and equipment | 12 | 5,047 | 5,799 | |||

Right of use assets | 13 | 3,960 | 2,283 | |||

Goodwill | 14 | 53,885 | 53,885 | |||

Other intangible assets | 14 | 48,381 | 51,474 | |||

Investments in associates and joint venture | 15 | 14,818 | 12,301 | |||

Derivative financial instruments | 15 | 212 | 302 | |||

Trade and other receivables | 16 | 1,089 | 353 | |||

Deferred tax asset | 22 | - | 719 | |||

Total non-current assets | 127,392 | 127,116 | ||||

Current assets | ||||||

Trade and other receivables | 16 | 9,763 | 9,321 | |||

Cash and cash equivalents | 17 | 23,675 | 21,940 | |||

Total current assets | 33,438 | 31,261 | ||||

Total assets | 160,830 | 158,377 | ||||

Equity and liabilities | ||||||

Share capital | 23 | 58 | 57 | |||

Share premium | 24 | 55,163 | 48,155 | |||

Capital redemption reserve | 24 | 20 | 20 | |||

Share option reserve | 24 | 4,312 | 6,045 | |||

Retained earnings | 24 | 14,109 | 15,921 | |||

Equity attributable to owners of the Parent Company | 73,662 | 70,198 | ||||

Non-controlling interests | 1,433 | 4,211 | ||||

Total equity | 75,095 | 74,409 | ||||

Liabilities | ||||||

Non-current liabilities | ||||||

Trade and other payables | 18 | 2,979 | 2,642 | |||

Redemption liability | 5 | 3,970 | 2,793 | |||

Lease liabilities | 13 | 3,377 | 1,805 | |||

Derivative financial instruments | 15 | 71 | 183 | |||

Loans and borrowings | 19 | 8,735 | 12,426 | |||

Deferred tax liability | 22 | 11,385 | 11,417 | |||

Total non-current liabilities | 30,517 | 31,266 | ||||

Current liabilities | ||||||

Trade and other payables | 18 | 36,503 | 35,225 | |||

Clawback liability | 21 | 12,591 | 10,331 | |||

Lease liabilities | 13 | 843 | 931 | |||

Loans and borrowings | 19 | 5,102 | 5,824 | |||

Corporation tax liability | 179 | 391 | ||||

Total current liabilities | 55,218 | 52,702 | ||||

Total liabilities | 85,735 | 83,968 | ||||

Total equity and liabilities | 160,830 | 158,377 | ||||

The notes that follow form part of these financial statements.

The financial statements were approved by the Board of Directors on 17 March 2025.

P Brodnicki E McCarthy

Director Director

Consolidated statement of changes in equity for the year ended 31 December 2024

Attributable to owners of the Parent Company | |||||||||

Share capital |

Share premium | Capital redemption reserve |

Share option reserve |

Retained earnings |

Total | Non- controlling interest |

Total equity | ||

Note | £'000s | £'000s | £'000s | £'000s | £'000s | £'000s | £'000s | £'000s | |

Balance as at 1 January 2023 | 57 | 48,155 | 20 | 4,511 | 15,154 | 67,897 | 7,548 | 75,445 | |

Profit for the year | - | - | - | - | 13,467 | 13,467 | (1,008) | 12,459 | |

Total comprehensive income | - | - | - | - | 13,467 | 13,467 | (1,008) | 12,459 | |

Transactions with owners Acquisition of non-controlling interests |

5 |

- |

- |

- |

- |

942 |

942 |

(1,487) |

(545) |

Share-based payment transactions | 27 | - | - | - | 3,380 | - | 3,380 | - | 3,380 |

Current and deferred tax recognised in equity | 9, 22 | - | - | - | 449 | 101 | 550 | - | 550 |

Reserve transfer | 27 | - | - | - | (2,295) | 2,295 | - | - | - |

Dividends paid | 11, 29 | - | - | - | - | (16,038) | (16,038) | (842) | (16,880) |

Total transactions with owners | - | - | - | 1,534 | (12,700) | (11,166) | (2,329) | (13,495) | |

Balance at 31 December 2023 and 1 January 2024 | 57 | 48,155 | 20 | 6,045 | 15,921 | 70,198 | 4,211 | 74,409 | |

Profit for the year | - | - | - | - | 15,896 | 15,896 | 186 | 16,082 | |

Total comprehensive income | - | - | - | - | 15,896 | 15,896 | 186 | 16,082 | |

Transactions with owners Acquisition of non-controlling interests |

5 |

1 |

7,008 |

- |

(2,544) |

(1,730) |

2,735 |

(2,735) |

- |

Share-based payment transactions | 27 | - | - | - | 1,682 | - | 1,682 | - | 1,682 |

Current and deferred tax recognised in equity | 9, 22 | - | - | - | (692) | 10 | (682) | - | (682) |

Reserve transfer | 27 | - | - | - | (179) | 179 | - | - | - |

Dividends paid | 11, 29 | - | - | - | - | (16,167) | (16,167) | (229) | (16,396) |

Total transactions with owners | 1 | 7,008 | - | (1,733) | (17,708) | (12,432) | (2,964) | (15,396) | |

Balance at 31 December 2024 | 58 | 55,163 | 20 | 4,312 | 14,109 | 73,662 | 1,433 | 75,095 | |

Consolidated statement of cash flows for the year ended 31 December 2024

|

| 2024 | 2023 | ||||||

| Note | £'000 | £'000 | ||||||

Cash flows from operating activities | |||||||||

Profit for the period before tax | 22,886 | 16,178 | |||||||

Adjustments for: | |||||||||

Depreciation of property, plant and equipment | 12 | 1,133 | 1,225 | ||||||

Depreciation of right of use assets | 13 | 718 | 857 | ||||||

Impairment of right of use assets | 13 | - | 428 | ||||||

Amortisation of intangibles | 14 | 5,707 | 5,470 | ||||||

Unwinding of loan arrangement fees | 32 | 68 | 77 | ||||||

(Gain)/Loss from disposal of fixed assets | 12 | (4) | 36 | ||||||

Share-based payments | 27 | 2,552 | 4,429 | ||||||

Share of profit from associates | 15 | (1,315) | (848) | ||||||

Loss/(Gain) on remeasurement of redemption liability | 5 | 551 | (4,486) | ||||||

Unwinding of redemption liability | 5 | 626 | 1,183 | ||||||

(Gain)/Loss on fair value movements taken to profit and loss | 15 | (21) | 190 | ||||||

Dividends received from associates | 15 | 798 | 403 | ||||||

Finance income | 8 | (585) | (291) | ||||||

Finance expense | 8 | 1,267 | 1,427 | ||||||

34,381 | 26,278 | ||||||||

Changes in working capital | |||

(Increase)/Decrease in trade and other receivables | 16 | (1,178) | 1,432 |

Increase/ (Decrease) in trade and other payables | 18 | 3,168 | (283) |

Increase in clawback liability | 21 | 2,260 | 2,293 |

Cash generated from operating activities | 38,631 | 29,720 | |

Income taxes paid | (6,599) | (5,390) | |

Interest received | 585 | - | |

Acquisition of non-controlling interests | 5 | (2,585) | (592) |

Net cash generated from operating activities | 30,032 | 23,738 | |

Cash flows from investing activities | |||

Purchase of property, plant and equipment | 12 | (381) | (932) |

Direct costs relating to right of use remeasurement | 13 | (45) | - |

Purchase of intangibles | 14 | (2,614) | (1,121) |

Acquisition of associates | 15 | (2,000) | (469) |

Net cash used in investing activities | (5,040) | (2,522) | |

Cash flows from financing activities | |||

Repayment of borrowings | 19,32 | (4,350) | (5,350) |

Interest received | - | 304 | |

Interest paid | (1,397) | (1,312) | |

Principal element of lease payments | 32 | (865) | (907) |

Acquisition of non-controlling interests | 5 | (249) | (593) |

Dividends paid to Company's shareholders | 11 | (16,167) | (16,038) |

Dividends paid to non-controlling interests | (229) | (842) | |

Net cash used in financing activities | (23,257) | (24,738) | |

Net increase/(decrease) in cash and cash equivalents | 1,735 | (3,522) | |

Cash and cash equivalents at the beginning of the period | 21,940 | 25,462 | |

Cash and cash equivalents at the end of the period | 23,675 | 21,940 | |

Notes to the consolidated financial statements for the year ended 31 December 2024

1 | Accounting policies |

Basis of preparation |

The principal accounting policies adopted in the preparation of the consolidated financial statements are set out below. The policies have been consistently applied to all the years presented. |

The consolidated financial statements are presented in Great British Pounds and all amounts are rounded to the relevant thousands, unless otherwise stated.

These financial statements have been prepared in accordance with UK-adopted International Accounting Standards in conformity with the requirements of the Companies Act 2006 that are applicable to companies that prepare financial statements in accordance with IFRS.

The preparation of financial statements in compliance with adopted IFRS requires the use of certain critical accounting estimates. It also requires Group management to exercise judgement in applying the Group's accounting policies. The areas where significant judgements and estimates have been made in preparing the financial statements and their effect are disclosed in note 2.

The financial statements have been prepared on a historical cost basis, except for derivative financial instruments that have been measured at fair value.

The Group's business activities, together with the factors likely to affect its future development, performance and position are set out in the Strategic Report as set out earlier in these financial statements. The financial position of the Group, its cash flows and liquidity position are also set out in the Strategic Report as set out earlier in these financial statements.

The Group made an operating profit of £24.7m during 2024 (2023: £14.0m) and had net current liabilities of £21.4m as at 31 December 2024 (31 December 2023: £21.4m) and equity attributable to owners of the Group of £73.7m (31 December 2023:

£70.2m).

Going Concern

The Directors have assessed the Group's financial prospects until 31 December 2026, considering the current operating environment, and impact of the ongoing geopolitical and macroeconomic uncertainties. The Directors' assessment includes a review of the approved Group plan, the principal risks and uncertainties as well as a review of profitability, cash flows, regulatory capital requirements and compliance with borrowing covenants under the Group's current debt facility.

Sensitivity analysis was conducted, applying severe but plausible stress tests to key assumptions related to business volumes, revenue mix, cash position, banking covenants and regulatory capital adequacy. This included reduction in business volumes between 15% and 20% across each business area within the Group. The Group's financial modelling shows that the Group should continue to be cash generative, maintain a surplus on its regulatory capital requirements and be able to operate within its current financing arrangements.

After evaluating this information, market and regulatory data, and leveraging the knowledge and experience of the Group and its markets, the Directors are comfortable that the Group will continue to generate positive cash flow, maintain regulatory capital surpluses, continue operate, comply with its existing financing arrangement and meet its liabilities as they fall due over this period. Accordingly, the Directors continue to adopt the going concern basis for the preparation of the financial statements.

The impact of climate risk on accounting estimates |

In preparing the financial statements, the Directors have considered the impact of climate change, taking into account the relevant disclosures in the Strategic Report, relevant legislation and regulations. |

The Group has assessed climate-related risks, covering both physical risks and transition risks.

Many of the effects arising from climate change will be longer term in nature with an inherent level of uncertainty and have limited impact on accounting estimates for the current period.

Climate change may also have an impact on the carrying value of goodwill but the potential impact of climate related risks on the Group's impairment assessment is considered sufficiently remote at this point in time and therefore no sensitivity analysis has been performed.

Changes in accounting policies

New standards, interpretations and amendments effective for the year ended 31 December 2024

The Group applied a number of standards and interpretations for the first time in 2024 but these did not have an impact on the consolidated financial statements of the Group. The Group has not early adopted any standards, interpretations or amendments that have been issued but are not yet effective.

Future new standards and interpretations |

A number of new standards and amendments will be effective for future annual and interim periods, and therefore have not been applied in preparing these consolidated financial statements. At the date of authorisation of these financial statements, the following standards and interpretations, which have not been applied in these financial statements, were in issue but not yet effective: |

IFRS S1 - General Requirements for Disclosure of Sustainability-related Financial Information |

IFRS S2 - Climate-related Disclosures |

IFRS S1 and IFRS S2 are not expected to have a material impact on the results of the Group other than to expand on climate related disclosures within the financial statements. It is anticipated that transition reliefs for comparative information prior to the first year of adoption will be utilised. At the time of preparing the most recent full year consolidated financial statements, a decision on the UK adoption of the IFRS Sustainability Standards hasn't been made and any decision on a date to adopt with a decision now been delayed to later on in 2025. We have decided not to voluntarily apply these standards within these financial statements.

IFRS 18 - Presentation and disclosure in financial statements

Management have not undertaken a detailed assessment of the impact of IFRS 18. Changes are only expected to impact the presentation and disclosure certain items within the consolidated financial statements.

IFRS 9 Financial Instruments and IFRS 7 Financial Instruments: Disclosures

Management have not undertaken a detailed assessment of the impact of the issued Amendments to the Classification and Measurement of Financial Instrumentswhich amended IFRS 9 Financial Instruments and IFRS 7 Financial Instruments: Disclosures. Changes are only expected to impact the presentation and disclosure of certain items within the consolidated financial statements.

Current vs non-current classification |

The Group presents assets and liabilities in the consolidated statement of financial position based on current/non-current classification. An asset is current when it is: |

• Expected to be realised or intended to be sold or consumed in the normal operating cycle. |

• Held primarily for the purpose of trading. |

• Expected to be realised within twelve months after the reporting date. |

All other assets are classified as non-current.

A liability is non-current when the Company has the right to defer settlement for at least 12 months after the end of the reporting date. All other liabilities are classified as current.

Due to their short-term nature, the carrying value of cash and cash equivalents, trade and other receivables approximates their fair value.

Basis of consolidation

Subsidiaries |

Where the Company has control over an investee, it is classified as a subsidiary. The Company controls an investee if all three of the following elements are present: power over the investee, exposure to variable returns from the investee and the ability of the investor to use its power to affect those variable returns. Control is reassessed whenever facts and circumstances indicate that there may be a change in any of these elements of control. |

The consolidated financial statements present the results of the Company and its subsidiaries as if they formed a single entity. Intercompany transactions and balances between Group companies are therefore eliminated in full.

The consolidated financial statements incorporate the results of business combinations using the acquisition method. In the consolidated statement of financial position, the acquiree's identifiable assets, liabilities and contingent liabilities are initially recognised at their fair values at the acquisition date. The results of acquired operations are included in the consolidated statement of comprehensive income from the date on which control is obtained. They are deconsolidated from the date on which control ceases.

Non-controlling interests |

The Group recognises non-controlling interests in an acquired entity either at fair value or at the non-controlling interest's proportionate share of the acquired entity's net identifiable assets. This decision is made on an acquisition-by-acquisition basis. For the non-controlling interests in First Mortgage Direct Limited, Project Finland Topco Limited, Vita Financial Limited and Aux Group Limited, the Group elected to recognise the non-controlling interests at its proportionate share of the acquired net identifiable assets and will be derecognised if the entity become a 100% owned subsidiary of the Group. There are no other non- controlling interests. See note 1 for the Group's accounting policies for business combinations. |

Associates |

Where the Group has the power to participate in, but not control the financial and operating policy decisions of another entity, it is classified as an associate where the Group holds between 20% and 49% of the voting rights or if evidence of significant influence can be clearly demonstrated. The Group regularly reassesses the circumstances of each associate to confirm that the treatment the classification as an associate remains appropriate. Associates are initially recognised in the consolidated statement of financial position at cost. Subsequently, associates are accounted for using the equity method, where the Group's share of post acquisition profits and losses and other comprehensive income is recognised in the consolidated statement of comprehensive income (except for losses in excess of the Group's investment in the associate unless there is an obligation to make good those losses). |

Accounting policies for equity-accounted investees have been adjusted to conform the accounting policies of the associate to the Group's accounting policies. Profits and losses arising on transactions between the Group and its associates are recognised only to the extent of unrelated investors' interests in the associate. The investor's share in the associate's profits and losses resulting from these transactions is eliminated against the carrying value of the associate.

Any premium paid for an associate above the fair value of the Group's share of the identifiable assets, liabilities and contingent liabilities acquired is capitalised and included in the carrying amount of the associate. Where there is objective evidence that the investment in an associate has been impaired the carrying amount of the investment is tested for impairment. More information on the assessment of impairment in associates is included in note 2.

Property, plant and equipment |

Items of property, plant and equipment are initially recognised at cost. As well as the purchase price, cost includes directly attributable costs. |

Depreciation is provided on all items of property, plant and equipment, except freehold land at rates calculated to write off the cost of each asset on a straight-line basis over their expected useful lives, as follows:

Gains and losses on disposal are determined by comparing the proceeds with the carrying amount and are recognised in the consolidated statement of comprehensive income. The Directors reassess the estimated residual values and useful economic lives of the assets at least annually.

Other intangible assets |

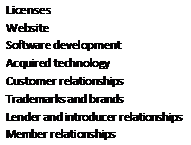

Intangible assets other than goodwill acquired by the Group comprise licences, the website software, acquired technology, customer and member relationships, lender and introducer relationships and trademarks and brands and are stated at cost less accumulated amortisation and impairment losses. |

Software development can include both third party costs and internal staff costs. Software development is only capitalised once development of the intangible has commenced, where technical feasibility of the project has been confirmed, and where it is probable the asset will generate future economic benefits. All costs prior to this are expensed in the period. Software development assets that are not in use are tested for impairment on an annual basis.

Amortisation is charged to the consolidated statement of comprehensive income on a straight-line basis over the period of the licence agreements or expected useful life of the asset and is charged once the asset is available for use. The Group reviews the expected useful lives of assets with a finite life at least annually.

Amortisation, which is reviewed annually, is provided on intangible assets to write off the cost of each asset on a straight-line basis over its expected useful life as follows:

|  |

Impairment of non-financial assets |

Impairment tests on goodwill and other intangible assets with indefinite useful economic lives are undertaken annually at the financial year end or whenever events or changes in circumstances indicate that their carrying amount may not be recoverable. Other intangible assets are tested for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. Where the carrying value of the asset exceeds its recoverable amount (i.e. the higher of value in use and fair value less costs to sell), the asset is written down accordingly. |

Where it is not possible to estimate the recoverable amount of an individual asset, the impairment test is carried out on the smallest group of assets to which it belongs for which there are separately identifiable cash flows, its cash generating units ('CGUs').

Goodwill is allocated on initial recognition to each of the Group's CGUs that are expected to benefit from the synergies of the combination giving rise to the goodwill.

Impairment charges are included in consolidated statement of comprehensive income except to the extent that they reverse gains previously recognised in other comprehensive income. An impairment loss for goodwill is not reversed.

Financial assets |

In the consolidated statement of financial position, the Group classifies its financial assets at amortised cost only if both of the following criteria are met: |

• the asset is held within a business model whose objective is to collect the contractual cash flows; and |

• the contractual terms give rise to cash flows that are solely payments of principal and interest. |

All other financial assets are classified as fair value through profit or loss.

Loans and trade receivables |

Loans and trade receivables are non-derivative financial assets with fixed or determinable payments which arise principally through the Group's trading activities, and these assets arise principally to collect contractual cash flows and the contractual cash flows are solely payments of principal and interest. They are initially recognised at fair value plus transaction costs that are directly attributable to their acquisition or issue, and are subsequently carried at amortised cost using the effective interest rate method, less provision for impairment. |

Impairment provisions for trade receivables are recognised based on the simplified approach within IFRS 9 using the lifetime expected credit losses. During this process the probability of the non-payment of the trade receivables is assessed on an individual receivable balance. This probability is then multiplied by the amount of the expected loss arising from default to determine the lifetime expected credit loss for the trade receivables. For trade receivables, which are reported net, such provisions are recorded in a separate provision account with the loss being recognised within cost of sales in the consolidated statement of comprehensive income. On confirmation that the trade receivable will not be collectable, the gross carrying value of the asset is written off against the associated provision.

Impairment provisions for loans to associates and other parties are recognised based on a forward-looking expected credit loss model. The methodology used to determine the amount of the provision is based on whether there has been a significant increase in credit risk since initial recognition of the financial asset. For those where the credit risk has not increased significantly since initial recognition of the financial asset, twelve month expected credit losses along with gross interest income are recognised. For those for which credit risk has increased significantly, lifetime expected credit losses along with the gross interest income are recognised. For those that are determined to be credit impaired, lifetime expected credit losses along with interest income on a net basis are recognised.

Derivative financial instruments |

Derivative financial instruments comprise option contracts to acquire additional ordinary share capital of associates of the Group. Derivative financial instruments are carried at fair value, with gains and losses arising from changes in fair value taken directly to the statement of comprehensive income. Fair values of derivatives are determined using valuation techniques, including option pricing models. |

Financial liabilities |

Trade and other payables are recognised initially at fair value and subsequently carried at amortised cost. |

Loans and other borrowings |

Loans and other borrowings comprise the Group's bank loans including any bank overdrafts. Loans and other borrowings are recognised initially at fair value net of any directly attributable transaction costs. After initial recognition, loans and other borrowings are subsequently carried at amortised cost using the effective interest rate method. |

Leases |

The Group leases a number of properties from which it operates and office equipment. Rental contracts are typically made for fixed periods of five to ten years, with break clauses negotiated for some of the properties. |

Contracts may contain both lease and non-lease components. The Group allocates the consideration in the contract to the lease and non-lease components based on their relative stand-alone prices.

Payments associated with short-term leases and leases of low value assets will continue to be recognised on a straight-line basis as an expense in the statement of comprehensive income.

Assets and liabilities arising from a lease are initially measured on a present value basis. Lease liabilities include the net present value of the following lease payments:

• fixed payments (including in-substance fixed payments), less any lease incentives receivable; |

• variable lease payments that are based on an index or a rate, initially measured using the index or rate as at the commencement date; and |

• payments of penalties for terminating the lease, if the lease term reflects the Group exercising that option. |

Lease payments to be made under reasonably certain extension options are also included in the measurement of the liability. The lease payments are discounted using the interest rate implicit in the lease. If that rate cannot be readily determined, which is generally the case for leases in the Group, the Group's incremental borrowing rate is used, being the rate that the Group would have to pay to borrow the funds necessary to obtain an asset of similar value to the right of use asset in a similar economic environment with similar terms, security and conditions.

To determine the incremental borrowing rate, the Group: |

• where possible, uses recent third-party financing received by the individual lessee as a starting point, adjusted to reflect changes in financing conditions since third party financing was received; |

• where it does not have recent third-party financing, the Group uses a build-up approach that starts with a risk-free interest rate adjusted for credit risk for leases held by the Group; and |

• makes adjustments specific to the lease, e.g. term, country and security. |

Right of use assets are measured at cost comprising the following: |

• the amount of the initial measurement of lease liability, |

• any lease payments made at or before the commencement date less any lease incentives received, and |

• any initial direct costs. |

Right of use assets are depreciated over the shorter of the asset's useful life and the lease term on a straight-line basis. The Group does not revalue its land and buildings that are presented within property, plant and equipment, and has chosen not to do so for the right of use buildings held by the Group. |

Variable lease payments |

When the Group is exposed to potential future increases in variable lease payments based on an index or rate, they are not included in the lease liability until they take effect. When adjustments to lease payments based on an index or rate take effect, the lease liability is reassessed and adjusted against the right of use asset. |

Extension and termination options |

Termination options are included in a number of the leases across the Group. These are used to maximise operational flexibility in terms of managing the assets used in the Group's operations. The majority of termination options held are exercisable only by the Group and not by the respective lessor. |

In determining the lease term, management considers all facts and circumstances that create an economic incentive to exercise an extension option, or not exercise a termination option. Extension options (or periods after termination options) are only included in the lease term if the lease is reasonably certain to be extended (or not terminated).

Remeasurement |

The Group will remeasure a lease when there has been a contractual variation that amends the scope or length of the lease or in cases where there is a change in the Group's intention to exercise a break option or clause that exists in the contract. The lease liability will be remeasured using the new interest rate implicit in the lease or a revised incremental borrowing rate if the interest rate implicit in the lease isn't readily determined. |

When the lease liability is remeasured, an equivalent adjustment is made to the right of use asset unless its carrying amount is reduced to nil, in which case any remaining amount is recognised within administrative expenses within the consolidated statement of comprehensive income.

Business combinations and goodwill |

Business combinations are accounted for using the acquisition method. The cost of an acquisition is measured as the aggregate of the consideration transferred, which is measured at the fair value on acquisition date, and the amount of any non-controlling interests in the acquiree. For each business combination, the Group elects whether to measure the noncontrolling interests in the acquiree at fair value or at the proportionate share of the acquiree's identifiable net assets. Acquisition-related costs are expensed as incurred. |

When the Group acquires a business, it assesses the financial assets and liabilities assumed for appropriate classification and designation in accordance with the contractual terms, economic circumstances and pertinent conditions as at the acquisition date. This includes the separation of embedded derivatives in host contracts by the acquiree.

Any contingent consideration to be transferred by the acquirer will be recognised at fair value at the acquisition date. Contingent consideration classified as equity is not remeasured and its subsequent settlement is accounted for within equity. Contingent consideration classified as a liability that is a financial instrument and within the scope of IFRS 9 Financial Instruments, is measured at fair value with the changes in fair value recognised in the statement of profit or loss in accordance with IFRS 9. Other contingent consideration that is not within the scope of IFRS 9 is measured at fair value at each reporting date with changes in fair value recognised in profit or loss.

Goodwill is initially measured at cost (being the excess of the aggregate of the consideration transferred and the amount recognised for non-controlling interests and any previous interest held over the net identifiable assets acquired and liabilities assumed). If the fair value of the net assets acquired is in excess of the aggregate consideration transferred, the Group re-assesses whether it has correctly identified all of the assets acquired and all of the liabilities assumed and reviews the procedures used to measure the amounts to be recognised at the acquisition date. If the reassessment still results in an excess of the fair value of net assets acquired over the aggregate consideration transferred, then the gain is recognised in the consolidated statement of comprehensive

After initial recognition, goodwill is measured at cost less any accumulated impairment losses. For the purpose of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash inflows which are largely independent of the cash inflows from other assets or groups of assets (cash-generating units).

Goodwill is capitalised as an intangible asset with any impairment in carrying value being charged to the consolidated statement of comprehensive income. Where the fair value of identifiable assets, liabilities and contingent liabilities exceed the fair value of consideration paid, the excess is credited in full to the consolidated statement of comprehensive income on the acquisition date.

Where goodwill has been allocated to the Group's cash-generating units and part of the operation within the unit is disposed of, the goodwill associated with the disposed operation is included in the carrying amount of the operation when determining the gain or loss on disposal. Goodwill disposed in these circumstances is measured based on the relative values of the disposed operation and the portion of the cash generating unit retained.

If the business combination is achieved in stages, the acquisition date carrying value of the acquirer's previously held equity interest in the acquiree is remeasured to fair value at the subsequent acquisition date. Any gains or losses arising from such remeasurement are recognised in profit or loss.

Where a business combination is for less than the entire issued share capital of the acquiree and there is an option for the acquirer to purchase the remainder of the issued share capital of the business and/or for the vendor to sell the rest of the entire issued share capital of the business to the acquirer, then the acquirer will assess whether a non-controlling interest exists and also whether the instrument(s) fall within the scope of IFRS 9 Financial Instruments and is/are measured at fair value with the changes in fair value recognised in the statement of profit or loss in accordance with IFRS 9.

Options that are not within the scope of IFRS 9 and are linked to service will be accounted for under IAS 19 Employee Benefits and/or IFRS 2 Share-based Payments as appropriate.

IFRS 3 prohibits the recognition of contingent assets acquired in a business combination. No contingent assets are recognised by the Group in business combinations even if it is virtually certain that they will become unconditional or non-contingent.

Provisions |

A provision is recognised in the statement of financial position when the Group has a present legal or constructive obligation as a result of a past event, and it is probable that an outflow of economic benefits will be required to settle the obligation. |

Share capital |

Financial instruments issued by the Group are treated as equity only to the extent that they do not meet the definition of a financial liability. The Company's ordinary shares are classified as equity instruments. Incremental costs directly attributable to the issue of new shares are shown in share premium as a deduction from the proceeds. |

Revenue |

The Group recognises revenue from the following main sources: |

• Mortgage procuration fees paid to the Group by lenders either via the L&G Mortgage Club or directly. |

• Insurance commissions from advised sales of protection and general insurance policies. |

• Client fees paid by the underlying customer for the provision of advice on mortgages, other loans and protection. |

• Other Income comprising income from services provided to directly authorised entities, fees in relation to Later Life lending and Wealth and ancillary services such as conveyancing and surveying. |