16 October 2025 GEO Exploration Limited ("GEO " or the "Company") Final Results for the Year Ended 30 June 2025 | GEO Exploration Limited (LSE AIM: GEO) announces its financial results for the year ended 30 June 2025. HIGHLIGHTS Operational · Rapid advancement of the Juno Project (Western Australia), with multiple surveys completed (gravity, aeromagnetic, LiDAR, EM/IP) and commencement of the maiden drilling programme in September 2025 with DDH1 as contractor. · Drillhole JUD001 completed at 810m on 15 September 2025, intersecting all targeted sequences; assays expected Q4 2025. JUD002 drilling underway. · Expanded tenure at Juno to 450 km² through further licence acquisitions, with further licence application pending which will increase the footprint to 644 km². · Continued farm-out process for Namibian licence PEL0094, with advanced talks ongoing and additional companies in the data room. · Independent technical update confirmed 4.31 billion barrels gross mean prospective resources, a 22% uplift, with GEO's share increasing to 614 MMbbl unrisked (103 MMbbl risk-adjusted). Financial · Group recorded a loss after tax of US$1.09m (2024: US$1.04m). · Year-end cash balance US$1.07m (30 June 2024: US$0.19m). · Fundraising rounds completed in August 2024 and January 2025 raised c.£2.40m, with an additional £10k via warrant exercise. · Further fundraise in September 2025 raised c.£1.11m (post year-end). · CEO interest-free loan of US$270k repaid in September 2025, leaving GEO debt free. Corporate · Strengthened board and management team: - Omar Ahmad appointed CEO & Executive Director on 5 September 2024. - Hamza Choudhry appointed CFO & Executive Director appointed on 5 September 2024. - Azib Khan appointed CCO & Executive Director. - Brian Chu appointed Non-Executive Director & Company Secretary on 5 December 2024. · Departures: Cecilia Yu ceased on 23 October 2024 and Andrew Draffin retired on 5 December 2024. Strategy and Outlook · GEO continues to pursue its dual focus in gold exploration (Australia) and oil exploration (Namibia). · Strong gold market backdrop, with Juno Project drilling programme positioning the Company to capitalise on a potentially district scale opportunity. · Namibia is rapidly emerging as a world-class oil province, with the Walvis Basin attracting majors such as Chevron following Orange Basin discoveries. · GEO aims to farm-out for PEL0094 which will be value accretive for shareholders. · The Company maintains a disciplined capital allocation strategy, targeting selective, high-quality opportunities and periodic review of all licences. Post Balance Sheet Events Since the year-end, the Company has announced several material developments: · Appointment of Drilling Contractor - On 18 August 2025, GEO entered into a contract with DDH1 Drilling Pty Ltd, Australia's leading provider of diamond core drilling services, to undertake the maiden programme at the Juno Project. · Commencement of Maiden Drilling Programme - On 2 September 2025, GEO commenced its maiden drilling programme at Juno, with drill hole JUD001 completed on 15 September 2025 to a final depth of 810 metres. All targeted sequences were intersected, with assays expected in calendar Q4 2025. Drilling of JUD002 is underway. · Capital Raise - On 8 September 2025, GEO successfully completed a placing of 277,250,000 new Ordinary Shares at 0.4 pence per share, raising £1.11m before expenses. · Loan Repayment - On 18 September 2025, the Company repaid in full the interest-free loan of US$270,000 provided by CEO Omar Ahmad. Following repayment, the Company is debt free. Omar Ahmad, Chief Executive Officer, commented: "GEO has delivered a year of transformation, strengthening our project portfolio and balance sheet while executing on our strategy to deliver value for shareholders. At Juno, we are now drilling what we believe has the potential to be a district-scale discovery, backed by a world-class team. In Namibia, we continue to focus on securing a transaction that is clearly value-accretive for our shareholders. We enter the new financial year with strong momentum - debt free and strategically positioned to grow the Company. This is an exciting time for GEO, and we remain focused on delivering results for our shareholders." The Company confirms that a full copy of its latest Annual Report and Accounts for Year Ended 30 June 2025 will be available immediately on the Company's website: www.geoexplorationlimited.com The information contained within this announcement is deemed by the Company to constitute inside information under the UK Market Abuse Regulations ("MAR"). Upon the publication of this announcement via a Regulatory Information Service ("RIS"), this inside information is now considered to be in the public domain. | For further information please visit: www.geoexplorationlimited.com or contact: | GEO Exploration Limited Hamza Choudhry, CFO and Executive Director | [email protected] | SPARK Advisory Partners Limited (Nominated Adviser) Andrew Emmott, Jade Bayat | +44 (0) 20 3368 3555 | CMC Markets (Joint Broker) Douglas Crippen | +44 (0) 20 3003 8632 | SI Capital Limited (Joint Broker) Nick Emerson | +44 (0) 14 8341 3500 | Follow us on social media |

| This announcement has been issued by and is the sole responsibility of the Company. | |

| |

LETTER TO SHAREHOLDERS Dear Shareholders, I am pleased to present to you the GEO Exploration Limited ("GEO" or the "Company") Annual Financial Report for the year ended 30 June 2025. Operations GEO's primary focus during the reporting period has been the rapid progression of the work programme for Juno Project in Western Australia and the continued farm-out process for the Namibian licence PEL 0094 ("Licence") alongside a significant technical update and 22% increased resource upgrade. In August 2024, GEO acquired a 70% interest (subsequently increased to 80%) in a joint venture with world-class mineral resource geologist Callum Baxter for the advancement of a mineral exploration licence 08/3497 located in Western Australia. GEO's primary aim is to conduct exploration for large Intrusion Related Gold Systems (IRGS) which have the potential to host precious and base metal mineralisation similar to the Havieron discovery in Western Australia which Callum Baxter was integral to. During the period, GEO also acquired exploration licences E52/4391 and E08/3744 thus taking GEO's total tenure in Project Juno to 450 square kilometres. The Company has also applied for a new Exploration Licence 08/3792, which upon grant will take the total tenure to 644 square kilometres. During the reporting period, the Company expedited the Juno Project work programme and completed several milestones in order to begin its drilling campaign. This included: ground-based gravity survey, airborne aeromagnetic survey, airborne Light Detection and Ranging (LiDAR) and geophysical modelling whose results are very encouraging as we head towards our initial drill campaign. Most recently the Company has executed the Heritage Agreement with Traditional Owners Nharnuwangga Wajarri and Ngarlawangga and concluded Electrical Geophysical programmes to allow drill targets to be identified. In August 2025, the Company engaged DDH1, a world-class drilling contractor, to undertake our maiden drill programme. Our maiden drill programme at the Juno Project commenced in Q3 of calendar year 2025 and drill hole JUD001 was completed on 15 September 2025 to a final depth of 810 metres, successfully intersecting all targeted sequences. The assays are expected during calendar Q4 2025 and drilling of the second hole, JUD002, is now underway. The farm-out process has been the primary focus for the Namibian licence PEL 0094. Our aim at GEO is to execute a farm-out for the licence on terms which represent the most value accretive to our shareholders. With one party in advanced talks with GEO and other companies now in our data room, we are excited about the increased interest in the licence and see Walvis Basin as the next frontier of oil delivery in Namibia. An independent technical study on the Licence was conducted, confirming a gross mean prospective resource of 4.31 billion barrels, a 22% uplift on the previous total resource total. GEO's working-interest share significantly increases now to 614 MMbbl unrisked(103 MMbbl risk-adjusted) supported by the newly mapped Emerald and Beryl sandstone plays in robust, fault-bounded traps validated by direct hydrocarbon indicators. The Licence covers 5,798 km² in the Walvis Basin "sweet-spot," analogue to Namibia's recent world-class discoveries. During the reporting period, we observed heightened activity in the offshore sector of Namibia, particularly in the Orange Basin. The recent Capricornus -1X discovery by Rhino Resources and Azule, a joint venture between BP and Eni, further indicate that Namibia is emerging as a world-class petroleum province, characterised by significant resource potential. The oil in the Orange Basin is interpreted both by the operators of discoveries in the region and the Company to be sourced from the Barremian-Aptian Kudu Shale. Work undertaken by the Company has demonstrated that this source rock is likely generating oil in and around the Company's PEL0094 licence. In addition, there are further similarities between some of the reservoirs and trapping styles in the Orange Basin and those mapped by the Company within its licence with significant charge in our Welwitschia Deep and Marula prospects. Accordingly, the Company is positive that the Walvis Basin, where PEL0094 is situated, also has the potential to be extremely successful, and has the advantage of much shallower water depths generally than the discoveries in the south. Regarding Italy, in September 2023 the Company announced that it had been informed that appeals against the environmental decrees granted in its favour by the Italian authorities had recently been dismissed by the Council of State (having previously been dismissed by the Tribunal in Rome). The actions were brought by the Municipality of Margherita di Savoia in Puglia against the relevant Italian Ministries and entities - with GEO joined as an "interested party" - and related to all four of the Company's exploration permit applications in the Southern Adriatic ("Applications"). The Company submitted further documentation in connection with the Applications in 2023 to the Italian Ministry of Ecological Transition and has been awaiting further dialogue with the Ministry regarding the process going forward. Once this process is complete, the Company will assess its options in relation to the Applications and make a further announcement accordingly. Financial Position and Corporate The Company successfully completed equity fundraising rounds in August 2024 and January 2025 totalling £2,401,050, with a further £10,000 proceeds from a warrant exercise in December 2024. These funds were primarily focused on advancing the acquisition, exploration and development of the Juno Project, in respect of which we have sufficient funds for the current drill campaign (as part of the £750,000 commitment for Juno Project), along with operational and farm-out costs in Namibia, and general working capital. I also provided an interest-free loan to the company totalling US$270,000, which I extended to September 2025 to allow for funds to be deployed to accelerate the Company's projects. During the reporting period, Hamza Choudhry and I were appointed as Executive Directors, with Hamza as Chief Financial Officer and myself as Chief Executive Officer. In November and December 2024, we were pleased to have Azib Khan join as Chief Commercial Officer and Executive Director with Brian Chu joining as Non-Executive Director and Company Secretary. Ms Cecilia Yu ceased as Executive Director on 21 October 2024 and Andrew Draffin retired from the board on 5 December 2024. The current leadership team underscores our commitment to driving the Company's growth, through its commercial, financial and market expertise with its aim to deliver results which will drive significant value growth to shareholders. Financial Results During the year ended 30 June 2025, the Group recorded a loss after tax of US$1,094,288 (2024: US$1,041,261) with cash balances at 30 June 2025 amounting to US$ 1,072,198 (30 June 2024: US$193,070). Strategy and Outlook GEO's strategy is to maximise its exposure to exploration success with the objective of enhancing shareholder value across high-impact projects in gold and oil exploration. The price of gold continues to perform strongly, recently reaching all-time highs and further bolstering market sentiment. At our flagship Juno Project, we have significantly expanded our footprint, recently securing new licences which doubled our exploration area, with an additional application still pending. Our partnership with a world-class technical operator Callum Baxter has accelerated our programme, and we commenced drilling in the second half of this year. This momentum positions GEO to capitalise fully on the buoyant gold market environment. Namibia continues to emerge as one of the most promising oil provinces globally, driven by substantial recent discoveries in the Orange Basin, including the significant Rhino & Azule Energy Capricornus -1X find. Industry focus is now shifting swiftly northwards to the Walvis Basin, underlined by Chevron's recent farm-in on neighbouring acreage. GEO is strategically located at the heart of this new exploration frontier, and our latest independent technical update demonstrates clear geological similarities to the high-impact discoveries in the Orange Basin. Our resource upgrade to 4.31 billion barrels underscores the immense potential of our block. Advanced discussions are progressing with a potential partner and other potential farm-out partners are continuing to advance their interest, which we are aiming to conclude as swiftly as possible whilst ensuring the best terms for GEO and its shareholders. Overall, GEO remains committed to actively expanding our project portfolio, focusing exclusively on value-accretive opportunities. Our strategy is clear: we will selectively invest in high-quality projects and where possible collaborate closely with expert operators, leveraging their expertise to accelerate projects to deliver results for our shareholders. In line with this disciplined approach, the Board undertakes a periodic review of all licences and projects to ensure an efficient allocation of resources. In addition, through disciplined capital allocation, we intend to build a diversified, balanced portfolio designed to deliver sustained growth and meaningful shareholder returns. GEO is optimistic about its future prospects and remains focused on delivering value to shareholders as it navigates this exciting period of growth. Omar Ahmad Chief Executive Officer |

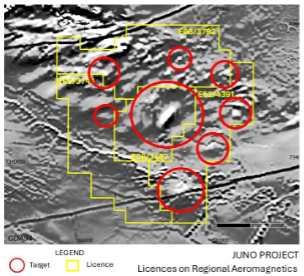

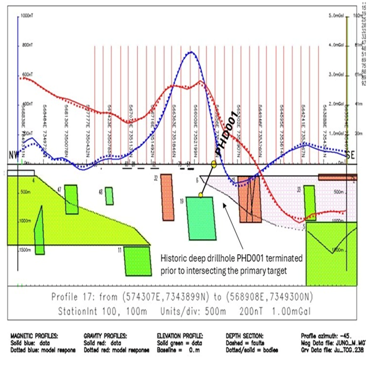

OPERATING AND FINANCIAL REVIEW Juno Project - Western Australia As part of the Company's transformation agenda, in August 2024, the Company announced the acquisition of a 70% interest in a joint venture ("the JV") with Callum Baxter. The JV is focused on the advancement of mineral exploration licence 08/3497 located in Western Australia, in a region recognised for its rich mineral deposits. Callum Baxter was Chief Technical Officer of Greatland Gold plc and was Chairman and CEO of Starvest plc. Callum was the key Geologist in the advancement and exploration of the Havieron Gold discovery in Western Australia, one of the largest high-grade gold discoveries in Australia in the last two decades. Callum Baxter is a member of the Australian Institute of Geoscientists and the Australasian Institute of Mining and Metallurgy. Under the terms of the Joint Venture, GEO: · acquired an initial 70% of the licence for consideration of £200,000. · exercised a 3 month option to purchase an additional 10% of the licence for £50,000 thus increasing GEO's interest to 80% of the licence, with Callum Baxter retaining 20%. · is committed to a minimum expenditure of £750,000 (capital commitment) under the JV over the 12 months following completion. · is to fund 100% of the JV expenditure up to the "Decision to Mine", after which both parties will contribute according to their JV interests. · is the JV Manager and responsible for all exploration activities and must furnish technical reports to Callum Baxter. · will pay up to a 5% royalty on any future production from the Licence. This royalty structure ensures that both parties benefit proportionally from the success of the project. The Company has subsequently been granted two further Exploration Licences, 52/4391 and 08/3744, adjacent to the licence, via its wholly owned subsidiary Juno Gold Pty Ltd. The total area of the Juno Project has increased from 106 square kilometres initially to 450 square kilometres covering multiple magnetic features. In February 2025, GEO applied for a new Exploration Licence, 08/3792, north of the current Exploration Licence 08/3497 in Western Australia, via its wholly owned subsidiary Juno Gold Pty Ltd. Upon the licence being granted, the total tenure for Juno will be 644 square kilometres covering multiple magnetic features. |

| Figure 1 - Juno Project tenure showing existing granted licence E08/3497, E52/4391 and E08/3744 |

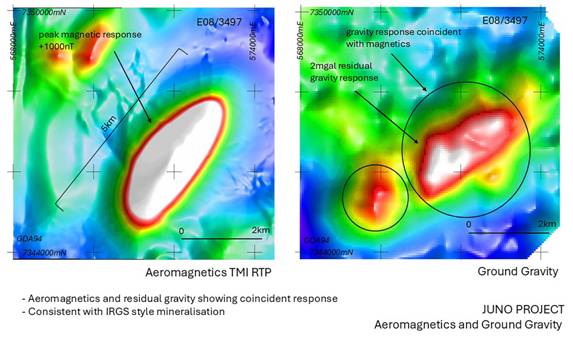

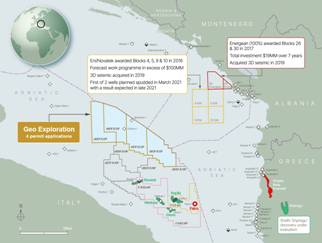

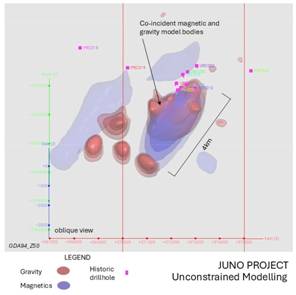

The Project, targeting Intrusion-Related Gold Systems (IRGS), has seen significant advancements through a series of geophysical surveys, including aeromagnetic, gravity, and LiDAR data collection. These activities have been aimed at identifying and refining high-potential drill targets, with the ultimate goal of discovering large-scale gold and copper mineralisation similar to the Havieron deposit in the Paterson Province. In early October 2024, Geo Exploration commenced an Airborne geophysical Survey at the Juno Project. This survey, which covered over 3,900 line kilometres, was designed to acquire high-resolution aeromagnetic data to better understand the subsurface geology. This survey was completed by mid-October, marking a significant milestone in the exploration program. The data collected revealed a strong, discrete magnetic feature, consistent with the characteristics of IRGS deposits, in the northern part of the Project area, this magnetic feature, not visible in historical lower-resolution surveys, provided the first clear indication of the Project's potential. During September 2024, Callum Baxter, Geo Exploration's Joint Venture Partner, conducted a site visit to assess access to the Project area and engage with local stakeholders. The visit confirmed that access to the site was viable via historical tracks, and discussions with local pastoralists were positive, with strong support for the exploration activities. Following the successful completion of the aeromagnetic survey, Geo Exploration initiated a ground-based gravity survey in late November 2024. This survey, conducted on a 400m x 200m grid (with 200m x 200m spacing in areas requiring higher resolution), focused on the northern part of the Project area. In early January 2025, Geo Exploration received the final LiDAR (Light Detection and Ranging) data for the Juno Project. The LiDAR survey, which provides high-resolution topographic and surface imagery, delivered Digital Terrain Models (DTMs) at 0.5m and 1.0m resolution, along with detailed digital imagery of the ground surface. The spatial accuracy of the LiDAR data was less than 20cm, making it a critical tool for refining drill targets and planning exploration activities. The LiDAR data, combined with the aeromagnetic and gravity data, has significantly enhanced the Company's ability to model the subsurface and identify high-potential drill sites. In mid-January 2025, the delivery of ground gravity data was received confirming a significant residual gravity response coinciding with the large magnetic feature previously identified. The gravity response covers an area of approximately 4km x 2km (8 sq km) with a peak amplitude of 2mgal, which is larger and more intense than the response observed at the Havieron deposit. The coincident magnetic and gravity response is a strong indicator of IRGS and IOCG (Iron Oxide Copper-Gold) mineralization, further validating the Project's potential. |

| Figure 2 - Juno Aeromagnetics and Ground Gravity |

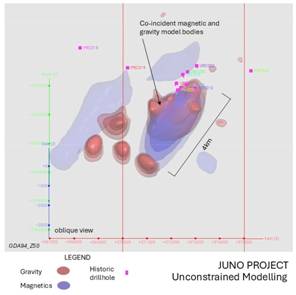

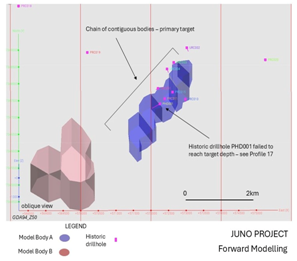

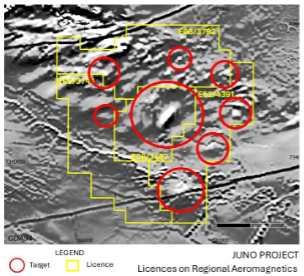

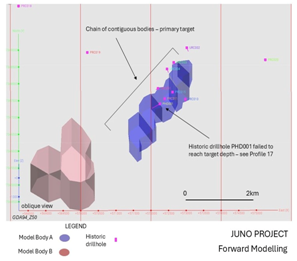

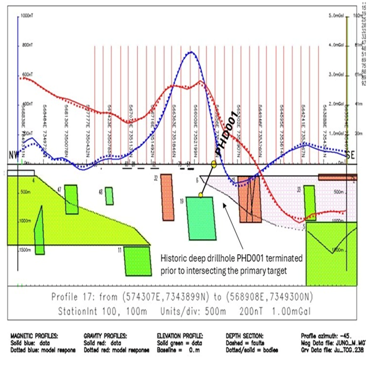

Historical drilling attempts in the 1990s and early 2000s targeted the magnetic feature but failed to reach the target depth due to limitations in drilling technology. Modern drilling equipment and advanced geophysical modelling techniques are expected to overcome these challenges, providing a clear pathway for exploration drilling. In May 2025, geophysical modelling showed independent 3-D magnetic-gravity inversions locked onto a single, coherent 4 × 2 km intrusive body, with the top of the system interpreted at ~600 m depth. Historic drillhole PHD001 terminated just short of this target, confirming immediate drillability. The modelling provides centimetre-scale collar positions for the maiden drill programme. |

| Figure 3 - Juno Project 3D unconstrained results showing coincident magnetic and gravity model bodies |

| Figure 4 - Juno Project 3D Forward Modelling results showing primary target |

| Figure 5 - Juno Project Forward Modelling Profile 17 showing primary target model body 19 |

In May 2025, a comprehensive Heritage Agreement was executed with the Nharnuwangga Wajarri & Ngarlawangga Traditional Owners. The agreement establishes clear protocols for activities from reconnaissance to potential development, removing the final non-technical barrier to drilling while ensuring protection of cultural heritage. In June 2025, IP & EM Surveys were conducted where field crews mobilised for dipole-dipole induced-polarisation (IP) and moving-loop electromagnetic (EM) surveys across the northern anomaly. In July 2025, the IP and EM responses were successfully modelled from subsurface data and the geophysical responses observed have upgraded the Juno Project from an IRGS perspective. This resulted in the proposed maiden drillhole locations being confirmed and will be drilled to depths of between 750m and 1000m and are planned to be vertical. In August 2025, the Company engaged DDH1, a world-class drilling contractor, to undertake our maiden drill programme. Our maiden drill programme at the Juno Project commenced in Q3 of calendar year 2025. Drill hole JUD001 was completed on 15 September 2025 to a final depth of 810 metres, successfully intersecting all targeted sequences. The assays are expected during calendar Q4 2025 and drilling of the second hole, JUD002, is now underway. Together, these milestones have advanced the Juno Project from target delineation to drill-ready status, and following the capital raise in January 2025, the Company is well-capitalised as per the capital commitment terms outlined above for its maiden drilling campaign which commenced in September 2025. |

| Figure 6 - Arrival of Drilling Equipment |

| Figure 7 - Drilling at JUD001 |

| Figure 8 - Drilling equipment on site at drill hole JUD002 |

| Figure 9 - Drill hole at JUD002 |

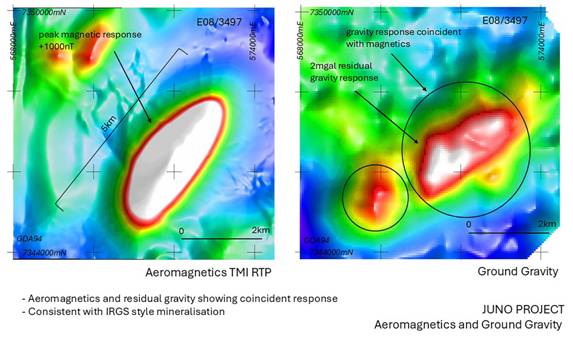

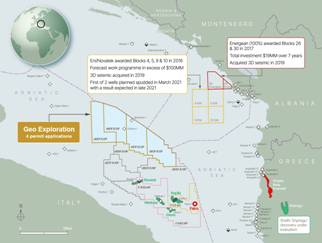

Namibian Project The Namibian Project consists of an operated 78 per cent participating interest in Petroleum Exploration Licence ("PEL") 0094 (acquired in 2018) which covers Block 2011A. Since the Company was awarded PEL0094, it has purchased and interpreted historic 2D and 3D seismic data over Block 2011A and across the Walvis Basin to enable a better understanding of the petroleum system and the resource potential of PEL0094. Various studies have been undertaken which have confirmed the view that PEL 0094 is very prospective. The Company purchased additional 2D seismic data in 2022 and carried out further technical interpretation both on the principal prospects (Marula and Welwitschia Deep) and on the leads in the eastern part of PEL0094. On 20 May 2025, the Company announced an independent significant resource upgrade for PEL0094. Licence-wide unrisked gross mean Prospective Resources have risen 22 % to c.4.31 billion barrels, with GEO's 78 % working interest translating to c.3.37 billion barrels unrisked (429 MMbbl risk-adjusted). The update introduced two new sandstone leads, Emerald (Albian) and Beryl (Cenomanian), which together account for c.792 MMbbl gross mean resources and materially de-risk the eastern sector of the block. In total, nine 2D-defined leads in the east now contain c.3 billion barrels gross mean resources, while the drill-ready 3D-imaged prospects Marula and Welwitschia Deep remain the primary near-term targets. Structural mapping shows robust dip- and fault-bounded closures in water depths of c. 750 m, supported by direct hydrocarbon indicators such as gas chimneys and flat spots. On 14 August 2023, the Company announced that the Namibian authorities had given approval for the Company and its partners to proceed to the First Renewal Exploration Period ("FREP"), which commenced on September 2023. Importantly, the usual requirement at the end of the Initial Exploration Period ("IEP") to relinquish 50 per cent of PEL 0094 area was waived. The work commitment for the FREP is to acquire, process and interpret 2,000 kms of 3D seismic data (the "3D Seismic") - carried over from the IEP and to drill a well contingent upon the results of interpretation of the 3D Seismic. Since early 2022, Namibia's oil and gas exploration sector has transformed due to significant oil discoveries in the Orange Basin. Total Energies and its partners made the Venus discovery and later drilled Mangetti-1X. Galp also made a significant discovery at Mopane-1X. The Orange Basin has seen increased activity with Woodside, Chevron, and Azule entering the region, providing reason to believe Namibia is on the path to becoming a major petroleum-producing province. In April 2025, operator Rhino Resources and partner Azule Energy (BP & Eni JV) reported a light-oil discovery at the Capricornus-1X well in PEL 85 in Namibia's deep-water Orange Basin. This further underpins the upward potential of the region with interest now moving north to the Walvis basin. In January 2025, Shell announced an approximately US$400m write-down in Namibia due to the high gas-to-oil ratio and gas condensate in its PEL0039 discoveries. This, combined with low rock permeability and high extraction costs, has meant that PEL0039 discoveries are yet to be confirmed for commercial viability. Chevron in the Orange basin for Block 2813B within PEL 90 also did not discover any commercial hydrocarbons in January 2025. Despite these setbacks, Namibia's oil potential remains strong, with other companies advancing more promising offshore projects and attention has shifted to the Walvis Basin, where PEL0094 is located. Public comments made by operators working in the Orange Basin have indicated that some of the reservoirs have low permeabilities and that there is a substantial volume of gas in the discoveries to date. The shallower reservoirs in PEL94 are less buried than their counterparts in the Orange Basin discoveries so, all other things being equal, should be less diagenetically altered and have higher permeabilities. Petroleum systems modelling carried out in conjunction with GEO's team by world-renowned geochemical consultancy IGI Ltd indicates that the source rock in the migration segments for the prospects and leads in PEL94 is in the main to early oil windows, and, although from a source rock of this type some gas would be expelled with the oil, the predominant hydrocarbon phase is modelled to be oil. Chevron's farm-in announcement in 2024 for PEL0082 close to PEL0094 has increased industry interest in the Walvis Basin, with more recent activity in January 2025 with Tower Resources announcing a farm-out agreement with Prime Global Energies Limited in the adjacent PEL0096 licence. In 2024, the Company entered and advanced negotiations with a potential farmee for the PEL0094 licence. These discussions are ongoing. Additionally, given increased interest in the Walvis Basin as discussed above and the Company's PEL0094 licence, the Company is engaging in talks with other potential farmees, some of whom are currently in the data room. GEO is aiming to secure the best transaction for the Company and shareholders alike whereby maximum value can be extracted from the licence. |

| Figure 10 - Map of Namibia showing PEL0094 |

Italian Applications In August 2013, the Company submitted applications for four offshore exploration areas in the Southern Adriatic, which are contiguous with the Italian median lines with Croatia, Montenegro, and Albania. Following a series of appeals against the environmental decrees related to these applications, the European Court confirmed in January 2022 that the applications did not violate EU law. In February 2019, the Italian Parliament suspended all hydrocarbon exploration activities for 18 months to evaluate their suitability under a new Plan, which came into effect in February 2022. This Plan mandates that only gas exploration is permitted, leading to a re-perimeterisation of the Company's application areas. The Italian Ministry of Ecological Transition later confirmed that the amended applications complied with the Plan. In September 2023, the Company announced that appeals against the environmental decrees granted in its favour had been dismissed by the Council of State. These appeals were related to all four of the Company's exploration permit applications in the Southern Adriatic. There have been no updates since June 2024. The Company will continue to assess its options regarding the applications and make further announcements as needed. Overall, across the business GEO applies a disciplined approach to capital allocation, with a fluid and continuous assessment of its project portfolio. Licences that no longer demonstrate clear value-add or progression potential will be reconsidered for impairment or exit. |

| Figure 11 - Map of Permit Applications - Italy Offshore |

EVENTS SUBSEQUENT TO REPORTING DATE Since the end of the financial year, the Company has announced several material developments: · Appointment of Drilling Contractor - On 18 August 2025, GEO entered into a contract with DDH1 Drilling Pty Ltd, Australia's leading provider of diamond core drilling services, to undertake the maiden diamond drilling programme at the Juno Project in Western Australia. Mobilisation and final site preparations were completed during August 2025. · Commencement of Maiden Drilling Programme - On 2 September 2025, GEO announced the commencement of its maiden drilling programme at the Juno Project, with drill hole JUD001 underway. This programme marks a significant milestone, targeting a large IRGS (Intrusion-Related Gold System) anomaly identified through integrated geophysical modelling. · Capital Raise - On 8 September 2025, GEO successfully completed a capital raise of £1,109,000 (before expenses) through the placing of 277,250,000 new Ordinary Shares at 0.4 pence per share. The proceeds will fund ongoing operational costs. In addition, 5,555,556 Ordinary Shares were issued in settlement of consultancy fees. · Repayment of CEO Interest Free Loan - On 18 September 2025, the Board resolved and repaid in full the interest-free loan of US$270,000 provided by the Company's Chief Executive Officer, Mr Omar Ahmad. The early repayment leaves GEO debt free and further strengthens the balance sheet. · First Drill Hole Complete and Second Commenced - On 15 September 2025, the Company completed its first drill hole (JUD001) at the Juno Project in Western Australia to a final depth of 810 metres. The geology team confirmed that all targeted sequences were intersected. Assay results are expected in calendar Q4 2025. Following completion of JUD001, drilling of the second hole (JUD002) commenced and remains underway. The Directors are not aware of any other matter or circumstance that has arisen since 30 June 2025 which has significantly affected, or may significantly affect, the operations of the Group, the results of those operations, or the state of affairs of the Group in subsequent financial periods. |

|