17th Sep 2025 07:00

Feedback plc

Full Year Results to 31 May 2025

Feedback plc (AIM: FDBK, "Feedback" or the "Company"), the clinical infrastructure specialist, announces its audited results for the 12 months to 31 May 2025 (the "Period").

Operational highlights

· Awarded £495k digital infrastructure contract with Queen Victoria Hospital NHS Foundation Trust ("QVH")

· Awarded further funding to extend the delivery of community diagnostic centre ("CDC") pathway pilot at the Northern Care Alliance NHS Foundation Trust ("NCA") site in Oldham

· Continued to progress discussions at a both a national level and locally with Integrated Care Boards ("ICBs")

o Focus on waitlist rationalisation within the NHS provides compelling backdrop

o Company's solutions tailored to the broader changing landscape

· MOU signed with primary care solutions partner and NHS Trust providing significant opportunities linked to the government's Neighbourhood Health model

· Received HSJ Partnership Award for reducing patient wait times and unnecessary hospital appointments through a digital breathlessness pathway

· Commenced integration of Bleepa® with key NHS referral systems to provide greater scalability

· Broadened product functionality and reach via collaboration with Vertex In Healthcare ("Vertex")

Financial highlights

· Revenue of £0.89m (2024: £1.18m)

· Sales1 were £0.89m (2024: £0.95m); Bleepa contributed 90%

· EBITDA loss of £3.06m (2024: £2.73m)

· Raised gross proceeds of approximately £6.1 million via a Placing and Retail Offer and completed a share capital reorganisation in November 2024

· Cash as at 31 May 2025 was £5.95m (31 May 2024: £3.88m)

o Sufficient for runway to early CY2027

Retail Investor Briefing, 16:00 Today

Management will be providing a presentation and hosting an Investor Q&A session on the results and future prospects today at 16:00, through the digital platform Investor Meet Company. Investors can sign up for free and add to attend the presentation via the following link:

https://www.investormeetcompany.com/feedback-plc/register-investor

Questions can be submitted pre event and at any time during the live presentation via the Investor Meet Company Platform.

Dr Tom Oakley, CEO of Feedback, said: "We have positioned the Company and our technology base to provide digital solutions that will enable increased efficiency at the same time as reducing the huge burden on the NHS. It is clear that the Government is focused on addressing the numerous, well publicised issues facing our health system. We have the relationships and systems in place to scale up rapidly once the NHS 10-year plan and Spending Review are complete. It's clear that the delays we have seen due to the ongoing changes to government and NHS funding programmes have impacted our performance during the Period, however we remain well positioned to generate strong returns."

1 "Sales" is non-IFRS metric representing the total customer contract value invoiced in a period. The figure does not take account of accrued or deferred income adjustments that are required to comply with accounting standards for revenue recognition across the life of a customer contract (typically 12 months).

-Ends-

Enquiries:

Feedback plc Tom Oakley, CEO Anesh Patel, CFO | +44 (0) 20 3997 7634 |

Panmure Liberum Limited (NOMAD and Broker) Emma Earl /Mark Rogers (Corporate Finance) Rupert Dearden (Corporate Broking) | +44 (0)20 7886 2500 |

Walbrook PR Ltd | Tel: 020 7933 8780 or [email protected] |

Nick Rome/Joe Walker | 07748 325 236 or 07407 020 470 |

About Feedback plc

Feedback plc liberates the data and knowledge from multiple healthcare IT systems and delivers better workflow to enable clinicians to communicate, collaborate and provide the best healthcare for their patients. We connect care settings with diagnostic and other relevant data to drive better, faster, safer decision that improve outcomes for patients.

By linking different clinical systems together into a seamless view of the patient, we can streamline patient pathways and deliver a digital health and diagnostics record across multiple care providers.

Bleepa is our communication and collaboration platform that displays clinical results at a certified and regulated quality, which enables multi-disciplinary team working and diagnostic-enhanced advice and guidance. CareLocker® is our patient-facing platform that gives patients access and control over their diagnostic and other clinical data.

The Company has a number of growth opportunities domestically and internationally across a range of public and private healthcare markets including the NHS. Our highly scalable software-as-a-service (SaaS) based model is expected to provide increasing levels of revenue visibility as the Company grows its customer base.

https://feedbackmedical.com/

Chairman's statement

Foundations for growth

The election of a new Government in July 2024, with a strong majority and ambitious vision, has offered optimism for the NHS, our largest target market. However, changes to NHS England, operational cost reductions across NHS Trusts and ICBs, combined with global geopolitical tensions and challenging domestic economic conditions have impacted the Government's fiscal outlook and near-term budget allocations. Consequently, this has proved a challenging year for the Company.

The strength of our proposition remains clear and the opportunity for Bleepa is more relevant than ever, as demonstrated by the successful renewal of contracts with all our existing NHS customers with whom we continue to generate positive outcomes. We were also selected to deliver the recent neighbourhood health service simulation in London, and to be awarded "Most Effective Contribution to Clinical Redesign" at the recent HSJ Partnership Awards- fantastic recognition of the work by the Feedback team and our partners at QVH.

However, despite the continued improvements to our platform, and the value we have added to our existing customers, ongoing disruption across the NHS has meant revenue growth has not reached the levels we anticipated. Nonetheless, the Government's overall vision for the future of the NHS remains strongly aligned with the Company's offering. The Prime Minister's six milestones include a key health commitment: achieving a 92% Referral to Treatment ("RTT") target within 18 weeks for elective care by 2029, and Wes Streeting's vision of a neighbourhood health service require a crucial technology layer. Through Bleepa, we are well positioned to support these ambitions.

The Reforming Elective Care plan, published in January 2025, strongly endorses the outpatient model that Feedback has long championed. Additionally, the July 2025 10 Year Plan sets out a vision for a more productive, digital-first, and collaborative NHS-an environment in which Bleepa's value proposition should flourish once current restructuring settles.

In November, we completed a successful fundraising which was upscaled to £6.1 million (gross) - with a number of new investors participating - and completed a share capital reorganisation. This has enabled us to continue ongoing development of Bleepa and position it as a crucial element to support the successful delivery of an efficient and effective health service.

Throughout the year, the Board has maintained an active and supportive role. We endorsed revisions to Feedback's sales and marketing strategy, including pursuing national contracts alongside targeted engagement with individual trusts and ICBs. We continue to monitor established and emerging risks, including cybersecurity threats and competitor developments, with vigilance.

As Chairman, I take seriously our duty to uphold robust governance that fosters long-term shareholder value. We continue to adhere to the QCA Corporate Governance Code, and the Board works closely with the Leadership Team on all facets of the business. While our revenue performance has fallen short of expectations this year, the team's dedication has driven improvement across every other aspect of the business. Our product is more scalable and refined, stakeholder relations have strengthened, and our regulatory and compliance standards remain industry leading. We are also focused on enhancing staff engagement Company wide.

The NHS's restructuring has presented an unforeseen challenge, but once the sector stabilises, Feedback well positioned to deliver the clinician collaboration solutions that are essential to unlocking the productivity gains the NHS urgently needs. I remain confident in our strategy and our team's ability to navigate these headwinds to create long-term value for shareholders and the healthcare system.

Rory Shaw

Non-executive Chairman

16 September 2025

CEO's statement

Background

Whether in elective or neighbourhood care, the message across healthcare is the same: a new operating model is needed, one that brings crucial patient information together, enables clinician collaboration, embraces a digital-first approach, and reduces supply costs. Unlocking productivity gains remains a significant challenge for healthcare systems worldwide. High fixed supply costs-including staffing, premises, outdated working practices, legacy technology systems and an overemphasis on cure rather than prevention-combined with increasing demand, often driven by demographic challenges and increased patient complexity, limit room for manoeuvre.

In the UK, these themes underpin both the Reforming Elective Care and NHS 10 Year Plans. Against this backdrop, our successful partnership with QVH has gained increasing significance this year. Our award-winning collaboration has attracted attention from key stakeholders within the Department of Health and Social Care (DHSC) and NHSE. We have already developed a model that should be followed. For example, the breathlessness pathway we created has achieved a 63% reduction in wait times compared to the national standard 18-week RTT target and a 90% reduction in outpatient appointments-transformative results that align closely with national ambitions. We are now expanding this model to five additional pathways at QVH, supported by influential national figures.

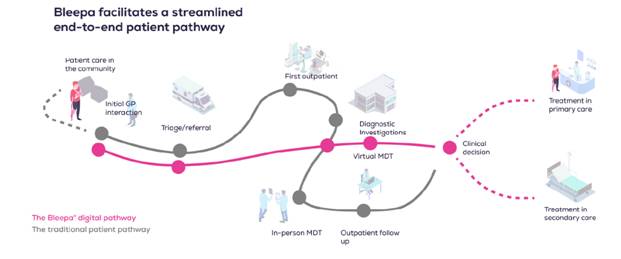

Figure 2 - How our redesigned outpatient model reduces inefficiencies in the patient pathway

Trading conditions over the past six months have undoubtedly been the toughest I have known, with consistent uncertainty around NHS funding, organisational structure, and technological appetite beyond major central initiatives; a reflection of frontline care providers seeing the value but lacking the time or budget to drive change. The announced abolition of NHSE has caused significant disruption across the health landscape. Additionally, the reorganisation of ICBs, also accompanied by significant cuts to management and back-office roles, has effectively halved management capacity at ICB and Trust level. Alongside ongoing pressures on providers to reduce budgets, this has left the NHS largely focused inward and hampered by uncertainty. This environment has paused or removed several promising pipeline opportunities, which has been hugely frustrating.

The Government's continued focus on reducing elective care waiting lists remains encouraging. This continues to be our primary use case and the area where Bleepa has demonstrated the most significant impact on productivity. The direction of travel set out in the NHS 10 Year Plan is now clearer, and our value proposition aligns closely with this. Of the three broad shifts the Government is pursuing, two - 'analogue to digital' and 'hospital to the community'- lie at the heart of our operating model. Our deployment diverts patients away from unnecessary outpatient appointments, accelerates diagnostics through straight-to-test pathways, utilises Community Diagnostic Centres, and embeds remote consultations as standard where appropriate-operational aims articulated in the Reforming Elective Care plan. Core to the Reforming Elective Care plan is the ability to deliver more activity from the existing workforce given budget and time constraints. Bleepa's asynchronous approach enables clinicians to collaborate from anywhere, at any time, and reduce the patient review time from approximately 30 minutes in a traditional outpatient setting, to as little as 5-6 minutes. Bleepa can therefore deliver 5-6x the number of patient interactions whilst also diverting 90% of patients away from the hospital, using the existing workforce.

Funding for outpatients has also evolved this year. The Elective Recovery Fund ("ERF") has now been rolled into wider NHS funding and no longer exists as a dedicated fund with a national price for diversion payments. The ERF has been replaced by a fixed funding allocation to ICBs for elective recovery (totalling £5.3bn* for 2025/26), linked to ICB indicative activity plans, placing increased pressure on ICBs to deliver activity within a fixed financial envelope and timeframe. The end of the national price for diversion payments under ERF provides greater contracting flexibility between the Company and ICBs as it stands to be paid for every patient hosted on the platform instead of linking payment to the number of successful diversions, aligning to Feedback's standard G-Cloud pricing and licencing model. These increased financial pressures and simpler model of licensing will make our product more compelling to customers.

Recently, we were chosen by PPL, the UK's leading social enterprise management consultancy, to provide the technology underpinning a Neighbourhood Health Record simulation. This event brought together over 100 delegates from NHSE, the Greater London Authority, London Councils, the Office for Health Improvement and Disparities, ICBs, local authorities across London boroughs, and the voluntary sector. The simulation demonstrated Bleepa's adaptability and suitability as an enabler of collaborative care delivery across various settings. We look forward to using feedback from this exercise to refine our product and work with partners to realise their vision of neighbourhood health-a developing market we believe has sizeable potential.

A recurring theme from across the NHS is that many technology systems are not interoperable. This year, we have made improvements to integrate Bleepa with key NHS systems, providing our customers with greater access to data and referral options, enabling Bleepa to operate as a standalone system.

The biggest internal change this year was the establishment of our External Affairs team, aimed at improving our understanding of government priorities and supporting the pursuit of a national rollout for Bleepa. We have engaged extensively with the leadership teams at DHSC, NHSE, and wider political bodies including the Tony Blair Institute. In the run-up to the Spending Review, we submitted a detailed business case outlining the national opportunity. While the headline figures were announced by the Chancellor in June 2025, the detailed funding allocations for individual teams and projects within departments have yet to be confirmed.

Improving our revenue performance remains our greatest challenge and focus. We have clarified our value proposition, enhanced our competitor analysis, and revised our sales strategy and team. Our product delivers clear and demonstrable benefits, and we continue to operate to the highest regulatory and compliance standards. We have also established a new partnership with Moorhouse Consulting as an implementation partner in anticipation of wider rollouts. Despite the challenges of recent months, we are ready to respond as soon as the NHS begins to look outwards again, at both local and national levels.

Business strategy

The long sales cycle associated with our target customers-particularly within the NHS-has required a business strategy focused on flexibility and breadth. We have deliberately positioned Bleepa to deliver a broad value proposition built around clinical collaboration, productivity, and bridging care settings. This has allowed us to pursue multiple customer segments simultaneously, enabling us to pivot when needed and capture emerging opportunities. While sales cycles remain lengthy and to date new sales have been impacted by significant changes within the NHS and NHS procurement challenges, we anticipate that they are offset by the long-term value of each contract, with most renewing annually over several years post-sale.

This year, we embedded a new sales strategy that leverages data insights to better identify and target priority customers. Our focus has been on those NHS Trusts and ICBs with the fewest operational barriers, strong potential for impact based on waiting list data, and existing access to senior decision-makers. We've also expanded our stakeholder engagement to include wider networks within these organisations to drive adoption and implementation. In parallel, we have significantly increased our engagement with central government and the DHSC. Our product addresses national challenges in outpatient care and offers scalable, uniform productivity improvements, making us well-positioned for central procurement. We've actively shaped conversations with DHSC and NHSE, aligning our value proposition with their strategic objectives to reduce waiting lists within existing budget constraints.

The most transformative impact of Bleepa lies in its deployment as a Single Point of Access (SPoA) tool across a revised outpatient model, which the partnership with Moorhouse Consulting positions us strongly to implement. We continue to explore further partnerships-both to raise awareness and to ensure Bleepa supports every stage of a modernised patient pathway.

While elective care has been our primary focus, Bleepa's adaptability extends to other healthcare contexts where secure collaboration and data sharing are essential, and we're working hard to demonstrate this in practice-the PPL simulation showcased Bleepa's potential as a key enabler for shifting services from hospitals into community settings. While the commercial model behind neighbourhood health is still evolving, our involvement positions us well to shape its future development-and our role within it.

Outside of elective care, on 19 September 2024 we announced an MOU with a primary care solutions partner with the intention of exploring opportunities to jointly develop a novel Neighbourhood Diagnostics Solution. After an initial period of constructive discussion and collaboration, the pace of these discussions was adversely impacted by a number of factors outside of the control of the Company including changes to the NHS and the partner going through significant organisational changes. However, we have now re-commenced constructive discussions which could open up an alternative route to market for Bleepa with this partner.

Operational review

Bleepa

Executing an agile strategy has required continued focus, team discipline, and product evolution. This year, we made the decision to pause development of CareLocker® and Feedback Connect® as standalone product offerings to focus resources entirely on Bleepa. In preparedness for any regional or national roll out. Product development has centred on integrations with the main NHS systems (GP Connect, PDS, MIG, and eRS and NHSMail as a single sign on, have all been successfully integrated) so that Bleepa can operate as a scalable one-stop shop for users. Given growing government scrutiny around poor interoperability in healthcare IT, we believe our integration-first approach provides a strong competitive advantage. We've also made targeted improvements to the user experience based on clinician feedback.

International

While the NHS remains our core customer base, we have been actively building a pipeline of international opportunities to diversify our revenue streams.

During the Period, Feedback Medical India Limited (100% subsidiary), secured a paid pilot with a large hospital group which has a presence across Asia, and launched its first paid pilot for live TB screening programme with HEAL Foundation arising from the partnership announced in March 2024. Despite this early success we believe that larger commercial opportunities are still a way off, given the complexity of this market and the length of decision making process. Post Period, given the increasing uncertainty in our domestic market, we have decided to curtail activities in India for the time being in order to extend our cash runway position. We remain open to reactivating and reinvesting in India subject to stronger traction and revenue growth in our core UK market.

As part of our broader sales strategy, we have initiated exploratory work in other international markets to a limited degree, led by an external consultant. Post Period, I visited North America and also participated in a Life Sciences Trade Mission to Canada, to begin early discussions with potential partners and customers. The requirements identified by potential customers overlap strongly with the existing use case and value proposition for Bleepa, and early analysis of the regulatory requirements is favourable. With procurement cycles in the UK often delayed by structural inertia, we are prudently equipping ourselves with strategic alternatives.

Our product and value proposition remain a very clear and compelling solution for the NHS. However, since March 2025, significant changes have unfortunately delayed decision-making processes. While I remain confident that new opportunities will emerge within the NHS, we will continue to proportionately explore other markets and avenues to offset these delays and support sustainable growth.

Financial review

We consistently manage our financial resources prudently and have taken sensible steps to explore other markets either as an alternative or as an addition to the UK and India.

2025 | 2024 | |

Key performance indicators | £m | £m |

Revenue | 0.89 | 1.18 |

Gross margin | 88% | 93% |

Sales (non IFRS) | 0.89 | 0.95 |

Operating expenses | (5.15) | (4.79) |

Operating loss | (4.21) | (3.69) |

EBITDA loss (non IFRS) | (3.06) | (2.73) |

Cash outflows from operating activities | (2.82) | (2.22) |

Cash outflows from investing activities | (0.72) | (1.22) |

Cash & cash equivalents end of period | 5.95 | 3.88 |

Intangible assets | 0.56 | 4.07 |

Contract liabilities (deferred income) | 0.22 | 0.22 |

Net assets | 6.16 | 7.64 |

Revenue for the year ended 31 May 2025 decreased 25% to £0.89m (2024: £1.18m), due to the prior period including non-recurring revenue from the CDC pilot contracts and software development fees from Image Engineering, partially offset by QVH converting to a full contract at a higher contract value and other existing NHS customers renewing with inflationary uplifts. Bleepa contributed 90% (2024: 87%). Gross margin reduced to 88% (2024: 93%) driven by the fall in revenue.

Sales, a non IFRS measure representing the total customer contract value invoiced in a period, decreased 5%, reflecting lower contract wins in the Period. Bleepa contributed 90% (2024: 85%) and Image Engineering license fees 6% (2024: 12%). Sales are recognised as revenue monthly across the life of a customer contract (typically 12 months), with any amount not recognised as revenue in the current financial year remaining on the balance sheet as contract liabilities (deferred income) and recognised as revenue in the forthcoming financial year. Contract liabilities (or deferred income) as at period end was £0.22m (2024: £0.22m).

Operating expenses increased 7% to £5.15m (2024: £4.79m), primarily due to headcount expansion and cost-of-living wage increases, higher non-cash share based payments expense of £0.22m (2024: £0.07m) including a one-off accelerated charge on surrendered share options of £0.07m (2024: Nil) and higher depreciation and amortisation costs of £1.15m (2024: £0.96m), offset by lower spend on advertising and marketing activities ahead of visibility on the fundraise. Operating loss increased 14% to £4.21m (2024: £3.69m). EBITDA loss widened 12% to £3.06m (2024: £2.73m).

Cash outflows from operating activities widened 27% to £2.82m (2024: £2.22m) primarily driven by the higher EBITDA loss and lower R&D tax credit refund in the Period. Cash outflows from investing activities decreased 41% to £0.72m (2024: £1.22m) due to lower spend with outsourced software development partners to preserve cash and Bleepa's maturity. The Group's cash position as at 31 May 2025 was £5.95m (31 May 2024: £3.88m) which we believe provides sufficient runway to early CY2027. This follows the successful fundraising of £6.1m (gross) during the year.

Intangible assets reduced to £0.56m (2024: £4.07m) due to lower software development expenditure, higher amortisation and a one-off impairment charge of £3.19m (2024: Nil) arising from the increasing uncertainty in the Company's trading environment, notably the ongoing NHS restructuring. In preparing the impairment assessment and reflecting that commercial progress has to date been slower than anticipated, conservative assumptions were required to be applied, for example, assuming no additional new customer wins over a five-year period; however, the Board continues to believe the technology has significant potential, and this impairment does not reflect their commercial assessment of the value of the Group's intangible assets. Under IFRS, an impairment loss can be reversed in future accounting periods if the circumstances that caused the original loss have been reversed. Net assets decreased to £6.16m (2024: £7.64m) as at 31 May 2025.

Outlook

Undoubtedly the rhetoric of the Secretary of State and the Interim Chief Executive of the NHS is as aligned to Feedback's expertise and deployment as it is possible to be. However, a shift is needed within the NHS - be it budgetary, a central mandate around technology adoption, or operational capacity; ideally all three - for the NHS to achieve its objectives, and for companies like Feedback to thrive. The issues we're facing are systemic and very difficult but despite these challenging circumstances, we have succeeded in raising awareness of our compelling product and impact with key decisions makers within DHSC and NHSE, and our more targeted sales strategy has led to positive and detailed discussions.

We continue local discussions with ICBs and NHS Trusts but are gaining more visibility of an opportunity to position Bleepa as a national solution with central NHS teams and feel that the national route may be more viable given increased pressures and tighter finances at the local level. In recent weeks we have also reinvigorated discussions with our primary care partner to open up alternative routes to market. Whilst progress has been slower than expected, management remain confident that there continues to be a sizable opportunity in the UK.

Post Period, to preserve our cash resources, we have taken steps to significantly reduce spend by curtailing activities in India, significantly downsizing our outsourced software development team in Poland, and identifying other areas of future cost savings to extend runway even further - we believe the current cash position provides runway to early CY2027 on this basis. The NHS remains our most obvious and natural market, but at the moment the biggest challenge we have is navigating this period of organisational change and delays it has created, as it is clear that Bleepa can play a very critical role in delivering the NHS outlined in the 10 Year Plan and that there is significant pent-up demand for the benefits of what Bleepa and asynchronous working can do across the NHS.

Dr Tom Oakley

Chief Executive Officer

16 September 2025

Consolidated Statement of Comprehensive Income

for the year ended 31 May 2025

|

Note |

2025 £ |

2024 £ | ||

Revenue | 4 | 885,623 | 1,181,544 | ||

Cost of sales | (106,976) | (79,129) | |||

Gross profit | 778,647 | 1,102,415 | |||

Other Income | 4 | 159,964 | - | ||

Other operating expenses |

|

| 5 | (5,149,158) | (4,792,548) |

|

| ||||

Operating loss |

|

| 6 | (4,210,547) | (3,690,133) |

Impairment of intangible assets | 14 | (3,192,429) | - | ||

Net finance income | 7 | 117,813 | 93,135 | ||

Loss before taxation |

| (7,285,163) | (3,596,998) | ||

Tax (charge)/credit | 9 | (32,260) | 298,631 | ||

Loss after tax attributable to the equity shareholders of the Company |

|

| (7,317,423) | (3,298,367) | |

Other comprehensive income/(losses)

Items that are or may be reclassified subsequently to profit or loss | |||||

Translation difference on overseas operation | 10,856 | (241) | |||

Total comprehensive loss for the year | (7,306,567) | (3,298,608) | |||

Loss per share (pence) | |||||

Basic and diluted* | 11 | (25.50) | (24.74) |

The notes below form part of these financial statements

Consolidated Statement of Changes in Equity

for the year ended 31 May 2025

GROUP | Share Capital | Share Premium | Capital Reserve | Retained Earnings | Translation Reserve | Share option Reserve | Total |

| £ | £ | £ | £ | £ | £ | £ |

At 31 May 2023 | 6,667,330 | 15,350,241 | 299,900 | (11,767,246) | (212,239) | 530,897 | 10,868,883 |

Loss of the year Other comprehensive loss for the year | - | - | - | (3,298,367) |

(241) | - | (3,298,367) (241)

|

Total Comprehensive Loss for the year | - | - | - | (3,298,367) | (241) | - | (3,298,608) |

Share-based payments | - | - | - | - | - | 74,462 | 74,462 |

Total transactions with owners | - | - | - | - | 74,462 | 74,462 | |

At 31 May 2024 | 6,667,330 | 15,350,241 | 299,900 | (15,065,613) | (212,480) | 605,359 | 7,644,737 |

Loss of the year | - | - | - | (7,317,423) | - | - | (7,317,423) |

Other comprehensive loss for the year | - | - | - | - | 10,856 | - | 10,856 |

Total Comprehensive Loss for the year | - | - | - | (7,317,423) | 10,856 | - | (7,306,567) |

New shares issued | 304,800 | 5,791,223 | - | - | - | - | 6,096,023 |

Costs associated with the raising of funds | - | (486,536) | - | - | - | - | (486,536) |

Share-based payments | - | - | - | - | - | 216,930 | 216,930 |

Total transactions with owners | 304,800 | 5,304,687 | - | - | - | 216,930 | 5,826,417 |

At 31 May 2025 | 6,972,130 | 20,654,928 | 299,900 | (22,383,036) | (201,624) | 822,289 | 6,164,587 |

The notes below form part of these financial statements

Company Statement of Changes in Equity

for the year ended 31 May 2025

COMPANY |

|

|

Share Capital |

Share Premium |

Retained Earnings |

Share option Reserve |

Total |

|

|

| £ | £ | £ | £ | £ |

At 31 May 2023 | 6,667,330 | 15,350,241 | (5,711,784) | 530,897 | 16,836,684 | ||

Loss for the year and Total comprehensive loss for the year | - | - | (1,488,345) | - | (1,488,345) | ||

Share-based payments | - | - | - | 74,462 | 74,462 | ||

Total transactions with owners | - | - | - | 74,462 | 74,462 | ||

At 31 May 2024 | 6,667,330 | 15,350,241 | (7,200,129) | 605,359 | 15,422,801 | ||

Loss of the year and Total comprehensive loss for the year

| - | - | (15,519,728) | - | (15,519,728) | ||

New shares issued | 304,800 | 5,791,223 | - | - | 6,096,023 | ||

Costs of new shares issued | - | (486,536) | - | - | (486,536) | ||

Share-based payments | - | - | - | 216,930 | 216,930 | ||

Total transactions with owners | 304,800 | 5,304,687 | - | 216,930 | 5,826,417 | ||

At 31 May 2025 |

|

| 6,972,130 | 20,654,928 | (22,719,857) | 822,289 | 5,729,490 |

The notes below form part of these financial statements

Consolidated Balance Sheet

for the year ended 31 May 2025

|

|

| 2025 | 2024 |

| Notes |

| £ | £ |

Assets |

|

|

|

|

Non-current assets | ||||

Property, plant and equipment | 13 | 11,583 | 12,993 | |

Intangible assets | 14 | 564,216 | 4,068,136 | |

575,799 | 4,081,129 | |||

| ||||

Current assets | ||||

Trade and other receivables | 15 | 98,538 | 81,641 | |

Corporation tax receivable | 129,516 | 298,644 | ||

Cash and cash equivalents | 5,949,757 | 3,877,503 | ||

6,177,811 | 4,257,788 | |||

Total assets | 6,753,610 | 8,338,917 | ||

Equity | ||||

Capital and reserves attributable to the Company's equity shareholders | ||||

Called up share capital | 18 | 6,972,130 | 6,667,330 | |

Share premium account | 18 | 20,654,928 | 15,350,241 | |

Capital reserve | 18 | 299,900 | 299,900 | |

Translation reserve | 18 | (201,624) | (212,480) | |

Share option expense reserve | 18 | 822,289 | 605,359 | |

Retained earnings | 18 | (22,383,036) | (15,065,613) | |

Total equity | 6,164,587 | 7,644,737 | ||

Liabilities |

|

| ||

Current liabilities |

|

| ||

Trade and other payables | 16 | 589,023 | 694,180 | |

589,023 | 694,180 | |||

|

|

| ||

Total liabilities |

|

| 589,023 | 694,180 |

|

|

| ||

Total equity and liabilities |

|

| 6,753,610 | 8,338,917 |

The notes below form part of these financial statements

Consolidated Cash Flow Statement

for the year ended 31 May 2025

| 2025 | 2024 |

| £ | £ |

Cash flows from operating activities | ||

Loss before tax | (7,285,163) | (3,596,998) |

Adjustments for: | ||

Net finance income | (117,813) | (93,135) |

Other Income - R&D tax credit | (159,964) | - |

Depreciation and amortisation | 1,146,711 | 957,549 |

Impairment of intangible assets | 3,192,429 | - |

Translation difference in overseas operation | 10,856 | (241) |

Share based payment expense | 216,930 | 74,469 |

Decrease/(Increase) in trade receivables | (1,079) | 129,714 |

Decrease/(Increase) in other receivables | (15,818) | 13,947 |

Increase/(Decrease) in trade payables | (66,166) | 116,085 |

Increase/(Decrease) in other payables | (38,990) | (277,361) |

Corporation tax received | 296,832 | 455,628 |

Total adjustments | 4,463,928 | 1,376,655 |

Net cash used in operating activities | (2,821,235) | (2,220,343) |

Cash flows from investing activities | ||

Purchase of tangible fixed assets | (10,450) | (12,506) |

Purchase of intangible assets | (823,361) | (1,300,318) |

Interest Income | 117,813 | 93,135 |

Net cash used in investing activities | (715,998) | (1,219,689) |

Cash flows from financing activities | ||

Net proceeds of share issue | 5,609,487 | - |

Net cash generated from financing activities | 5,609,487 | - |

Net increase/(decrease) in cash and cash equivalents | 2,072,254 | (3,440,031) |

Cash and cash equivalents at beginning of year | 3,877,503 | 7,317,534 |

| ||

Cash and cash equivalents at end of year | 5,949,757 | 3,877,503 |

The notes below form part of these financial statements

Notes to the Financial Statements

1. General information

The Company is a public limited company limited by shares, domiciled in the United Kingdom and incorporated under registered number 00598696 in England and Wales. The Company's registered office is 201 Temple Chambers, 3-7 Temple Avenue, London, England, United Kingdom, EC4Y 0DT.

The Company is quoted on AIM, a market operated by the London Stock Exchange. These Financial Statements were authorised for issue by the Board of Directors on 16 September 2025.

2. Adoption of the new and revised International Financial Reporting Standards

The Company has adopted all of the new or amended Accounting Standards and Interpretations issued by the International Accounting Standards Board (IASB) that are mandatory for the current reporting period.

The following new and revised Standards and Interpretations are relevant to the Company, but the Company has not early adopted these new standards. The Directors do not anticipate that the adoption of these standards will have a material impact on the reported results of the Company:

- IFRS 1 - First-time adoption of International Financial Reporting standards - amendments resulting from annual improvements to IFRS accounting standards - Volume 11 (hedge accounting by first-time adopter)

- IFRS 7 - Financial Instruments: Disclosures; amendments regarding classification and measurement of financial instruments, amendments regarding annual improvements Accounting Standards - Volume 11 (Gain or loss on derecognition, deferred difference between fair value and transaction price and credit risk disclosures). Amendments regarding the supplier finance arrangements.

- IFRS 9 - Financial Instruments: amendments regarding classification and measurement of financial instruments, amendments regarding annual improvements Accounting Standards - Volume 11 (Lessee derecognition of lease liabilities and Transaction price)

- IFRS 10 - Consolidated Financial Statements - Amendments resulting from Annual Improvements to IFRS Accounting Standards - Volume 11 (Determination of a 'de facto agent')

- IFRS 18 - Presentation and Disclosures in Financial Statements

- IFRS 19 - Subsidiaries without Public Accountability: Disclosures

- IAS 7 - Statement of Cash Flows - Amendments resulting from Annual Improvements to IFRS Accounting Standards - Volume 11 (Cost method) and amendments regarding supplier finance arrangements

- IAS 21 - The effects of changes in foreign exchange rates - lack of exchangeability

3. Significant accounting policies

(a) Basis of preparation

These financial statements have been prepared in accordance with UK adopted international accounting standards. The policies set out below have been consistently applied to all the years presented.

No separate income statement is presented for the parent Company as provided by Section 408, Companies Act 2006.

(b) Basis of consolidation

The Group financial statements consolidate the financial statements of Feedback plc and its subsidiaries (the "Group") for the years ended 31 May 2025 and 2024 using the acquisition method.

The financial statements of subsidiaries are prepared for the same reporting year as the parent company, using consistent accounting policies. All inter-company balances and transactions, including unrealised profits arising from them, are eliminated.

Subsidiaries are fully consolidated from the date on which control is transferred to the Group and cease to be consolidated from the date on which control is transferred out of the Group.

Investments in subsidiary companies are held at cost less any impairment. Impairment reviews are performed annually or more frequently if events or changes in circumstances indicate a potential impairment. The impairment review compares the carrying value to the recoverable amount, which is calculated as the higher of the value in use and the fair value less costs to sell.

(c) Going Concern

The Group incurred a net loss of £7,306,567 for the year ended 31 May 2025 however it had net assets of £6,164,587 inclusive of £5,949,757 of cash and cash equivalents at 31 May 2025.

The directors have considered the applicability of the going concern basis in the preparation of the financial statements. This included a review of financial results, internal budgets and cash flow forecasts to 30 September 2026, including downside scenarios. After making enquiries, the Directors have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future, and that the Group and Company will have sufficient funds to continue to meet their liabilities, including providing financial support to the Company's subsidiaries, as they fall due for at least twelve months from the date of approval of the financial statements. Accordingly, the Directors believe that the Group and Company are a going concern and have therefore prepared the financial statements on a going concern basis.

(d) Intangible assets

Intangible assets are carried at cost less accumulated amortisation and accumulated impairment losses. An intangible asset acquired as part of a business combination is recognised outside goodwill if the asset is separable or arises from contractual or other legal rights and its fair value can be reliably measured.

The significant intangible asset cost related to external software development of products which are integral to the trade of the Group's medical imaging products.

Amortisation and impairment charges are recognised in other operating expenses in the income and expenditure account. Internal development costs are not capitalised but written off during the year in which the expenditure is incurred. The carrying value of intangible assets which are not yet being amortised because they are not yet available for use are reviewed for impairment annually. The carrying value of intangible assets which are currently being amortised are reviewed for impairment when there is an indication that they may be impaired. Impairment losses are recognised in other operating expenses in the income and expenditure account.

Costs incurred on development projects (relating to the design and testing of new or improved products) are recognised as intangible assets when it is probable that the project will be a success, considering its commercial and technological feasibility, and costs can be measured reliably. Only external software development expenditure is capitalised. Internal research expenditure is written off in the year in which it is incurred.

Other development expenditure is recognised as an expense as incurred. Intangible assets that have a finite useful life and that have been capitalised are amortised on a straight-line basis as follows:

Intangible asset | Useful economic life |

Intellectual Property | 5 - 10 years |

Customer relationships | 4 years |

Software development | 5 years |

Intellectual Property primarily relates to patent and trademark application costs. Software development costs capitalised in the year relate to products and product improvements which are yet to be ready for use.

(e) Valuation of Investments

Investments held as non-current assets are stated at cost less provision for impairment.

(f) Cash and cash equivalents

Cash and cash equivalents include cash in hand, deposits held at call with banks, other short-term highly liquid investments with original maturities of three months or less, and bank overdrafts. When used, bank overdrafts are shown within borrowings in current liabilities on the balance sheet.

(g) Goodwill

Business combinations on or after 1 April 2006 are accounted for under IFRS 3 using the acquisition method. Any excess of the cost of business combinations over the Group's interest in the net fair value of the identifiable assets, liabilities and contingent liabilities is recognised in the balance sheet as goodwill and is not amortised.

After initial recognition, goodwill is not amortised but is stated at cost less accumulated impairment loss, with the carrying value being reviewed for impairment, at least annually and whenever events or changes in circumstance indicate that the carrying value may be impaired.

For the purposes of impairment testing, goodwill is allocated to the related cash generating units monitored by management. Where the recoverable amount of the cash generating unit is less than its carrying amount, including goodwill, an impairment loss is recognised in the statement of comprehensive income.

(h) Property, plant and equipment

All property, plant and equipment is stated at historical cost less depreciation. Depreciation on other assets is provided on cost or valuation less estimated residual value in equal annual instalments over the estimated lives of the assets. The rates of depreciation are as follows:

Computer and office equipment 10 - 50% p.a.

Gains and losses on disposals are determined by comparing the proceeds with the carrying amount and are recognised in the income statement.

(i) Foreign currency

Transactions denominated in foreign currencies are translated into sterling at the rates ruling at the date of the transactions. Monetary assets and liabilities denominated in foreign currencies at the balance sheet date are translated at the rates ruling at that date. These translation differences are dealt with in the income statement.

Translation to presentation currency: The results and financial position of Group entities (none of which has the currency of a hyper‐inflationary economy) that have a functional currency different from the presentation currency (GBP) are translated into the presentational currency as follows:

· assets and liabilities presented are translated at the closing rate at the date of that reporting period;

· income and expenses are translated at average exchange rates; and

· all resulting exchange differences are recognised in other comprehensive income.

On consolidation, exchange differences arising from the translation of the net investment in foreign operations are taken to other comprehensive income.

(j) Revenue recognition

Sales transactions include software installation, software licenses, scientific and software support and consultancy. Revenue is measured at the fair value of the contractually agreed consideration received or receivable and represents amounts receivable for services provided in the normal course of business, net of VAT.

The Group recognises revenue on the basis of following IFRS15 whereby revenue is recognised on the promise of goods and services to the customer at the transaction price contractually agreed and once the performance obligations have been met. Revenue relating to software consultancy and similar services is recognised as the services are performed and completed. The invoice is recognised on a linear basis over the duration of the contract. Revenue relating to the sale of software licences such as Bleepa or associated support services is recognised over the contractual period to which the licence relates or the duration of the support contract.

Revenue recognised from the sale of TexRAD software and related scientific support services are recognised over the estimated duration of the Group's involvement in a customer's project which is considered to represent its performance obligation. This is that the Group will provide the support required as agreed when the sale was made.

The difference between the amount of revenue from contracts with customers recognised and the amount invoiced on a particular contract is included in the statement of financial position as contract liabilities. Normally, the full contract value is invoiced when the customer's purchase order is received.

Cash payments received as a result of this advance billing are not representative of revenue earned on the contract as revenues are recognised over the duration of the contract (typically twelve months). Contract liabilities which are expected to be recognised within one year are included within current liabilities. Contract liabilities which are expected to be recognised after one year are included within non-current liabilities.

Government Grants:

Grants that reimburse the Group for specific expenses are recognised in the income statement over the periods in which the related expenses are incurred, on a basis that reflects the pattern of those expenses. Claims are submitted for pre-defined periods, with any timing differences recorded as accrued or deferred income.

(k) Pension Costs

The Group operated a defined contribution pension scheme during the year. The pension charge represents the amounts payable by the Group to the scheme in respect of that year.

(l) Taxation

The tax credit represents the sum of the current tax credit and deferred tax credit.

The tax currently payable is based on taxable profit for the period. Taxable profit differs from net profit as reported in the income statement because it excludes items of income or expense that are taxable or deductible in other years and it further excludes items that are never taxable or deductible. The Group's liability for current tax is calculated by using tax rates that have been enacted or substantively enacted by the balance sheet date.

Tax credits claimed under the Merged Scheme R&D Expenditure Credit (RDEC) are accounted for under IAS 20 as government grants in line with the accounting policy above. The company previously made claims under the Small and Medium-sized Enterprise (SME) R&D tax relief scheme where the tax credit would be treated as non-taxable income unlike the RDEC scheme.

Deferred tax is the tax expected to be payable or recoverable on differences between the carrying amount of assets and liabilities in the financial statements and the corresponding tax bases used in the computation of taxable profit and is accounted for using the balance sheet liability method. Deferred tax

liabilities are recognised for all taxable temporary differences and deferred tax assets are recognised to the extent that it is probable that taxable profits will be available against which deductible temporary differences can be utilised. Such assets and liabilities are not recognised if the temporary difference arises from the initial recognition of goodwill or from the initial recognition (other than in business combination) of other assets and liabilities in a transaction which affects neither the tax profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary differences arising on investments in subsidiaries, except where the Group is able to control the reversal of the temporary difference and it is probable that the temporary difference will not reverse in the foreseeable future.

Deferred tax is calculated at the tax rates that are expected to apply to the period when the asset is realised or the liability is settled based upon tax rates that have been enacted or substantively enacted by the balance sheet date.

Deferred tax is charged or credited in the income statement, except when it relates to items credited or charged directly to equity, in which case the deferred tax is also dealt with in equity.

(m) Financial instruments

Financial assets

Financial assets are measured at amortised cost, fair value through other comprehensive income (FVTOCI) or fair value through profit or loss (FVTPL). The measurement basis is determined by reference to both the business model for managing the financial asset and the contractual cash flow characteristics of the financial asset. The group's financial assets comprise of trade and other receivables and cash and cash equivalents.

Trade receivables

Trade receivables are initially recognised at transaction price and subsequently measured at amortised cost, carried at the original invoice amount less allowances for expected credit losses. Expected credit losses are calculated in accordance with the simplified approach permitted by IFRS 9, using a provision matrix applying lifetime historical credit loss experience to the trade receivables. The expected credit loss rate varies depending on whether, and the extent to which, settlement of the trade receivables is overdue and it is also adjusted as appropriate to reflect current economic conditions and estimates of future conditions.

For the purposes of determining credit loss rates, customers are classified into groupings that have similar loss patterns. The key drivers of the loss rate are the aging of the debtor, the geographic location and the customer type (public vs private).

When a trade receivable is determined to have no reasonable expectation of recovery it is written off, firstly against any expected credit loss allowance available and then to the income statement.

For trade receivables, which are reported net, such provisions are recorded in a separate provision account with the loss being recognised in the consolidated statement of comprehensive income.

Subsequent recoveries of amounts previously provided for or written off are credited to the income statement.

Cash and cash equivalents

Cash and cash equivalents comprise cash at hand and deposits with maturities of three months or less.

Financial liabilities

The Group's financial liabilities consist of trade payables and other financial liabilities. Financial liabilities are classified as measured at amortised cost or FVTPL. A financial liability is classified as FVTPL if it is held-for trading, it is a derivative or it is designated as such on initial recognition. Other financial liabilities are subsequently measured at amortised cost using the effective interest method. Interest expense is recognised in profit or loss.

(n) Employee share options and warrants

The Group has applied the requirements of IFRS 2 Share-based Payments.

The Group has issued equity-settled share-based payment transactions to certain employees and previously issued warrants to the vendors of the acquired subsidiary, TexRAD Limited. Equity-settled

share-based payment transactions are measured at fair value at the date of grant. The fair value determined at the grant date of equity-settled share-based payments is expensed on a straight-line basis over the vesting period, based on the Group's estimate of shares that will eventually vest.

Fair value is measured by use of the Black Scholes option pricing model for share options without performance obligations and the Monte Carlo option pricing model for share options with performance obligations. The expected life used in the model has been adjusted, based on management's best estimate, for the effect of non-transferability, exercise restrictions, and behavioural considerations.

(o) Key areas of judgement

The preparation of financial statements requires the Board of Directors to make estimates and judgments that affect reported amounts of assets, liabilities, revenues and expenses. These estimates and judgements are based on historical experience and various other assumptions that management and the Board of Directors believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources.

The key areas of judgement are:

· Intangible assets - Patent and trademark applications are included at cost less amortisation and impairment. Other intangible assets including development costs are recognised only when it is probable that a project will be a success. There is a risk therefore that a project previously assessed as likely to be successful fails to reach the desired level of commercial or technological feasibility. Where there is no probable income to be generated from these assets an estimation of the carrying value and the impairment of the intangible assets and development costs, including goodwill, has been made.

· Impairment review of intangible assets - The Group conducts an annual impairment review of its intangible assets (with a net book value post impairment of £564,216 at the 31 May 2025 year-end, 2024: £4,068,136), or more frequently if indicators of impairment are identified. In performing this review, the Group takes into consideration various factors, including the inherent uncertainty around winning new NHS contracts, the timing of those contracts, and the cash flows expected to be generated. An impairment review has been conducted using under conservative assumptions using a 5-year net present value (NPV), value-in-use model to compare the estimated recoverable amount of the intangible assets to their carrying value. Management has applied the following key assumptions:

o a pretax discount rate of 20.15%

o Forecast period of 5 years, without any terminal value

o Revenues generated from existing customer contracts only

Given the inherent uncertainty in these assumptions, the carrying value of the intangible assets is sensitive to changes in key estimates. The most significant risks to the carrying amount are:

o Discount rate sensitivity in that an increase would reduce the recoverable amount

o NHS contract wins and timing, lower or slower conversion of expected sales forecast impacting future cash flow projections

o Growth rates affected due to market conditions, impacting future cash flows

A reasonable possible change in any of these key assumptions could result in a material change to impairment loss. The Group and management continue to monitor these assumptions when reassessing the intangible assets.

Fair value measurement - share options and warrants issued included in the Group's and Company's financial statements require measurement at fair value. The calculation of fair values requires the use of estimates and judgements, details of the valuation can be found in Note 18 of this report.

· Revenue recognition - revenue on the sale of software and provision of related scientific support services is recognised over the expected duration of the group's involvement in customer's projects as the group's staff contribute significant support, analysis and input to those customers using our software for research purposes. Judgement based on past experience is used to determine the expected duration of involvement over which income should be deferred and recognised however the duration of the group's involvement may vary from expectations.

4. Segmental reporting

The Directors have determined that the operating segments based on the management reports which are used to make strategic decisions are medical imaging and head office. The trading activities of the Company solely relate to Medical Imaging, Feedback Medical Imaging India and the Head Office covers the costs of running the parent company, Feedback PLC.

|

|

| |||

Year ended 31 May 2025 |

| Medical Imaging | Feedback Medical Imaging India | Head Office | Total |

|

| £ | £ | £ | £ |

Revenue | |||||

External | 880,221 | 5,402 | - | 885,623 | |

Expenditure | |||||

Total (excluding depreciation and amortisation) | (2,681,421) | (136,605) | (1,173,584) | (3,991,610) | |

Impairment of intangible assets | (3,192,429) | - | - | (3,192,429) | |

Depreciation and amortisation | (1,146,387) | (324) | - | (1,146,711) | |

Other Income - tax credit | 159,964 | - | - | 159,964 | |

Loss before tax | (5,980,052) | (131,527) | (1,173,584) | (7,285,163) | |

Balance sheet | |||||

Total assets | 929,272 | 4,812 | 5,819,526 | 6,753,610 | |

Total liabilities | (486,204) | (5,599) | (97,220) | (589,023) | |

443,068 | (787) | 5,722,306 | 6,164,587 | ||

Capital expenditure | (832,241) | (1,569) | - | (833,810) | |

The revenues from external customers in 2025 are comprised of the following products Bleepa: £794,440, Image Engineering license fees: £57,545 and legacy products Cadran PACS: £33,638.

| |||||

Year ended 31 May 2024 | Medical Imaging | Head Office | Total | ||

£ | £ | £ | |||

Revenue | |||||

External | 1,181,544 | - | 1,181,544 | ||

Expenditure | ||||

Total (excluding depreciation and amortisation) | (2,829,839) | (991,154) | (3,820,993) | |

Depreciation and amortisation | (957,549) | - | (957,549) | |

Loss before tax | (2,605,844) | (991,154) | (3,596,998) | |

Tax credit | 298,631 | - | 298,631 | |

Balance sheet | ||||

Total assets | 4,467,243 | 3,871,674 | 8,338,917 | |

Total liabilities | (608,888) | (85,292) | (694,180) | |

| ||||

3,858,355 | 3,786,382 | 7,644,737 | ||

Capital expenditure (all located in the UK) | (1,312,824) | - | (1,312,824) | |

Reported segments' assets are reconciled to total assets as follows:

| External revenue by | Non-current assets by | |||||

| location of customer | location of assets | |||||

| 2025 | 2024 | 2025 | 2024 | |||

| £ | £ | £ | £ | |||

United Kingdom | 822,676 | 1,058,956 | 589,023 | 4,081,129 | |||

Europe | - | - | - | - | |||

Rest of the world | 62,947 | 122,588 | - | - | |||

Total | 885,623 | 1,181,544 | 589,023 | 4,081,129 | |||

| |||||||

£221,378 of revenue recognised in the current year was recorded in contract liabilities in the prior year (2024: £441,048).

Major customers

During the year ended 31 May 2025, the Group generated £491,250 of revenue from one customer in the United Kingdom, which is equal to 55% of total Group revenues in the year. Major customer from the rest of the world is located in USA and accounts for £57,545 of group revenue generated.

5. Other operating expenses

2025 | 2024 | ||||

£ | £ | ||||

Administrative costs: | |||||

Employment and other costs | 4,002,447 | 3,834,999 | |||

Amortisation and depreciation costs | 1,146,711 | 957,549 | |||

5,149,158 | 4,792,548 | ||||

6. Operating loss

|

|

|

| 2025 | 2024 |

|

|

|

| £ | £ |

This is stated after charging | |||||

Owned assets | 11,860 | 14,422 | |||

Amortisation of intangible assets | 1,134, 852 | 943,128 | |||

Impairment of intangible assets | 3,192,429 | - | |||

Provision for doubtful debts | (720) | (320) |

Foreign exchange differences | 36,621 | 26,122 | ||||

Auditors' remuneration | ||||||

Audit of parent company and group financial statements | 25,200 | 22,170 | ||||

Audit of subsidiaries | 16,800 | 14,780 | ||||

| ||||||

7. Net finance income

|

|

|

| 2025 | 2024 |

|

|

|

| £ | £ |

Interest received | 117,813 | 93,135 | |||

117,813 | 93,135 |

8. Directors and employees

|

|

| 2025 | 2024 | 2025 | 2024 |

|

|

| Average | Average | Year-end FTE | Year-end FTE |

Number of employees |

|

|

|

|

|

|

Selling and distribution | 6 | 2 | 7 | 3 | ||

Administration | 16 | 17 | 15 | 17 | ||

Research and development | 7 | 7 | 7 | 7 | ||

29 | 26 | 29 | 27 | |||

|

|

|

|

|

2025 |

2024 |

|

|

|

|

| £ | £ |

Staff costs |

|

|

|

|

|

|

Wages and salaries | 2,293,588 | 2,138,863 | ||||

Social security costs | 262,068 | 250,428 | ||||

Payments to defined contribution pension scheme | 238,044 | 225,800 | ||||

Share based payment expense | 216,930 | 74,469 | ||||

3,010,630 | 2,689,560 | |||||

Details of Directors' remuneration for the year ended 31 May 2025 and the prior year ended 31 May 2024 are set out in the Remuneration Committee report.

9. Taxation on loss

| 2025 | 2024 | ||

| £ | £ | ||

(a) | The tax credit for the year: | |||

| UK Corporation tax | 1,867 | (298,631) | |

| ||||

| ||||

| Deferred Tax: Origination and reversal of timing differences |

30,393 |

- | |

| Current tax (credit)/expense | 32,260 | (298,631) | |

|

| |||

| 32,260 | (298,631) | ||

|

(b) | Tax reconciliation | |||

| Loss before tax | (22,108,134) | (4,507,137) | |

| ||||

| Loss at the standard rate of corporation tax in the UK of 25% (2023 - 20%) | (5,527,033) | (1,126,784) | |

| Fixed asset differences | 1 | (1,665) | |

| Expenses non-deductible for tax purposes | 3,796,893 | 270,884 | |

| Other permanent differences | (298) | 164 | |

| Additional deduction for R&D expenditure | - | (345,517) | |

| Surrender of tax losses for R & D tax credit refund | - | 448,368 | |

| Deferred tax not recognised | 1,760,830 | 455,637 | |

| Foreign tax credits | 1,867 | 282 | |

| Tax charge for the year | 32,260 | (298,631) |

(c) Factors which may affect future tax charges

In view of the tax losses carried forward there is a deferred tax amount of approximately -£3,727,451 (2024: £1,966,621) which has not been recognised in these Financial Statements. This contingent asset will be realised when the Group makes sufficient taxable profits in the relevant company.

(d) Deferred tax - Company

In view of the tax losses carried forward there is a deferred tax amount of approximately -£1,289,666 (2024: £1,179,468) which has not been recognised in the Company Financial Statements. This contingent asset will be realised when the Company makes sufficient taxable profits.

10. Results of Feedback Plc

As permitted by Section 408 of the Companies Act 2006, the income and expenditure account of the parent company is not presented as part of these financial statements. The Company's loss for the financial year is £15,519,728 (2024 loss: £1,488,345). The loss for the financial year 2025 includes an impairment charge on the investment in its subsidiary Feedback Medical Ltd of £14,699,125, further detail on this can be found in note 12.

11. Loss per share

Basic loss per share is calculated by reference to the loss on ordinary activities after taxation of £7,317,423, (2024: £3,298,367) and on the weighted average shares in issue of 28,699,980 (2024: 13,334,659).

|

| 2025 £ | 2024 £ |

Net loss attributable to ordinary equity holders |

| (7,317,423) | (3,298,367) |

| 2025 | 2024 | |

Weighted average number of ordinary shares for basic earnings per share | 28,699,980 | 13,334,659 | |

Effect of dilution: | |||

Share Options | - | - | |

Warrants | - | - | |

Weighted average number of ordinary shares adjusted for the effect of dilution |

| 28,699,980 | 13,334,659 |

Loss per share (pence) | |||

Basic | (25.50) | (24.74) | |

Diluted | (25.50) | (24.74) | |

There is no dilutive effect of the share options and warrants as the dilution would be negative for the periods presented. There are 4,010,875 share options outstanding as at 31 May 2025 which could potentially dilute basic earnings per share in the future but were not included in the calculation of diluted earnings per share because they are anti-dilutive for the periods presented.

12. Investments

Share in Group undertakings | Total | ||

Company | £ | £ | |

|

|

| |

Cost |

|

| |

At 31 May 2023 | 12,317,795 | 12,317,795 | |

Addition (see note below) | 8,080 | 8,080 | |

| At 31 May 2024 | 12,325,875 | 12,325,875 |

Addition (see note below) | 54,226 | 54,226 | |

As at 31 May 2025 | 12,380,101 | 12,380,101 | |

| |||

| Provision for impairment | ||

At 31 May 2023 | 2,817,693 | 2,817,693 | |

Additional impairment included in operating expenses | 1,004,649 | 1,004,649 | |

At 31 May 2024 | 3,822,342 | 3,822,342 | |

Additional impairment included in operating expenses (see note below) | 8,557,759 | 8,557,759 | |

| |||

At 31 May 2025 | 12,380,101 | 12,380,101 | |

|

|

| |

| Net Book Value |

|

|

| At 31 May 2025 | - | - |

| At 31 May 2024 | 8,503,533 | 8,503,533 |

All of the above investments are unlisted.

The cost additions in 2025 of £54,226 are related to options in Feedback Medical Limited which would be satisfied with Feedback Plc shares if/when they are exercised.

The impairment loss in 2025 by the Company (Head Office segment) primarily relates to a £8,557,657 impairment against the cost of investment in the principal operating subsidiary of the Group, Feedback Medical Limited. The carrying value of the Company's investment in Feedback Medical Limited was £8,557,657 prior to an impairment review and has now been fully impaired. A full impairment of £102 against the cost of investment in Feedback Medical India PVT Limited was also made.

The total carrying value of the Company's equity investment plus loan investment of £6,141,468 in Feedback Medical Limited was £14,699,125 prior to an impairment review.

The impairment review, which is performed annually or more frequently if events or changes in circumstances indicate a potential impairment, compares the carrying value to the recoverable amount, being the higher of value in use ("VIU") and fair value less costs to sell.

Management prepared five-year cash flow forecasts (aligned with IAS 38) under several scenarios reflecting a range of potential outcomes. To ensure a prudent assessment the most conservative scenario was selected as the basis for the impairment review, with a modest revenue growth rate of 5% (Level 3 of the fair value hierarchy) over this five-year period and without any terminal value, inherently assuming no new customer wins. The cashflows were discounted using a discount rate (pre-tax) of 20.15% (Level 3 input of fair value hierarchy). Management has determined the VIU of Feedback Medical Limited as being Nil under these conservative assumptions.

On this basis, the recoverable amount has a shortfall compared to the total carrying value of £14,699,125 (equity investment plus loan) and therefore an impairment of £14,699,125 has been recognised, of which £8,557,657 has been recognised against the equity investment in Feedback Medical Limited, bringing the carrying value to Nil (2024: £8,503,533) and £6,141,468 has been recognised against the loan investment in Feedback Medical Limited, also bringing this carrying value to Nil.

Sensitivity analyses of key inputs have been performed, which would result in a change to the impairment conclusion as follows:

Sensitivity | VIU (recoverable amount) | Impairment |

-2% change in discount rate | Nil | £14,699,125 |

10% annual revenue growth | £334,777 | £14,364,349 |

25% annual revenue growth | £4,830,163 | £9,868,963 |

50% annual revenue growth | £18,016,765 | Nil |

An impairment loss for a non-goodwill asset can be reversed in future accounting periods if the circumstances that caused the original loss have been reversed. No impairment reversals were recognised during the year.

Particulars of principal subsidiary companies during the year, all the shares of which being beneficially held by Feedback Plc, were as follows:

Company | Activity | Country of incorporation and operation | Proportion of Shares held |

Brickshield Limited | Dormant | England | 100%Ordinary £1 |

Bleepa Limited | Dormant | England | 100%Ordinary £2 |

Feedback Medical Limited | Medical Imaging | England | 100% A Ordinary £1 100% B Ordinary 1p |

Feedback Medical India Private Limited | Medical Imaging | India | Direct 0.1% and Indirect 99.9% Ownership 100% Ordinary INR 10 |

TexRAD Limited | Medical Imaging | England | 100% Ordinary 1p |

All the subsidiary companies have been included in these consolidated financial statements.

TexRAD Limited is owned 100% by virtue of a direct holding by Feedback plc of 91% and an indirect holding via Feedback Medical Ltd of 9%.

Feedback Medical India Private Limited is owned 100% by virtue of a direct holding by Feedback Plc of 0.1% and an indirect holding via Feedback Medical Ltd of 99.9%. Its registered office address is Shop G 183, Ground Floor, Raghuleela, Mega Mall, SV Road, Kandivali West, Mumbai, Mumbai City, Maharashtra, India, 400067. The statutory year end for Feedback Medical India Private Limited is 31 March.

Each of the other subsidiary's registered office address is 201 Temple Chambers, 3-7 Temple Avenue, London, England, United Kingdom, EC4Y 0DT.

In accordance with section 394A of the Companies Act 2006, a company is exempt from preparing individual accounts for a financial year. This section 394A of the Companies Act 2006 applies to Brickshield Limited (company registration number 06514313) and Bleepa Limited (company registration number 12118570). | |||

13. Property, plant and equipment

|

| Computer | Total |

|

| Equipment | |

Group |

| £ | £ |

|

|

|

|

Cost |

|

|

|

At 31 May 2023 | 71,038 | 71,038 | |

Additions | 12,506 | 12,506 | |

At 31 May 2024 | 83,544 | 83,544 | |

Additions | 10,450 | 10,450 | |

As 31 May 2025 | 93,994 | 93,994 | |

Depreciation | |||

At 31 May 2023 | 56,129 | 56,129 | |

Charge for the year | 14,422 | 14,422 | |

At 31 May 2024 | 70,551 | 70,551 | |

Charge for the year | 11,860 | 11,848 | |

At 31 May 2025 | 82,411 | 82,399 | |

| |||

Net Book Value |

| ||

At 31 May 2025 | 11,583 | 11,583 | |

At 31 May 2024 | 12,993 | 12,993 | |

14. Intangible assets

| Software development | Intellectual Property | Total |

| £ | £ | £ |

Cost |

|

|

|

At 31 May 2023 | 5,630,692 | 197,852 | 5,828,544 |

Additions | 1,293,342 | 6,976 | 1,300,318 |

At 31 May 2024 | 6,924,034 | 204,828 | 7,128,862

|

Additions | 823,361 | - | 823,361 |

At 31 May 2025 | 7,747,395 | 204,828 | 7,952,223

|

Amortisation and Impairment | |||

At 31 May 2023 | 1,952,123 | 165,475 | 2,117,598 |

Amortisation charge for year | 932,383 | 10,745 | 943,128 |

At 31 May 2024 | 2,884,506 | 176,220 | 3,060,726 |

Impairment | 3,175,233 | 17,196 | 3,192,429 |

Amortisation charge for year | 1,123,440 | 11,412 | 1,134,852 |

At 31 May 2025 | 7,183,179 | 204,828 | 7,388,007 |

Net Book Value |

|

|

|

At 31 May 2025 | 564,216 | - | 564,216 |

At 31 May 2024 | 4,039,528 | 28,608 | 4,068,136 |

An impairment review for the cash generating unit (CGU) - Bleepa has been performed based on its VIU. Bleepa belongs to the Medical Imaging reportable segment. Management prepared five-year cash flow forecasts (aligned with the useful life of the intangible assets) under several scenarios reflecting a range of potential outcomes. To ensure a prudent assessment the most conservative scenario was selected as the basis for the impairment review, whereby revenues are assumed to be generated from existing customer contracts only of which only two customers renew annually over this five-year period and without any terminal value.

The cashflows were discounted resulting in an NPV of £564,216 in this conservative scenario. This compares to a pre-impairment carrying amount of £3,764,517, resulting in the recognition of an impairment loss of £3,192,429. The impairment loss has been allocated to individual assets that constitute the Bleepa CGU in accordance with IAS 36 (104-105). The primary events and circumstances that led to the recognition of an impairment loss were:

· Fall in the share price of parent company Feedback plc;

· Uncertainty around NHS contracts and the timing of those contracts due to the ongoing merging of NHSE with the DHSC and the requirement for ICBs to reduce operational costs; and

· Wider macro-economic environment of the UK having an effect on growth rates.

Key assumptions applied in the VIU assessment:

· Discount rate (pre-tax) of 20.15% using the Capital Asset Pricing Model (CAPM), with the following key assumptions:

- Beta of 2.0, considered conservative when benchmarked against comparable companies

- Risk-free rate of 4.7% based on the UK 10-year government bond

- Equity risk premium of 5.1% based on latest publicly available data

- Business risk premium of 5.0%

- Long term gearing target of 11.1%

· Forecast period: 5 years, without any terminal value

· Revenues from existing customer contracts only of which only two customers renew annually

Sensitivity analyses of key inputs has been performed, which would result in a change to the impairment conclusion as follows:

Sensitivity | VIU (recoverable amount) | Impairment |

+2% change in discount rate | £556,744 | £3,207,773 |

-2% change in discount rate | £588,437 | £3,176,079 |

+50% change in revenue | £1,252,032 | £2,512,484 |

-20% change in revenue | £358,884 | £3,405,633 |

Summary:

|

|

|

Carrying value before impairment | £3,764,517 | |

VIU (recoverable amount) | £564,216 | |

Impairment loss recognised | £3,192,429 |

Management considers that the revised carrying amount of the intangible assets reflects their recoverable amount as at 31 May 2025. In preparing the impairment assessment, conservative assumptions were required to be applied, for example, assuming no additional new customer wins over a five-year period. The Board continues to believe that the technology has significant potential, and this impairment does not reflect their commercial assessment of the value of the Group's intangible assets. An impairment loss for a non-goodwill asset can be reversed in future accounting periods if the circumstances that caused the original loss have been reversed. No impairment reversals were recognised during the year.

15. Trade and other receivables

| Group | Company | ||

| 2025 | 2024 | 2025 | 2024 |

| £ | £ | £ | £ |

Amounts falling due within one year |

|

|

|

|

Trade receivables | 2,189 | 1,110 | - | - |

Other receivables | 13,069 | 10,601 | 11,919 | 9,868 |

Prepayments | 73,623 | 59,720 | 40,540 | 33,715 |

Accrued Revenue | 9,657 | 10,210 | - | - |

98,538 | 81,641 | 52,459 | 43,583 | |

16. Trade and other payables

| Group | Company | ||

| 2025 | 2024 | 2025 | 2024 |

| £ | £ | £ | £ |

Amounts falling due within one year |

|

|

|

|

Trade payables | 113,589 | 179,755 | 13,619 | 9,654 |

Other payables | 25,650 | 21,412 | - | - |

Other taxes and social security | 76,184 | 98,394 | 19,966 | 18,503 |

Accruals | 149,422 | 178,163 | 63,620 | 57,123 |

Contract liabilities | 224,178 | 216,456 | - | - |

589,023 | 694,180 | 97,205 | 85,280 | |

Neither the Group or the Company have any borrowings and so there are no changes in liabilities arising from external financing activities.

17. Financial instruments

The Group's overall risk management programme seeks to minimise potential adverse effects on the Group's financial performance.