16th Feb 2026 10:30

Jangada Mines plc / EPIC: JAN.L / Market: AIM / Sector: Mining

16 February 2026

Jangada Mines plc ('Jangada' or 'the Company')

Drilling Commenced at Molly Gold Project in Brazil

Building a resource in a premium gold district

Jangada Mines Plc (AIM: JAN), a Brazil focused natural resource development company, is pleased to announce that the first stage of its fully funded 2,000m drilling programme at the Molly Gold Project ('Molly' or 'the Project') located in the Tapajós region of Pará State, Brazil has commenced.

Highlights:

· 2,000m drilling campaign commenced utilising three rigs and five crews

· Programme includes diamond drilling to:

o confirm historical data

o confirm the westward continuity of the Molly 1 quartz vein

o test potential continuity to the east

o explore beneath the known vein exposure

· Shallow nature of the mineralisation means planned hole depths ranging from a minimum of 150m to a maximum of 200m

· Molly 1 target has a JORC inferred resource of 130,000 oz Au - drilling aims at expanding resource and known mineralised corridor and identifying further primary gold occurrence beyond extensive alluvial occurrences

Jangada Mines CEO Paulo Misk said, "We are delighted to have commenced the initial 2,000m diamond drilling programme at the high grade, shallow Molly Gold Project. The existing drill data, with grades including 6.5m at 10.5 g/t and 1m at 200 g/t, excellent geophysical signatures and approximately 300 hectares of alluvial excavation, provide us with high confidence that we either are targeting a substantial gold-bearing vein system that lies beneath the alluvial workings, or a complex network of mineralised veins exists within the adjacent higher-elevation terrain.

"The initial campaign is focussed on the Molly 1 target, confirming existing and identifying additional vein structures, as well as understanding multiple extensions to the east and west. With five drill crews and three rigs being utilised, secured quickly through the Board's operational network, means that we will quickly understand the direction the programme needs to develop to execute our obligations for the acquisition. We look forward to updating the market as soon as practicable on the programme and understanding what we believe to be the excellent potential of the Molly Gold Project."

Details:

Molly already has outstanding high-grade intercepts from historic drilling, including 6.5m at 10.5 g/t and 1m at 200 g/t, and an initial JORC resource of 130,000 ounces of gold. A three-dimensional geological and mineralisation model already shows that gold mineralisation extends from near surface to depths of approximately 150m over a strike length of around 400m at the Molly 1 target and geophysical data indicates that the identified mineralisation, where the initial resource is located, represents only part of a much larger system, with a well-defined structural corridor extending more than 500m to the west and potentially to the east. This highlights strong potential for significant resource expansion through exploration.

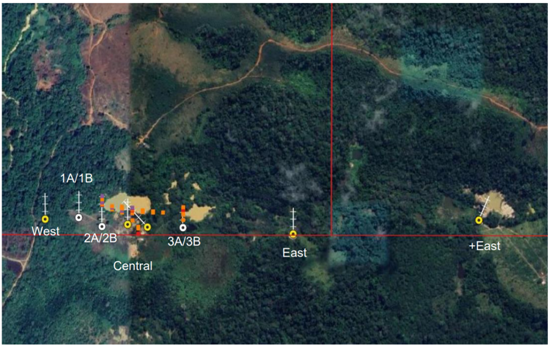

The short-term drilling strategy, comprising approximately 2,000m of drilling through to April 2026. This programme includes diamond drilling to confirm historical data, drilling to confirm the westward continuity of the Molly 1 quartz vein, and selected holes to test potential continuity to the east, approximately 2km beyond the existing garimpeiro excavations, as well as limited deeper drilling beneath the known vein exposure.

Five drilling teams and three drill rigs will be utilised to drill the Molly 1 target and adjacent areas. The proposed drill plan comprises three drill positions for a total of an initial five holes. These are designed at dip angles of 50° and 65°, for approximately 900 metres of drilling, with planned hole depths ranging from a minimum of 150m to a maximum of 200m.

Once initial drill holes are executed and tested and geological surveys are completed, the remaining 1,100m programme will be finalised.

Additionally new target opportunities are being generated. A regional exploration team is being assembled to conduct detailed structural mapping in the north-central portion of the mineral right, in the area named Boomerang, which was the site of intense artisanal mining activity in previous years. The extensive alluvial area (Boomerang) indicates that the primary sources are proximal and located within the mineral concession area, allowing a preliminary interpretation of shallow mineralized veins, which will be verified through regional exploration.

The medium-term drilling strategy, targeting a further 2,500 metres through to December 2026, aims to define new targets and expand resources. This includes detailed mapping across the entire mineral right, particularly focusing on higher-elevation areas, systematic evaluation of the 300 hectares of alluvium to identify underlying quartz vein structures, trenching along the projected continuity of the Molly 1 vein and newly identified quartz veins, and assessment of geophysical and geochemical methods to improve targeting and identify additional mineralised structures.

Please refer to the Company's 9 February 2026 RNS for further details on the Molly gold project potential acquisition.

**ENDS**

For further information please visit www.jangadamines.com or contact:

Hugo de Salis | Jangada Mines plc

| |

Ritchie Balmer James Spinney Harry Hiley | Strand Hanson Limited Nominated & Financial Adviser | Tel: +44 (0)20 7409 3494 |

Jonathan Evans | Tavira Financial Ltd Broker | Tel: +44 (0)20 7100 5100 |

About Jangada Mines Plc

Jangada is a natural resource development company listed on AIM of the London Stock Exchange (AIM:JAN) with assets in Brazil. It is led by a team with deep industry, financial and in-country experience, and has a dual growth strategy to:

• Advance its portfolio projects including the high-grade Molly Gold Project (over which the Company is currently earning into an option to acquire), the Paranaíta Gold Project and the 100%-owned Pitombeiras vanadium titanomagnetite Project

• Utilise its proven in-country and geological expertise to identify/acquire additional projects that it can rapidly advance to build value for shareholders.

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014 as it forms part of United Kingdom domestic law by virtue of the European Union (Withdrawal) Act 2018, as amended by virtue of the Market Abuse (Amendment) (EU Exit) Regulations 2019.

Related Shares:

Jangada Mines