22nd Jul 2025 07:00

The information contained within this announcement is deemed to constitute inside information as stipulated under the retained EU law version of the Market Abuse Regulation (EU) No. 596/2014 (the "UK MAR") which is part of UK law by virtue of the European Union (Withdrawal) Act 2018. The information is disclosed in accordance with the Company's obligations under Article 17 of the UK MAR. Upon the publication of this announcement, this inside information is now considered to be in the public domain.

Oriole Resources PLC

('Oriole Resources' or the 'Company')

Confirmed Extension of Sub-Surface Gold System at Mbe

Oriole Resources PLC (AIM: ORR), the AIM quoted gold exploration company focused on West and Central Africa, is pleased to report further positive drilling results for its 90%[1] owned Mbe orogenic gold project ('Mbe' or the 'Project') in Cameroon.

Highlights

· Results from holes MBDD014 to MBDD017 have returned multiple gold ('Au') mineralised intersections from maiden ('Phase 1') drilling at the MB01-S target.

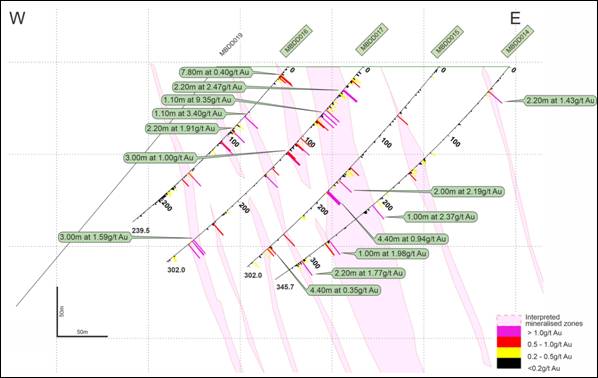

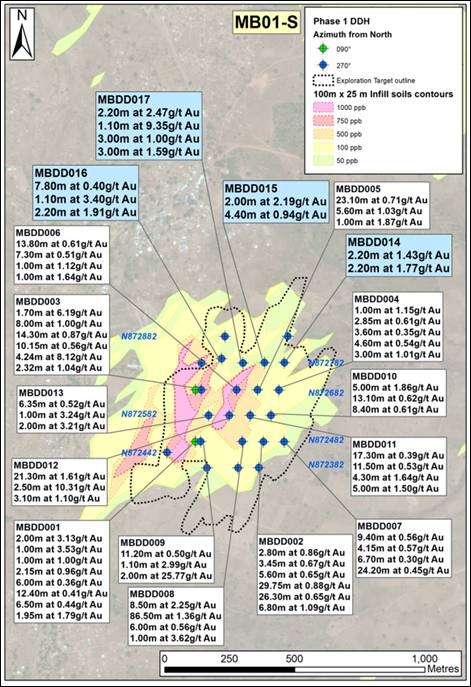

· Results include 1.10m at 9.35g/t Au, 2.20m at 2.47g/t Au and 3.00m at 1.59g/t Au (using a 0.20 g/t Au lower cut-off grade; see Figures 1 & 2 and Table 1 below).

· The strike length of sub-surface mineralisation has been increased to at least 300m, underpinning the maiden Exploration Target published earlier this month. The system remains open in all directions and at depth.

· Following a review of the Exploration Target geostatistical data, the fully-funded Phase 1 drilling programme at MB01-S has been expanded to 7,050m in 25 holes. A total of 5,580.50m has been drilled to date, with 18 holes (MBDD001-018) completed and a nineteenth hole (MBDD019) is nearing completion.

· Following completion of the maiden drilling programme, the Company anticipates publishing an independent consultant's maiden, pit-constrained Mineral Resource Estimate ('MRE') for MB01-S in Q4-2025.

Commenting, Chief Executive Officer of Oriole Resources, Martin Rosser, said: "The latest set of drilling results continues to support our expectation, based on the recently publish JORC exploration target, of defining a resource of considerable scale at MB01-S. We now have delineated a substantial gold system which, importantly, remains open in all directions and at depth and we look forward to reporting the maiden MRE in Q4-2025."

Figure 1. Interpretative cross section for fence line N872782 with gold assay results from holes MBDD014 - MBDD017. Hole MBDD019 is in progress.

Further Details

A Phase 1 diamond drilling programme commenced at MB01-S in late November 2024. A total of 5,580.50m has been drilled to date, with 18 holes (MBDD001-018) completed and a nineteenth hole (MBDD019) nearing completion.

The Company today reports results for holes MBDD014 to MBDD017, all drilled towards the west (270˚) on fence line N872782 that is located 100m to the north of fence line N872682 (holes MBDD003-006). Results have delivered 58 further mineralised intersections, including 1.10m at 9.35g/t Au, 2.20m at 2.47g/t Au and 3.00m at 1.59g/t Au (Table 1, Figure 2), bringing the running total to over 250 gold bearing intersections which equates to a discovery rate of over one intersection per 19m. A review of the QAQC samples has confirmed that the data falls within acceptable limits of error except for one blank that returned very low levels of gold and remedial action for this blank sample is underway.

Figure 2. Updated plan for Phase 1 drilling at MB01-S with a selection of best results to date from MBDD001 to MBDD017, and the holes reported today in blue boxes. Green dots denote holes drilled/planned towards 090 degrees (from Grid North) and blue dots are those drilled towards 270 degrees. Drilling fence line numbers are in blue text.

Importantly, this drilling fence line was not covered by the 2024 trenching campaigns and so has provided greater data resolution over this part of system. The results have extended the strike length of sub-surface mineralisation at MB01-S to 300m, underpinning the recently published Exploration Target. Drilling results to date have also confirmed that the system at MB01-S is up to 400m wide and has a vertical depth of at least 290m; it remains open in all directions and at depth.

Table 1. Calculated intersections from Phase 1 holes MBDD014-017, using a 0.20g/t Au lower cut-off grade. Results greater than 1.00g/t Au are in bold and 'including' intervals are in bold italics.

Hole ID | From (m) | To (m) | Au grade (g/t) | Intersection |

MBDD014 | 33.30 | 35.50 | 1.43 | 2.20m at 1.43g/t Au |

including | 34.40 | 35.50 | 2.58 | 1.10m at 2.58g/t Au |

and | 38.80 | 39.90 | 0.22 | 1.10m at 0.22g/t Au |

and | 125.50 | 126.60 | 0.34 | 1.10m at 0.34g/t Au |

and | 137.90 | 140.10 | 0.28 | 2.20m at 0.28g/t Au |

and | 151.50 | 153.50 | 0.26 | 2.00m at 0.26g/t Au |

and | 155.60 | 156.60 | 0.42 | 1.00m at 0.42g/t Au |

and | 158.60 | 159.60 | 0.58 | 1.00m at 0.58g/t Au |

and | 192.10 | 193.20 | 0.21 | 1.10m at 0.21g/t Au |

and | 204.70 | 205.70 | 0.45 | 1.00m at 0.45g/t Au |

and | 211.70 | 212.70 | 2.37 | 1.00m at 2.37g/t Au |

and | 272.40 | 273.40 | 1.98 | 1.00m at 1.98g/t Au |

and | 275.50 | 278.90 | 0.39 | 3.40m at 0.39g/t Au |

and | 305.30 | 306.40 | 0.27 | 1.10m at 0.27g/t Au |

and | 308.60 | 310.80 | 1.77 | 2.20m at 1.77g/t Au |

including | 309.70 | 310.80 | 3.32 | 1.10m at 3.32g/t Au |

and | 315.30 | 316.30 | 0.43 | 1.00m at 0.43g/t Au |

MBDD015 | 69.30 | 70.35 | 0.78 | 1.05m at 0.78g/t Au |

and | 145.60 | 146.60 | 0.66 | 1.00m at 0.66g/t Au |

and | 149.60 | 151.60 | 0.45 | 2.00m at 0.45g/t Au |

and | 153.60 | 154.60 | 0.41 | 1.00m at 0.41g/t Au |

and | 164.20 | 166.20 | 2.19 | 2.00m at 2.19g/t Au |

including | 164.20 | 165.20 | 4.14 | 1.00m at 4.14g/t Au |

and | 173.30 | 174.30 | 0.22 | 1.00m at 0.22g/t Au |

and | 180.70 | 185.10 | 0.94 | 4.40m at 0.94g/t Au |

including | 180.70 | 184.00 | 1.18 | 3.30m at 1.18g/t Au |

and | 219.40 | 221.70 | 0.22 | 2.30m at 0.22g/t Au |

and | 248.10 | 249.20 | 0.90 | 1.10m at 0.90g/t Au |

and | 268.70 | 272.90 | 0.35 | 4.20m at 0.35g/t Au |

and | 292.40 | 293.50 | 0.46 | 1.10m at 0.46g/t Au |

MBDD016 | 10.70 | 18.50 | 0.40 | 7.80m at 0.40g/t Au |

and | 71.10 | 72.20 | 3.40 | 1.10m at 3.40g/t Au |

and | 82.50 | 83.50 | 0.44 | 1.00m at 0.44g/t Au |

and | 87.50 | 88.50 | 0.22 | 1.00m at 0.22g/t Au |

and | 91.70 | 93.90 | 1.91 | 2.20m at 1.91g/t Au |

including | 91.70 | 92.80 | 3.48 | 1.10m at 3.48g/t Au |

and | 108.80 | 110.80 | 0.91 | 2.00m at 0.91g/t Au |

including | 109.80 | 110.80 | 1.05 | 1.00m at 1.05g/t Au |

and | 122.80 | 123.80 | 0.35 | 1.00m at 0.35g/t Au |

and | 156.90 | 161.10 | 0.41 | 4.20m at 0.41g/t Au |

including | 157.90 | 158.90 | 1.03 | 1.00m at 1.03g/t Au |

and | 167.70 | 168.80 | 0.55 | 1.10m at 0.55g/t Au |

and | 180.20 | 181.20 | 0.28 | 1.00m at 0.28g/t Au |

and | 186.20 | 190.20 | 0.20 | 4.00m at 0.20g/t Au |

MBDD017 | 14.80 | 19.90 | 0.35 | 5.10m at 0.35g/t Au |

and | 22.00 | 23.10 | 0.26 | 1.10m at 0.26g/t Au |

and | 32.20 | 34.40 | 2.47 | 2.20m at 2.47g/t Au |

including | 32.20 | 33.20 | 4.13 | 1.00m at 4.13g/t Au |

and | 37.60 | 39.70 | 0.42 | 2.10m at 0.42g/t Au |

and | 48.30 | 49.40 | 0.28 | 1.10m at 0.28g/t Au |

and | 52.70 | 53.80 | 0.36 | 1.10m at 0.36g/t Au |

and | 57.10 | 58.20 | 0.40 | 1.10m at 0.40g/t Au |

and | 60.40 | 62.60 | 0.93 | 2.20m at 0.93g/t Au |

including | 61.50 | 62.60 | 1.51 | 1.10m at 1.51g/t Au |

and | 65.90 | 67.00 | 9.35 | 1.10m at 9.35g/t Au |

and | 70.30 | 71.30 | 1.83 | 1.00m at 1.83g/t Au |

and | 74.40 | 81.50 | 0.36 | 7.10m at 0.36g/t Au |

and | 102.60 | 103.60 | 0.73 | 1.00m at 0.73g/t Au |

and | 109.00 | 112.00 | 1.00 | 3.00m at 1.00g/t Au |

and | 122.80 | 126.00 | 0.86 | 3.20m at 0.86g/t Au |

including | 125.00 | 126.00 | 1.02 | 1.00m at 1.02g/t Au |

and | 147.90 | 148.90 | 0.56 | 1.00m at 0.56g/t Au |

and | 156.40 | 159.30 | 0.92 | 2.90m at 0.92g/t Au |

including | 158.30 | 159.30 | 2.36 | 1.00m at 2.36g/t Au |

and | 215.50 | 216.50 | 0.22 | 1.00m at 0.22g/t Au |

and | 235.80 | 236.80 | 0.87 | 1.00m at 0.87g/t Au |

and | 263.50 | 266.50 | 1.59 | 3.00m at 1.59g/t Au |

including | 265.50 | 266.50 | 3.71 | 1.00m at 3.71g/t Au |

and | 268.70 | 272.00 | 0.45 | 3.30m at 0.45g/t Au |

including | 270.90 | 272.00 | 1.12 | 1.10m at 1.12g/t Au |

and | 292.05 | 294.20 | 0.32 | 2.15m at 0.32g/t Au |

* Intersections greater than 1.00m, calculated using a 0.20g/t Au lower cut-off grade and no more than 5.00m consecutive internal dilution or 35% total internal dilution. True widths are not currently known.

The lithologies encountered in these holes correlate well with those seen in previously reported holes, and the style of mineralisation is consistent with the rest of the Mbe deposit. Gold mainly occurs in steeply NE-dipping smoky quartz veins (bearing tellurides and pyrite) hosted by quartz feldspar porphyry (QFP) units.

A review of the Exploration Target variogram published earlier this month, has led to an expansion of the Phase 1 drilling programme at MB01-S to 7,050m in 25 holes. A number of the remaining holes have been relocated (new positions are shown in Fig. 2) to focus on identifying additional mineralised material that currently falls outside of the model, in particular to target the western soil 1,000ppb Au soil anomaly contour shown in Figure 2.

Following completion of the Phase 1 drilling programme, the Company anticipates publishing an independent consultant's maiden, pit-constrained MRE for MB01-S in Q4-2025 and believes that the Project could be mined by open pit methods.

Further information can be found in the JORC Table 1 disclosure on the following page of the Company's website: https://orioleresources.com/projects/mbe/.

Enquiries:

Oriole Resources Plc | Tel: +44 (0)23 8065 1649 |

Martin Rosser / Bob Smeeton / Claire Bay | |

| |

Strand Hanson Limited (Nomad & Broker) | Tel: +44 (0)20 7409 3494 |

Christopher Raggett / James Spinney / Edward Foulkes

| |

IFC Advisory Ltd (Financial IR & PR) | Tel: +44 (0)20 3934 6630 |

Tim Metcalfe / Graham Herring / Florence Staton |

Competent Persons Statement

The information in this announcement that relates to the Mineral Resource Estimate and the Exploration Target is based on data compiled by Mr. Robert Davies, EurGeol, CGeol, an independent consultant to Oriole. Mr Davies is a Director of Forge International Limited. Mr Davies has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code. Mr Davies consents to the inclusion in the report of the matters based on his information in the form and context in which it appears. The Company confirms that it is not aware of any new information or data that materially affects the Mineral Resource Estimate or the Exploration Target, and that all material assumptions and technical parameters underpinning the MRE and the Exploration Target continue to apply.

The technical information in this release that relates to Exploration Results and the planned exploration programme has been compiled by Mrs Claire Bay (Executive Director). Claire Bay (MGeol, CGeol) is a Competent Person as defined in the JORC code and takes responsibility for the release of this information. Claire has reviewed the information in this announcement and confirms that she is not aware of any new information or data that materially affects the information reproduced here.

Glossary and Abbreviations

Au | Gold |

Forge | Forge International Limited |

g/t | Grammes per tonne |

JORC | Joint Ore Reserves Committee |

JORC Code | 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves |

km | Kilometre |

km2 | Square kilometre |

Mbe | Mbe orogenic gold project |

m | Metres |

MRE | Mineral Resource Estimate |

Mt | Million tonnes |

Oriole Resources or the Company | Oriole Resources PLC |

oz | Troy ounce of gold |

Phase 1 | Maiden diamond drilling programme at the MB01-S target, Mbe |

Project | Mbe orogenic gold project |

QFP | Quartz Feldspar Porphyry |

t/m3 | Tonnes per cubic metre |

Notes to Editors

Oriole Resources

Oriole Resources PLC is an AIM-quoted gold exploration company, with projects in West and Central Africa. It is focused on early-stage exploration in Cameroon, where the Company has reported a Resource of 460,000oz contained gold at 2.06g/t Au in the JORC Indicated and Inferred categories at its 90% owned Bibemi project and has identified multi-kilometre gold and lithium anomalies within the district scale Central Licence Package project, including the Mbe project. At Mbe, the Company has published a maiden Exploration target range of 33 to 44 million tonnes at a grade of 0.77 to 0.95g/t Au for 0.82Moz to 1.34Moz contained gold for the MB01 prospect, and a maiden Resource for the MB01-S target is scheduled for Q4-2025. BCM International is currently earning up to a 50% interest in the Bibemi and Mbe projects in return for a combined investment of US$1.5 million in signature payments, up to US$8 million in exploration expenditure, as well as JORC resource-based success payments. BCM International is currently earning up to a 50% interest in the Bibemi and Mbe projects in return for a combined investment of US$1.5 million in signature payments, up to US$8 million in exploration expenditure, as well as JORC resource-based success payments.

At the Senala gold project in Senegal, AGEM Senegal Exploration Suarl ('AGEM'), a wholly owned subsidiary of Managem Group, has completed a six-year earn-in to acquire an approximate 59% beneficial interest in the Senala Exploration Licence by spending US$5.8 million. The Company has reported a Resource of 155,000oz contained gold at 1.26g/t Au in the JORC Inferred category for the Faré South prospect, and an additional, complementary Exploration target range of 17 to 24Mt at a grade of 0.69 to 0.84g/t Au for 380,000 to 650,000oz contained gold for all prospects at Senala. Discussions on the formation of a joint venture company are currently underway. The Company also has several interests and royalties in companies operating in East Africa and Turkey that could give future cash payments.

For further information please visit www.orioleresources.com, @OrioleResources on X

Background on Mbe

Mbe, with a licence area of 312km2, is an orogenic gold project located within the broader 2,266km2 'Eastern CLP' package of five contiguous gold focused exploration licences in the Adamawa Region of central Cameroon. Since 2022, the Company's systematic exploration programmes have identified a 3km long, NE trending prospect, named MB01, which sits within a wider 12.5km long zone of gold-in-soil anomalism that trends ENE.

At MB01, increased dilation at the sites of structural intersections (steeply dipping NNE and NNW trending shear structures) is believed to have resulted in enhanced levels of gold deposition at the northern target, MB01-N, and MB01-S, the southern target. Gold mineralisation at these targets comprises high-grade, sulphide- and telluride-rich quartz veins, veinlets and breccias within wider envelopes of pervasive, lower-grade gold mineralisation.

After highly encouraging results from infill soil sampling, rock-chip sampling, and trench sampling, a fully funded maiden drilling programme commenced at the MB01-S target in late November 2024 and is planned for 7,050m in 25 holes. BCM International has acquired an initial 10% interest in Mbe and is earning up to a further 40% interest by spending up to US$4 million on exploration.

An Exploration Target[2] range of 33 to 44 million tonnes at 0.77 to 0.95g/t A for 0.82Moz to 1.34Moz contained Au was published in July 2025 based on diamond drilling results from holes MBDD001 to MBDD013 at MB01-S, as well as trenching data, and the interpretation of geophysical and geochemical anomaly maps from both MB01-N and MB01-S. The Exploration Target remains open in all directions and at depth and it is anticipated that it will be succeeded by a maiden MRE in Q4 2025, following completion of the Phase 1 drilling programme later this quarter.

[1] Oriole is currently undertaking a restructuring process that, once completed, will see it increase its holding from 80% to a 90% interest in the Project (announcement dated 17 October 2024).

[2] The potential quality and grade of the Exploration Target are conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource, and there is no certainty that further exploration work will result in the determination of a Mineral Resource.

Related Shares:

Oriole Resources