24th Mar 2025 08:12

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (596/2014/EU) AS THE SAME HAS BEEN RETAINED IN UK LAW AS AMENDED BY THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS (SI 2019/310). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

Trading Symbols

AIM: UFO

FWB: I3A1

24 March 2025

Alien Metals Limited

("Alien" or the "Company")

Alien Metals conditionally secures Joint Venture partner for West Australian Silver Project

Alien Metals Limited (AIM: UFO), a minerals exploration and development company, is pleased to announce that it has entered into a conditional joint venture agreement with Errawarra Resources Ltd (ASX: ERW) ("Errawarra") (the "JV Agreement") in respect of the Elizabeth Hill Silver Project and surrounding tenements totalling 180km² located in the West Pilbara ("Elizabeth Hill"), and certain rights to explore for, and mine, silver from the Pinderi Hill tenements (the "Project").

Highlights

As more fully described below, subject to Errawarra, inter alia, completing due diligence on the Project to its sole satisfaction, completion of a capital raise by Errawarra and receipt of requisite Errawarra shareholder approvals for both the capital raise and issue of the Consideration Shares (as defined below):

· Errawarra, via its wholly owned subsidiary, Crest Silver Pty Ltd ("Crest"), will acquire a 70% interest in the Elizabeth Hill tenement (M47/342) (the "Elizabeth Hills Assets") as well as 70% of the rights to explore for, and mine, silver from the Pinderi Hill tenements (the "Pinderi Hill Assets", and together with the Elizabeth Hill Assets, the "Assets") (the "Transaction").

· Alien, via its wholly owned subsidiary, A.C.N. 643 478 371 Pty Ltd, will enter into a joint venture agreement with Crest to facilitate the exploration of the potential silver-bearing Elizabeth Hill Assets (the "Elizabeth Hill JV Agreement"), whilst Alien, via its wholly owned subsidiary, Alien Metals Australia Pty Ltd ("AMA"), and Crest, will enter into a joint venture agreement to facilitate the exploration of the potential silver-bearing Pinderi Hill Assets (the "Pinderi Hills JV Agreement").

· Pursuant to the terms of both the Elizabeth Hill JV Agreement and Pinderi Hills JV Agreement, a project joint venture holding the Assets (the "JV") will be formed. Alien will hold a 30% interest in the JV with Errawarra holding 70% and acting as manager of the JV.

· Errawarra will operate and fund the JV through to a decision to mine.

· In conjunction with the Transaction, Errawarra has received firm commitments for a capital raising of A$3 million (the "Placement") from institutional and sophisticated investors at a placement price of A$0.027 (the "Placement Price"). Errawarra will require shareholder approval to create the capacity for the Placement.

· Consideration for the transaction comprises a cash payment to Alien Metals of A$500,000 and receipt of 44.5 million ordinary shares in the capital of Errawarra ("Errawarra Shares") (the "Consideration Shares"). Errawarra requires shareholder approval for the issue of the Consideration Shares. Alien has elected to sell down 14 million of its 44.5 million Errawarra Shares in the Placement at the Placement Price (and closing price) of A$0.027, valued at A$380,000 before costs, leaving Alien with a 12.1% shareholding in Errawarra. Alien Metals will retain 30.5 million Errawarra Shares following the Placement. Assuming completion of the Transaction, and the Placement, Alien Metals will receive in aggregate A$880,000 in cash consideration which will be applied to the further development of the Hancock iron ore project and Pinderi Hills platinum group metals project.

· Based on the closing share price of Errawara on 21 March 2025 (A$0.027), being the latest practicable date prior to this announcement, and before a sale of part of its shareholding in Errawara, which is also the Placement price (A$0.027) the value of the Consideration for a 70% interest in the Project to be received following Errawarra's shareholder approval will be A$1.7 million, being the cash payment of A$500,000 plus the value of the Consideration Shares valued at A$1.2 million.

· Alien will benefit from immediate access to a Perth-based technical team expediting the planned fieldwork exploration works that will commence in 1-2 weeks, followed by drilling in 6-8 weeks.

· In conjunction with the Transaction, Rob Mosig, the Non-Executive Technical Director for Alien, has also joined Errawarra's board of directors as a Non-Executive Director. Mr Mosig has over 40 years of experience in mining and exploration with over a decade of experience directly at the Pinderi Hills project, with extensive knowledge of ultramafic complexes which host the Elizabeth Hill Silver mine and Munni Munni Platinum Group Metals project.

· This transaction further strengthens Alien Metals' relationship with an ASX-listed company, providing access to potential sources of funding in Australia and overseas, with which to advance silver exploration and development at Elizabeth Hill and Pinderi Hills.

Guy Robertson, Chairman, commented:

"This transaction has culminated after months of discussions, highlighting the investable potential of Alien's assets. Assuming completion of the Transaction, Alien will benefit from any upside of any major silver discovery at Elizabeth Hill and Pinderi Hills. We know that the project has significant value, which requires the necessary funding and an expert team, and this transaction delivers on that promise. The agreement will be non-dilutive for Alien, and any major discovery should result in material value to Alien and its shareholders. We will also continue to focus on developing the Hancock Iron Ore and Munni Munni PGM projects in Western Australia."

Robert Mosig, Technical Director, commented:

"Our review made it clear that this silver exploration project requires exposure to a resources market which has a strong demand for a local pure play silver project.

"In addition to receiving a cash injection on completion of the Transaction, and a 17.7% interest in Errawarra equity (after the issue of the Consideration Shares and the Placement shares but before the planned placement of a portion of our shareholding), Alien will retain a 30% ownership of Elizabeth Hill free carried to the decision to mine, providing significant potential upside."

Key Joint Venture Terms and Additional Details

A. The consideration to Alien is:

i. a payment of A$500,000 in cash to Alien on completion of the Transaction; and

ii. 44,500,000 Errawarra Shares, representing 17.7% of Errawarra's issued share capital following the issue of the Consideration Shares and the Placement shares. Alien has committed to a sell down of 14 million Errawarra shares in the Placement for $380,000 which would bring its interest down to 12.1% of the then issued share capital of Errawarra.

The conditions precedent to the transaction are as follows:

i. Completion of legal and technical due diligence by Errawarra to its sole and absolute satisfaction;

ii. Errawarra completing a minimum of A$2,500,000 capital raising via a share placement. (Errawarra have today announced that they have received firm commitments to a $3 million capital raise);

iii. Errawarra shareholder approval for the issue of Consideration Shares to Alien in accordance with the ASX Listing Rule 7.1;

iv. Execution of and entering into the JV Agreement;

v. Execution of the Pinderi Hills JV Agreement between Crest and AMA; and

vi. Execution of a mineral rights deed, granting Errawarra the right to access, explore for and mine, process, own dispose of and exploit any silver within the ground of the Pinderi Hill Tenements (and any extension, renewals, conversion and successor tenements on that ground), on terms that are customary for a deed of this nature.

B. Subject to the agreement, Alien agrees to the application of a holding lock for a period of:

i. 6 months from the date of issue on 50% of the Consideration Shares; and

ii. 12 months from the date of issue on 50% of the Consideration Shares.

C. The parties agree that up to A$500,000 worth of Consideration Shares are not subject to the holding lock. The 14 million Errawarra shares that Alien has committed to sell down are included within this amount.

D. The key terms of the JV are as follows:

i. On and from the date of completion of the Transaction, Errawarra and Alien (together, the "JV Parties") will be deemed to have established and commenced the joint venture and hold the joint venture interests on a 70/30 basis ("JV Start Date").

ii. On and from the JV Start Date, Errawarra agrees to solely fund all joint venture expenditure and free carry Alien's joint venture interest until Errawarra announces a decision to mine.

iii. Upon a decision to mine, Alien must, within 10 business days, elect to:

a) convert its interest in the JV to a 2% net smelter royalty (in which case the JV Parties agree to use reasonable endeavours to enter a royalty deed); or

b) from that point onwards, contribute to all joint venture expenditure made or incurred in respect of the joint venture in proportion to their respective joint venture interests and where either JV Party does not contribute to the joint venture expenditure its joint venture interest will dilute in accordance with the formulae set out in the Elizabth Hill JV Agreement or Pinderi Hills JV Agreement (as the case may be).

While the Board of Alien Metals is confident that all of the conditions set out above will be satisfied or waived as the case may be, there can be no guarantee that such conditions will be satisfied and that the Transaction will proceed.

Alien Metals Portfolio

Following the completion of the Transaction, Alien will retain the following interests:

· Silver - the Company retains a significant interest in the Elizabeth Hill Silver project (30% direct and an indirect interest via a shareholding in a silver-focused ASX company) with no funding requirement until a decision to mine is made.

· Platinum Group Metals ("PGMs") - Pinderi Hills (100%): This asset exhibits significant potential for PGM's, nickel and copper, containing a historic JORC resource of 2Moz PGM with multiple targets currently under investigation.

· Iron Ore - Hancock Iron Ore (90%) (Mining Lease): This lease holds an 8Mt resource with a current mining inventory of 4Mt.

o Hancock West (Mallina) Exploration Licence ("EL"): This EL is nearing grant (announced 24 February 2025, "Alien Metals Hancock West")

o Vivash Gorge: This asset contains high-grade iron ore (approximately 58%), located adjacent to a significant Fortescue Metals Group deposit.

o Brockman: This asset contains high-grade iron ore (up to 65%), located adjacent to the Mineral Resources/AMCI/BHP Steel JV (currently producing at a forecast annual production rate of 15Mtpa).

Figure 1: Alien Metals Limited projects

Elizabeth Hill Silver Project Overview

Elizabeth Hill, one of Australia's highest-grade silver projects has a proven production history outlined below:

· High grades enable low processing tonnes: 1.2Moz of silver was produced from just 16,830t of ore at ahead grade of 2,194g/t (77.4 oz/t Ag)

· Previous mining operation ceased abruptly in 2000 because of low silver prices (US$5/oz) and a dispute between previous joint venture parties

· Simplistic historical processing technique: native silver was recovered via low-cost gravity separation due to high grades and large silver nugget sizing

· Significant untapped potential remains in and around the historic mine site, with limited, outdated drilling and geophysics deployed

· Tier-1 Mining Jurisdiction - located on a mining lease with processing facilities adjacent at the nearby Radio Hill

Figure 2 - Project Location

Outstanding Geology - High-Grade Silver

There has been very little historical drilling at Elizabeth Hill, but high grades have been confirmed from more recent drilling including:

· 11.7 m @ 5,371 g/t Ag from 13m (21EHDD003)

· 24 m @ 1,228 g/t Ag from 64m (AMEHRC009)

· 43 m @ 370 g/t Ag from 0m (22AMC001)

· 24.8m @ 915g/t Ag from 2m (21EHDD001)

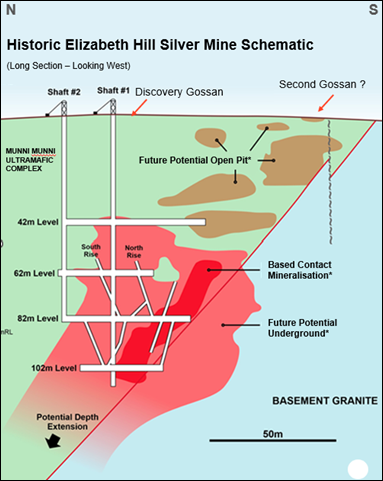

Updated geological modelling suggests extensions to areas of known mineralisation:

· Munni Munni fault: considered prospective for repeat silver deposits/pods

· Historic lodes: six lodes are recognised underground within the Historic Elizabeth Hill Mine mineralised envelope

· Broader surface anomalies: the basal unit of Munni Munni Intrusion reports anomalous silver in soils over 2km

Significant Growth Potential

Through the consolidation of the surrounding land packages into a single contiguous 180km² package, Elizabeth Hill offers significant exploration and growth potential, both near mine and regionally.

Three distinct avenues have been identified to add significant value to the Elizabeth Hill Project:

1. Current Mine Resource Assessment including

a. Reprocessing & interpretation of data

b. Assessment of historical core & geophysics reprocessing

c. Resource quantification to JORC 2012 standards

2. Near Mine Targeting including

a. Near mine targeting for repeat silver lodes

b. Assessment of near surface open pit potential

c. Geophysics & Geochemistry

Figure 3 - Elizabeth Hill Mine Cross Section

3. Regional Repeat targeting for new look-a-like Elizabeth Hill deposits within large 180km² land package including:

a. Multiple look-a-like geological structures with similar characteristics to Elizabeth Hill - untested

b. Historical geochemistry carried out exploring for Lithium returned anomalous readings for Ag - all untested

c. Walk up targets to explore for Elizabeth Hill style mineralisation

d. Prospect for multiple Elizabeth Hill style mineralised bodies based on geological setting

Figure 4 - Regional map of Elizabeth Hill and geological setting

Elizabeth Hill Advancement Strategy

Errawarra Resources' strategy with respect to the Elizabeth Hills Project over the coming months and year will focus on the following:

1. Geological Modelling and Targeting - Already underway

a. Complete data analysis and geological modelling utilising all historic geophysical and geochemical data

b. Generation of targets across the three exploration avenues

2. Maiden Resource Declaration development - Already underway

a. Conversion of historical data into JORC 2012 compliant maiden resource

b. Additional drilling may be carried out to complete this resource declaration

3. Fieldwork Exploration - expected to commence in 1-2 weeks including:

a. Field reconnaissance and mapping

b. Geochemical and geophysical works

c. Regional Exploration

4. Resource Growth through maiden and ongoing drilling - expected commencement in 6-8 weeks

For further information, please visit the Company's website at www.alienmetals.uk or contact:

Strand Hanson (Financial and Nominated Adviser)

James Harris / James Dance / Robert Collins

Tel: +44 (0) 207 409 3494

Zeus Capital Limited (Joint Broker)

Harry Ansell / Katy Mitchell

Tel +44 (0) 203 829 5000

CMC Markets (Joint Broker)

Douglas Crippen

Tel: +44 (0) 203 003 8632

Yellow Jersey (Financial PR)

Charles Goodwin / Shivantha Thambirajah / Zara McKinlay

Tel: +44 (0) 203 004 9512

Notes to Editors

Alien Metals Limited is a mining exploration and development company listed on the AIM market of the London Stock Exchange (AIM: UFO). The Company's focus is on delivering a profitable direct shipping iron ore operation from it 90% Hancock iron ore project in the central Pilbara region of Western Australia. The Hancock tenements currently contain a JORC-compliant resource of 8.4Mt iron ore @ 60% Fe and offers significant exploration upside which is targeted to deliver a mining operation of 2Mtpa for 10 years.

These Hancock Project tenements have direct access to the Great Northern Highway, which provides an essential export route to export facilities at Port Hedland, from where more than 500Mt of iron ore is exported annually (30% of global production). The Company also has an interest in two iron ore exploration projects Brockman and Vivash, located in the West Pilbara.

The Company owns the Elizabeth Hill Silver Project, located near Karratha in the Pilbara, which consists of the Elizabeth Hill Mining Lease and exploration tenements surrounding the historical silver mine which has produced some of Australia's highest-grade silver ore during the late 1990's. The Company also owns one of Australia's largest PGM deposits, Munni Munni which hosts a deposit containing a historic resource of 2.2Moz PGM (Palladium, Platinum, Gold, and Rhodium).

Related Shares:

Alien Metals