19th Nov 2025 07:00

19 November 2025

Bezant Resources Plc

("Bezant" or the "Company")

Publication of Circular and Notice of GM to approve

Proposed Acquisition of Processing Plant for Hope and Gorob Project

Bezant (AIM: BZT), the copper-gold exploration and resource development company, announces that it has today published a circular in relation to the Proposed Acquisition of a 90% shareholding in Namib Lead and Zinc Mining (Proprietary) Limited which owns the NLZM Processing Plant, containing a notice of a General Meeting of shareholders (the "GM Circular") to be held at The Dome Room, 5th Floor, 1 Cornhill, London EC3V 3ND at 11:00 a.m. on 8 December 2025 (the "General Meeting").

The purpose of the General Meeting is to obtain shareholders approval to the Proposed Acquisition.

The GM Circular, encompassing at Part I a letter from Colin Bird the Company's Executive Chairman, is reproduced in full below without material adjustments or amendments, is being posted today and will shortly be available to download from the Company's website at www.bezantresources.com.

Definitions and Technical Terms are included as Appendix 1 to this announcement whilst Expected Timetable of Principal Events is set out in Appendix 2.

The Board is of the opinion that the Resolutions are in the best interests of the Company and its Shareholders as a whole. Accordingly, the Directors unanimously recommend that Shareholders vote in favour of the Resolution, as the Directors intend to do in respect of their own beneficial shareholdings, which amount in aggregate to 1,495,833,461 Existing Ordinary Shares, representing approximately 8.81 per cent. of the Existing Ordinary Shares.

Consequence of Resolution not being passed. Prior to receiving a Mining Licence for the Hope and Gorob Project, the Company considered a number of possible mineral processing alternatives for run of mine ore and after a detailed evaluation and an audit conducted by an external technical expert, the Company's Directors selected using the NLZM Processing Plant located approximately 190 km from the Hope and Gorob Project, (which until 2020 was used by NLZM for processing lead and zinc from its NLZM Project) as the preferred development option for the processing of preconcentrate that will be trucked from the Hope and Gorob Project to the NLZM Processing Plant. If the Resolution is not approved then the Company will not acquire the NLZM Processing Plant and will not be able to implement the development of the Hope and Gorob Project in the manner outlined in its application for the Mining Licence approved by the Ministry which may affect the Mining Licence and will breach a condition precedent of the Financing and Offtake Agreements which is an important component of the financing of the Hope and Gorob Project. Shareholders not passing the Resolution will not trigger the payment of the break fee.

Unless otherwise indicated, all capitalised terms in this announcement have the same meaning as in the GM Circular.

Part I

LETTER FROM THE CHAIRMAN OF BEZANT RESOURCES PLC

(Incorporated and registered in England and Wales under company registration number 02918391)

Directors | Registered Office |

Colin Bird (Executive Chairman) | Quadrant House Floor 6 |

Raju Samtani (Finance Director) | 4 Thomas More Square |

Edward Slowey (Technical Director) | London E1W 1YN |

Evan Kirby (Non-executive Director) |

|

Ronnie Siapno (Non-executive Director) |

|

19 November 2025

To the Shareholders (and, for information only, to the holders of options and warrants to subscribe for Ordinary Shares)

Dear Shareholder

1. Introduction

I am writing to you to explain the background to and reasoning for the Proposed Acquisition and the Resolution to be voted on at the General Meeting which will be held at The Dome Room, 5th Floor, 1 Cornhill, London EC3V 3ND at 11:00 on 8 December 2025.

Given the size of the Proposed Acquisition and the financial commitment required to bring the NLZM Processing Plant Implementation Plan into operation, whilst the Company has been advised that this would not amount to a Reverse Transaction under the AIM Rules, it recognises that it is a sufficiently large enough commitment to be put to Shareholders for approval together with the Technical Report and details of how the Proposed Acquisition is proposed to be financed.

As announced on 14 August 2025, on 13 August 2025 the Company has entered into the Share and Asset Purchase Agreement to acquire a 90% shareholding in Namib Lead and Zinc Mining (Proprietary) Limited ("NLZM") from the Vendor [1] , details of which are set out at paragraph 3 of this Part I below. NLZM owns an ore processing plant (the "NLZM Processing Plant") which once modified it is proposed, will process copper - gold pre-concentrate produced via dry ore sorting to be undertaken at the Company's Hope and Gorob Project mine site in Namibia before being transported to the NLZM Processing Plant for final concentration. Information on the Hope and Gorob Project and the NLZM Processing Plant as well as the implementation plan is set out at paragraph 5 of this Part I below.

At the Closing Date of the Share and Asset Purchase Agreement the Vendor will be paid US$2.5m for its 90% shareholding in and the Purchased Assets and be issued the Vendor Warrants. Once the NLZM Processing Plant is operating the Vendor will be paid a fixed amount for each tonne of ore processed by the NLZM Processing Plant (US$6.50 per tonne for years 1 to 8, US$2.00 per tonne for years 9 to 12 and thereafter US$1.00 per tonne). The Vendor will also receive a royalty of 1.5% on the Gross Revenue from the Intermediary Entity. The conditions precedent to the SPA include certain regulatory approvals and the approval of Bezant shareholders.

2. Background to and Reasons for the Proposed Acquisition

Prior to receiving a Mining Licence for the Hope and Gorob Project, the Company considered a number of possible mineral processing alternatives for run of mine ore. Using the NLZM Processing Plant was selected as a viable option subject to modification of the NLZM Processing Plant to make it better suited to copper - gold preconcentrate treatment. After detailed evaluation and an audit conducted by an external technical expert, the Company's Directors selected using the NLZM Processing Plant located approximately 190 km from the Hope and Gorob Project, (which until 2020 was used by NLZM for processing lead and zinc from its NLZM Project) as the preferred development option for the processing of preconcentrate that will be trucked from the Hope and Gorob Project to the NLZM Processing Plant.

The Proposed Acquisition presents a strategic opportunity for the Hope and Gorob Project, offering substantial benefits across cost, time, infrastructure and operational reliability. These benefits include:

i. Capital Cost Reduction: Building a new processing facility would require a significant capital outlay for engineering, procurement, construction and commissioning. By acquiring an existing, operational plant, the Project avoids these costs, improving capital efficiency and strengthening overall Project economics.

ii. Accelerated Time-to-Production: Greenfield plant development typically involves long lead times due to design, construction and regulatory approvals. The NLZM Processing Plant, being already built and previously operational, allows for rapid integration and commissioning, significantly shortening the timeline to first concentrate production and revenue generation.

iii. Regulatory Efficiency: Developing a new plant would require extensive environmental and operational permitting, which can be time-consuming and complex. The NLZM Processing Plant already holds the necessary permits and infrastructure, reducing regulatory risk and streamlining the path to production.

iv. Infrastructure and Accessibility: The Hope and Gorob Project is located in a remote area with limited infrastructure. Constructing and operating a plant in such a location would pose logistical challenges, including access to skilled labour, materials and services and water for mineral processing. The NLZM Processing Plant, situated in a more accessible area, mitigates these risks and simplifies operational logistics.

v. Reliable Power and Water Supply: Remote sites often face challenges with electricity availability, which is critical for processing operations. The NLZM Processing Plant benefits from established grid connections and reliable power infrastructure, eliminating the need for costly and complex off-grid energy solutions. The Plant is also connected to a state-operated water pipeline that supplies a number of mines in the region.

vi. Enhanced Profitability: By combining mine-site ore sorting with off-site final concentration at the NLZM Processing Plant, the Project optimises material handling, reduces costs compared to building a new processing plant and maximises recovery. This integrated approach improves overall profitability and supports a strong economic case for advancing to the execution phase of the Hope and Gorob Project.

3. Principal terms and conditions of the Proposed Acquisition

Parties

Bezant Resources Plc as the Parent and three of its subsidiaries i) the Intermediary Entity ii) the Purchaser and iii) Hope and Gorob and the Vendor and NLZM.

Date of agreement

13 August 2025

Purchase Price payable at Closing of the Share and Asset Purchase Agreement

The consideration payable to the Vendor for the Purchased Shares and the Purchased Assets (the "Purchase Price") is set out below with $1 being the value of the Purchase Price to be apportioned to the acquisition of the Purchased Shares and the balance of the Purchase Price to be apportioned to the acquisition of the Purchased Assets:

i) the Deposit Payment of US$50,000 (previously paid);

ii) $2,500,000 less the Deposit Payment (the "Closing Cash Consideration"); and

iii) 350,000,000 warrants (the "Vendor Warrants"), each exercisable at 0.05787 pence for one Bezant Share for 3 years from the Closing Date.

Revenue Royalty

The Vendor shall be entitled to quarterly royalty payments equal to 1.5% of the Gross Revenue by the Intermediary Entity (the "Revenue Royalty Payments") for each Quarter during the period beginning on the Closing Date and ending on, and inclusive of, the twelfth anniversary of the date immediately following the sixty (60)-day period during which the NLZM Plant processes, on an annualized basis, at least 98,000 tonnes of ore ("Commencement Date") (the "Revenue Royalty Period"). The Revenue Royalty Payment is capped at a copper price of US$12,000 per tonne and is due and payable to the Vendor even in an event if the ore from Hope and Gorb is processed at another facility and not at the NLZM Plant.

Ore Processing Payments

Once the NLZM Processing Plant is operating the Vendor will be paid a fixed amount for each tonne of ore processed by the NLZM Processing Plant (US$6.50 per tonne for years 1 to 8 after the Commencement Date, US$2.00 per tonne for years 9 to 12 after the Commencement Date and thereafter US$1.00 per tonne).

The ore processing payments are subject to a minimum of;

i) US$200,000 for the six months immediately following the Commencement Date; and

ii) US$25,000 per year for years 1 to 12 after the Commencement Date

Conditions Precedent

The Closing of the Share and Asset Purchase Agreement is conditional on the following:

(a) to be met within 180 days of the date of the agreement.

a. Regulatory Approvals

i) The Namibian Competition Commission Approval and the Exchange Control Approvals shall have been obtained (this condition has been met);

ii) The Hope and Gorob Mining Licence is Fully Valid;

iii) The confirmation from the Parent's NOMAD or AIM that the consummation of this SPA would not constitute a reverse takeover under AIM Rule 14 (this condition will be met if Bezant shareholders approve the SPA); and

iv) Any necessary notifications required under the Namibian Minerals (Prospecting And Mining) Act, 1992 in relation to the change of ownership of the Company.

(b) To be met within 120 days of the date of the SPA:

a. Approval of the SPA by Bezant shareholders.

b. Other closing conditions customary for an agreement of this nature including, the delivery of documents related to the Closing and no legal proceedings preventing closing

Security Arrangements

For the period up to 8 years from the Commencement Date the Revenue Royalty and Ore Processing payments due to the Vendor and the Security Covenants (set out below) given to the Vendor will be secured by the granting of (i) a share charge by the Intermediary Entity providing for a first ranking security interest in all of the issued shares of the Purchaser, and (ii) a debenture by the Intermediary Entity providing for a first ranking security interest in all of the outstanding intercompany loan receivables due from the Purchaser or the Company.

Events of Default under the Security Arrangements include the Commencement Date not being within 24 months of the Closing Date, and those typically included in security agreements including late payment of secured payments, insolvency, the SPA becoming unlawful and breaches of Security Covenants.

Security Covenants

Given the ongoing liability to pay the Ore Processing Payments and the Revenue Royalty the Vendor has been granted certain security covenants including in relation to access to books and records, restrictions on indebtedness of the Purchaser, the Intermediary Entity, the Company and Hope and Gorob and Bezant's continued ownership of the Hope and Gorob project.

Blackstone Share sale proceeds, if any, to be applied to Projects. Bezant is not required to sell any of its Blackstone Shares but if it does sell any of the Blackstone Shares which it owns prior to i) the Commencement Date and ii) completion of NLZM Plant Updates it has undertaken to apply 75% of the proceeds in Namibia for the Project.

Break Fee

In the event (i) Bezant or the Purchaser do not fulfil certain of their obligations in relation to performance of covenants at closing, the warrants to be issued to Vendor are not valid and the documents to be delivered at closing are not delivered or (ii) the Hope and Gorob Mining License is no longer a Fully Valid Licence due to any act, omission or other breach of the Hope and Gorob Mining License on the part of the Parent, the Purchaser or Hope and Gorob or its affiliates then a break fee of US$1m will be due to the Vendor. Shareholders not passing the Resolution will not trigger the payment of the break fee.

4. Group Namibian structure

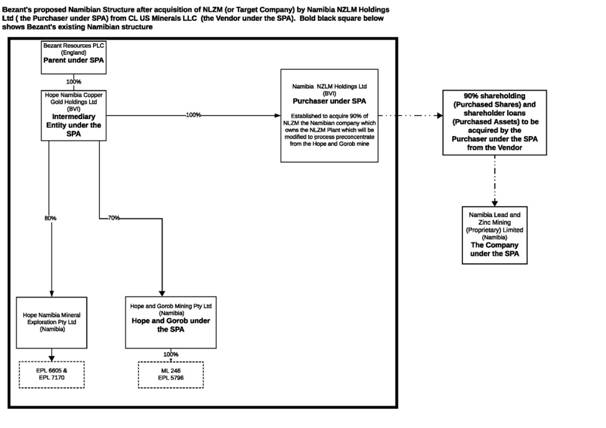

Following Completion, the Namibian part of the Group structure will be reorganised. The current and future organisation is shown in Figure 1.

Figure 1: Current and Proposed Namibian Group Structure

5. Information on the Hope and Gorob Project and the NLZM Processing Plant

5.1 Information and the Hope and Gorob Project

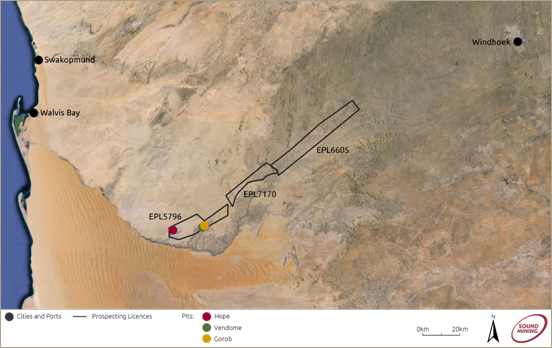

The Hope and Gorob copper - gold Project located on the Matchless Belt in central Namibia comprises Mining Licence ML246 and exclusive Exploration Licences EPL 5796, EPL6605 and EPL7170. Collectively, the EPL's provide more than 150km of additional prospective ground beyond the limits of the Mining Licence. The licences have been subject to intensive exploration over a number of years with more than 69,000 metres of drilling having been completed.

The interest in the licences is held through the Company's Namibian subsidiaries (as presented in Figure 1 in paragraph 4 of Part 1 of this document and also summarised in Table 1 below). In conjunction with the Mining Licence, the Project also obtained an Environmental Clearance Certificate (ECC 2502358) from the Namibian Ministry of Environment, Forestry and Tourism, dated 01 April 2025, based on the submitted Environmental Management Plan (EMP) and Environmental Social Impact Assessments (ESIA).

Table 1: Tenure of the Project Mineral Licences within the Republic of Namibia

Licence No. | Licence Name | Licence Holder | Mineral Groups | Area (Ha) | Expiry | Bezant interest |

Mining Licence 246 | Hope and Gorob Mining Licence | Hope and Gorob Mining (Pty) Ltd | Base and Rare Metals, Precious Metals | 8,040 | 31 March 2040 | 70 % |

Exploration Licence 5796 | Hope and Gorob Exploration Licence | Hope and Gorob Mining (Pty) Ltd | Base and Rare Metals, Precious Metals | 24,294 | 28 November 2026 | 70% |

Exploration Licence 6605 | Hope Namibia Exploration Licence | Hope Namibia Mineral Exploration (Pty) Ltd | Base and Rare Metals, Dimension Stone, Industrial Minerals Precious Metals | 41,910 | 28 August 2026 | 80% |

Exploration Licence 7170 | Hope Namibia Exploration Licence | Hope Namibia Mineral Exploration (Pty) Ltd | Base and Rare Metals, Dimension Stone, Industrial Minerals Precious Metals | 41,910 | 28 August 2026 | 80% |

Source: Technical Report, Table 10

The Mineral Resource that will be mined to produce a feed for on-site ore sorting and subsequent final concentration of a preconcentrate at the NLZM Processing Plant is currently confined to Mining Licence ML246. Additional potential which will be evaluated by the Company occurs within the contiguous EPLs.

The Hope and Gorob Project lies approximately 250km southwest of Namibia's capital, Windhoek, and 120km southeast of the country's main port, Walvis Bay and includes three main orebodies: Hope, Vendome, and Gorob together with numerous other recognised targets whose locations are shown in Figure 2.

Figure 2: General Location of the Hope and Project Licences - ML246 is within EPL5796

Source: Technical Report, Figure 8

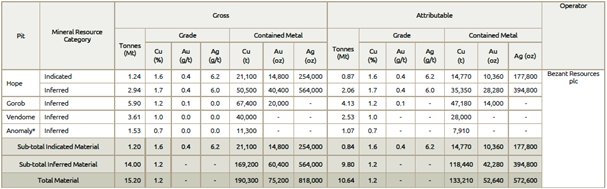

The Mineral Resource estimate (MRE) for the Hope and Gorob Project was conducted by AMS and compiled in their Report "Mineral Resource Estimate (JORC 2012), Hope and Gorob Copper-Gold Project, Namibia, with effective date of 30 May 2023". Details of the MRE are shown in Table 2

Table 2: Mineral Resource Estimate as at 30 May 2023:

Indicated and Inferred Mineral Resource Estimate for the Hope and Gorob Project, Namibia. Gross representing 100% estimated Resources - Bezant has a 70% interest in the Hope and Gorob Project

Source: AMS, 2023

Source: AMS, 2023

Note: Rounding errors may occur in original Mineral Resource Estimate (as at May 2023)

"Gross" are 100% of the resources attributable to the licence whilst "Net Attributable" are those attributable to Bezant Resources plc.

This table is a summary of the signed Mineral Resource Estimate by Adison Mining, which can be found in the report "Mineral Resource Estimate (JORC 2012), Hope and Gorob Cu-Au Project, Namibia" extracts of which were announced by the Company on 27 October 2023.

Sequencing and design of the Hope, Gorob and Vendome pits (including production overlap), results in a total mining inventory from these pits of 3.3Mt, equalling seven years of RoM production with a balance of ten year LoM used in financial modelling to be sourced from other declared Resources (Anomaly) and exploration targets (Du Preez, Luigi and Anomaly Est and immediate extensions to Hope, Gorob and Vendome).

The Anomaly, Du Preez, Luigi targets, as well as the underground potential for both Gorob and Vendome are yet to be assessed in a detailed mining study, which could add additional tonnage to the operation. Further upside exists to extend the Project via possible lateral extensions of these known deposits and any other discoveries made over several broadly defined targets on EPLs 5796, 6605 and 7170.

Bezant Resources has undertaken comprehensive metallurgical test work using recognised external expertise to assess gravity, magnetic separation, multi sensor dry ore sorting and flotation methodologies on Hope and Gorob run of mine ore. The test work was conducted on fresh drill core collected specifically for the purpose of providing representative fresh material for test work together with other drill core collected from historic drilling and assay sample rejects returned by certified laboratories. Results of this test work were announced previously to the market via Regulatory Information Services. All assays connected with test work were undertaken by recognised certified laboratories in both Namibia and South Africa.

5.2 Information on the NLZM Processing Plant

The NLZM Processing Plant is located approximately 40km northeast of Swakopmund, Namibia. The nearest airport to the NLZM Processing Plant is the Walvis Bay International Airport. Figure 3 below shows the location of the NLZM Processing Plant in relation to Swakopmund and Walvis Bay - shown as Namib Lead and Zinc area of interest on the map.

Figure 3: Site Location of the NLZM Processing Plant in relation to Swakopmund and Walvis Bay

Source: Technical Report, Figure 19

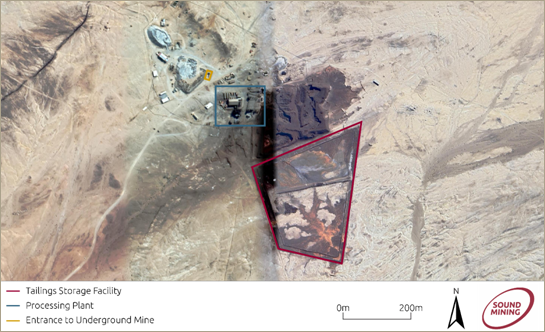

The NLZM site (Figure 4) consists of an underground mine accessed by two declines with drives and crosscuts developed to access lead-zinc run of mine ore and is associated with the NLZM ML 185 which expires on 24 February 2026. NLZM has applied for the ML 185 licence to be renewed and according to the electronic database of the Ministry of Mines and Energy as at the date of this document a renewal application is pending. On 24 February 2025 NLZM was issued an Environmental Clearance Certificate No. ECC- 2502231 including in respect of ML185 which expires on 24 February 2028. The Processing Plant is located on the same site as the underground mine and the tailings storage facility flanks the site. Figure 4 below shows the site layout.

Figure 4: Satellite Image of the NLZM Site including NLZM Processing Plant

Source: Technical Report, Figure 20

The NLZM Process Plant, built in 2018 for North River Resources, the previous controlling shareholder of NLZM, faced operational issues and never reached full capacity. These issues, compounded by the Covid-19 pandemic, led to the NLZM Processing Plant being placed on care and maintenance.

As part of the due diligence process for the Proposed Acquisition and given Bezant intends to repurpose the Plant for copper ore processing, the Company engaged MetalX who produced a site review report detailing findings and recommendations following a comprehensive site audit of the NLZM Processing Plant. The audit assessed the NLZM Processing Plant's readiness to transition from lead-zinc processing to a dual copper oxide and sulphide flotation system, in preparation for ore from the Hope and Gorob mines. The findings and recommendations are contained at Section 10 of the Technical Report.

Key recommendations include upgrading flotation circuits, improving milling and dewatering systems, and implementing modern automated controls. Flexibility to revert to lead-zinc processing is also advised.

The proposed way forward begins with a Detailed Engineering phase, followed by an Execution phase covering procurement, construction, and commissioning. Estimated direct field costs are ZAR41 M (approx. U$2.2M), with indirect costs of ZAR10.25 M (approx. US$0.55M) (EPCM) or ZAR13.5 M (approx. US$0.73M) (EPC). Figure 5 and Figure 6 show photographs of the NLZM Processing Plant. [2]

As stated above the NLZM has an ECC for its Mining Licence ML 185 which expires on 24 February 2026. If ML 185 is not renewed or its renewal is delayed this may affect the Company ability to use the NLZM Processing Plant as intended which may adversely affect the Company's plans and its ability to economically develop the Hope and Gorob Project.

Figure 5: NLZM Processing Plant: Mill and associated infrastructure

Source: Technical Report, Figure 18A

Figure 6: NLZM Processing Plant: Primary and secondary crushers

Source: Technical Report, Figure 18B

The NLZM Project site comes with a Tailings Storage Facility (TSF) which was designed by Epoch Resources (Pty) Ltd ("Epoch"), a qualified tailings deposition engineering company based in South Africa, engaged by the NLZM Processing Plant operator to design a TSF with a total capacity of 1,520.00 tonnes at an average deposition rate of 217ktpa. The TSF was constructed as part of the NLZM mine development according to the Epoch TSF design with an estimated total of 100kt having been deposited in the TSF prior to the NLZM mine and plant going under care and maintenance. This results in a remaining designed and permitted capacity 1,420,000 tonnes with deposition rates of up to 217ktpa achievable. The Hope and Gorob Project has an estimated annual deposition rate of 160ktpa (180ktpa plant feed less concentrate extracted) which is well below design deposition rates of 217ktpa and amounts to a remaining life of facility of 9 years before an expansion to the TSF is required.

5.3 Hope and Gorob Project and NLZM Processing Plant Implementation Plan

The implementation plan centres around two separate sites, firstly, the Hope and Gorob mine, the site of the copper - gold Mineral Resource where run of mine ore will be crushed and waste separated from mineralisation using a multi-sensor dry ore sorting process and secondly, the NLZM Processing Plant where an existing flotation plant, currently under care and maintenance will be repurposed to treat the Hope and Gorob copper - gold preconcentrate that will be hauled by 50 tonne trucks from the Hope and Gorob Project mine site to the NLZM Processing Plant for final concentration and production of a concentrate for sale.

Hope and Gorob Implementation Plant requires the establishment of an open pit mine to access ore and the construction and commissioning of a combined crusher and dry ore sorter designed to take run of mine ore and produce a copper - gold preconcentrate resulting in a significant reduction in volume of copper-bearing feed for transportation to the NLZM Processing Plant. Implementation at Hope and Gorob will also entail development of offices and employee accommodation, explosives storage and other infrastructure typical of a mine site of this scale. Development at Hope and Gorob is not constrained by any development at the NLZM Processing Plant and can continue in parallel with the upgrade of the NLZM Processing Plant.

Hope and Gorob production including drilling, blasting, mining and haulage of run of mine ore to the crusher will be the responsibility of a designated contractor. The contractor will be responsible for the engagement of suitably qualified personnel and the subsequent safe and efficient operation of mine production according to international best practice and Namibian Law. The contractor will supply heavy plant and equipment and suitable maintenance facilities and access to spares inventory sufficient to operate efficiently and according to the agreed production rate.

NLZM Processing Plant Implementation Plan requires the upgrade and repurposing of the NLZM Plant originally designed for the processing of lead - zinc - silver ore and the production of lead and zinc concentrates. The Plant has been kept in good order thanks to a well-managed care and maintenance programme. All elements of the NLZM Processing Plant were assessed in detail by an external technical expert leading to an agreed upgrade programme including a detailed specification of key components, a capital budget and implementation schedule. The majority of the work to be undertaken by the Company involves addition of more appropriate crushing infrastructure, additional surge tank capacity and automation, all designed to improve the efficiency of the NLZM Processing Plant and to ensure optimised copper - gold recovery and production of a concentrate meeting the required specification for sale.

The NLZM Processing Plant Implementation Plan also includes engagement of a contractor to haul preconcentrate from the Hope and Gorob mine site to the NLZM Processing Plant and the subsequent haulage of a final concentrate to the deepwater terminal at Walvis Bay, Namibia.

Office infrastructure is in place at the NLZM Processing Plant along with suitable engineering workshops, an assay laboratory and all other infrastructure including loading facilities for the transport of a final concentrate product. The site is connected to the national grid and also has a pipeline connection to a water pipeline originating in the Kuiseb river supplying water to a number of mining operations in the region.

Implementation of the Plant refurbishment is planned to commence from the Closing Date. The refurbishment will be overseen by the Company but implemented by a recognised external contractor skilled in the upgrade of flotation plants.

The Company has taken advice from its Namibian shareholder and the Ministry of Industries, Mines and Energy with regard to employment policy and plans to engage a recognised Namibian employment agency used by mining companies in Namibia to source skilled and unskilled employees for all designations. The contractor responsible for mining operations will source its own employees, the majority of whom are expected to be Namibian nationals as the contractor is Namibian based.

Grade control at the mine site, ongoing exploration to replace depleted Mineral Resources and the NLZM Processing Plant operation will be staffed and managed by the Company through its local Namibian owned subsidiaries owning the Hope and Gorob Project and the NLZM Processing Plant respectively.

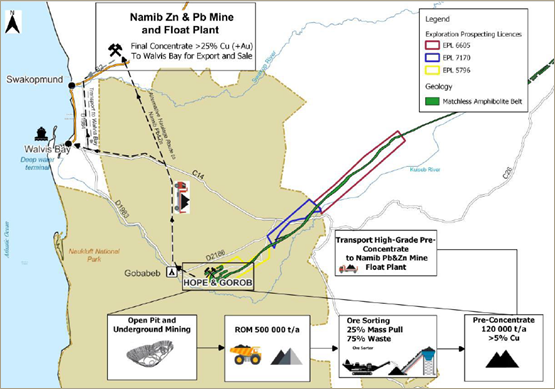

Figure 7 shows the transport route of the preconcentrate from the Hope and Gorob Project to the NLZM Processing Plant (referred to in the figure as Namib Zn & Pb Mine and Float Plant). The mining licence ML240 is within EPL 5796 shown in Figure 7.

Figure 7: Transport Route from the Hope and Gorob Project to the NLZM Processing Plant

Source: Technical Report, Figure 18

Information on the Project Costing and Financials is extracted without any adjustments from the Technical Report and presented at Part III of this document.

6. The Company, its Projects and Strategy

In recent times, the Company has focused on the development of the Hope and Gorob project with an emphasis on delivery of sufficient Mineral Resource to provide for a minimum 10-year life of mine, with scope for further additional Resource development through ongoing exploration whilst simultaneously pushing the Project towards near-term production. The Company has discontinued its interest in PCB Mining Ltd project in Zambia and disposed of Eureka Project in Argentina. Accordingly, the Company's current Projects are:

(i) The Hope and Gorb Project in Namibia - further details of which are contained at paragraph 5 above; and

(ii) The Kanye Project in Botswana.

Detailed information on the Hope and Gorob Project in Namibia is set out in paragraph 5 above, which also includes information on the Hope and Gorob and the NLZM Processing Plant Implementation Plans and the Company's short- and medium-term strategy.

The Kanye Manganese Project comprises five current prospecting licenses located in south-central Botswana south of the town of Jwaneng, west of the town of Kanye and 150km by road from the capital Gaborone. The licenses are held by Cypress Sources Pty Ltd and Coastal Minerals Pty Ltd, which are 100% owned subsidiaries of the Bezant Resources.

The Kanye Project:

· Land package contains several occurrences of high-grade manganese mineralisation potentially suitable for the high value battery market

· Area is close to the K-Hill manganese deposit where a TSX listed public company reports a PEA based on a life of project MnO grade of 15.2% yielding a NPV (8%) of US$984m and an IRR of 29.4% - a full feasibility study was under way as of July 2023. Demonstration plant testing is currently under way.

In August 2024 the Company announced the positive outcome of geophysical surveying which was planned to assist in extending the potential footprint of the deposit.

· IP/resistivity geophysical surveying has traced near surface areas of high conductivity/low resistivity which could reflect manganiferous mineralisation for about 900m to the NW of the previously exposed manganese occurrence in the Moshaneng borrow pit, making 1.4km of potential target strike extent in total.

· The geophysical anomaly extends up to 300m width in places, double that in the area already drill tested, and remains open further to the NW beyond the limit of the survey.

The Company is planning a programme of reverse circulation drilling to test the source of the IP anomalies with the aim of significantly extending the currently demonstrated manganese occurrence. Samples generated by the programme will be subject to multi-element assay to determine the grade of manganese mineralisation and the content of accompanying minerals and will also be available for further manganese recovery test work as required. This will be progressed as and when the Company has sufficient funds given the current focus is on completing the Proposed Acquisition and thereafter the NLZM Processing Plant modifications and the development of the Hope and Gorob mine bringing it into production so it is generating revenue for the Group.

Additionally, Bezant holds a minority indirect interest in the Mankayan Copper-Gold Porphyry Deposit through its shareholding in ASX listed Blackstone Minerals Ltd. Situated in the heart of the prospective Mankayan Mineral District in Northern Luzon, Philippines, the Mankayan copper-gold project is regarded as one of the largest undeveloped copper-gold porphyry mining projects in the world. The project holds a 25-year mining licence (MPSA) and is strategically positioned near major operating mines, including the Lepanto epithermal deposit and Gold Fields Far Southeast porphyry deposit.

7. Funding of the Proposed Acquisition and Current Financial Position

The aggregate expenditure related to the Proposed Acquisition is £3.9m comprising the Closing Cash Consideration of £1.85M (US$2.5M) as per the SPA and the anticipated cost of the NLZM Processing Plant Implementation Plan, which is estimated at USD2.8M (£2.07M) as per Part 11 Financials section of the Technical Report, extracts of which are contained at Part III of this document.

The Company currently has aggregate working capital funds available to it of £3.9m comprising cash of £1.9M, and the Drawdown Facility of gross £2M Drawdown Facility which is sufficient to cover the cost of the Proposed Acquisition and related expenditure for the 12 months from the completion of the Proposed Acquisition.

The Company; has announced the conditional Financing and Offtake Agreements of up to US$7M (£5.19M) which would be an important component of the financing of the Hope and Gorob Implementation Plan cost of £6.7m; is also in ongoing negotiations with other parties who have expressed an interest in participating in the funding of the Hope and Gorob Project by way of loans and or equity at the project or parent company level; anticipates the exercise of some of the warrants issued in relation to previous fundraisings (currently in the money); and holds listed investments in the form of Blackstone Minerals shares (with a market value of approximately £1.6m at current FX rates) (together the "Additional Sources of Funding"). The Company believes that it has sufficient flexibility within the overall plan for the Hope and Gorob Project to match this to the availability of finance.

Accordingly, the Directors are of the opinion, having made due and careful enquiry, that the working capital available to the Company will be sufficient for at least 12 months from the date of this document.

8. Risk Factors

Shareholders and other prospective investors in the Company should be aware that an investment in all exploration and development companies involves a high degree of risk. Your attention is drawn to the risk factors set out in Part II of this document.

9. Further Information on NLZM

Financial information on NLZM

NLZM in its audited accounts for the year ended 31 December 2024 reported in Namibian dollars (NAD) NLZM had NAD 258M (approximately £10.8M using an FX rate of £1.00= NAD23.75 ) of Net Assets excluding the shareholder loans that will be assigned to the Purchaser at the Share and Asset Purchase Agreement Closing Date. For the year ended 31 December 2024 NLZM made a loss after adjusting for unrealised foreign exchange losses and finance costs on the shareholder loans equated to a loss of NAD9.8M (approximately £413K) and included a provision of NAD 5.3 M (approximately £222K) provision for decommission and rehabilitation costs.

Information on former NLZM Project

The NLZM lead -zinc-silver mine has been under care and maintenance since 2020 (during COVID). Whilst the mine has significant underground development in place and Mineral Resources available, it has not been reactivated due to less than favourable lead and zinc metal prices. During the intervening period, the NLZM Processing Plant has been maintained under a well-managed and diligent care and maintenance programme with the processing plant regularly tested and the underground infrastructure inspected and kept water-free.

A mining licence renewal application for the current mining licence ML 185 which expires 24 February 2026 is pending confirmation from the Ministry and there are also two Exploration Licences, EPL 2902 expiring 8 November 2025, renewal under way and EPL 5075 expiring 14 May 2026, renewal submission required in February 2026. The NLZM lead and zinc mine has a Mineral Resource Estimate (JORC 2012) generated by external consultants CSA Global of approximately 1.11Mt @ 2.31% Pb, 6.63% Zn and 46g/t Ag.

Shareholders should read the whole of this document, which provides additional information on the Company, the Proposed Acquisition and the Resolution, and should not rely on summaries of, or individual parts only of, this document. Your attention is drawn, in particular, to Parts II and III of this document. Part IV of this document sets out the pro-forma financial information of the Enlarged Group post completion of the Proposed Acquisition.

10. General Meeting

You will find set out at the end of this document in Part IV a notice convening the General Meeting of the Company to be held at The Dome Room, 5th Floor, 1 Cornhill, London EC3V 3ND on 8 December at 11:00 at which the Resolution will be proposed to approve the Proposed Acquisition.

The General Meeting is an important event for the Company and provides an opportunity for the Company's directors to engage with shareholders. If you plan to attend in person, we would appreciate prior confirmation by email to [email protected] by 11:00 a.m. on Friday 4 December 2025 to allow us to plan appropriately.

11. Action to be Taken

Voting Electronically: You will be able to vote electronically via the Investor Centre app or at https://uk.investorcentre.mpms.mufg.com/ you will need to log into your Investor Centre account or register if you have not previously done so. To register you will need your Investor Code, this is detailed on your share certificate or available from our Registrar, MUFG Corporate Markets.

You will not receive a hard copy form of proxy for the general meeting in the post. Instead, you will be able to vote electronically using the Investor Centre app or at https://uk.investorcentre.mpms.mufg.com/. You will need to log into your account or register if you have not previously done so. To register you will need your Investor Code, this is detailed on your share certificate or available from our Registrar, MUFG Corporate Markets. You may request a hard copy form of proxy directly from the registrars, MUFG Corporate Markets by emailing [email protected] or on Tel: 0371 664 0391. Calls are charged at the standard geographic rate and will vary by provider. Calls outside the United Kingdom will be charged at the applicable international rate. Lines are open between 09:00 - 17:30, Wednesday to Friday excluding public holidays in England and Wales.

12. Recommendation

The Board is of the opinion that the Resolutions are in the best interests of the Company and its Shareholders as a whole. Accordingly, the Directors unanimously recommend that Shareholders vote in favour of the Resolution, as the Directors intend to do in respect of their own beneficial shareholdings, which amount in aggregate to 1,495,833,461 Existing Ordinary Shares, representing approximately 8.81 per cent. of the Existing Ordinary Shares.

Consequence of Resolution not being passed. Prior to receiving a Mining Licence for the Hope and Gorob Project, the Company considered a number of possible mineral processing alternatives for run of mine ore and after a detailed evaluation and an audit conducted by an external technical expert, the Company's Directors selected using the NLZM Processing Plant located approximately 190 km from the Hope and Gorob Project, (which until 2020 was used by NLZM for processing lead and zinc from its NLZM Project) as the preferred development option for the processing of preconcentrate that will be trucked from the Hope and Gorob Project to the NLZM Processing Plant. If the Resolution is not approved then the Company will not acquire the NLZM Processing Plant and will not be able to implement the development of the Hope and Gorob Project in the manner outlined in its application for the Mining Licence approved by the Ministry which may affect the Mining Licence and will breach a condition precedent of the Financing and Offtake Agreements which is an important component of the financing of the Hope and Gorob Project. Shareholders not passing the Resolution will not trigger the payment of the break fee.

If it is necessary to alter the arrangements for the GM shareholders will be notified promptly via RNS and the Company's website.

Yours faithfully,

Colin Bird, Chairman

ENDS

For further information, please contact:

Bezant Resources Plc Colin Bird Executive Chairman |

| |

Beaumont Cornish (Nominated Adviser) Roland Cornish / Asia Szusciak | +44 (0) 20 7628 3396 | |

Novum Securities Limited (Joint Broker) Jon Belliss |

+44 (0) 20 7399 9400 | |

Shard Capital Partners LLP (Joint Broker) Damon Heath |

+44 (0) 20 7186 9952 |

or visit http://www.bezantresources.com

Qualified Person:

The technical information contained in this announcement has been reviewed, verified, and approved by Colin Bird, CC.ENG, FIMMM, South African and UK Certified Mine Manager and Director of African Pioneer plc, with more than 40 years' experience mainly in hard rock mining.

Forward Looking Statements:

Certain statements in this announcement are or may be deemed to be forward looking statements. Forward looking statements are identified by their use of terms and phrases such as ''believe'' ''could'' "should" ''envisage'' ''estimate'' ''intend'' ''may'' ''plan'' ''will'' or the negative of those variations or comparable expressions including references to assumptions. These forward-looking statements are not based on historical facts but rather on the Directors' current expectations and assumptions regarding the Company's future growth results of operations performance future capital and other expenditures (including the amount. Nature and sources of funding thereof) competitive advantages business prospects and opportunities. Such forward looking statements reflect the Directors' current beliefs and assumptions and are based on information currently available to the Directors. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements including risks associated with vulnerability to general economic and business conditions competition environmental and other regulatory changes actions by governmental authorities the availability of capital markets reliance on key personnel uninsured and underinsured losses and other factors many of which are beyond the control of the Company. Although any forward-looking statements contained in this announcement are based upon what the Directors believe to be reasonable assumptions. The Company cannot assure investors that actual results will be consistent with such forward-looking statements.

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 as it forms part of UK Domestic Law pursuant to the Market Abuse (Amendment) (EU Exit) regulations (SI 2019/310).

Appendix 1 Definitions, and Glossary of Technical Terms from GM Circular

DEFINITIONS

The following definitions apply throughout this document unless the context otherwise requires:

"Additional Sources of Funding" | is as described in paragraph 7 of Part I of this document; |

"AIM" | the market of that name operated by the London Stock Exchange |

"AIM Rules" | the AIM Rules for Companies and the AIM Rules for Nominated Advisers; |

"AIM Rules for Companies" | the rules which set out the obligations and responsibilities in relation to companies whose shares are admitted to AIM as published by the London Stock Exchange from time to time; |

"AIM Rules for Nominated Advisers" | the rules which set out the eligibility, obligations and certain disciplinary matters in relation to nominated advisers as published by the London Stock Exchange from time to time; |

"Articles" | the articles of association of the Company for the time being; |

"Blackstone Shares" | shares of ASX listed Blackstone Minerals Limited (ASX:BSX) owned by the Company at the date of publication of this document; |

"Board" or "Directors" | the current directors of the Company, whose names are set out on page 4 of this document; |

"Certificated" or "in Certificated Form" | a share or other security recorded on the relevant register of the relevant company as being held in certificated form and title to which may be transferred by means of a stock transfer form; |

"Closing Cash Consideration" | the cash consideration to be paid to the Vendor at the Closing Date under the SPA as set out in paragraph 3 of Part I of this document; |

"Closing Conditions" | the closing conditions of the Share and Asset Purchase Agreement further details of which are provided at paragraph 3 of Part I of this document; |

"Closing Date" | means: (1) the date that is fourteen (14) Business Days following the day on which the Closing Conditions (other than those conditions that by their nature can only be satisfied as of the Closing Date) have been satisfied or waived by the appropriate Party; or (2) such earlier or later date as the Vendor and the Purchaser may agree in writing; |

"Commencement Date" | means the date from which the Royalties are due to the Vendor under the SPA as set out in paragraph 3 of Part I of this document; |

"Company" or "Bezant" | Bezant Resources Plc, a company incorporated and registered in England and Wales under company registration number 02918391; |

"CREST" | the computerized settlement system to facilitate the transfer of title of shares in uncertificated form operated by Euroclear UK & Ireland Limited; |

"CREST Regulations" | the Uncertificated Securities Regulations 2001 (SI 2001 No. 3755), as amended; |

"Drawdown Facility" | a new unsecured loan facility for £2 million executed by the Company on 18 November 2025, with a maturity date of 30 November 2027, interest of 8% per annum, a drawdown fee of 5% on amounts drawn down and an unused facility fee of 7% on any amount of the loan facility not drawn down payable on 30 November 2027. The loan facility can be drawn down in eight equal tranches of £250,000 from December 2025 up to July 2026; |

"Enlarged Group" | the Group, as enlarged by the Proposed Acquisition; |

"Financial Conduct Authority" | the United Kingdom Financial Conduct Authority; |

"Financing and Offtake Agreements" | the binding term documentation for a conditional prepayment facility of up to USD 7 million and an associated concentrate offtake agreement with a globally recognised commodities trading company announced by the Company on 31 October 2025, to support the development of the Hope and Gorob Project; |

"Form of Proxy" | the form of proxy enclosed with this document for use by Shareholders in connection with the General Meeting; |

"FSMA" | the Financial Services and Markets Act 2000 of the United Kingdom, as amended; |

"General Meeting" | the general meeting of the Company, convened for 11:00 on 8 December 2025, and any adjournment thereof, notice of which is set out at Part IV of this document; |

"Group" | the Company and its subsidiaries; |

"Gross Revenue" | means all the gross revenues of the Hope and Gorob Project and the NLZM Project for the relevant calendar quarter; |

"Hope and Gorob" | means Hope and Gorob Mining (Pty) Ltd, a company incorporated under the laws of Namibia which is a 70 per cent. owned subsidiary of Bezant and the registered holder of the Mining Licence; |

"Hope and Gorob Mining Licence" or "Mining Licence" | means mining licence ML 246 (Office Reference No 14/2/5/1/246) granted by the Minister of Industries, Mines and Energy to Hope and Gorob in respect of Base and Rare Metals and Precious Metals group of minerals in terms of the provisions of the Minerals (Prospecting and Mining) Act, 1992, with an expiry date of 31 March 2040; |

"Hope and Gorob Project" or "Project" | means the Hope and Gorob copper-gold project located in Namibia in which the Company has a 70 per cent. interest through its subsidiary Hope and Gorob Mining (Pty) Ltd and for which the Mining Licence has been issued; |

"Hope and Gorob Implementation Plan"

| is as described in paragraph 5 of Part I of this document; |

"Hope Namibia" | means Hope Namibia Mineral Exploration (Proprietary) Limited, a company incorporated under the laws of Namibia which is a 80 per cent. owned subsidiary of Bezant; |

"Intermediary Entity" | means Hope Namibia Copper Gold Holdings Ltd a company incorporated in the British Virgin Islands which is a 100 per cent owned subsidiary of Bezant; |

"London Stock Exchange" | London Stock Exchange plc; |

"Ministry" | The Namibian Ministry of Industries, Mines and Energy; |

"NAD", "N$" or "Namibian dollar" | the legal currency of Namibia; |

"Notice" | the notice of the General Meeting set out at Part IV on page 46 of this document; |

"NLZM" | means Namib Lead and Zinc Mining (Proprietary) Limited, a company incorporated under the laws of Namibia which is subject to the Proposed Acquisition; |

"NLZM Mineral Licences" | means those Mineral Licences relating to the NLZM Project namely; (i) mining licence ML 185 (Office Reference No14/2/3/2/185) which expires 24 February 2026 and for which a renewal application has been submitted to the Ministry, (ii) exclusive prospective licence EPL 2902 expiring on 8 November 2025 for which a renewal application has been submitted to the Ministry and (iii) exclusive prospective licence EPL 5075 expiring 14 May 2026 for which a renewal application is required in February 2026; |

"NLZM Minority Shareholders" | means the Namib Lead & Zinc Mine Community Empowerment Trust (Master's filing number T 103/17) and the NLZM Employee Benefit Trust (Master's filing number T 104/17), each trust established in terms of the laws of Namibia; |

"NLZM Plant Technical Report" | means the independent technical report on the NLZM Processing Plant prepared by MetalX for the Company in relation to assessing the requirements for the NLZM Processing Plant to be modified to process copper gold pre-concentrate from the Hope and Gorob Project extracts from which are as set out in section 10 of the Technical Report and Part III of this document; |

"NLZM Processing Plant Implementation Plan" | is as described in paragraph 5 of Part I of this document; |

"NLZM Processing Plant" or "Plant" | means the ore processing plant and related facilities and equipment owned by the Target Company which were previously used in connection with the NLZM Project and which, once modified, is intended to process copper-gold pre-concentrate generated from the crushing at the Hope and Gorob mine of run-of-mine (RoM) ore from the Hope and Gorob Project;

|

"NLZM Project" | means the lead zinc project owned and operated by NLZM and all other assets licensed to NLZM under the NLZM Mineral Licences, including mining licence ML 185, exclusive prospecting licences (EPLs), Environmental Clearance Certificate No. ECC- 2502231 with Serial No. 25hySV52231 (expiring on 24 February 2028) covering those licences, all other rights relating thereto and all real property used in connection thereto; |

"Ordinary Shares" | ordinary shares of 0.002p in the issued share capital of the Company; |

"Ore Processing Payments" | are the quarterly ore processing payments due to the Vendor under the SPA as set out in paragraph 3 of Part I of this document; |

"Parties" | the parties to the Share and Asset Purchase Agreement are Bezant as the Parent and its subsidiaries i) the Intermediary Entity; ii) the Purchaser; and iii) Hope and Gorob; CL US Minerals LLC as the Vendor and NLZM; |

"Purchased Assets" | means the Vendor's shareholder loans to NLZM which are being sold to the Purchaser under the SPA; |

"Purchase Price" | means the purchase price payable under the SPA as set out in paragraph 3 of Part I of this document; |

"Purchased Shares" | means 90% of the shares of NLZM which are being sold by the Vendor to the Purchaser under the SPA; |

"Purchaser" | means Namibia NZLM Holdings Ltd a company incorporated in the British Virgin Islands which is a 100 per cent owned subsidiary of Bezant; |

"Projects" | the project's the Company operates comprise the Hope and Gorob Project in Namibia and the Kanye Manganese Project in Botswana; |

"Proposed Acquisition" | the proposed acquisition of 90% interest in NLZM from the Vendor; |

"Resolution" | the resolution to be proposed at the General Meeting, details of which are set out in the Notice; |

"Revenue Royalty Payments" |

are the quarterly royalty payments equal to 1.5% of the Gross Revenue payable to the Vendor under the SPA as set out in paragraph 3 of Part I of this document; |

"Revenue Royalty Period" | is the period for which the Revenue Royalty Payments are due to the Vendor under the SPA as set out in paragraph 3 of Part I of this document; |

"Shareholders" | the persons who are registered as holders of the Ordinary Shares;

|

"Share and Asset Purchase Agreement" or "SPA" | the share and asset purchase agreement entered into between the Parties dated 13 August 2025 setting out the terms of the Proposed Acquisition, further details of which are provided at paragraph 3 of Part I of this document; |

"Sterling" or "£" | the legal currency of the UK; |

"Target Company" | means NLZM; |

"Technical Expert" or "Sound Mining" | Sound Mining International Limited, a company incorporated and registered in South Africa under the company registration number 2002/002265/07 which is an international, independent consultancy delivering independent solutions to the mining industry, who have prepared the Technical Report; |

"Technical Report" or "Study" | the Hope and Gorob Project, Feasibility Study Report Summary prepared by Sound Mining which consolidates various reports and studies commissioned by Bezant on the Hope and Gorob Project including the NLZM Plant Technical Report and the mine implementation plan for the Hope and Gorob Project following the Proposed Acquisition, extracts of which are contained at Part III of this document and which is available on the Company's website at https://www.bezantresources.com/; |

"UK" or "United Kingdom" | the United Kingdom of Great Britain and Northern Ireland; |

"Uncertificated" or "in Uncertificated Form" | a share or other security recorded on the relevant register of the relevant company concerned as being held in uncertificated form in CREST and title to which, by virtue of the CREST Regulations, may be transferred by means of CREST; |

"US" or "United States" | the United States of America, its territories and possessions, any states of the United States of America and the District of Columbia and all other areas subject to its jurisdiction; |

"US$" | the legal currency of the United States; |

"VAT" | value added tax; |

"Vendor" | CL US Minerals LLC, a company registered in the state of Delaware in the United States of America, which owns 1,890 issued shares representing 90% of the issued capital of NLZM; |

"Vendor Warrants" | the 350,000,000 warrants to be issued to the Vendor under the SPA as set out in paragraph 3 of Part I of this document; and |

"ZAR" | the legal currency of South Africa. |

CURRENCY

Unless otherwise indicated, all references in this document to:

- "UK Pounds Sterling", "Pounds Sterling", "pound", "pence", "GBP", "£" or "p" is to the lawful currency of the United Kingdom;

- "US Dollars", "US$", "USD" or "cents" is to the lawful currency of the United States;

- "NAD" or "Namibian Dollar" is to the lawful currency of Namibia; and

- "ZAR" or "South African Rand" are to the lawful currency of South Africa.

Unless indicated to the contrary the exchange rates used in this document for the conversion from other currencies into sterling are as follows:

£ 1 = | US$1.35 |

£ 1 = | NAD23.75 |

£ 1 = | AUD 2.02 |

NAD 1 = | ZAR 1 |

US$1 = | ZAR 17.59 |

GLOSSARY OF TECHNICAL TERMS AND MEASUREMENTS

The following table provides an explanation of certain technical terms and abbreviations used in this document. The terms and their assigned meanings may not correspond to standard industry meanings or usage of these terms.

Term | Explanation |

Assay | The chemical analysis of ore samples to determine their metal content |

Cleaner Floats | Secondary flotation stage to purify concentrates |

Cut-off grade | The lowest grade of mineralised rock that determines as to whether or not it is economic to recover its gold content by further concentration |

Density | Measure of the relative "heaviness" of objects with a constant volume, density = mass/volume |

Deposit | Any sort of earth material that has accumulated through the action of wind, water, ice or other agents |

Dilution | Waste or material below the cut-off grade that contaminates the ore during the course of mining operations and thereby reduces the average grade mined |

Definitive Feasibility Study (DFS) | A definitive engineering estimate of all costs, revenues, equipment requirements and production at a -5% to +10% level of accuracy. The study is used to define the economic viability of a project and to support the search for project financing |

Drillhole | Exploration hole drilled for the purposes of exploring for and evaluating sub-surface geology, in this instance the presence and distribution of gold |

Estimation | The quantitative judgement of a variable |

Exploration | Prospecting, sampling, mapping, drilling and other work involved in the search for mineralisation |

Facies | An assemblage of metamorphic rocks which are considered to have formed under similar conditions of temperature and pressure |

Fault | A fracture in earth materials, along which the opposite sides have been displaced parallel to then plane of the movement |

Fire Assay | The assaying of metallic ores by methods requiring the use of furnace heat |

Flotation | A process to separate minerals based on their surface properties |

Footwall | The underlying side of a stope or ore body |

Indicated Mineral Resource | Is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated Mineral Resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated Mineral Resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated Mineral Resource may only be converted to a probable Mineral Reserve. |

Inferred Mineral Resource | Is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred Mineral Resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred Mineral Resource has the lowest level of geological confidence of all Mineral Resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred Mineral Resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a Mineral Reserve. |

Kriging | An interpolation method that minimises the estimation error in the determination of a mineral resource. Kriging is a method of interpolation for which the interpolated values are modelled by a Gaussian process governed by prior covariances |

Licence, Permit, Lease or other similar entitlement | Any form of licence, permit, lease or other entitlement granted by the relevant Government department in accordance with its mining legislation that confers on the holder certain rights to explore for and/or extract minerals that might be contained in the land, or ownership title that may prove ownership of the minerals |

Life-of-Mine (LoM) | Number of years in the current mine plan that an operation will extract and treat ore |

Magnetic Separation | Technique to separate magnetic minerals from non-magnetic ones |

Measured Mineral Resource | is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured Mineral Resource is sufficient to allow a qualified person to apply modifying factors, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured Mineral Resource has a higher level of confidence than the level of confidence of either an indicated Mineral Resource or an inferred Mineral Resource, a measured Mineral Resource may be converted to a proven Mineral Reserve or to a probable Mineral Reserve. |

Mineable | That portion of a mineral resource for which extraction is technically and economically feasible |

Mineral Asset(s) | Any right to explore and / or mine which has been granted ("property"), or entity holding such property or the securities of such an entity, including but not limited to all corporeal and incorporeal property, mineral rights, mining titles, mining leases, intellectual property, personal property (including plant equipment and infrastructure), mining and exploration tenures and titles or any other right held or acquired in connection with the finding and removing of minerals and petroleum located in, on or near the Earth's crust. Mineral Assets can be classified as Dormant Properties, Exploration Properties, Development Properties, Mining Properties or Defunct Properties |

Mineral Resource | Is a concentration or occurrence of material of economic interest in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A Mineral Resource is a reasonable estimate of mineralisation, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralisation drilled or sampled. |

Modifying Factors | Are the factors that a qualified person must apply to indicated and measured Mineral Resources and then evaluate in order to establish the economic viability of Mineral Reserves. A qualified person must apply and evaluate modifying factors to convert measured and indicated Mineral Resources to proven and probable Mineral Reserves. These factors include, but are not restricted to: Mining; processing; metallurgical; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations, or agreements with local individuals or groups; and governmental factors. The number, type and specific characteristics of the modifying factors applied will necessarily be a function of and depend upon the mineral, mine, property, or project. |

Ore Sorting | Pre-concentration method using sensors to separate ore from waste |

Rougher Floats | Initial flotation stage to recover minerals |

Run-of-Mine (RoM) | Means the mineralised, raw unprocessed or uncrushed material obtained after blasting or excavating |

Strike | Refers to the orientation of a geologic feature which is a line representing the intersection of that feature with a horizontal plane. This is represented as a compass bearing of the strike line |

Syncline | A fold with strata sloping upward on both sides from a common valley/base |

Tailings | Material remaining after ore has been processed |

Variogram | A measure of the average variance between sample locations as a function of sample separation |

Wireframe | A 3D surface constructed from vertices with connecting straight lines or curves |

Abbreviation | Explanation |

° | Degree |

~ | approximate |

3D | three dimensional |

% | percentage |

µm | micrometre |

AMS | Addison Mining Services Limited |

ALS Johannesburg | ALS Chemex South Africa (Proprietary) Limited |

ALS Okahandja | ALS Laboratory Namibia (Proprietary) Limited |

ALS Windhoek | Analytical Laboratory Services (Proprietary) Limited |

Au | Gold |

Azi | Azimuth |

BHID | Drillhole identification |

BMA | Bulk Mineralogical Analysis |

Capex | Capital Expenditure |

CBE | CrossBoundary Energy Holdings |

Covid-19 | Coronavirus Disease 2019 |

Cu | Copper |

DCF | Discounted Cashflow |

DFS | Definitive Feasibility Study |

ECC | Environmental Clearance Certificate |

ECT | Environam Consultants Trading CC |

EIA | Environmental Impact Assessment |

EMP | Environmental Management Plan |

ENC Minerals | ENC Minerals (Proprietary) Limited |

EOH | End of Hole |

EPC | Engineering, Procurement and Construction |

EPCM | Engineering, Procurement and Construction Management |

EPL | Exclusive Prospecting Licence |

ESIA | Environmental and Social Impact Assessment |

Fe | Iron |

g | gram |

GPS | Global Positioning System |

g/t | grams per tonne |

ha | hectare |

HG | High Grade |

ICP | Inductively Coupled Plasma |

IRR | Internal Rate of Return |

kg | kilogram |

km | kilometre |

kt | Thousands of tonnes |

kW | kilowatt |

LG | Low Grade |

LoM | Life-of-Mine |

m | metres |

m³ | cubic meter |

M | million |

m³/day | cubic metres per day |

m³/hour | cubic metres per hour |

MetalX | MetalX (Proprietary) Limited |

Moz | Millions of ounces |

MR | Mining Right |

Mt | Million tonnes |

Multotec | Multotec Process Equipment (Proprietary) Limited |

NAHS | Sodium Hydrosulphide |

NLZM | Namib Lead and Zinc Mining (Proprietary) Limited |

NPV | Net Present Value |

Opex | Operating Expenditure |

oz | troy ounce (conversion to troy ounces is 31.10348) |

PEA | Preliminary Economic Assessment |

PFS | Preliminary Feasibility Study |

pH | scale used to specify the acidity or basicity of an aqueous solution |

PSD | particle size distribution |

ppm | parts per million |

QA/QC | Quality Assurance and Quality Control |

RoM | Run-of-Mine |

S | Sulfur |

SGS South Africa | SGS South Africa (Proprietary) Limited |

SMI | Sound Mining International Limited |

SMU | Selective Mining Unit |

SMP | Sound Mining Projects (Proprietary) Limited |

SMPP | Structural, Mechanical, Piping and Platework |

SMS | Sound Mining Solution (Proprietary) Limited |

Sound Mining | Sound Mining International Limited |

Steinert | Steinert GmbH |

t | metric tonne |

TEA | Trace Element Analysis Laboratories (Proprietary) Limited |

TSF | Tailings Storage Facility |

t/hour | tonnes per hour |

t/m3 | tonnes per cubic meter |

t/month | tonnes per month |

TIA | Traffic Impact Assessment |

tpa | tonnes per annum |

tph | tonnes per hour |

USD/oz | United States Dollars per ounce |

USD/t | United States Dollars per tonne |

VAT | Value Added Tax |

Weir | Weir Minerals Africa (Proprietary) Limited |

XRF | X-ray Fluorescence |

XRT | X-ray Transmission Sensor |

ZAR/t | South African Rands per tonne |

A glossary, abbreviations and units section is also contained within the Technical Report which is available on the Company's website at https://www.bezantresources.com/ and extracts from which are contained in Part III of this document.

Appendix 2 - EXPECTED TIMETABLE OF PRINCIPAL EVENTS

| 2025 |

Publication of this document | 19 November |

Latest time and date for lodging votes via the Investor Centre and / or CREST and / or receipt of Forms of Proxy for the General Meeting | 11:00 on 4 December |

Time and Date for the General Meeting | 11:00 on 8 December |

Completion of the Proposed Acquisition is subject to the conditions in paragraph 3 of Part I of this document |

|

Note: All references to times in this timetable are to London times. The times and dates may be subject to change.

[1] The remaining 10% of NLZM is owned by NLZM Minority Shareholders as defined in this document

[2] Note: FX rate at USD1 = ZAR18.6 which is the average rate in 2025 to September 2025 - _source https://www.ceicdata.com/en/south-africa/foreign-exchange-rates-annual/official-exchange-rate-period-average-local-currency-to-usd

Related Shares:

Bezant Resources PLC