5th Feb 2026 10:20

Gunsynd PLC("Gunsynd" or the "Company")

Barb Gold Project Update

Barb Gold Project Expansion and Target Development Update

Issue of Equity

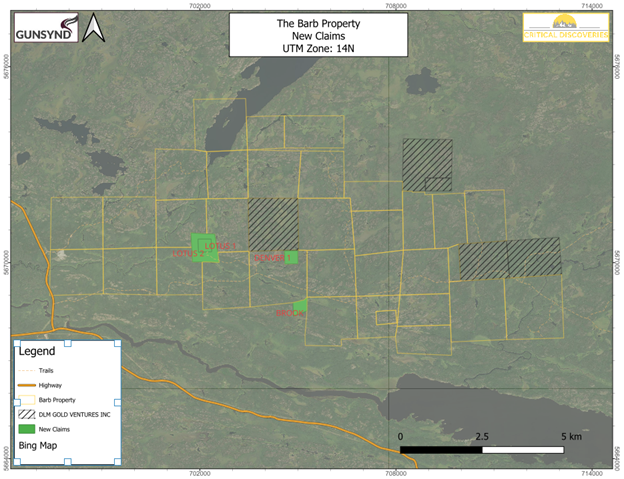

Gunsynd PLC (AIM: GUN) is pleased to announce that, further to the announcement on 12 January 2026, the Company has completed the acquisition of the Lotus 1, Lotus 2 and Brook mineral claims, which host historic shafts, and the Denver claim, which hosts a historic gold showing, all located within the Company's 100%-owned Barb Gold Project in Manitoba, Canada (the "Acquisition").

The newly acquired claims are contiguous with the existing Barb Gold Project and consolidate highly prospective ground within a structurally complex portion of the Archean Rice Lake Greenstone Belt.

Figure 1. New claims highlighted in green.

|

The addition of these claims strengthens the Company's land position across key structural trends and provides multiple high-priority targets for follow-up exploration, including the historically mapped Lotus, North, Cross, Ling and Wasp quartz veins. The historic workings, combined with geophysical responses and surface geochemical results from the broader property, suggest potential for structurally controlled gold mineralisation typical of the Rice Lake Greenstone Belt.

Claim Name | Hectares |

Lotus 1 | 15.820 ha |

Lotus 2 | 51.805 ha |

Denver 1 | 16.309 ha |

Brook (aka Betty) | 16.837 ha |

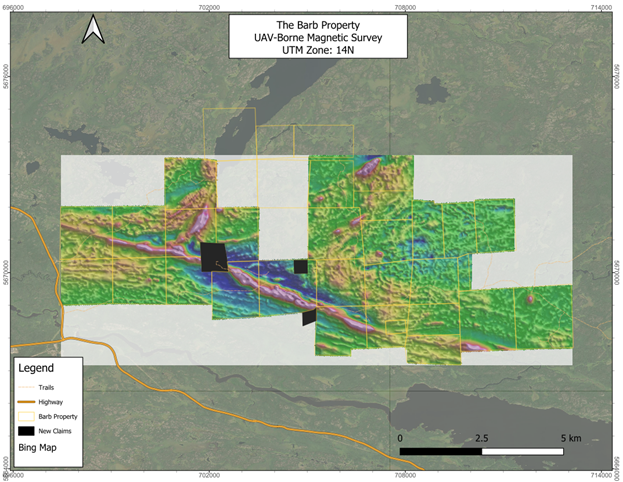

Recent, high-resolution airborne magnetic survey data indicates that the Lotus and Denver showings coincide with interpreted structural corridors considered favourable for gold mineralisation. These structural features are interpreted as shear zones and lithological contacts that may have acted as conduits for mineralising fluids.

Previous sampling from the new claims includes:

Sample ID | Rock Type | Description | FA-AAAu (ppb) | FA-GRA Au (g/t) | |

LM-001 | LM Qtz Vein Rubble | Grab sample from blast pile, close to Lotus Mine. Rubble from quartz vein consists of smoky grey quartz, trace chlorite, 1% pyrite, trace arsenopyrite, and trace very fine-grained gold. All pieces in sample have VG. | > 10000 | 79.8 | |

LM-002 | LM ser alt host rock | Grab sample from blast pile at Lotus Mine. Consists of sericite altered host rock at margins of Lotus vein. Mainly sericite altered host, 10% quartz vein, 1-3% fine grained patchy pyrite, and trace very fine grained silvery grey sulphides. | 1190 | 1.19 | |

LM-003 | LM Qtz Vein Rubble | Grab samples of Lotus Mine quartz vein from 1m sized waste rock. Sample consists of white, vitreous quartz, fuchsite, tourmaline bands, altered sericite host xenoliths, and trace fine-medium grained pyrite. | > 10000 | 29.5 | |

BT001 | Mine Waste | Betty Shaft mine waste contained malachite and possibly azurite. Sulphide percentage is ~2-5% and comprises pyrite and arsenopyrite. | 3060 | 3.06 | |

Figure 2. iView (interpreter's view) of the Barb exMAG. Note: that the RMI defines lithological boundaries well and the black and white 2vd defines structures well. The iView1 as a hybrid aims to present these details from both images in a single view. Note new claims are in black.

Planned Work Programme

To advance drill target generation, Gunsynd plans to conduct an Induced Polarisation (IP) survey across priority areas encompassing the Lotus and Denver claims, as well as selected targets on the existing Barb Gold Project. The IP survey is intended to identify chargeability and resistivity anomalies associated with sulphide-bearing structures within quartz-carbonate vein systems, and to refine diamond drill hole targeting. In parallel, the Company has initiated discussions with the local First Nation community regarding planned exploration activities and looks forward to building a positive and collaborative relationship.

Next Steps

· Completion of IP geophysical surveys over priority targets

· Integration of IP, magnetic, geological, and geochemical datasets

· Finalising priority drill targets and advancing diamond drilling permitting

Consideration and Issue of Creditor Shares

Pursuant to the terms of the Property Purchase agreement, the Company has made a cash payment of approximately £135,000 to the Vendor and issued to a third party associated with the Acquisition 11,654,783 new ordinary shares of 0.085 pence ("Ordinary Shares") at a price of 0.115 pence per share (the "Consideration Shares").

The Company has also issued 11,304,346 new Ordinary Shares at a price of 0.115 pence per share to an outstanding creditor to settle existing liabilities ("Creditor Shares").

Admission

Application will be made to the London Stock Exchange for the admission of the aggregate 22,959,129 Consideration Shares and Creditor Shares to trading on AIM ("Admission"). Admission is expected to occur on or around 11 February 2026. The new Ordinary Shares will rank pari passu with the existing ordinary shares.

Total Voting Rights

For the purposes of the Disclosure and Transparency Rules, following Admission, the Company's issued share capital will comprise 1,615,598,332 ordinary shares of 0.085 pence each. This figure may be used by shareholders as the denominator for calculations to determine if they are required to notify their interest in, or a change to their interest in, the Company under the Disclosure and Transparency Rules.

Hamish Harris, Executive Chairman of Gunsynd, commented:

"The acquisition of the Lotus, Betty, and Denver claims adds important historic gold occurrences within a highly prospective structural setting. When combined with our recent geophysical results, these targets further enhance the drill potential of the Barb Project. The shear zone running through the claims not only provides us with confidence moving forward but also emphasises why we are so pleased to have been able to acquire these recent claims, not least Lotus 1 and 2, which as can be seen from Figure 3, sit right on top of the structural corridor.

We look forward to advancing these targets through IP surveys and continued engagement with local communities as we move toward drilling."

Forward Looking Statements

This announcement contains forward-looking statements relating to expected or anticipated future events and anticipated results that are forward-looking in nature and, as a result, are subject to certain risks and uncertainties, such as general economic, market and business conditions, competition for qualified staff, the regulatory process and actions, technical issues, new legislation, uncertainties resulting from potential delays or changes in plans, uncertainties resulting from working in a new political jurisdiction, uncertainties regarding the results of exploration, uncertainties regarding the timing and granting of prospecting rights, uncertainties regarding the Company's ability to execute and implement future plans, and the occurrence of unexpected events. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors.

This announcement contains inside information for the purposes of the UK Market Abuse Regulation and the Directors of the Company are responsible for the release of this announcement.

Qualified Person

The technical information contained in this disclosure has been reviewed and approved by Aaryn Hutchins, P. Geo., a Professional Geoscientist registered with Engineers Geoscientists Manitoba. Ms. Hutchins has sufficient experience, relevant to the styles of mineralization and types of deposits under consideration, to qualify as a Qualified Person as defined by the AIM Note for Mining, Oil and Gas Companies.

For further information, please contact:

Gunsynd plc Hamish Harris | +44 (0)20 3582 6636 |

Cairn Financial Advisers LLP Liam Murray / James Western | +44 (0)20 7213 0880 |

| |

AlbR Capital Limited Lucy Williams | +44 (0)20 7469 0936

|

Related Shares:

Gunsynd