8th Oct 2025 07:00

The information contained within this announcement is deemed by the Company to constitute inside information pursuant to Article 7 of EU Regulation 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 as amended.

8 October 2025

Sunda Energy Plc

("Sunda" or "Sunda Energy" or the "Company")

Philippines Licence Round: Award of Two High Impact Exploration Blocks

Sunda Energy Plc (AIM: SNDA), the AIM-quoted company focused on gas in Southeast Asia, is pleased to announce that it has been awarded non-operated interests in two Petroleum Service Contracts (the "Service Contracts") for offshore licence areas in the 1st Conventional Energy Bid Round of the Bangsamoro Autonomous Region of Muslim Mindanao ("BARMM") in the Philippines. The successful licence awards are a direct result of the joint applications submitted by the bid group composed of Triangle Energy (Global) Limited (ASX: TEG, "Triangle"), Sunda Energy, PXP Energy Corporation (PSE: PXP, "PXP") and The Philodrill Corporation (PSE.OV, "Philodrill"), as set out in the Company's announcement of 28 August 2024 in connection with the licence round application.

Highlights:

• | Sunda has been awarded a 37.5% working interest in two licence blocks in the south-west part of the Sulu Sea, offshore Philippines. |

• | SC-80 (formerly PDA-BP-2) has estimated combined 1C Contingent Gas Resources of 1811-2212 Bcf, 2C Contingent Gas Resources of 4701-5742 Bcf and 3C Contingent Gas Resources of 1,3171-2,5042 Bcf. |

• | SC-80 (formerly PDA-BP-2) has estimated Pmean Prospective Gas Resources of 10,0882 Bcf. |

• | SC-81 (formerly PDA-BP-3) prospective trend is covered by several 3D seismic surveys with a number of seismic anomaly-supported prospects and leads. |

• | Commitment work programmes in the first two-year sub-phase of the Service Contracts consist of 2D and 3D seismic reprocessing and associated geological studies. |

• | Favourable fiscal terms across both blocks. |

• | Sunda's team has extensive knowledge of the fields and the jurisdiction. |

• | New assets diversify Sunda's asset base, whilst offering potential for value creation via possible farmout and carried high impact drilling, with limited upfront investment. |

Service Contracts SC-80 and SC-81 have been awarded with the following working interests:

• | Triangle | 37.5% |

• | Sunda | 37.5% |

• | PXP | 12.5% |

• | Philodrill | 12.5% |

Triangle has been nominated as operator, working in close liaison with Sunda, PXP and Philodrill.

Dr Andy Butler, Chief Executive Officer, commented:

"We are delighted to have been awarded these two Service Contracts and extend our thanks to the Philippines and Bangsamoro authorities. These assets offer Sunda the potential to uncover high impact appraisal and exploration targets which should be of interest to major E&P players.

We're excited to return to an area that the Sunda team knows well and where the potential for vast energy resources is undoubted. We look forward to working closely with Triangle and our other joint venture partners as we leverage the extensive data set that exists to set about unlocking that potential quickly and at relatively low cost."

|

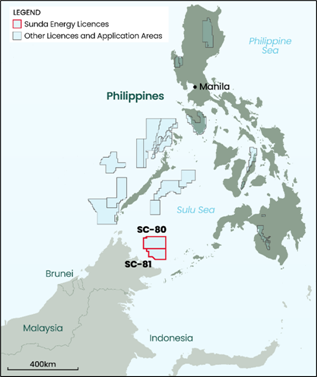

Figure 1: Location of Sulu Sea blocks SC-80 and SC-81 |

Technical Summary of Service Contracts SC-80 (PDA-BP-2) and SC-81 (PDA-BP-3)

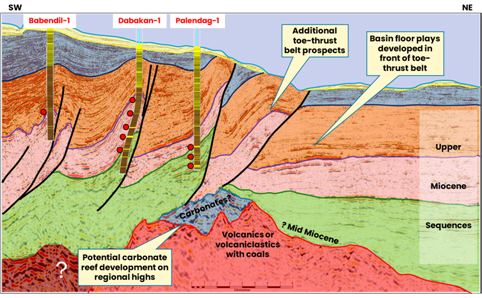

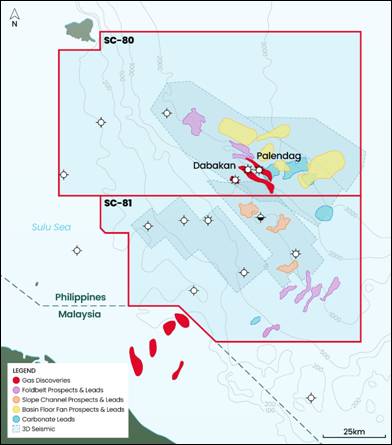

The two Service Contract blocks lie in the south-west part of the Sulu Sea, within the Sandakan Basin, in water depths of <100m to >3000m. The main play is Upper Miocene turbidite sands trapped in toe-thrust anticline structures and basin floor stratigraphic traps in the deep-water areas (>800m), whilst secondary prospectivity exists in Middle to Upper Miocene shallow water sandstones in the western shallow water areas and in deeper Miocene carbonate reef features. Examples of the play styles in the new Service Contracts are shown in Figure 2 and the location of the main prospective features illustrated in Figure 3.

|

Figure 2: Seismic structural section illustrating Sulu Sea discoveries and plays |

|

Service Contract SC-80 covers much of the area of a former Service Contract (SC 56), where key members of the Sunda team gained extensive knowledge working with a previous operator (Mitra Energy). ExxonMobil farmed in and drilled four exploration wells in the deepwater fold belt play in 2009-2010, finding two significant gas fields with the Dabakan-1 (75m net pay) and Palendag-1 wells (47m net pay), plus a minor gas discovery at Babendil-1 (39m net pay). The two fields have estimated combined 1C Contingent Gas Resources of 221 Bcf2, 2C Contingent Gas Resources of 574 Bcf2 and 3C Contingent Gas Resources of 2,504 Bcf2, these estimates being based on a Competent Person's Report ("CPR") produced by Mitra Energy Inc. in 2015 (the "Mitra Energy CPR"). A later CPR published by Mitra Energy Inc.'s successor company Jadestone Energy in 2018 (the "Jadestone CPR") estimated combined 1C Contingent Gas Resources of 181 Bcf1, 2C Contingent Gas Resources of 470 Bcf1 and 3C Contingent Gas Resources of 1,319 Bcf1.

ExxonMobil exited in 2011 although Total Energies ("TOTAL") farmed into the block a year later and acquired additional 3D seismic data and committed to drill the giant Halcon prospect. Halcon is a low relief, anticlinal structure interpreted to be a basin floor turbidite fan sandstone complex trapped against the frontal thrust of the fold-belt, with estimated Pmean Prospective Gas Resources of 6,735 Bcf2. TOTAL cancelled drilling plans following management and strategic changes in 2016, and the block was relinquished in 2020 without further drilling. With Halcon remaining undrilled, and a number of other gas prospects on trend, Sunda believes that there are significant Prospective Resources to pursue on the block, already derisked through existing discoveries.

The Prospective Resources from the Mitra Energy CPR for the five key prospects amount to 10,088 Bcf of gas and 247 MMbbls of associated liquids, as shown in Tables 1 and 2 below.

Prospect | Low | Best | High | Pmean | POSg |

Dabakan Extension | 190 | 282 | 392 | 288 | 36% |

Palendag Extension | 63 | 143 | 248 | 151 | 32% |

Luntang | 317 | 509 | 762 | 528 | 21% |

Halcon | 1,533 | 5,783 | 13,138 | 6,735 | 21% |

Samat | 958 | 2,260 | 3,961 | 2,386 | 16% |

TOTAL | 10,088 |

Table 1: Gross Prospective Gas Resources2 in Bcf from the Mitra Energy CPR for key prospects within the area of SC-80. Note the Jadestone CPR1 did not include an assessment of Prospective Resources.

Prospect | Low | Best | High | Pmean | POSg |

Dabakan Extension | 1.7 | 3.4 | 4.7 | 3.5 | 36% |

Palendag Extension | 1.0 | 2.4 | 4.3 | 2.7 | 32% |

Luntang | 5.3 | 9.4 | 15.5 | 10.1 | 21% |

Halcon | 33.0 | 136.0 | 344.0 | 169.0 | 21% |

Samat | 21.0 | 54.0 | 109.0 | 62.0 | 16% |

TOTAL | 247.3 |

Table 2: Gross Prospective Oil Resources2 in MMbbls from the Mitra Energy CPR for key prospects within the area of SC-80. Note the Jadestone CPR1 did not include an assessment of Prospective Resources.

Service Contract SC-81 lies adjacent and to the south of SC-80 and encompasses both a slope clastic play and a shallow water shelf play.

On the slope trend in SC-81, two wells have demonstrated the presence of hydrocarbons: Wildebeest-1 recovered oil samples from thin sands and Lumba Lumba-1 encountered significant hydrocarbon shows but was abandoned early due to anomalous pressures. Sunda and its joint venture partners consider that these earlier wells were poorly located as missed key target areas - as with SC-80, prospective areas appear to be associated with seismic amplitude anomalies, though neither well targeted such an anomaly. Most of the prospective trend on the slope is covered by a 750km2 3D survey acquired in 2007, on which a number of seismic anomaly-supported prospects and leads have been identified. Several carbonate reef buildups have also been identified which represent additional potential exploration targets; such targets have proven highly prospective elsewhere offshore Borneo and globally.

Five wells have been drilled in the shelf area of SC-81, and all were dry or had minor gas shows and this area is consequently considered less prospective, although five discovered fields in the neighbouring Malaysian waters indicates some gas potential.

Work Commitments and Plans

The geological environment of the two new Service Contracts, the presence of extensive 3D seismic data, and good calibration from a number of wells, make this area ideal for the deployment of modern seismic imaging technologies. The significant earlier investments made by ExxonMobil, and later TOTAL, in these data, create a great opportunity for Sunda and its joint venture partners to deploy special processing techniques to properly delineate the gas discoveries and further de-risk the material exploration prospectivity. If successful, this low-cost approach should reveal high impact appraisal and exploration targets for farmout and future drilling.

The commitment work programmes in the early stages of the 7-year exploration term consist principally of seismic reprocessing and desktop studies, with two optional wells in each Service Contract in the final 3 years. Commitments in the first two-year sub-phase of the PSC for the two blocks consist of 3D and some 2D seismic reprocessing, and associated geological studies.

Petroleum Contract and Fiscal Terms

Philippines Service Contracts are similar to Production Sharing Contracts in other countries, with fiscal terms that are favourable by international standards. Some key terms are as follows:

• | 7-year Exploration Phase, divided into sub-phases with separate work programme obligations. The Service Contract can be surrendered before proceeding to the next sub-phase if the work obligation is fulfilled. |

• | 25-year Production Phase, extendable by 15 years, provided total does not exceed 50 years. |

• | Cost recovery: 70% maximum of annual gross proceeds or actual expenses per calendar year; unrecovered costs in a calendar year are carried over to succeeding calendar years until fully recovered. 100% recovery of non-capital expenditures - capital expenditures depreciated over 5 to 10 years. |

• | Gross income split: 60% government, 40% contractor on net proceeds. |

• | Corporate tax: 30% on net proceeds, paid out of government share. |

• | Filipino Participation Incentive Allowance (FPIA): 7.5% of gross proceeds before cost recovery if Filipino companies hold at least 15% participating interest. |

Additionally, Special Allowance for Petroleum Service Contractors have been implemented by the Philippines Department of Energy to provide additional fiscal incentives for certain situations, including New Plays, Frontier Areas. and Gas Developments in Remote Areas.

-ENDS-

For further information, please contact:

Sunda Energy Plc Andy Butler, Chief Executive Rob Collins, Chief Financial Officer

| Tel: +44 (0) 20 7770 6424 |

Allenby Capital Limited (Nominated Adviser and Joint Broker) Nick Athanas, Nick Harriss, Ashur Joseph (Corporate Finance) Matt Butlin, Kelly Gardiner (Sales and Corporate Broking)

| Tel: +44 (0) 203 328 5656 |

Hannam & Partners Advisory Limited (Advisor and Joint Broker) Neil Passmore (Corporate Finance) Leif Powis (Sales)

| Tel: +44 (0) 20 7907 8502

|

Celicourt Communications (Financial PR and IR) Mark Antelme, Philip Dennis, Charles Denley-Myerson | Tel: +44 (0) 20 7770 6424

|

Qualified Person's Statement

Pursuant to the requirements of the AIM Rules - Note for Mining and Oil and Gas Companies, the technical information and resource reporting contained in this announcement has been reviewed by Dr Andrew Butler, Fellow of the Geological Society of London and member of the Society of Petroleum Engineers. Dr Butler has more than 28 years' experience as a petroleum geologist. He has compiled, read and approved the technical disclosure in this regulatory announcement and indicated where it does not comply with the Society of Petroleum Engineers' standard.

Glossary

1C | Denotes the low estimate qualifying as Contingent Gas Resources. Reflects a volume estimate that there is a 90% probability that the quantities actually recovered will equal or exceed the estimate. |

2C

3C

| Denotes the best estimate qualifying as Contingent Gas Resources. Reflects a volume estimate that there is a 50% probability that the quantities actually recovered will equal or exceed the estimate. Denotes the high estimate qualifying as Contingent Gas Resources Reflects a volume estimate that there is a 10% probability that the quantities actually recovered will equal or exceed the estimate.

|

Bcf | Billion cubic feet of gas |

| |

POSg | The geological chance of success is an estimate of the probability that drilling the prospect would result in a discovery |

Contingent Gas Resources | Those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations by application of development projects, but which are not currently considered to be commercially recoverable owing to one or more contingencies |

Mean or Pmean | Reflects a mid-case volume estimate of resource derived using probabilistic methodology. This is the mean of the probability distribution for the resource estimates and may be skewed by resource numbers with relatively low probabilities |

MMbbls | Millions of barrels of hydrocarbon liquids (oil or condensates) |

Prospective Resources | Quantities of petroleum that are estimated to exist originally in naturally occurring reservoirs, as of a given date. Crude oil in-place, natural gas in-place, and natural bitumen in-place are defined in the same manner |

Footnotes:

[1] Competent Person's Report ("P3645 - YE2017 Reserves & Resources Report for Australia, Vietnam and Philippines Asset"), published by Jadestone Energy in 2018 as part of Admission Document. Results in accordance with the March 2007 SPE/WPC/AAPG/SPEE Petroleum Resources Management System ("PRMS") as the standard for classification and reporting.

2 Competent Person's Report: Resources Assessment of the Assets of Mitra Energy Inc., 2015. Results in accordance with the standards set out in the Canadian Oil and Gas Evaluation Handbook ("COGEH") prepared jointly by the Society of Petroleum Evaluation Engineers (SPE) and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM"), and the Petroleum Resources and Reserves definitions contained in Canadian National Instrument 51-101 (NI 51-101) Standards of Disclosure for Oil and Gas Activities.

Related Shares:

Sunda Energy