17th Sep 2025 07:00

SUPERMARKET INCOME REIT PLC

(the "Company", "SUPR" or together with its subsidiaries the "Group")

AUDITED RESULTS FOR THE YEAR ENDED 30 JUNE 2025

A TRANSFORMATIONAL YEAR POSITIONING THE COMPANY FOR INCREASED SCALE AND EARNINGS GROWTH. DEMONSTRATING ALIGNMENT WITH SHAREHOLDERS, ASSET VALUATIONS AND AFFORDABILITY OF RENTS.

The Board of Directors of Supermarket Income REIT plc (LSE: SUPR, JSE: SRI), the real estate investment trust, reports its audited consolidated results for the Group for the year ended 30 June 2025 (the "Year").

FINANCIAL HIGHLIGHTS

12 months to 30-June-25 | 12 months to 30-June-24 |

Change in Year | |

Net rental income | £113.2m | £107.2m | +6% |

EPRA earnings per share1 | 6.0 pence | 6.1 pence | -2% |

IFRS earnings per share | 4.9 pence | (1.7) pence | n/a |

Dividend per share declared | 6.12 pence | 6.06 pence | +1% |

Dividend cover1, 3 | 0.98x | 1.01x | n/a |

EPRA cost ratio1 | 13.0% | 14.7% | n/a |

30-June-25 | 30-June-24 | Change in Year | |

Portfolio valuation2 | £1,625m | £1,776m | -8% |

Portfolio net initial yield1, 2 | 5.9% | 5.9% | n/a |

Investment in Joint Venture | £96.6m | - | n/a |

EPRA NTA per share1 | 87.1 pence | 87.0 pence | - |

IFRS NAV per share | 88.5 pence | 89.8 pence | -1% |

Loan to value1, 2 | 31% | 37% | n/a |

Significant strategic milestones achieved

· Positioned for materially improved earnings and dividend cover

o Internalisation to deliver £4 million of expected cost savings and clear alignment between the Company, management team and shareholders

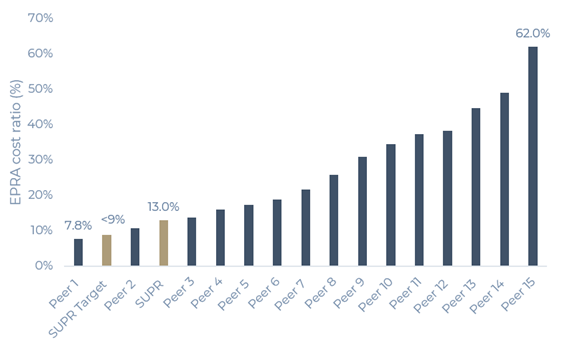

o Committed to being one of the lowest cost companies in the sector targeting below 9% EPRA cost ratio

o Debut sterling bond issuance fixing £250 million of debt costs for 6 years at 5.125% coupon

· Active capital recycling proving asset valuations and releasing capital for reinvestment

o Strategic £403 million Joint Venture (the "JV") with funds managed by Blue Owl Capital ("Blue Owl") at 3% premium to 31 December 2024 book value

§ SUPR holds a 50% interest in the JV and realised c.£200 million of net proceeds to deploy into an attractive pipeline of investment opportunities

o Sale of Tesco, Newmarket for £63.5 million at 7.4% premium to 30 June 2024 book valuation

o Active capital recycling has resulted in a marginal decline in EPRA earnings per share of 2%, which reflects temporary cash drag as the Company continues to redeploy the net proceeds from the JV

· Renewed leases on the three shortest leased supermarkets demonstrating affordability of rents

o Extended leases to 15 years with RPI linked annual reviews

o New starting rents in line with acquisition underwrite at 4% rent to turnover, 35% ahead of MSCI supermarkets average rent per sq.ft. and 13% above valuer's ERVs

· Secondary listing on the JSE broadening SUPR's exposure to international investors

Positioning for future growth

· FY26 target dividend increased to a minimum of 6.18 pence per share

· Reduction in EPRA cost ratio of 1.7% during the year, with additional reductions expected in FY26, reflecting a full year of benefits from Internalisation cost reductions

· LTV of 31% as at 30 June 2025 (30 June 2024: 37%) providing capacity for growth through increased leverage to fund earnings accretive acquisitions (current LTV of 34%)

· 100% occupancy and 100% rent collection4 since IPO

o Income backed by the leading and largest operators in the non-discretionary grocery sector

· c. £450 million of liquidity in the form of cash and undrawn committed facilities

· Fitch BBB+ investment grade rating reaffirmed providing access to attractively priced long-dated debt

· Post balance sheet debut £250 million oversubscribed sterling bond issuance with a six-year term and a fixed coupon of 5.125%

Earnings accretive acquisitions

· Acquired a Sainsbury's store in Huddersfield for £49.7 million at a 7.6%5 net initial yield ("NIY")

· Acquired nine Carrefour assets in France through a sale and leaseback for a total purchase price of €36.7 million6, at a portfolio NIY of 6.8%

· Post balance sheet acquisitions include a Tesco store in Ashford for £54.1 million at a 7.0%7 NIY and a Waitrose store in Anglesey for £4.8 million at a 6.1%8 NIY.

Strong grocery sector growth

· The non-discretionary grocery market continues to demonstrate growth and resilience

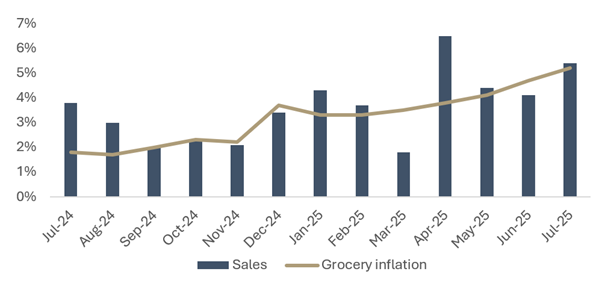

· UK grocery market has shown consistent growth, with sales up 5.4% year on year in July 20259 and forecast to grow to £259 billion in 202510

o Tesco and Sainsbury's increased sales and market share in the year with a combined 43% market share11

o Total online market share at 12% and growing11

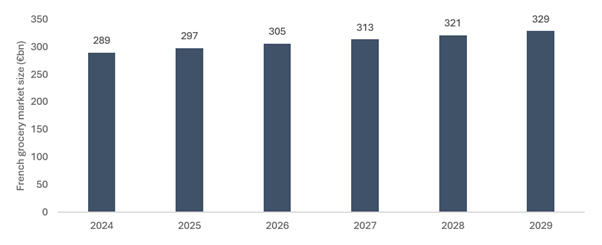

· French grocery market sales forecast to reach €329 billion in 2029, representing 3% annual growth12

o Carrefour has a 21.5% market share in France, an increase of 2.2 percentage points since June 2024.11

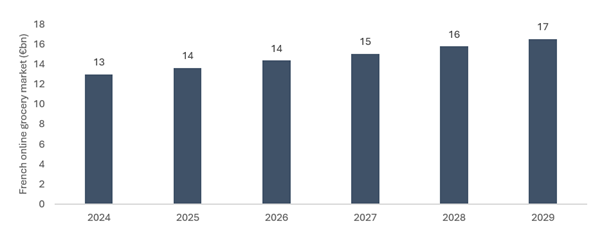

o Online is one of the fastest growing channels experiencing 88% growth between 2018 and 202512, accounting for approximately 10% of the market

Material cost savings and increased alignment with shareholders

· Internalisation of the management function expected to deliver at least £4 million of annual cost savings

· Reduced EPRA cost ratio to 13%, targeting further cost efficiencies in FY26 with the aim of achieving below 9%, among the lowest in the sector

· Broader investor appeal with the transfer of listing from the closed-ended investment fund category to the equity shares (commercial companies) category of the Official List

Supermarket property valuations increasing

· The Company's portfolio valuation increased by 1.9%13 on a like-for-like basis

· NIY of 5.9% (30 June 2024: 5.9%)

· The Company acquired £81.2 million14 of assets at an average yield of 7.3%, representing an attractive 2.3% spread to the incremental cost of debt

· The Company disposed of £466.8 million15 of assets, highlighting strong demand for omnichannel stores

o Tesco, Newmarket: sold to Tesco plc for £63.5 million, 7.4% above book value16

o Eight stores in the 50:50 JV: £403.3 million, 3% above book value17

· Constrained transaction volumes with potential sellers choosing to hold on to assets, placing upwards pressure on valuations

Further progress on key sustainability initiatives

· EPRA Sustainability Best Practices Recommendations ("sBPR") Silver and Most Improved Awards

· First Climate Transition Plan published

· Improved ESG data collection processes with electricity and natural gas data collected from all supermarket tenants

· Strong tenant net zero commitments continue to drive significant tenant capital expenditure on stores

· EV charging operational at 38% of sites and solar arrays operational across 16% of stores in the Portfolio

· Awarded sixth consecutive EPRA Gold award for governance

Robert Abraham, CEO of Supermarket Income REIT plc, commented:

"This has been a transformational year for SUPR which has positioned the Company to return to growth. The team has delivered shareholder value through a number of key strategic milestones, most notably the Internalisation which will deliver significant cost savings and provides greater alignment with shareholders. We have proactively sought to deliver further shareholder value through establishing a £403 million JV, issuing our debut £250 million sterling bond, demonstrating the affordability of rents and validating asset valuations, whilst broadening our investor base through our secondary listing on the JSE.

The investment case for supermarket real estate is as compelling as ever and our relationship led model combined with sector specialism allow us to unlock attractive opportunities for shareholders. Our portfolio of 8218 high-quality foodstores let to operators of significant scale, under triple net leases with contractual inflation linked uplifts, enables us to deliver an efficient platform with a falling cost ratio.

We remain focused on delivering shareholder value as we look to scale the platform further. Our team of grocery sector specialists continues to demonstrate its ability to originate and execute on an attractive acquisition pipeline of earnings enhancing opportunities. Through this pipeline we expect to deliver a growing and fully covered dividend."

PRESENTATION FOR ANALYSTS

The Company will be holding an in-person presentation for analysts at 08.30am today at FTI Consulting's offices, 200 Aldersgate, Aldersgate Street, London, EC1A 4HD. To register to attend in-person, please contact FTI Consulting: [email protected]. There will also be a webcast available. To join the presentation via the webcast, please register using the following link:

Supermarket Income REIT - Full Year Results Presentation 2025 | SparkLive | LSEG

The results presentation is available in the Investor Centre section of the Group's website.

| FOR FURTHER INFORMATION |

| ||

| Supermarket Income REIT plc | |||

| Rob Abraham / Mike Perkins / Chris McMahon | |||

|

Stifel Nicolaus Europe Limited |

+44 (0)20 7710 7600 | ||

| Mark Young / Rajpal Padam / Catriona Neville |

| ||

|

|

| ||

| Goldman Sachs International Tom Hartley / Luca Vincenzini | +44 (0)20 7774 1000

| ||

|

| |||

| FTI Consulting | +44 (0)20 3727 1000 | ||

| Dido Laurimore / Eve Kirmatzis / Andrew Davis | |||

| ||||

NOTES TO EDITORS:

Supermarket Income REIT plc (LSE: SUPR, JSE: SRI), a FTSE 250 company, is the only LSE listed company dedicated to investing in grocery properties which are an essential part of national food infrastructure. The Company focuses on grocery stores which are predominantly omnichannel, fulfilling online and in-person sales and are let to leading supermarket operators in the UK and Europe. The portfolio was valued at £1.8 billion as at 31 December 2024.

The Company's properties earn long-dated, secure, inflation-linked, growing rental income. SUPR targets a progressive dividend and the potential for long term capital growth.

The Company's shares are traded on the LSE's Main Market and on the Main Board of the JSE Limited in South Africa.

Further information is available on the Company's website www.supermarketincomereit.com

LEI: 2138007FOINJKAM7L537

Stifel Nicolaus Europe Limited, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority, is acting exclusively for Supermarket Income REIT plc and no one else in connection with this announcement and will not be responsible to anyone other than the Company for providing the protections afforded to clients of Stifel Nicolaus Europe Limited nor for providing advice in connection with the matters referred to in this announcement.

Goldman Sachs International, which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the United Kingdom, is acting exclusively for Supermarket Income REIT plc and no one else in connection with this announcement and will not be responsible to anyone other than the Company for providing the protections afforded to clients of Goldman Sachs International nor for providing advice in connection with the matters referred to in this announcement.

CHAIR'S STATEMENT

Dear Shareholder,

I am pleased to present the Company's first results as an operating REIT, following the internalisation of its management function ("Internalisation") in March 2025. The Internalisation, which I discuss in more detail below, was a key milestone among several achieved in a transformational year for the Company. These accomplishments have positioned the Company to capitalise on the compelling investment opportunities that we are seeing at this stage of the real estate cycle.

In November 2024, we set out a series of key strategic initiatives, aimed at reducing costs, delivering sustainable and growing earnings, and ultimately narrowing the share price discount to NTA. Having successfully delivered on these initiatives, including recycling capital, lease renewals on three of our supermarkets and completing the Internalisation of the business, it is encouraging to see a positive market response. In the calendar year-to-date, SUPR's share price has risen 16%, versus the FTSE EPRA NAREIT UK Index which is down 2% (based on the closing share price as at 15 September 2025) and the discount to NTA has narrowed markedly. However, we recognise that there is still more work to be done.

These strategic initiatives have evidenced the affordability of rents across our high-performing omnichannel supermarket portfolio, supported our asset valuations, and demonstrated strong alignment with shareholder interests, as described below.

Demonstrating affordable rental levels. In February, lease renewals for the Company's three shortest-leased stores provided clear evidence of the above-average affordable rental levels for our high-quality stores. New 15-year leases were agreed with Tesco, featuring inflation-linked annual uplifts. The day one starting rents on these renewed leases were struck at an average of 35% above the MSCI supermarket rental index and 13% ahead of our own valuer's Estimated Rental Values ("ERVs"), highlighting the above average rents that operators are prepared to pay for continued access to stores in our high-quality portfolio of grocery assets.

Demonstrating asset valuations. The Company completed two key disposals this year, crystalising the market value of the Company's assets.

Tesco, Newmarket: We sold this store to Tesco for £63.5 million, at a net initial yield of 5.2%19 and 7.4% above the June 2024 book value, highlighting the strong demand for low-yielding omnichannel stores. Tesco's purchase of the store also underlines the asset's strategic importance to the operator.

Strategic joint venture ("JV"): In April, SUPR formed a strategic JV with funds managed by Blue Owl Capital, a global asset manager with $284+ billion of assets under management. The JV was seeded with eight of SUPR's high-yielding supermarkets, which were transferred into the JV at 3% above the December 2024 book value. SUPR retained a 50% stake in the JV, generating c.£200 million in net proceeds and will receive an ongoing management fee enhancing the Company's earnings. The JV further supported SUPR's asset valuations, endorsed our investment thesis, and unlocked additional capital for further acquisitions while preserving future growth optionality.

Demonstrating alignment with investors. In March this year, the Company internalised its management function, delivering significant benefits for shareholders. Firstly, the Internalisation is on-track to deliver the expected c.£4 million of annual cost savings. The benefits of these cost reductions are already evident in our EPRA cost ratio which has reduced from 14.7% to 13.0% reflecting savings made during the year and we are on-track to see the full benefits in FY26. With the annual savings realised from the Internalisation, we are targeting one of the lowest EPRA cost ratios in the sector-below 9%-to deliver a highly efficient platform for our shareholders. As we continue to scale the business, we are confident in our ability to drive these costs even lower.

The Internalisation also provides greater alignment between management, the Board and shareholders and we are delighted to welcome Rob Abraham, CEO, and Mike Perkins, CFO, to the Board as Executive Directors. The Board would like to extend its thanks to the Atrato team for their contribution to the growth of the Company since its IPO.

Listing Changes. The Company completed a secondary listing on the Johannesburg Stock Exchange ("JSE") in December enhancing its profile with a broader investor base and I am pleased to welcome our new South African shareholders to the register. Following completion of the Internalisation, the Company also secured shareholder support to change its UK listing to the equity shares (commercial companies) category of the Official List, which has, among other things, enhanced efficiency, operational flexibility and the attractiveness of the Company to investors in the UK and overseas.

Governance. The Nomination Committee continues its succession planning. Sapna Shah, SID and Chair of the Nomination Committee, has overseen the appointment of Roger Blundell to the Board to succeed Jon Austen as Audit & Risk Committee Chair. As part of the Board's succession planning, Jon will step down from the Board following the 2025 AGM as he approaches the end of his nine-year term. On behalf of the Board, I would like to offer my sincerest thanks to Jon for the huge contribution that he has made to the Company, having served on its Board since the IPO in 2017.

Sustainability. We continue to put sustainability at the heart of the business and this year I am pleased to report that in addition to the publication of our inaugural Climate Transition Plan, we have published our third annual sustainability report to coincide with the release of our TCFD compliant full year results.

Post period end actions. Following the period end, the Company has reinforced its commitment to delivering long-term shareholder value, with the earnings enhancing acquisition of a Tesco supermarket in Ashford, a top performing foodstore, marking the first reinvestment of proceeds from the JV. The Company also issued its first sterling bond which secures long-term financing at an attractive fixed rate. The investment grade bond enhances the Company's financial flexibility and the potential earnings accretion of the acquisition pipeline as the business continues to scale.

Outlook

With a fully aligned internal management structure now in place, supported by a high-calibre team of sector specialists, we believe we are well positioned to deliver significant long-term value for shareholders. The Company's supermarket tenants continue to perform strongly with the non-discretionary and highly resilient grocery market benefitting from an extended period of food price inflation and sales growth across the market.

The Board recommends a minimum target dividend of 6.18p for the year ending June 2026. While our near-term focus remains on delivering a growing and fully covered dividend, ultimately our aim is to position the Company to deliver dividend growth ahead of that seen in recent years, during which we have been actively managing the impact of higher financing costs since 2022.

The Company has delivered a huge amount of progress this year and I am pleased with the positive response from our shareholders. The Company has demonstrated its agility and innovation, evidenced through strategic transactions such as the JV which attracted a strategic partner, warehoused future pipeline, released capital and leveraged our team's sector expertise to generate additional earnings through the ongoing management fee. We have a current and compelling pipeline of opportunities, access to capital and the right team to deliver them. I look forward to updating the market as we maintain the pace of activity and creativity displayed this year, and as we continue to grow the business and deliver long-term value for shareholders.

Nick Hewson

Chair

16 September 2025

KEY PERFORMANCE INDICATORS

We set out below the key performance indicators for the Company.

KPI | Definition | Performance |

1. Total Shareholder Return | Shareholder return is one of the Group's principal measures of performance. Total Shareholder Return ("TSR") is measured by the movement in share price over the period plus dividends reinvested in shares on the ex-dividend date, expressed as a percentage of the share price at the start of the period. | 24.0% for the year to 30 June 2025 (30 June 2024: 1.8%)20 |

2. Total Accounting Return | Growth in the Group's NTA over a period plus dividends paid for that period | 7.2% for the year ended 30 June 2025 (30 June 2024: 0.3%) |

3. EPRA EPS* | A measure of EPS designed by EPRA to present underlying earnings from core operating activities. | 6.0 pence per share for the year ended 30 June 2025 (30 June 2024: 6.1 pence)

|

4. WAULT | WAULT measures the average unexpired lease term of the Property Portfolio, weighted by rent. | 11 years WAULT as at 30 June 2025 (30 June 2024: 12 years) |

5. EPRA NTA per share | The value of our assets (based on an independent valuation) less the book value of our liabilities, attributable to shareholders and calculated in accordance with EPRA guidelines. EPRA states three measures of NAV to be used; of which the Group deem EPRA NTA as the most meaningful measure. See Note 30 for more information. | 87.1 pence per share as at 30 June 2025 (30 June 2024: 87.0p) |

6. Net Loan to Value | Net borrowings divided by the market value of investment properties reported on a proportionally consolidated basis. | 31% as at 30 June 2025 (30 June 2024: 37%) |

\* The Company previously included an additional earnings measure called "Adjusted earnings" and "Adjusted EPS". The metric adjusted EPRA earnings by deducting one-off items such as debt restructuring costs.

Following the updated September 2024 EPRA best practice recommendations guidelines, the specific adjustments to EPRA earnings are now included within the EPRA earnings calculation. As such the comparative period calculations in the tables have been adjusted to reflect the new guidelines retrospectively.

The Group uses alternative performance measures including the European Public Real Estate ("EPRA") Best Practice Recommendations ("BPR") to supplement its IFRS measures as the Board considers that these measures give users of the financial statements the best understanding of the underlying performance of the Group's property portfolio. The EPRA measures are widely recognised and used by public real estate companies and investors and seek to improve transparency, comparability and relevance of published results in the sector.

Reconciliations between EPRA measures and the IFRS financial statements can be found in Notes 12 and 30 to the financial statements.

EPRA PERFORMANCE INDICATORS

The table below shows additional performance measures, calculated in accordance with the Best Practices Recommendations of the European Public Real Estate Association (EPRA). We provide these measures to aid comparison with other European real estate businesses.

For a full reconciliation of all EPRA performance indicators, please see the Notes to EPRA measures within the supplementary section of the financial statements.

Measure | Definition | Performance |

1. EPRA EPS | A measure of EPS designed by EPRA to present underlying earnings from core operating activities. | 6.0 pence per share for the year ended 30 June 2025 (30 June 2024: 6.1 pence)

|

2. EPRA Net Reinstatement Value (NRV) per share | An EPRA NAV per share metric which assumes that entities never sell assets and aims to represent the value required to rebuild the entity. | 96.0 pence per share as at 30 June 2025 (June 2024: 96.7 pence) |

3. EPRA Net Tangible Assets (NTA) per share | An EPRA NAV per share metric which assumes entities buy and sell assets, thereby crystallising certain levels of unavoidable deferred tax. | 87.1 pence per share as at 30 June 2025 (30 June 2024: 87.0 pence) |

4. EPRA Net Disposal Value (NDV) per share | An EPRA NAV per share metric which represents the shareholders' value under a disposal scenario, where deferred tax, financial instruments and certain other adjustments are calculated to the full extent of their liability, net of any resulting tax. | 88.0 pence per share as at 30 June 2025 (30 June 2024: 89.6 pence) |

5. EPRA Net Initial Yield (NIY) & EPRA "Topped-Up" Net Initial Yield | Annualised rental income based on the cash rents passing at the balance sheet date, less non-recoverable property operating expenses, divided by the market value of the property, increased with (estimated) purchasers' costs. | NIY 5.8% & "Topped Up" 5.9% as at 30 June 2025 (30 June 2024: 5.9%) |

6. EPRA Vacancy Rate | Estimated Market Rental Value (ERV) of vacant space divided by ERV of the whole portfolio. | 0.3% as at 30 June 2025 (30 June 2024: 0.5%) |

7. EPRA Cost Ratio (Including direct vacancy costs) | Administrative & operating costs (including costs of direct vacancy) divided by gross rental income. | 13.0% for the year ended 30 June 2025 (30 June 2024: 14.7%) |

8. EPRA Cost Ratio (Excluding direct vacancy costs) | Administrative & operating costs (excluding costs of direct vacancy) divided by gross rental income. | 12.4% for the year ended 30 June 2025 (30 June 2024: 14.4%) |

9. EPRA LTV | Net debt divided by total property portfolio and other eligible assets, on a proportionally consolidated basis. | 36.1% as at 30 June 2025 (30 June 2024: 38.8%) |

10. EPRA Like-for-like Rental Growth | Changes in net rental income for those properties held for the duration of both the current and comparative reporting period. | Rental increase of 2.4% for the year ended 30 June 2025 (30 June 2024: 2.1%)

|

11. EPRA Capital Expenditure | Amounts spent for the purchase and development of investment properties (including joint ventures and any capitalised transaction costs). | £82.1 million for the year ended 30 June 2025 (30 June 2024: £146.2 million) |

CHIEF EXECUTIVE'S REVIEW

Business Review

Chief Executive Robert Abraham.

A Transformational Year for SUPR

1) This year marked a pivotal moment for the business, with significant milestones achieved and portfolio initiatives delivered in quick succession. These accomplishments are the culmination of an extraordinary team effort, driving real value for our shareholders.

2) Internalisation of the Company's management function delivering material cost savings and enhanced alignment with investors.

3) Demonstrating the affordability of rents in our high-quality portfolio through lease renewals as well as crystalising the value of our assets through capital recycling.

4) The formation of the JV with a highly credible global real estate investor in Blue Owl unlocked capital while providing further supporting evidence for our investment thesis on higher yielding UK supermarkets. The JV offers an attractive management fee and the ability to retain a stake in these high-quality assets.

5) Public bond issuance had long been on our strategic agenda, and post year-end, we acted swiftly to seize a window of opportunity for a significantly oversubscribed £250 million debut bond issue - a testament to the team's agility and readiness.

6) Investor interest continues to broaden, notably with the successful JSE listing completed in December 2024. We're pleased to welcome our South African investors, who now represent approximately 3% of our register. We look forward to growing this in the coming years and further diversifying the share register.

Opportunity for growth

1) With a strengthened balance sheet and access to capital at a competitive cost across equity, debt, and joint ventures, we are well positioned to execute on a compelling pipeline of assets, as we continue to scale the business.

2) This pipeline provides attractive avenues for growth across the grocery real estate spectrum while maintaining a focus on leading operators with significant scale and market share.

3) New supply is entering the market through sale and leaseback transactions for the first time in many years. These supermarket sites are often top-performing grocery locations which have been operating for 30+ years.

4) The grocery real estate investment case remains highly compelling: a sector underpinned by non-discretionary spend, national food infrastructure and mission critical real estate for tenants.

5) Drivers for rental growth are evident: zero vacancy, mission critical properties, strong grocery sales growth (particularly for omnichannel stores), prohibitively high development costs and a shortage of prime locations (see Sainsbury's acquisition of Homebase stores to convert into supermarkets).

6) Our internalised structure provides clear alignment with shareholders and the desire to scale does not come at the cost of quality and delivering sustainable returns.

The year in review

A year of significant achievements for the Company

FY25 has been defined by the successful delivery of the key strategic initiatives which were announced in November 2024. Against a backdrop of continued economic uncertainty, we have maintained our focus on proactively seeking to drive value for our shareholders. From internalising our management structure to launching a landmark JV with Blue Owl, SUPR has taken the decisive and necessary steps to improve alignment with shareholders, reduce costs, and enhance long-term earnings. We remain focused on capital recycling, sustainability, and broadening our investor base. These achievements position SUPR well for growth and a continued leadership in the UK grocery real estate sector.

A team aligned with shareholders, delivering on strategic initiatives

1. Internalisation reducing costs and enhancing shareholder alignment

In March, we announced our intention to internalise the Company's management function. The Internalisation offered compelling financial and strategic benefits, including estimated annual cost savings of at least £4 million, stronger shareholder alignment, a streamlined management structure and broader investor appeal beyond externally managed vehicles.

The Board agreed to pay Atrato Group a £20.8 million termination fee which secured the termination of the management contract and the transfer of SUPR's staff and Intellectual Property ("IP") to the Company.

The Internalisation is on track to deliver significant cost savings of at least £4 million per year which is equivalent to a c.19% yield on cost, the highest return on capital of any available allocation option at the time of Internalisation. The cost saving has a direct impact to SUPR's EPRA cost ratio with our target of below 9% forecasted to be one of the lowest in the sector.

EPRA cost ratios (including direct vacancy costs): FTSE350-listed REITs21

The internalised structure materially enhances shareholder alignment with the Company able to retain a team of sector specialists whose goals and remuneration are aligned with shareholder returns. The simplified management structure also provides greater strategic flexibility to explore potential future fee generating opportunities such as joint ventures and broadens SUPR's potential investor universe.

2. Proving rents & outperforming ERVs

In February, we took the decision to agree lease renewals on the three shortest leased Tesco stores in the Company's portfolio. We agreed new 15-year leases with Tesco on supermarkets located in -Bracknell, Bristol, and Thetford - at rents 35% above the MSCI supermarket benchmark index and 13% above the Company's valuer's ERV. These leases included annual RPI-linked rent reviews (capped at 4%, floored at 0%) and extended the portfolio WAULT from 11 to 12 years, with no major renewals now due until 2032.22

Average figures for the three supermarket lease renewals

Lease term | 15 years (from average of 5 years) |

Regear rent | £28per sq. ft. |

Vs. Valuer's ERV | +13% |

Vs. MSCI supermarket benchmark index | +35% |

Vs. Passing rent | -20% |

Rent to turnover23 | 4% |

There was an average 20% reduction in passing rent on these stores which was anticipated in our original acquisition price with our returns analysis guided by the 4% rent to turnover benchmark. The three stores had previously been valued at a c.7% NIY (due to their overrented nature ahead of the lease renewal) compared to our portfolio level NIY of 6% at the time. Following the lease renewals the three supermarkets have been revalued at an average NIY of 5.3% delivering a capital value increase of 8.0%.

This active management of the shorter leases in the Company's portfolio has demonstrated the attractive supermarket rental levels that UK grocers are willing to pay to secure long-term trading from a high performing mission critical site. We believe this should release embedded value in the Company's portfolio that is not yet reflected in valuations.

Long term projections for food price inflation and supermarket sales growth, continue to underpin the affordability of rents in SUPR's portfolio.

A case study on this topic is available on page 21.

3. Capital recycling, proving valuations and growing earnings

During the year, we sold a Tesco store in Newmarket for a consideration of £63.5 million representing a 7.4% premium to book value. This was acquired by Tesco plc, underlining the strategic importance of strong trading, large format, omnichannel stores to the supermarket operators.

The sale of this supermarket provided further market evidence of our ability to crystallise valuations and release capital from a tight yielding asset which can be redeployed into earnings enhancing opportunities.

In addition, we acquired one omnichannel store in the UK and a portfolio of nine stores in France at a highly attractive spread to the cost of debt of c.2.3%, these were:

· Sainsbury's, Huddersfield (7.6% NIY): an omnichannel store with an 11-year remaining lease term and annual RPI linked rent reviews (0% - 4%), for £49.7 million (excluding acquisition costs). This store was subsequently transferred as a seed asset into the JV. See page 20 for a detailed case study on this store.

· Carrefour tranche two, France (6.8% NIY): a portfolio of nine stores acquired via a direct sale and leaseback with Carrefour, for a total purchase price of €36.7 million24. The transaction was financed through a private placement, with a maturity of seven years and a fixed rate coupon of 4.1%.

We have continued this investment cycle post-year end with two additional acquisitions, totalling £58.9 million excluding transaction costs, including a Tesco in Ashford and a Waitrose in Anglesey, at an average NIY of 7.0% with annual inflation linked uplifts.

4. Growth through strategic partnership

In April, the Company entered into a strategic JV with Blue Owl, seeded with eight of SUPR's high yielding, omnichannel supermarket assets from its existing portfolio. The partnership marked Blue Owl's first investment into the UK real estate market, endorsing SUPR's sector specialism and investment thesis for mission critical grocery real estate.

SUPR will benefit from a management fee of 0.6% per annum of the gross asset value on Blue Owl's stake in the vehicle, equating to c.£1.2 million, or around 0.1p in additional annual earnings, and proceeds from the JV have already begun to be deployed into earnings enhancing acquisitions.

The ambition is to grow the JV up to c.£1 billion in gross asset value over the coming years. The JV transaction also enables SUPR to retain a stake in the assets.

See page 26 for a detailed case study.

Continued progress on sustainability

Investing responsibly for long-term value creation is embedded in the Company's business model.

The Company has published its third standalone Sustainability Report which details its sustainability performance and priorities for the year ahead.

Sustainability highlights from the period include the enhanced ESG data collection processes implemented to improve the completeness and accuracy of the Company's GHG inventory, the publication of the Company's first Climate Transition Plan, as well as further environmental and social asset management initiatives to benefit both occupiers and local communities. The Company's sustainability efforts have been recognised by the European Public Real Estate Association ("EPRA"), with an EPRA Sustainability Best Practices Recommendations ("sBPR") Most Improved Award and a Silver Award received in September 2024 for the Company's inaugural EPRA sBPR reporting.

For the second time the Company has also undertaken external assurance over its reported location-based Scope 1, 2 and 3 GHG figures for FY25. The Assurance Report is available on the Sustainability page of the Company's website.

· Refer to our standalone Sustainability Report for more information.

Broadening SUPR's investor base

Along with achieving our strategic goals, we have sought to broaden the Company's appeal to a wider investor base:

· Secondary listing on the JSE: in response to positive feedback and strong demand from South African institutional investors, the Company completed a secondary listing on the Main Board of the JSE in December 2024. In March 2025 the Company was included in several South African indices, most notably the FTSE/JSE All Share Index ("ALSI") and FTSE/JSE All Property Index ("ALPI") and has seen a positive response from South African Investors with around 3% of SUPR's register currently on the JSE.

· Change in listing category: transferring from the closed-ended investment funds category to the equity shares (commercial companies) category of the Official List. This structure brings SUPR in line with peers in the UK REIT space, provides the Company with more flexibility to execute transactions as they arise and opens the Company to a wider range of potential investors.

We believe these initiatives, along with simplifying the management structure through the Internalisation, will increase SUPR's appeal in the investment community.

Outlook

Following the delivery of our stated strategic initiatives, SUPR is now a more efficient, lower-cost business that is better aligned with shareholders and overall, a more attractive investment proposition to current and prospective shareholders.

The attractiveness of our supermarket investment thesis has been demonstrated through the establishment of the JV which we aim to grow over time. The JV warehouses a long-term asset pipeline while delivering near term capital for us to deploy into earnings enhancing opportunities. We have already begun the redeployment of the JV proceeds and look forward to executing on a large and attractive pipeline. Through this pipeline we expect to deliver a growing and fully covered dividend, which should help to close the remaining discount to NAV.

We have made good progress this year and are pleased to see SUPR's share price appreciating 16% in the calendar year to date alongside the discount to NTA narrowing. We have positioned the business for the next exciting phase of growth as we look to deliver greater scale, liquidity and ultimately dividend growth which more closely matches our rental uplifts.

OUR PORTFOLIO

The portfolio benefits from long unexpired lease terms with predominantly upwards only, index linked leases, helping to provide long-term income with contractual rental growth.

Within the UK, operators typically look at the affordability of rent based on a benchmark of c.4% rent to turnover, simply seen as two weeks of trade. The Group's UK supermarkets average rent to turnover is 4%, which equates to £23 per sq.ft. We have highly secure income with 100% rent collection during the year25, with Tesco and Sainsbury's accounting for 71% of the Group's rent roll.

The Group's Carrefour stores are subject to annual, uncapped inflation-linked rent reviews and are let on low and affordable rents of €8 per sq.ft. with an average rent to turnover of 2.0%. The rents produce a low capital value of €109 per sq.ft.

As part of the Company's investment strategy to acquire high-quality, strong trading supermarkets, the Company sometimes acquires complementary non-grocery units that are co-located with a store. These units often create a retail destination helping to drive further footfall into the supermarket. Non-grocery assets represent 7% of the Portfolio by value.

During the year, the Company selectively strengthened its wholly owned ("Direct") Portfolio with the addition of 10 supermarkets for a combined total of £81.2 million26, 28.

November 2024: A Sainsbury's in Huddersfield, acquired for £49.7 million. The store has an 11-year unexpired lease term27 and is subject to annual upwards only RPI-linked rent reviews.

February 2025: A portfolio of nine Carrefour supermarkets located in France, acquired for €36.7 million28. The portfolio was a direct sale and leaseback with Carrefour with a 12-year unexpired lease terms and subject to annual, uncapped inflation-linked, rent reviews.

The acquisitions during the year were purchased at an average net initial yield of 7.3%29 providing an attractive spread to the Group's incremental cost of debt and were immediately accretive to earnings. The increased exposure to index-linked income also generates further contractual earnings growth underpinned by strong performing investment-grade tenants.

The acquisitions during the year were financed using existing headroom within unsecured debt facilities and through the €39 million private placement which was announced in February 2025.

For more information on financing arrangements refer to note 22 of the financial information.

| ||

Tenant | Exposure by rent roll | Exposure by Valuation |

Tesco | 41% | 43% |

Sainsbury's | 30% | 32% |

Carrefour | 6% | 6% |

Morrisons | 5% | 4% |

Waitrose | 5% | 5% |

Asda | 2% | 2% |

Aldi | 1% | 1% |

M&S | 1% | 1% |

Non-food | 9% | 7% |

Total | 100% | 100%4 |

The Portfolio's weighting towards investment grade tenants provides secure long-term income with a weighted average unexpired lease term of 11 years. In addition, the portfolio is heavily weighted towards upwards only inflation-linked rent reviews, providing contractual rental growth. The average cap on our UK inflation-linked leases' rental uplifts is 4%, while our French leases are uncapped.

The Portfolio's weighting towards inflation-linked rent reviews is 77% with 56% of the Portfolio being reviewed annually (including post balance sheet acquisitions).

Indexation | Income mix byrent review type |

RPI | 64% |

CPI | 7% |

ILC | 6% |

Fixed | 2% |

OMV | 21% |

Total | 100% |

*Including post balance sheet events | |

Rent review | Income mix byrent review type |

Annual | 56% |

5 yearly | 43% |

7 yearly | 1% |

Total | 100% |

*Including post balance sheet events

| |

UK rental caps | % of UK supermarket index-linked portfolio |

0-1 % | 0% |

1-2 % | 1% |

2-3 % | 15% |

3-4 % | 67% |

4-5 % | 17% |

Total | 100% |

The rent profile of the Portfolio is broadly in line with the affordable market benchmark at 4% Rent to Turnover ("RTO"). The rental maturity profile is well dispersed with the first material lease expiry in 2032.

WAULT | Supermarket WAULT breakdown | Supermarket WAULT rental breakdown | Supermarket WAULT count breakdown |

0-1 yrs | 0.2% | 0.2 | 1 |

1-2 yrs | - | - | 0 |

2-3 yrs | - | - | 0 |

3-4 yrs | 0.3% | 0.3 | 1 |

4-5 yrs | - | - | 0 |

5-6 yrs | - | - | 0 |

6-7 yrs | 4.9% | 4.6 | 4 |

7-8 yrs | 5.4% | 5.0 | 5 |

8-9 yrs | 13.5% | 12.7 | 21 |

9-10 yrs | 10.6% | 9.9 | 14 |

10+ yrs | 65.1% | 60.8 | 34 |

Total | 100.0%30 | 93.530 | 8131 |

The UK supermarket Portfolio Net Initial Yield ("NIY") has tightened from 5.8% to 5.7% driven by both the formation of a strategic JV with Blue Owl and the return of market stability which is placing upwards pressure on valuations. The sale of the 50% interest in eight short WAULT stores to the JV has increased the Portfolio Net Reversionary Yield ("NRY") from 5.1% to 5.2%.

Valuation yield metrics for the SUPR portfolio

UK Supermarkets | June-24 | June-25 |

NIY | 5.8% | 5.7% |

NRY | 5.1% | 5.2% |

NEY32 (Direct Portfolio) | 5.8% | 5.8% |

NEY32 (Joint Venture) | - | 6.1% |

The environmental efficiency of the Company's stores and prospective acquisitions continues to be a key priority. Improvements in store efficiency are delivered through the ongoing investment by our grocery tenants into their respective store estates. A breakdown of the Company's supermarket EPC ratings can be seen below:

Supermarket EPC breakdown | |

EPC rating | % of supermarket portfolio by value |

A | 5% |

B | 43% |

C | 36% |

D | 16% |

Total | 100% |

*% excludes Scottish, French and non-food units | |

Active asset management delivering additional value and improving sustainability of sites

Alongside SUPR's tenants, the Company is looking at ways to increase the number of Electric Vehicle ("EV") charging points. SUPR has now installed 58 EV charging bays across five sites. Current EV sites include:

· Morrisons, Workington

· Morrisons, Wisbech

· Tesco, Bradley Stoke

· Tesco, Chineham

· Tesco, Beaumont Leys

The Company has two additional sites agreed and in legal negotiation, which will bring a further 14 EV charging bays to the portfolio.

Opportunities to add complementary discount grocery operators continue to progress. At Chineham, the existing planning consent was successfully implemented, and terms have been agreed with a discount grocery retailer for a new build store. At Bradley Stoke, the development of an additional discount grocery store on the retail terrace is in final legal negotiations after successfully achieving planning consent, with delivery targeted in 2026.

At Chineham, Jett's Gyms has completed fit out works on a 7,000 sq ft vacant unit following the agreement of a new 10-year lease. In addition to this, Savers and Brockenhurst Estate Agents have taken access of two vacant units on the scheme widening the offer at site, encouraging further footfall. Greggs has upsized into a larger unit following strong trading at this location. The new lettings at Chineham have resulted in £167,000 of additional rental income. The final remaining vacant units continue to be marketed widely to secure new occupiers and to continue to add value to the site.

At Bradley Stoke, Loungers Plc is currently fitting out the main unit in the Town Square on a 15-year lease. This will see a material investment by the tenant, modernising a central unit and adding a new tenant to the scheme.

At Sainsbury's, Newcastle, other retail developments are being considered, and negotiations are ongoing with potential tenants for this site.

In anticipation of Homebase's administration, which was announced during the year, SUPR had been proactively engaging with alternative occupiers for the two Homebase units in its portfolio. The Company has facilitated an assignment of Homebase's lease to The Range at Bangor, Northern Ireland, and agreed a new lease with B&M at Hessle. These new agreements have replaced the existing rental income, extended the WAULT and added operators with stronger covenant strength to the portfolio, increasing value. The Range assignment was completed within four months of the administration (albeit there was no void during this intervening period) and B&M new letting was completed within nine months, this included achieving a revised planning consent to allow a widening of the user class from DIY store.

Portfolio valuation

Cushman & Wakefield valued the Direct Portfolio as at 30 June 2025, and the properties in the JV were independently valued by Jones Lang LaSalle. These valuations are in accordance with the RICS Valuation - Global Standards which incorporate the International Valuation Standards and the RICS UK Valuation Standards edition current at the valuation date.

The Direct Portfolio was valued at a total market value of £1,423 million33. During the year the Company disposed of Tesco, Newmarket for £63.5 million (7% above book value) and eight stores into a newly formed JV with Blue Owl for a total consideration £403.3 million (3% above 31 December 2024 book value).

The Joint Venture properties were valued at a £404.7 million, resulting in a combined Portfolio value of £1,625 million34, reflecting a like-for-like valuation increase across the Company's Portfolio of 1.9%35 vs MSCI All Property Capital Index during the same period which was up 1.5%.

The valuation increase has been primarily driven by our contractual rental reviews, with 77% linked to inflation and 2% on a fixed basis and the capital appreciation achieved on the three Tesco regears. The average annualised increase from rent reviews performed during the year was 3.4%.

SUPR Investment Case

Defensive sector, resilient through economic cycles

· The UK grocery market has repeatedly demonstrated its defensive characteristics over the last few years, with exceptional resilience during macroeconomic shocks, including the pandemic and recent inflationary cycles

· With consistent footfall and non-discretionary consumer spending, grocery tenants have seen robust performance, supporting sustainable rental growth across the portfolio

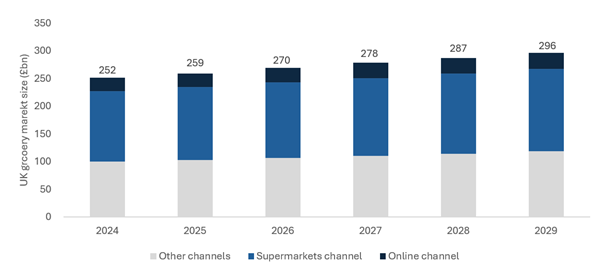

UK grocery market expected to grow from £259 billion to £296 billion by 202936

Highly secure and excellent visibility of income

· Long-dated lease structure with an 11-year WAULT

· 100% occupancy and 100% rent received since IPO37

· 77% of rental income is inflation-linked, providing stable, predictable income

· Let to leading operators in the UK and France

11-year WAULT

Cost efficient platform

· EPRA cost ratio is one of the lowest in the sector with costs continuing to be tightly controlled, with a target EPRA cost ratio of under 9%

· Significant cost reductions expected in FY26 to offset the increased cost of finance, meaning the business is now well positioned for growth in a higher interest rate environment

13.0% EPRA cost ratio

Mission critical and future proofed omnichannel stores acting as last mile fulfilment hubs

· The Company is dedicated to investing in grocery properties that are an essential part of national food infrastructure

· Managing a leading portfolio of handpicked, high-quality supermarkets, with a focus on omnichannel stores fulfilling both online and in person sales

· Stores are mission critical to our tenants' operational businesses

93% Omnichannel supermarkets38

Growing store revenues provide sustainable rental growth

· SUPR's key UK tenants, Tesco and Sainsbury's, continue to perform well with grocery sales up 4.9%39 and 4.5%40 in 2025 respectively

· This increase in sales has been primarily driven by strong performance across the existing store estate, rather than through the addition of new stores, supporting sustainable rental growth

Tesco regear rents set 35% above MSCI benchmark index

THE UK GROCERY MARKET

The UK grocery market has continued its strong performance with the Institute of Grocery Distribution ("IGD") forecasting grocery sales reaching £259 billion this year. This trend is expected to continue in the coming years, with total grocery market sales forecast to grow to £296 billion by 2029. The non-discretionary nature of grocery retail means it remains a highly defensive sector and is well-positioned to maintain growth momentum through 2025 and beyond.

IGD: UK Grocery Market Value 2024 to 2029 (forecast)41

Figure 1

Operators have largely been able to pass on cost rises from changes to National Insurance and the Minimum Wage to consumers, with UK grocery market sales growing by 5.4% in the four weeks to 13 July 2025 compared with last year, above the 5.2% rise in UK inflation in July42. This dynamic underscores one of the key advantages of investing in this non-discretionary spend sector: demand remains resilient, enabling operators to preserve their margins over the long term. As a result, the sector remains well-positioned to navigate inflationary environments without significant erosion of profitability. This supports affordable rental levels, even in a challenging macroeconomic environment.

UK Grocery Sales Growth vs Grocery Inflation43

Supermarkets remain the dominant sales channel

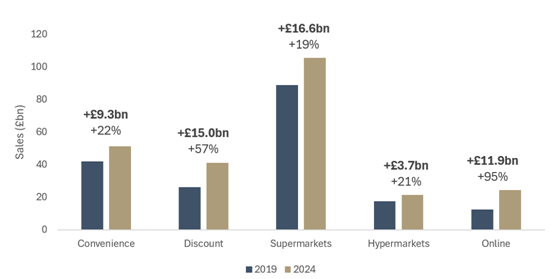

Over the last five years, the supermarket channel has remained the dominant sales channel in the UK grocery market. Online grocery continues to be a key pillar of the market and one of the fastest growing channels, accounting for 12% of the total market, demonstrating a permanent shift in consumer behaviours following the pandemic. Omnichannel stores remain mission critical for the fulfilment of online sales due to their proximity to customers, existing supply chain infrastructure and the full product ranges that these stores carry to maximise product availability for online orders.

IGD: UK grocery market sales by channel (£bn)44

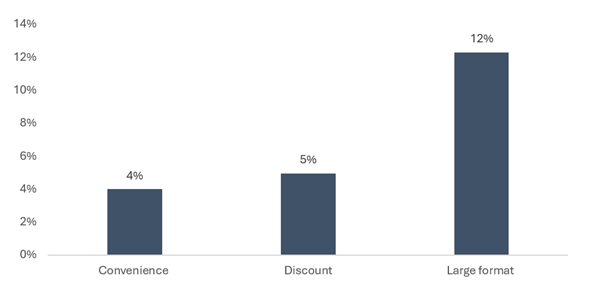

While sales growth from the discounters Aldi and Lidl over the last five years has attracted attention, this is primarily driven by new store openings. As illustrated below, when adjusting for store footprint, discounter sales growth trails behind that of full product range supermarkets, with sales per square foot for the discounters rising by only 5%, compared to 12% for the full product range supermarkets from 2022 to 2025.

IGD: Increase in sales per square foot by channel (2022-2025)45

In contrast, sales growth in the larger format stores is being generated from existing store estates, rather than new store openings. Large format omnichannel stores, require multi-acre sites, close to densely populated areas, with good transport links. A lack of available space, strict planning regulations and increased construction costs provide significant barriers to entry for developing new store space. The positive impact of increased sales being fulfilled through existing supermarket sites should result in improved sales densities and enhanced store-level profitability. From a landlord's perspective, this should deliver increasingly affordable rental levels for tenants and a strong foundation for potential rent increases in the future.

Continued strong performance from SUPR's key tenants

Over the past year, the Company's key tenants Tesco and Sainsbury's have continued to be the leading operators in the UK grocery market. As seen in the table below, Tesco achieved the largest increase in market share, driven by its continued investment in stores, product ranges and loyalty schemes. Tesco operates c.400 omnichannel stores in the UK and continues to invest further in its capabilities, recently widening its delivery window for same day orders. Tesco's weekly online orders increased by 10.8% in 2024/25 and basket sizes by 3.6% year on year ("YoY"). The combined impact saw Tesco's online sales increase by 10.2% YoY46.

Sainsbury's reported 4.6% volume growth versus market over a two-year period47 reflecting a rebound in consumer demand following a prolonged period of cost-of-living pressure. Efforts to expand its own label offering and deepen customer engagement with its loyalty programme have helped Sainsbury's capture greater market share, while also positioning the brand for sustained growth in a competitive market.

Together, Tesco and Sainsbury's, continue to anchor the UK grocery sector, reinforcing the defensive nature of the asset class and supporting long-term income visibility for the Company.

Operator | Market share (as at June 2025)48 | % Market share change (12 months to June 2025)49 | Exposure by valuation | Total number of stores (2024)50 | New stores (not incl. convenience)50 |

Tesco | 28.2% | +0.5% | 43% | 3,993 | 2 |

Sainsbury's | 15.2% | +0.1% | 32% | 1,454 | 2 |

Asda | 12.1% | - 0.8% | 2% | 1,072 | 2 |

Aldi | 10.8% | +0.1% | 1% | 1,042 | 21 |

Morrisons | 8.4% | -0.3% | 4% | 1,507 | 1 |

Lidl | 8.1% | +0.4% | - | 1,026 | 24 |

Waitrose | 4.5% | +0.1% | 5% | 346 | 0 |

Turning point for Asda and Morrisons

Following the private equity takeovers of Asda and Morrisons, both operators struggled to maintain market share as increased debt costs and senior management turnover disrupted operations and hampered price competitiveness.

Morrisons reacted more quickly focusing on price through initiatives such as the More Card loyalty scheme, launched in May 2023. The initiative reached 5.6 million active users by June 2024 and by January 2025, it was used in 76% of Morrisons' transactions, successfully driving customer engagement52. Morrisons has also refocused its online presence; the operator will gradually phase out its use of the Erith centralised customer fulfilment centre ("CFC") and integrate Ocado's AI technology to fulfil more orders directly from its existing store estate. This has enhanced customer engagement, streamlined operations and has positioned the business for more cost-effective growth in a competitive grocery market. Morrisons has reported improved trading in 2025, with second quarter like-for-like sales up 3.9% and total sales rising 4.2% to £3.9bn53.

Asda experienced a larger decline in market share, falling from 14.3% in November 2022 to 12.1% in June 2025. However, 2024 saw the return of former CEO, Allan Leighton as Executive Chairman, who has refocused the operator on value, with the Rollback campaign successfully lowering prices by an average of 22% across 50% of its products. This is proving successful. Asda has won the Grocer 33 Price Award for the lowest-cost major supermarket 18 weeks out of the 32 between January and August 2025 and has been identified as the cheapest supermarket by Which? in the six months between January and July 2025. The operator is yet to see an increase in market share, however it reported its fourth consecutive quarter of improved like-for-like sales for the period ending 30 June 2025, representing an improving trend in sales performance.

This indicates a turning point for Asda and Morrisons' performance with both operators stabilised and positioned for growth.

THE FRENCH GROCERY MARKET

IGD: Grocery market sales (2024 actual, 2025-2029 forecasted)

The French grocery market has showed consistent and prolonged growth, with total sales forecast to reach €329 billion in 2029, representing 3% annual growth. The market is highly consolidated with over 60% of market share controlled by three operators E.Leclerc, Carrefour and Intermarche. Over the last 12 months, Carrefour has increased its market share from 19.3% to 21.5% primarily driven by the strategic acquisitions of the grocery operators, Cora and Match. This brings it much closer to the market leader, E.Leclerc, which has a 24% market share.

Additionally, Carrefour has recently launched a €1.2 billion cost-saving initiative which will contribute towards price investment initiatives such as 'Le Club Carrefour' which was announced in 2025 and delivered its first wave of price cuts in March, earlier this year.

Online Grocery Market Sales (2024 actual, 2025-2029 forecasted)54

Similar to the UK, the pandemic has permanently enlarged the French online grocery market with the channel experiencing 88% growth between 2018 and 2025; a further 21% growth is expected by 2029 making it the fastest growing channel in the grocery market. Due to lower population density the primary online model in France is Click & Collect, accounting for 80% of all online orders; by comparison Click & Collect represents 20% of the UK online grocery market. Online fulfilment in France is also dependent on omnichannel stores, with baskets picked in store and the majority of customers travelling to a site to receive orders. As part of its 2026 strategic objectives, Carrefour Group has highlighted the importance of omnichannel to its strategy. Carrefour's objective is for omnichannel customers to represent 30% of all its customers by 2026 as omnichannel shoppers spend more on average and have a higher retention rate than customers from stores alone55.

Investment market

Since IPO, transaction volumes have remained broadly flat with a long-term average of £1.7 billion per year56. However, during the year UK supermarket volumes have been constrained (at £1.0 billion) reflecting a shortage of available stock and a preference for potential sellers to hold supermarket assets as they provide stable inflation-linked cashflow backed by strong tenants. The constrained supply and greater visibility on future cost of capital is expected to place upwards pressure on valuations.

This year, there has been a return of a broad range of market participants bidding for supermarkets assets. Active buyers in the market include Royal London Asset Management, ICG, Local Government Pension Schemes, and French property funds (SCPI's). A key driver of the increased demand is the appeal of long term, inflation linked earnings in a higher interest rate environment. The secure earnings derived from these mission critical assets offer a compelling safe haven asset for investors seeking stable, predictable and growing income against the current macroeconomic backdrop.

Supermarket property valuations are showing signs of stabilisation, and a gradual recovery from the 2023/24 levels, supported by competitive bidding and new sources of capital entering the market.

This presents an attractive entry point in the cycle. SUPR has demonstrated its ability to sell assets above book value and redeploy capital at wider yields, leveraging the team's deep asset selection expertise. As a sector specialist, SUPR continues to identify earnings-accretive opportunities that support scale while maintaining capital discipline.

Further supporting this growth trajectory is SUPR's debut sterling bond issuance in July 2025, fixed at a 5.125% coupon. This issuance will help extend the maturity profile of SUPR's debt and provide a stable foundation for continued expansion.

FINANCIAL OVERVIEW

Summarised Financial results

Year Ended 30 June 2025 £'000 | Year Ended 30 June 2024 £'000 | |

Net rental income | 113,234 | 107,232 |

Management fees | 305 | - |

Net income | 113,539 | 107,232 |

Administrative expenses | (14,469) | (15,218) |

Net finance costs | (26,985) | (16,262) |

Share of joint venture income | 1,072 | - |

Exceptional items1 | 1,062 | 70 |

EPRA earnings2 | 74,219 | 75,822 |

Valuation surplus/(deficit)3 | 28,469 | (65,825) |

Loss on disposal of investment properties | (1,327) | - |

Changes in fair value of interest rate derivatives | (18,842) | (31,251) |

Termination fee4 | (20,800) | - |

Exceptional items1 | (1,062) | (70) |

IFRS profit/(loss) before tax | 60,657 | (21,324) |

1. Adjusted to exclude exceptional items relating to legal fees incurred in relation to the management internalisation (£0.6 million), JSE listing fees (£0.2 million), and non-cash accelerated loan arrangement fees (£0.3 million)

2. \* The Company previously included an additional earnings measure called "Adjusted earnings" and "Adjusted EPS". The metric adjusted EPRA earnings by deducting one-off items such as debt restructuring costs.

3. Change in fair value of investment properties including joint venture assets at share

4. The termination fee includes; £19.7 million termination of investment advisory agreement, an additional £0.3 million for the termination of the AIFM agreement and a further £0.8 million for the provision of transitionary services.

Net rental income

The portfolio generated net rental income of £113.2 million for the year ended 30 June 2025, compared with £107.2 million in the prior year. This represents an increase of £6.0 million or 5.6%, driven by the positive net impact of like-for-like rental growth and income from acquisitions, partially offset by the impact of property disposals.

On a like-for-like basis, EPRA net rental income increased by 2.4% (30 June 2024: 2.1%). During the year, 45 rent reviews were successfully completed, generating £3.1 million of additional rental income, equating to a 4.1% uplift (or 3.4% on an annualised basis).

Direct property expenditure remained broadly stable at £0.8 million (30 June 2024: £0.6 million). The portfolio continues to deliver a gross to net margin of 99.3% (30 June 2024: 99.4%), which remains among the highest in the sector. This reflects the strength of our single-let strategy and the high covenant quality of our tenant base.

Rent collection remained robust, with 99.7% of rent collected for the year (30 June 2024: 99.9%). During the year, Homebase entered administration, however, both impacted assets have been successfully relet to tenants with significantly stronger covenants, enhancing the quality of income.As at 30 June 2025, the portfolio maintained a low EPRA vacancy rate of 0.3%, underscoring the high quality of our portfolio and proactive asset management.

Administrative expenses and EPRA cost ratio

Administrative expenses have reduced by 5% to £14.5 million, reflecting the operational efficiencies gained following the Internalisation in March 2025.

Driven by these cost efficiencies achieved through the Internalisation, our EPRA cost ratio improved by 170 basis points, reducing to 13.0% for the year. We anticipate further savings in the financial year ending 30 June 2026 and remain focused on achieving an EPRA cost ratio below 9%, consistent with our commitment to disciplined cost management and operational optimisation.

30 June | 30 June | |

2025 | 2024 | |

EPRA cost ratio including direct vacancy costs | 13.0% | 14.7% |

EPRA cost ratio excluding direct vacancy costs | 12.4% | 14.4% |

Net finance costs

Net finance costs increased by £10.7 million to £27.0 million, primarily driven by a £113.6 million rise in the average drawn debt balance compared to the prior year, alongside an increase in the weighted average cost of debt.

In May 2025 we received £200.4 million net proceeds from the completion of the strategic JV with Blue Owl. In the near term, we have used these proceeds to pay down existing debt drawn under revolving credit facilities and the purchase of the Tesco store in Ashford after the year end.

EPRA earnings

The Company delivered EPRA earnings of £74.2 million for the year ended 30 June 2025, compared to £75.8 million in the prior year. EPRA earnings per share were 6.0 pence, down slightly from 6.1 pence in 2024, representing a 2% decrease.

EPRA earnings are a key measure of the Company's underlying operating performance, and therefore, excludes non-recurring items. The marginal decline in earnings per share reflects temporary cash drag as the Company continues to redeploy net proceeds from its recently completed JV.

The Board remains confident in the Company's strategic direction and its ability to generate sustainable long-term value.

A full reconciliation between IFRS and EPRA earnings can be found in note 12 of the Financial Statements.

EPRA net tangible assets and IFRS net asset

Proportionally consolidated basis | As at 30 June 2025 £'000 | As at 30 June 2024 £'000 |

Investment properties | 1,618,169 | 1,768,216 |

Fair value of financial asset held at amortised cost | 7,280 | 7,530 |

Total portfolio value | 1,625,449 | 1,775,746 |

Bank borrowings | (603,602) | (694,168) |

Cash | 100,937 | 38,691 |

Other net liabilities | (34,711) | (35,737) |

EPRA net tangible assets | 1,088,073 | 1,084,532 |

Fair value of interest rate derivatives | 11,224 | 31,449 |

Fair value adjustment for financial assets held at amortised cost | 3,955 | 3,493 |

IFRS net assets | 1,103,252 | 1,119,474 |

Movement in EPRA NTA per share | Pence |

EPRA NTA per share at 30 June 2024 | 87.0 |

EPRA earnings | 6.0 |

Dividends paid | (6.1) |

Realised and unrealised gains | 2.2 |

Management internalisation | (1.7) |

Other | (0.3) |

EPRA NTA per share as at 30 June 2025 | 87.1 |

EPRA net tangible assets ("EPRA NTA") is considered to be the most relevant measure for the Group and includes both income and capital returns but excludes fair value of interest rate derivatives and includes revaluation to fair value of investment properties held at amortised cost.

At 30 June 2025, EPRA NTA was £1,088 million (30 June 2024: £1,085 million), representing an EPRA NTA per share of 87.1 pence, an increase of 0.3% since 30 June 2024, with realised and unrealised gains from our investment property portfolio being mostly offset by the one-off termination payment in respect of the Internalisation.

Including dividends paid in the year, our Total Accounting Return ("TAR") was 7.2% compared with 0.3% in the prior year.

Portfolio Valuation

Our Portfolio, which includes share of joint ventures and the fair value of financial assets held at amortised cost, was valued at £1.6 billion as set out below:

Movement in portfolio valuation | £'000 |

Group opening property portfolio valuation | 1,768,216 |

Property additions | 81,753 |

Disposals | (466,825) |

Capital expenditure | 365 |

Revaluation movement | 30,730 |

Foreign exchange movement | 1,580 |

Group closing property portfolio valuation | 1,415,819 |

Fair value of financial assets held at amortised cost | 7,280 |

Share of joint venture | 202,350 |

Total property portfolio value | 1,625,449 |

During the year, the Group continued to actively manage its portfolio through selective acquisitions and disposals aligned with its strategic objectives.

The Group acquired a Sainsbury's omnichannel supermarket in Huddersfield for a total consideration of £49.7 million, excluding acquisition costs. In addition, the Group expanded its footprint in France with the acquisition of a portfolio of nine Carrefour omnichannel supermarkets24 for €36.7 million28, also excluding acquisition costs.

The Group disposed of a Tesco supermarket in Newmarket for £63.5 million, representing a 7% premium to book value. Furthermore, eight supermarket assets were transferred into the Group's strategic JV, at a value of £403 million, achieving a 3% premium to book value.

Valuation yields remained broadly stable throughout the year. The Group recorded a revaluation gain of £30.7 million, equivalent to a 1.9% increase, primarily driven by contracted rental uplifts and the capital appreciation achieved on the three Tesco regears.

Net Debt, Leverage and Financing

Adjusted net debt is a proportionally consolidated measure, which includes the Group's share of joint ventures, and is represented as bank borrowings, less cash and cash equivalents.

Movement in adjusted net debt | £m |

Adjusted net debt at 30 June 2024 | 655 |

EPRA earnings | (73) |

Dividends paid | 74 |

Acquisitions | 82 |

Disposals | (263) |

Internalisation | 21 |

Other | 7 |

Adjusted net debt at 30 June 2025 | 503 |

The Group's adjusted net debt reduced by £152 million during the year, closing at £503 million (30 June 2024: £655 million). This reduction was primarily driven by net proceeds received from the disposal of eight supermarket assets into the Group's strategic JV with Blue Owl.

These proceeds were initially utilised to repay amounts drawn under existing revolving credit facilities, resulting in a significant improvement in the Group's leverage metrics. At year-end, the net debt to EBITDA ratio stood at 5.1x, down from 7.1x in the prior year. On a weighted average basis, the ratio was 7.4x for the year.

The Group expects adjusted net debt to increase over the course of the next financial year, as the net proceeds from the JV are redeployed into the Group's attractive pipeline of investment opportunities. Accordingly, the net debt to EBITDA ratio is anticipated to rise and is expected to operate within a medium-term target range of 7.0x to 8.0x.

Financing

|

| 30 Jun 2025 | 30 Jun 2024 |

Undrawn facilities1 |

| £350m | £54m |

Loan to value |

| 31% | 37% |

Net debt / EBITDA ratio (period-end) |

| 5.1x | 7.1x |

Weighted average cost of debt (at period end) |

| 4.2% | 3.5% |

Interest cover |

| 3.8x | 6.2x |

Average debt maturity1 |

| 3.9 years | 2.0 years |

% of drawn debt which is fixed/hedged1 |

| 100% | 90% |

1. Figures presented for 30 June 2025, include post period end transactions and are therefore stated as at the date of these report and accounts.

The Group continued to actively manage its debt structure during the year, executing a series of strategic financing transactions across a range of markets. These actions were aimed at optimising the Group's capital structure and further strengthening its financial position.

Including post period end activity, the Group has raised £652 million of new debt (including share of joint venture) and repaid £322 million of near-term facilities:

- In July 2024, the Group completed its first private placement debt issuance with a group of institutional investors. The €83 million senior unsecured notes have a maturity of seven years and a fixed rate coupon of 4.44%.

- In July 2024, the Group refinanced its £97 million secured debt facility with Deka through a new £100 million unsecured facility with ING Bank N.V., London Branch. The interest only facility has a maturity of three years and is priced at a margin of 1.55% over SONIA.

- In February 2025, the Group completed a €39 million private placement with a seven-year maturity and a fixed rate coupon of 4.10%.

- In April 2025 the Group signed a £90 million unsecured bi-lateral term loan facility with Barclays. The net proceeds were used to refinance the Company's existing secured debt facilities with Wells Fargo and Bayerische Landesbank of £30 million and £55.4 million respectively. The facility has a three-year term and is priced at a margin of 1.55% above SONIA and hedged with a cap of 3.45% against SONIA.

- In June 2025, the Group signed a new £215 million secured term loan facility for its JV with Blue Owl, through a bank syndicate comprising Barclays, HSBC, ING and SMBC. The facility is priced at 1.50% above SONIA and has been hedged via interest rate swaps, fixing the interest at 5.10% for the three-year term (excluding fees). It was undrawn as at 30 June 2025.

Post year end

- In July 2025, the Group completed a debut £250 million Sterling bond issuance, with a six-year term and a coupon of 5.125%, 115 basis points over Gilts.

As a result of these transactions, the weighted average debt maturity profile of the Group has improved significantly, increasing by 1.9 years to 3.9 years (at the date of this report). The Group has c.£450 million of undrawn facilities and available cash, which we expect to utilise for deployment into the Group's attractive pipeline of investment opportunities.

The Group's interest rate risk is mitigated through a combination of fixed debt and derivative interest rate swaps and caps. 100% of the Group's drawn debt is fixed or hedged, and further to the £250 million bond issuance, we intend to use the value of existing interest rate derivatives to hedge the Group's overall interest rate exposure to c.4.7%, once the JV proceeds have been redeployed.

The Group maintains good long-term relationships with all lenders and is currently in discussions regarding the refinancing requirements over the next financial year.

The Group continues to monitor its banking covenants and maintains significant headroom on its LTV and ICR covenants. As at 30 June 2025, property values would need to fall by around 40% before breaching the gearing covenant. Similarly, net operating income would need to fall by 54% before breaching the interest cover covenant.

Fitch Ratings, as part of its annual review, reaffirmed the Group's BBB+ rating with a stable outlook.

Financial Summary

The financial year has been transformative for the Company, marked by the successful execution of strategic initiatives aimed at enhancing operational efficiency and strengthening the balance sheet. These initiatives have already delivered cost efficiencies, and the Company expects further savings in the financial year ending 30 June 2026, with a continued focus on achieving an EPRA cost ratio below 9%.

In addition, the Company undertook a series of financing transactions, which have extended the average debt maturity profile, diversified funding sources, and enhanced liquidity. As a result, the Company is well positioned to execute on a high-quality pipeline of investment opportunities, supporting its long-term growth strategy.

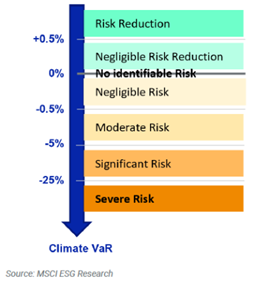

TCFD CONSISTENT CLIMATE-RELATED FINANICAL DISCLOSURES STATEMENT 2025

Energy and GHG Emissions Foreword

Recognising the urgent need to address climate change and support the transition to a net zero economy, the Company is committed to reaching net zero greenhouse gas ("GHG") emissions across its value chain by 2050.

During the reporting period, the Company reached a further milestone linked to its net zero commitment, with the publication of its first Climate Transition Plan ("Transition Plan"). The Transition Plan details how the Company intends to reduce its emissions in line with the Company's Science Based Targets initiative ("SBTi") approved emissions reduction targets, building on the initial decarbonisation analysis conducted when the Company's targets were first set in 2024.

The publication of the Transition Plan reflects the Company's belief in the importance of transparent, decision-useful sustainability reporting to improve our accountability to stakeholders. The Company's SECR and TCFD Report can be found below on pages 36 to 48. In addition, the Company's GHG independent limited-assurance report and standalone Sustainability Report, covering its wider performance against the three pillars of its Sustainability Strategy, are both available on the Company's website.

The Company remains committed to further progressing its climate-related strategy and emissions reductions activities, as it continues to make progress on its Transition Plan and Net Zero commitment.

Streamlined Energy and Carbon Reporting ("SECR")

The below table and supporting narrative summarise the Company's SECR disclosure, in compliance with the Companies (Directors' Report) and Limited Liability Partnerships (Energy and Carbon Report) Regulations 2018. Data for the years FY24 and FY25 is included as this is the Company's third year of SECR disclosures.