22nd Sep 2025 15:14

Incommunities Limited publishes Annual Report and Financial Statements for 31 March 2025

Incommunities Limited ("Group") has released its audited financial statements for the financial year ended 31 March 2025. Incommunities Limited is the parent company of Incommunities Treasury Plc, and two other smaller entities.

As one of the largest housing providers in Yorkshire, Incommunities provides over 22,000, social and affordable homes predominantly across the Bradford district, but also in areas such as Kirklees, Wakefield and Sheffield.

Strategic milestones

During the year, Incommunities launched its Corporate Strategy 2024-2029, emphasising a customer-first approach. Listening to and involving customers in how it builds and improves services is essential. Incommunities reports that the positive impact of the strategy is already evident, even within its first year of implementation. Customer satisfaction has improved to 69.9% from 67%, and colleague engagement also improved to 6.5 from 6.3.

The Group also achieved a G1 governance rating from the Regulator, reflecting strong oversight and risk management practices. Alongside this, Incommunities financial viability rating was regraded from V1 to V2. This anticipated change reflects strategic investment in existing homes and long-term asset sustainability, reinforcing the Group's commitment to safety and quality for its customers.

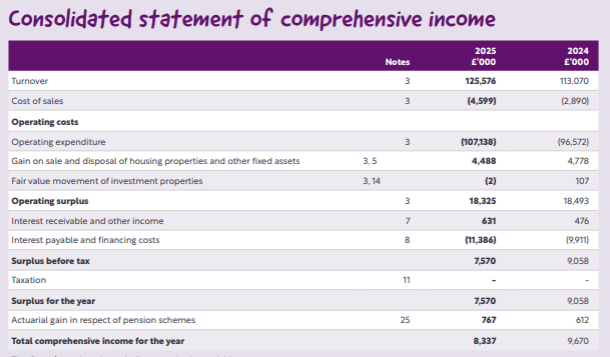

Key financial highlights:

- S&P credit rating: 'A-' (outlook negative).

- Social housing turnover: up by £9.8m to £116.8m (2024: £107.0m)

- Group turnover: up by £12.5m to £125.6m (2024: £113.1m)

- Operating surplus for the year maintained at £18.3m (2024: £18.5m)

- Operating margin for the year was 14.6% (2024: 16.4%)

- Housing properties at cost (before depreciation and impairment) of £743.9m (2024: £684.6m)

- The Group's reserves at the year-end are £111.0m (2024: £102.7m)

- Improvements to existing stock: £36.5m (2024: £26.4m)

- New developments £47.6m (2024: £53.3m)

- Covenant conditions satisfied with healthy headroom.

Credit Rating Incommunities' credit rating is 'A-' (outlook negative). This was issued by S&P Global Ratings in February 2025.

Regulatory Judgement (G1/V2)

The Group governance rating was retained following a stability check at G1 in January 2025. This had previously been upgraded from G2 to G1 in September 2024 as the Regulator recognised the significantly improved governance oversight and risk management arrangements that had been put into place. The Group was regraded to V2 viability status. This regrade reflects the Board's strategic decisions to invest in existing homes and to ensure the ongoing safety of customers.

Financial Commentary

Total income increased by £12.5m (11%) to £125.6m (2024: £113.1 m), driven by strong performance across both core and supplementary activities. Social housing income accounted for 93% of total income, with the uplift primarily attributed to a 7.7% rent increase for general needs housing.

Incommunities also completed the sale of 46 shared ownership properties, generating £5.1m revenue (2024: 37 units, £4.0 million), reflecting sustained demand for affordable homeownership options.

The operating surplus was £18.3m for the year (2024: £18.5m), reflecting continued financial resilience.

The Statement of Financial Position highlights continued financial strength, with net assets increasing by £8.3m to £111.0m (2024: £102.7m).

Incommunities continues to demonstrate its commitment to enhancing the quality of housing provided to customers through sustained investment in its housing stock. Over the course of the year, the Group allocated £45.8 million (2024: £32.5 million) towards routine maintenance, planned works, and major repairs to existing properties. Of this, £36.5 million (2024: £26.4 million) was directed specifically towards the replacement of major components, reflecting a strategic focus on long-term asset improvement.

Incommunities' ambitious development programme is central to its growth strategy, aimed at enabling customers to access homes they can take pride in. During the year, development expenditure totalled £47.6 million, supported by £8.0 million in grant funding successfully secured through the Affordable Homes Programme.

The Group has fully complied with all financial loan covenants, maintaining substantial headroom across all metrics. Performance against these covenants is formally assessed on an annual basis, with testing conducted as at 31 March each year.

The Group's Statement of Comprehensive Income for the year ended 31 March 2025 is presented below:

The full audited financial statements for Incommunities are available from the Investor Relations section of the website: https://www.incommunities.co.uk/investor-relations

Please contact the Executive Director of Finance, John Wright for further information: [email protected]

Related Shares:

Incommun.tr.49