31st Oct 2025 07:00

IMC Exploration Group Plc - Annual Financial ReportIMC Exploration Group Plc - Annual Financial Report

PR Newswire

LONDON, United Kingdom, October 31

THE DIRECTORS OF IMC EXPLORATION GROUP PLC CONSIDER THIS ANNOUNCEMENT TO CONTAIN INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF REGULATION (EU) NO. 596/2014 OF THE EUROPEAN PARLIAMENT AND THE COUNCIL OF 16 APRIL 2014 ON MARKET ABUSE AS IT FORMS PART OF RETAINED EU LAW AS DEFINED IN THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (THE "MARKET ABUSE REGULATION"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT THE INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

FINAL RESULTS FOR THE YEAR 1 st JULY 2024 TO 30 th JUNE 2025

IMC Exploration Group Public Limited Company

("IMC" or the "Company")

Chairman's Statement

IMC Exploration Group Public Limited Company

for the year ended 30 June 2025

The Directors of IMC Exploration Group plc ("IMC" or the "Company") are pleased to present the final financial results for IMC for the twelve months to 30th June 2025.

This has been a year when further progress has been made on a number of projects and there have been two major post balance sheet developments of note.

Armand Pinarbasi, former Managing Partner Grant Thornton Armenia, has been appointed to the Company's Board as an Executive Director with immediate effect and he has also been appointed as Chief Executive Officer of IMC's Armenian mining subsidiary, ASSAT LLC. In addition, Lumír Vaštík , a long-term partner in the Company's shareholder Mineral Ventures Invest s.r.o ("MVI") will become the Deputy Director of ASSAT LLC.The conversion into ordinary shares in the Company of all loans provided by MVI to IMC up to the date of completion of the reverse take-over on 31 October 2023. The amount loaned up to 31 October 2023 by MVI totalled €702,286 (equivalent to £613,350) and is being converted on the basis of an IMC share price of 0.75p into 81,780,029 new ordinary shares in the Company.

Armand has been providing assistance with our developments in Armenia and is currently in discussions with the Armenian Stock Exchange with regard to moving forward IMC's application for a dual listing on that exchange. We are delighted to welcome Armand to the management team where Armand will also take on, at IMC Board level, the role of business development, not only in Armenia, but in the South Caucasus countries and in Eastern Europe where a number of opportunities are opening and especially for those companies with a proven eco-mining solution. Prior to joining IMC, Armand served as Group CEO of SoftConstruct, a multinational technology group with 6,000+ employees. Before that, Armand spent more than 20 years at Grant Thornton, holding senior leadership roles including Managing Partner of Grant Thornton Armenia, Partner at Grant Thornton in France, where he also served as Managing Partner Grant Thornton PACA region (Nice, Provence-Alpes-Côte d'Azur) for nine years, and Executive Director for Network Member Relations at Grant Thornton International.

The conversion of €702,286 of debt to equity strengthens the balance sheet, reducing interest costs, improving the debt-to-equity ratio and financial stability, and is in keeping with IMC's strategy to grow the company and make it attractive to new investors as we prepare for a dual listing on the Armenian Stock Exchange.

IRISH OPERATIONS

Summary: IMC, considering the significant increasing price of an Oz of gold and silver from $1,226 and $14.5 per Oz respectively, when IMC completed its 2018 JORC compliant inferred Mineral Resource Estimate, to the end June 2025 values of $3,264 and $36 respectively, and given the very encouraging results from the drilling on the Wexford licence PL2551 along with the up to three potential projects to be associated with IMC's two Avoca licences, it was decided that IMC should focus its investment in the Avoca licences PL 3850 and PL 3849 and the Wexford PL2551, and accordingly IMC gave up licences 1199 and 1200.

The Avoca Project - PL 3850 and PL 3849

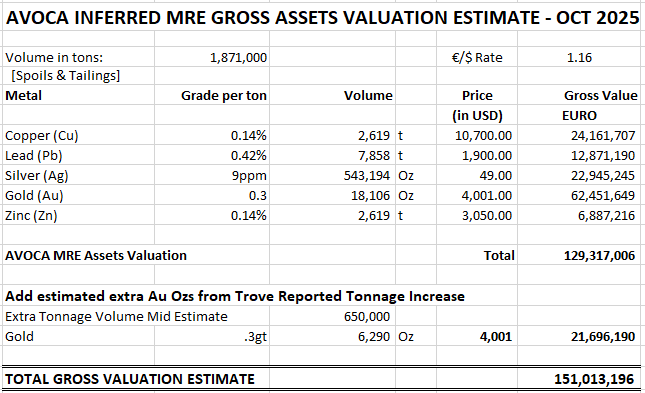

IMC undertook further works on Avoca. These were carried out by Trove Metal and inspection was carried out by the relevant Government department. This resulted in a mid-estimated increase (+650,000 tons) in the tonnage of spoils and tailings from 1,871,000 to 2,521,000.

As I write, and based on the Grade-tonnage estimate for the waste heaps at Avoca table (Page 6 CSA Global Report N o R369.2018) of the MRE plus the increased tonnage the following table sets out the gross value of the metals contained in the waste heaps made up of spoils and tailings -

A number of important events favourable to progression of our Avoca project have also taken place as follows:

· 29 November 2024 - a new Irish Government was elected. This new government is very enthusiastic about development of Ireland's mineral resources.

· The European Union have passed a Nature Restoration Law requiring member countries to restore 30% of damaged habitats. The Avoca mining site of 155 Acres meets this classification. This includes restoration, re-creation, maintenance and enabling measures. Funding under the EU Multiannual Financial Framework (MFF), estimates for allocations to biodiversity amount to nearly EUR 16 billion annually.

· The European Union's Critical Raw Minerals Act has been approved in Ireland and includes requirements that will be very beneficial to our Avoca project as follows:

# Streamline project approvals: The Act introduces provisions for companies, such as simplified approval procedures for "strategic projects" to help speed up project timelines

# Set strategic targets: By 2030, the EU wants to source at least 10% of its annual extraction needs domestically, have 40% of its annual processing capacity within the EU, and have 15% of its annual recycling needs met by EU facilities.

Following the recent works completed by IMC on its Avoca project a meeting with the Geoscience Policy section of Department of Climate, Energy and the Environment was held recently. Discussion was held on the three possible projects that can take place within our Avoca PL's namely:

- Abstraction of metals from the spoils and tailings

- Remediation of the site

- Re-opening / extending the old copper mine

This was a positive and informative meeting with advices provided in relation to advancing the project and a further meeting is to be scheduled with the Department.

Our colleagues from China National Geological & Mining Corporation confirmed, in a recent communication, that they are on standby to work with IMC on those projects.

The Wexford Gold Project - PL 2551

IMC continues with its gold exploration programme on PL 2551. Assessments, further to the assay in March 2024 of its results from drillhole 24-2551-01 at IMC's Boley project, were carried out in May 2025 and significant analysis of core was carried out by the Raw Materials Laser Ablation ICP-MS Laboratory of Trinity College under the supervision of Dr. Sean McClenaghan.

While a complete report is yet to be finalised, I can confirm that initial mineralogical and micro-analytical assessment of the Boley Quartz veins indicate significant Au fertility in the region and the presence of broader orogenic Au mineralization. As announced already the drillhole 24-2552-01 intersected two mineralized zones that returned values of 1m grading 5.8g/t Au from 90.5 - 91.5m in the upper zone and 1m grading 1.1g/t Au from 139.5 - 140.5m in the lower zone. The drillhole reached a depth of 172.5m. Background gold values are present throughout both zones, which are interpreted as shear zones.

ARMENIAN OPERATIONS

Senior Management appointments

Armand Pinarbasi - CEO of IMC's Mining Subsidiary ASSAT LLC

Lumír Vaštík - Deputy Director of IMC's Mining Subsidiary ASSAT LLC

Mr. David Marášek - Director MVI and now also Director of MASIS Refinery

Mr. Tomáš Sedláček - formerly of MVI and now Technical Director of MASIS Refinery

Masis Refinery - Acquisition, Finalisation and Start of Production

As mentioned before, due to the sanctions on Russian entities, Assat, IMC's mining subsidiary could no longer process it's crushed ore through the GeoProMining facility. As an alternative option, associate investors of IMC's shareholder Mineral Ventures Invests (MVI) sought to acquire one of the two only available refinery plants in Armenia, Masis Refinery, that holds a valid license for refining gold. Due to complex bureaucracy, corporate issues on the seller's side, involvement of several banks, the takeover was only completed in March 2025.

A technical audit was conducted throughout July 2025, requiring key operational upgrades, including the complete replacement of the Electrolysis Section. The other main challenge for Masis remains its relatively low capacity, which is being addressed in cooperation with corporate advisors Grant Thornton Yerevan.

Importantly, processing of IMC's pre-mined Karaberd ore has already resumed.

KARABERD MINE - CONSTRUCTION PERMIT FOR CGM ECO-PLANT

While ore extraction was paused due to the absence of processing facilities, it will commence again shortly given the completion and upgrade of the Masis refinery. To date all mining has been open-pit, but by end 2025 an underground mining project linked to this licence is scheduled to begin alongside the finalisation of the construction permit for the China National Geological & Mining Corporation built Eco-Plant with an annual processing capacity of 100,000 tons.

From April 2026, underground ore production is expected to gradually reach over 1,000 tons per month, with significant increases per month throughout the summer, as new gold-bearing veins are penetrated. In accordance with the Karaberd CPR report, grades from the underground mining are expected to be higher than from the open-pit operations (4 g/t vs. 1.4 g/t).

When IMC visited Armenia this September, I am pleased to mention that we received a warm welcome from Aren Mkrtchyan the new Governor of Lori Province in Armenia where the Karaberd Mine is located. He was aware of our company and very supportive of our development plans.

AMX - Armenian Stock Exchange

IMC believes that a "dual listing" trading IMC shares on both the primary London Stock Exchange (LSE) and AMX-is an excellent marketing strategy for the company, particularly given the development of "green mining", which our CGM Eco-Plant promotes.

The key advantages of this process include full transparency, enhanced creditworthiness and credibility, and increased attractiveness for local banking and institutional investors.

The application procedure, led by our new Director and ASSAT CEO Armand Pinarbasi, has been commenced and is expected to be relatively straightforward, especially for companies already listed on other global exchanges.

It is noteworthy that the AMX has flourished since 2023, when the exchange was acquired by the Warsaw Stock Exchange (GPW), which now owns 65% of AMX.

Armenia-Azerbaijan Peace Agreement

After 35 years of violent conflict, the leaders of Armenia and Azerbaijan signed a "historic peace agreement" at the White House on August 8, 2025.

This long-sought agreement-supported over the years by numerous political groups, and countries including Russia, Turkey, the UK, France, Iran and the EU- represents a real opportunity to achieve lasting peace in the region.

Both nations committed to ending hostilities, establishing diplomatic relations, and respecting each other's territorial integrity.

Under the terms of the agreement, the United States will gain access to a strategic transit corridor on Armenian territory, located along the border with Iran and connecting Azerbaijan with its Nakhchivan exclave. This corridor will also provide a highly efficient trade route linking China and Central Asia to Europe via the so-called "Middle Corridor" (China-Kazakhstan-Azerbaijan-Turkey-EU), serving as an alternative to both the Russian route and the current main China-Suez trade path.

The stability and economic benefits of the treaty are viewed by the Armenian government and business community, including IMC, as highly positive for the country's future.

There is no doubt that there is now a confluence of EU and national requirements that in the years ahead will offer great opportunities to IMC in Ireland as well as Armenia and having developed strong relationships/partnerships at both the technology, professional and political level and having greatly strengthened our team, IMC is looking forward to a busy and bright future.

Eamon P. O'Brien,

Executive Chairman,

Dublin, 31 October 2025

IMC Exploration Group Public Limited Company

Consolidated Statement of Comprehensive Income

for the year ended 30 th June 2025

Continuing Operations

|

|

|

|

|

|

|

|

|

|

|

| Jun'25 |

| Jun'24 |

|

|

| Revenue |

| 66,000 |

| 1,524,000 |

|

|

| Cost of Sales |

| (366,694) |

| (828,097) |

|

|

|

|

|

|

|

|

|

|

| Gross Profit |

| (300,694) |

| 695,903 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Administration Costs |

| (1,331,816) |

| (797,719) |

|

|

| Other Income |

| - |

| 104,000 |

|

|

|

|

|

|

|

|

|

|

| Operating Profit /(loss) for the period |

| (1,632,510) |

| 2,184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest Payable & Similar (charges)/Income |

| 44,701 |

| (40,336) |

|

|

| Gain on Disposal of Plant and Machinery |

| 11,000 |

| - |

|

|

| Foreign Exchange Gain/(Loss) |

| 2,000 |

| - |

|

|

| Expected credit loss |

| (260,250) |

| - |

|

|

| Translation Reserve |

| (657,835) |

| - |

|

|

| Bargain Purchase |

| - |

| 617,895 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit / (Loss) for period before tax |

| (2,492,894) |

| 579,743 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expenses |

| (300,935) |

| (112,402) |

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss for the period |

| (2,793,829) |

| 467,341 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss attributable to: |

|

|

|

|

|

|

| Equity holders of the Company |

| (2,793,829) |

| 467,341 |

|

|

|

|

|

|

|

|

|

|

| Total Comprehensive Loss attributable to: |

|

|

|

|

|

|

| Equity holders of the Company |

| (2,793,829) |

| 467,341 |

|

|

|

|

|

|

|

|

|

|

| Earnings per share |

|

|

|

|

|

|

| From continuing operations |

|

|

|

|

|

|

| Basic and Diluted profit per share (cent) |

| (0.04) |

| 0.07 |

|

|

|

|

|

|

|

|

|

All activities derived from continuing operations. All losses and total comprehensive losses for the period are attributable to the owners of the Company.

The Company has no recognised gains or losses other than those dealt with in the statement of comprehensive income.

The financial statements were approved by the Board of Directors on 30 th October 2025, and signed on its behalf by:

On behalf of the board

Eamon O'Brien Andrew Laz Fleming

Director Director

The Directors of IMC Exploration Group Public Limited Company , after due and careful enquiry, accept responsibility for the contents of this announcement.

IMC Exploration Group Public Limited Company

Consolidated Statement of Financial Position

As at 30 th June 2025

|

|

|

|

|

|

|

|

|

|

|

| Jun'25 |

| Jun'24 |

|

|

| Assets |

|

|

|

|

|

|

| Intangible assets |

| 3,492,455 |

| 4,058,253 |

|

|

| Property, plant and equipment |

| 98,000 |

| 138,472 |

|

|

| Non-Current Prepayments |

| 630,000 |

| - |

|

|

|

|

|

|

|

|

|

|

| Total Non-Current Assets |

| 4,220,455 |

| 4,196,725 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

| Inventory |

| 345,000 |

| 384,000 |

|

|

| Trade and other receivables |

| 2,817,914 |

| 2,970,358 |

|

|

| Cash and cash equivalents |

| 8,000 |

| 9,527 |

|

|

|

|

|

|

|

|

|

|

| Total Current Assets |

| 3,170,914 |

| 3,363,885 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Assets |

| 7,391,369 |

| 7,560,610 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

| Share Capital |

| 736,990 |

| 723,191 |

|

|

| Share premium & Capital |

| 8,878,158 |

| 8,818,818 |

|

|

| Other Reserves |

| - |

| - |

|

|

| Retained deficit |

| (7,149,760) |

| (4,355,931) |

|

|

|

|

|

|

|

|

|

|

| Attributable to owners of the Company |

| 2,465,389 |

| 5,186,078 |

|

|

|

|

|

|

|

|

|

|

| Total Equity |

| 2,465,389 |

| 5,186,078 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities - Current |

|

|

|

|

|

|

| Trade and other payables |

| 1,793,286 |

| 844,739 |

|

|

| Current tax liabilities |

| - |

| - |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities-Current |

| 1,793,286 |

| 844,739 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities - Non-Current |

|

|

|

|

|

|

| Loan & Borrowings |

| 1,175,994 |

| 889,722 |

|

|

| Shareholder Contribution |

| 1,468,000 |

| - |

|

|

| Provision |

| 28,000 |

| 31,000 |

|

|

| Deferred Tax Liability |

| 460,700 |

| 609,071 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities-Current |

| 3,132,694 |

| 1,529,793 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Equity and Liabilities |

| 7,391,369 |

| 7,560,610 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The financial statements were approved by the Board of Directors on 30 th October 2025, and signed on its behalf by:

On behalf of the board

Eamon O'Brien Andrew Laz Fleming

Director Director

The Directors of IMC Exploration Group Public Limited Company , after due and careful enquiry, accept responsibility for the contents of this announcement.

IMC Exploration Group Public Limited Company

Consolidated Statement of Changes in Equity

for the year ended 30 th June 2025

|

|

|

|

|

|

|

|

|

|

| Share Capital € | Share Premium € | Retained Losses € | Total € |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at 30 June 2023 | 364,384 | 4,253,642 | (4,823,272) | (205,246) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income for the period |

|

|

|

|

|

|

| Loss for year | - | - | 467,341 | 467,341 |

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income for the period | - | - | 467,341 | 467,341 |

|

|

|

|

|

|

|

|

|

|

| Transactions with owners, recorded directly in equity contributions and distributions to owners |

|

|

|

|

|

|

| Shares issued | 358,807 | 4,565,176 | - | 4,923,983 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at 30 June 2024 | 723,191 | 8,818,818 | (4,355,931) | 5,186,078 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income for the period |

|

|

|

|

|

|

| Loss for year | - | - | (2,793,829) | (2,793,829) |

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income for the period | - | - | (2,793,829) | (2,793,829) |

|

|

|

|

|

|

|

|

|

|

| Transactions with owners, recorded directly in equity contributions and distributions to owners |

|

|

|

|

|

|

| Shares issued | 13,799 | 59,340 | - | 73,140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at 30 June 2025 | 736,990 | 8,878,158 | (7,149,760) | 2,465,389 |

|

|

|

|

|

|

|

|

|

The financial statements were approved by the Board of Directors on 30 th October 2025, and signed on its behalf by:

On behalf of the board

Eamon O'Brien Andrew Laz Fleming

Director Director

The Directors of IMC Exploration Group Public Limited Company , after due and careful enquiry, accept responsibility for the contents of this announcement.

IMC Exploration Group Public Limited Company

Consolidated Statement of Cash Flows

for the year ended 30 th June 2025

|

|

|

|

|

|

|

|

|

|

|

| Jun'25 |

| Jun'24 |

|

|

| Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit /(Loss) for the year |

| (1,835,059) |

| 579,743 |

|

|

| Adjustments for: |

|

|

|

|

|

|

| Depreciation & Amortisation |

| 356,166 |

| 340,238 |

|

|

| Bad Debts |

| 257,841 |

| - |

|

|

| Movement in Provision |

| - |

| 2,000 |

|

|

| Gain on Disposal on Fixed asset |

| (11,000) |

| - |

|

|

| Bargain Purchase |

| - |

| (617,895) |

|

|

| Translation Reserve |

| (657,835) |

| - |

|

|

| Taxation |

| 661,935 |

| - |

|

|

| Foreign Exchange translation difference |

| (288,941) |

| (24,400) |

|

|

| Interest payable and similar charges /income |

| - |

| 41,336 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash from operations before changes in working capital |

| (1,516,893) |

| 321,022 |

|

|

|

|

|

|

|

|

|

|

| Movement in trade and other receivables |

| (84,592) |

| (706,313) |

|

|

| Movement in trade inventories |

| 39,000 |

| 10,193 |

|

|

| Movement in trade and other payables |

| 963,839 |

| 70,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash flow from operating activities |

| (598,646) |

| (305,098) |

|

|

|

|

|

|

|

|

|

|

| Taxation Paid |

| (407,000) |

| - |

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

|

| Capital Expenditure |

| (640,000) |

| (135,657) |

|

|

| Purchase of Subsidiary |

| - |

| (4,799,105) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash (used in) investing activities |

| (640,000) |

| (4,934,762) |

|

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

| Proceeds from the issue of new shares |

| 73,140 |

| 4,923,983 |

|

|

| Proceeds from loans or borrowings |

| 1,591,272 |

| 185,259 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash generated by financing activities |

| 1,664,412 |

| 5,109,242 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Movement in cash and cash equivalents |

| 18,766 |

| (130,618) |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at beginning of period |

| (29,600) |

| 101,018 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of year |

| (10,834) |

| (29,600) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The financial statements were approved by the Board of Directors on 30 th October 2025, and signed on its behalf by:

On behalf of the board

Eamon O'Brien Andrew Laz Fleming

Director Director

The Directors of IMC Exploration Group Public Limited Company , after due and careful enquiry, accept responsibility for the contents of this announcement.

Enquiries

IMC Exploration Group plc

Eamon O'Brien

+353 87 6183024

Kathryn Byrne

+353 85 233 6033

Keith, Bayley, Rogers & Co. Limited

Stephen Clayson

+44 (0)7771 871 847

Brinsley Holman

+44 (0)7776 302 228

IFC Advisory Limited (Financial PR and IR)

Tim Metcalfe

Florence Chandler

+44 (0)203 934 6630

REGULATORY ANNOUNCEMENT ENDS.

Related Shares:

IMC Exploration Group PLC