20th Oct 2025 07:00

20 October 2025

Switch Metals plc

("Switch Metals" or the "Company")

Alluvium Exploration Programme Underway at Issia

Switch Metals (LSE: SWT), the critical metals focused mining company with assets located in Côte d'Ivoire, is pleased to announce that, following the successful completion of its mineral resource estimate ("MRE") pitting programme, the Company has started a programme targeting additional tantalum-rich coltan deposited in alluvial drainage basins, on the Badinikro licence of the Issia Project.

Highlights

· First MRE is focused on eluvium and colluvium targets and is expected to be completed in early 2026.

· Pilot wash plant is currently being assembled to complete assaying of samples for tantalum and associated heavy minerals for the MRE.

· To demonstrate district-scale potential, the exploration focus now moves to the drainage basins which are considered good additional targets for high-grade and shallow alluvium deposits.

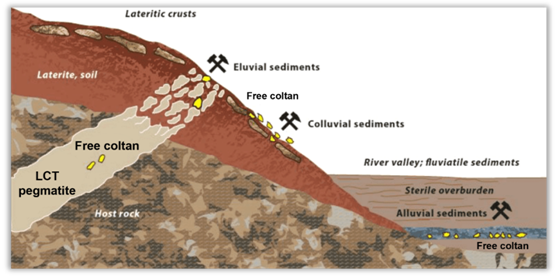

Our work to date has been focused exclusively on eluvium and colluvium target zones pre-defined during previous exploration programmes (see Figure 1), and is the subject of the ongoing MRE.

Due to their heavy nature, minerals such as tantalum-rich coltan are often deposited in high concentrations in drainage basins by gravity (see Figure 1). Located near mineralised pegmatites which are weathered over time, these alluvial basins are tangible resource targets.

Figure 1: Schematic of eluvial (and colluvial), alluvial and hard rock LCT pegmatite contexts typical of the interpreted Issia coltan district.

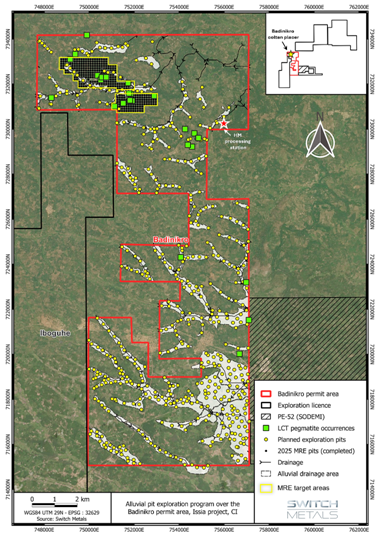

The exploration programme underway has been designed to systematically sample the gravel layer within the Badinikro drainage basins covering a total of 2,763 hectares or 27.63 km2 (see Figure 2). On average, one sample will be collected for each five hectares of basin surface area. The programme plans the collection of a total of 491 samples which will be manually panned for heavy mineral concentrates followed by laboratory analysis for tantalum and niobium content.

The results will allow the alluvial drainage basins to be ranked according to their tantalum and niobium prospectivity and will define the follow-up programmes for alluvium resource targeting.

Figure 2: Drainage basins within the Badinikro permit area.

Karl Akueson, CEO of Switch Metals commented:

"The first MRE work which focuses exclusively on the priority MRE 1 and MRE 2 target zones is well underway at Issia with the arrival and the ongoing installation of the pilot wash plant. Whilst our priority remains the delivery of the first MRE at Issia in early 2026, we continue to explore on the Badinikro licence to delineate new resource targets and thereby demonstrate the district-scale potential of this unique project.

The combination of shallow eluvium, colluvium and alluvium resource targeting to support Phase 1 production, to be followed by hard rock exploration for Phase 2 development, will progressively unveil the extent of the Issia Project.

For further information, please contact:

Switch Metals plc Karl Akueson, CEO Andy Yeo, CFO

| Via IFC Advisory |

Allenby Capital Limited (Nominated Adviser & Joint Broker) Corporate Finance: Nick Harriss / James Reeve Sales: Kelly Gardiner / Lauren Wright/ Matt Butlin

| +44 (0) 203 328 5656 |

OAK Securities (Lead Broker) Jerry Keen, Head of Corporate Broking Henry Clarke, Head of Sales

| +44 (0) 203 973 3678 |

IFC Advisory Limited (Financial PR and IR) Tim Metcalfe / Florence Staton

| +44 (0) 203 934 6630 |

About Switch Metals

Switch Metals plc, admitted to trading on AIM in April 2025, is a mining company focused on critical technology and battery minerals in Côte d'Ivoire, one of the most attractive mining jurisdictions in Africa. The Company is the largest land holder covering tantalum, lithium and other critical metals prospects in the country (and potentially in West Africa) today.

Its core assets include Issia (Ta + Nb), Bouaké (Ta + Nb + REE) and Tiassalé (Li) projects. Issia is the current focus for the Company as it exhibits potential for early cash flow through ethical tantalum production from shallow coltan placer deposits with significant scale-up potential (from both placers and hard rock pegmatites).

Related Shares:

Switch Metals