14th Jul 2025 07:00

14 July 2025

Alba Mineral Resources Plc

("Alba" or the "Company")

Transformational Acquisition of Greenland Critical Metals Project

Share Placing to Raise £550k

Alba Mineral Resources plc (AIM: ALBA), the gold and critical raw materials focused exploration and development company, is pleased to announce that it has entered into an agreement to acquire a majority stake in the Motzfeldt Critical Metals Project, a large and highly prospective niobium-tantalum-zirconium-rare earth element (Nb-Ta-Zr-REE) project located in southern Greenland ("Motzfeldt" or the "Project"). The Company has also raised £550,000 (before costs) in a share placing to institutional investors.

Highlights

· Acquisition of Motzfeldt Project: Alba to acquire a majority stake in the Motzfeldt Critical Metals Project in southern Greenland, enriched in Niobium (Nb), Tantalum (Ta), Zirconium (Zr), and Rare Earth Elements ("REEs").

· Strategic Metals Exposure: Motzfeldt provides diversified exposure to four critical raw materials ("CRMs"), Niobium, Tantalum, Zirconium, Rare Earths, essential for clean energy, advanced technology, and defence.

· Motzfeldt one of only five CRM projects in Greenland granted "very large deposit" status by GEUS (Danish & Greenlandic Geological Survey), and one of only two multi-element CRM projects with scale.

· JORC-Compliant Resource: Motzfeldt's Aries deposit holds an inferred resource of 340Mt, containing 41,000t of Tantalum, 629,000t of Niobium, 1.56Mt of Zirconium and 884,000t of Total Rare Earth Oxides.

· Complementary to Alba's existing CRM asset portfolio, comprising its investment in GreenRoc Strategic Materials plc ("GreenRoc"), owner of the Amitsoq Graphite Project, and its earn-in to the Finnsbo REE & Gold Project in Sweden ("Finnsbo").

· Strategic Funding Potential: Strong alignment with UK, EU, and US critical mineral strategies, providing potential access to non-dilutive or low cost governmental, institutional and international export/import bank grants and loans.

· Alba team highly experienced operators in Greenland, having previously operated four projects there and completed three successful drilling campaigns between 2016-2021.

· The current project owners have partnered with the University of St Andrews, experts in the Motzfeldt Centre style of mineralisation, over the past three years to develop an exciting new model for high-grade REE mineralisation at Motzfeldt.

· The current operators are about to commence a field programme at Motzfeldt, meaning Alba will benefit from immediate news-flow and valuable data generation for high-grade REE prospects at the Project.

· Alba has identified certain key value drivers for the Project including a detailed metallurgical test work programme on an Aries deposit bulk sample and a Scoping Study / Preliminary Economic Assessment.

· Alba estimates that at least £5-6m has been spent on the Project by previous operators, including on two drill programmes and other field and technical work programmes.

· Acquisition terms: consideration for the acquisition of a 51% controlling interest in the Project comprises £30,000 in cash and £945,000 in Alba shares, with the shares issued at 0.02414p, a premium of approximately 10% above the last closing price of Alba shares of 0.022p on 11 July 2025.

· Fundraising: A share placing has raised £550k (before costs) to progress work at Motzfeldt and Finnsbo and support the next phase of blasting and bulk sampling at the Clogau-St David's Gold Mine in Wales ("Clogau").

Strategic Rationale

This acquisition fits squarely within the Company's long-stated strategy which is to target assets that have a history of production or advanced exploration and are in stable jurisdictions, and which thereby offer real potential to be brought into commercial production.

The acquisition of the Motzfeldt Project represents a transformational step for Alba, delivering:

· Exposure to multiple strategic metals in a single project;

· A large, drill-confirmed resource base with clear and significant expansion potential;

· Location in a pro-mining jurisdiction with increasing geopolitical importance; and

· Alignment with global decarbonisation and critical materials strategies.

The Project also complements the Company's investment in GreenRoc, which is advancing the high-grade Amitsoq Graphite Project in Greenland, as well as Alba's earn-in to the earlier-stage Finnsbo Rare Earth & Gold Project in southern Sweden.

The Alba team has considerable expertise in operating in Greenland, having owned and operated four 100% owned projects there in the period 2016-2021, namely the Amitsoq Graphite, TBS Ilmenite, Melville Bay Iron and Inglefield Multi-Element projects. This included successfully completing the maiden drilling campaign at Amitsoq in 2021 and carrying out two separate drilling programmes at TBS in 2018 and 2021.

Alba intends to continue to focus on developing the Clogau Mine in Wales, as announced in the Company's RNS of 26 June 2025. Part of the proceeds from the share placing announced today will be applied to the next blasting and bulk sampling phase at Clogau.

Figure 1: Gardar Province of southern Greenland, location of three of the largest CRM projects in Greenland: Kvanefjeld, Kringlerne and Motzfeldt.

Company Comment

The independent Non-Executive Directors of the Company, Elizabeth Henson and Michael Nott, commented:

"The Company is delighted to have agreed to acquire a significant interest in the Motzfeldt Project, which offers scale, strategic metals, and a stable jurisdiction - a rare combination in today's critical minerals landscape. Motzfeldt's multi-commodity potential, particularly in niobium, tantalum, zirconium and rare earths, positions us strongly to support the transition to a low-carbon global economy. We look forward to accelerating exploration and development and unlocking Motzfeldt's considerable value.

"In addition to Motzfeldt's strategic geology and resource base, its alignment with the critical raw material priorities of governments in the US, UK, EU, and other allied economies opens up the possibility of public and institutional support for the project. This offers us a significant opportunity - the potential to access grant funding, development loans, or strategic partnerships, which would enable us to advance the project with far less dilution than would traditionally be required on the public markets. This is a compelling differentiator."

Project Overview

Location and Climate

The Motzfeldt Project is situated within the Motzfeldt Centre of the Ilímaussaq Intrusive Complex, one of the world's largest known alkaline igneous systems. The Project covers a substantial area and hosts a large zone of mineralisation enriched in critical metals that are essential to the green energy transition and advanced technologies.

The Motzfeldt Project is located in the Gardar Province of southern Greenland, some 18 km from the nearest fjord and 24 km east of the town of Narsarsuaq. South Greenland is a relatively populated area with reasonably well-developed regional services. Access to the area is by air through Narsarsuaq, which receives scheduled international flights from Copenhagen all year and from Reykjavik in the summer. There are regular helicopter connections from Narsarsuaq to towns and villages in South Greenland, and also a small harbour from which many of the fjords are navigable, generally remaining ice-free during winter.

The area has a sub-Arctic climate, with summer temperatures in Narsarsuaq of around 8-10°C, allowing for a defined exploration season, and winter temperatures of around -6°C. Being further inland and at altitude, temperatures at Motzfeldt are lower.

Significant changes are in train to further develop Greenland's current transportation and energy generation infrastructure, and these developments are expected to greatly benefit the country's minerals industry in the coming years. For instance, a new international airport was opened in the capital city, Nuuk, in November 2024. As regards energy generation, the goal of the Greenland Government Greenland is to transition to 100% renewable energy by 2030, with greatly increased hydropower capacity being a crucial part of this transition.

Figure 2: Map of southern Greenland showing the CRM resource potential of Greenland (known deposits and undiscovered resources); filled symbols sized according to potential: low, moderate or high. Motzfeldt shown as a very large deposit.

Figure 2: Map of southern Greenland showing the CRM resource potential of Greenland (known deposits and undiscovered resources); filled symbols sized according to potential: low, moderate or high. Motzfeldt shown as a very large deposit.

Diagram extracted from "Critical Raw Material Resources in Greenland", GEUS publication No.34, Nov 2023.

Project Geology

The mineralisation in the Motzfeldt Sø Formation is hosted by syenite and peralkaline microsyenite that are both strongly affected by hydrothermal (albitiic, hematitic and silicic) alteration resulting in a coarse-grained, often pegmatitic rock. The peralkaline microsyenite is fine- to medium-grained, often porphyritic, and exhibits various aplitic and pegmatitic phases. In the upper and eastern areas of the intrusion, where mineralisation is most widespread, lithology is predominantly altered syenite, showing minor intrusions of pegmatite and diorite dykes.

The majority of the minerals of economic interest are present as relatively coarse "free" grains above 50 μm that are anticipated to be relatively straightforward to recover and concentrate by milling and heavy mineral separation. Initial verification of the potential to concentrate the zirconium-REE and tantalum-niobium minerals has been demonstrated by previous studies.

Exploration History

The Motzfeldt Centre was mapped by Greenland's Geological Survey in the 1960s. Surveys in the 1980s discovered widespread pyrochlore mineralisation, including via an airborne radiometric survey that identified significant radiometric anomalies around Motzfeldt Sø. In the early 2000s, a ground-based radiometric survey was also carried out and it identified anomalies along two main trends - NNW-SSE and NE-SW - over a strike length of 1.5 km. The radiometric anomalies were used to target a diamond drilling programme in 2001 (nine holes with a total length of 1,621 m were drilled on the Aries plateau). Further work established that the full extent of the surface expression of Ta-rich mineralisation at the Aries plateau was about 1,400 m north-south, and 200-300 m in width.

An Engineering Report was produced in 2002, which was subsequently reviewed by leading mining consultancy Behre Dolbere International. At that time, no flaws or reasons to cease exploration were identified, although it was acknowledged that a mining operation at Motzfeldt would face significant logistical and infrastructural challenges. This is considered to be a feature of the Greenland mining industry generally, however as mentioned above, significant progress is also being made in terms of developing the country's transportation and energy infrastructure.

In 2010-11, a further 3,227 m of drilling was completed at Aries across 21 holes, leading to the declaration of a maiden JORC resource for the project in 2012. The Aries deposit remains open to the south and east.

Since it took over the project in 2019, the current operator has focused on advancing some of the other prospects which sit alongside the Aries deposit within the Project area, such as the Voskop and Merino targets (Figure 3), with field programmes undertaken in 2019 and, post Covid pandemic, 2023, and a 2025 field programme about to be commence. This recent work, in conjunction with the team led by Professor Adrian Finch at St Andrews University, an expert on the Motzfeldt Centre, has led to the exciting potential discovery of high-grade rare earth mineralisation at the Merino prospect, only about 1km from the main Aries deposit.

Alba has been able to verify at least £4m of exploration expenditures incurred on the Project since 2010. The Company estimates that if the pre-2010 exploration expenditures were also included, the total historic exploration expenditure on the Project would be at least £5-6m. Alba therefore takes the benefit of all of this historic work and sunk costs as part of its acquisition of a controlling interest in the Project.

JORC Resource

The Project benefits from a JORC-compliant inferred resource at the Aries deposit of 340 million tonnes at 0.012% Ta2O5 (Tantalum), 0.185% Nb2O5 (Niobium), 0.460% ZrO2 (Zirconium) and 0.260% TREO (Total Rare Earth Oxides). This equates to a contained metal inventory of 41,000 tonnes (t) of Tantalum, 629,000 t of Tantalum, 1,564,000 t of Zirconium and 884,000 t of TREO. It should also be noted that the average uranium content in the Aries resource is 70ppm, well within the 100ppm maximum threshold set by the Greenlandic law passed in 2021 restricting the exploration and exploitation of uranium.

Figure 3: Motzfeldt licence map (purple polygons) with Aries resource area marked, plus other main prospects Voskop, Merino and Romney.

In the report "Review of the critical raw material potential in Greenland" produced by the Center for Minerals and Materials of the Geological Survey of Denmark and Greenland ("GEUS") (https://data.geus.dk/pure-pdf/MiMa-R_2023_1_web.pdf), Motzfeldt is one of only five critical raw material ("CRM") projects in Greenland which are given "very large deposit" status. The others are:

- Kringlerne: Niobium-Tantalum-Zirconium-Rare Earth project also in the Gardar Province of south Greenland, acquired in June 2024 by Critical Metals Corp (NASDAQ: CRML) for $US211m.

- Kvanefjeld: REE-Uranium project also in the Gardar Province of south Greenland, currently prohibited for further development due to its uranium content.

- Karstryggen: strontium project in east Greenland.

- Mjalmberg: molybdenum project in east Greenland.

Of these deposits, only Kringlerne and Motzfeldt are multi-element, with multiple different CRMs within the same defined resource. This provides a hedge against the risk to which single commodity projects are particularly susceptible of a sustained downturn in global prices for a single metal or mineral.

Strategic Metals at Motzfeldt

The Motzfeldt Project is enriched in four key critical raw materials, all considered vital for high-tech and low-carbon applications:

Niobium (Nb): Primarily used in high-strength, low-alloy steels for infrastructure, aerospace, and automotive applications. Also used in superconducting materials and emerging battery technologies. Listed as a critical material by both the EU and USA due to supply concentration and industrial relevance.

Tantalum (Ta): Essential for capacitors in electronic devices (e.g., smartphones, laptops), as well as in aerospace alloys and medical implants. Often produced as a by-product in politically unstable regions, leading to strong interest in ethical and stable sources.

Zirconium (Zr): Used in ceramics, refractory materials, and as cladding in nuclear reactors due to its corrosion resistance. Industrial demand growing alongside nuclear power generation and advanced ceramics manufacturing.

Rare Earth Elements: REEs, particularly heavy rare earths (HREEs), are vital for permanent magnets in wind turbines, EV motors, electronics, and military applications. China dominates global REE production, making non-Chinese sources increasingly valuable.

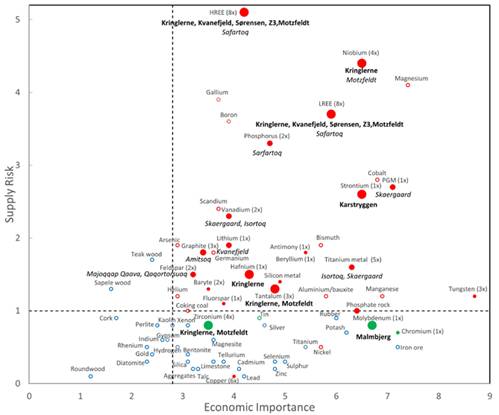

Figure 4: Assessment of mineral criticality based on economic importance and supply risk (after European Commission 2023). Diagram extracted from "Critical Raw Material Resources in Greenland", GEUS publication No.34, Nov 2023.

Figure 4: Assessment of mineral criticality based on economic importance and supply risk (after European Commission 2023). Diagram extracted from "Critical Raw Material Resources in Greenland", GEUS publication No.34, Nov 2023.

Raw materials shown in red are considered critical by the EU, whereas those shown in green were considered as near critical in the CRM assessment made by GEUS. Motzfeldt's Nb, Ta and REEs are categorised as critical, with its Zr considered near critical.

Filled symbols are sized according to the EU's Inspire deposit size categories for each given commodity at the largest known Greenlandic deposits: very small to medium, large (deposit names in italics), or very large (deposit names in bold). Numbers in brackets are the number of deposits with a resource estimate.

Motzfeldt is shown in bold as a "very large deposit", with its Niobium, Tantalum, Zirconium and Rare Earths (shown as HREE and LREE for heavy and light rare earth elements respectively) plotted on the map, with its rare earth element and niobium resources in particular characterised as being commodities with a high degree of supply risk and having high to very high economic importance.

Strategic Funding Opportunities

Given the Motzfeldt Project's alignment with national and international critical raw materials priorities, Alba believes there are significant prospects for accessing non-dilutive or low-cost funding from various governmental and strategic sources.

In particular:

- The US has enacted legislation such as the Inflation Reduction Act and the Defense Production Act, which support the development of secure, non-Chinese supply chains for critical minerals through grants, loans, and offtake agreements.

- The EU and UK have both launched dedicated critical raw materials strategies, including the EU Critical Raw Materials Act and UK Critical Minerals Strategy, which provide for public investment and partnerships in projects that can enhance supply chain resilience.

- Greenland, while semi-autonomous, has close ties with Denmark (an EU member) and increasing engagement with Western strategic partners seeking to reduce reliance on single-source suppliers, especially for REEs, niobium, and tantalum.

The Company will also assess potential funding support from international development banks, innovation funds, and climate-finance institutions targeting sustainable resource development. These mechanisms provide a potential pathway to advance exploration and development at Motzfeldt without over-reliance on equity dilution via the public markets, helping to preserve shareholder value while accelerating progress.

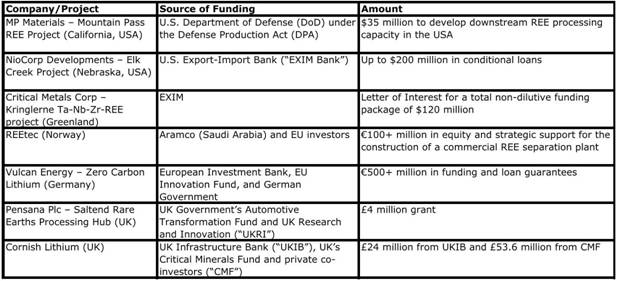

Several high-profile critical mineral projects have recently secured government or institutional funding support, underscoring the appetite for investment in secure, ethical supply chains in the West. See Table 1 for examples.

The EU Critical Raw Materials Act ("CRMA") supports upstream and downstream REE projects. Greenland projects can benefit via Denmark's EU status, as demonstrated by the Amitsoq Project's recent award of "Strategic Project" status under the CRMA (see GreenRoc RNS of 4 June 2025).

Next Steps

The current operator is due to commence a field programme at Motzfeldt shortly. This will include:

- The carrying out of a ground radiometric survey at the high-grade rare earth prospect, Merino, as well as mapping and sampling of Merino to identify high-grade "chimney mineralisation style" structures.

- Mapping and sampling of other known high-grade prospects (eg Voskop).

The objective of the field programme is to delineate a significant mineralised body at Merino and to provide the data to enable a maiden drilling campaign to be designed for that target.

In the coming months, Alba also intends to:

- Carry out a detailed mineralogical and metallurgical study of the Aries deposit, in order to establish the optimal processing routes for Aries material. This will be undertaken using the 2.5 tonne bulk sample which has previously been collected from the Aries plateau by the current operator.

- Commence a Scoping Study or Preliminary Economic Assessment for the Project, building on the previous Engineering Report and incorporating the results from the Aries metallurgical test work programme.

Alba will also be focused on seeking non-dilutive or low-cost funding for Motzfeldt from various governmental and strategic sources.

Table 1: CRM Projects Having US/EU/UK etc. Funding Support

Acquisition Terms and Related Party Transaction

The consideration for the acquisition by Alba of a 51% interest in the Project, which is expected to complete in a few weeks' time, will comprise £30,000 in cash and £945,000 in Alba shares, calculated based on a 10-day volume-weighted average price ("VWAP") of £0.0002414 (0.02414p), a premium of approximately 10% above the last closing price of Alba shares of 0.022p on 11 July 2025. The transaction will be undertaken in two stages, firstly the acquisition of a 49% interest in the Project for £30,000 in cash and £895,000 in Alba shares, and then, upon receipt of Greenland Government approval, the acquisition of a further 2% interest in the Project for £50,000 in Alba shares. Upon completion of the first stage of the transaction, a total of 3,707,539,354 consideration shares will be issued. Upon completion of the second stage of the transaction, a total of 207,125,104 consideration shares will be issued.

Part of the consideration will be applied in the repayment of shareholder and third-party loans and accrued invoices through which the current operator and 100% owner of the Project, Elemental Rare Metals Ltd ("ERM") has funded the development of the Project in the past several years, amounting to approximately £375K, with the balance of the consideration, approximately £600k, to be paid for the 51% controlling interest in the Project and distributed to ERM shareholders pro rata.

Following Completion, a 51:49 joint venture will be established between Alba and ERM. Alba will act as operator and manager of the Project and will sole fund the next £350,000 of project expenditure by the joint venture partners (which shall not include grant or loan funding which may be received from governments and institutions).

As part of the agreement, Alba will have a right of first refusal over ERM's remaining 49% interest. ERM will hold a tag-along right in the event of a proposed sale by Alba of its 51% stake. The agreement also provides that Alba shares issued in the transaction will be subject to a total of 12 months of restrictions on sale, namely:

- an initial three-month lock-in from completion for 100% of the Alba consideration shares;

- a further three months during which 50% of the shares will be locked-in and 50% subject to orderly marketing provisions; and

- a further six-month orderly market period for 100% of the remaining shares.

Alba Chairman George Frangeskides is a founder, significant shareholder and funder of ERM and therefore stands to receive part of the consideration from the transaction (see Table 1). Alba CFO Sarah Potter has, independently of her role with Alba, provided accounting services to ERM which will be paid from the transaction consideration as part of the settlement of accrued invoices referred to above (Table 1). The independent directors of the Company, Michael Nott and Elizabeth Henson, consider, having consulted with SPARK Advisory Partners Ltd, the Company's nominated adviser, and having obtained independent valuation advice, that the terms of the transaction are fair and reasonable insofar as the Company's shareholders are concerned.

Table 1

Interest of Related Parties in ERM/Project

Related Party | Provision of Loans/Services to ERM | ERM/Project Interest | Total Consideration Shares | Percentage shareholding in Alba post Completion |

George Frangeskides (and associated entities) | £153k | 49.9% | 1,814,703,811 | 10.7% |

Sarah Potter | £15k | N/A | 62,137,531 | 0.3% |

NB: Immediately following the consummation of the transaction in full, no loan amounts or accrued invoices will be owing by ERM to George Frangeskides or his associated entities or to Sarah Potter, and George Frangeskides and his associated entities will have a 24.451% interest in the Project.

Share Placing

The Company is pleased to announce that it has raised £550,000 (before expenses) in a share placing to institutional investors involving the issue of 3,235,294,118 new ordinary shares at a price of 0.017 pence per ordinary share (the "Issue Price") (the "Placing"), conditional on the admission of such new ordinary shares to trading on AIM. The placing price represents a discount of approximately 15% to the last closing bid price of the Company's shares on 11 July 2025.

One warrant is being granted for every two placing shares. Each warrant will have an exercise price of 0.0255 pence and an expiration date of two years from grant ("Exercise Period") and will be subject to an accelerator provision whereby the Company may give warrant holders notice to exercise their Warrants if at any time during the Exercise Period the 10-trading day volume-weighted average price of Alba ordinary shares exceeds 0.035 pence per share.

The proceeds from the Placing are intended to be used to continue the Company's activities across its projects, including:

- Progressing some of the work streams in relation to Motzfeldt, as set out above;

- At Clogau, continuing the blasting and bulk sampling programme at the Llechfraith Target, the primary gold development target at the Mine, scheduled to commence in late July;

- Preparing for a drilling programme at Finnsbo; and

- General working capital requirements.

Application will be made for the placing shares to be admitted to trading on AIM ("Admission"). It is expected that Admission of the new ordinary shares will become effective at 8.00 a.m. on or around 17 July 2025. The new ordinary shares will be issued credited as fully paid and will rank in full for all dividends and other distributions declared, made or paid after Admission and will otherwise rank on Admission pari passu in all respects with the existing ordinary shares.

Total Voting Rights

Following Admission of the placing shares, the total number of ordinary shares in issue will be 14,777,016,067. The Company does not hold any ordinary shares in treasury. Therefore, the total number of ordinary shares with voting rights will be 14,777,016,067. This figure may be used by shareholders in the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the share capital of the Company under the Financial Conduct Authority's Disclosure and Transparency Rules.

This announcement contains inside information for the purposes of the UK Market Abuse Regulation and the Directors of the Company are responsible for the release of this announcement.

Forward Looking Statements

This announcement contains forward-looking statements relating to expected or anticipated future events and anticipated results that are forward-looking in nature and, as a result, are subject to certain risks and uncertainties, such as general economic, market, financial and business conditions, competition for and availability of qualified staff and contractors, regulatory processes and actions, technical issues, new legislation, uncertainties resulting from potential delays or changes in plans, uncertainties resulting from working in a new political jurisdiction, uncertainties regarding the results of exploration, uncertainties regarding the timing and granting of prospecting rights, uncertainties regarding the timing and granting of regulatory and other third party consents and approvals, uncertainties regarding the Company's or any third party's ability to finance, execute and implement future plans and programmes, and the occurrence of unexpected events. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors.

Competent Person Declaration

The information in this release that relates to Exploration Results has been reviewed by Mr Mark Austin. Mr Austin is a member of SACNASP (Reg. No. 400235/06), Fellow of The Geological Society and Fellow of the Geological Society of South Africa. He has a B.Sc. Honours in Geology with 40 years' experience.

Mark Austin has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration targets, Exploration Results, Mineral Resources and Ore Reserves', also known as the JORC Code. The JORC code is a national reporting organisation that is aligned with CRIRSCO. Mr Austin consents to the inclusion in the announcement of the matters based on his information in the form and context in which they appear.

**ENDS**

Engage with Alba by asking questions, watching video summaries and reading what other shareholders have to say. Navigate to our interactive Investor Hub here:

https://albamineralresources.com/link/r6VMXr

For further information, please visit the Alba Mineral Resources plc investor website (www.albamineralresources.com) and sign up to receive news and engage with the Alba management team. Subscribe to our news alert service (https://alba-l.investorhub.com/auth/signup) and visit @AlbaMinerals on X (formerly Twitter).

Alba Mineral Resources plc George Frangeskides, Executive Chairman | +44 20 3950 0725

|

SPARK Advisory Partners Limited (Nomad) Andrew Emmott | +44 20 3368 3555

|

CMC Markets plc (Broker) Thomas Smith / Douglas Crippen | +44 20 3003 8632

|

Alba's Projects & Investments

| ||

Projects Operated by Alba | Location | Ownership |

Clogau (gold) | Wales | 100% |

Dolgellau Gold Exploration (gold) | Wales | 100% |

Gwynfynydd (gold) | Wales | 100% |

Investments Held by Alba | Location | Ownership |

GreenRoc Strategic Materials Plc (graphite - anode) | Greenland | 26.15% |

Horse Hill (oil) | England | 11.765% |

Earn-in Projects | Location | Earn-in Rights |

Finnsbo (rare earths, copper, gold) | Sweden | Up to 100% |

Optioned Projects | Location | Further details |

Norrby (gold, other metals) | Sweden | RNS 6/11/24 |

Glava (copper, gold) | Sweden | RNS 6/11/24 |

Related Shares:

Alba Mineral Resources