27th Nov 2025 07:00

Buccaneer Energy Plc

("Buccaneer" or the "Company")

27 November 2025

Acquisition of Additional Fouke Area Acreage,

Enabling Sidetrack and New Production Potential

Buccaneer Energy (AIM: BUCE), an international oil & gas exploration and production company with development and production assets in Texas, USA, is pleased to announce the acquisition of a 32.5% interest in offsetting leasehold acreage in the Fouke area of the Pine Mills field.

Highlights:

• | New Acreage: 32.5% working interest in acreage directly west of the Allar #1 location. |

• | Sidetrack Opportunity: Enables potential westward sidetrack of the Allar #1 away from bounding fault. |

• | Shut-in Wells: Includes Turner #1 and Daniel #1 wells (32.5% WI each). Turner #1 planned for near-term return to production; Daniel #1 retained as potential injector for future waterflood development. |

• | Enhanced Recovery Plan: Discussions underway with Texas Railroad Commission regarding formation of an enhanced recovery unit in the Fouke area. |

• | Next Well: Fouke #4 remains on track to spud in late December 2025. |

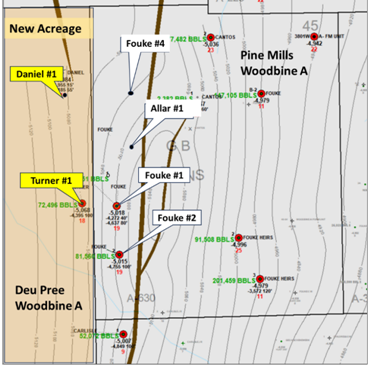

The following map illustrates the new acreage position, including the location of Allar #1, the Fouke wells, and the area now accessible for a potential sidetrack.

|

Paul Welch, Buccaneer Energy's Chief Executive Officer, commented:

"The addition of this acreage is an important step for Buccaneer as we look to further our development of the Fouke area by unlocking the opportunity to pursue an optimal sidetrack for the Allar #1 well. The Company will now progress preparatory work including reviewing the well plan, cost estimates, and timing in conjunction with its partner. The Turner #1 well provides near-term production potential, while Daniel #1 offers longer-term development optionality.

With this acreage now secured and Fouke #4 progressing toward spud, we are well positioned to continue building production and value across Pine Mills. I look forward to updating investors as we progress these various workstreams."

For further information, contact:

Buccaneer Energy plc Paul Welch, CEO | Email: | |

SP Angel Corporate Finance LLP (NOMAD/Joint Broker) Stuart Gledhill / Richard Hail / Adam Cowl

| Tel: | +44 (0) 20 3470 0470 |

Oak Securities (Joint Broker) Robert Bell / Nick Price | Tel: | +44 (0) 20 3973 3678 |

Celicourt Communications (PR/IR) Mark Antelme / Charles Denley-Myerson | Tel:Email: | +44 (0) 20 7770 [email protected] |

Related Shares:

Buccaneer Ergy