19th Jun 2025 07:00

This information communicated within this announcement is deemed to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR. Upon the publication of this announcement, this inside information is now considered to be in the public domain.

Star Energy Group plc (AIM: Star)("Star Energy" or "the Company")

2025 Annual General Meeting ("AGM") Trading Update

Star Energy today provides the following trading update in advance of the Company's AGM, which is being held at 10.30 am today.

Highlights

· Production remains in line with full year guidance at c. 2,000 boepd

· As at 31 May 2025, cash balances were £10.5m and net debt was £1.9m. On track to repay Facility A (€6.7m) by end June 2025

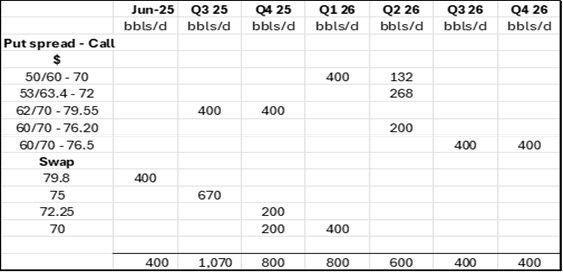

· We have the following hedging in place:

· Capex of c£10m including £5.8m on the Singleton gas-to-wire project.

· Continuing the expansion of our UK geothermal pipeline with MoUs being signed with Bring Energy, to decarbonise and extend the existing Southampton District Heat Network, and Veolia.

· Croatia geothermal portfolio is being matured through the establishment of the exploitation field withini the Ernestinovo licence and through technical de-risking of the Sječe and Pčelić licences.

Ross Glover, Chief Executive Officer, said:

"The core of our strategy is simple: to create value for shareholders through disciplined execution, cash generation, and the creation of long-term growth opportunities.

The past few years - and especially recent global events - have made clear the strategic value of secure, domestic energy production. UK-produced oil and gas are not just geopolitical necessities; they can increase our industrial competitiveness, improve economic resilience, and build geopolitical independence. Our onshore operations provide safe, reliable, domestic energy with local economic benefits - and they generate the cash flow that underpins our reinvestment and shareholder return potential.

We are focused on optimising our existing producing assets, seeking to reduce operating costs whilst future proofing the operations and maintaining our strong HSE record.

At the same time, we are executing on our long-term growth platform: geothermal energy.

The UK geothermal sector is underdeveloped, but the demand drivers heat decarbonisation, energy security, and long-term predictable pricing are all intensifying. Our early entry and technical know-how give us a strong competitive edge. Our pipeline of private and public sector projects is growing, and we are working with credible partners like the NHS, Veolia and Bring Energy to mature the pipeline.

In Croatia, we benefit from a supportive regulatory and investment climate for geothermal. Our licenses cover prospective areas, and we are finalising technical de-risking to enable phased development. The Croatian market offers access to scalable power opportunities in a jurisdiction that welcomes clean energy investment capital.

As we look ahead, our value creation strategy remains clear and focused:

· Maximise cash returns from UK oil and gas operations to fund growth and improve financial resilience

· Grow a high-quality geothermal platform with scalable, de-risked opportunities in the UK and Croatia

· Maintain capital discipline and agility, with focus on value creation

We are uniquely positioned to deliver value from cash-generative UK oil and gas operations, while building a diversified energy business that can thrive in multiple market scenarios. Our geothermal activities are not a pivot away from hydrocarbons they are a logical, deployment of our core strengths in subsurface, permitting, and infrastructure development into a growth area.

This is about building a broader, more resilient business one that can generate sustainable returns across energy cycles and policy environments. Thank you to our shareholders for your continued support. Everything we are doing is focused on protecting and growing shareholder value."

For further information please contact:

Star Energy Group plc

Tel: +44 (0)20 7993 9899

Ross Glover, Chief Executive Officer

Frances Ward, Chief Financial Officer

Zeus (Nominated Adviser & Broker)

Tel: +44 (0)203 829 5000

Antonio Bossi, Alexandra Campbell-Harris (Investment Banking)

Simon Johnson (Corporate Broking)

Vigo Consulting

Tel: +44 (0)207 597 5970

Patrick d'Ancona/Finlay Thomson/Kendall Hill

Related Shares:

Star Energy