30th May 2025 07:00

30 May 2025

Invinity Energy Systems plc

("Invinity" or the "Company")

2024 Financial Results

Invinity Energy Systems plc (AIM: IES) (OTCQX: IESVF), a leading global manufacturer of utility-grade energy storage, announces its Full Year Results for the year ended 31 December 2024.

The Company confirms that its trading results are in line with expectations and largely reflect a shift in Invinity's product line from the VS3 to the ENDURIUM battery. As stated in the recent trading update, Invinity continues to deliver against its key corporate objectives including important progress made in respect of the ENDURIUM product development roadmap. As a result, the Company remains on track to achieve its cost reduction targets while continuing to iteratively develop the ENDURIUM product to further enhance performance and expand its capabilities in order to reach new markets and customers.

Highlights

Financial

· First revenues recognised against ENDURIUM product deliveries;

· 20% improvement in adjusted EBITDA loss to £18.0m (2023: £22.4m);

· Total Income: £5.0m (2023: £22.0m);

· Total Cash: £32.4m (2023: £5m);

· The Group remains debt free.

Commercial and Operational

· >5.4 GWh of energy dispatched to date from Invinity batteries (since Q1 2022);

· Successful launch of next-generation ENDURIUM product in December 2024;

· First ENDURIUM battery system operating in line with expectations at Gamesa Electric's V-iOn project at La Plana;

· 24% cost reduction achieved on ENDURIUM product in 2025 YTD vs first order;

· +315% increase in average deal size in 2025 YTD vs 2024 FY, with further growth expected to be driven by the Company's battery technology being considered for numerous projects relating to global Long Duration Energy Storage ("LDES") procurement programmes including, but not limited to, the UK's LDES Cap and Floor Scheme.

The Company will hold a virtual meeting for analysts at 9.30 a.m. today. Analysts wishing to attend are kindly requested to email [email protected] to receive dial-in details.

Invinity's management team will also host a results presentation and Q&A for all shareholders on Monday 9 June 2025 at 4.30 p.m. Those wishing to join the session can sign up to Investor Meet Company for free via this link.

The Company's 2024 Annual Report will be available to download from the Company's website shortly.

Notice of Cancellation of Trading on the AQSE Growth Market ('Aquis')

Additionally, further to the announcement made in the trading update on 31 March, the Company today gives notice of cancellation of trading on AQSE. As the Company will retain its AIM listing on the London Stock Exchange, the Company is not required to send a circular and seek shareholder approval of a resolution to cancel in accordance with Rule 5.3 of the AQSE Growth Market Access Rulebook. In accordance with the procedures of the AQSE Growth Market, the Board anticipates the cancellation will be completed on or around 4.30 p.m. on 30 June 2025.

Jonathan Marren, Chief Executive Officer at Invinity said:

"These results speak to a very important year for the Company which saw us execute an important transition to our new ENDURIUM battery product, a successful funding round and a change in management team. In just the past few weeks, we have met with high-level government officials, featured in national news coverage and further advanced commercial discussions with prospective customers. These recent developments firmly underline the significant shift we are currently observing across global battery markets towards the next generation of energy storage technologies and I firmly believe we are in a strong position to take our place at the forefront of this shift.

"As detailed in my report, we still have challenges to overcome and although we have made strong progress against the corporate targets I set out when I took over as CEO, there is more work to be done if we are to compete at the scale we envision and convert the demand we are seeing for our products into revenue. However, I remain confident in our team's ability to deliver and believe there is much to be excited about in Invinity's short-, medium- and long-term future."

Stay up to date with news from Invinity. Join the distribution list for the Company's monthly investor newsletter here.

Enquiries:

Invinity Energy Systems plc | +44 (0)20 4551 0361 |

Jonathan Marren, Chief Executive Officer Joe Worthington, Senior Director, Corporate Affairs | |

Canaccord Genuity (Nominated Adviser and Joint Broker) | +44 (0)20 7523 8000 |

Henry Fitzgerald-O'Connor / Harry Pardoe / Charlie Hammond | |

VSA Capital (Financial Adviser and Joint Broker) | +44 (0)20 3005 5000 |

Andrew Monk / Andrew Raca |

Notes to Editors

Invinity Energy Systems plc (AIM: IES) (OTCQX: IESVF) manufactures vanadium flow batteries for large-scale, high-throughput energy storage requirements of business, industry and electrical networks.

Invinity's factory-built flow batteries run continually with no degradation for over 25 years, making them suitable for the most demanding applications in renewable energy production. Energy storage systems based on Invinity's batteries are safe, reliable, and economical, and range in size from less than 250 kilowatt-hours to tens of megawatt-hours.

Invinity was created in April 2020 through the merger of two flow battery industry leaders: redT energy plc and Avalon Battery Corporation. With more than 190 MWh of systems deployed, contracted for delivery or awarded for projects across more than 90 sites in 17 countries, Invinity is active in all major global energy storage markets and has operations in the UK, Canada, USA and China. Invinity Energy Systems plc is quoted in the UK on AIM and trades in the USA on OTCQX.

To find out more, visit invinity.com, sign up to our monthly Investor Newsletter here or contact Investor Relations on via +44 (0)20 4551 0361 or [email protected].

Audited Financial Results for the Year Ended 31 December 2024

Introducing ENDURIUM - Charging the Future

Matt Harper, President & Chief Commercial Officer

Delivering Abundance

Launching ENDURIUM, our next-generation vanadium flow battery, at the end of 2024 was a massive step forward for Invinity.

Around the world, governments and regulators are focused on securing domestic energy supply. As renewable generation is becoming widely accepted as the way to achieve that goal at the lowest economic and environmental cost, longer duration energy storage ("LDES") that can stabilise intermittent renewables is increasingly acknowledged as a critical component of the future grid.

We and our development partner Gamesa Electric conceived ENDURIUM to deliver the durable, flexible, safe and low-cost energy storage capabilities that will fill this need. Capable of serving both megawatt-scale industrial sites and datacentres as well as gigawatt-scale projects for the electric grid, it is proving to be up to the challenge of resolving the most difficult supply-and-demand imbalances within our rapidly evolving energy landscape.

Gamesa's support since 2021 has been vital to delivering a product driven by market fundamentals and customer needs. With our first ENDURIUM delivery operating as expected at their wind, solar and battery test site in La Plana, Spain, we are convinced more than ever that ENDURIUM has what it takes to be the path to our "north star" - a battery that delivers energy on demand at lower cost than any conventional fuel-based generation.

Benefits of ENDURIUM - Bigger, Better, Faster, Stronger

To deliver on its promise, ENDURIUM must first and foremost be reliable and robust, and so it was important that the product be based on our proven vanadium flow battery technology. From there, we went back to the drawing board to design a scalable and adaptable hardware and software platform that would far exceed our customers' expectations while serving their most challenging storage needs.

Like all of Invinity's flow batteries, ENDURIUM's capacity does not degrade with use, making it ideal for high-throughput projects whether they be standalone systems or collocated with intermittent wind or solar generation. High safety and low noise characteristics also help to streamline planning permission.

Specifically, just like its predecessors, ENDURIUM features:

· No battery fire risk;

· 100% depth of discharge cycles over 100% of its lifetime;

· Limitless cycling anywhere within its state of charge range;

· Industry-standard interfaces to a wide variety of off-the-shelf power converters;

· Eliminated reliance on noisy, power-hungry air conditioners for cooling; and

· An asset life of 25 years or more.

· Enhanced battery round-trip efficiency of 75%

· Significantly reduced up-front capital cost,

· A projected 75% reduction in maintenance and service costs,

· Greater operational flexibility with discharge cycles from 3 to 18 hours;

· Significantly reduced installation complexity, and

· Next-generation, AI-enhanced monitoring and optimisation software.

These critical characteristics, confirmed by global assurance and risk leader DNV, give operators an inherently safe and long-term asset which costs nothing to cycle. This means they can dispatch renewable power at near-zero marginal cost, making reliable wind and solar power for our homes and businesses an achievable goal.

Finally, ENDURIUM's compact design enables our customers to deploy significantly more energy storage capacity on their sites compared to our previous products. This enhanced site energy density is particularly relevant as battery storage and general LDES projects are becoming larger and larger, meaning that our customers now have an increasingly proven LDES product that is suitable for more of their sites at a lower total cost.

Market Opportunities - Primed to Charge

As the year-on-year growth of renewable generation continues, policymakers, utilities and large utility buyers are looking to LDES to maintain the ability to deliver firm, dispatchable power while continuing to adopt more low-cost, low-carbon energy. Policies and programmes that seek to stabilise the grid while reducing reliance on costly imports or hydrocarbon-fuelled peaking capacity are at the forefront of decision-makers' minds. LDES solutions delivering six to ten hours of firm daily capacity are now widely viewed as the best solution, a capability right in ENDURIUM's sweet spot.

Policymakers and developers are also considering the environmental and human impact of large-scale storage. Lithium battery fires, notably the one in January 2025 that destroyed a significant portion of one of the largest batteries in the world at Moss Landing in California, have highlighted the need for safer solutions. Recent geopolitical shifts are already disrupting supply chains for the critical minerals needed for many conventional battery solutions, increasing costs for those devices. And replacing conventional generation with offshore-manufactured, renewable equipment means the loss of good, durable jobs.

For these reasons, LDES programs and policies are increasingly favouring non-lithium-ion technologies. The UK's LDES Cap & Floor scheme, Ontario's Long Lead Time Resources solicitation and comparable programmes in California, New York, Australia and elsewhere are increasingly minimising or discouraging lithium eligibility. Independently, each of these aims to deploy gigawatt-hours of LDES capacity on their respective grids by 2030; together, they represent a massive opportunity for ENDURIUM.

Importantly, these specialised schemes and market-based incentives move beyond the earlier grant-funded demonstration scale projects and are giving a beneficial boost to drive highly scalable, economically viable future LDES deployment at scale.

Domestic Solutions for Domestic Problems

At the same time, recent macro events underscore the need for energy security. In early February 2025, several Baltic countries disconnected from the Russian electric grid. Several U.S. jurisdictions, including California and across the Midwest, regularly see renewable energy supply exceed demand, necessitating wasteful curtailment of gigawatts of power. In late 2024 an interconnector fault between the UK and Norway put severe strain on the UK's grid, narrowly avoiding blackouts. Spain was less lucky, with interconnectors to France tripping ahead of a massive power outage on 28 April 2025. While grid reliability is critical, cost is a close second. UK consumers continue to pay for wind curtailment in times of low demand, while relying heavily on expensive gas generation to deliver capacity at peak times. These costs weigh on both economic competitiveness and family budgets. A better solution is needed.

ENDURIUM is a natural fit to deliver made-at-home solutions to improving grid reliability and decreasing the cost of power. Made in Britain and in Canada, it has the flexibility to deliver sub-second regulation to multi-hour energy shifting. Unlike pumped hydro, which requires specific geography, or lithium-ion, whose safety risks and noise mean they struggle to be installed close to homes or businesses, Invinity's batteries can be installed practically anywhere, solving wind or solar intermittency or alleviating critical grid constraints wherever the need arises.

Valuing Abundance

Today's LDES policy initiatives are the starting gun in the race to deliver abundant, low-cost, clean energy on demand. Grids will require ever more flexibility to accommodate an increasing amount of low-cost but intermittent renewable generation. Choosing the right storage solutions, meaning ones that deliver flexibility from milliseconds to hours, are safe and quiet enough to be installed alongside homes and businesses, and whose manufacture contributes to our domestic economy is critical. ENDURIUM is up to the task.

Low cost, reliable and clean power is the answer to reducing dependency on expensive, carbon-emitting generation. The momentum generated by supportive LDES policy has given important clarity to investors and developers alike to drive market-based solutions for this toughest of energy challenges. With ENDURIUM now commercially proven, developers and grid operators have the right tool for large scale energy storage wherever it is needed.

Chairman's Report: Powering Through

2024 felt like the year that the shift to long duration energy storage ("LDES") began to happen in a meaningful way. Supportive government policies appeared in many of the major energy storage markets to enable the increased supply of renewable generation. In Europe, renewables now make up nearly 50% of total electricity supply, compared to less than 20% just six years ago. Similar trends can be seen in the UK, the United States, Australia and other parts of the world. How grid operators balance their network is now a key question and LDES is increasingly seen as an essential part of the answer. We are entering the next phase of the global energy transition, and Invinity's vanadium flow batteries are well-placed to take advantage of this opportunity.

These major policy developments came with a degree of market uncertainty which temporarily slowed commercial activity and pushed out project timelines. Whilst this uncertainty still persists in some markets such as the United States, the ever-evolving policy landscape has presented significant opportunities for Invinity in other markets. For instance, the UK's LDES Cap and Floor scheme is designed to support gigawatt hours of projects for which our vanadium flow batteries are well-suited - underlined by the announcement in February 2025 that leading developer Frontier Power will target the deployment of up to 2 GWh of Invinity batteries in the UK through this scheme.

Falling competitor costs remain a key commercial consideration, but I am so far delighted with the team's response to this ongoing challenge. Key milestones have been met in terms of product launch and our first ENDURIUM batteries have already been delivered to our long-term partner, Gamesa Electric, and are operating in line with expectations. The team has also made significant progress towards hitting our cost targets for ENDURIUM, and whilst the team will always continue to work on reducing costs and improving performance, their achievements to date should be recognised.

I feel Invinity now finds itself with the right product in the right markets at the right time - a view shared by those new and existing investors who participated in a successful £57.4 million fundraise the team completed in May 2024. Notably, this funding round brought in the support of the UK Government via the National Wealth Fund, which in the process has become our largest shareholder. Their support, along with that of our other institutional and strategic investors, has been instrumental in enhancing our credibility. The funds raised have been put to work, including expanding Invinity's manufacturing capability and more recently deploying ringfenced capital into our own projects, most notably the LoDES project which we expect to become an important commercial asset for the Company at a time of major demand for LDES battery technology in the UK and globally.

In July, I was delighted to welcome so many of you to our capital markets day, held at our facilities in Scotland. The event presented an important opportunity for us to meet face to face with our shareholders and use that opportunity to showcase our new factory in Motherwell as well as hearing from our talented team who put on a number of demonstrations highlighting the safety and durability of our products.

Finally, Invinity completed work to redomicile the Company to the UK from Jersey in early 2025. This move has already streamlined various corporate processes and will result in an associated reduction in ongoing costs. Our new executive team has continued to perform effectively and I am pleased to note the progress the Company is making in respect of its corporate priorities, which are covered in more detail in the Chief Executive's report.

In closing, I would like to thank my Board colleagues for their continued support. We are grateful for the dedication, hard work and vision provided by Larry Zulch during his tenure as Chief Executive and we wish him all the best in his retirement. Under Jonathan Marren's leadership, supported by Matt Harper in the role of President and CCO, I have every faith the Company can continue to grow to reach its potential and he has my full support, along with that of the entire Invinity board. I am delighted to welcome our new CFO, Adam Howard, who joined Invinity from the National Wealth Fund and whose experience in energy and finance is already bringing significant benefits. Lastly, I am particularly grateful to Michael Farrow for his guidance over his many years of service to the Company which has been greatly appreciated and has provided Invinity with strong governance structures to stand it in good stead. With the redomiciliation complete, Michael has given notice to the Board of his intention to retire at the next Annual General Meeting. We wish him all the best.

Invinity has taken the critical steps in 2024 to build our capabilities ahead of the transition to volume production of the ENDURIUM product. Jonathan, Matt and Adam are the right team and, combined with the right product, are powering the Company on.

Neil O'Brien

Non-Executive Chair

29 May 2025

Chief Executive's Report: From Megawatts to Gigawatts

The rhetoric on batteries was notably transformed throughout 2024 and continues apace into 2025. Interest in Long Duration Energy Storage ("LDES") and the role it will play in making our electricity supply not only more secure, but cheaper and greener too, is at an all-time high and politicians and policymakers in our core markets (and further afield) appear to have finally pinned their colours to the energy storage mast, further helped by recent well-publicised grid outage events in the UK and Europe. The opportunity ahead of us is enormous and our achievements in 2024 position us well to capture significant value.

The year saw the Company grow and enhance our own capabilities and global partnership network to position us to capture value whilst carefully managing our own resources. Perhaps most notably, 2024 saw Invinity close a significant funding round in the context of persistently challenging equity markets, raising £57.4 million in May. This fundraise brought in the UK Government via the National Wealth Fund as our new largest shareholder, enabling the Company to invest in our manufacturing capabilities, our team and our projects. 2024 was also the year of the long-awaited launch of ENDURIUM, our highly advanced, vanadium flow battery product. This was a critical milestone and enabled us to enter 2025 with a product that can meet the market's LDES requirements at a competitive price. I am more excited than ever about the opportunity developing in front of us and believe we are in a strong position to deliver on our corporate plan.

Delivering Against our 12-month Corporate Plan

When I took over as CEO in September 2024, I set out five corporate goals to be achieved within the next 12 months. These goals, covering revenue, products, cost reduction and commercial traction, have formed the backbone of the agenda at every senior management meeting held since. Our fantastic team are focused on the task at hand and I am delighted with the progress they have made since. Notwithstanding this, there is still much more we can achieve and we continue to challenge ourselves to make further progress.

Goal 1: Recognise Revenue in Line with 2024 Year-End Revised Analyst Forecasts

Shipping product quickly to customers underlines our dedication to good customer service and operating effectively for the future of the business. Our team were successful in shipping a number of orders prior to year end, including the 4 MWh sale to Powerflex, part of EDF Renewables North America, for a project in California and the 1.2 MWh ENDURIUM system to Gamesa Electric. Thanks to our team's efforts, this ensured we met our revised revenue forecasts for FY24.

Goal 2: Launch the ENDURIUM Product for General Sale Before 2024 Year-End

The formal release of ENDURIUM was a critical milestone for Invinity. Our team successfully executed a well-received global launch of our new product before year end to achieve this corporate goal. They then went further and successfully manufactured, tested and shipped before year end our first ENDURIUM batteries for our partner Gamesa Electric and commissioned them in early 2025. As I write this report now, these batteries are operating in line with expectations at the La Plana site in Spain, with further orders for other customers currently in the project fulfilment phase.

Operating data showing Power and State of Charge of the 1.2 MWh system at La Plana - February 2025

Goal 3: Close Deals from our Commercial Pipeline to Support Volume Ramp-up in line with Forecasts

In a year that saw lithium-ion battery costs fall ~20% (the sharpest drop since 2017) and continue to fall into 2025, the Company also navigated significant policy changes related to long duration energy storage deployment globally. Whilst the vast majority of these changes are designed to promote the adoption of LDES and this is clearly a positive long-term outcome for our business, this move did have the effect of slowing down discussions on a number of projects in our commercial pipeline as our partners considered the implications. In the final quarter of the year, we expanded our commercial team to help close out nearer term projects and prepare for the new LDES opportunities embodied by the introduction of new initiatives. The launch of ENDURIUM has assisted this process and, with the team's renewed focus, I am encouraged by the progress achieved in the year to date, including a strategic partnership with Frontier Power targeting the deployment of 2 GWh of our batteries into the UK via the LDES Cap and Floor Scheme, repeat business with our partner in Hungary with whom we have secured a supply agreement for a 10.8 MWh project and securing the approval, subject to a planning amendment, to proceed in respect of the 20.7 MWh LoDES project that Invinity will develop and which, once built, is expected to be the largest of its kind anywhere in Europe.

This recent deal flow is demonstrating to our customers that we can support larger-scale projects and this is imperative if we are to make the transition to delivering at gigawatt-scale. Converting commercial interest is also essential, and the commercial team remain focused on closing out opportunities from our wider commercial pipeline to support near-term revenue targets while developing in parallel the extremely large deal opportunities that will be instrumental in supporting Invinity's journey to mass manufacturing.

Goal 4: Further Advance the Cost Reduction Programme for ENDURIUM and Incrementally Improve Product Margins.

Our progress over the last four years on the VS3 cost curve has resulted in the Company being able to secure larger projects at incrementally improving margins and the launch of ENDURIUM facilitates the next step on this journey. When I took over as CEO in September 2024, I made it clear that advancing our cost reduction programme on ENDURIUM was an area I had prioritised for immediate action.

I am happy to report that the team has so far achieved a 24% cost reduction on ENDURIUM since launch. This has been realised through a combination of product optimisation, value engineering, supply chain development and process enhancements which have enabled us to incrementally improve performance and reduce the delivered cost of our products. This is remarkable progress within a relatively short timeframe, but this work is far from complete and I continue to challenge our team to reduce costs yet further, targeting further material reductions to be realised by the end of 2025 as a next step on this journey.

The team has already identified a viable route to exceeding our targets as part of our product development roadmap. The projected outcomes of our cost down programme are detailed in the following graphic and I'm pleased to note that we are currently ahead of our own expectations in terms of progress along our cost curve and on track to meet our incremental projected targets out to 2030.

ENDURIUM Cost Roadmap August 2024 vs May 2025

Economies of scale will also play an important part in our cost roadmap and I was pleased that the team were able to swiftly secure and harness the capabilities of our new Motherwell facility in Q3 to enable the faster, more efficient delivery of projects from the Company's commercial pipeline. This quadrupling of capacity, alongside the soon to be installed semi-automated production line in our Bathgate facility, which is expected to nearly double stack production at this site, will contribute to a further incremental reduction in unit production costs.

Finally, the operating data coming from the 1.2 MWh ENDURIUM system at La Plana is encouraging, as well as providing important guidance for future cost reduction. Having this system operating so soon after launch is greatly assisting the team and by using AI-driven statistical analysis, we are making the best use of this high-value data to inform our product development and value engineering workstreams. This work has already led to material improvements in the stack design and electrolyte performance in addition to separate initiatives which see us adopting a higher-volume, lower-cost manufacturing process and outsourcing appropriate activities to best-cost regions, for example through our licence and royalty model with partners such as Everdura Technology Company in Taiwan.

Goal 5: Review Capital Allocation Across the Business and Drive Operational Efficiencies.

Ensuring our limited resources are allocated effectively is vital to achieving sustainable corporate growth and I have ensured that this goal remains front of mind across the entire organisation, with our new CFO, Adam Howard, taking executive responsibility for this crucial initiative.

The team made important progress during the year enhancing our systems and processes to drive operational efficiencies. These include advancing the process of implementing an ERP system, improving our supplier development procedures and simplifying our corporate structure. Combined, these initiatives have improved the speed of our contract delivery as well as helping to reduce overheads in the future. This is an area which benefits from continued optimisation and by better aligning our supply chain, finance and customer-facing functions we will continue to unlock incremental benefits as we grow.

Finally, I am pleased that Invinity's redomiciliation to the UK, a condition of NWF's investment, completed early in 2025. In line with our efforts to drive operational efficiencies, this move reduces our corporate costs, simplifies administrative matters and enhances our corporate positioning within the UK, a key commercial market for the Company.

Placing LDES Front of Mind with Policy and Political Engagement

Thanks to extensive, constructive engagement with the UK Department for Energy Security and Net Zero ("DESNZ") during 2024 and in the year to date, we were delighted to announce in March this year that we had now secured approval to proceed, subject to a planning amendment, with the LoDES project - an up to 20.7 MWh vanadium flow battery project which will be one of the largest of its kind anywhere in the world. Owning this project ourselves will bring significant long-term benefits as we will retain the financial value generated from this DESNZ grant and enhance our commercial activities by leveraging full control and access to a flagship LDES asset.

We will always aim to be at the forefront of LDES policy discussions as they evolve and we made significant progress in this important initiative during 2024 in parallel to the delivery of the corporate goals set out earlier in my report. All over the world, new support schemes for LDES deployments are now being implemented and engaging with policy and political stakeholders at all levels in an effective and collaborative manner remains a vital part of our market development strategy.

Throughout 2024 we continued our ongoing engagements with the UK Government and in particular I was pleased to spend time discussing our technology and expansion plans with Graham Stuart, the UK Minister of State for Energy Security and Net Zero and Gillian Martin MSP, the Scottish Acting Cabinet Secretary for Net Zero. In Canada, where our ongoing political engagement is led by Matt Harper, we were delighted to have the opportunity to engage extensively with key British Columbia government ministers including Premier David Eby, following the visit by Canadian Energy Minister Wilkinson to our facility in 2023. More recently, we were also delighted to welcome a host of elected officials from both British Columbia and the City of Vancouver as part of New Economy Canada's "Getting Things Built Tour". In late 2024, shortly after the U.S. election, I also joined our U.S.-based team in Washington D.C. where we had a number of productive meetings with U.S. government officials including representatives from the Department of Energy and Department of Defence.

Further afield, our projects also continue to attract the attention of key stakeholders around the world. In March 2024, the Belgian Minister for Energy attended the launch of our vanadium flow battery alongside our customers Engie, Equans and Jan de Nul at a commercial site in Aalst, Belgium. Furthermore, in November 2024, the Western Australian Minister for Energy, Environment and Climate Action formally launched our battery at Horizon Power's Kununurra LDES project.

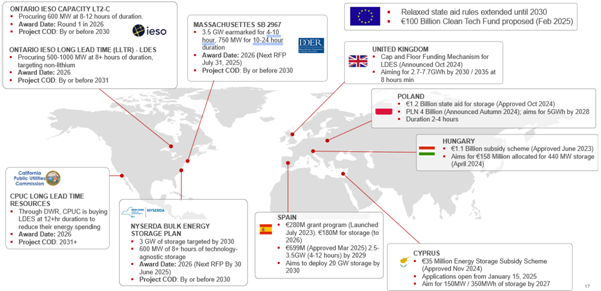

Global Energy Storage Funding Programmes

As demonstrated in the graphic "Global Energy Storage Funding Programmes", many, if not all, of these LDES deployment support schemes are targeting projects in or before 2030, just five years from now. These opportunities require storage duration covering 6+ to 10+ hours and more importantly, many highlight preferences for non-lithium-based storage technologies (particularly the UK and Canada). They also favour technologies that offer availability and cycling over 25+ years without degradation of the system, an improved depth of discharge and a reduced capex/kWh over longer durations - KPIs that play to ENDURIUM's strengths.

Invinity, along with the support of our established partners, is carefully targeting these opportunities in our core markets. Our newest partner, Frontier Power, is applying for up to 2 GWh of LDES Cap and Floor projects using our VFBs in the UK. Our partner STS Group is well-placed to apply for projects for the regime in Hungary. Our experience in California, alongside our partner Indian Energy, is enabling us to address new opportunities as part of the State's LDES program and we are using this experience to also target opportunities in New York's LDES program. Beyond these markets, our long-term partner Everdura gives us reach into the Taiwanese and Southeast Asian markets where we are confident that our product has a strong commercial advantage.

Summary and Outlook

In summary, despite the reduction in year-on-year revenue for the period, Invinity is making incremental progress against our corporate plan. This work to improve our margins, scale our operations and optimise our cost base remains a key deliverable and our commitment to achieving this is evidenced by significant progress made so far since I took over the role as Chief Executive Officer against our corporate targets in the year to date which I set out earlier in this report.

There will of course continue to be challenges which we must overcome, and our approach to these is set out in the risk management section of this report, but I believe our team have the mindset and skillset to succeed. As we address the global LDES opportunity across our core markets, I am grateful to be supported by both Matt and Adam as we navigate the next steps along our pathway to profitability, moving from Megawatt to Gigawatt scale in a market where long duration energy storage has now fully come of age.

Jonathan Marren

Chief Executive Officer

29 May 2025

Chief Financial Officer's Report: Material Progress Against Cost-Down and Investment Plan

2024 | 2023 | 2022 | |

Year to 31 December | £m | £m | £m |

Revenue | 5.0 | 22.0 | 2.9 |

Gross (Loss)/Profit | (3.5) | (3.3) | 0.7 |

Adjusted EBITDA1 | (18.0) | (22.4) | (19.1) |

Pre-tax Loss | (22.8) | (23.2) | (18.5) |

Property, Plant and Equipment plus Intangible Assets | 26.3 | 25.7 | 25.3 |

Total Inventory and Pre-paid Inventory | 8.2 | 4.4 | 14.9 |

Net Cash | 32.4 | 5.0 | 5.1 |

Net Assets | 65.7 | 33.8 | 34.4 |

1 Adjusted EBITDA is a non-statutory measure. The calculation is shown below. | |||

2024 | 2023 | 2022 | |

Year to 31 December | £m | £m | £m |

Loss from Operations | (24.1) | (22.8) | (19.0) |

Add back |

| ||

Depreciation and Amortisation | 1.3 | 1.1 | 1.2 |

Loss on Disposal of Non-Current Assets | 0 | 0.2 | 0 |

Impairment of Inventory and Obsolete Inventory | 0.4 | 0.2 | 0 |

Gain on Legal Settlement | (0.2) | 0 | 0 |

Share-based Payment Charge | 0.6 | 0.7 | 0.3 |

Redomiciliation and Other One off | 0.6 | 0 | 0 |

Warranty and Onerous Contract Provisions | 2.1 | (1.7) | (3.2) |

Research and Development Costs | 2.4 | 1.9 | 2.2 |

Grants and Research and Development Recoveries | (1.1) | (2.0) | (0.6) |

Adjusted EBITDA | (18.0) | (22.4) | (19.1) |

2024 Financial Performance

The financial performance of the business during 2024 reflected a transitional period as the Company ran an overlap of product lines; manufacturing and selling VS3 at the same time as preparing for the launch of the next-generation ENDURIUM product. It took longer to get ENDURIUM ready for launch, and a portion of revenue and grant income shifted into 2025 including from the Everdura contract and the recently announced supply agreement with STS, which the Company now expects to receive formal notice to proceed on later this year. In addition, the LoDES project previously anticipated to progress during the year, is now moving forward in 2025.

As a result, total income including sales revenue and project related grant income for the year decreased significantly to £5 million in 2024 (2023: £22 million). In the year, revenue was recognised on three main projects across Europe and the United States, with V-iOn, Rincon and OPALCO delivering over 7 MWh. While this has been a material decrease from the prior year, it is worth noting 2023 reflected the culmination of significant VS3 activity over multiple years prior to 2023. Revenue recognition dictates that project sales are only shown in the financial statements when specific performance obligations related to those projects have been satisfied.

The Company recorded a gross loss of £3.5 million (2023: gross loss of £3.3 million). It is notable that £2.1 million of this relates to provisions for warranties and onerous contracts for parts including the legacy S4 stack and converters, which have since been superceded. The Company continues its strategic objective to enhance margins and this trend remains with 2025 projects having been signed at positive gross margins at the project level.

Administrative expenses at £20.3 million (2023: £19.1 million) increased in line with inflation after allowing for one-off costs, reflecting a continued focus on controlling costs while growing operations. Administrative expenditure was represented by stable staff costs of £12.9 million in 2024 (2023: £12.8 million) and professional fees of £0.8 million in 2024 (2023: £0.7 million) predominantly related to the re-domiciliation exercise. Sales and marketing costs decreased to £0.8 million (2023: £1.0 million). Net research and development recoveries were £1.1 million (2023: £1.9 million) including £0.8 million of recoveries from Gamesa Electric S.A.U. ("Gamesa Electric") under the Joint Development and Commercialisation Agreement for ENDURIUM.

Net Finance income increased to £1.3 million (2023: £0.4 million costs) due to interest payments received on proceeds from the May 2024 fundraising which were placed into term deposits. Total inventory and pre-paid inventory increased to £8.2 million (2023: £4.4 million) preparing for the delivery of several projects including Everdura Technology Company and LoDES.

Overall, the Company recorded a loss for the year of £22.8 million (2023: loss of £23.2 million), an improvement of £0.4 million supported mainly by Finance income. There have been a number of 'one-off' costs experienced in the year including professional fees in relation to the redomiciliation of Invinity's parent company from Jersey to the UK which concluded early in January 2025. The EBITDA loss after adjusting for these one-off items, non-cash expenditures and grant income, reduced from £22.4 million to £18.0 million year-on-year.

The Company has continued to invest in its future capabilities with the opening of a new production facility in Motherwell, Scotland in June 2024 and a contract was signed to supply a new semi-automated production line in Bathgate, Scotland to be delivered in Q2 2025. The outcome of these investments will realise product cost savings and support increased scale ahead of the outcome of the UK LDES Cap and Floor application process.

2024 Cash Performance

Year-on-year cash outflow from operations increased to £25.9 million (2023: £19.7 million) principally because of a net increase in operating assets, primarily inventory, as set out in note 14.

Delivering on increased margins is a key corporate priority and will make an important contribution to the Company being able to fund its administrative costs from operational cash receipts in the future. To this end, the Company successfully delivered and commissioned the 1.2 MWh ENDURIUM system at the La Plana site in early 2025 under its partnership with Gamesa Electric. As noted in the previous year, ENDURIUM is expected to be manufactured at significantly lower cost than the Company's VS3 product and occupies a comparatively smaller physical footprint to support lower operation and maintenance costs, in addition to higher round-trip-efficiency. These characteristics should enable the Company to sell this new product at a materially lower and more competitive price point than currently to support future cash generation and profitability.

Funding and Net Working Capital

In 2024 it was inspiring to note the huge support from our investors in raising over £57 million to support the growth of the Company as it continues to develop a market leading solution in non-lithium, long duration battery energy storage systems.

On 31 December 2024 the Company had cash and cash equivalents of £32.4 million (2023: £5.0 million). The Company's cash balance during 2024 has been materially increased following the successful conclusion of the capital raising of £57.4 million which completed in May 2024.

The Company was debt free as of 31 December 2024 and remains so as at the date of this document.

Going Concern

The Directors have made an assessment of going concern covering the period from the date of approval of the financial statements to 30 June 2026 and in making this assessment, have prepared a cash flow forecast covering this period. The Directors have also considered whether there are any significant events expected to arise beyond the going concern period.

This forecast indicates that the Group expects to remain cash positive during the going concern period, without the requirement for further fundraising. This forecast includes judgements and estimates regarding income from pipeline projects and expected costs of delivering the contracts.

It is important to note that the visibility around the sales pipeline underpinning the Company's projected cashflow is more reliable over a period of 12 months, which is in line with the going concern period noted above. While a cash flow forecast and projections have been carried out for a period greater than 12 months, the risk and uncertainty increase in the time following the going concern assessment period.

Invinity has prepared a downside cash flow forecast for the purposes of going concern evaluation, which excludes all pipeline contracts that are not yet signed. In this scenario, the forecast assumes a reduction or deferral of costs in order to preserve cash. If required, the Directors consider that the Group has the ability to reduce or defer costs without adversely affecting the short-term delivery of contracted income in the downside forecast. The outcome of this scenario is that the Company has sufficient cash throughout the going concern period. The accounts have therefore been prepared on a going concern basis.

Adam Howard

Chief Financial Officer

29 May 2025

Financial Statements

Consolidated Statement of Profit and Loss

For the year ended 31 December 2024

|

| 2024 | 2023 | ||

| Note | £000 | £000 | £000 | £000 |

Revenue | 4 |

| 5,015 | 22,006 | |

Direct costs | (8,528) |

| (25,361) | ||

Grant income against direct costs | 4 | - |

| 11 |

|

Cost of sales | 5 |

| (8,528) | (25,350) | |

Gross loss |

| (3,513) | (3,344) | ||

Operating costs |

|

| |||

Administrative expenses | 6 |

| (20,334) | (19,085) | |

Other items of operating income and expense | 10 |

| (210) | (349) | |

Loss from operations |

| (24,057) | (22,778) | ||

Finance income |

| 1,358 | 719 | ||

Finance costs |

| (106) | (1,233) | ||

Gain on foreign currency transactions |

| 8 | 113 | ||

Net finance income/(costs) | 11 |

| 1,260 | (401) | |

Loss before income tax |

| (22,797) | (23,179) | ||

Income tax expense | 12 |

| - | - | |

Loss for the year |

| (22,797) | (23,179) | ||

|

| ||||

|

| ||||

Loss per ordinary share in pence |

|

| |||

Basic | 13 |

| (6.7) | (13.1) | |

Diluted | 13 |

| (6.7) | (13.1) | |

The above consolidated statement of profit and loss should be read in conjunction with the accompanying notes.

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2024

| 2024 | 2023 | |

Continuing operations |

| £000 | £000 |

Loss for the year

Other comprehensive expense

Items that may be reclassified subsequently to profit or loss: | (22,797) | (23,179) | |

Exchange differences on the translation of foreign operations | (355) | (60) | |

Total comprehensive loss for the year | (23,152) | (23,239) |

The above consolidated statement of comprehensive income should be read in conjunction with the accompanying notes.

Consolidated Statement of Financial Position

As at 31 December 2024

|

| 2024 | 2023 |

| Note | £000 | £000 |

Non-current assets | |||

Goodwill and other intangible assets | 15 | 23,959 | 24,002 |

Property, plant and equipment | 16 | 2,346 | 1,699 |

Right-of-use assets | 17 | 1,526 | 1,558 |

Contract assets | 21 | - | 304 |

Total non-current assets | 27,831 | 27,563 | |

| |||

Current assets |

| ||

Inventory | 19 | 5,753 | 3,288 |

Other current assets | 20 | 7,648 | 2,721 |

Contract assets | 21 | 1,149 | 888 |

Trade receivables | 22 | 827 | 2,496 |

Cash and cash equivalents | 23 | 32,352 | 5,014 |

Total current assets | 47,729 | 14,407 | |

Total assets | 75,560 | 41,970 | |

Current liabilities |

| ||

Trade and other payables | 24 | (4,525) | (3,948) |

Derivative financial instruments | 25 | (271) | (406) |

Contract liabilities | 21 | (1,392) | (1,312) |

Lease liabilities | 26 | (550) | (723) |

Provisions | 21 | (381) | (812) |

Total current liabilities | (7,119) | (7,201) | |

Net current assets | 40,610 | 7,206 | |

| |||

Non-current liabilities |

| ||

Lease liabilities | 26 | (1,145) | (833) |

Provisions | 21 | (1,627) | (123) |

Total non-current liabilities | (2,772) | (956) | |

Total liabilities | (9,891) | (8,157) | |

Net assets | 65,669 | 33,813 | |

| |||

Equity |

| ||

Called up share capital | 27 | 53,473 | 51,348 |

Share premium | 27 | 215,121 | 162,883 |

Share-based payment reserve | 27 | 7,328 | 6,683 |

Accumulated losses | 27 | (208,070) | (185,273) |

Currency translation reserve | 27 | (2,222) | (1,867) |

Other reserves | 27 | 39 | 39 |

Total equity | 65,669 | 33,813 |

The above consolidated statement of financial position should be read in conjunction with the accompanying notes.

The financial statements were authorised by the Board of Directors and authorised for issue on 29 May 2025 and were signed on its behalf by:

Adam Howard

Director

Consolidated Statement of Changes in Equity

As at 31 December 2024

| Called up share capital | Share premium | Share-based payment reserve | Accumul-ated losses | Currency transla-tion reserve | Other reserves | Total |

| £000 | £000 | £000 | £000 | £000 | £000 | £000 |

At 1 January 2024 | 51,348 | 162,883 | 6,683 | (185,273) | (1,867) | 39 | 33,813 |

Loss for the year | - | - | - | (22,797) | - | - | (22,797) |

Other comprehensive income | |||||||

Foreign currency translation differences | - | - | - | - | (355) | - | (355) |

Total comprehensive loss for the year | - | - | - | (22,797) | (355) | - | (23,152) |

Transactions with owners in their capacity as owners | |||||||

Investment funding arrangement, net of transaction costs | 2,125 | 52,234 | - | - | - | - | 54,359 |

Exercise of share options | 4 | - | - | - | - | 4 | |

Share-based payments | - | - | 645 | - | - | - | 645 |

Total contributions by owners | 2,125 | 52,238 | 645 | - | - | - | 55,008 |

At 31 December 2024 | 53,473 | 215,121 | 7,328 | (208,070) | (2,222) | 39 | 65,669 |

The above consolidated statement of changes in equity should be read in conjunction with the accompanying notes.

| Called up share capital | Share premium | Share-based payment reserve | Accumul-ated losses | Currency transla-tion reserve | Other reserves | Total |

| £000 | £000 | £000 | £000 | £000 | £000 | £000 |

At 1 January 2023 | 50,716 | 141,579 | 5,957 | (162,094) | (1,807) | 39 | 34,390 |

Loss for the year | - | - | - | (23,179) | - | - | (23,179) |

Other comprehensive income | |||||||

Foreign currency translation differences | - | - | - | - | (60) | - | (60) |

Total comprehensive loss for the year | - | - | - | (23,179) | (60) | - | (23,239) |

Transactions with owners in their capacity as owners | |||||||

Investment funding arrangement, net of transaction costs | 631 | 21,295 | - | - | - | - | 21,926 |

Exercise of share options | 1 | 9 | - | - | - | - | 10 |

Share-based payments | - | - | 726 | - | - | - | 726 |

Total contributions by owners | 632 | 21,304 | 726 | - | - | - | 22,662 |

At 31 December 2023 | 51,348 | 162,883 | 6,683 | (185,273) | (1,867) | 39 | 33,813 |

The above consolidated statement of changes in equity should be read in conjunction with the accompanying notes.

Consolidated Statement of Cash Flows

For the year ended 31 December 2024

|

| 2024 | 2023 |

| Note | £000 | £000 |

Cash flows from operating activities | |||

Cash used in operations | 14 | (26,103) | (19,657) |

Interest received | 1,222 | 299 | |

Interest paid | (13) | (1) | |

Net cash outflow from operating activities | (24,894) | (19,359) | |

| |||

Cash flows from investing activities |

| ||

Acquisition of property, plant and equipment | 16 | (1,294) | (1,013) |

Proceeds from disposal of property, plant and equipment | 16 | - | 57 |

Deposits on right-of-use assets | (7) | (28) | |

Net cash outflows from investing activities | (1,301) | (984) | |

| |||

Cash flows from financing activities |

| ||

Payment of lease liabilities | 26 | (676) | (629) |

Interest paid on lease liabilities | 26 | (92) | (44) |

Proceeds from the issue of share capital | 57,383 | 23,044 | |

Proceeds from the exercise of share options and warrants | 4 | 10 | |

Payment of transaction costs for the issue of share capital | (3,001) | (1,117) | |

Proceeds from sale of conversion shares | - | 742 | |

Financing charges on repayment of derivative financial instruments | - | (992) | |

Repayment of investment funding arrangement |

| (881) | |

Net cash inflow from financing activities | 53,618 | 20,133 | |

| |||

Net increase/(decrease) in cash and cash equivalents | 27,423 | (210) | |

Cash and cash equivalents at the beginning of the year | 5,014 | 5,137 | |

Effects of exchange rate changes on cash and cash equivalents | (85) | 87 | |

Cash and cash equivalents at the end of the year | 32,352 | 5,014 |

The above consolidated statement of cash flows should be read in conjunction with the accompanying notes.

Notes

1 General Information

Invinity Energy Systems plc (the 'Company') is a public company limited by shares incorporated and domiciled in Jersey. For the period under review, the registered office address was Third Floor, IFC5, Castle Street, St. Helier, JE2 3BY, Jersey.

The Company is quoted on the AIM Market of the London Stock Exchange with the ticker symbol IES.L and on the OTCQX Best Market in the United States of America with the ticker symbol IESVF.

The principal activities of the Company and its subsidiaries (together the 'Group') relate to the manufacture and sale of vanadium flow battery systems and associated installation, warranty and other services.

2 Accounting Policies

Basis of Preparation

These consolidated financial statements have been prepared in accordance with International UK-adopted International Accounting Standards, the associated interpretations issued by the IFRS Interpretations Committee (together 'IFRS') and in accordance with the Companies (Jersey) Law 1991.

Separate presentation of the parent company financial statements is not required by the Companies (Jersey) Law 1991 and, accordingly, such statements have not been included in this report.

The accounting policies applied in preparing these consolidated financial statements are set out below. These policies have been consistently applied throughout the period and to each subsidiary within the Group.

The financial statements have been prepared under the historical cost convention except where stated.

Going Concern

The Directors are satisfied that the Group has adequate resources to continue to operate as a going concern for the foreseeable future and that no material uncertainties exist which could cause significant doubt with respect to this assessment. In making this assessment, the Directors have considered the Group's balance sheet position and forecast earnings and cash flows for the period from the date of approval of these financial statements to 30 June 2026.

As part of the going concern assessment the Directors have prepared a cash flow forecast which indicates that the Group would expect to remain cash positive during this period and without the requirement for further fundraising. The business continues in a cash outflow position, using funding generated from previous fundraises. However, it plans to move to a cash inflow position upon the launch and delivery of material volume of the next generation product.

This cash flow forecast was stress-tested for a worst-case scenario of limited positive cash receipts from sales and management of costs where necessary. In these tested scenarios, the business would remain cash positive for the 12 months from the date of approval of these financial statements.

Therefore, the Directors believe it is appropriate to prepare the accounts on a going concern basis.

New Standards, Amendments and Interpretations Effective and Adopted by the Group in 2024

Amendments to existing standards previously issued by the IASB with effective dates during the year ended 31 December 2024 are summarised below. There was no effect on the Group's consolidated financial statements for the year ended 31 December 2024 as a result of the adoption of these amendments.

Amendments to 'IAS 1 Presentation of Financial Statements - Classification of Liabilities as Current or Non-Current Liabilities with Covenants'

The Group has adopted the amendments to IAS 1 for the first time in the current year. The amendments clarify that the classification of liabilities as current or noncurrent is based solely on an entity's right to defer settlement for at least 12 months after the reporting date. The right needs to exist at the reporting date and must have substance. Only covenants with which an entity must comply on or before the reporting date affect this right. Covenants to be complied with after the reporting date do not affect the classification of a liability as current or noncurrent at the reporting date. However, disclosure about covenants is now required to help users understand the risk that those liabilities could become repayable within 12 months after the reporting date.

The amendments also clarify that the transfer of an entity's own equity instruments is regarded as settlement of a liability, in certain circumstances. If a liability has any equity conversion options, they generally affect its classification as current or noncurrent (e.g. if the conversion option is bifurcated as an embedded derivative from the host debt), unless these conversion options are recognised as equity under IAS 32, Financial Instruments: Presentation.

Amendments to 'IFRS 16 Leases - Lease Liability in a Sale and Leaseback'

The Group has adopted the amendments to IFRS 16 for the first time in the current year. The amendment requires a seller-lessee to account for variable lease payments that arise in a sale-and-leaseback transaction as follows:

· On initial recognition, include variable lease payments when measuring a lease liability arising from a sale-and-leaseback transaction.

· After initial recognition, apply the general requirements for subsequent accounting of the lease liability such that no gain or loss relating to the retained right of use is recognised.

Seller-lessees are required to reassess and potentially restate sale-and-leaseback transactions entered into since the implementation of IFRS 16 in 2019.

Amendments to 'IAS 7 Statement of Cash Flows and IFRS 7 Financial Instruments: Disclosures - Supplier Finance Arrangements'

The Group has adopted the amendments to IAS 7 and IFRS 7 for the first time in the current year. The amendments require an entity (the buyer) to disclose qualitative and quantitative information about its supplier finance arrangements, such as terms and conditions - including, for example, extended payment terms and security or guarantees provided.

Amongst other characteristics, IAS 7 explains that a supplier finance arrangement provides the entity with extended payment terms, or the entity's suppliers with early payment terms, compared to the related invoice payment due date.

New Standards and Interpretations Not Yet Adopted

Certain new accounting standards and interpretations have been published that are not mandatory for 31 December 2024 reporting periods and have not been early adopted by the Company. These standards are not expected to have a material impact on the entity in the current or future reporting periods or on foreseeable future transactions and are summarised below:

§ IAS 21 The Effects of Changes in Foreign Exchange Rates - Lack of Exchangeability (effective for periods beginning on or after 1 January 2025);

§ IFRS 9 Financial Instruments and IFRS 7 Financial Instruments: Disclosures - Classification and measurement of financial instruments (effective for periods beginning on or after 1 January 2026).

§ Annual Improvements to IFRS Accounting Standards (effective for periods beginning on or after 1 January 2026) - Amendments to:

o IFRS 1 First-time Adoption of International Financial Reporting Standards;

o IFRS 7 Financial Instruments: Disclosures and its accompanying Guidance on implementing IFRS 7;

o IFRS 9 Financial Instruments;

o IFRS 10 Consolidated Financial Statements; and

o IAS 7 Statement of Cash flows

§ IFRS 18 Presentation and Disclosure in Financial Statements (effective for periods beginning on or after 1 January 2027);

§ IFRS 19 Subsidiaries without Public Accountability: Disclosures (effective for periods beginning on or after 1 January 2027)

Foreign Currency

Presentation Currency

The consolidated financial statements are presented in Great British Pounds (GBP) rounded to the nearest thousand (£000), except where otherwise indicated.

Functional Currency

Items included in the financial information of the individual companies that comprise the Group are measured using the currency of the primary economic environment in which each subsidiary operates (its functional currency).

Whilst Jersey uses the Jersey Pound as its currency, Jersey is in a currency union with the United Kingdom and so the functional currency of the parent company of the Group at 31 December 2024 has been determined to be GBP.

Foreign Currency Transactions

Transactions in currencies other than an entity's functional currency (foreign currencies) are translated using the exchange rate on the date of the transaction. Foreign exchange gains and losses resulting from the settlement of transactions denominated in a foreign currency are translated into functional currency using the relevant exchange rate at the date of the transaction.

Foreign exchange gains and losses resulting from the settlement of foreign currency transactions and from the translation at the balance sheet date of monetary assets and liabilities denominated in foreign currencies, are recognised in the consolidated statement of comprehensive loss within gains/(losses) on foreign currency transactions.

Foreign currency gains/(losses) realised on the retranslation of subsidiaries as part of the year-end consolidation are recorded in the translation reserve that forms a part of shareholders' funds in the consolidated financial statements of the Group.

Consolidation of Subsidiaries

Subsidiaries are all entities over which the Company has control. The Company controls an entity when it is exposed to, or has rights over, variable returns from its involvement with the entity and can affect those returns through its ability to exercise control over the entity. Subsidiaries are consolidated in the Group financial statements from the date at which control is transferred to the Company.

Subsidiaries are deconsolidated from the date that control ceases. The ability to control an entity may cease because of the sale of a subsidiary or other change in the Company's shareholding in that subsidiary, voting rights or board representation.

Foreign Currency Operations

Subsidiaries of the Company may have functional currencies that are different from that of the Company. Since the Group financial statements are presented in GBP, the assets and liabilities of foreign currency subsidiaries consolidated into these financial statements are translated into the Group's presentational currency using exchange rates prevailing at the end of the reporting period. Income and expense items are similarly translated using the average rate for each month during the year. The exchange rates on the actual dates of transactions are used where exchange rates fluctuate significantly within a month. Exchange differences arising on consolidation are recognised in other comprehensive income and are accumulated as part of shareholder's equity.

Transaction Between Entities Within the Group

Transactions and balances between companies forming part of the Group together with any unrealised income and expenses arising from intra-group transactions are eliminated in the preparation of the consolidated financial statements of the Group.

Operating Segments

The Group is organised internally to report to the Executive Directors as a whole. The Executive Directors comprise the Chief Executive Officer, the President & Chief Commercial Officer, and the Chief Financial Officer. The Executive Directors, as a group, have been determined, collectively, to prosecute the role of chief operating decision maker of the Group. The chief operating decision maker is ultimately responsible for entity-wide resource allocation decisions, the evaluation of the financial, operating and ESG performance of the Group.

The Group's activities have been determined to represent a single operating segment being the provision of vanadium flow batteries and ancillary services, principally comprising installation and integration services, and the provision of extended warranties for battery units sold.

Revenue

The Group generates revenue from the sale of battery storage systems integration hardware, installation, extended warranty and other services. These multiple elements are separate performance obligations that are derived from contractual arrangements with customers. The sales contracts do not include a general right of return.

For contracts that contain multiple elements or promises, the Group accounts for individual goods and services separately if they are distinct. A product or service is distinct if it is separately identifiable from other items in the agreement and where a customer can benefit from the good or service on its own or together with other resources that are readily available.

The consideration paid for each performance obligation is typically fixed. A significant portion of the aggregate payment due under a contract for sale is normally due before delivery or completion of the service. The total consideration under the contract is allocated between the distinct performance obligations contained in the contract based on their stand-alone selling prices. The stand-alone selling price is estimated using an adjusted market assessment approach that looks to industry benchmarks or pricing surveys for certain standalone products or services.

The Group measures revenue based on the consideration specified in the contracts for sale with customers. Revenue is recognised when a performance obligation is satisfied by transferring control over a good or service to a customer. With respect to the battery system, associated control systems and integration hardware, control is transferred at a point in time and is usually based on the contractual shipping terms. In certain instances, the battery system and integration hardware may be ready for delivery although the customer is not ready to receive the product. The Group will recognise revenue in accordance with IFRS 15 as a Bill-and-Hold arrangement if all of the following conditions are satisfied:

§ The reason for the bill and hold arrangement is substantive;

§ The battery systems and hardware are identified separately as belonging to the customer;

§ The battery systems and hardware are currently ready for physical transfer to the customer; and

§ The Company does not have the ability to use the product or to direct it to another customer.

With respect to the services that includes installation and commissioning, the performance obligation is usually satisfied at a point in time when a when a commissioning certificate or site performance report has been issued to the customer. Revenue excludes any taxes such as sales taxes, value added tax or other levies that are invoiced and collected on behalf of third parties, such as government tax authorities.

In addition, under the terms of its contracts for sale, the Group may be responsible for other services such as storing and delivering battery systems to its customers. When this is the case, the Group will invoice the relevant customer for, and will recognise as revenue, any charges incurred together with any associated handling costs. Revenue is recognised for the storage services over time as the services are delivered and for shipping services at a point in time when the goods are delivered to the agreed upon location. The related costs incurred by the Group for storage, shipping and handling services are recognised as cost of sales concurrent with the recognition of the associated revenue.

Grant Income

Government and other grants received are recognised in the consolidated statement of profit and loss in the period that the related expenditure is incurred. Grant income received in respect of costs incurred is presented net within the associated cost category. Capital grants are similarly netted against the relevant asset acquired or constructed.

Grant income received in advance of the associated expenditure is presented as deferred income within contract liabilities and released to profit and loss as the associated expenditure is incurred. Grant income receivable is presented as accrued income within contract assets until such time as it can be claimed or is received.

Finance Income and Costs

Finance income comprises interest on cash deposits, foreign currency gains and the unwind of discount on any assets that are carried at amortised cost. Interest income is recognised as it accrues using the effective interest rate method.

Finance costs include foreign currency losses and the unwind of the discount on any liabilities held at amortised cost, such as lease liabilities arising from lease contracts.

Employee Benefits

Short-term Benefits

Benefits provided to employees that are short-term in nature are recognised as expenses in the statement of profit and loss as the related service is provided. The principal short-term benefits given to employees are salaries, associated holiday pay and other periodic benefits such as healthcare and pension contributions made by the Group for the benefit of the employee. A liability is recognised for the amount expected to be paid under short-term cash bonus plans if there is either a present legal or constructive obligation to pay the amount and the amount can be reliably estimated.

Share-based Payments

The Group operates equity-settled share-based compensation plans, under which it compensates employees for services rendered through the issue of equity instruments, deferred share awards or options to subscribe for ordinary shares of the Group. The fair value of the employee services received in exchange for the grant of the equity instruments, shares or options is recognised as an expense. The total amount to be expensed is determined by reference to the fair value of the options granted:

§ including any market conditions (for example, the Group's share price);

§ excluding the impact of any service and non-market performance vesting conditions (for example, profitability, sales, growth targets, and the requirement to remain as an employee of the Group over a specified period); and

§ including the impact of any non-vesting conditions.

Non-market performance and service conditions are included in the assumptions regarding the number of options that are expected to vest. The total expense is recognised over the vesting period, which is the period over which all the specified vesting conditions are to be satisfied.

In some circumstances, employees may provide services in advance of the grant date and therefore the grant date fair value is estimated for the purposes of recognising the expense during the period between service commencement and the grant date.

At the end of each reporting period, the Group revises its estimates of the number of options that are expected to vest based on the non-market vesting conditions. It recognises the impact of the revision to original estimates, if any, in the consolidated statement of profit and loss, with a corresponding adjustment to equity.

Any social security contributions payable in connection with the grant of the share options is considered an integral part of the grant itself, and the charge will be treated as a cash-settled transaction.

Taxes

The total tax charge or credit recognised in the statement of profit and loss comprises both current and deferred taxes. Taxation is recognised in the consolidated statement of profit and loss except to the extent that it relates to a business combination or items recognised directly in equity or other comprehensive income.

Current Tax

The current tax charge is based on the taxable profit for the year. Taxable profit or loss is different from the profit or loss reported in the statement of profit and loss as it excludes items of income and/or expense that are taxable or deductible in other years (temporary differences) and it further excludes items that are never taxable nor deductible (permanent differences).

Deferred Tax

Deferred tax is the tax that is expected to be payable or recoverable on differences between the carrying value of assets and liabilities in the financial statements and the corresponding value of those assets and liabilities used to calculate taxable profit or loss.

Deferred tax assets are recognised for all deductible temporary differences, the carry forward of unused tax credits and any unused tax losses. Deferred tax assets are recognised to the extent that it is probable that taxable profit will be available against which the deductible temporary differences, and the carry forward of unused tax credits and unused tax losses can be utilised.

Deferred tax assets and liabilities are recognised using the liability method for all taxable temporary differences, except in respect of taxable temporary differences associated with investments in subsidiaries and associates. Where the timing of the reversal of temporary difference arising from such investment related assets and liabilities can be controlled and it is probable that the temporary difference will not reverse in the foreseeable future then the Group does not recognise deferred tax liabilities on these items.

A deferred tax asset or liability is not recognised if a temporary difference arises on initial recognition of an asset or liability and, at the time of the transaction, affects neither the accounting profit nor taxable profit or loss.

Current and deferred tax is calculated using tax rates and laws that have been enacted or substantively enacted at the balance sheet date. Deferred tax balances are presented on a gross basis. Refer to note 18, deferred tax balances.

Earnings per Share

The Group presents basic and diluted earnings per share ("EPS") data for its ordinary shares. Basic EPS is calculated by dividing the profit or loss attributable to ordinary shareholders of the Company by the weighted average number of ordinary shares outstanding during the year.

Diluted EPS is determined by adjusting the weighted average number of ordinary shares outstanding used in the EPS calculation to include all potentially dilutive ordinary shares, which, in the case of the Company, represents additional shares that could be issued in relation to 'in-the-money' convertible notes, warrants or share options.

The effects of anti-dilutive potential ordinary shares are ignored in calculating diluted EPS. Anti-dilution is when an increase in earnings per share or a reduction in loss per share would result from the exercise of such options, warrants or convertible instruments.

Intangible Assets

Goodwill

The Group allocates the fair value of the purchase consideration on the acquisition of a subsidiary to the assets acquired and liabilities assumed based on an assessment of fair value at the acquisition date. Any excess of purchase consideration is recognised as goodwill. Where goodwill is recognised, it is allocated to the cash generating units (CGUs) in a systematic manner reflective of how the Group expects to recover the value of the goodwill. Because the Group has been determined to consist of a single business unit, the carrying value of goodwill is tested for impairment based on the recoverable value of the Group as a whole.

Goodwill is not amortised but is tested for impairment on an annual basis, and the Group will also test for impairment at other times if there is an indication that an impairment may exist. Determining whether goodwill is impaired requires an estimation of the value-in-use of the CGU. The key estimates are therefore the selection of the suitable discount rates and the estimation of future growth rates which may depend on specific risks and the anticipated economic and market conditions related to the CGU.

As part of determining the value in use of the CGU, sensitivities have been considered on the underlying inputs included within the value-in-use calculations used for impairment reviews and no impact exists on the carrying value of goodwill, given the headroom identified as a result of the impairment test. Goodwill is impaired where circumstances indicate that the recoverable amount of the underlying CGU may no longer support the carrying value of the CGU. An impairment charge is recognised in the statement of profit and loss for the period in which it is determined the goodwill is no longer recoverable. Impairment losses related to goodwill cannot be reversed in future periods.

Internally Generated Intangible Assets - Research and Development Costs

Research

Expenditure on research activities is recognised as an expense in the period in which it is incurred. Research activities are aimed at creating new knowledge or the use of existing knowledge in new or creative ways to generate new concepts. Research activity does not typically have a defined commercial objective at the outset.

Development

Where projects evolve toward commerciality or are related to a specific commercial objective they are assessed to determine whether the activity constitutes development that is associated with a commercial objective or practical application.

The associated costs represent development costs and can be capitalised if, and only if, the following conditions can be demonstrated:

§ the technical feasibility of completing the intangible asset so that it can be made available for use or sale;

§ the intention to complete the intangible asset for use or sale;

§ the availability of adequate technical, financial and other resources to complete the development and to use or sell it;

§ an asset is created that can be separately identified for use or sale;

§ it is probable that the asset created will generate future economic benefits; and

§ the development cost of the asset can be measured reliably.

Development work undertaken by the Group typically relates to the refinement of design, materials selection, construction techniques, firmware and control systems to enhance battery system performance over successive generations. Where development costs are capitalised, they are amortised over the expected period to the introduction of the next generation of battery system.

Amortisation is recorded over that period on a straight-line basis with the corresponding amortisation charge recognised in the statement of profit and loss as a component of administrative expenses.

Four years has historically been the typical cycle time between successive generations of battery system design.

Other Intangible Assets

Intangible assets other than goodwill that are acquired by the Group are stated at their historical cost of acquisition less accumulated amortisation and any impairment losses.

Software and Purchased Domain Names